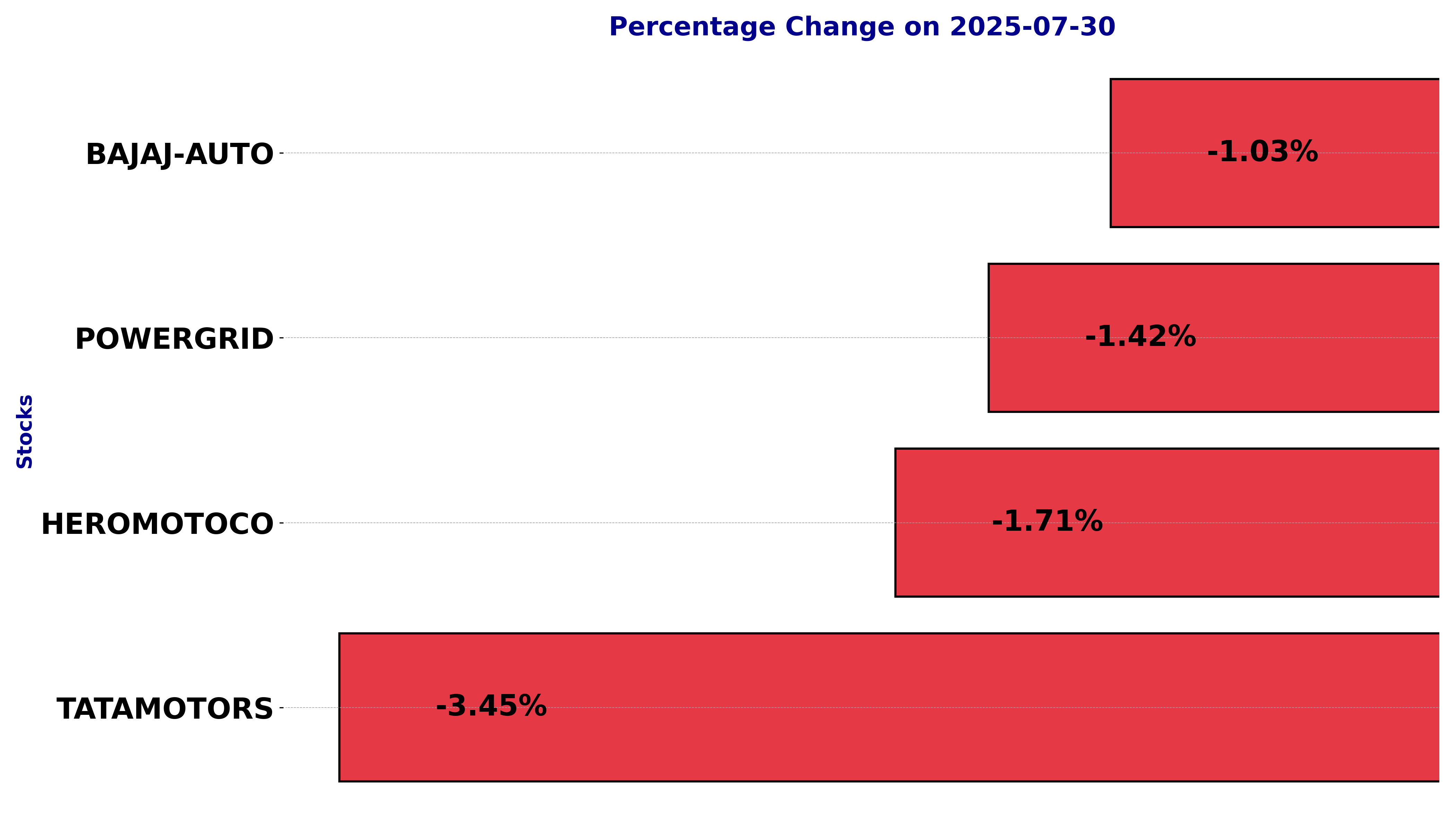

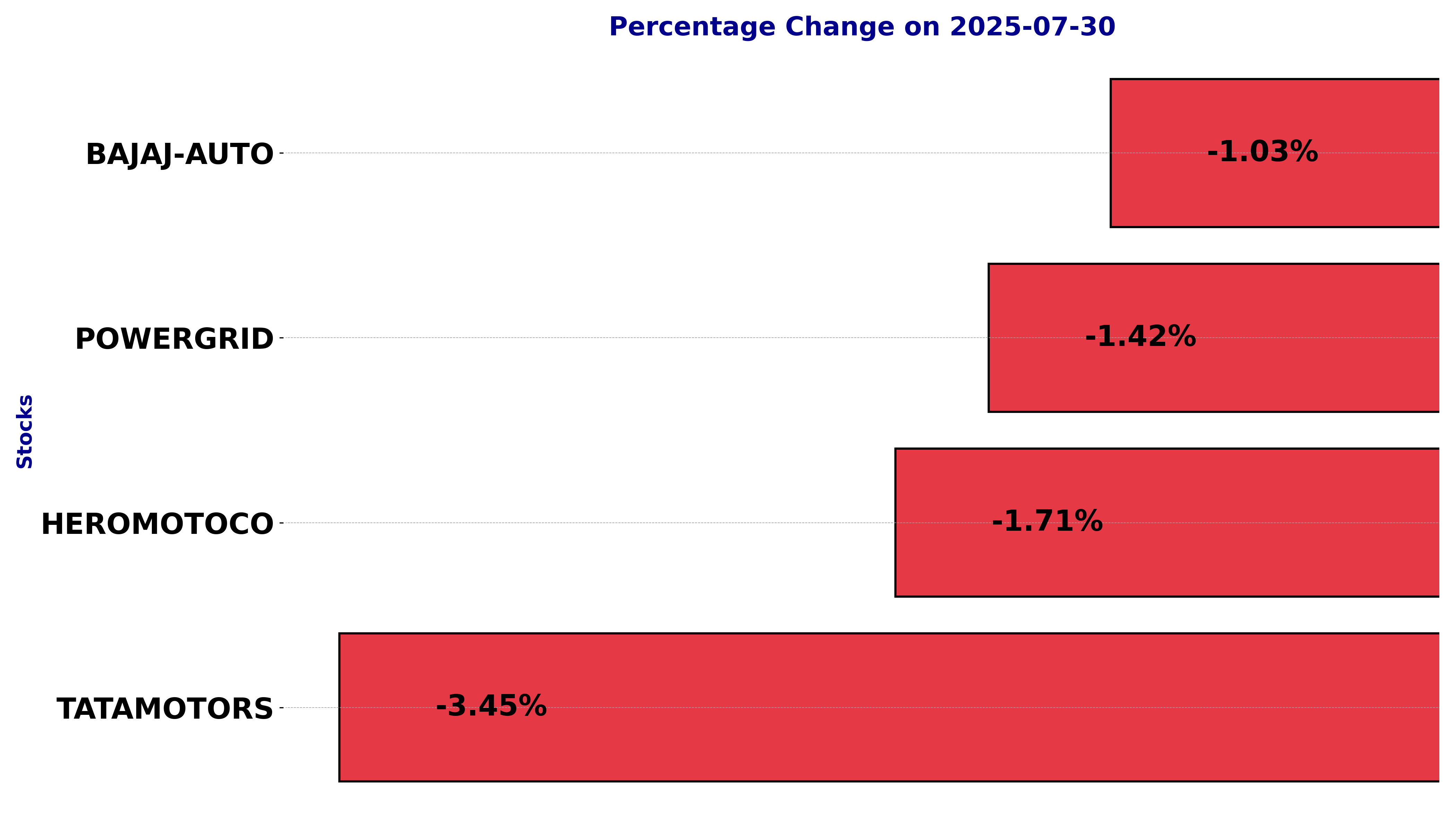

In this article, we will explore the technical indicators of some of the low-performing stocks on the Indian stock market, including BAJAJ-AUTO, HEROMOTOCO, POWERGRID, and TATAMOTORS.

By looking at these stocks through the lens of key technical factors, we aim to better understand their price movements, trends, and potential future performance.

