In this article, we will explore the technical indicators of some of the low-performing stocks on the Indian stock market, including BAJFINANCE, BHARTIARTL, INDUSINDBK, KOTAKBANK, and WIPRO.

By looking at these stocks through the lens of key technical factors, we aim to better understand their price movements, trends, and potential future performance.

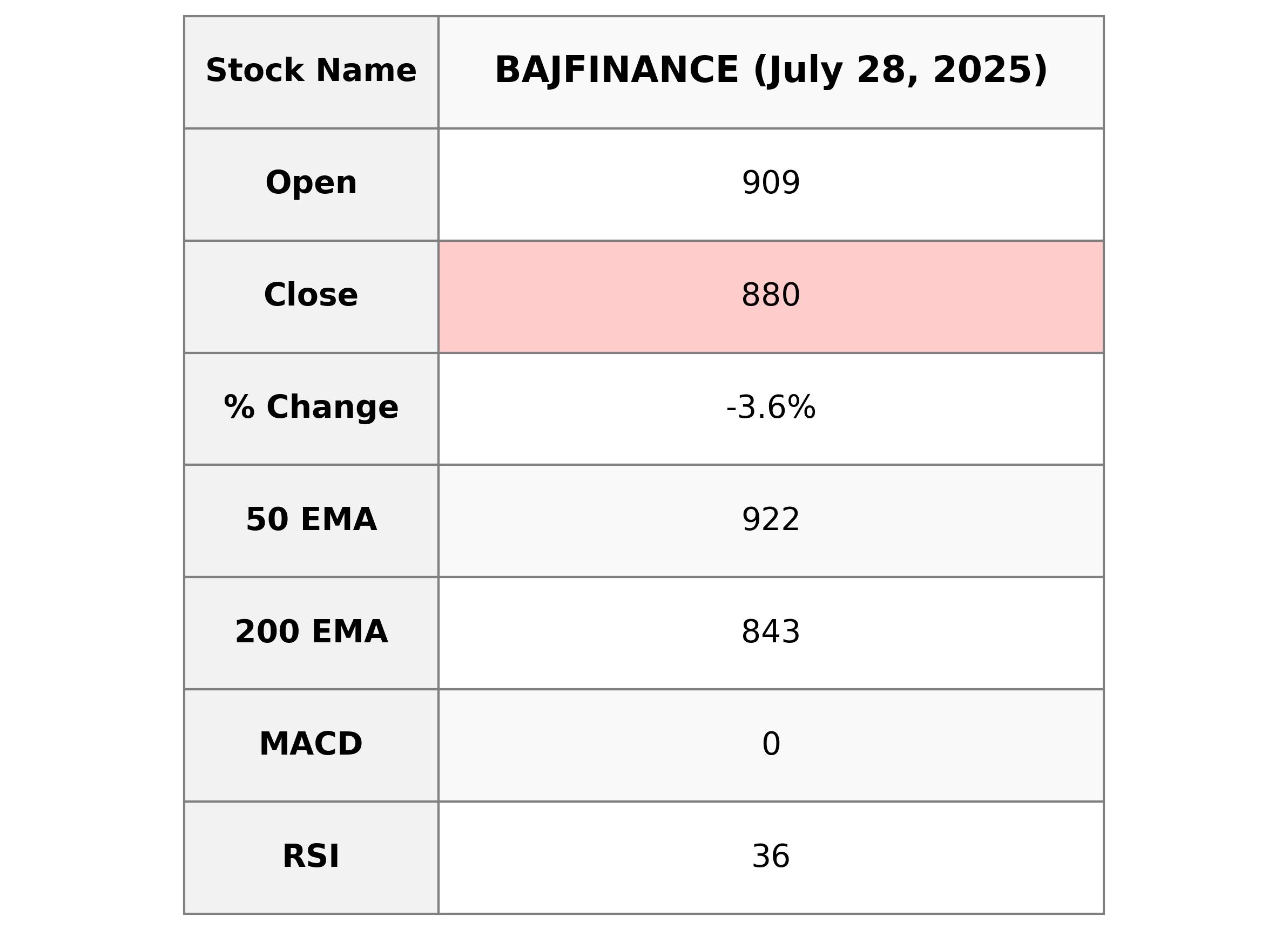

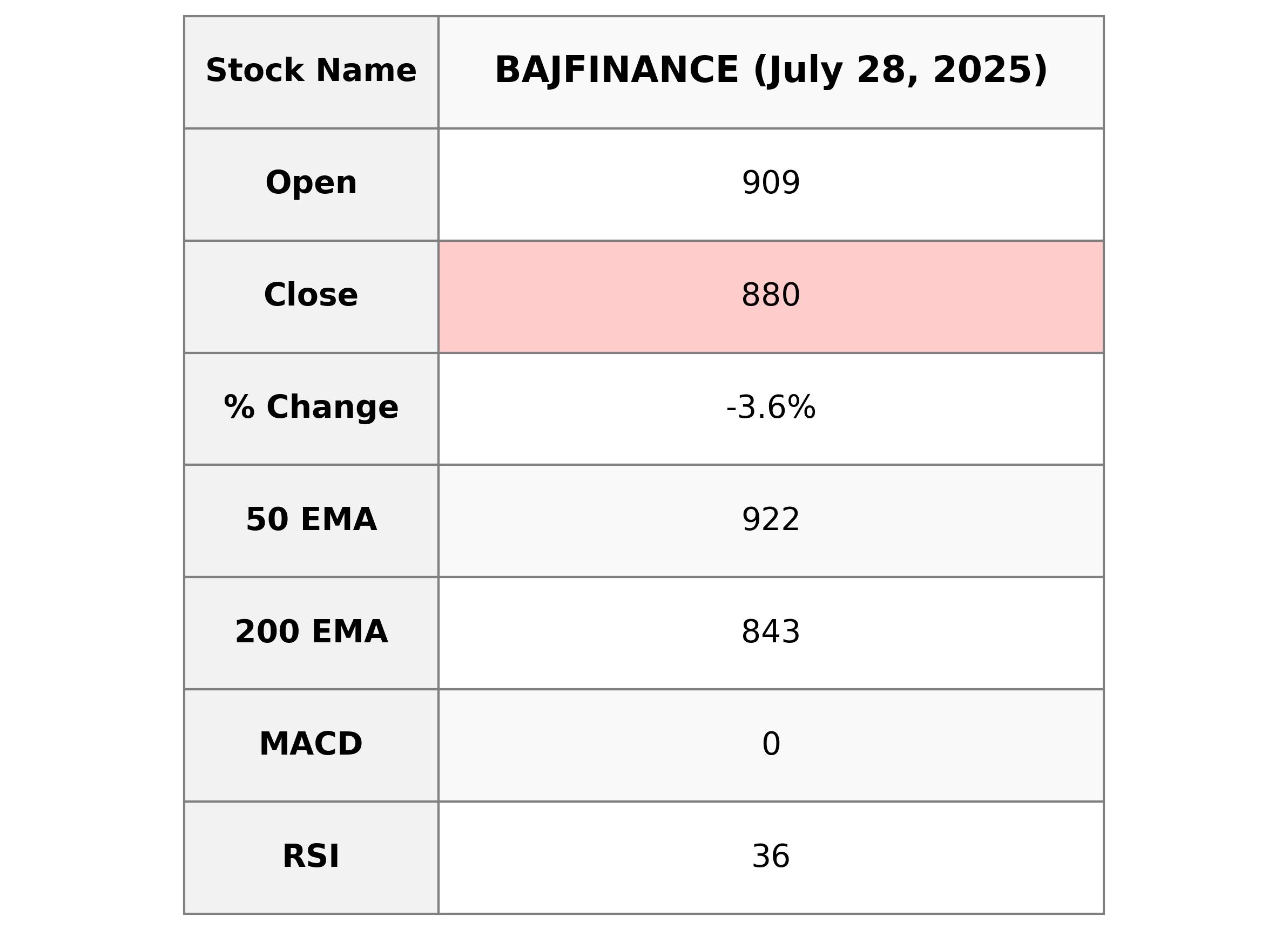

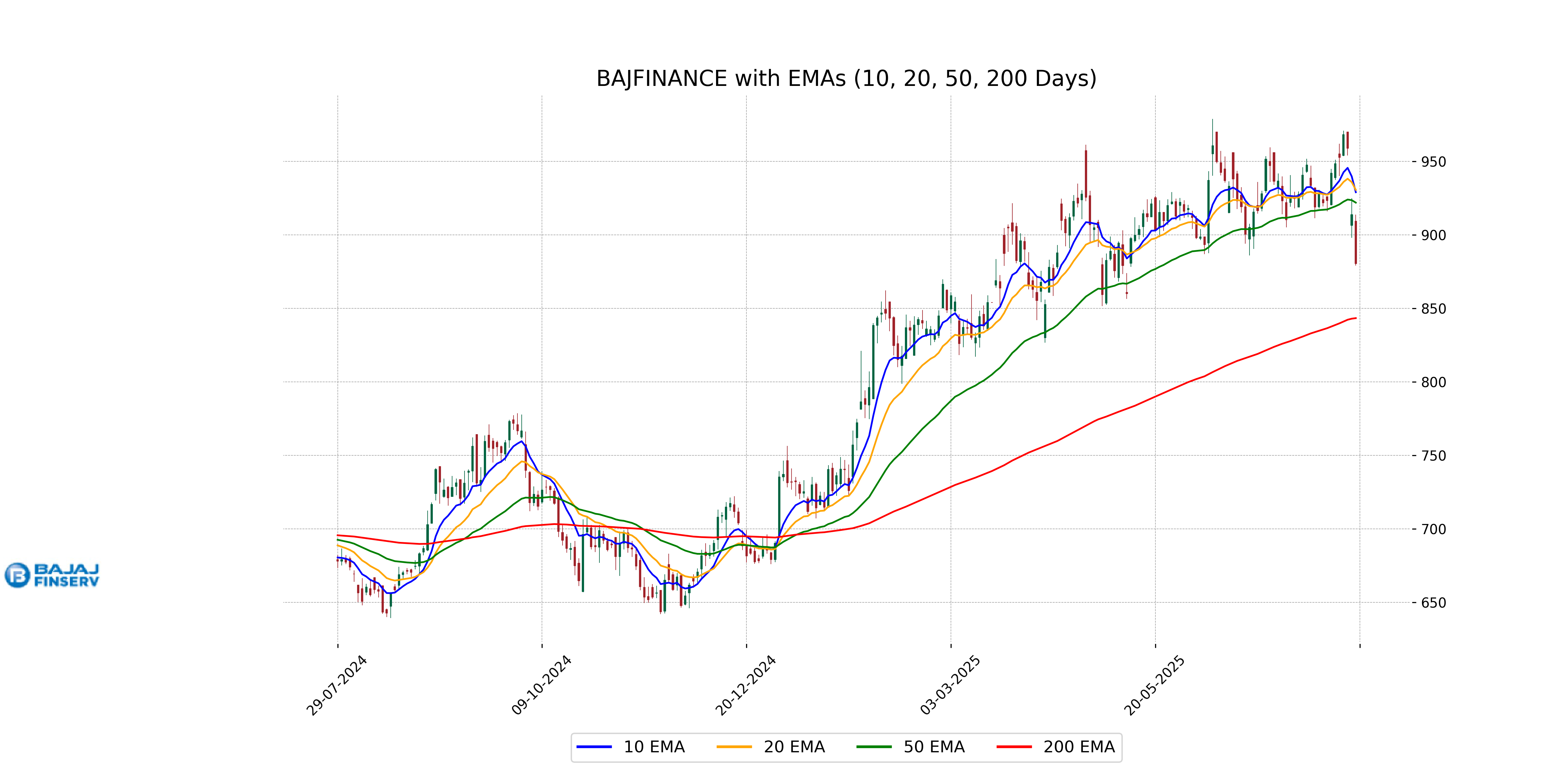

Analysis for Bajaj Finance - July 28, 2025

Bajaj Finance: The stock opened at 909.25 and closed at 880.5, reflecting a decrease of 3.64% from the previous close. The stock's Relative Strength Index (RSI) sits at 36.27, indicating potential oversold conditions. Despite recent volatility, its 200-day exponential moving average of 843.36 suggests a stable long-term trend.

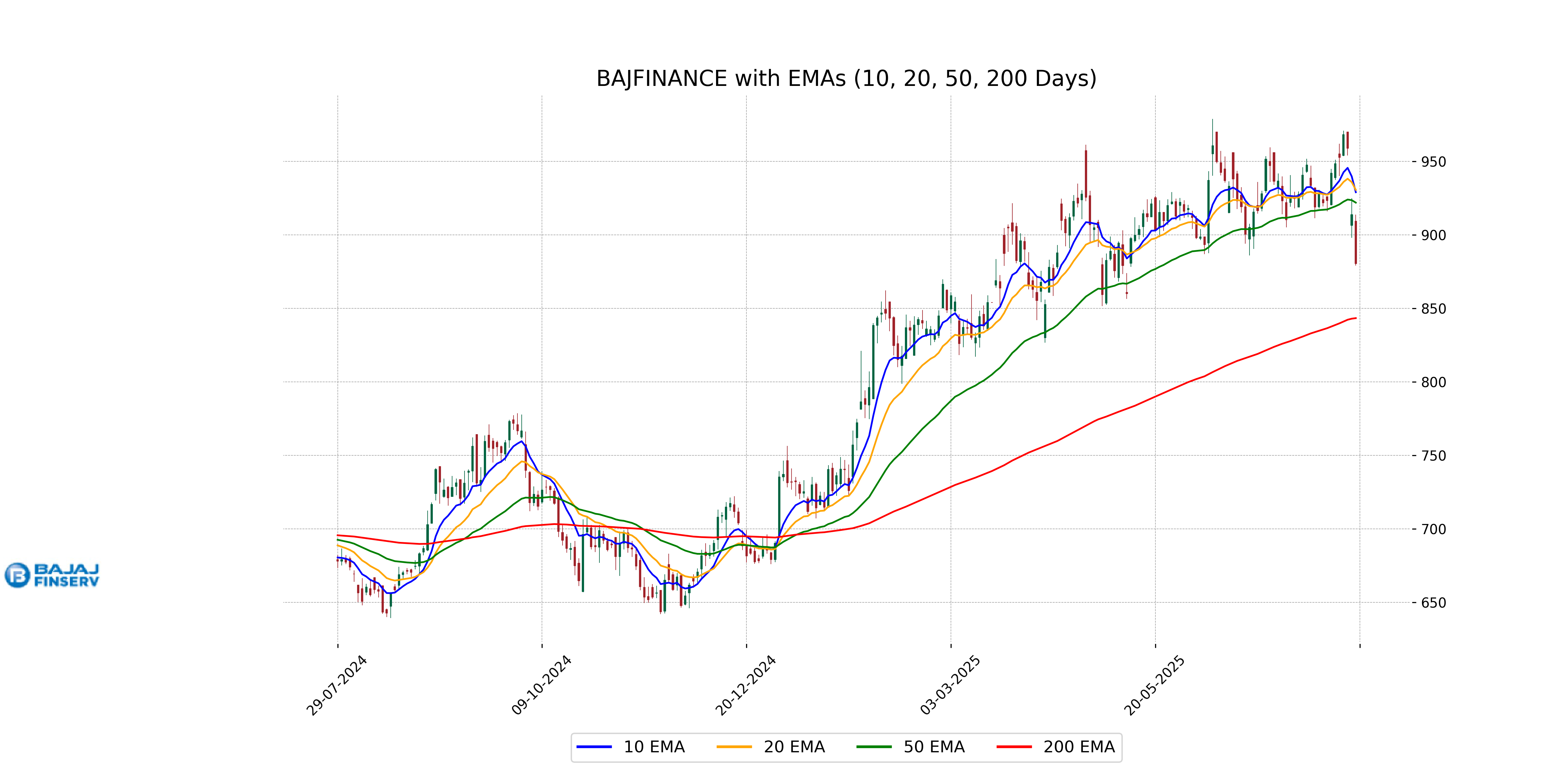

Relationship with Key Moving Averages

Bajaj Finance: The current closing price of 880.5 is below the 50 EMA (921.93), 10 EMA (929.01), and 20 EMA (930.61), indicating a bearish trend in the short to mid-term. Additionally, the stock is trading above the 200 EMA (843.36), suggesting a long-term bullish trend despite current short-term weaknesses.

