Highlights

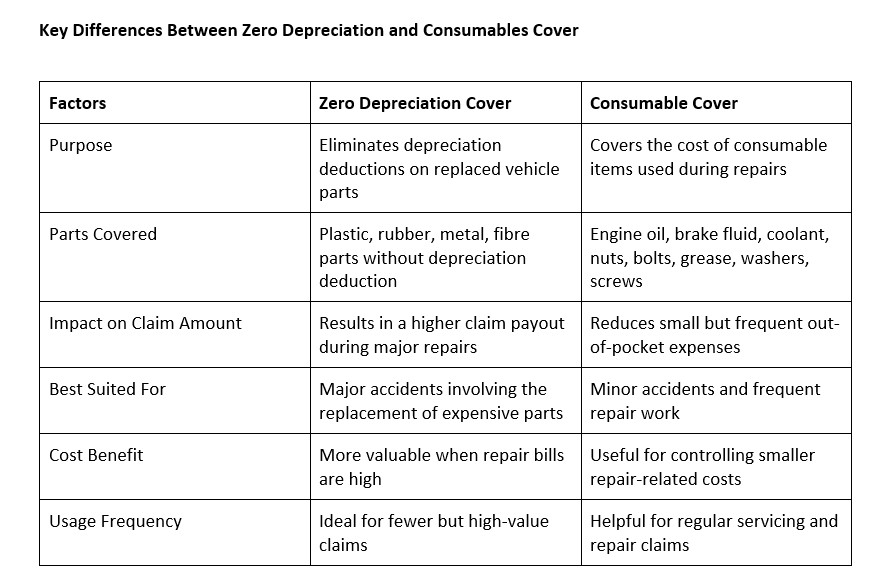

Zero depreciation avoids claim deductions. Consumables cover reduces minor repair costs. Combining both offers comprehensive protection.

Latest news

Punjab CM Bhagwant Mann holds Lok Milni in Jalandhar, reaffirms pro-people governance

Poco M8 review: A smart evolution of Poco’s budget formula

UP CM Adityanath listens to people's grievances during 'Janta Darshan'

Punjab govt approaches UK, seeks Bhagat Singh's trial proceedings papers, other material

Development is holistic when technology, compassion are connected, says UP CM Adityanath

PM Modi holds wide ranging talks with Germany's Merz

Vijay-starrer Jana Nayagan's maker moves SC against lower court order

AAP holds 'Parivartan Sabha' in Bhavnagar, Gadhvi criticizes BMC, promises reforms for farmers and women

Zero Depreciation Vs Consumable Cover- Know the Difference Now!

Up Next

Zero Depreciation Vs Consumable Cover- Know the Difference Now!

Sensex declines 455 points on foreign fund outflows, trade-related concerns

India projected to grow at 6.6%, resilient consumption, public investment to offset US tariffs impact: UN

Air India takes delivery of its first line fit Dreamliner in over eight years

Reliance says not received any Russian oil in three weeks, none expected in Jan

ATF price cut by steep 7 pc, commercial LPG rate up Rs 111 per cylinder

More videos

Tobacco and pan masala to get costlier as new excise, health cess takes effect from February 1

India imposes three-year safeguard duty on certain steel products to curb cheap imports

Govt approves package for VIL; freezes AGR dues at Rs 87,695 cr to be paid from FY32 to FY41: Sources

India revamps tax regime in 2025, new I-T Act to take effect from April 1

New Zealand commits USD 20 bn investment in India under FTA in 15 yrs; on lines of EFTA pact

India, New Zealand conclude FTA talks; pact to offer duty-free access, USD 20 bn FDI

FTA with New Zealand to significantly deepen bilateral economic engagement: Govt

Rupee breaches 91-mark against US dollar for first time in intra-day trade

Microsoft commits USD 17.5 billion investment in India: CEO Satya Nadella

CBI books Anil Ambani's son, Reliance Home Finance Ltd. in Rs 228 crore bank fraud case