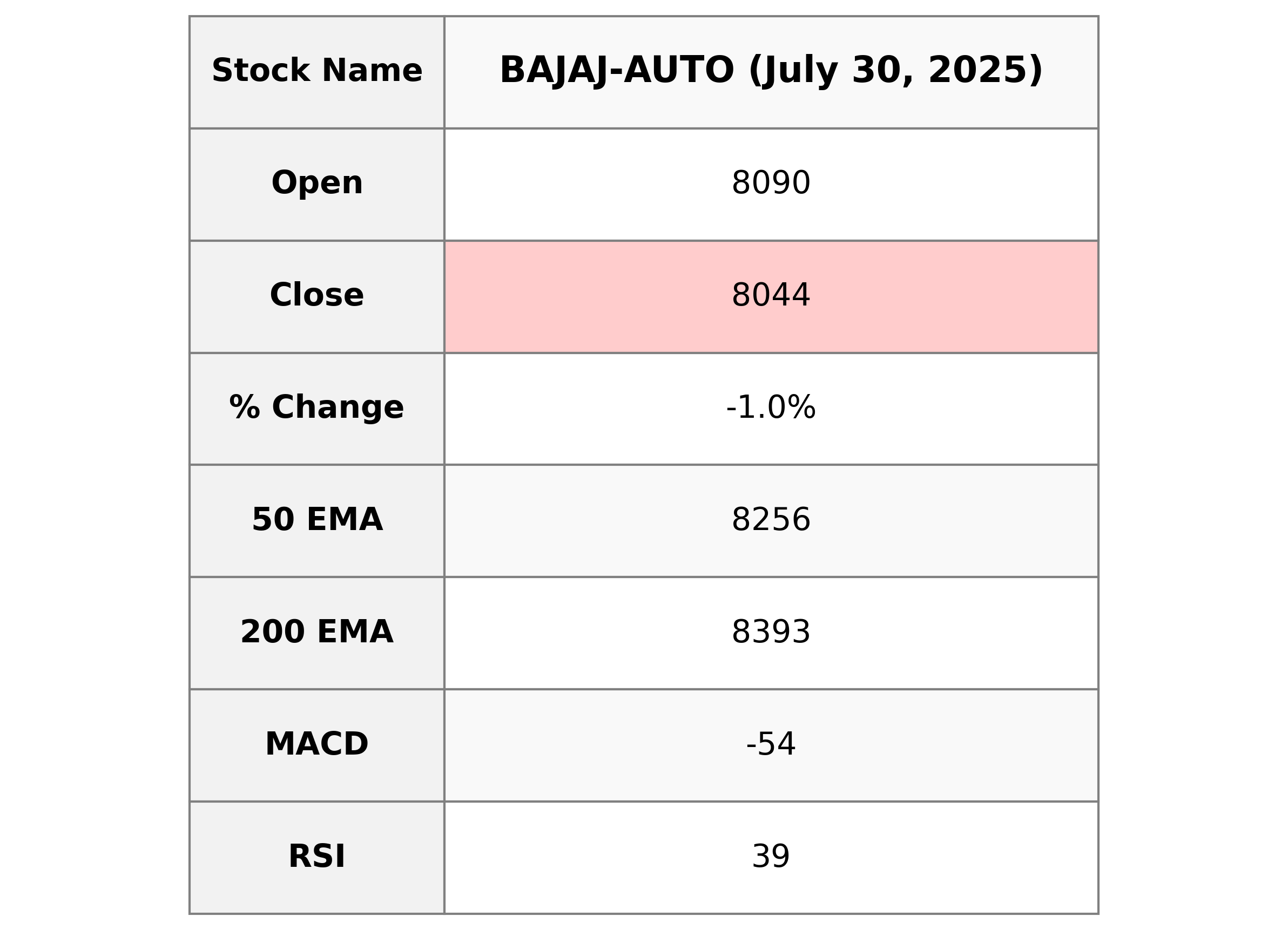

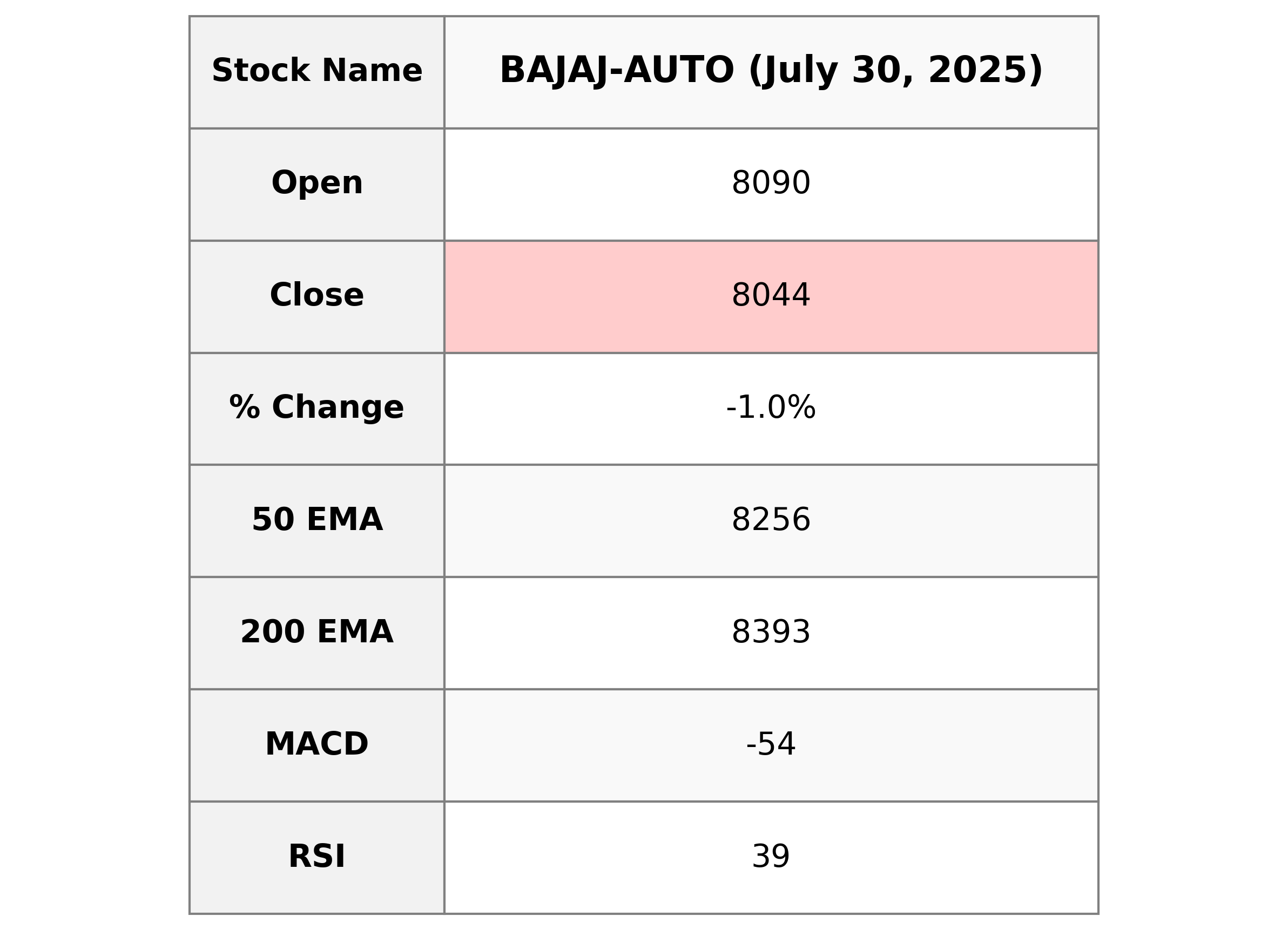

Analysis for Bajaj Auto - July 30, 2025

Bajaj Auto Performance: Bajaj Auto's stock experienced a decrease of 1.03%, indicated by the points change of -84. The stock closed at 8043.5, lower than its previous close of 8127.5. The RSI is currently at 39.44, suggesting it may be edging toward an oversold condition, while the MACD shows a bearish trend. With a market cap of approximately 2.34 trillion INR, Bajaj Auto is part of the Consumer Cyclical sector and operates within the Auto Manufacturers industry in India. The PE Ratio is 30.73, and the company has an EPS of 261.71.

Relationship with Key Moving Averages

Relationship with Key Moving Averages for Bajaj Auto: The stock is currently trading below its 10 EMA, 20 EMA, 50 EMA, and 200 EMA, indicating a bearish trend. The lower RSI at 39.44 suggests it may be oversold.

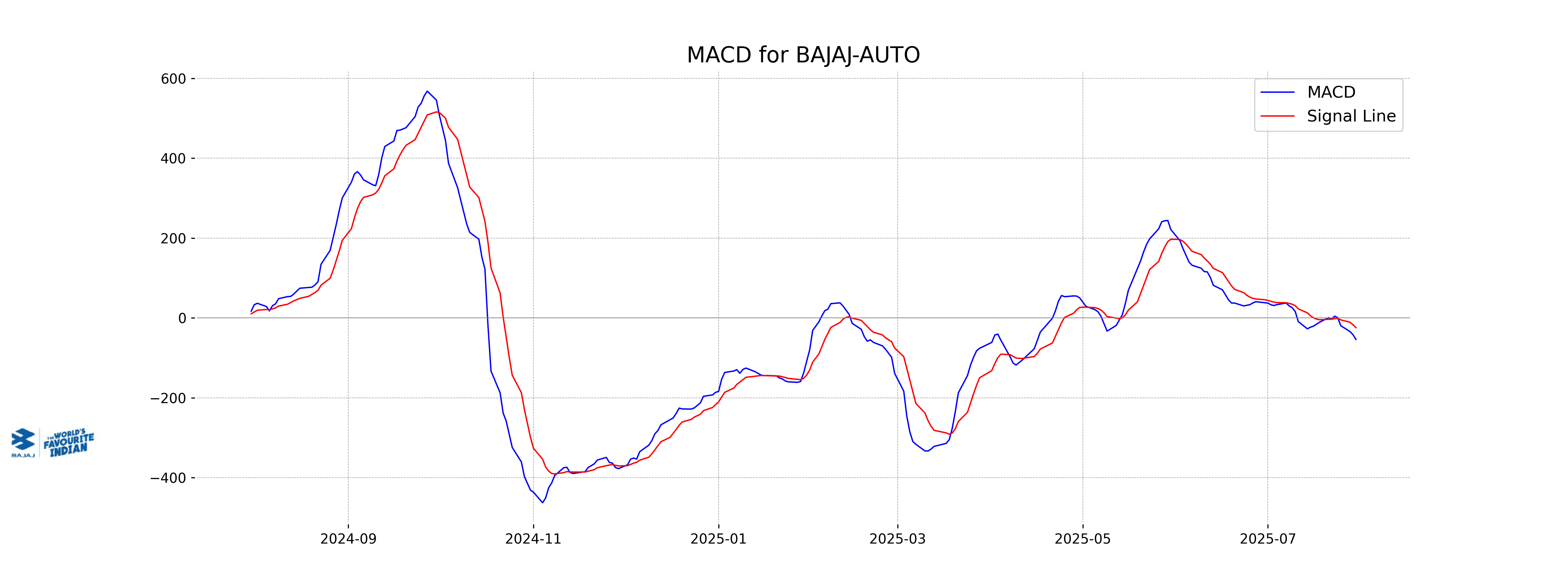

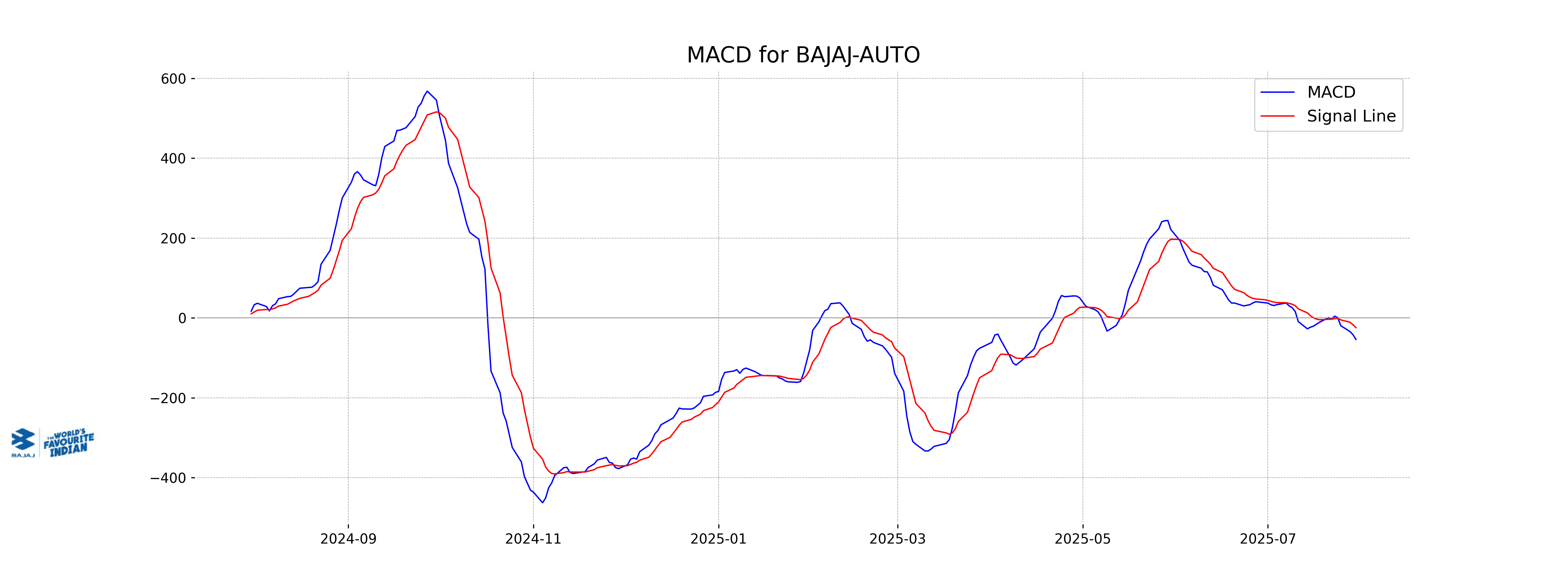

Moving Averages Trend (MACD)

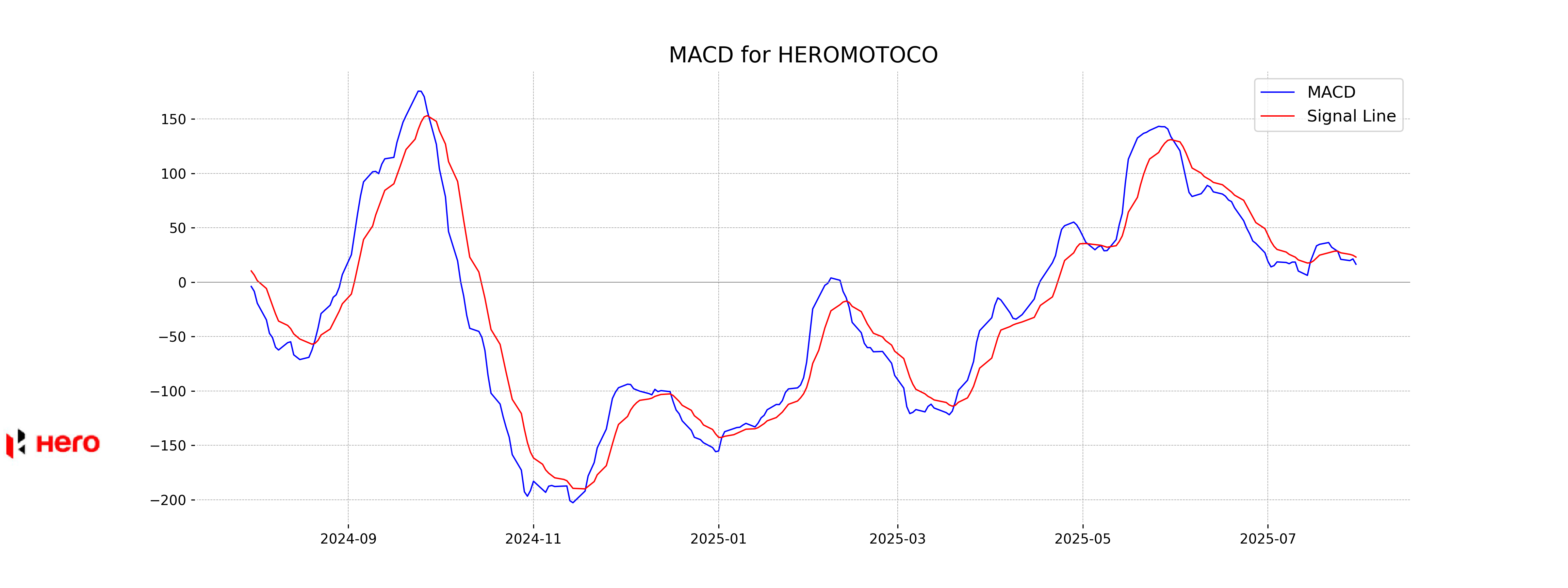

Bajaj Auto's MACD is currently at -54.07, which is below the MACD Signal line of -24.36. This suggests a bearish trend, indicating that the stock might be experiencing downward momentum. With the RSI at 39.44, it is approaching oversold territory, which could lead to a potential reversal or consolidation.