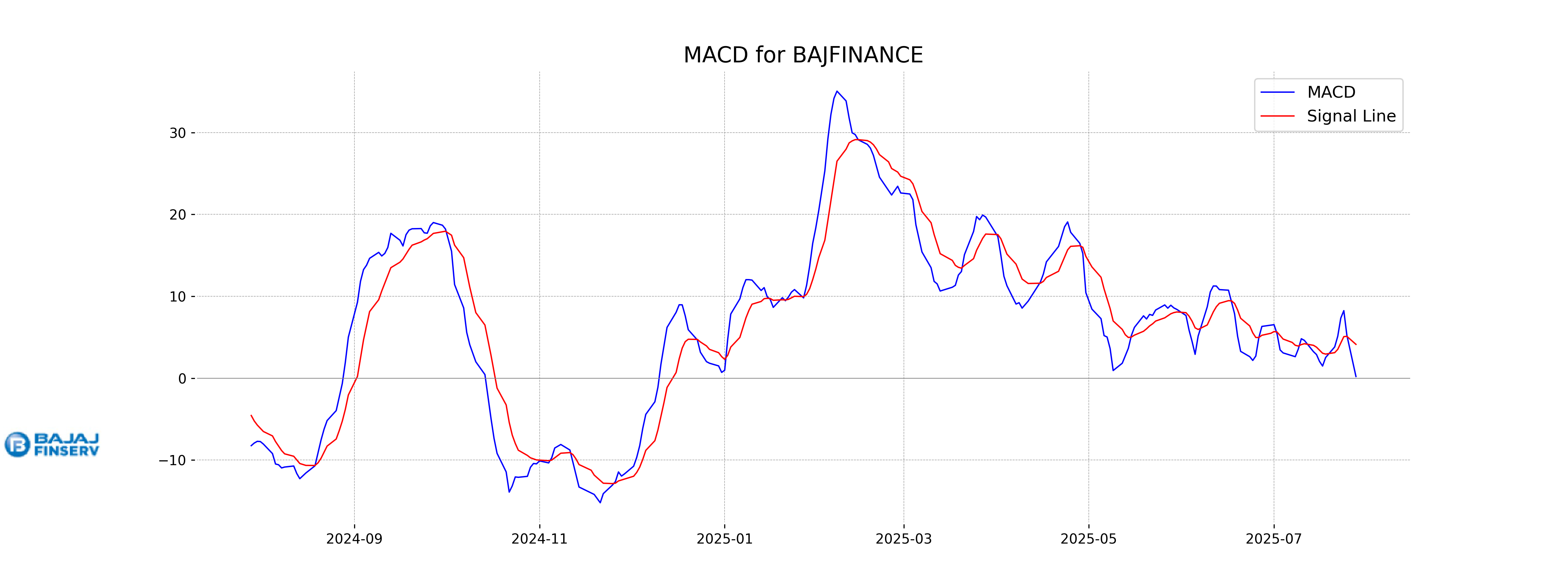

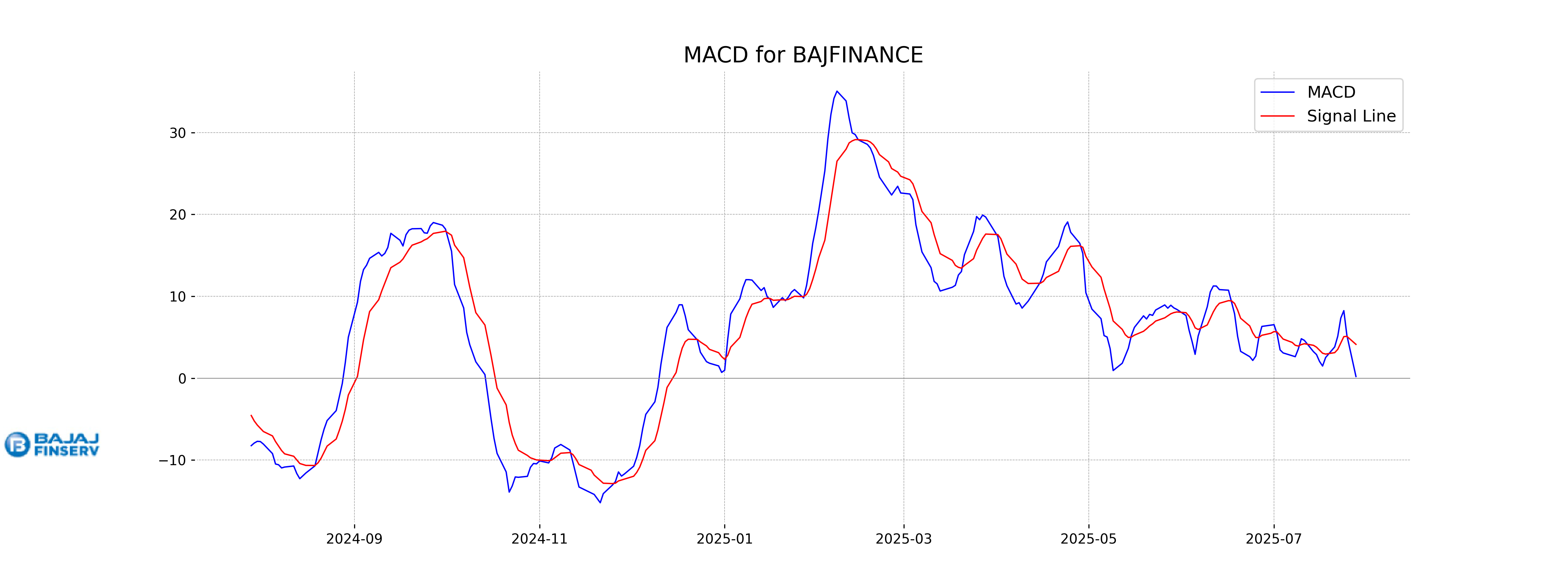

Moving Averages Trend (MACD)

Bajaj Finance's MACD is presently at 0.1986, which is below the signal line of 4.1245. This suggests bearish momentum and potential downward price movement. Investors might want to keep an eye on any further decline or wait for a signal crossover for bullish indications.

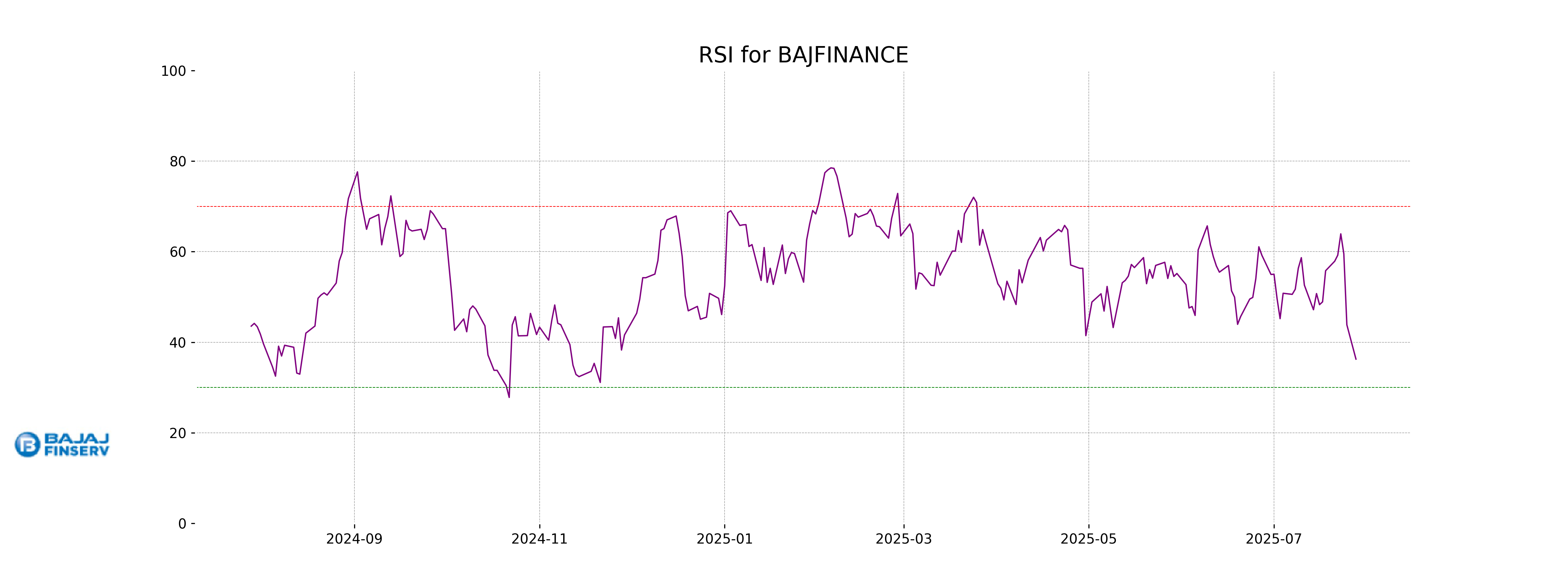

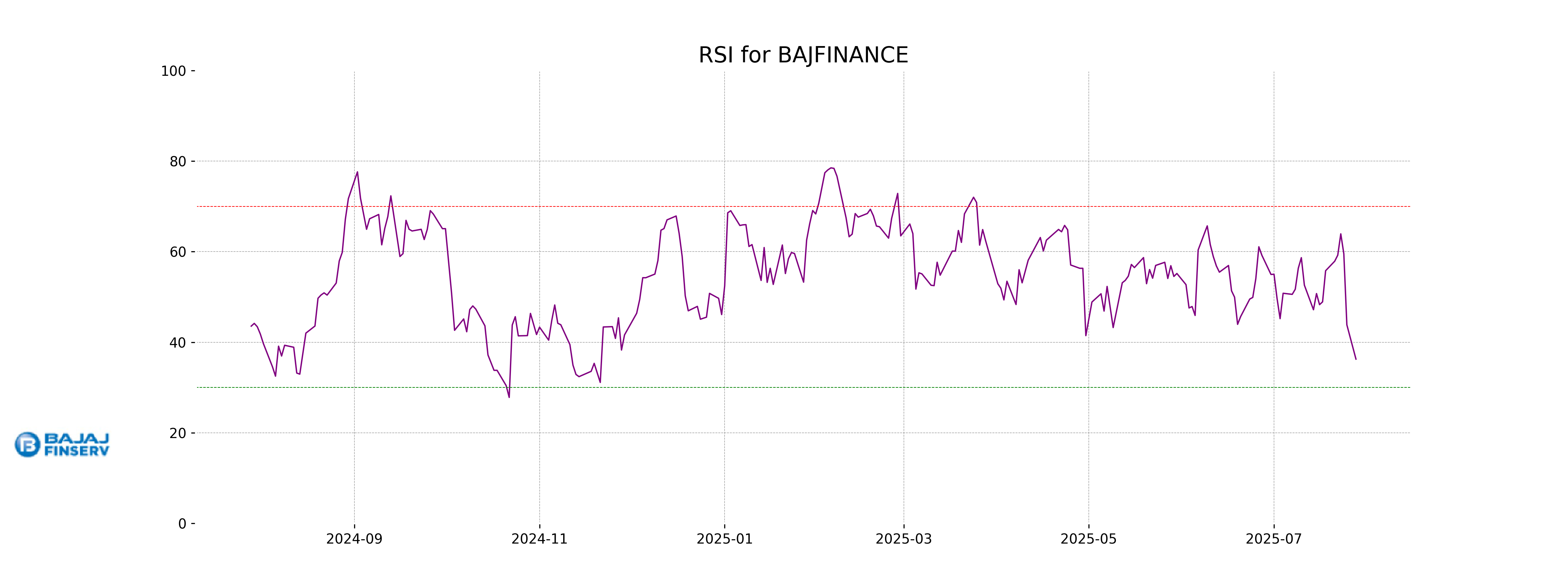

RSI Analysis

Based on the provided RSI of 36.27, Bajaj Finance is currently in the lower range of the RSI scale, which typically indicates that the stock might be approaching oversold conditions. This could suggest potential buying opportunities if the downtrend continues and starts reversing.

