In this article, we will explore the technical indicators of some of the low-performing stocks on the Indian stock market, including BEL, EICHERMOT, HEROMOTOCO, ITC, and M&M.

By looking at these stocks through the lens of key technical factors, we aim to better understand their price movements, trends, and potential future performance.

Analysis for Bharat Electronics - February 12, 2025

Bharat Electronics, a company in the Aerospace & Defense industry, experienced a decline with the stock closing at 259.15, down 2.23% from the previous close, reflecting a points change of -5.90. This decline is set against key moving averages (50 EMA at 281.68 and 200 EMA at 272.56), indicating its current negative trend. With a market cap of 1,894,329,483,264 INR and an RSI of 39.62, Bharat Electronics shows a weak momentum.

Relationship with Key Moving Averages

Bharat Electronics' current stock price is below its key moving averages, with the 10, 20, and 50-day EMAs all above the current close of 259.15. This indicates a bearish trend as the stock is trading below both its short-term and long-term moving averages.

Moving Averages Trend (MACD)

The MACD for Bharat Electronics indicates a bearish trend, as the MACD line is below the MACD Signal line. This suggests that there might be continued downward momentum in the stock price. The significant difference between the MACD and its Signal line further confirms this bearish signal.

RSI Analysis

Based on the RSI value of 39.62 for Bharat Electronics, the stock is currently approaching the oversold territory, typically indicated by an RSI below 30. This suggests a potential buying opportunity as investor sentiment may soon shift positively.

Analysis for Eicher Motors - February 12, 2025

**Eicher Motors Performance:** Eicher Motors had a decrease in its stock performance, with a closing price of 4849.45 INR, a drop of 2.47% from the previous close. The trading volume was 813,827. Despite a robust market cap of over 1.3 trillion INR and a PE Ratio of 30.01, the RSI indicates the stock is in the bearish territory at 37.10.

Relationship with Key Moving Averages

**Eicher Motors**: The stock is currently trading below its 50-day EMA of 5066.66 and its 10-day EMA of 5174.56, indicating potential downward momentum. However, it remains above the 200-day EMA of 4753.26, suggesting that the long-term trend could still be positive despite recent declines.

Moving Averages Trend (MACD)

The MACD for Eicher Motors is at 34.51, with a MACD Signal of 75.85, indicating a bearish crossover as the MACD line is below the signal line. This suggests a potential downtrend or continuation of the current negative momentum. The RSI is at 37.10, further supporting the bearish sentiment as it approaches oversold levels.

RSI Analysis

**RSI Analysis for Eicher Motors:** Eicher Motors currently has an RSI (Relative Strength Index) of 37.1. This suggests that the stock is approaching the oversold territory, as RSI values below 30 typically indicate an oversold condition, which could signal a potential buying opportunity if the stock is undervalued.

Analysis for Hero MotoCorp - February 12, 2025

**Hero MotoCorp Performance:** Hero MotoCorp has shown a slight uptick with a close of 4015.75, marking a 0.76% increase from the previous close. Despite trading below its 50 and 200-day EMAs, indicating a bearish trend, the stock managed some gains. The RSI of 44.52 suggests the stock is nearing oversold territory. With a PE Ratio of 19.39, the company's market cap stands at approximately ₹803.2 billion in the consumer cyclical sector, specifically within the auto manufacturers industry in India.

Relationship with Key Moving Averages

Hero MotoCorp's current closing price of 4015.75 is below all key moving averages, with the 50 EMA at 4206.94, the 10 EMA at 4072.21, and the 200 EMA at 4550.10. This suggests a potential bearish trend as the stock is trading below short and long-term averages.

Moving Averages Trend (MACD)

Hero MotoCorp's MACD is -16.33 with a MACD Signal of -25.28, indicating a negative trend as the MACD is above the signal line. This suggests that the stock might be experiencing downward momentum, although the gap between the MACD and the signal line is narrowing, which could hint at potential consolidation.

RSI Analysis

**Hero MotoCorp RSI Analysis:** The Relative Strength Index (RSI) for Hero MotoCorp is currently at 44.52, suggesting that the stock is neither overbought nor oversold. This indicates a neutral market condition, where the stock may not exhibit significant upward or downward momentum at this time.