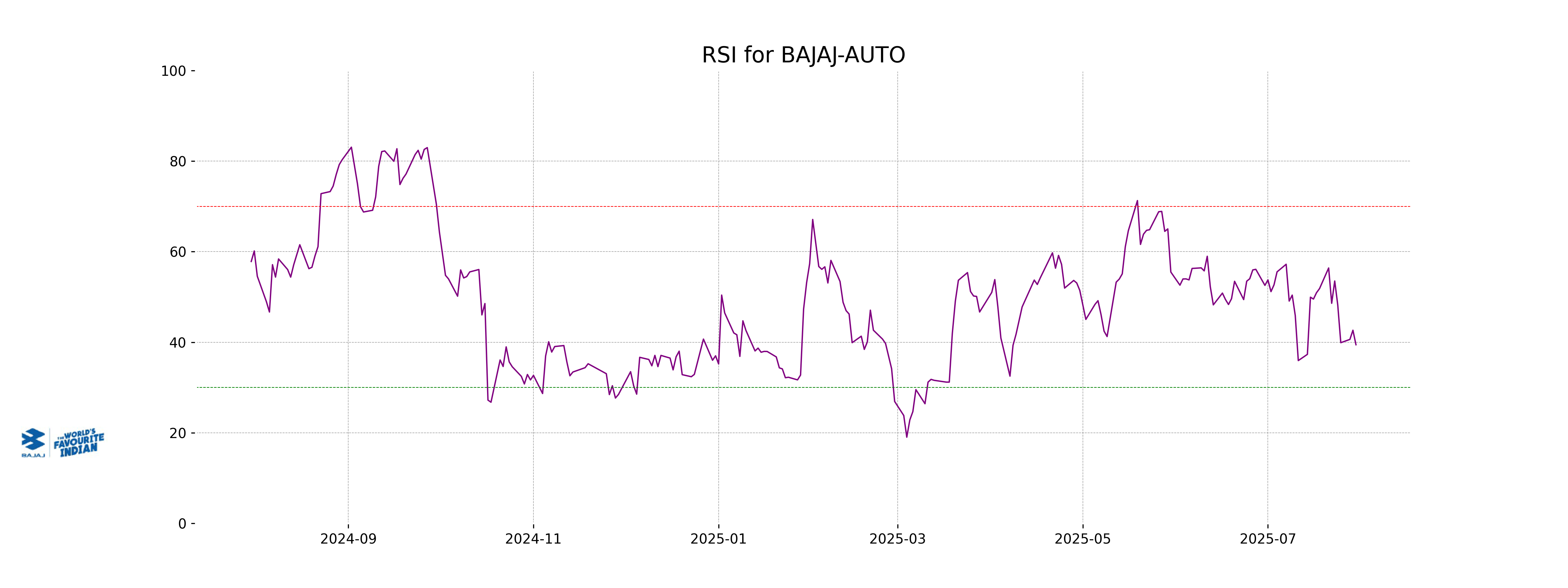

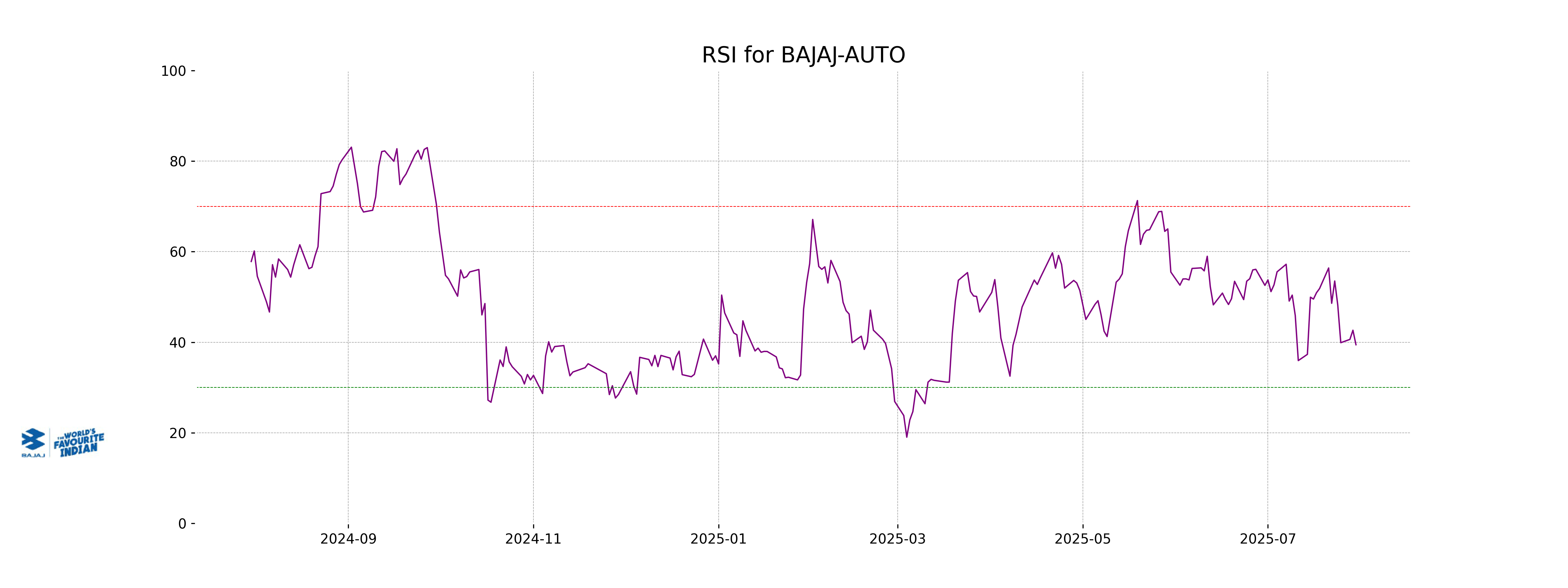

RSI Analysis

Bajaj Auto's RSI is at 39.44, which indicates that the stock is approaching the oversold territory, generally considered a signal that it might be undervalued and a potential buying opportunity. However, it is essential to analyze additional indicators and market conditions before making investment decisions.

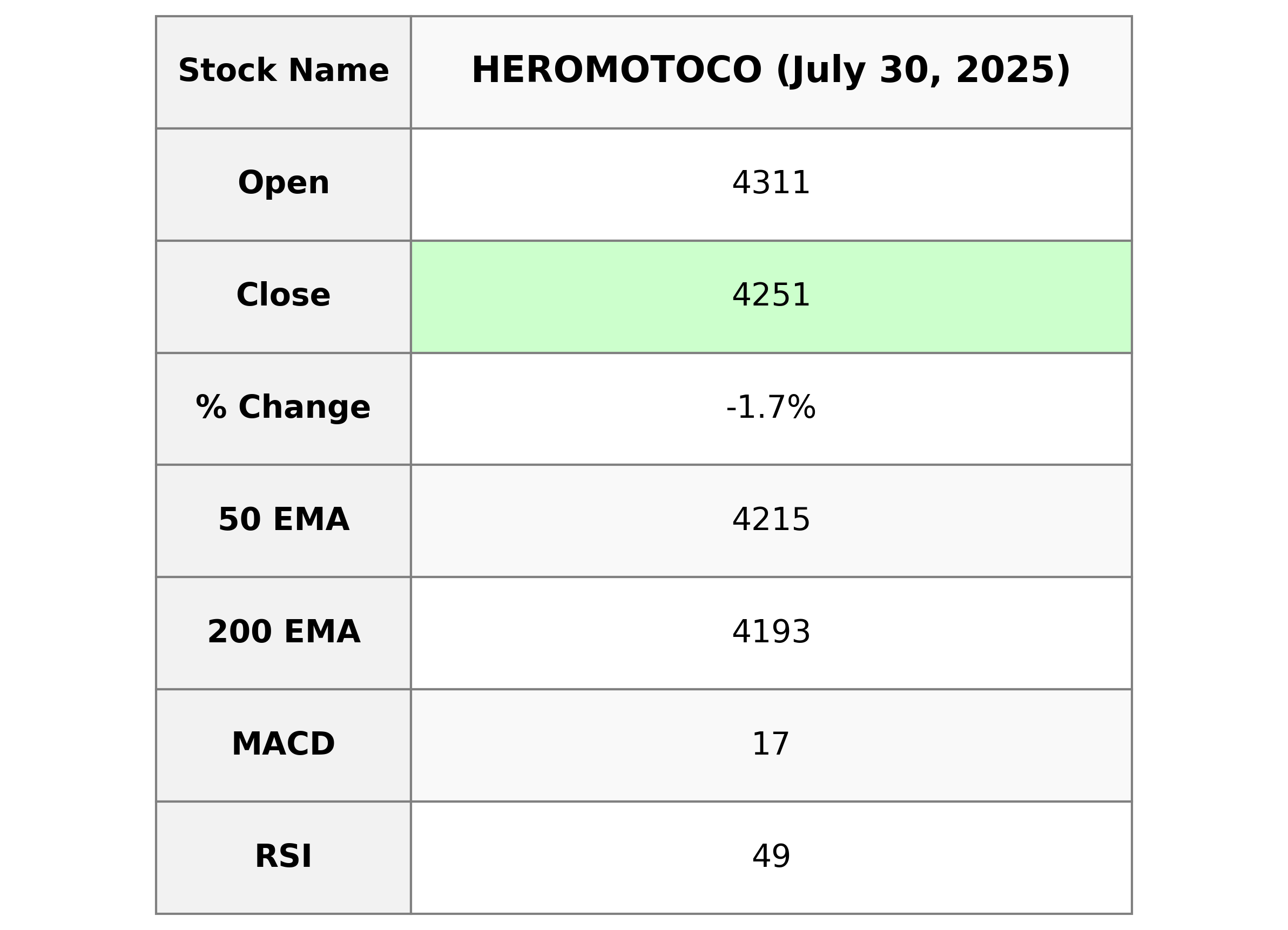

Analysis for Hero MotoCorp - July 30, 2025

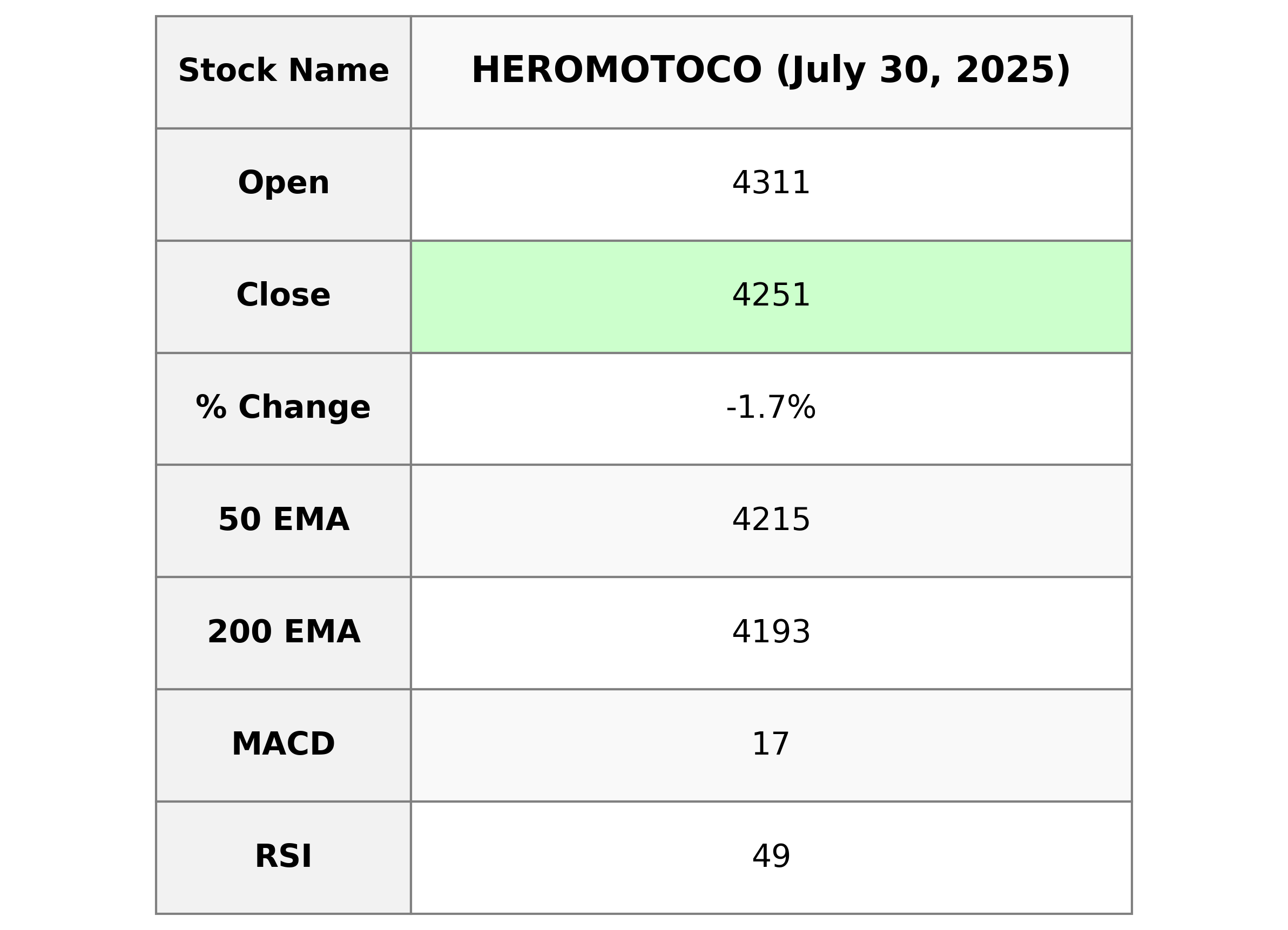

Hero MotoCorp Performance: Hero MotoCorp saw a decline in its stock price, with a closing price of 4251.30, reflecting a -1.71% change from the previous close of 4325.20. The stock's trading volume was 546,984 shares. Technical indicators show the stock is slightly above its 50 EMA and 200 EMA, but the RSI is 48.59, suggesting it is nearing a neutral momentum. Additionally, the MACD value of 16.51 is below the signal line, possibly indicating a bearish trend. With a PE Ratio of 19.42 and an EPS of 218.86, the company operates in the Consumer Cyclical sector, specifically in Auto Manufacturers, and has a market cap of 850.3 billion INR.