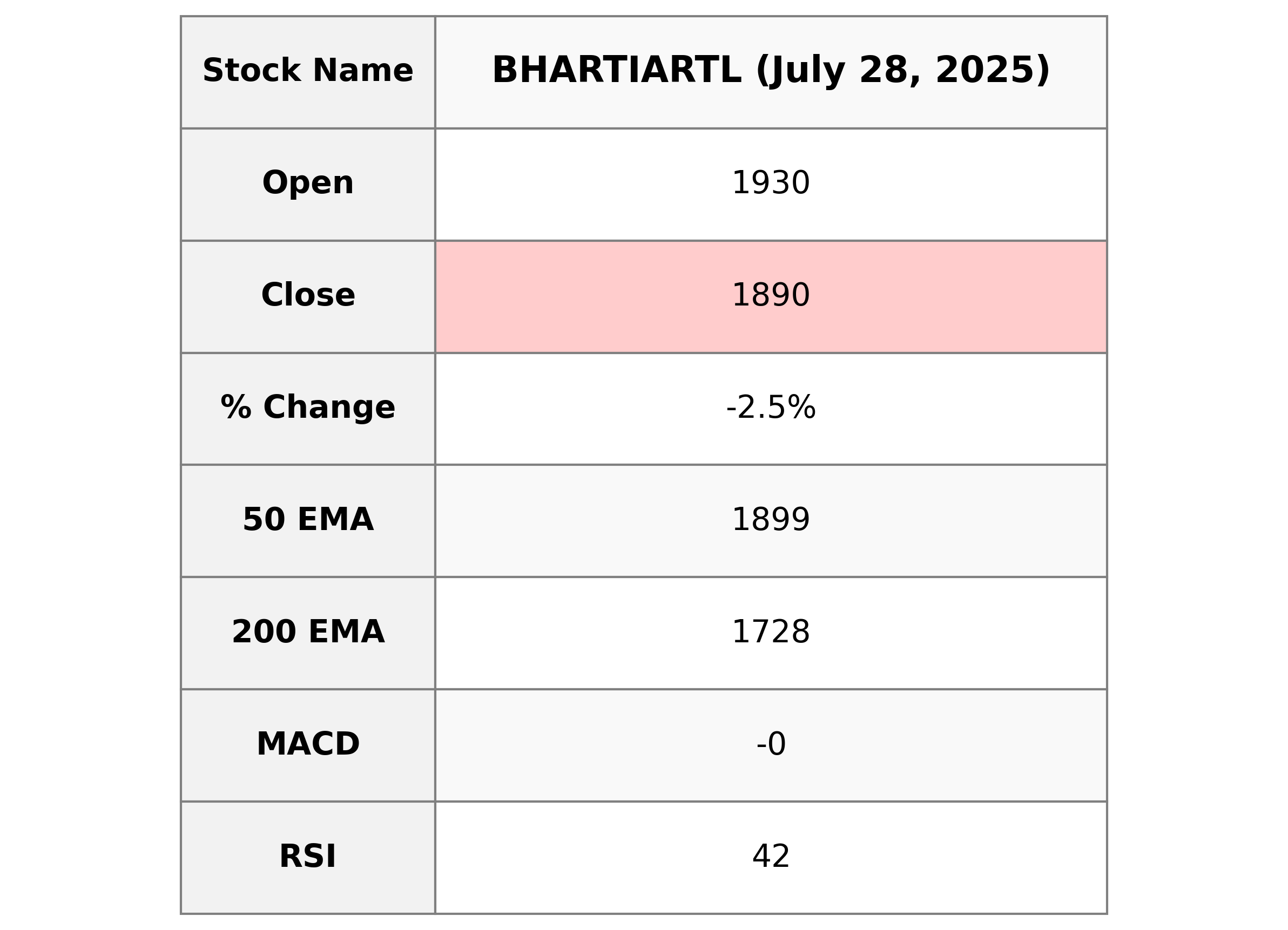

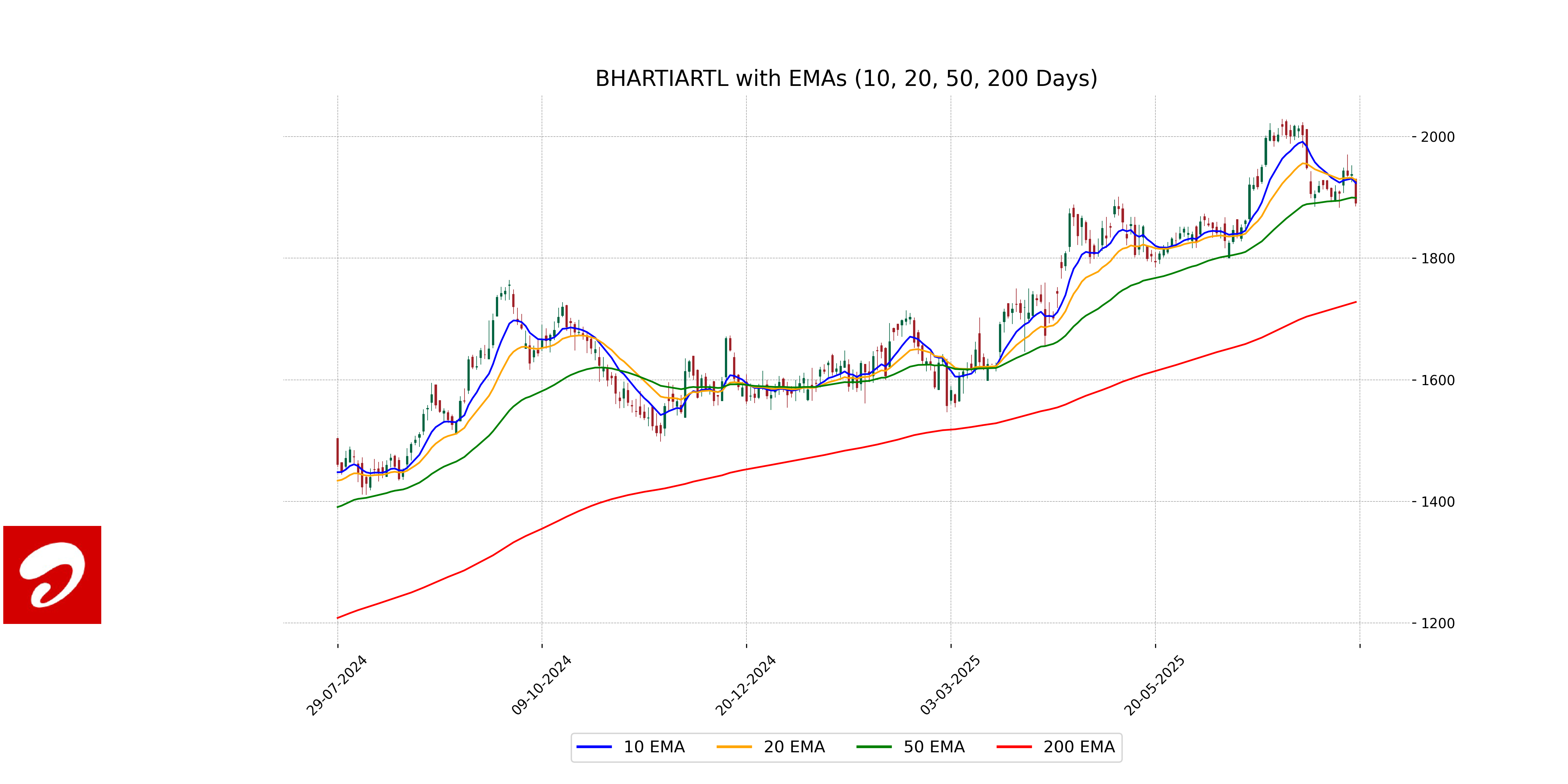

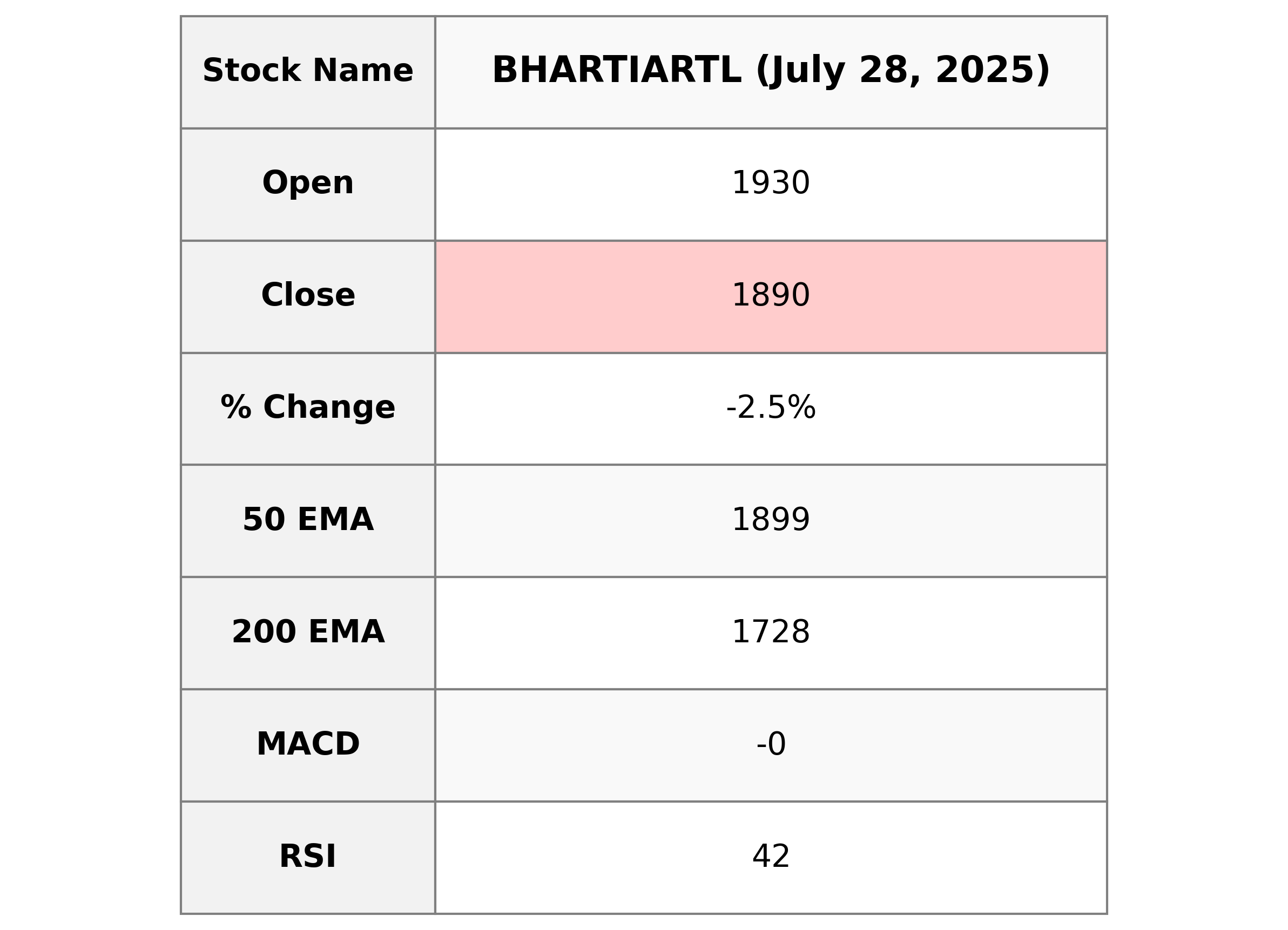

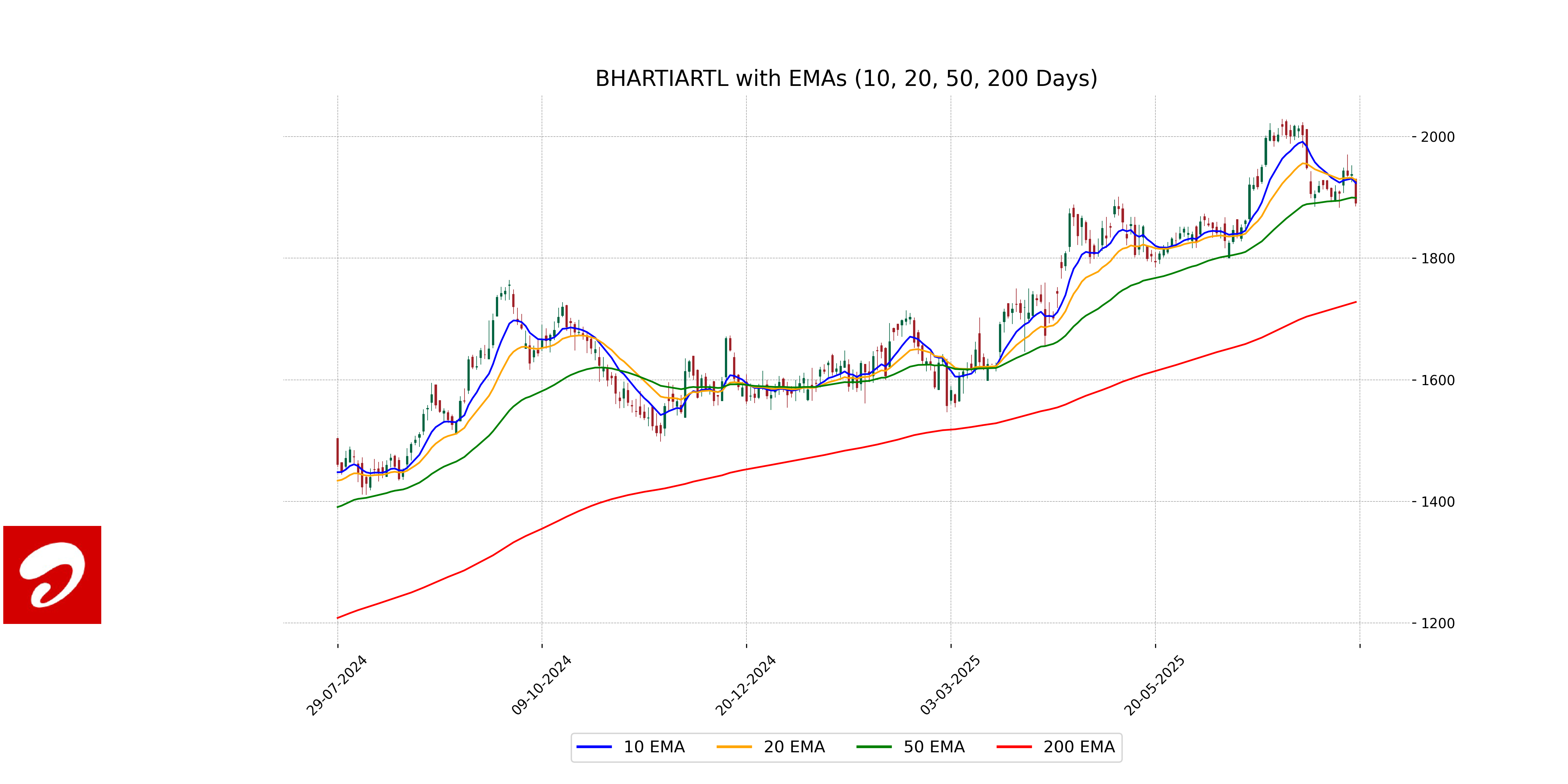

Analysis for Bharti Airtel - July 28, 2025

### Bharti Airtel Performance Bharti Airtel's stock closed at 1890.30, down by approximately 2.46% with a volume of 3,574,663 shares. The current price is below both the 10 and 20-day EMAs, indicating short-term bearish momentum, and the RSI is at 41.92, suggesting mild selling pressure.

Relationship with Key Moving Averages

Bharti Airtel's current closing price of 1890.30 is below its 10-day EMA (1923.53) and 20-day EMA (1928.48), suggesting a short-term bearish trend. However, it remains marginally below the 50-day EMA (1899.31), indicating possible consolidation or minor bearish momentum in the medium term.

