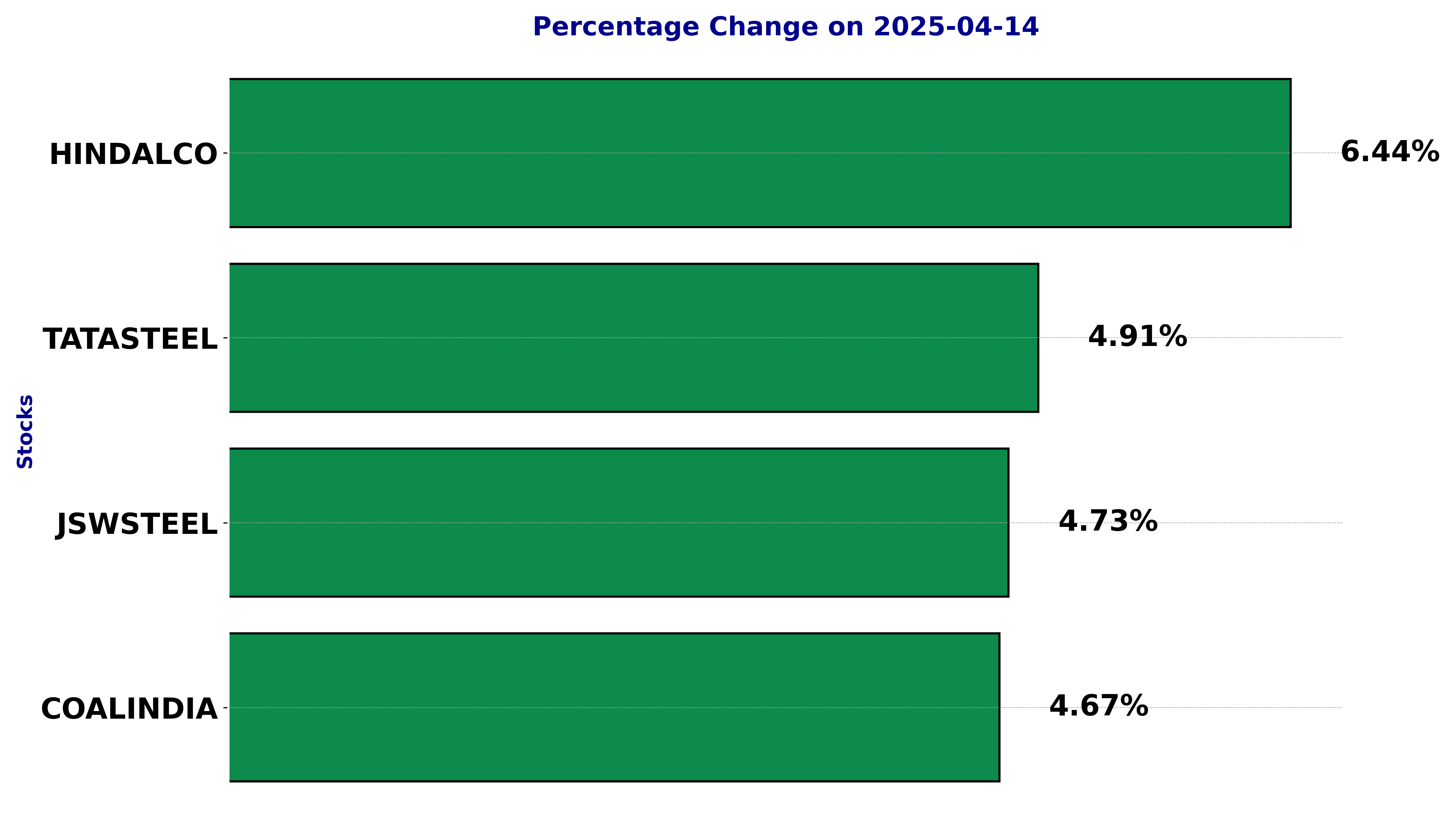

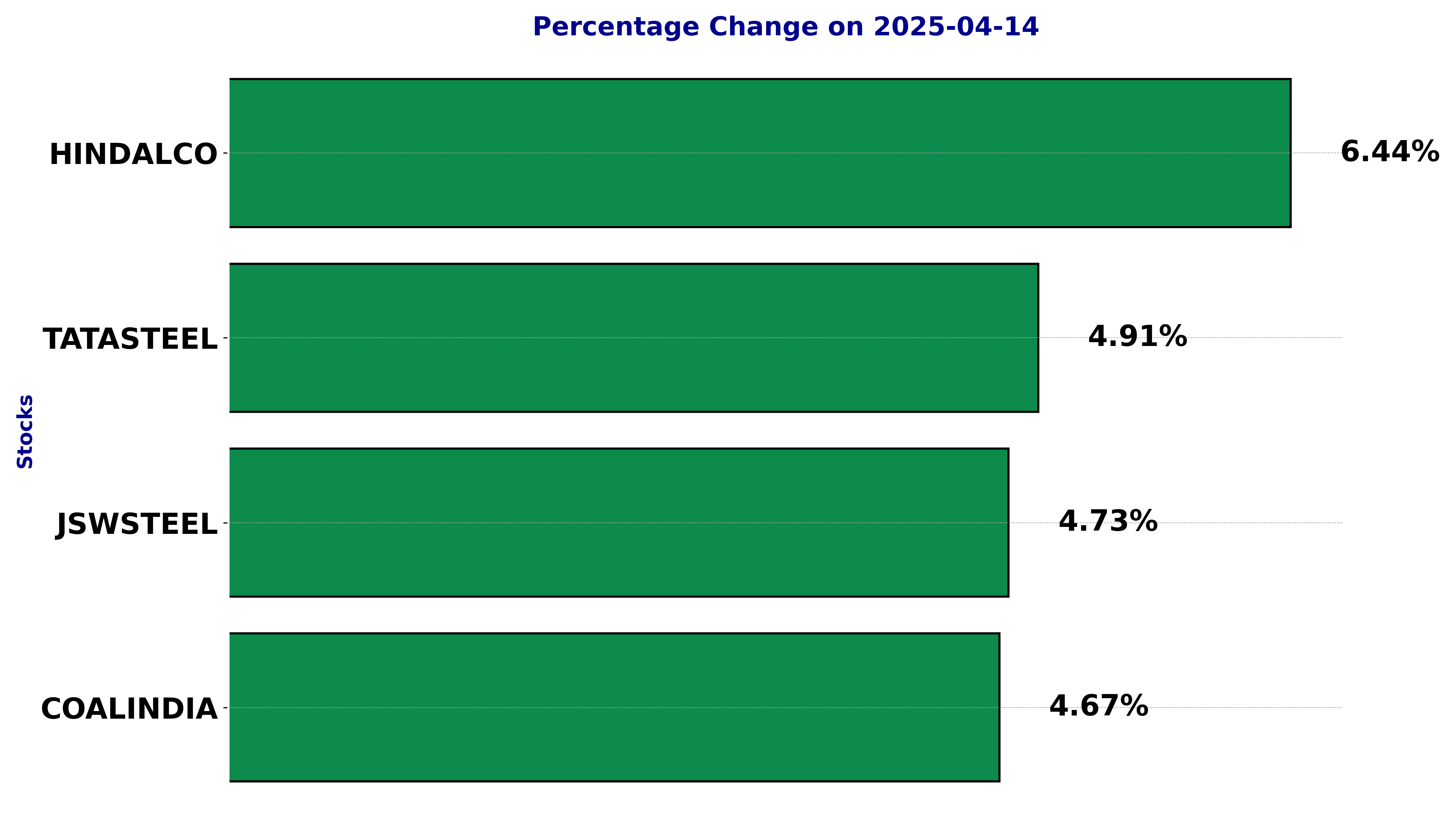

In this article, we will explore the technical indicators of some of the high-performing stocks on the Indian stock market, including COALINDIA, HINDALCO, JSWSTEEL, and TATASTEEL.

By looking at these stocks through the lens of key technical factors, we aim to better understand their price movements, trends, and potential future performance.