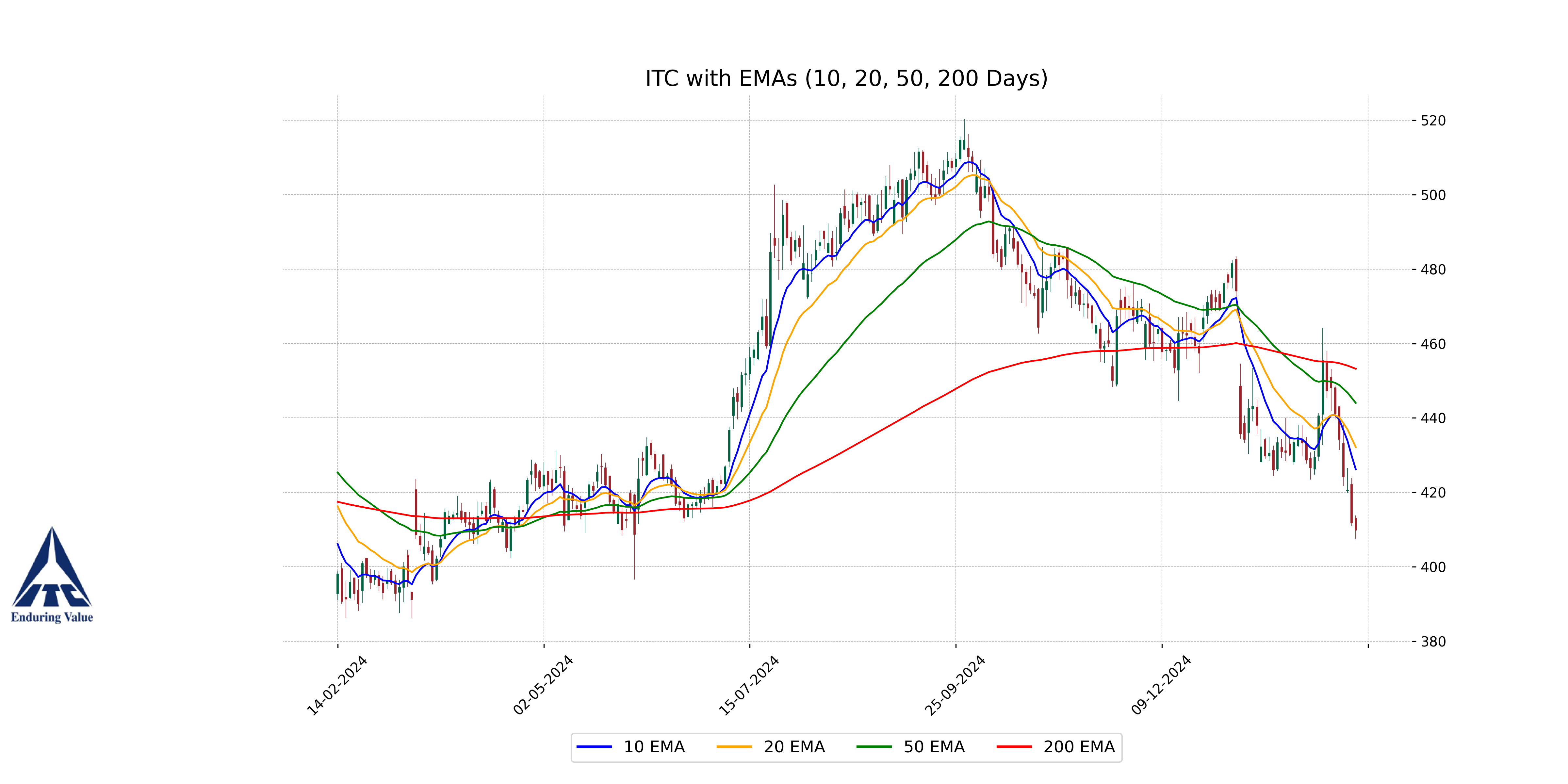

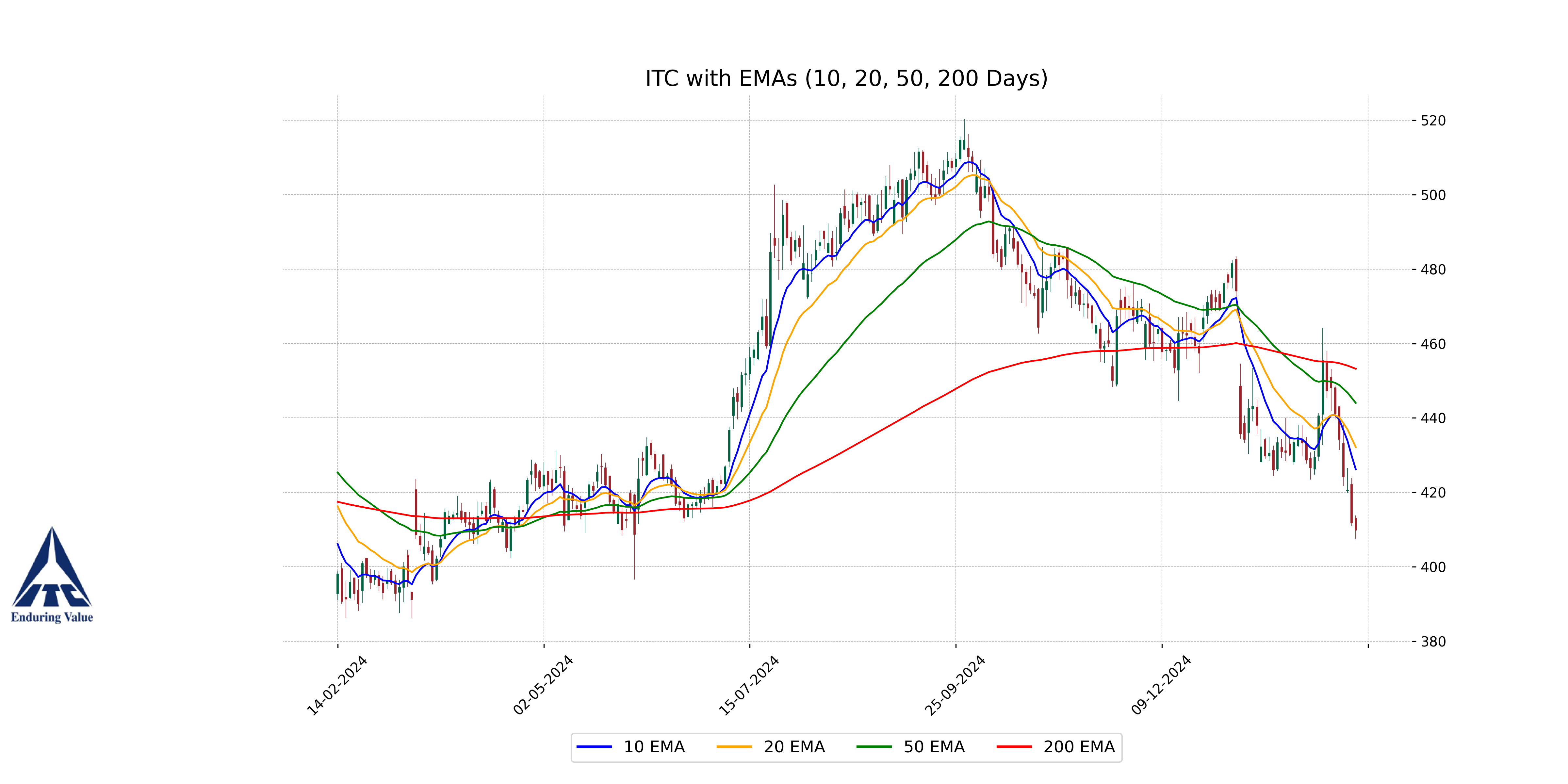

Analysis for ITC - February 12, 2025

ITC has experienced a minor decline in its stock price with a close at 409.90, down from the previous close of 411.80, indicating a -0.46% change. The Relative Strength Index (RSI) is at 31.70, suggesting the stock may be nearing oversold territory. The stock's 50-day and 200-day Exponential Moving Averages are significantly higher than the current price, pointing towards a bearish trend in the medium to long term.

Relationship with Key Moving Averages

ITC's current stock price at 409.90 is below its key moving averages: the 50-day EMA at 444.03 and the 200-day EMA at 453.21, indicating a bearish trend. The price is also below the 10-day EMA at 426.21 and the 20-day EMA at 432.17, reinforcing short-term downward pressure.

Moving Averages Trend (MACD)

ITC's MACD value of -7.15, which is below its MACD Signal line at -5.05, indicates a bearish momentum in the stock price. This suggests a prevailing downtrend, with potential for further price decline unless market conditions change. The RSI value of 31.70 also supports this bearish outlook as it approaches oversold territory.

RSI Analysis

The RSI (Relative Strength Index) for ITC currently stands at 31.70. This value indicates that the stock is nearing the oversold territory, as an RSI below 30 typically suggests that a stock may be undervalued or experiencing strong downward momentum. Investors might watch for potential buying opportunities if the RSI continues to decline.