Relationship with Key Moving Averages

Hero MotoCorp's current closing price of 4251.30 is above both the 50-day EMA (4214.50) and 200-day EMA (4193.15), indicating a bullish sentiment over these longer time frames. However, it is below the 10-day EMA (4287.12) and 20-day EMA (4279.11), suggesting recent short-term pressure may exist.

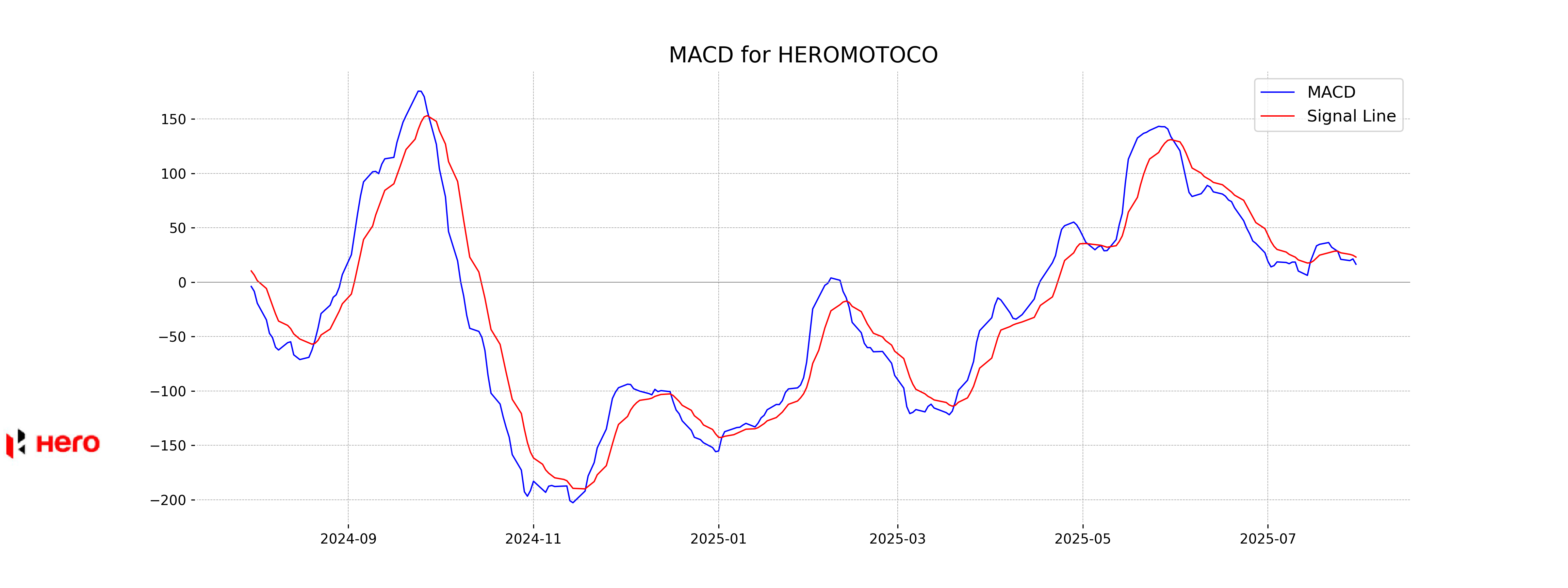

Moving Averages Trend (MACD)

Hero MotoCorp exhibits a bearish signal as the MACD (16.51) is below the MACD Signal line (23.10). This may suggest a potential downtrend or decrease in bullish momentum.

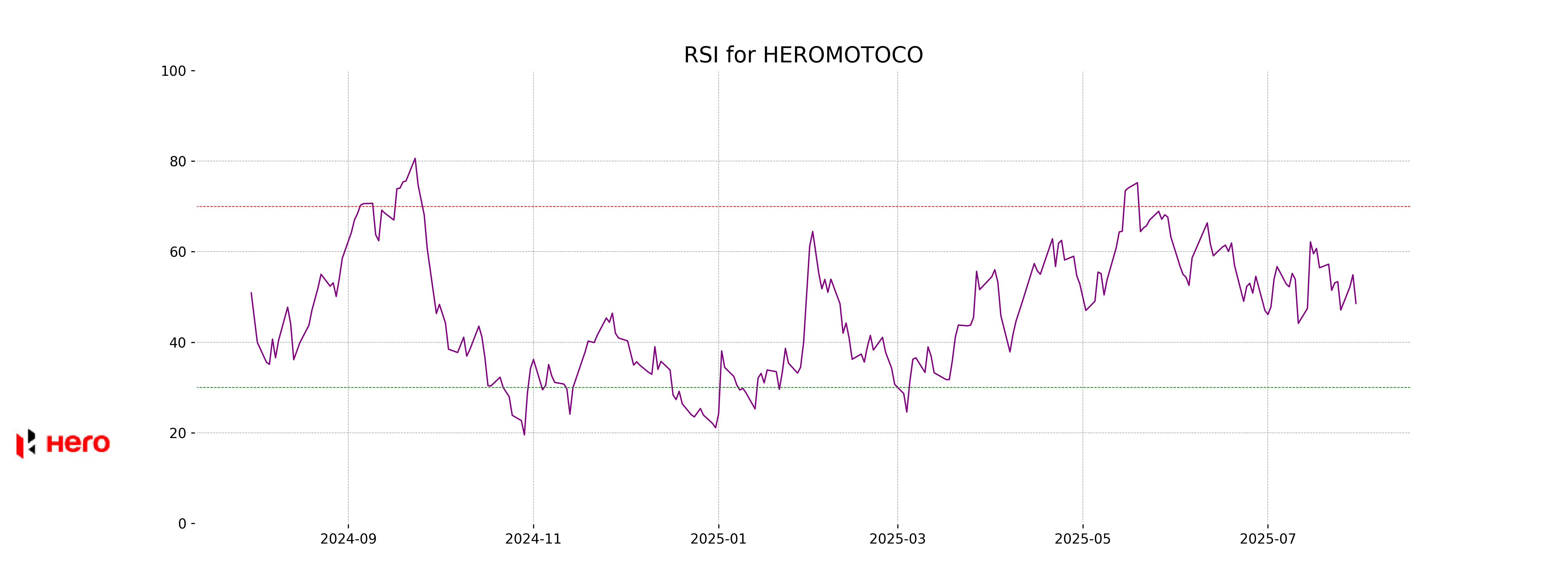

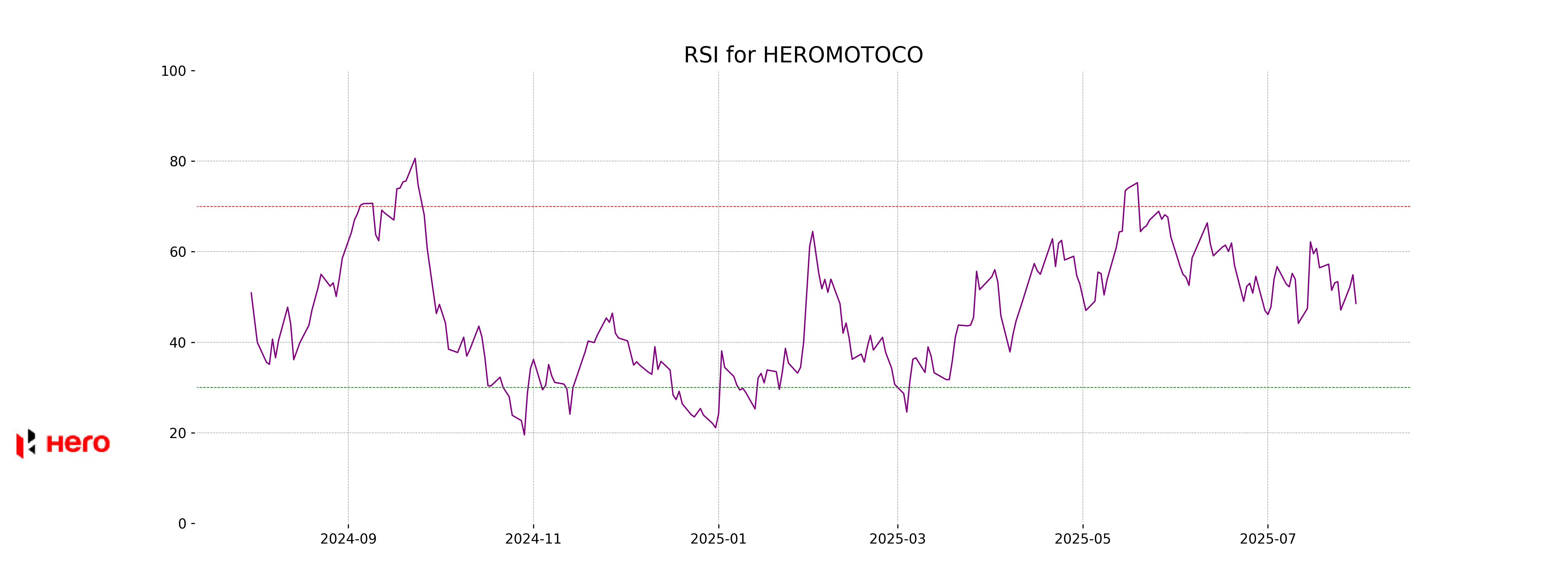

RSI Analysis

RSI Analysis for Hero MotoCorp: The RSI value for Hero MotoCorp is 48.59, which indicates that the stock is neither in the overbought nor oversold territory. It is approaching the mid-range level of 50, suggesting a balance between buying and selling pressures.