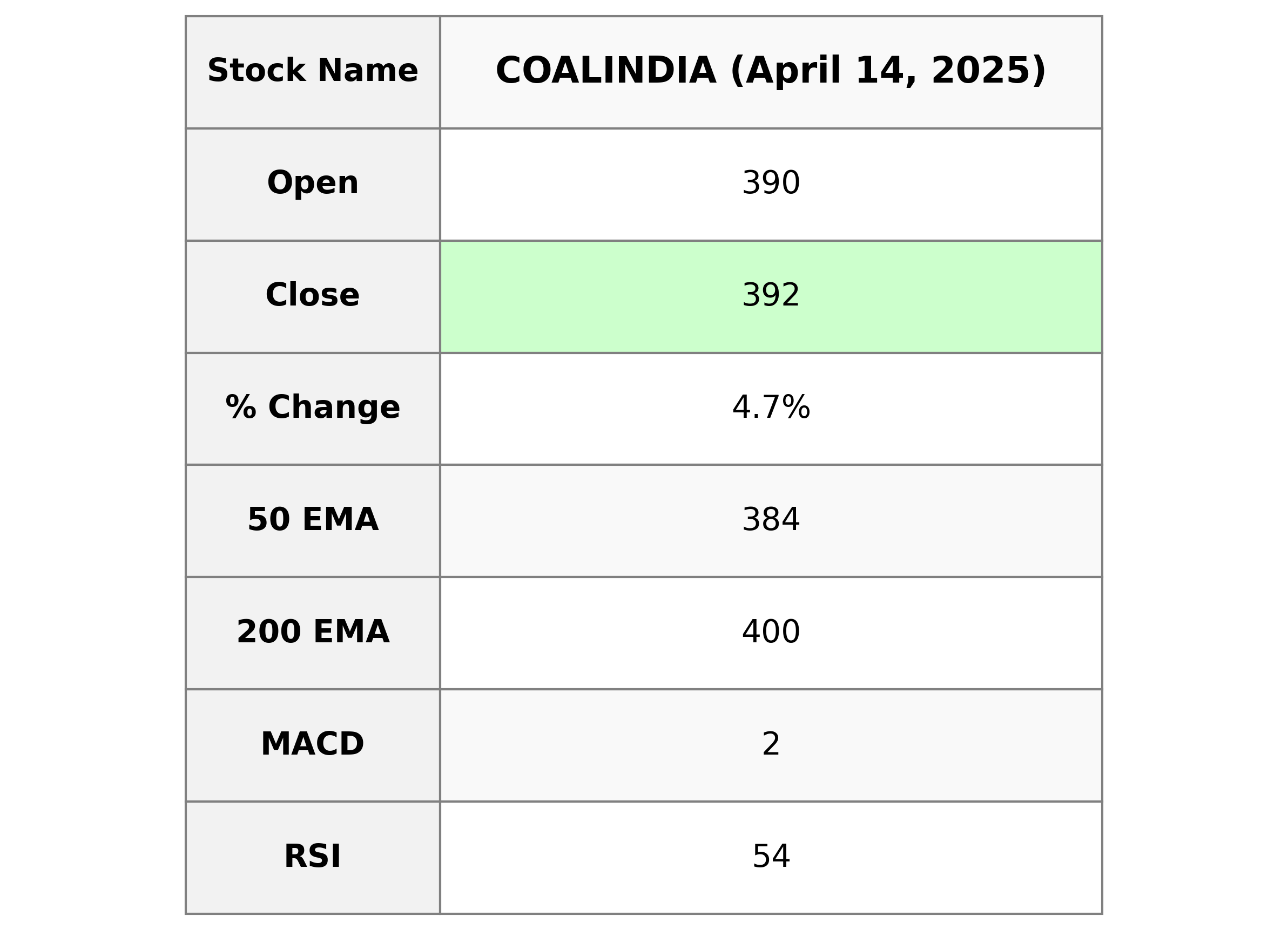

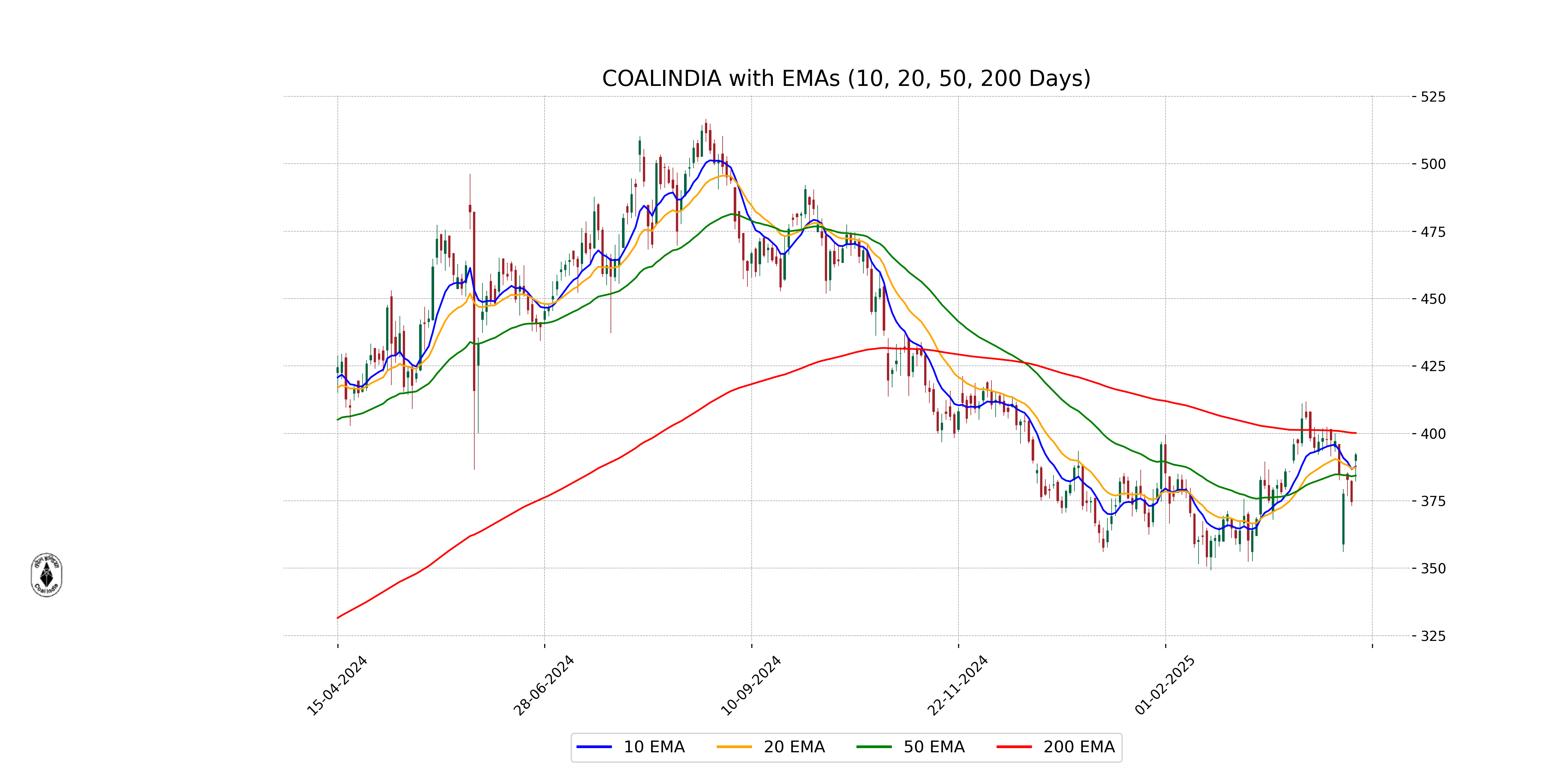

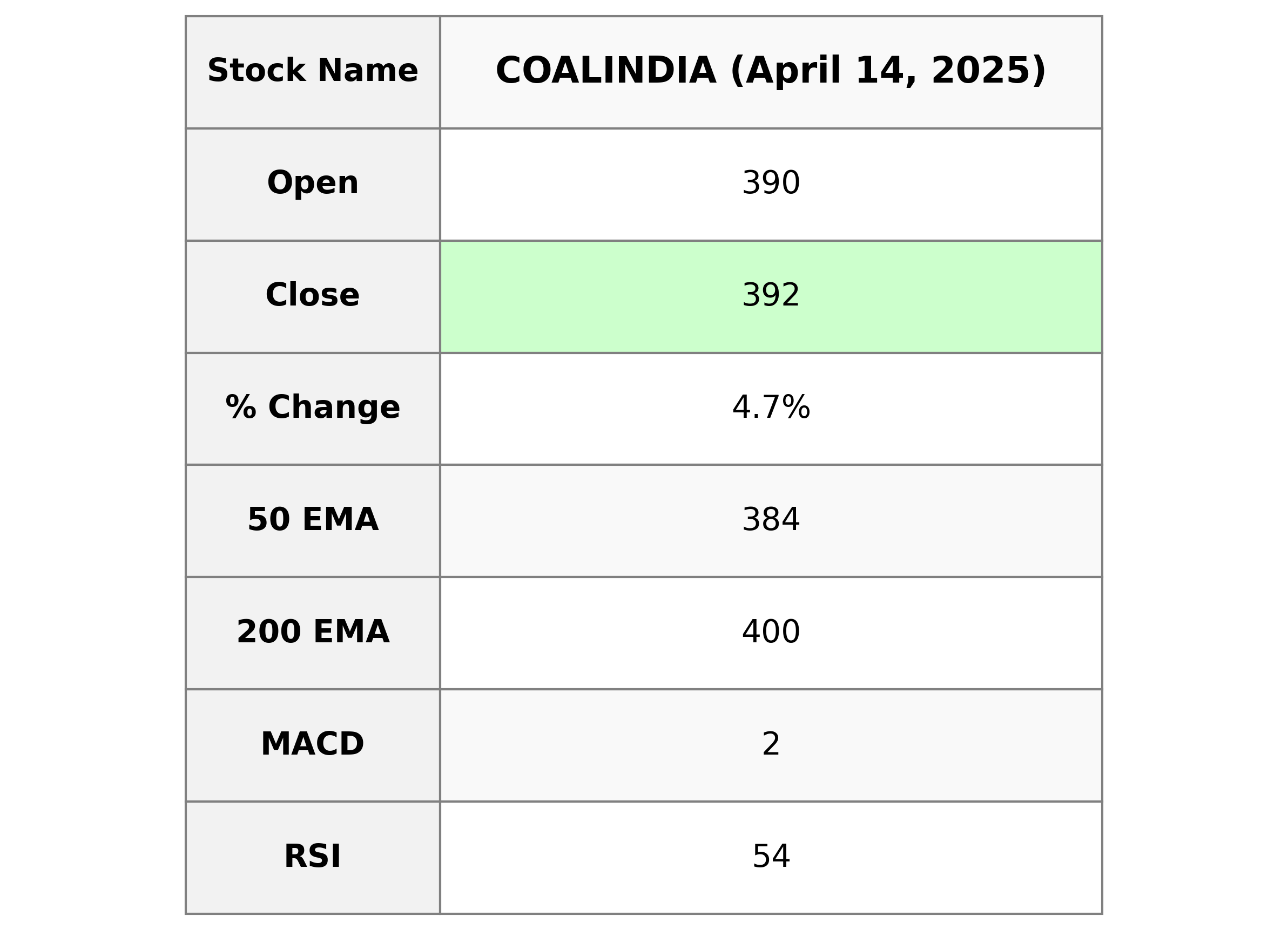

Analysis for Coal India - April 14, 2025

Coal India showcased a solid performance with a closing price of 392.10, up by 4.67%, representing a 17.5 point increase from its previous close. The stock's RSI is at 54.09, indicating neutral momentum, while the MACD suggests a potential bullish trend. With a market cap of over 2.41 trillion, this energy sector giant continues to outperform despite its PE ratio of 7.03.