Analysis for Mahindra & Mahindra - February 12, 2025

Mahindra & Mahindra saw a decrease in its stock price, closing at 2987.20, down from the previous close of 3085.95, marking a -3.20% change. The stock's 50-day EMA is slightly above the current price at 3015.56, indicating a short-term downturn. Despite the recent dip, the company maintains a robust market cap of approximately 3.58 trillion INR, operating within the Auto Manufacturers industry in India.

Relationship with Key Moving Averages

Mahindra & Mahindra's closing price is below its 10 EMA (3078.48) and 50 EMA (3015.56), indicating short-term weakness, but remains above the 200 EMA (2761.33), suggesting a long-term uptrend. The 10 EMA is acting as immediate resistance, while the 200 EMA provides strong support.

Moving Averages Trend (MACD)

The MACD value for Mahindra & Mahindra is 32.47, while the MACD Signal is 25.43. This indicates a positive trend, as the MACD is higher than the signal line, suggesting potential buying momentum. However, the RSI at 46.23 suggests that the stock is not in overbought territory, which might indicate cautious optimism.

RSI Analysis

The RSI (Relative Strength Index) of Mahindra & Mahindra is 46.23, which suggests that the stock is nearing a neutral state. Typically, an RSI below 30 is considered oversold, while above 70 is considered overbought. With an RSI of 46.23, the stock is moving towards a balanced position, indicating neither overbuying nor overselling pressures currently dominate.