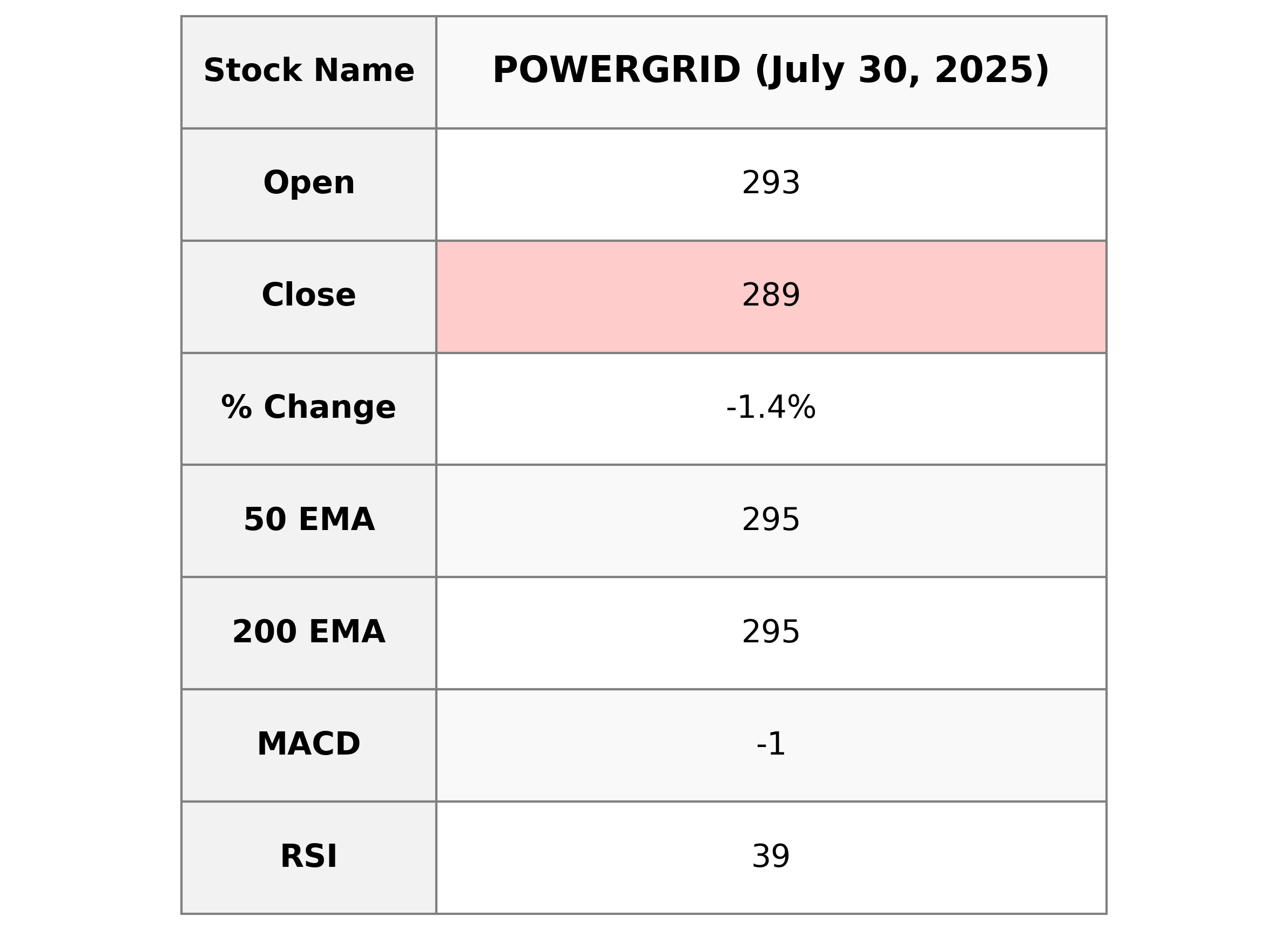

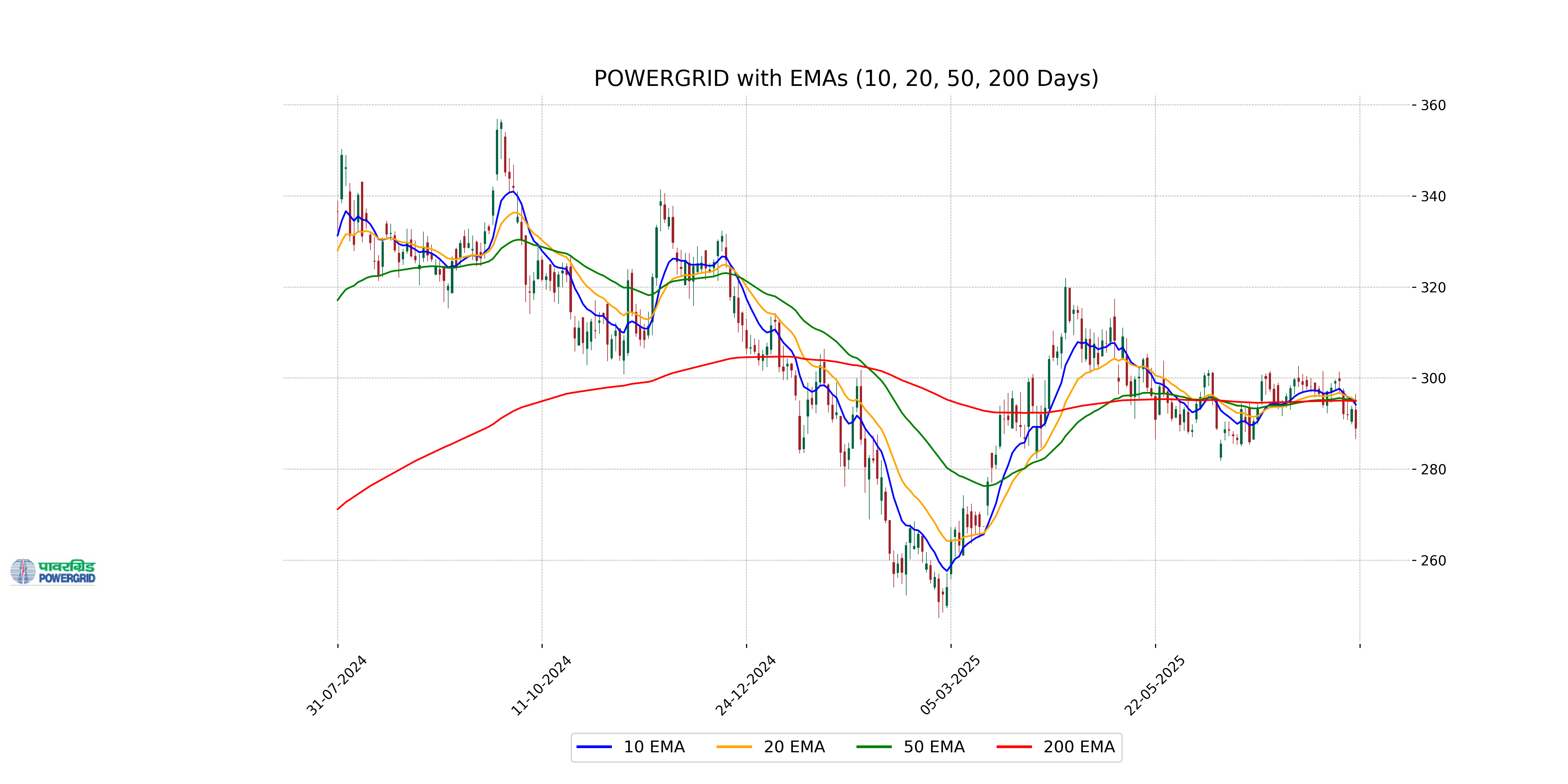

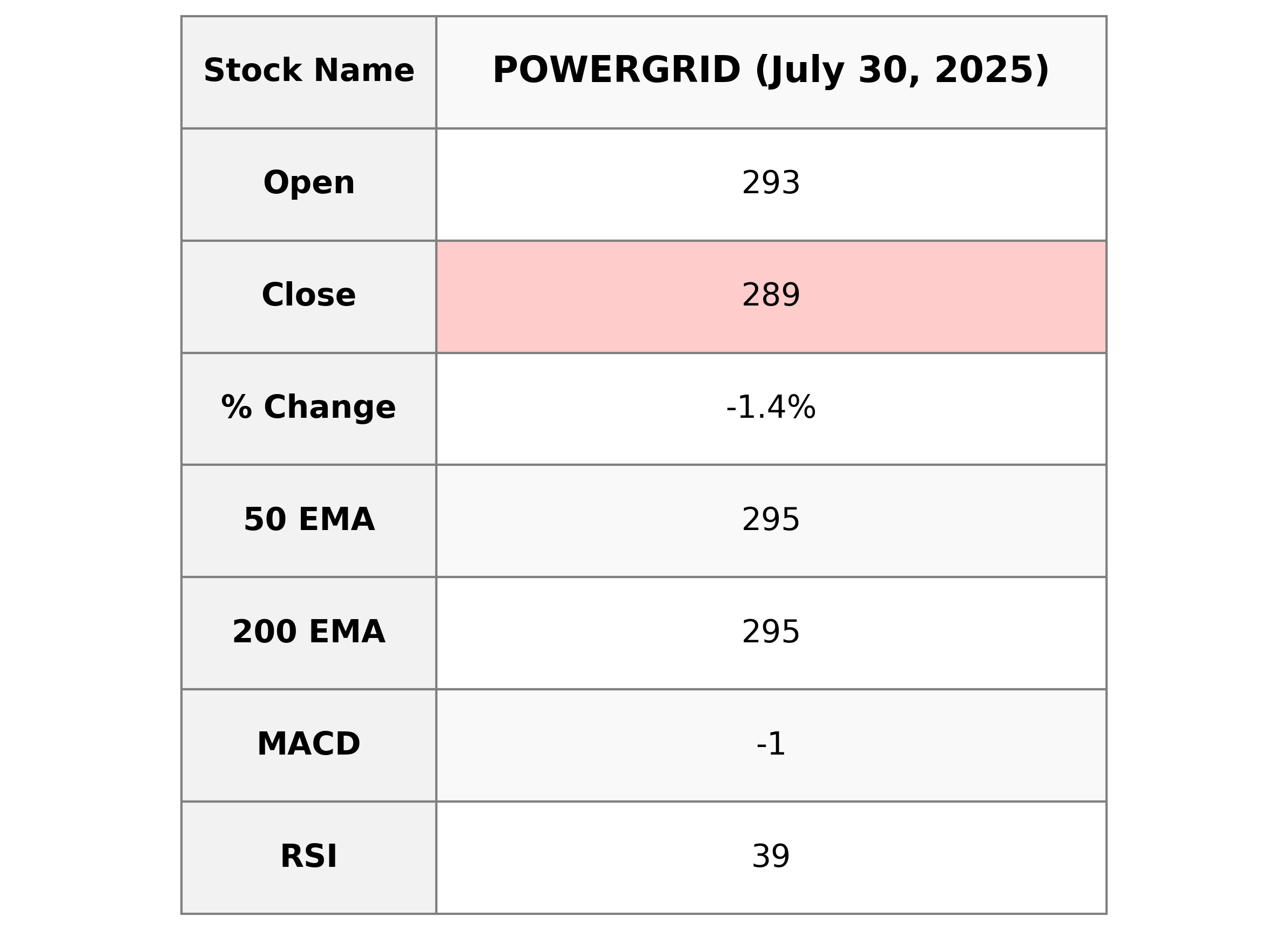

Analysis for Power Grid - July 30, 2025

Power Grid Performance: Power Grid's stock opened at 293.00 and closed at 288.95, marking a percentage decline of approximately -1.42% from the previous close. The stock experienced a day range between a high of 296.5 and a low of 286.6 with a noticeable volume of 10.515 million shares. With a market capitalization of 2.714 trillion INR, it operates in the Utilities sector, specifically under Utilities - Regulated Electric, and exhibits a somewhat bearish trend indicated by its RSI of 38.9 and a negative MACD.

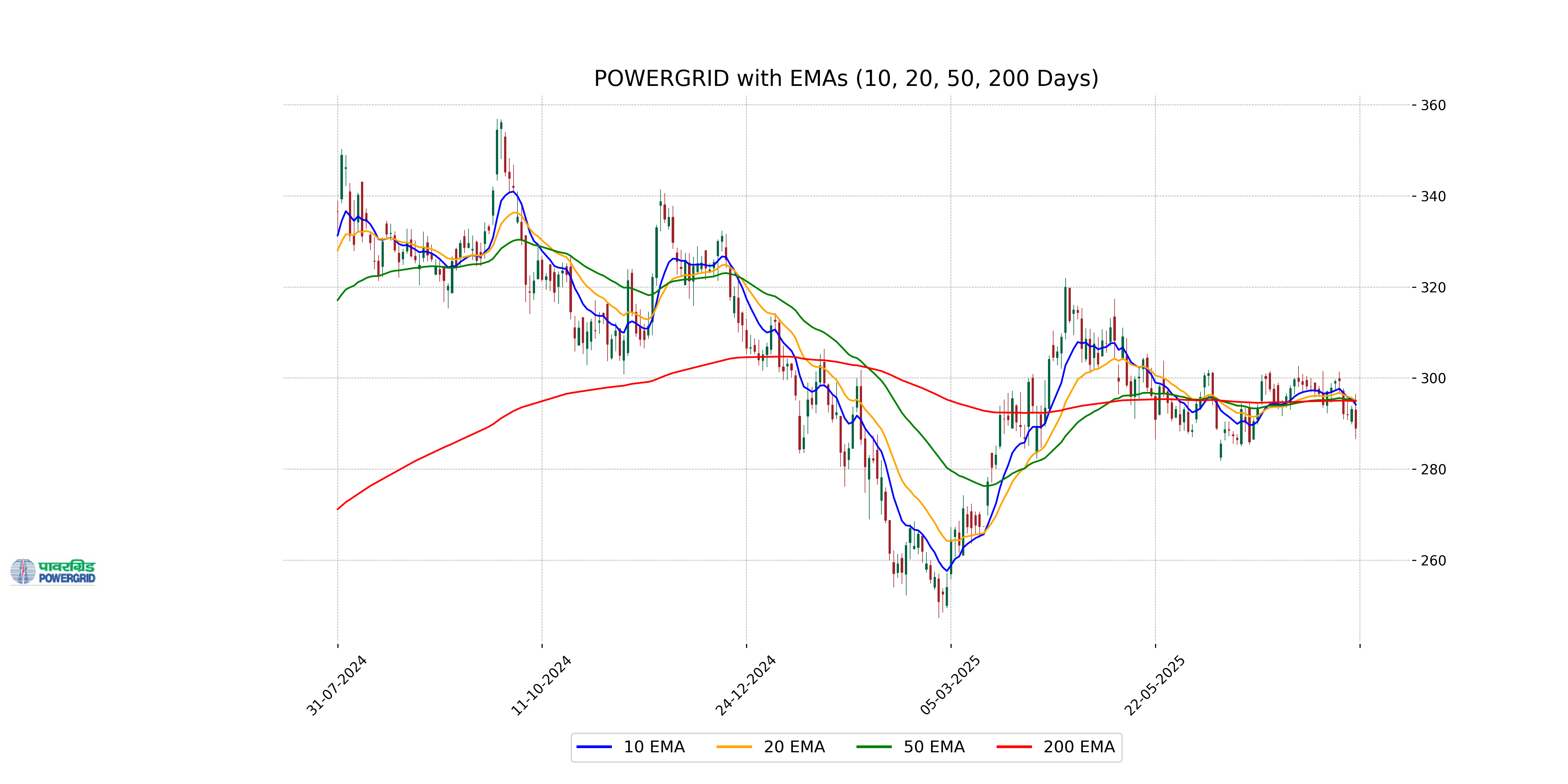

Relationship with Key Moving Averages

Power Grid's current stock price at 288.95 is below all its key moving averages, including the 50 EMA (294.99), 200 EMA (294.93), 10 EMA (294.15), and 20 EMA (295.01). This indicates a potential bearish trend in the short to medium term.