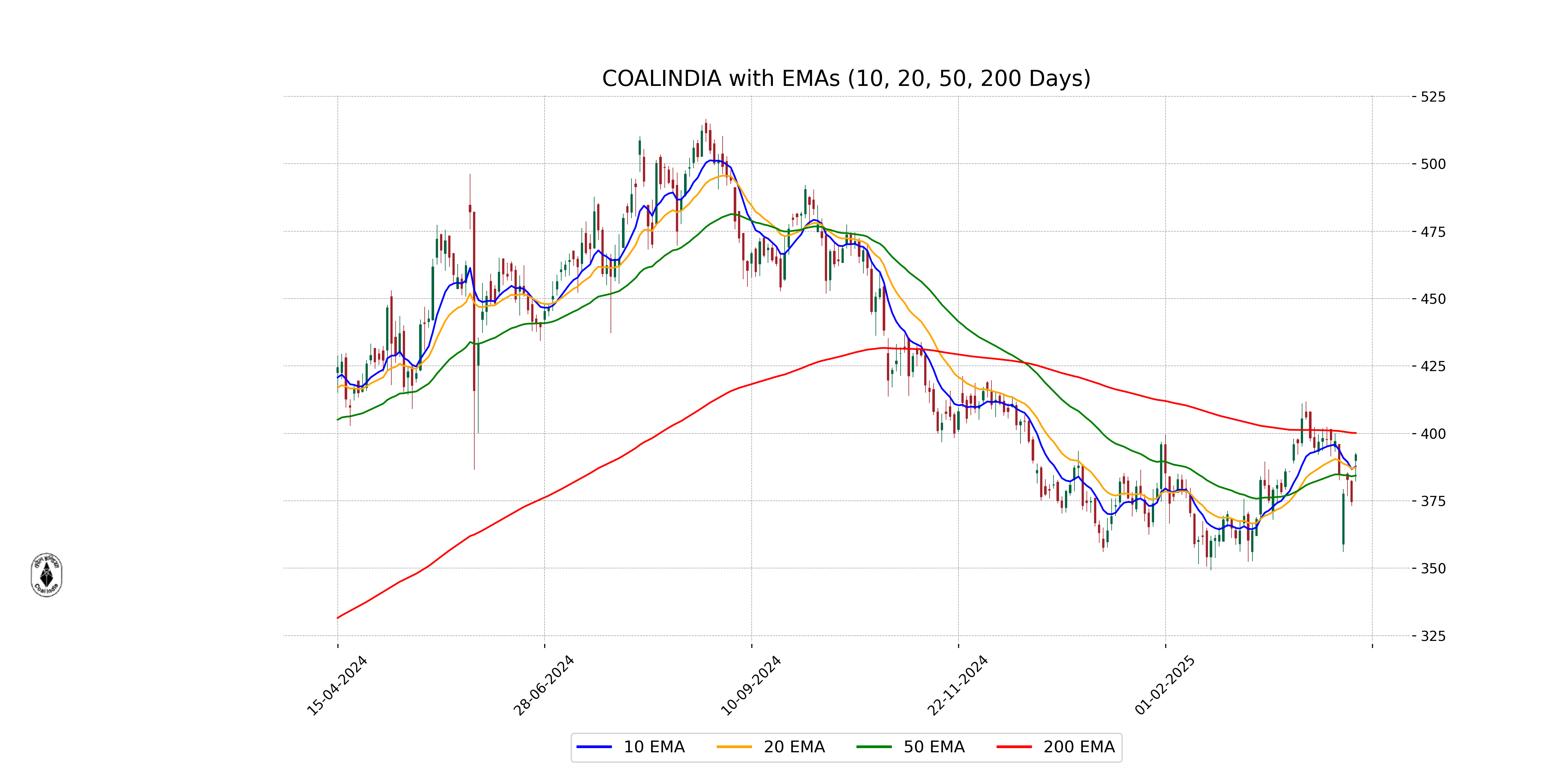

Relationship with Key Moving Averages

Coal India's current stock price is above both the 10-day EMA (387.71) and the 20-day EMA (387.40), suggesting positive short-term momentum. However, it remains below the 200-day EMA (400.13), indicating that it still may be in a longer-term downtrend despite recent gains.

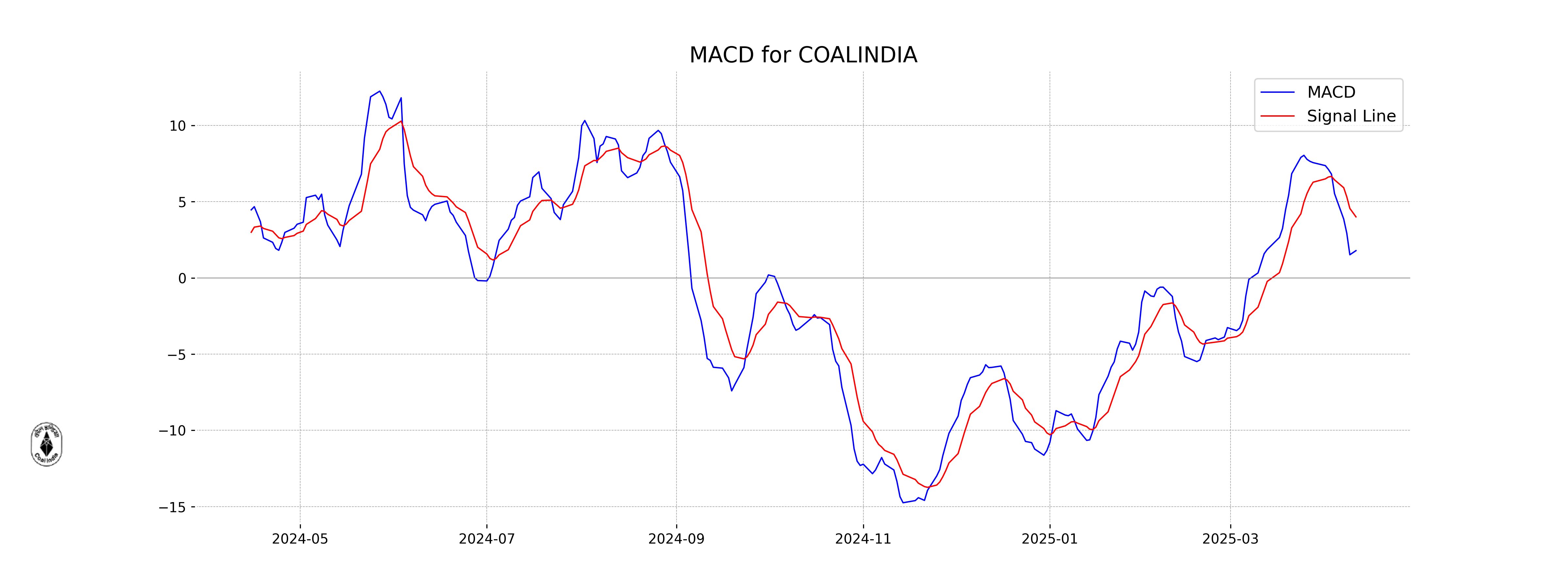

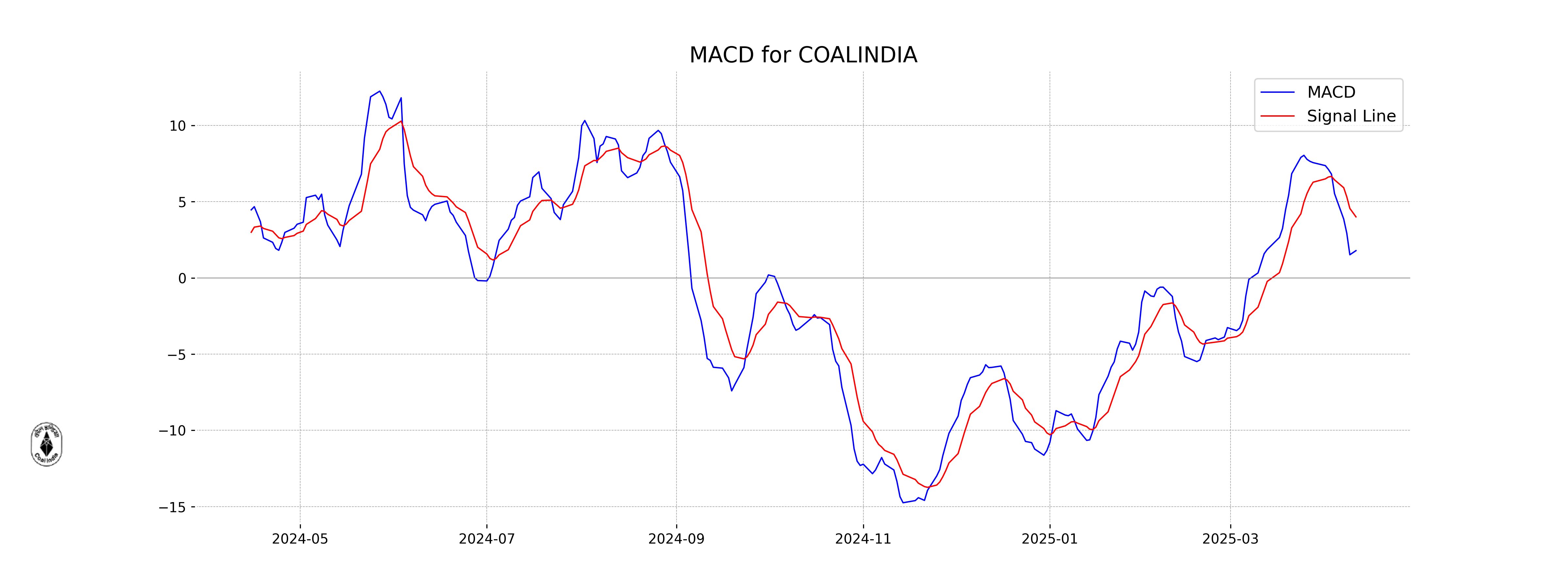

Moving Averages Trend (MACD)

Coal India's MACD value of 1.78 is below its MACD Signal of 4.00, indicating a potential bearish momentum. This suggests that the stock may experience selling pressure unless the MACD value crosses above the signal line, which would suggest a shift to positive momentum.

