Highlights

Death certificates not needed. Simplified claims process. Extensive support network.

Latest news

Vande Bharat trains with 20 coaches to operate between Jammu, Srinagar from March 1

Lucknow Super Giants unveil new logo ahead of IPL 2026 season

India's GDP expected to register over 8 pc growth in Sep-Dec: Report

Zelensky says Ukraine unbroken after 4 years, but Russia vows to fight on

AAP launches ‘Parivartan Lao, Khedut Bachao Yatra’ from Somnath to highlight farmers’ issues

PM Modi should scrap 'anti-farmer' trade deal with US, says Rahul Gandhi

Man shot dead over old enmity in Greater Noida, two held

Amitabh Bachchan shooting for 'Kalki 2' in Hyderabad, shares BTS photo with Kamal Haasan

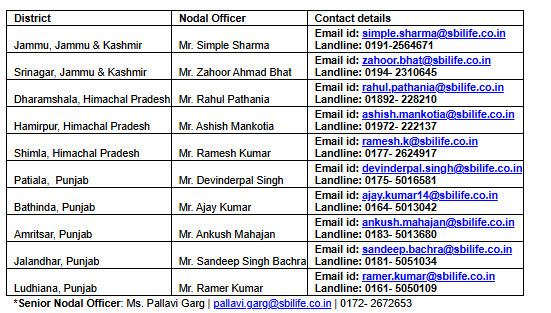

SBI Life eases claim documentation requirements for flood affected policyholders in Jammu & Kashmir, Punjab and Himachal Pradesh

Up Next

SBI Life eases claim documentation requirements for flood affected policyholders in Jammu & Kashmir, Punjab and Himachal Pradesh

Govt announces seven measures to help boost exports

RBI keeps interest rates on hold after US trade deal boosts outlook

RBI proposes to compensate customers up to Rs 25,000 loss due to fraud

RBI raises GDP growth projection of Q1, Q2 of FY27

RBI pauses rate cuts, retains interest rate at 5.25 pc

More videos

Rupee jumps 122 paise to close at 90.27 against US dollar on India-US trade deal

Stock markets cheer India-US trade deal: Sensex, Nifty surge 2.5 pc

UPI transactions hit record high of Rs 230 lakh crore in 2025-26 till Dec: Govt

Explained: India-US trade deal, tariffs and trade benefits

Trade deal with US adds momentum to India's growth ambition: Industry leaders

Rupee jumps 119 paise to 90.30 against the US dollar on India-US trade deal

President Trump announces US-India trade deal, lowers tariffs from 25 pc to 18 pc

Stock markets cheer India-US trade deal: Sensex jumps over 5 pc; Nifty nears all-time high

Sustaining 7–8% growth top priority to create jobs: FM Nirmala Sitharaman

Budget FY27 demonstrates commitment to macro stability: Fitch