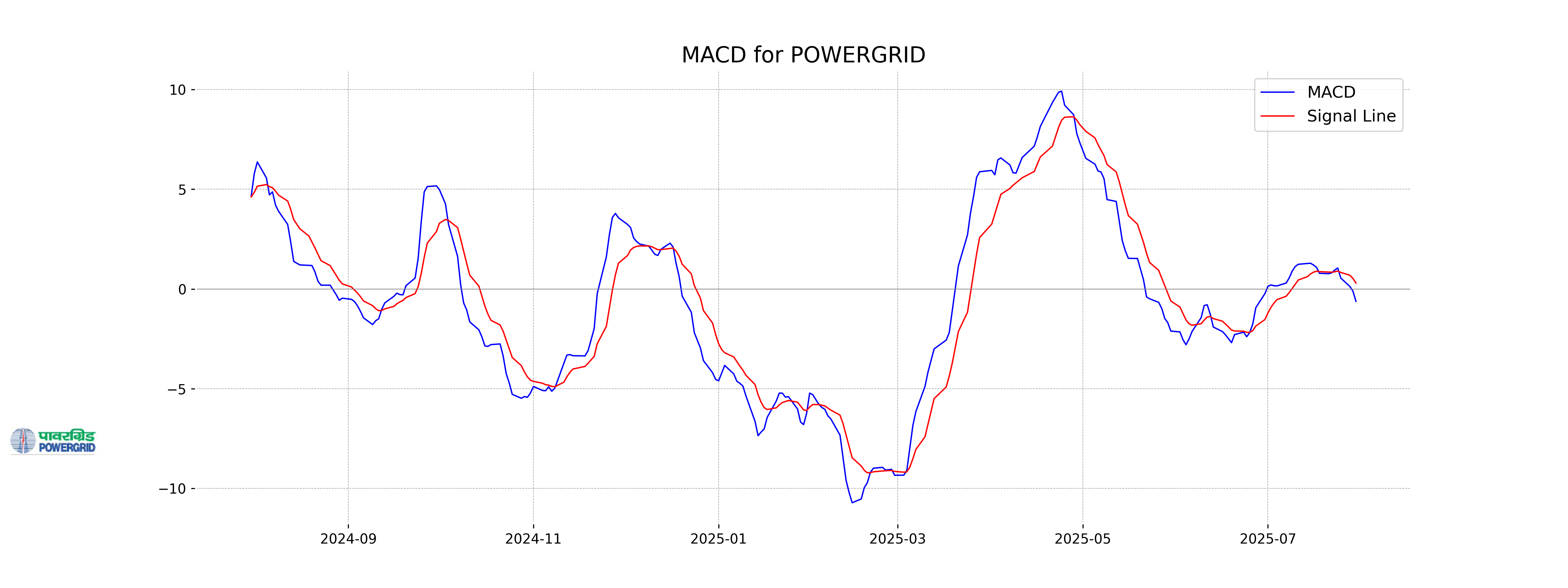

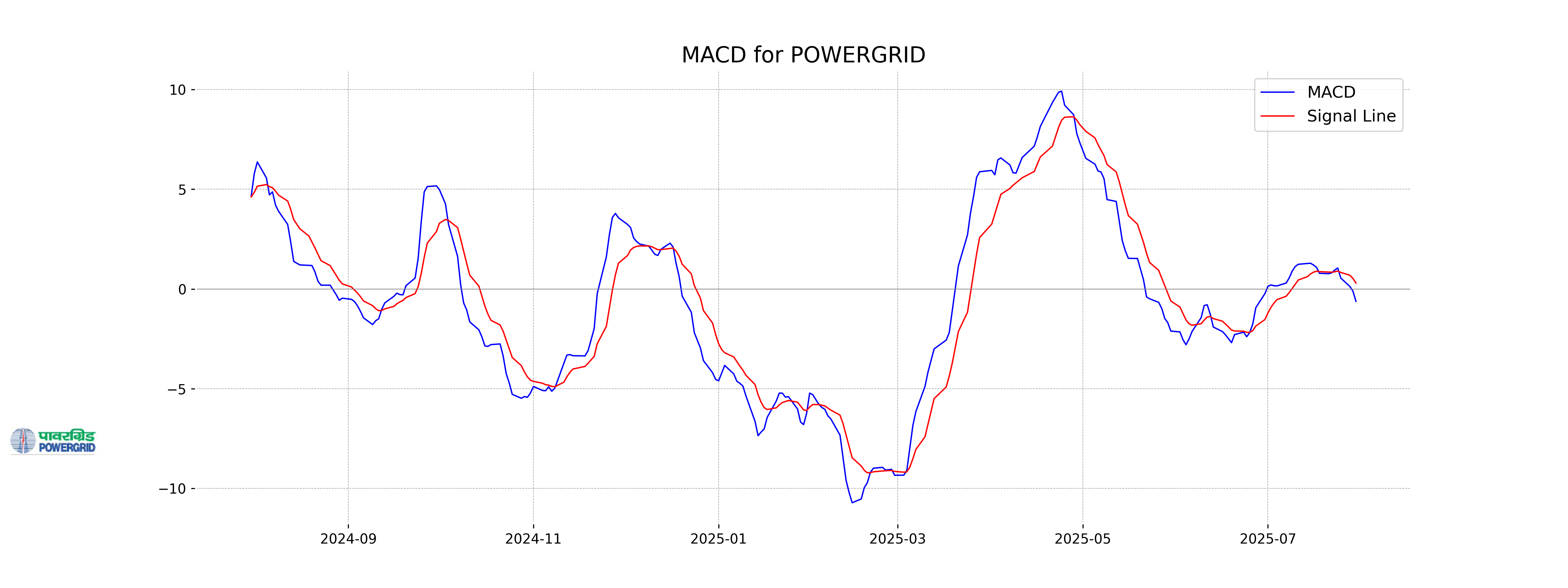

Moving Averages Trend (MACD)

Power Grid's MACD value is -0.6197, which is below the MACD Signal of 0.3012. This suggests a bearish momentum as the MACD line is below the Signal line. Additionally, the RSI of 38.90 indicates weak buying strength.

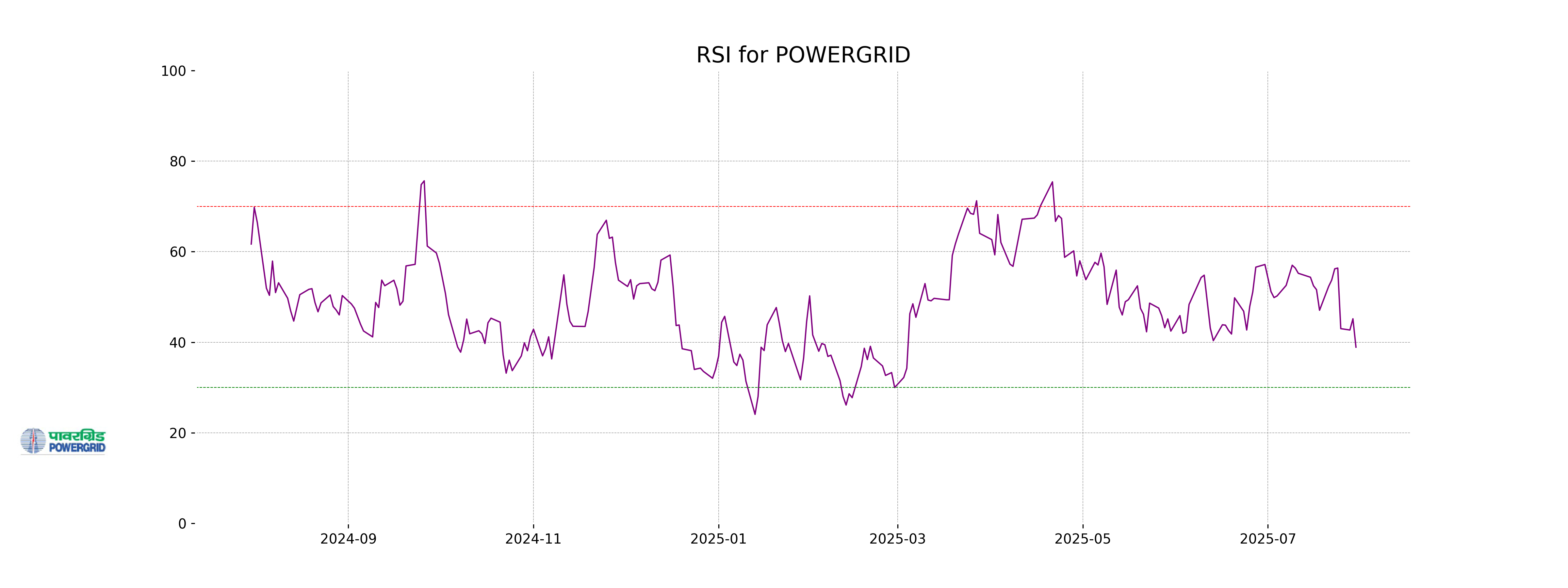

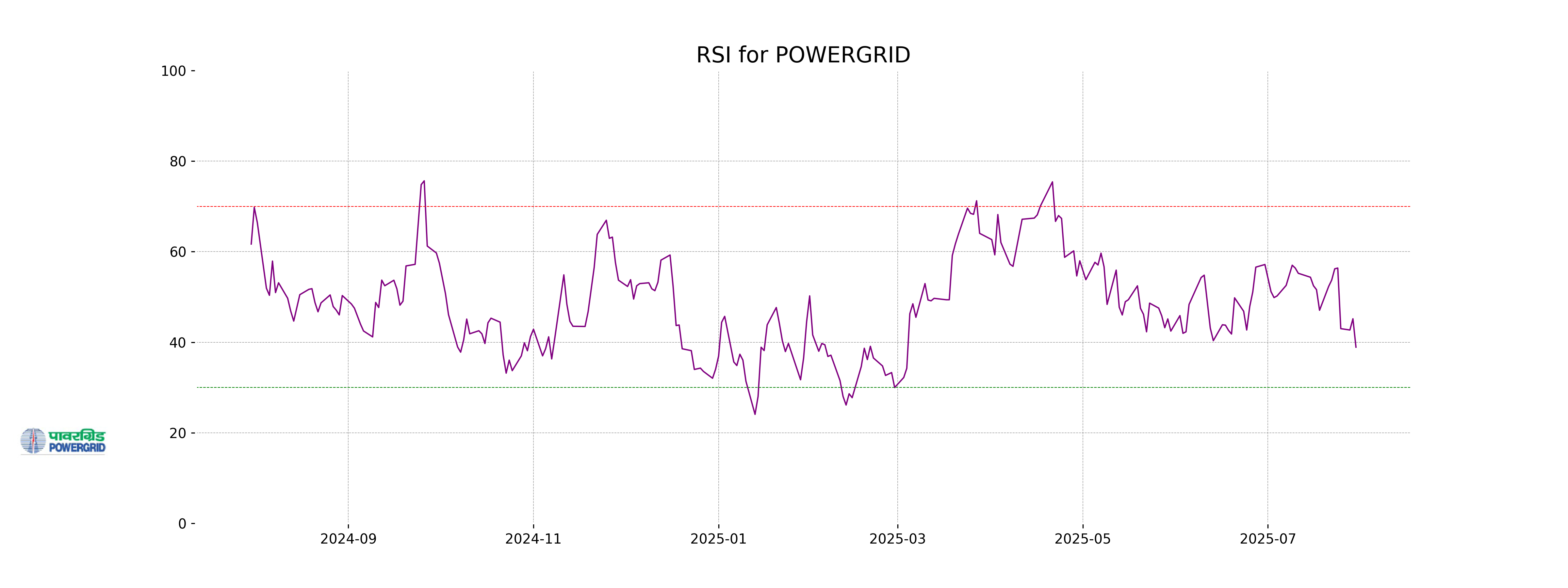

RSI Analysis

RSI Analysis for Power Grid: The Relative Strength Index (RSI) for Power Grid is 38.90, indicating that the stock is nearing oversold territory. Typically, an RSI below 30 is considered oversold, suggesting the potential for a price reversal or upward movement.