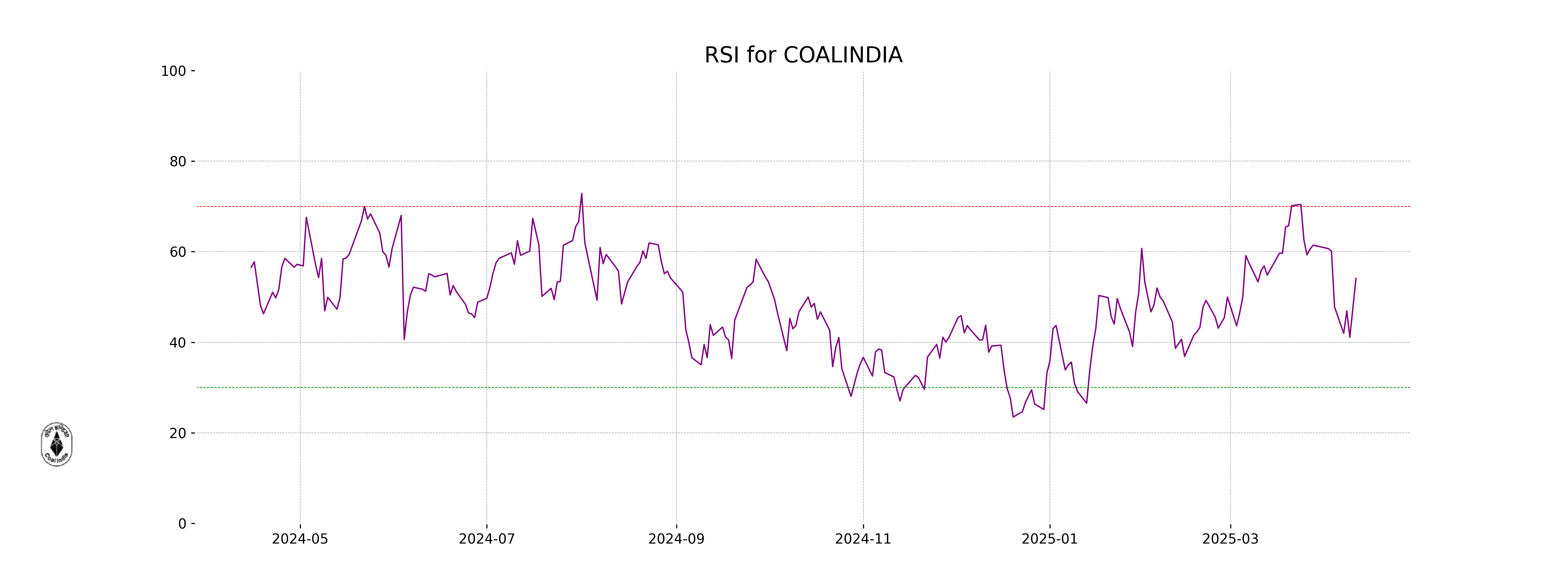

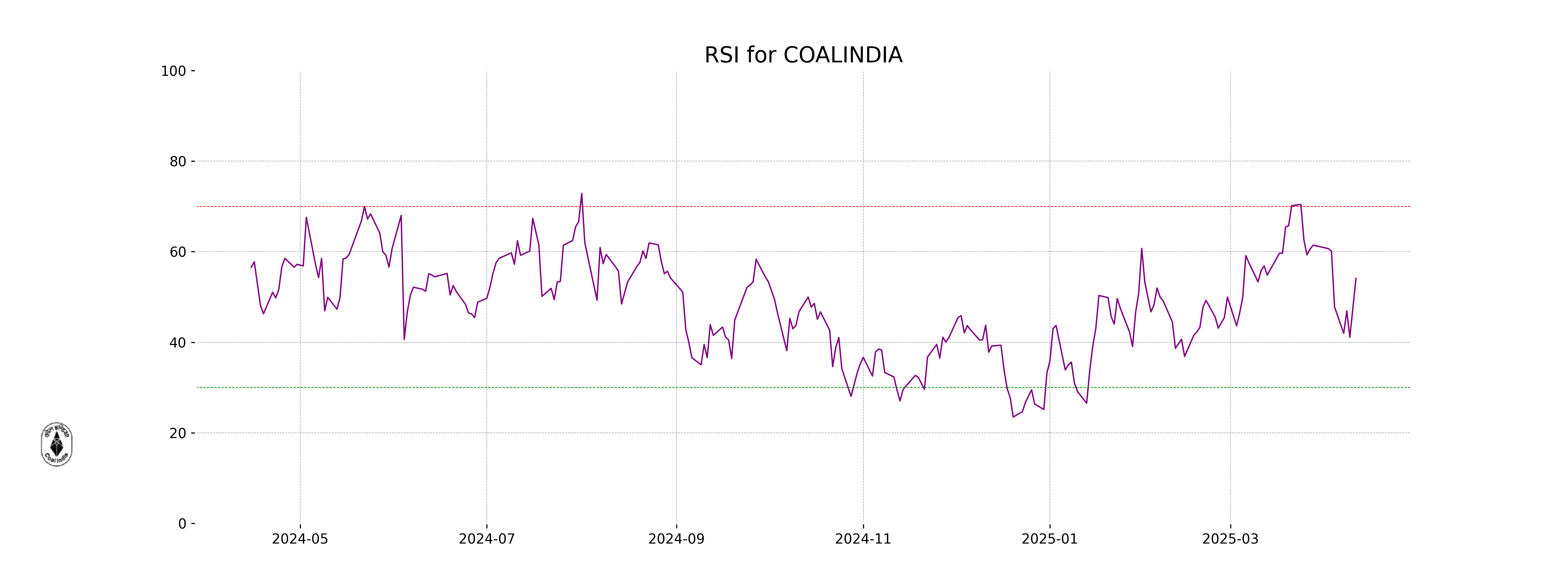

RSI Analysis

The RSI for Coal India is 54.09, which indicates a neutral position. Typically, an RSI below 30 suggests that a stock is oversold, while above 70 indicates it is overbought. In this case, the RSI near the middle range suggests no strong momentum in either buying or selling.

Analysis for HINDALCO - April 14, 2025

Performance Review for Hindalco Industries Ltd:

Hindalco posted a solid performance with a notable percentage change of approximately 6.44%, closing at 600.30 from a previous close of 564. The significant volume of 12.56 million indicates strong market activity, despite the RSI suggesting it's in a somewhat oversold territory. The company's PE ratio of 9.64 suggests it's relatively undervalued compared to sector peers within the Basic Materials sector, specifically in Aluminum.

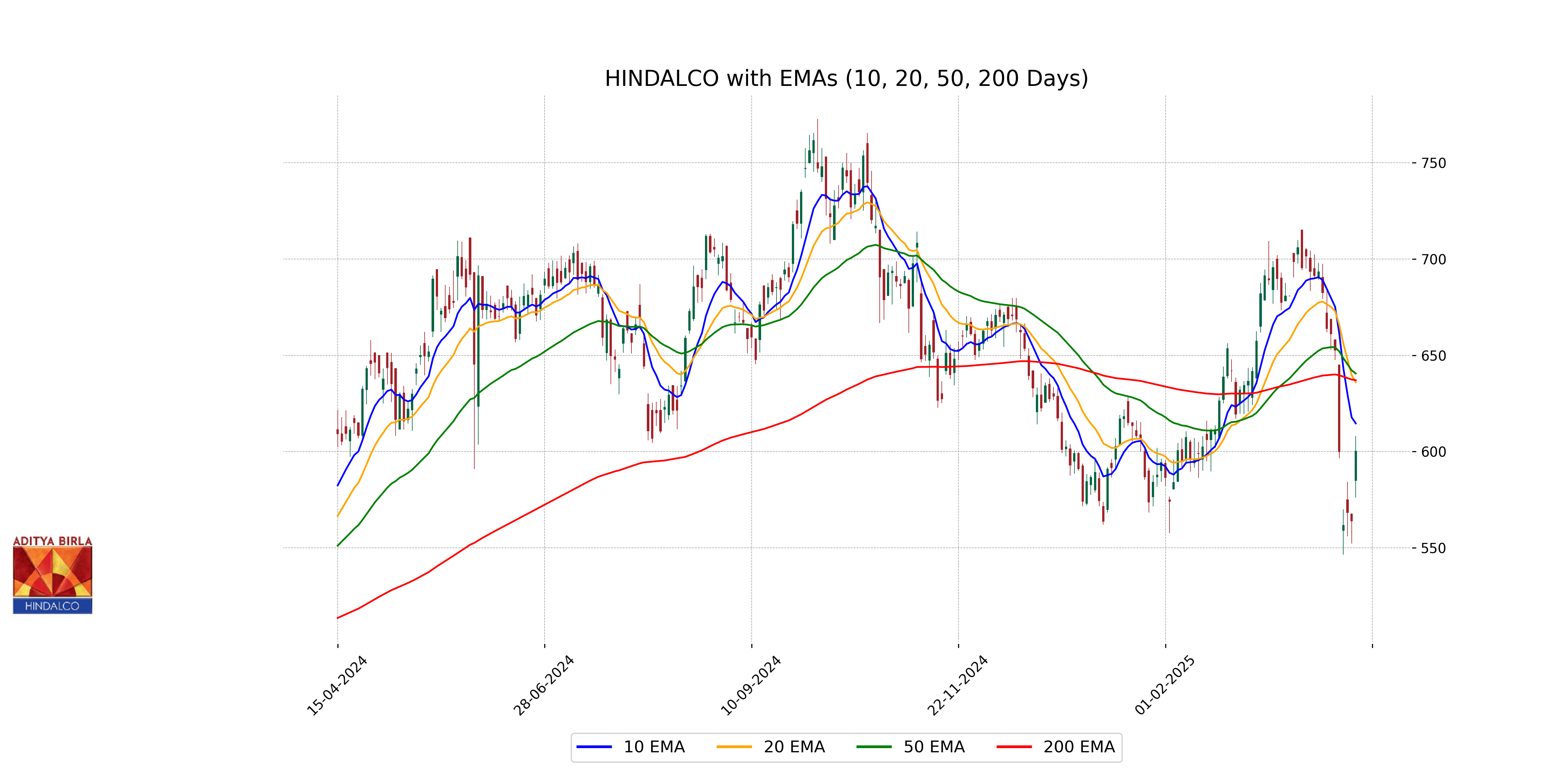

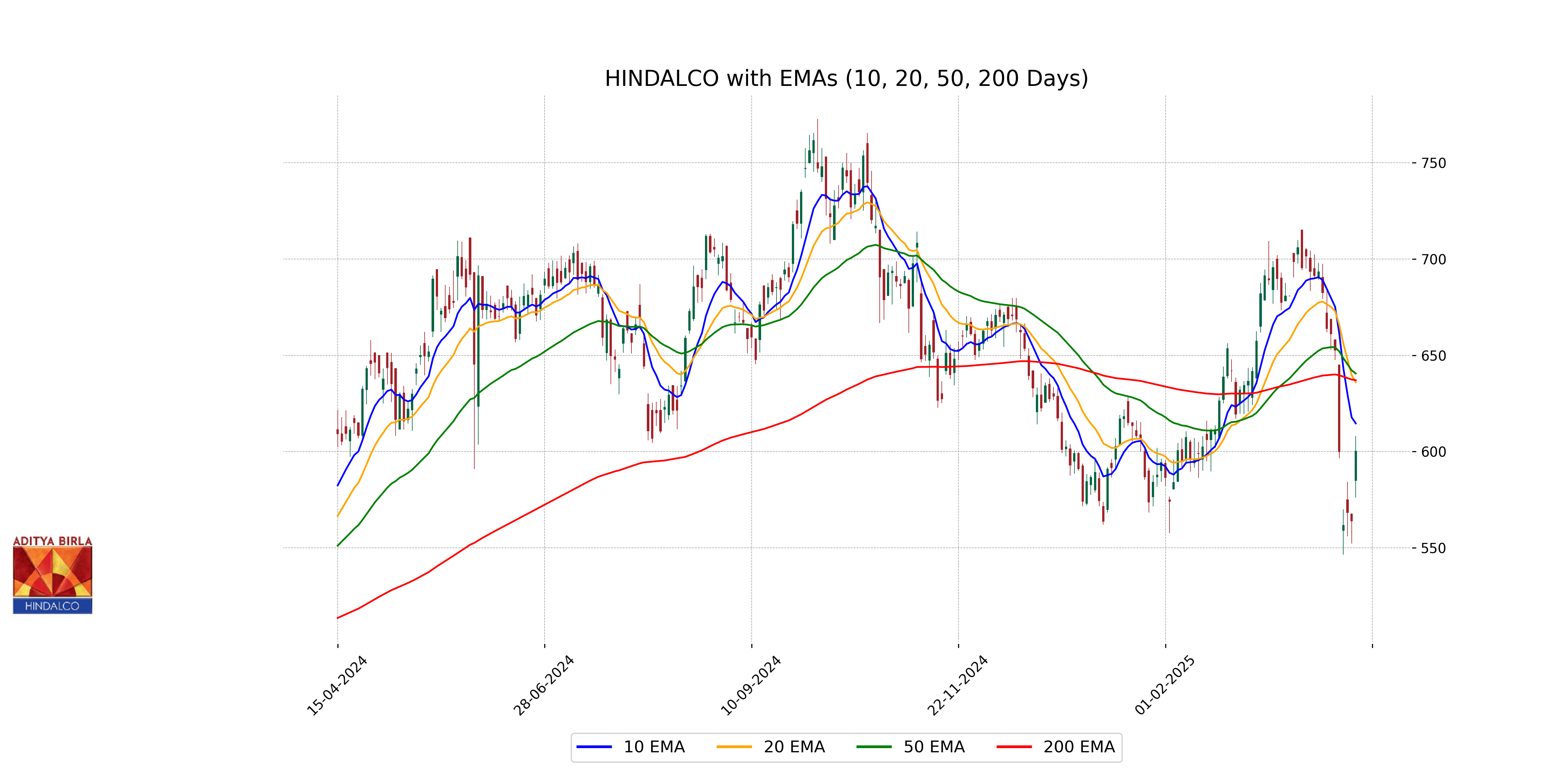

Relationship with Key Moving Averages

The stock price of Hindalco is presently trading below its 10-day, 20-day, 50-day, and 200-day EMA values, indicating a bearish trend. The current price of 600.30 is lower than all the mentioned EMAs, suggesting that the stock might encounter resistance around these average levels.

