Highlights

- Nifty 50 Top Losers Today 20 December 2024

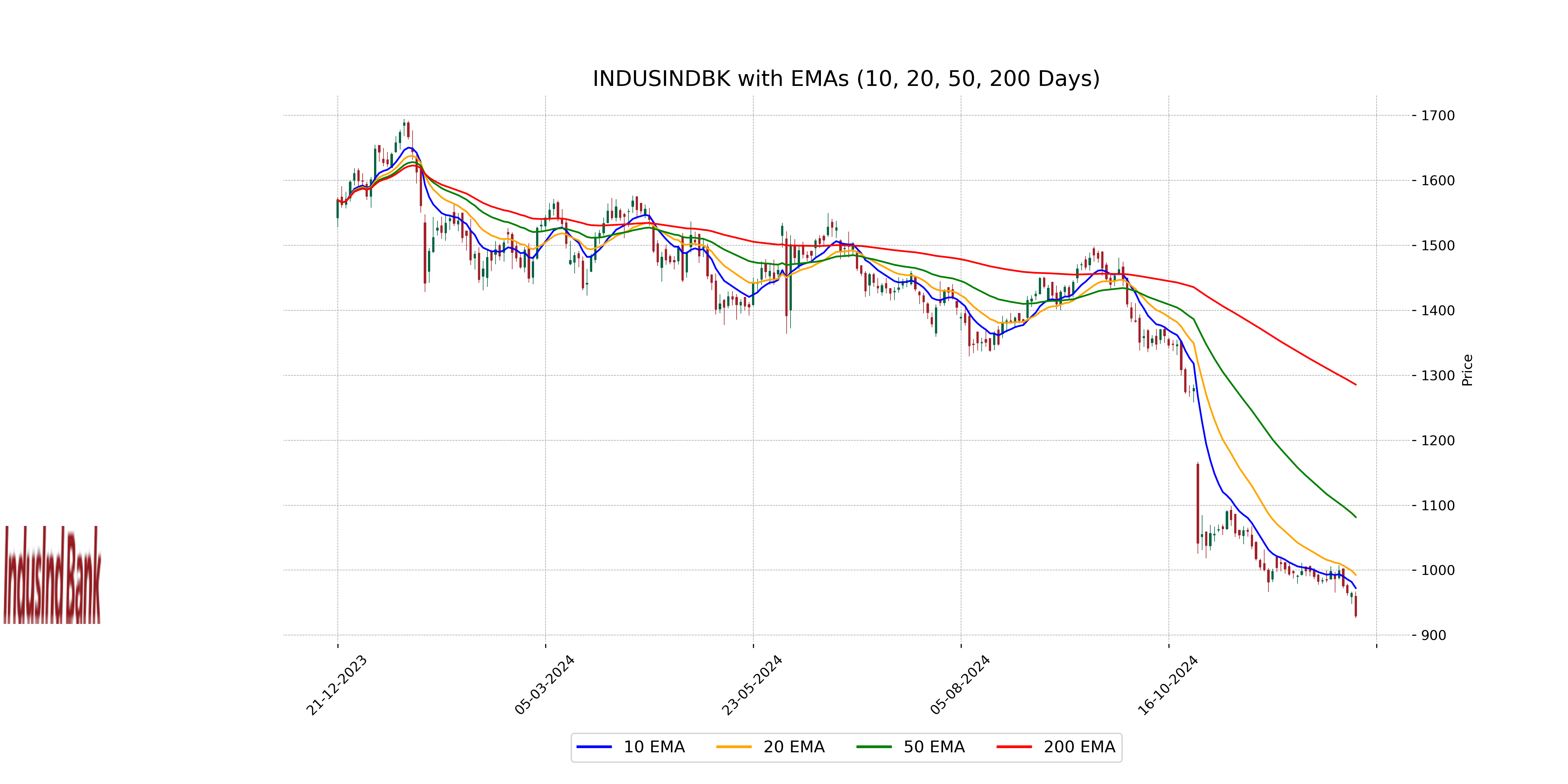

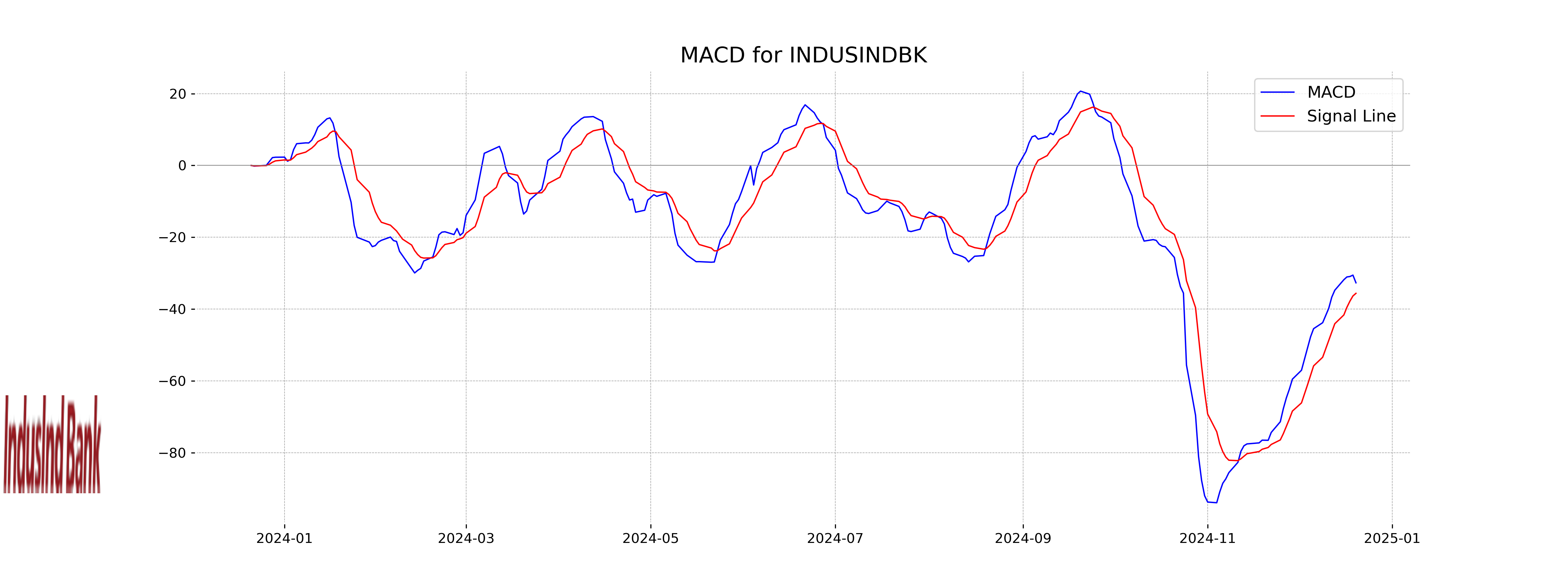

- Tech Mahindra, Axis Bank, IndusInd Bank signal bearish trends

- RSI indicates oversold conditions for potential reversals

Latest news

Under-19 World Cup: Sooryavanshi fires India to record-extending sixth title with a knock for the ages

Vaibhav Sooryavanshi smashes second fastest hundred, most sixes in U19 World Cup

'Can't compel woman to complete pregnancy': SC allows minor to terminate 30-week pregnancy

31 killed, 169 injured in suicide attack at Shia mosque in Pakistan's capital Islamabad

Three Delhi Jal Board engineers suspended over biker's death in west Delhi construction pit

India pacer Harshit Rana set to be ruled out of T20 World Cup

Oakley Meta HSTN Smart Glasses Review: The Most Livable Smart Glasses Yet?

Meghalaya mine blast: Two persons arrested as CM warns of strict action

Nifty 50: Top losers today - 20 December 2024

Up Next

Nifty 50: Top losers today - 20 December 2024

RBI keeps interest rates on hold after US trade deal boosts outlook

RBI raises GDP growth projection of Q1, Q2 of FY27

RBI pauses rate cuts, retains interest rate at 5.25 pc

Rupee jumps 122 paise to close at 90.27 against US dollar on India-US trade deal

Stock markets cheer India-US trade deal: Sensex, Nifty surge 2.5 pc

More videos

UPI transactions hit record high of Rs 230 lakh crore in 2025-26 till Dec: Govt

Explained: India-US trade deal, tariffs and trade benefits

Trade deal with US adds momentum to India's growth ambition: Industry leaders

Rupee jumps 119 paise to 90.30 against the US dollar on India-US trade deal

President Trump announces US-India trade deal, lowers tariffs from 25 pc to 18 pc

Stock markets cheer India-US trade deal: Sensex jumps over 5 pc; Nifty nears all-time high

Sustaining 7–8% growth top priority to create jobs: FM Nirmala Sitharaman

Budget FY27 demonstrates commitment to macro stability: Fitch

STT hike on Futures dampen stock market sentiment; Sensex, Nifty crash nearly 2 pc

Budget 2026: Cancer drugs, Microwave Ovens to be cheaper; imported umbrellas, ATMs to be costlier