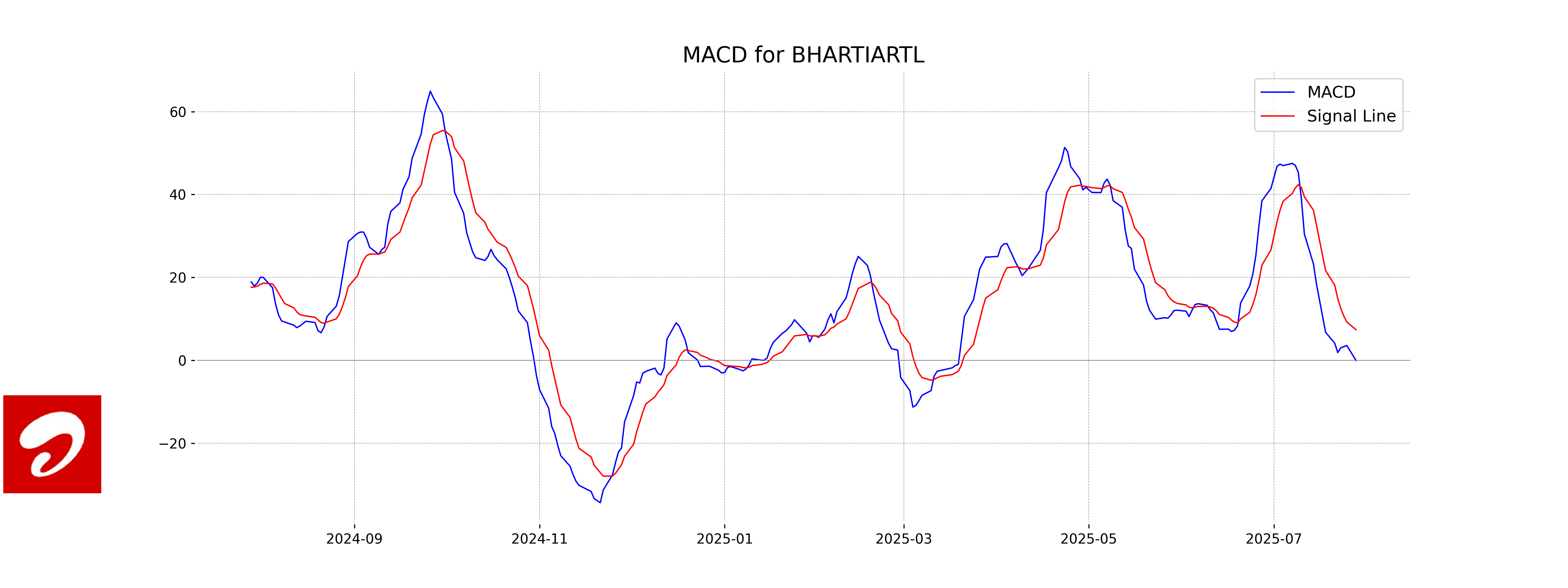

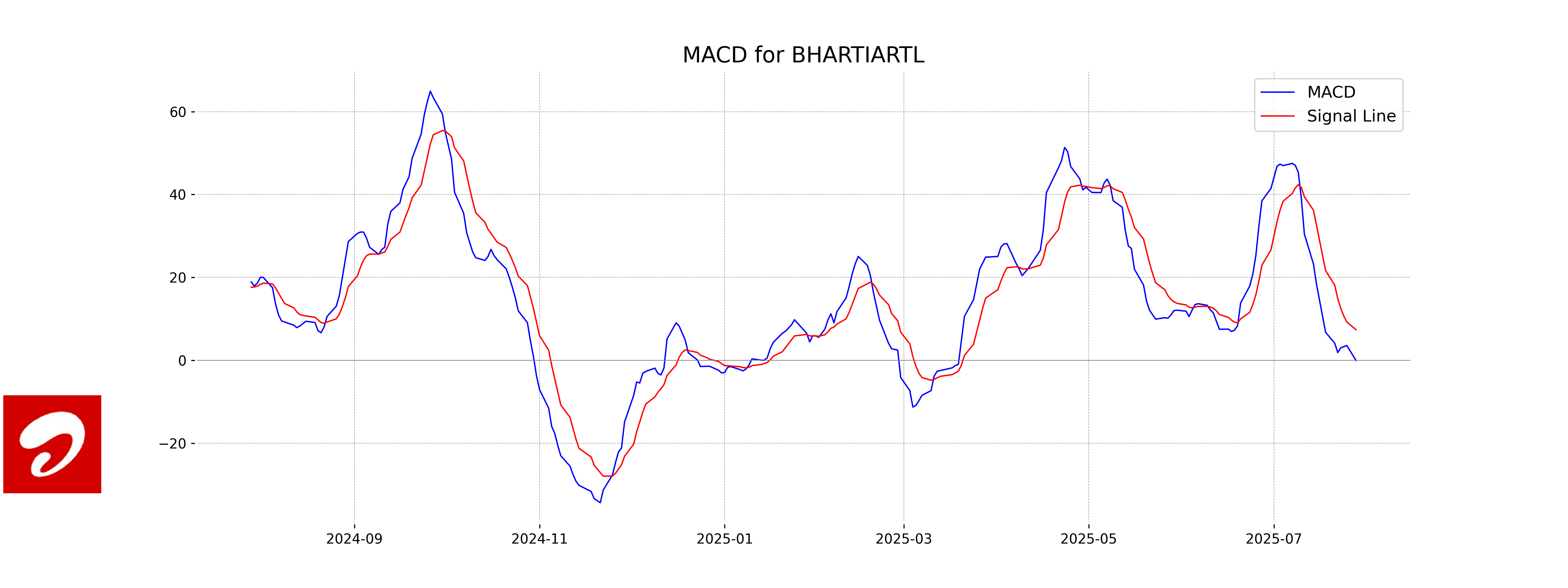

Moving Averages Trend (MACD)

MACD Analysis for Bharti Airtel: The MACD for Bharti Airtel is -0.027, which is below the MACD Signal of 7.393. This suggests a potential bearish trend or momentum for the stock as the MACD line is below the signal line.

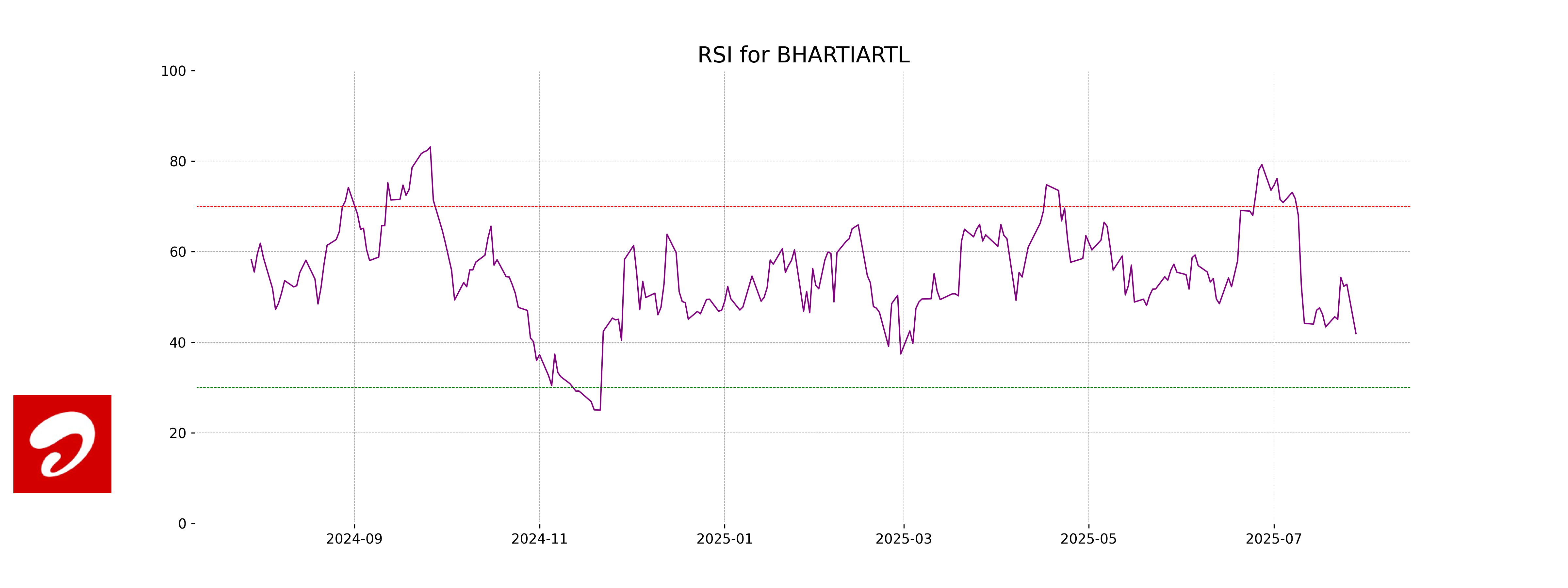

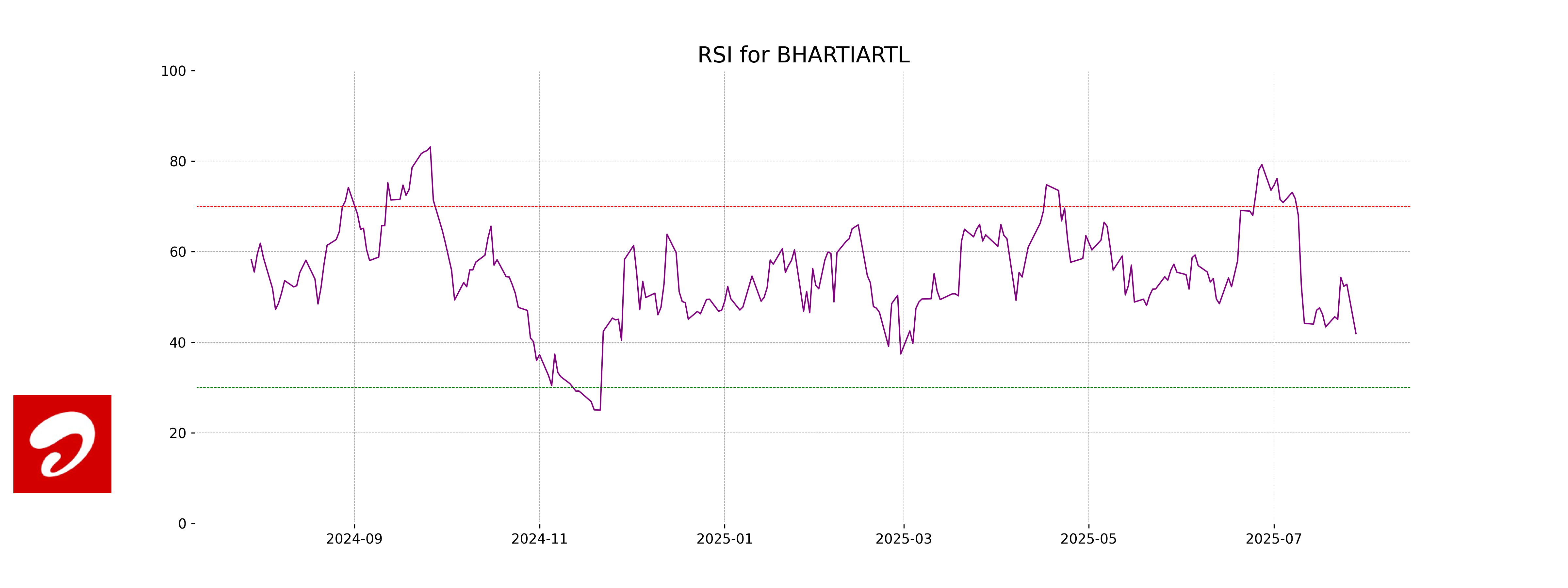

RSI Analysis

The RSI (Relative Strength Index) for Bharti Airtel is currently at 41.92, which suggests that the stock is approaching the oversold territory. RSI values below 30 generally indicate that the security may be undervalued or oversold, while above 70 suggests overbought conditions. With an RSI close to 42, Bharti Airtel is not in either extreme, but cautious monitoring may be advisable for trend changes.