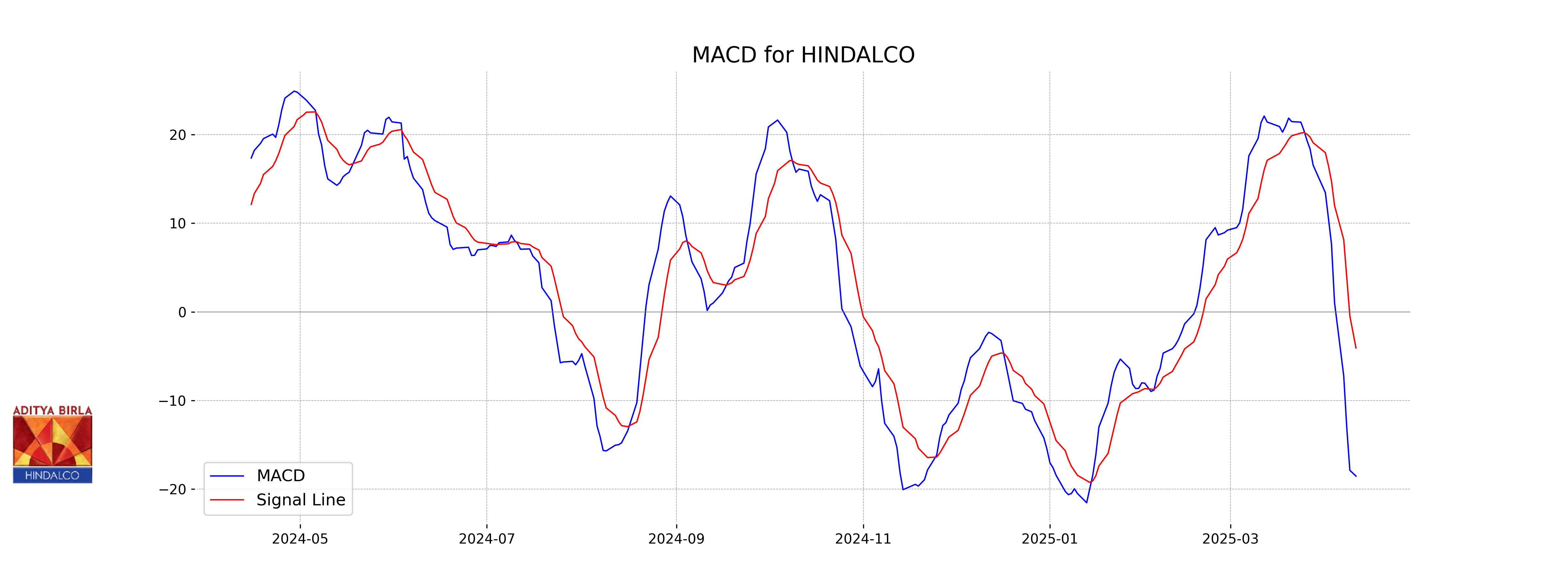

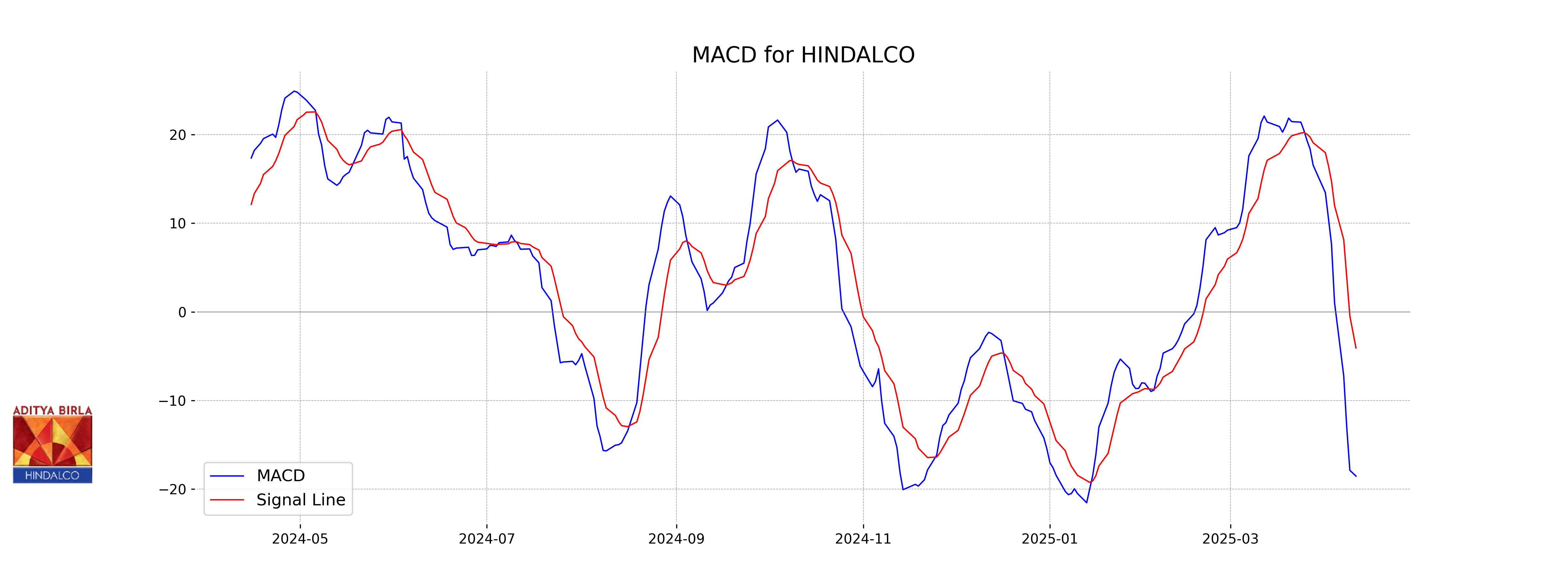

Moving Averages Trend (MACD)

Hindalco's MACD is currently at -18.53, which is below its MACD Signal of -4.07, indicating a potential bearish trend. This suggests that the momentum is negative, and the stock may continue to face selling pressure. The RSI, at 39.07, supports the bearish outlook as it indicates a slightly oversold condition, but not extremely so.

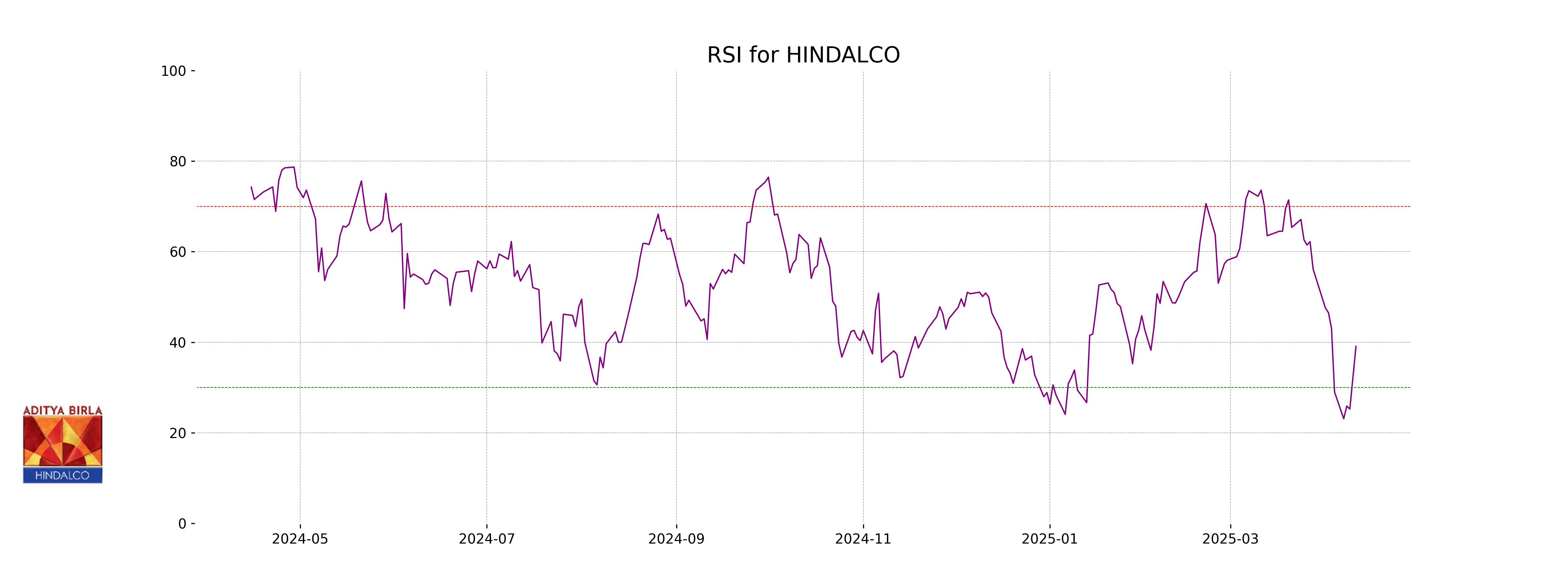

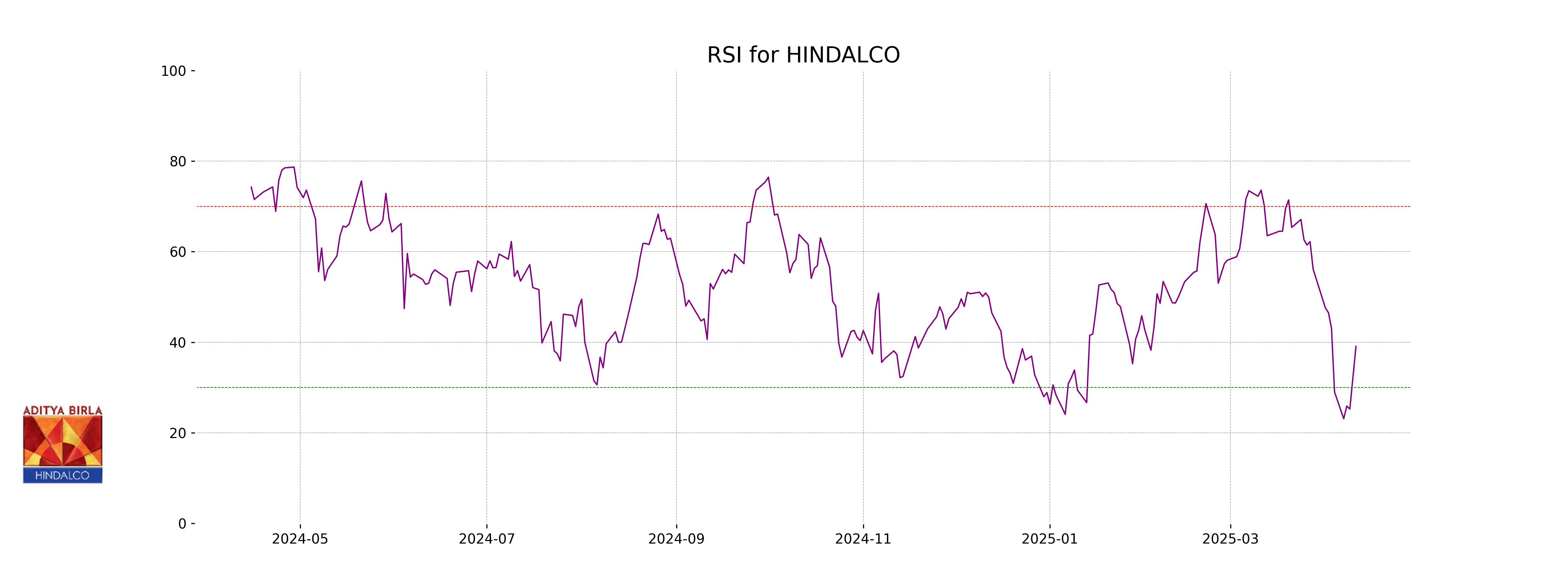

RSI Analysis

The RSI analysis for Hindalco indicates a reading of 39.07, suggesting that the stock is in the oversold territory. This could imply potential for a price reversal or an upward trend if buying interest returns. However, it is also important to consider other technical indicators and market conditions for a comprehensive analysis.