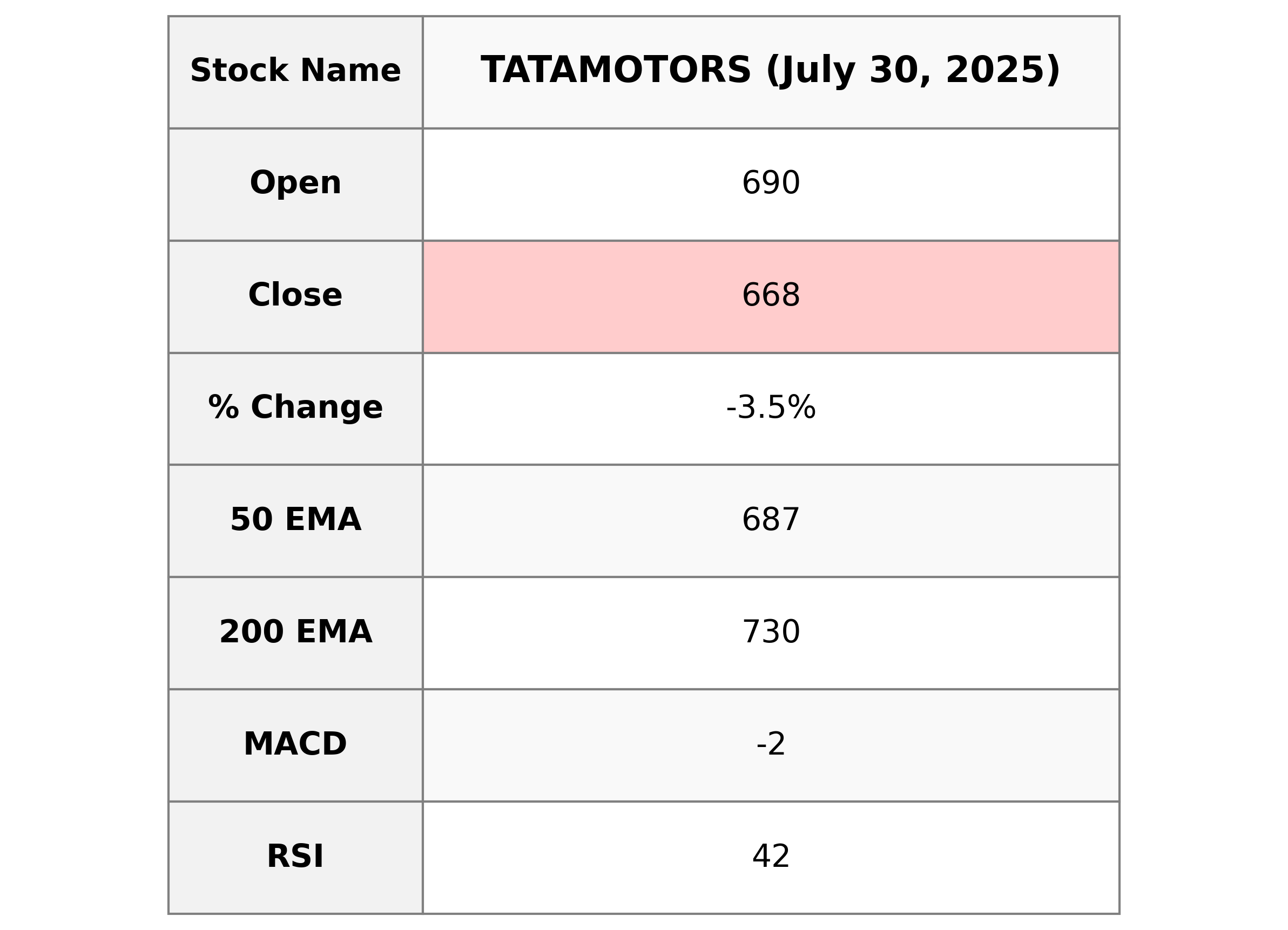

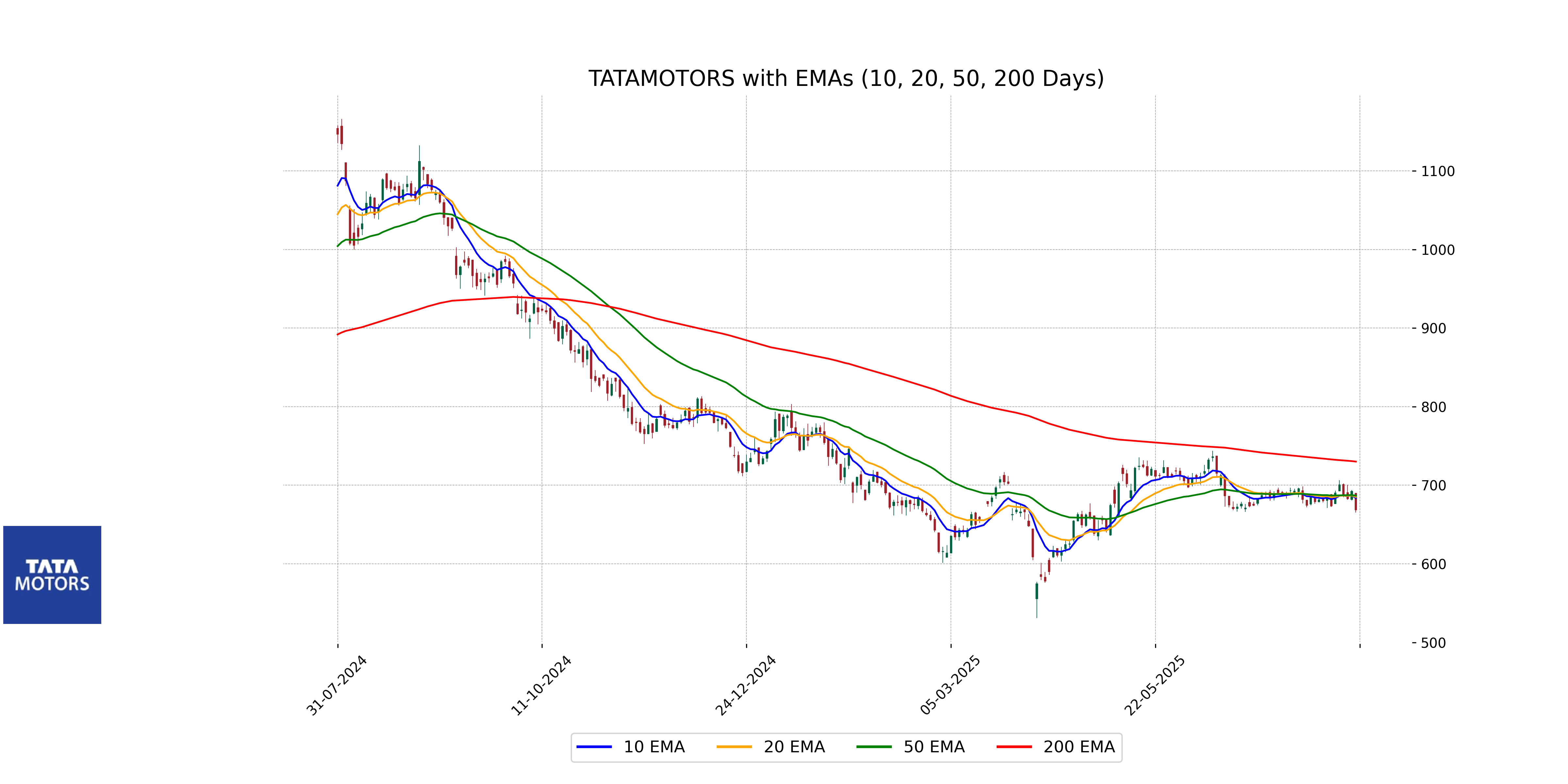

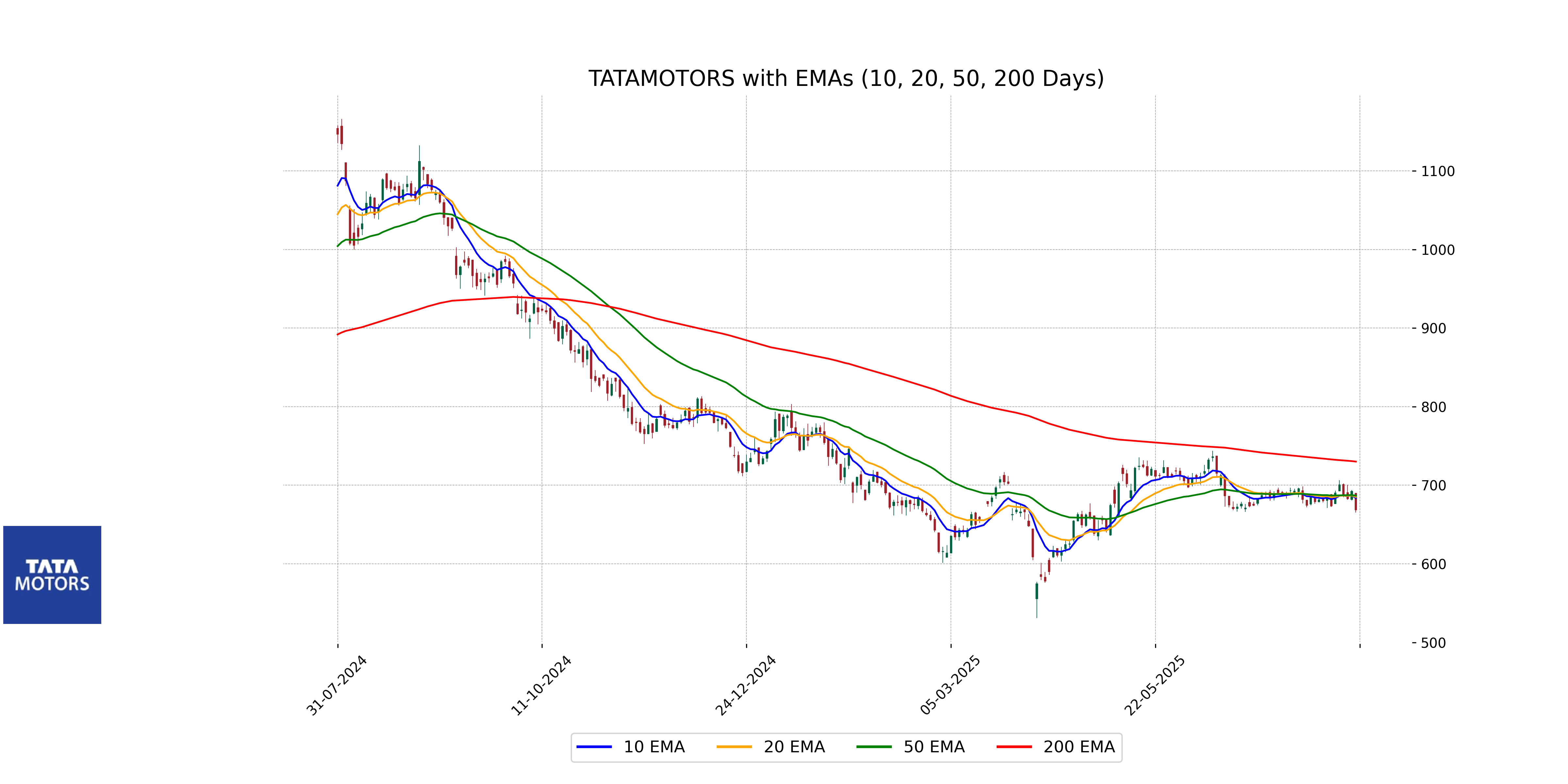

Analysis for Tata Motors - July 30, 2025

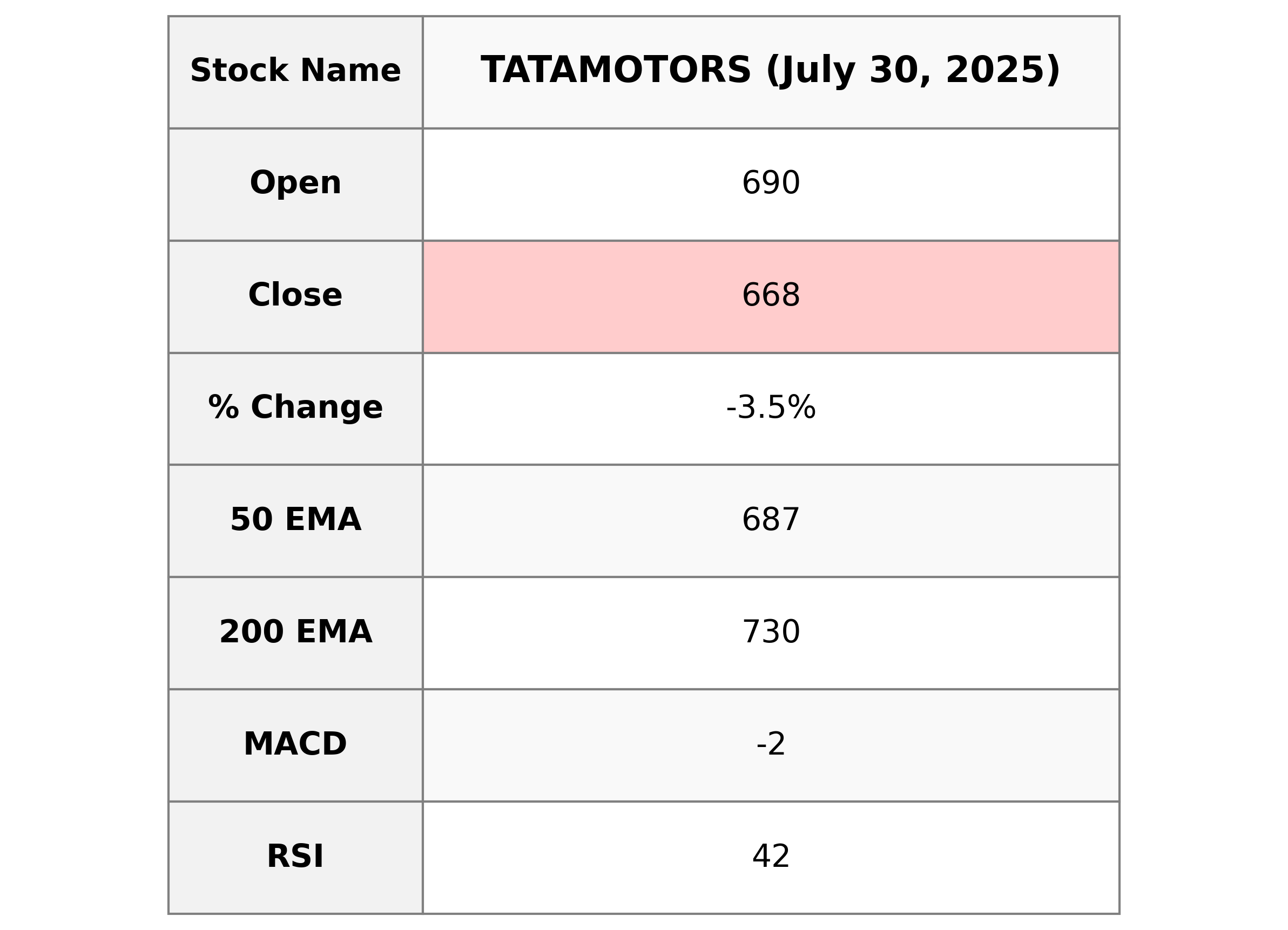

Tata Motors' recent performance shows a stock closing price of 668.45, marking a decrease of approximately -3.45% from the previous close. The stock is trading below its 50-day EMA of 686.80 and the 200-day EMA of 730.12, indicating a bearish trend. With an RSI of 42.19, the stock is nearing the oversold territory, suggesting potential caution for investors.