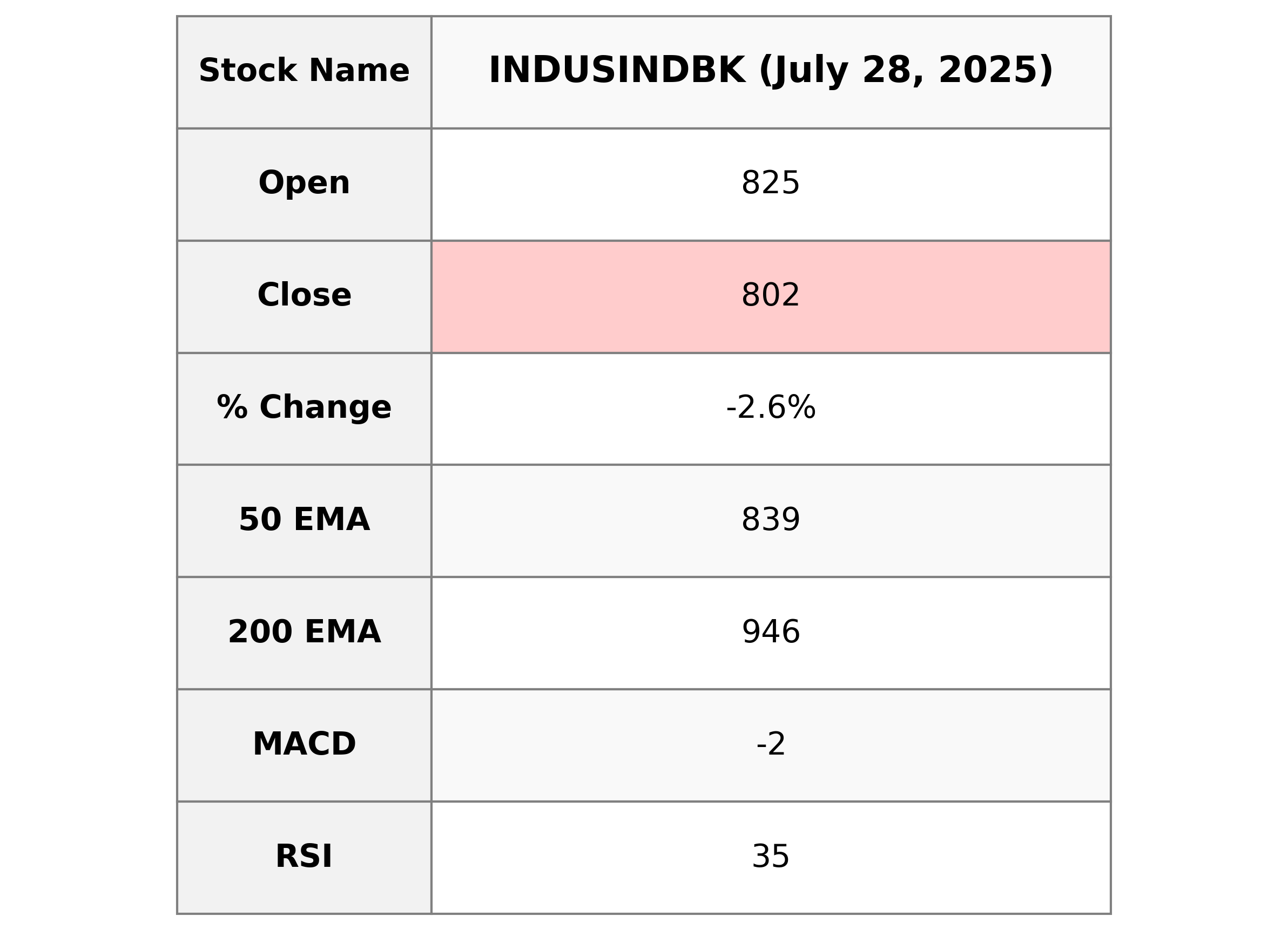

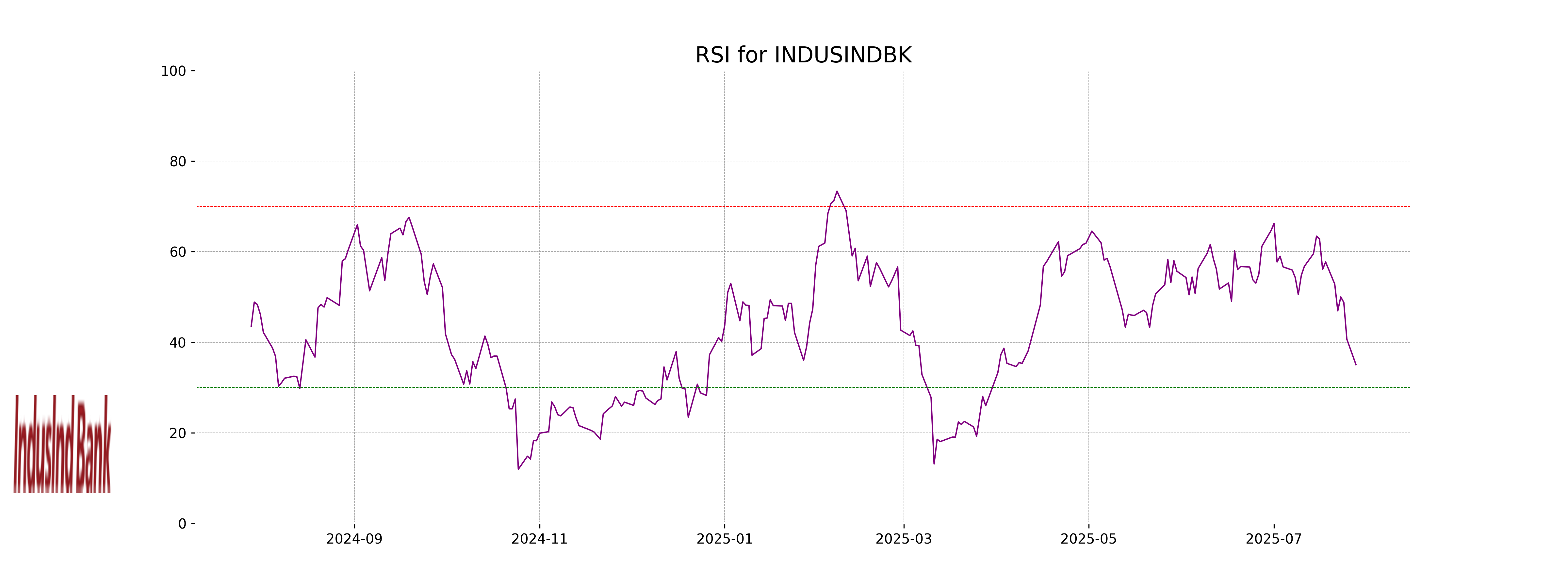

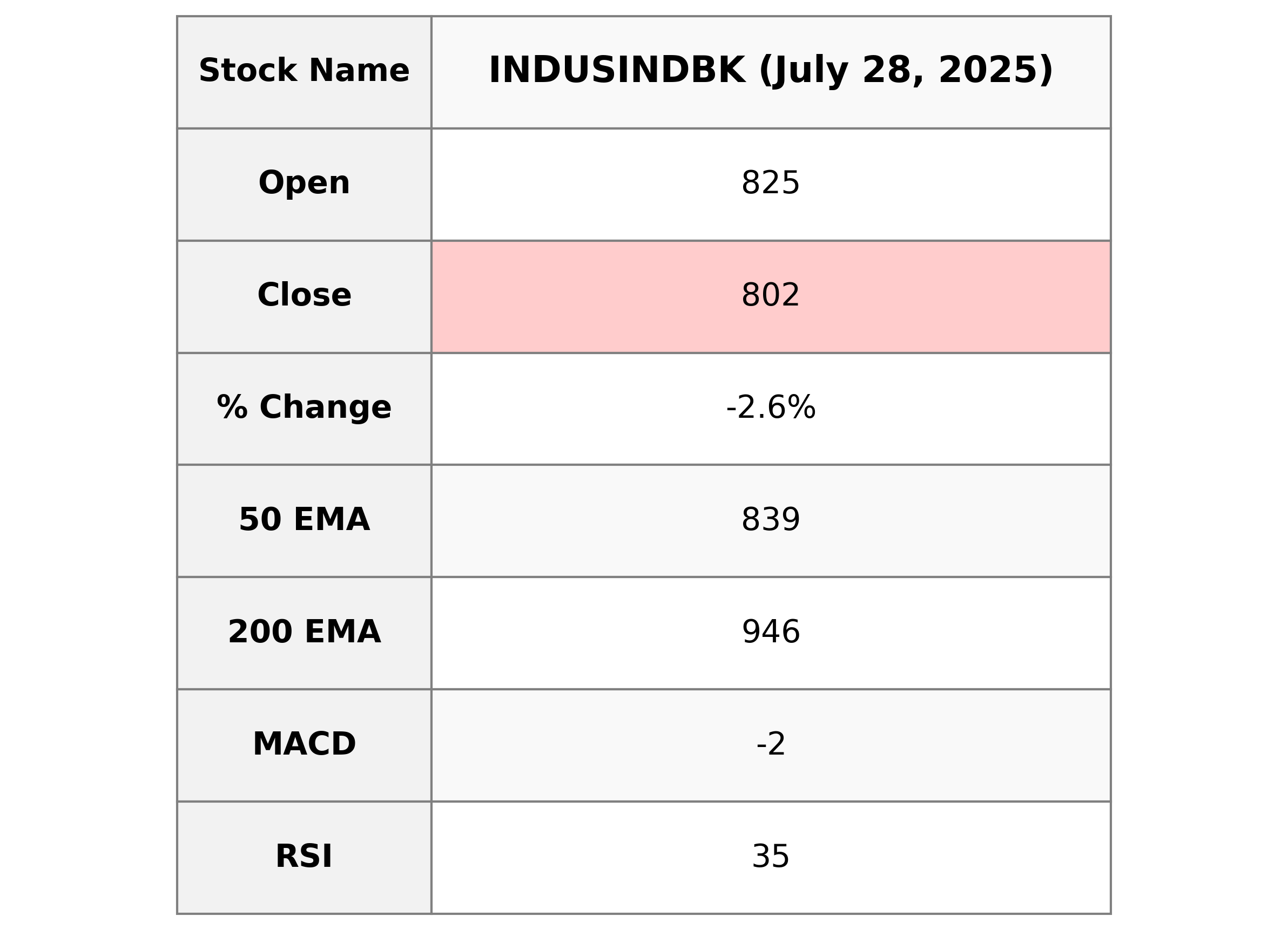

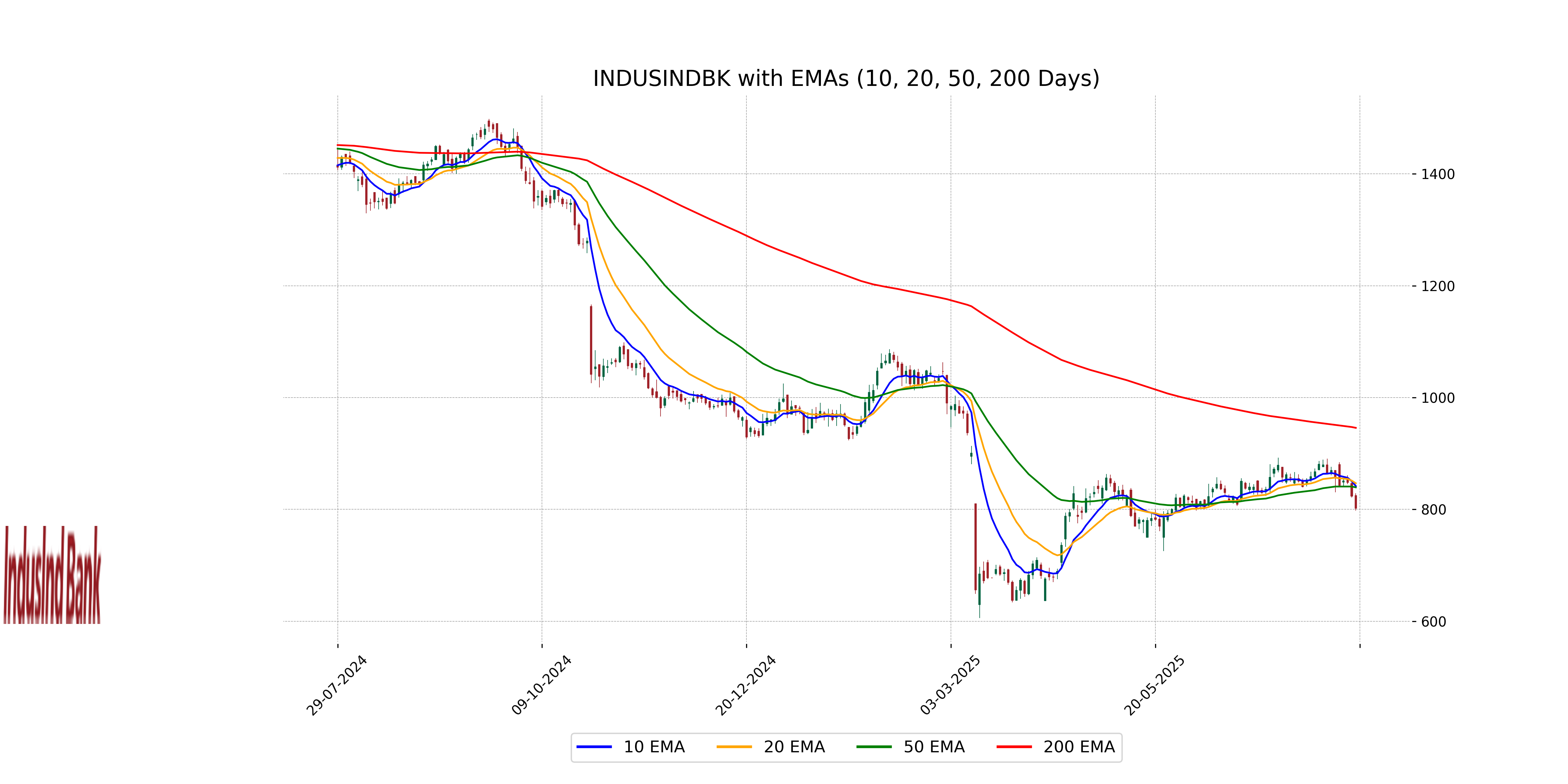

Analysis for IndusInd Bank - July 28, 2025

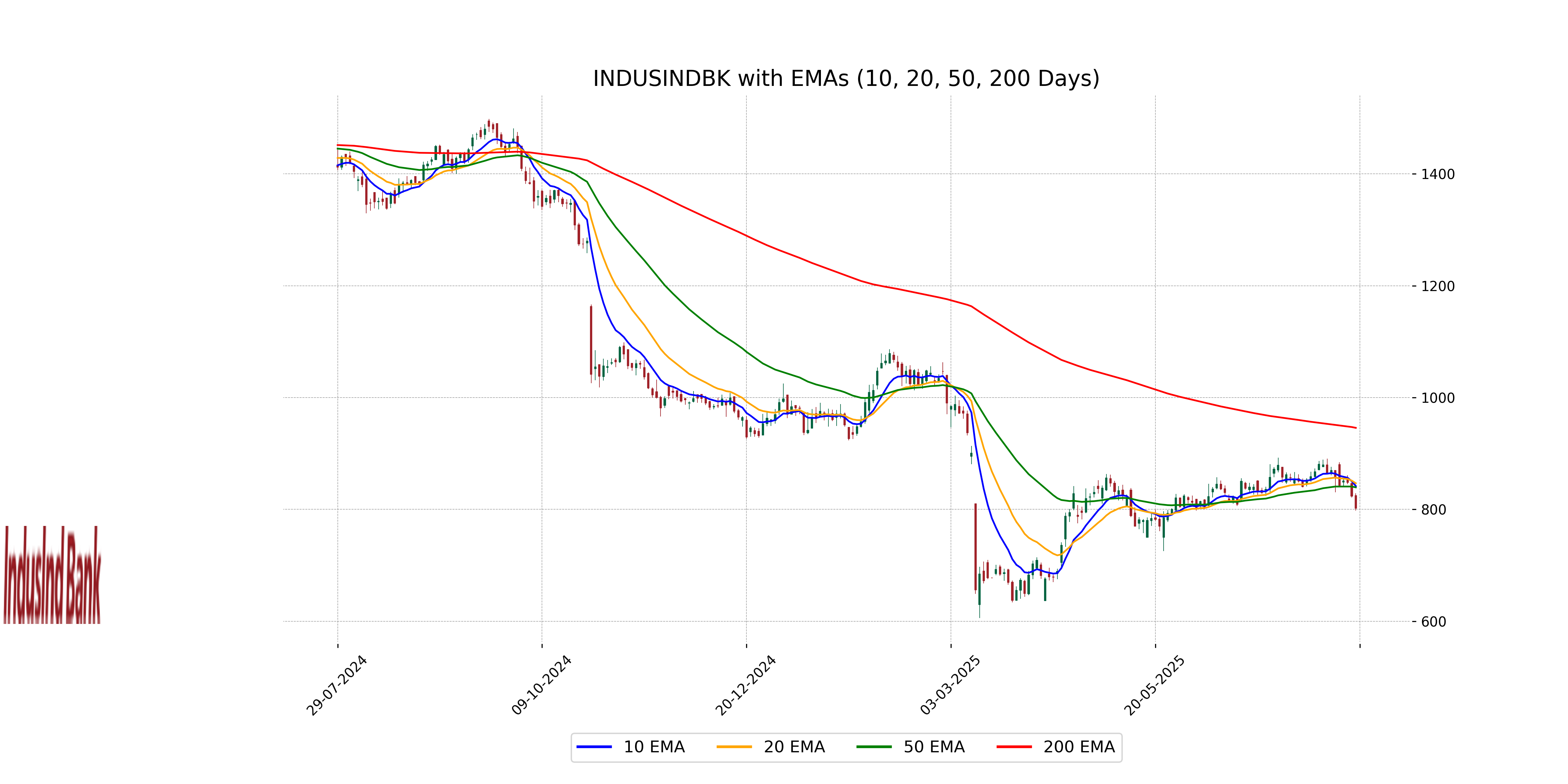

IndusInd Bank experienced a decline in its stock price with a close at 802.05, down by approximately 2.63% from the previous close of 823.70. The stock traded with a high of 828.75 and a low of 798.00, reflecting the recent market volatility. The bank's Relative Strength Index (RSI) indicates oversold conditions, sitting at 35.05, while technical indicators such as the MACD suggest bearish momentum.