Analysis for JSW Steel - April 14, 2025

JSW Steel opened at 972.45 and closed at 990.25, registering a gain of 4.73% with a points change of 44.70 from the previous close of 945.55. The stock's performance showed a positive momentum, while the RSI was at 46.62, indicating it is not yet overbought. Despite the rise, the MACD indicates bearish sentiment as it remains in the negative.

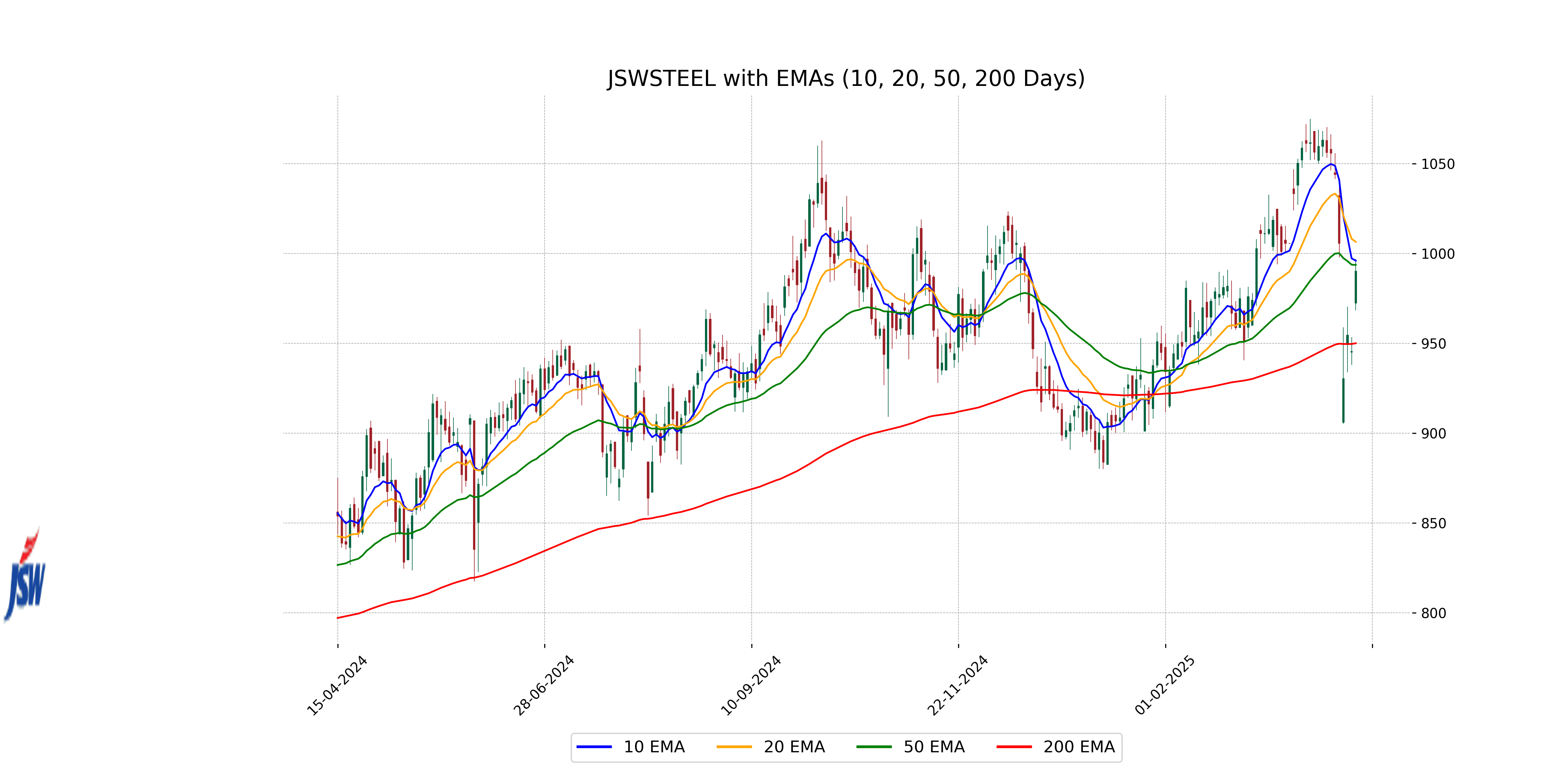

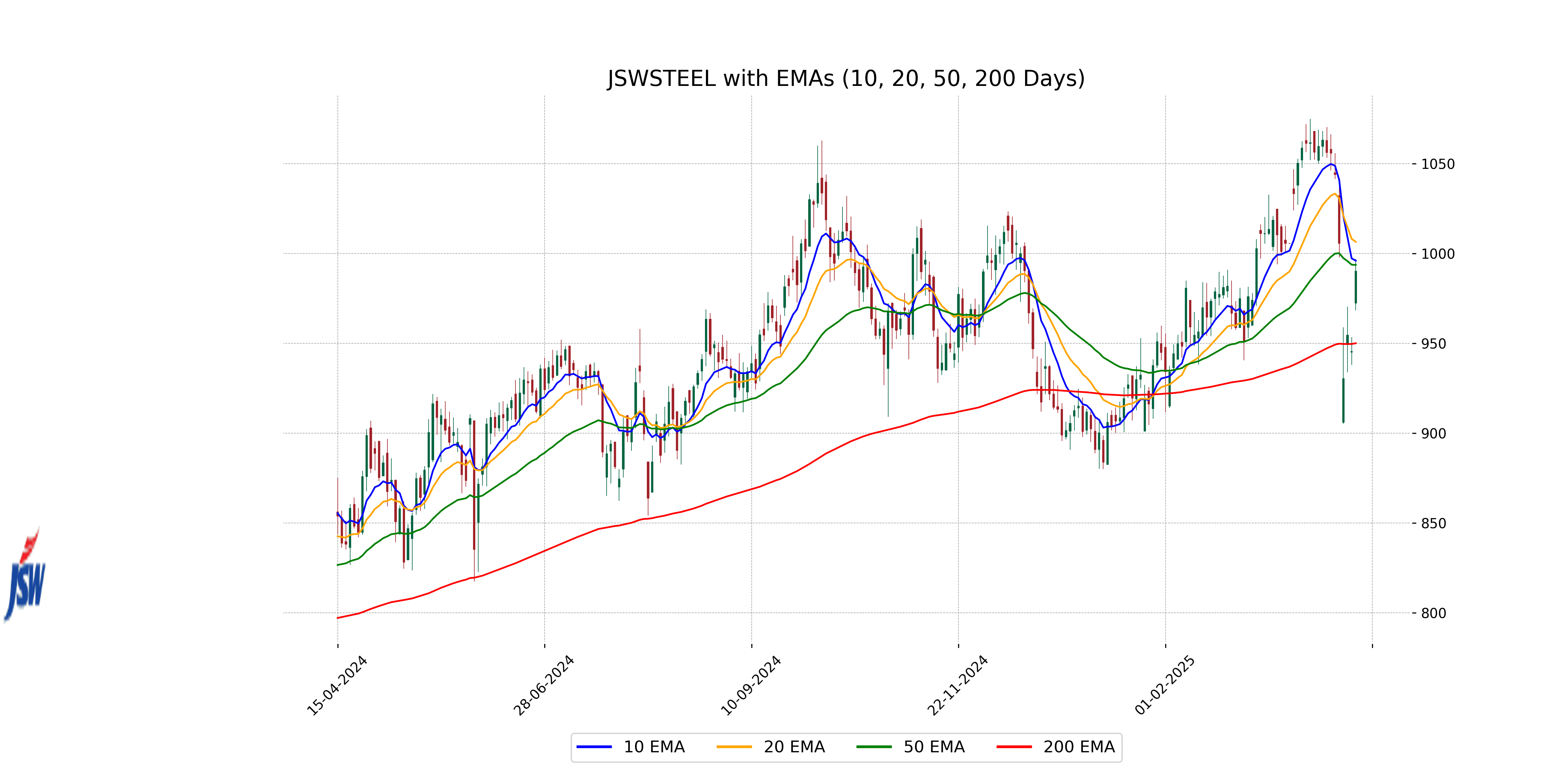

Relationship with Key Moving Averages

JSW Steel's current stock price of 990.25 is below its 10 EMA of 996.03 and the 50 EMA of 993.67, indicating potential bearish sentiment in the short term. However, it remains above the 200 EMA of 950.05, suggesting potential longer-term support.