Relationship with Key Moving Averages

Tata Motors is currently trading below its key moving averages, with a close price of 668.45, which is lower than its 50-day EMA of 686.80 and significantly below the 200-day EMA of 730.12. This positioning indicates potential short-term and long-term bearish momentum.

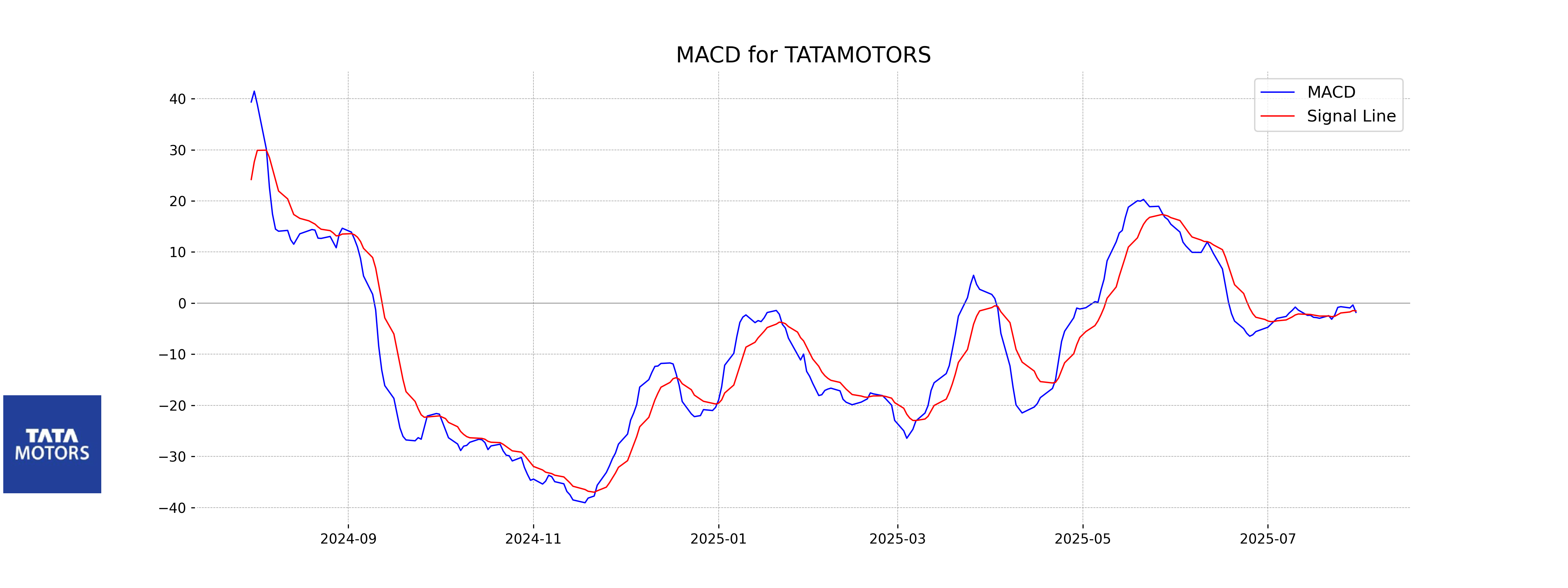

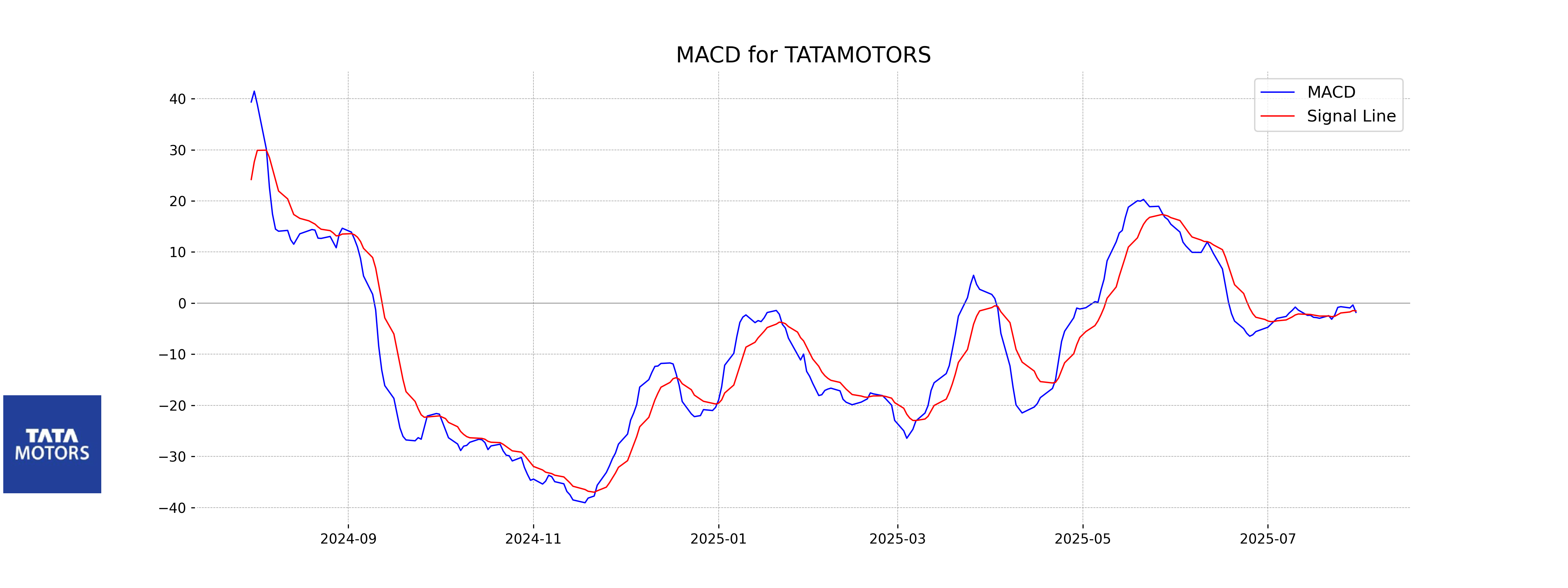

Moving Averages Trend (MACD)

Tata Motors' MACD analysis indicates that the MACD line is currently below the signal line with a value of -1.8169842372691392 compared to the signal line at -1.5320664518148326. This suggests a bearish momentum in the stock, aligning with the declining trend shown by the recent price movements and the RSI value of 42.19405185207866 which also signals weak market sentiment.

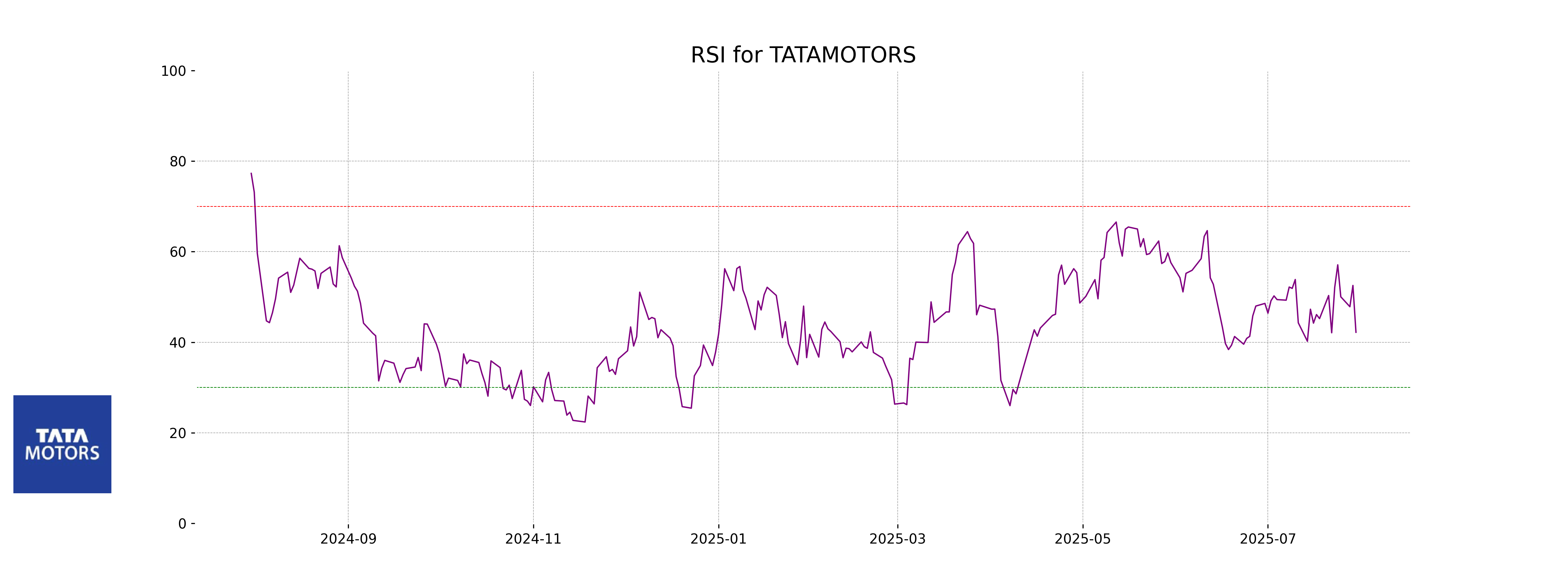

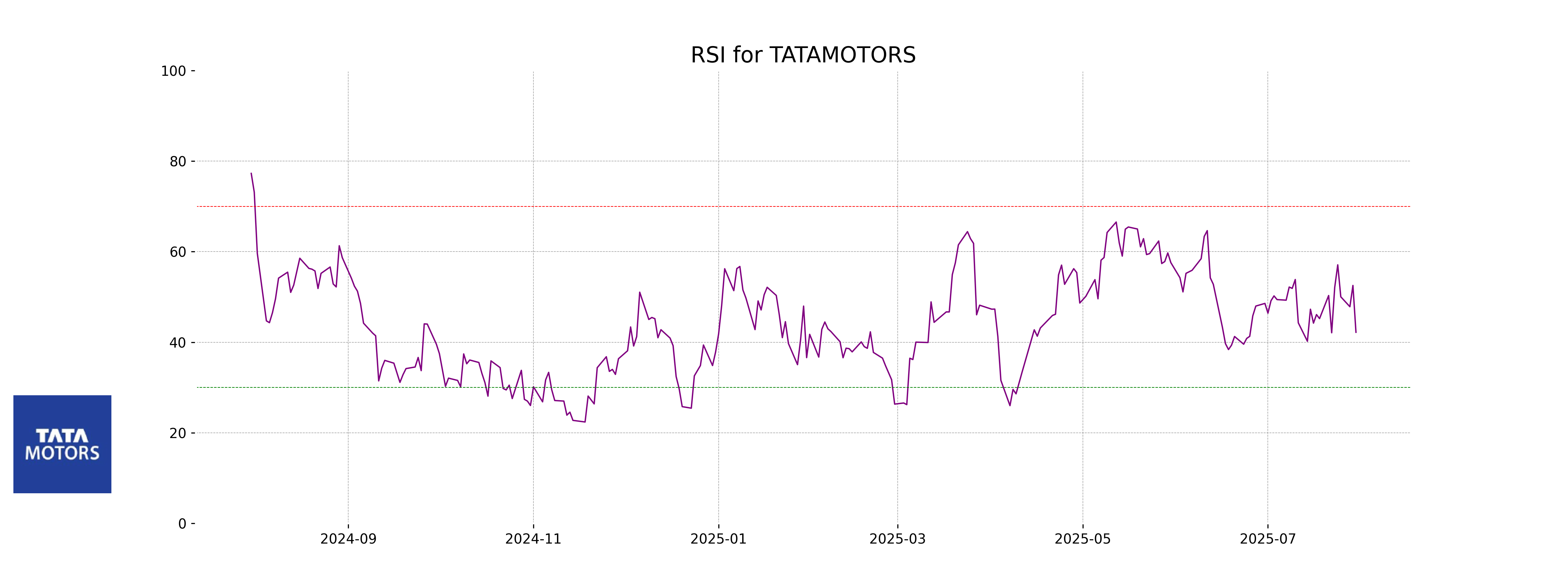

RSI Analysis

The RSI (Relative Strength Index) for Tata Motors is 42.19, which suggests that the stock is currently in a neutral to slightly oversold territory. Typically, an RSI below 30 indicates oversold conditions, while an RSI above 70 suggests overbought conditions. Therefore, Tata Motors may potentially face a slight upward correction if conditions remain favorable.