Relationship with Key Moving Averages

IndusInd Bank's current close of 802.05 is below its 50 EMA and 10 EMA, which are 839.44 and 841.77 respectively, indicating a potential downtrend in the short-term. Additionally, being below the 200 EMA at 945.88 suggests weakness in the longer-term trend.

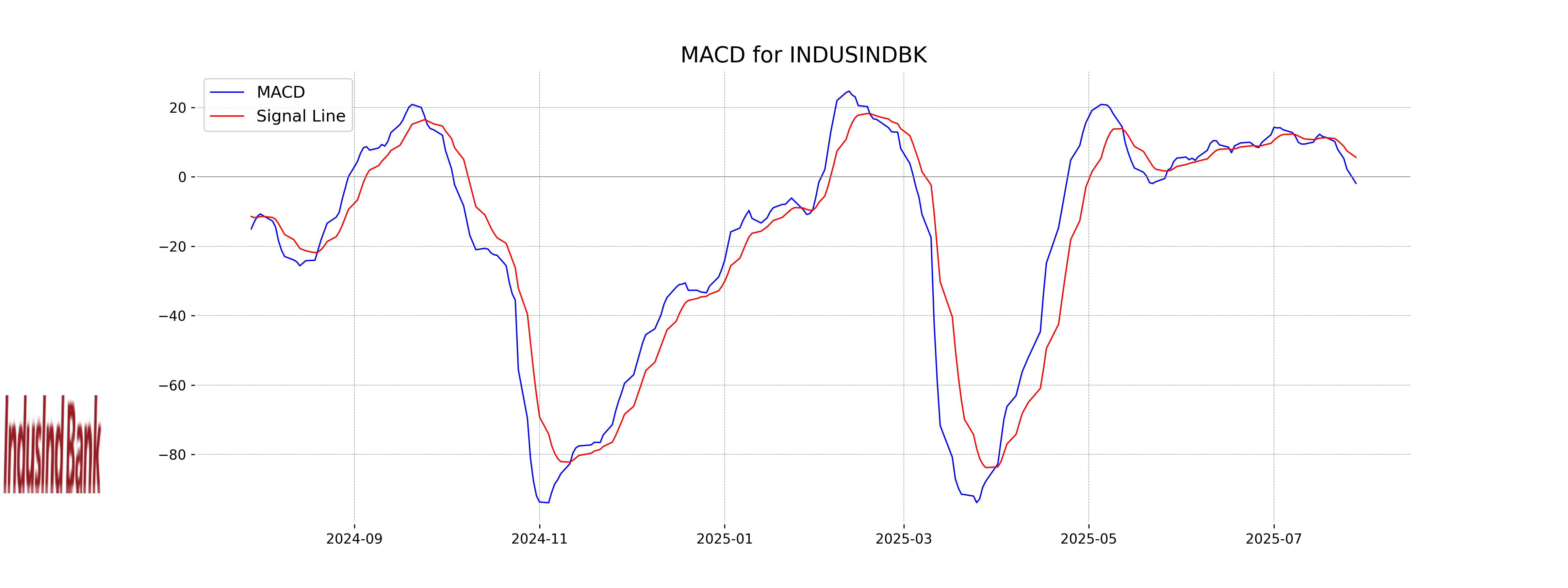

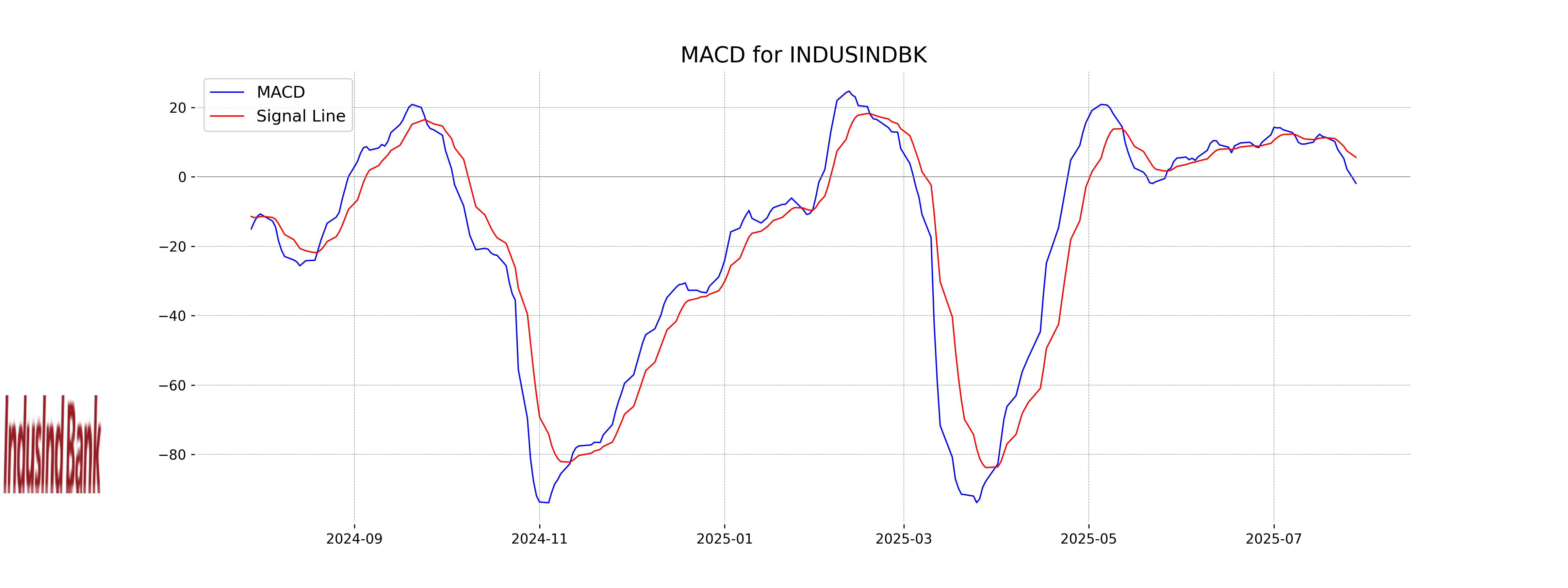

Moving Averages Trend (MACD)

IndusInd Bank's MACD is currently negative at -1.85, while the MACD Signal line is at 5.62, indicating a potential bearish trend. The MACD line crossing below the Signal line suggests that the stock may experience downward momentum in the near term.

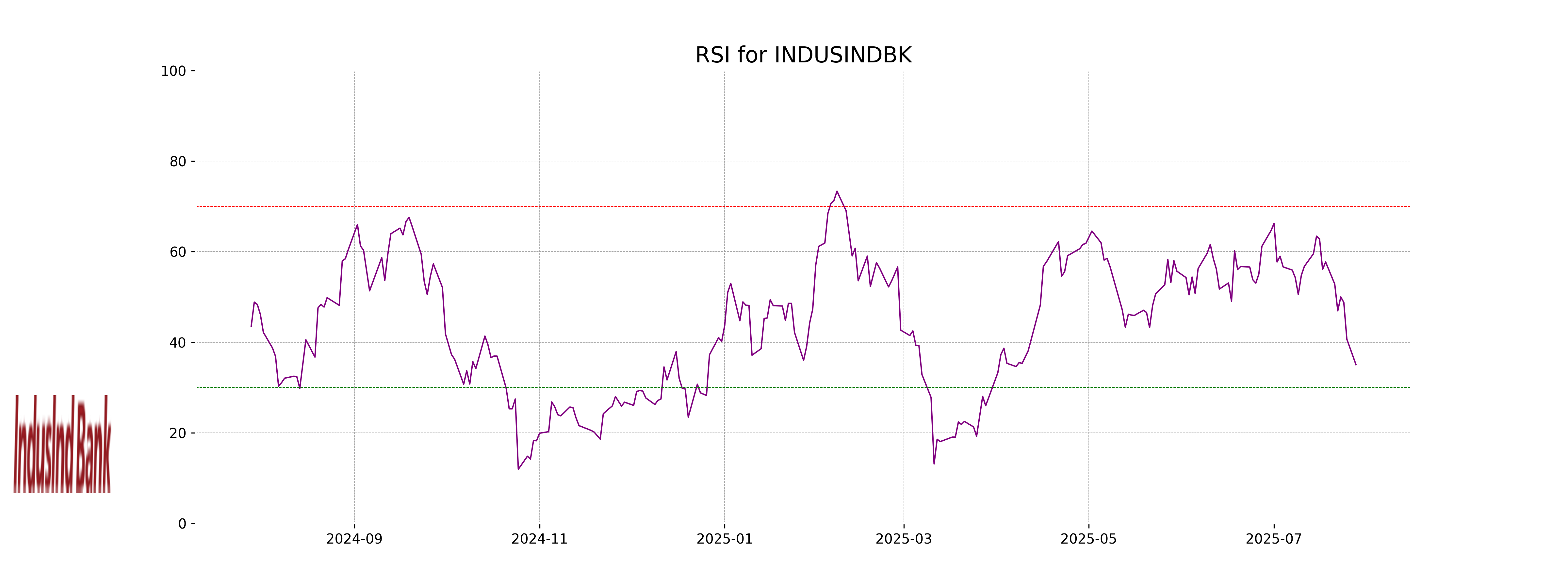

RSI Analysis

RSI Analysis for IndusInd Bank: The RSI (Relative Strength Index) for IndusInd Bank stands at 35.05, indicating that the stock is approaching oversold territory. This suggests potential undervaluation and might signal a buying opportunity if the trend reverses. However, investors should consider other factors and analyses before making decisions.