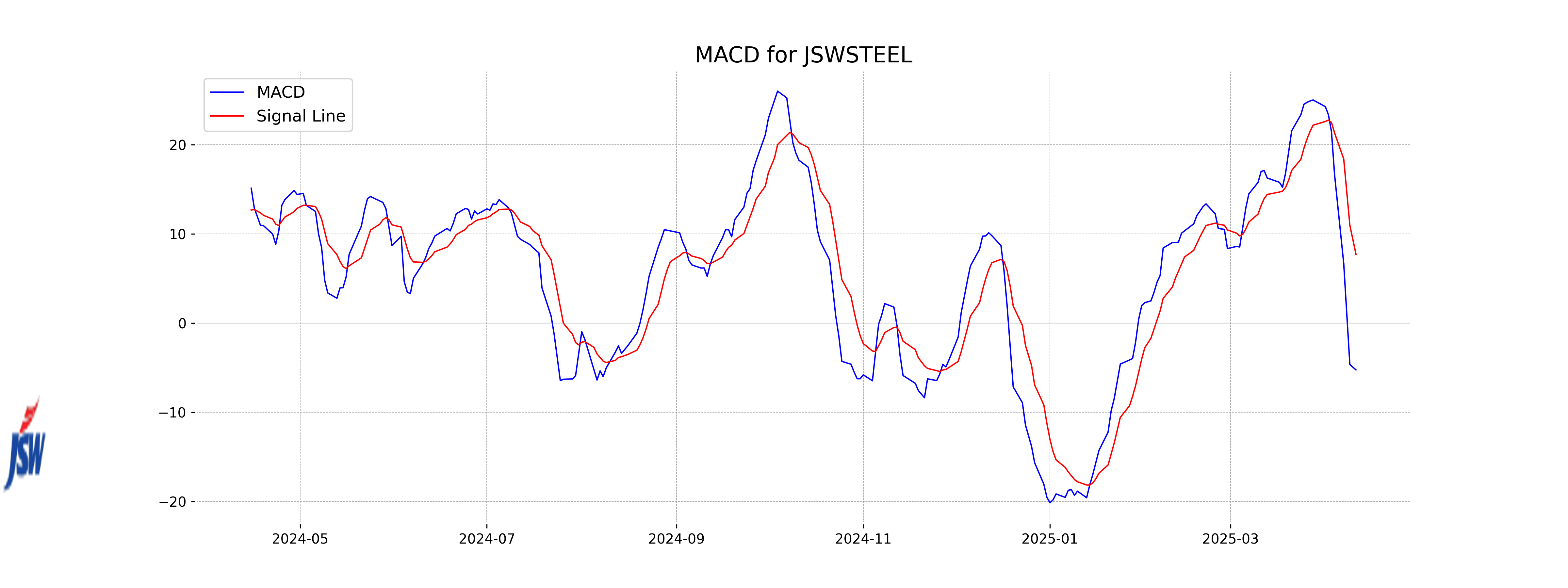

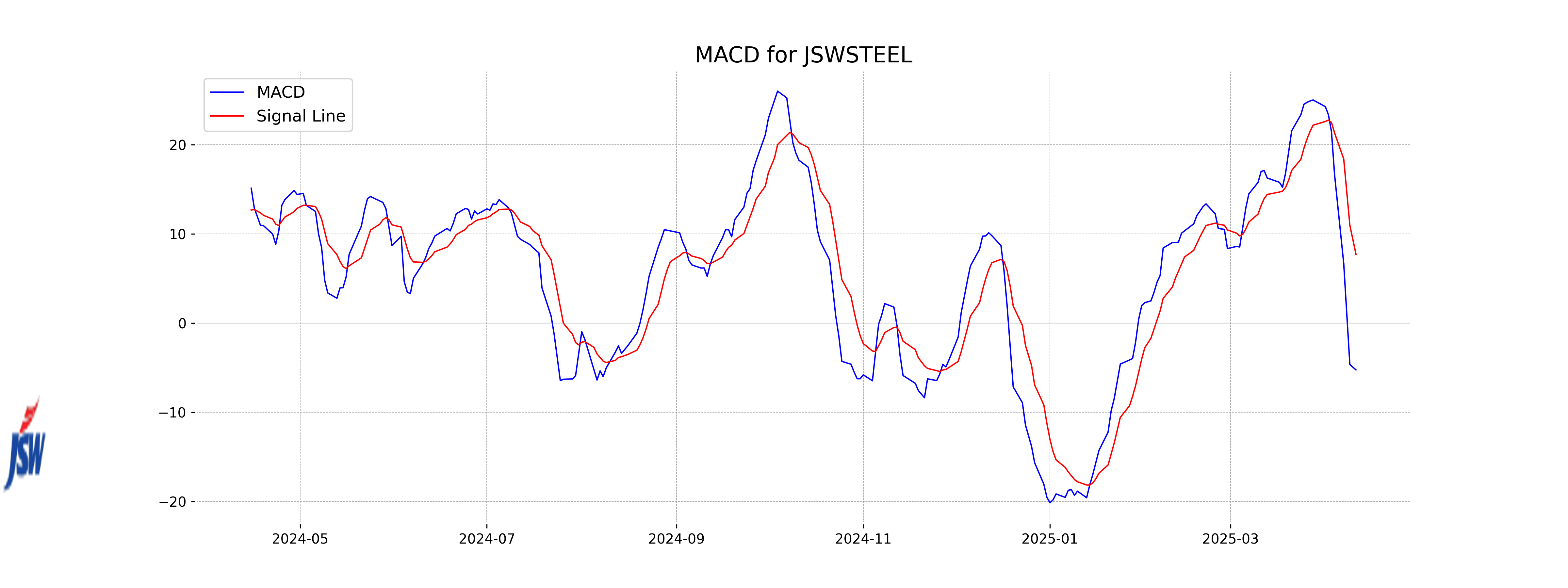

Moving Averages Trend (MACD)

JSW Steel's MACD is currently at -5.26, which is below the MACD Signal of 7.71. This indicates that the stock may be experiencing bearish momentum in the short term. Traders might look for potential signs of a trend reversal if the MACD starts to converge with the Signal line.

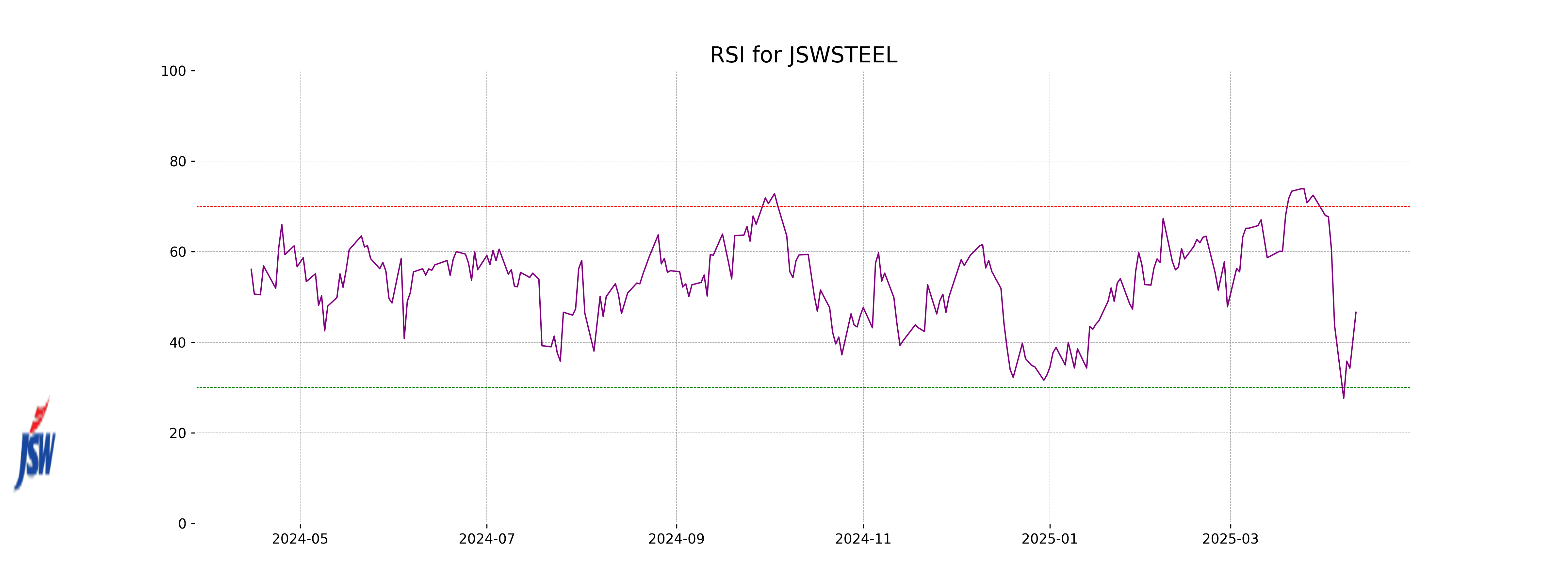

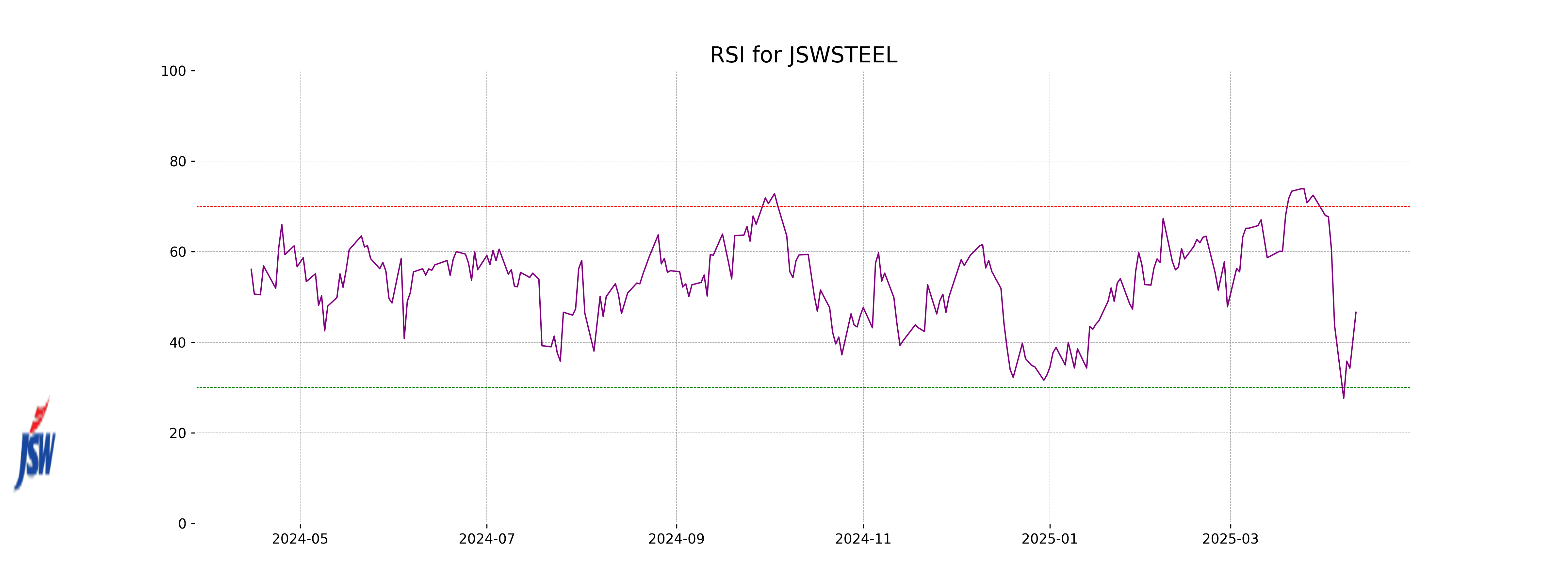

RSI Analysis

RSI Analysis for JSW Steel: The Relative Strength Index (RSI) value of 46.62 indicates that the stock is in the neutral zone, suggesting neither overbought nor oversold conditions. Traders might consider this range as a period of consolidation, with potential for movement in either direction depending on future market conditions.