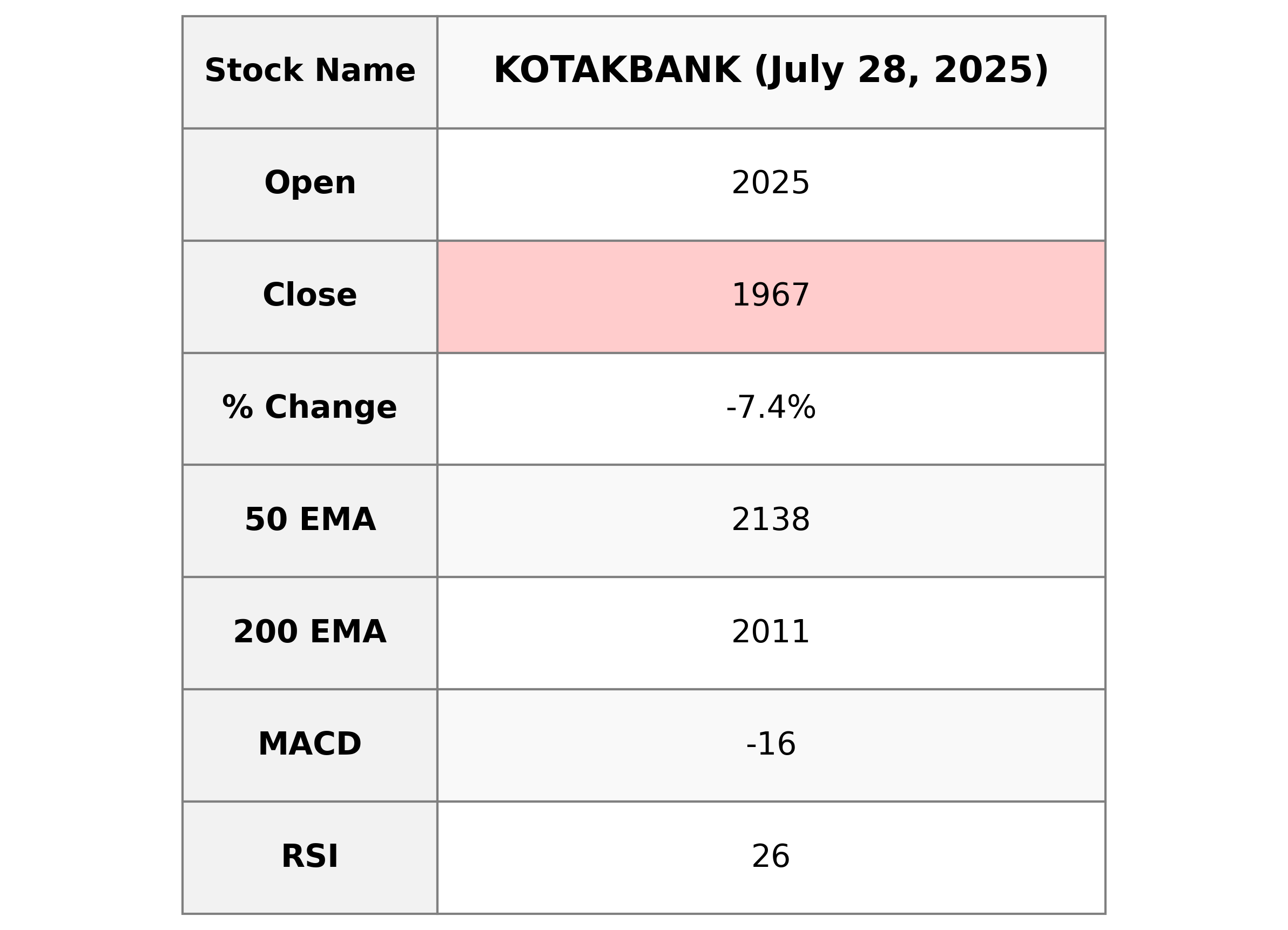

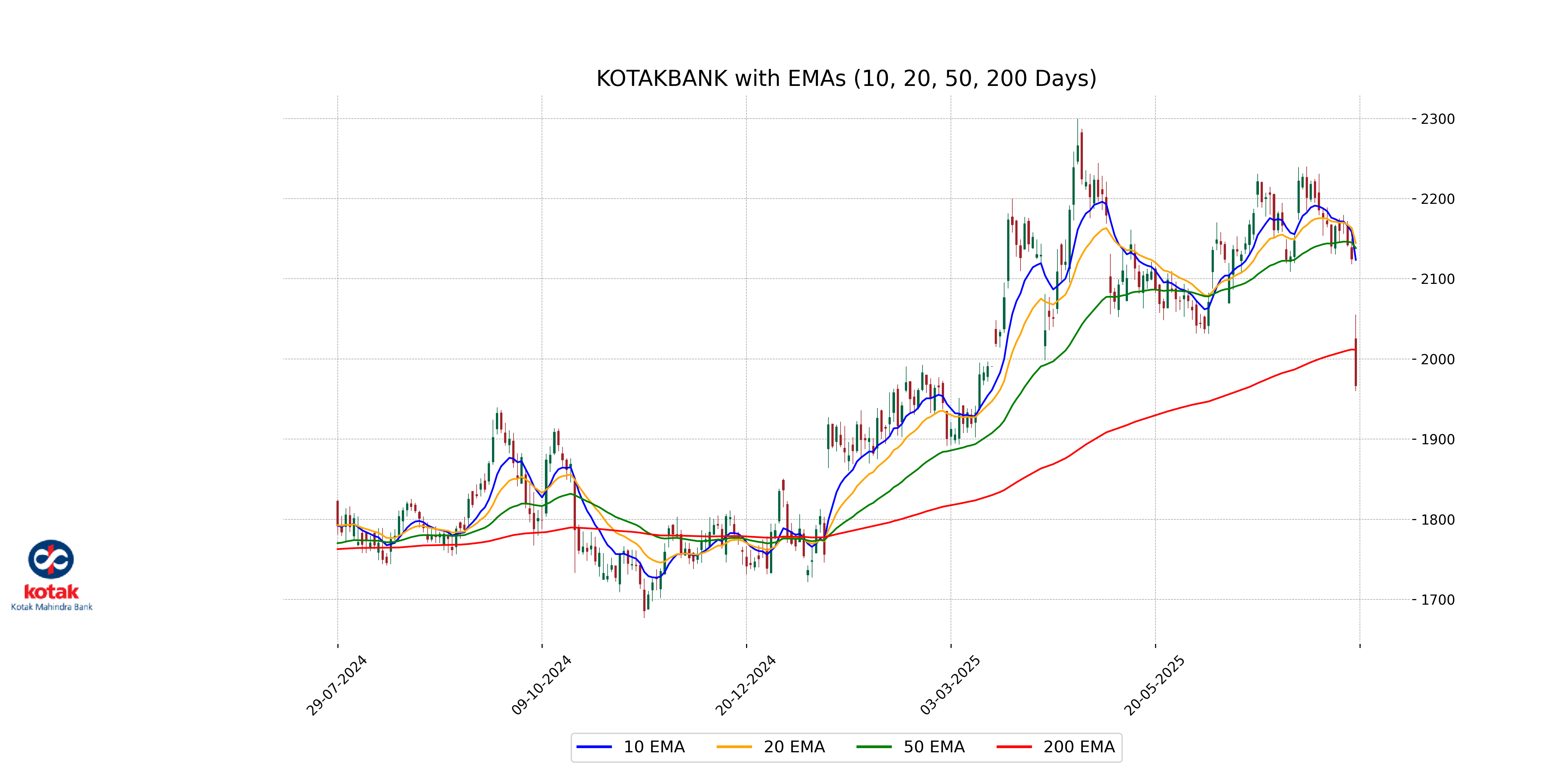

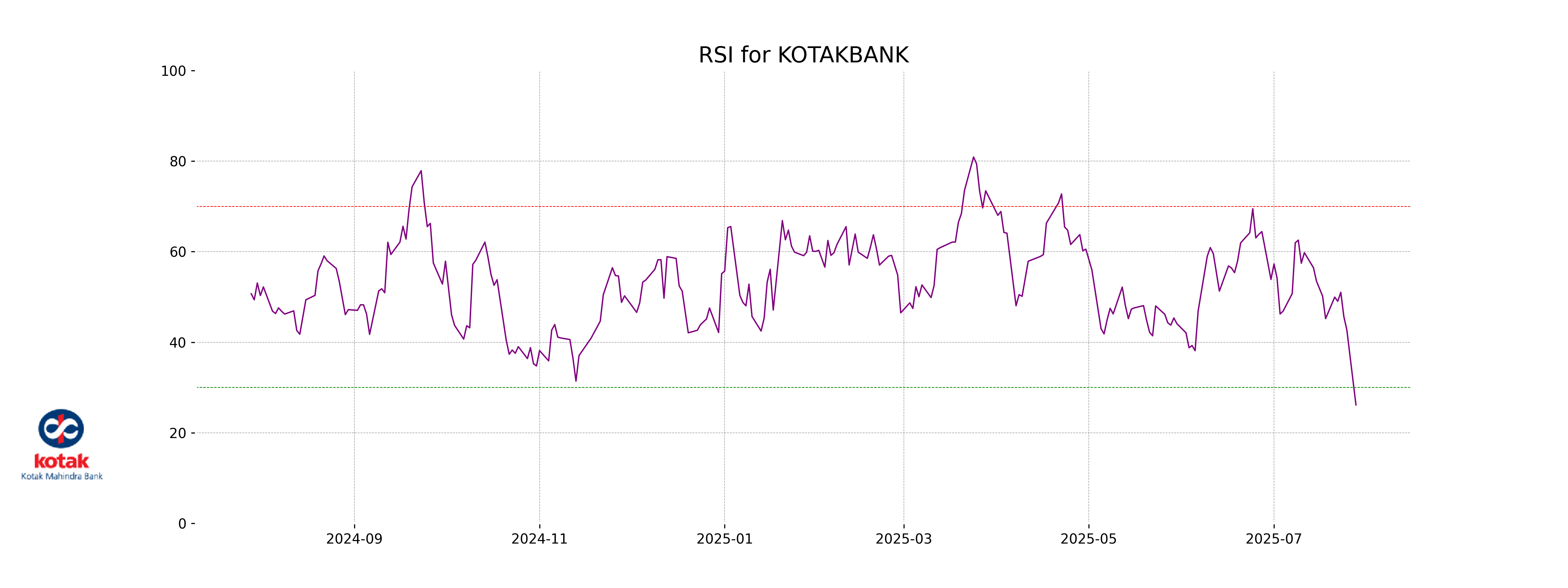

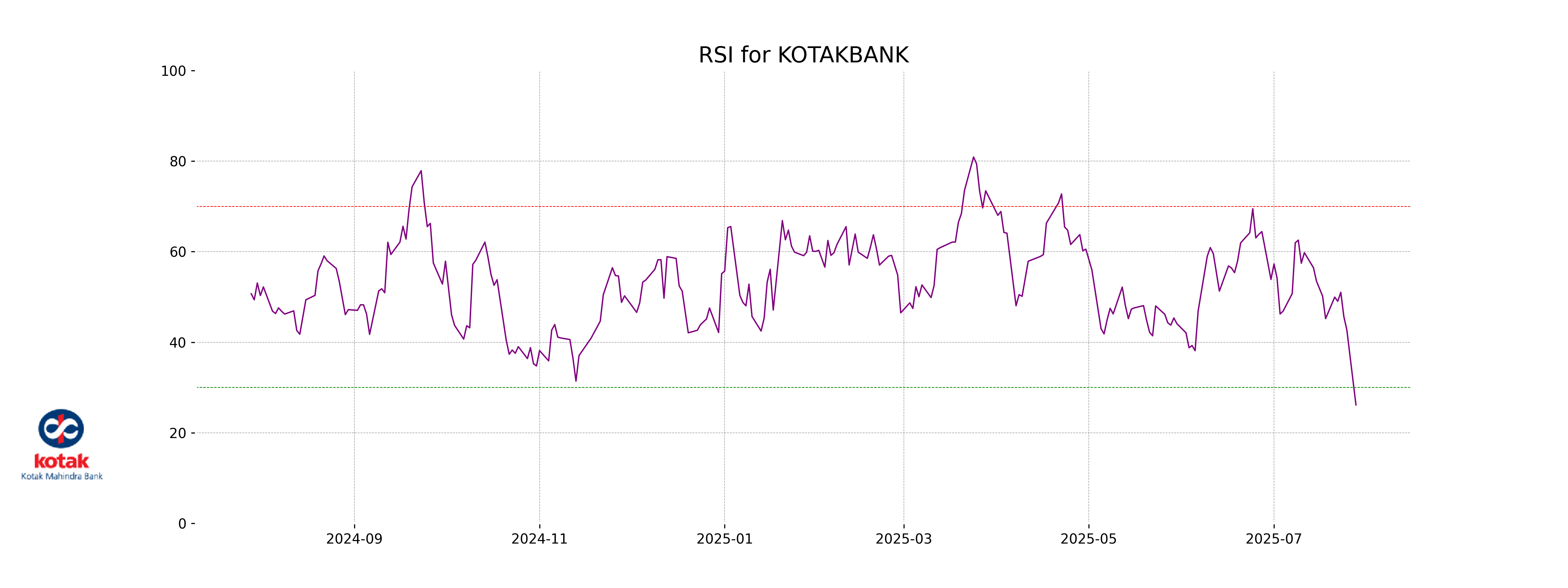

Analysis for Kotak Mahindra Bank - July 28, 2025

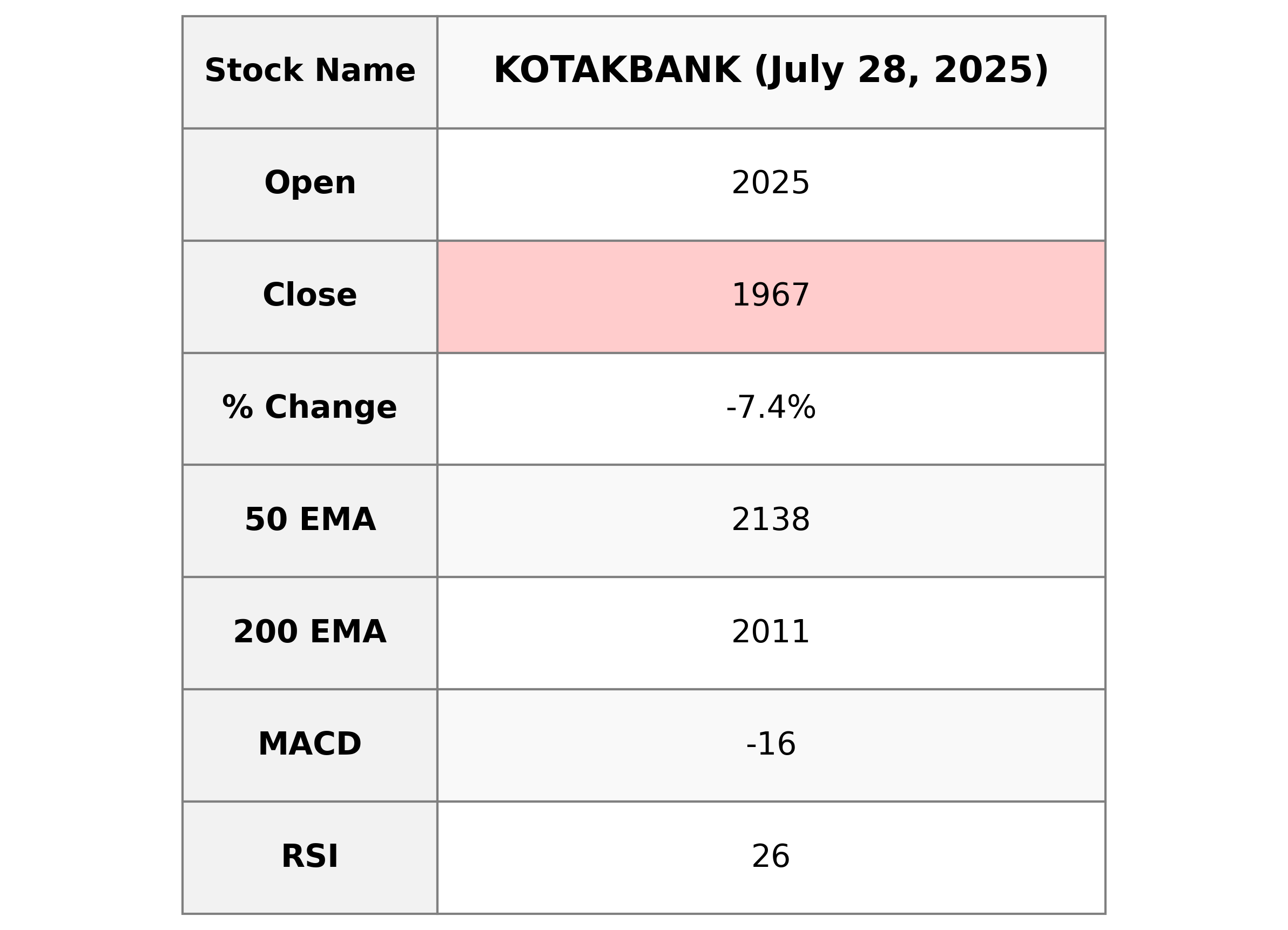

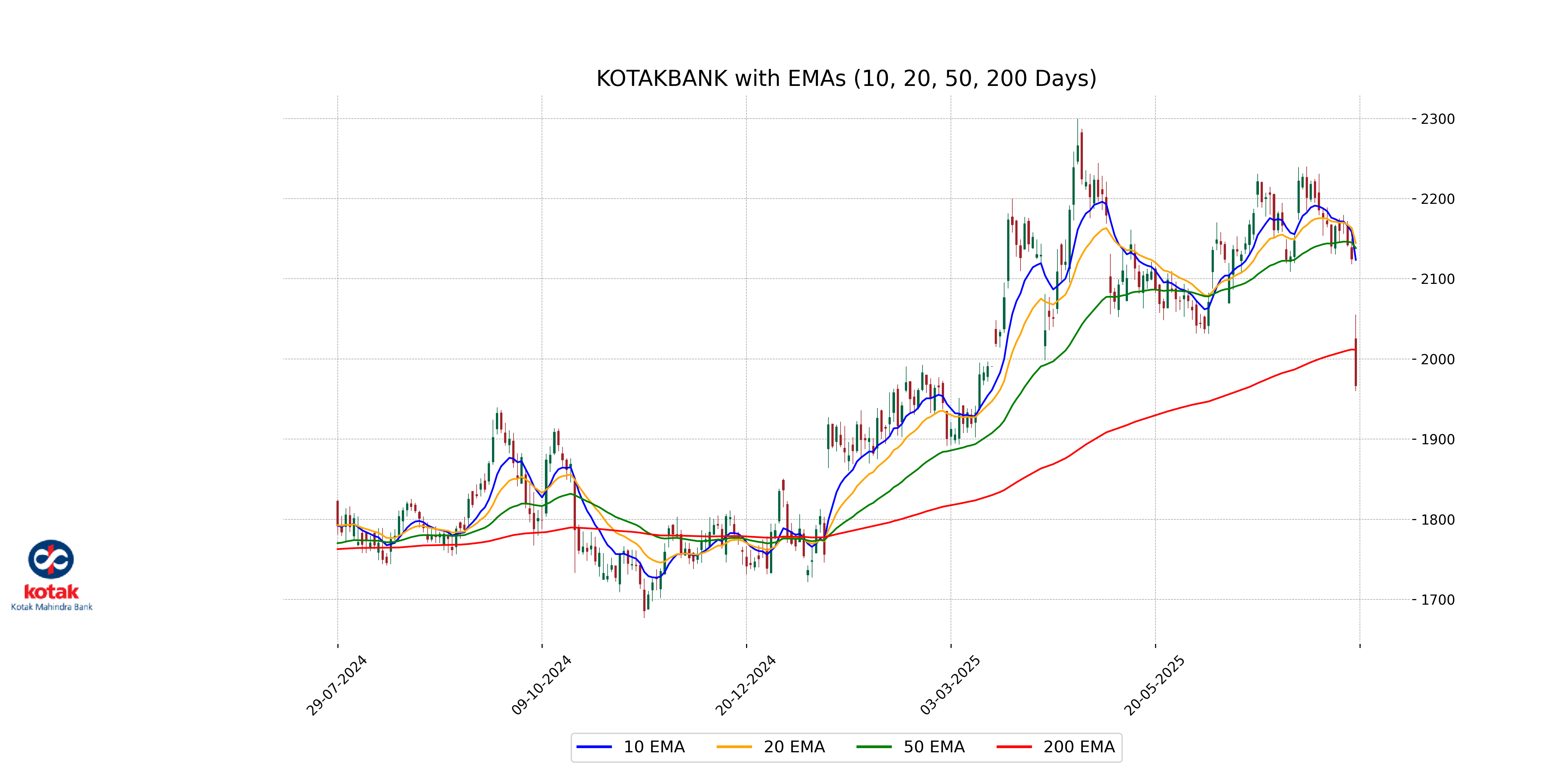

Kotak Mahindra Bank experienced a significant decline, with its stock closing at 1966.60, down 7.44% from the previous close. The RSI indicates a potential oversold condition at 26.14, and the MACD is negative, suggesting bearish momentum. The 50-day and 10-day EMAs are both above the current price, indicating a bearish trend.

Relationship with Key Moving Averages

Kotak Mahindra Bank's current closing price of 1966.60 is below its 10 EMA (2123.68), 20 EMA (2144.59), and 50 EMA (2138.34), indicating a bearish trend with the current price trading below key moving averages. The 200 EMA at 2011.44, which is also higher than the current price, further supports a longer-term downward trend.

Moving Averages Trend (MACD)

The MACD line for Kotak Mahindra Bank is currently at -15.94, which is below the signal line at 3.18. This suggests a bearish momentum, indicating a potential downtrend or selling pressure in the stock.

RSI Analysis

The RSI (Relative Strength Index) for Kotak Mahindra Bank is currently at 26.14, which indicates that it is in the oversold territory. This suggests that the stock has been under significant selling pressure recently and may potentially be undervalued.

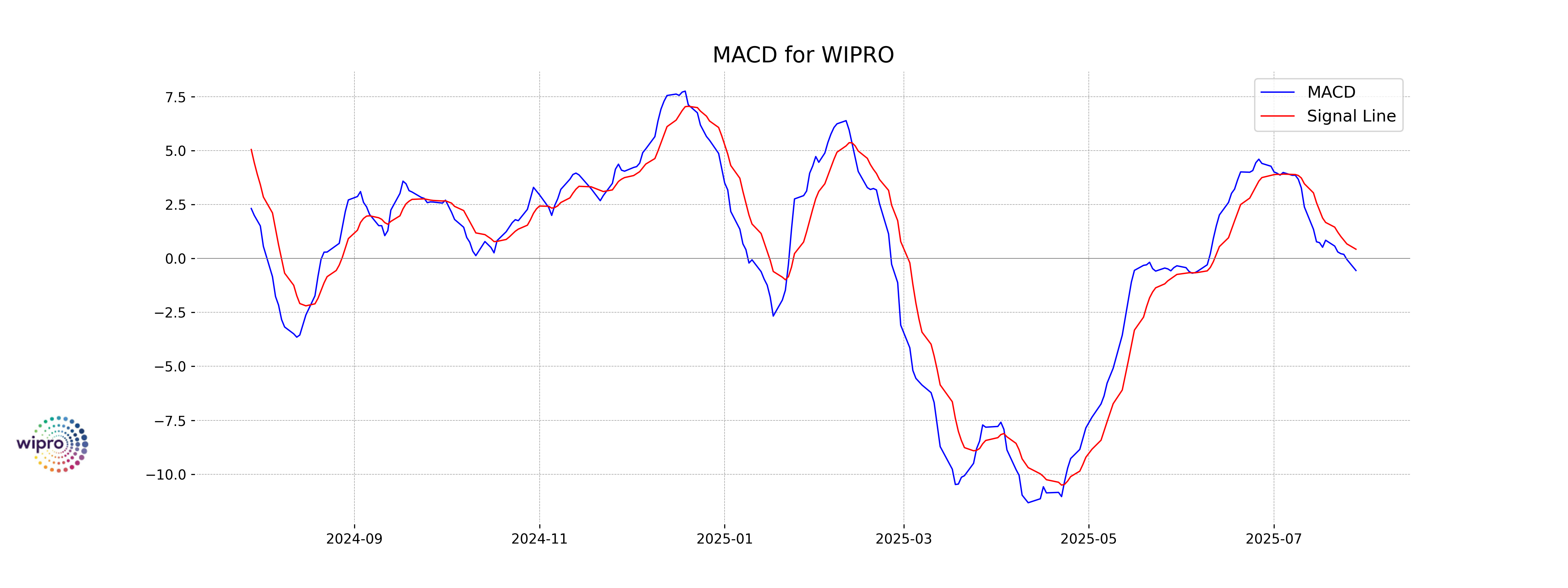

Analysis for Wipro - July 28, 2025

Wipro Performance Overview: Wipro's stock closed at 250.05, marking a decline of approximately 1.63% from its previous close of 254.20. The trading volume was 8,996,510 shares. The technical indicators suggest bearish momentum with the stock trading below its 50-day, 20-day, and 10-day EMAs, and a MACD value below the signal line. The RSI indicates the stock is nearing oversold territory. Wipro operates in the Technology sector within the Information Technology Services industry in India, with a Market Cap of 2.7 trillion INR.

Relationship with Key Moving Averages

Wipro's stock is currently trading below its 10-day, 20-day, and 50-day exponential moving averages, indicating short to medium-term bearish momentum. With the current close at 250.05 compared to these moving averages, it suggests downward pressure. The 200-day EMA also being higher indicates a broader downtrend.

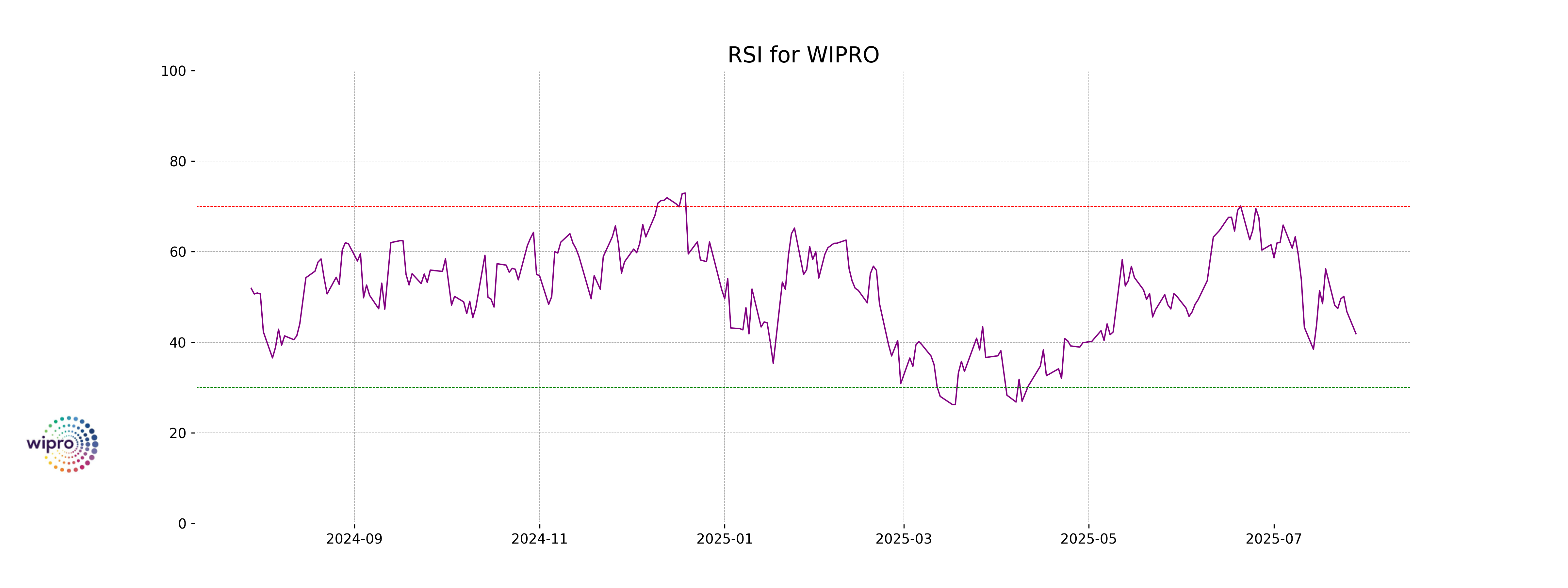

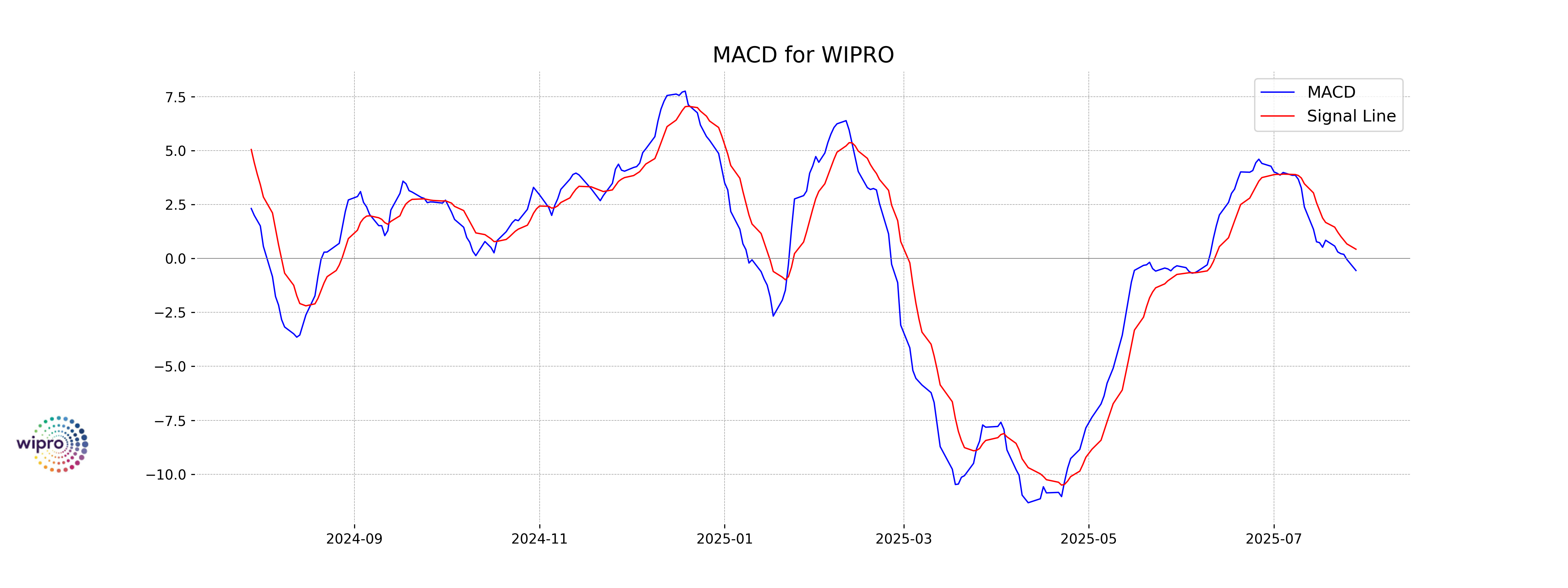

Moving Averages Trend (MACD)

The MACD for Wipro is indicating a bearish trend as the MACD line is at -0.5587, which is below the Signal line at 0.4284. With the MACD being negative, it suggests that the stock may be experiencing downward momentum.

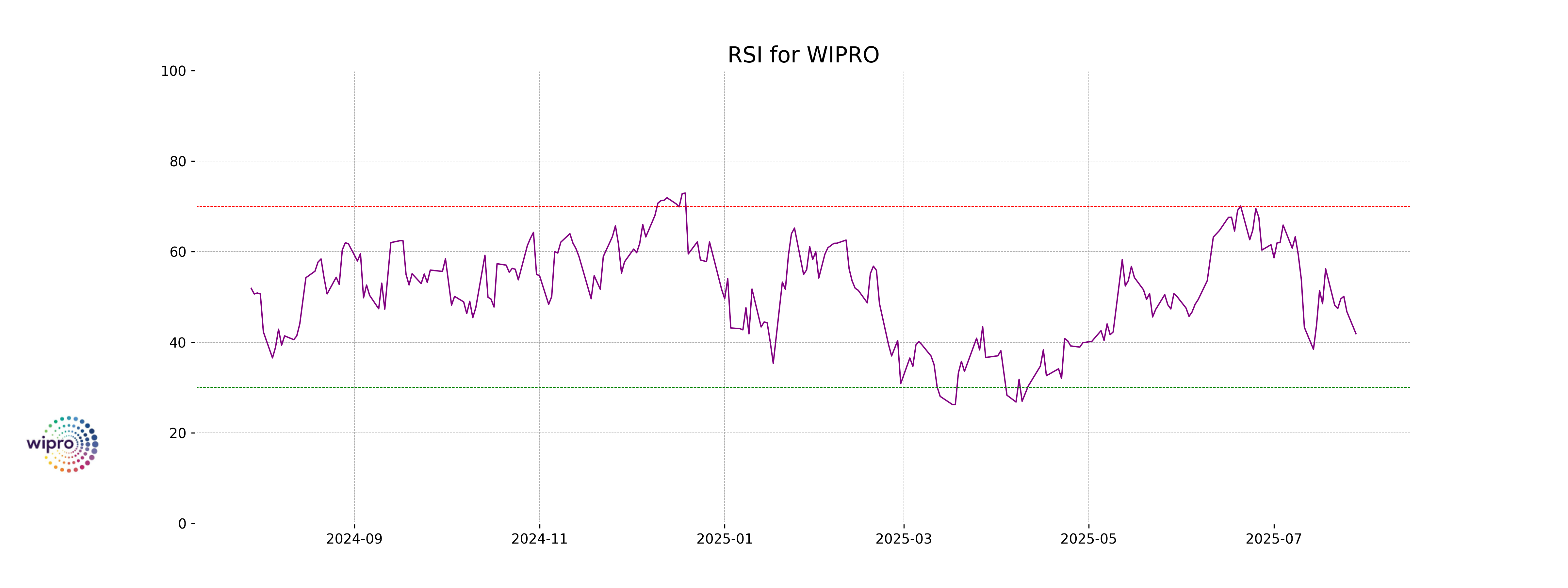

RSI Analysis

The RSI (Relative Strength Index) for Wipro is currently 41.88, indicating a market that is neither overbought nor oversold, but leaning toward the oversold territory. This suggests a potential buying opportunity if the stock continues to show strength.