Analysis for Tata Steel - April 14, 2025

Tata Steel Performance:

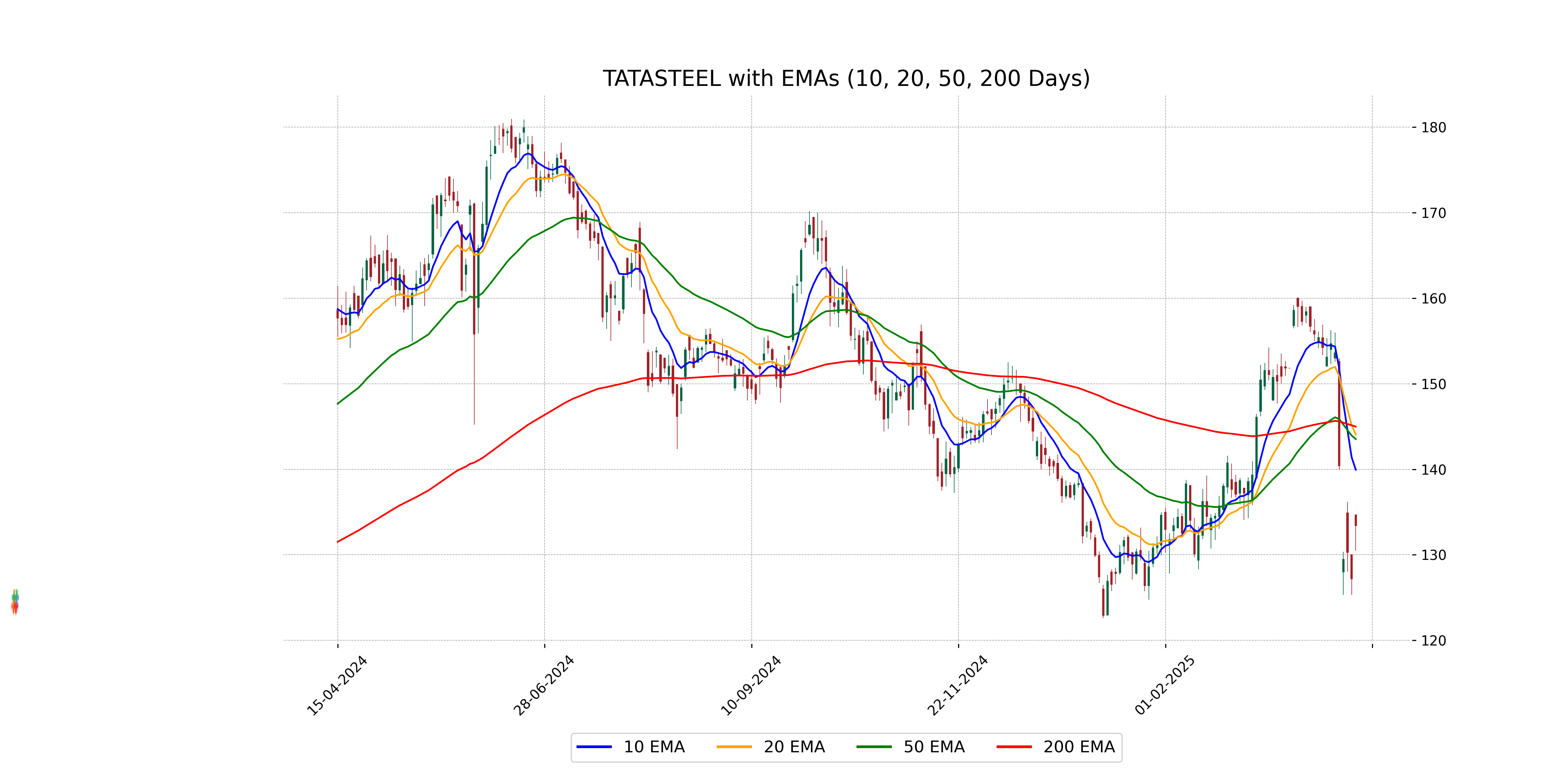

Tata Steel has shown a notable percentage increase of 4.91% with a points change of 6.24, closing at 133.42, following a previous close of 127.18. The volume of shares traded is significant at 73,706,472. However, key indicators such as the EMA values suggest the stock is trading below its major averages, and the RSI is relatively low at 36.27, indicating potential bearish sentiment. With a PE ratio of 60.39 and an EPS of 2.21, the company operates in the Basic Materials sector, specifically in the Steel industry in India.

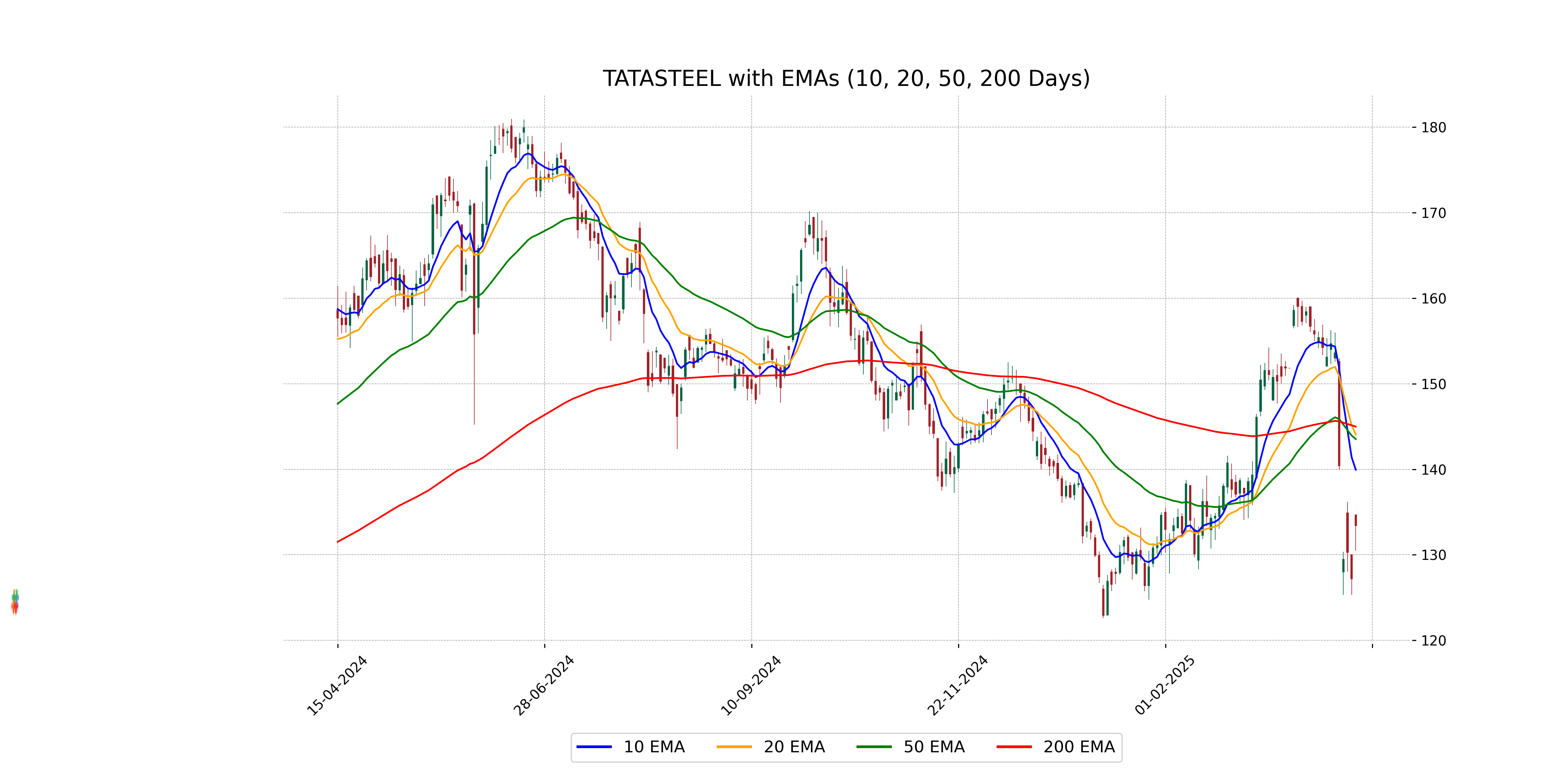

Relationship with Key Moving Averages

Tata Steel's current stock price is below its short-term (10 EMA) and medium-term (50 EMA) moving averages, as well as the long-term (200 EMA) moving average, indicating a potential bearish trend. The RSI value of 36.27 also suggests it is nearing the oversold territory.

Moving Averages Trend (MACD)

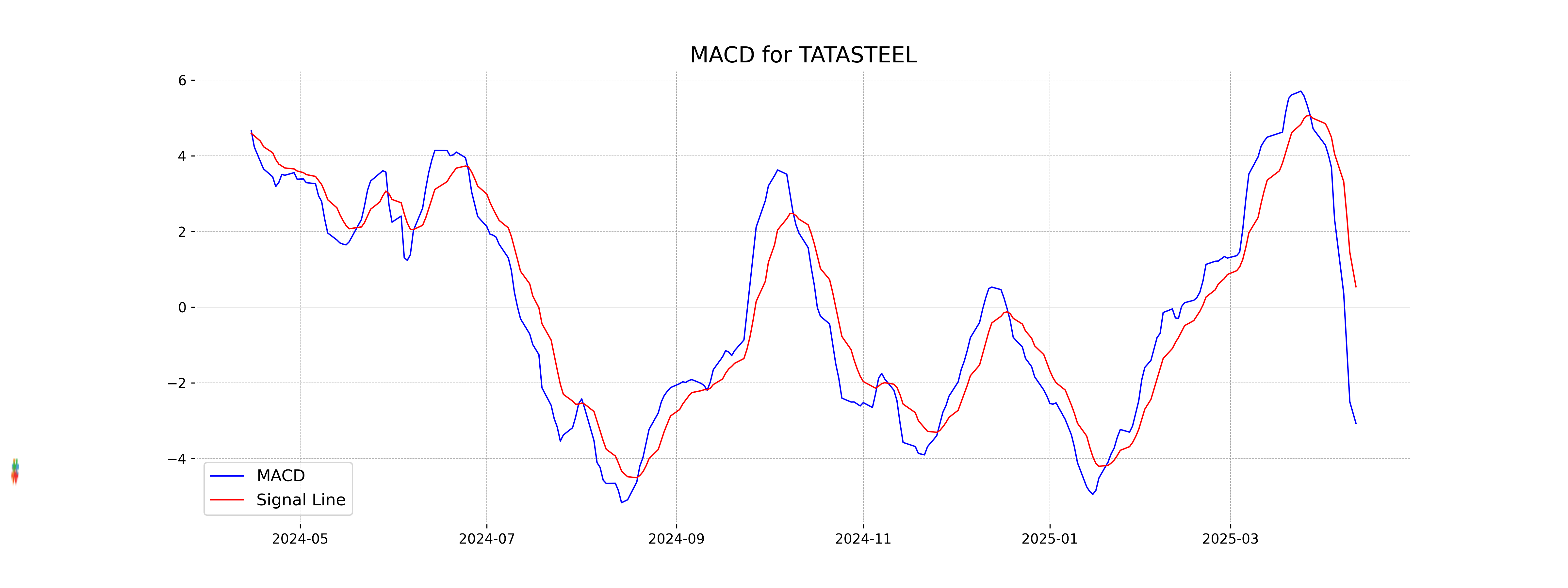

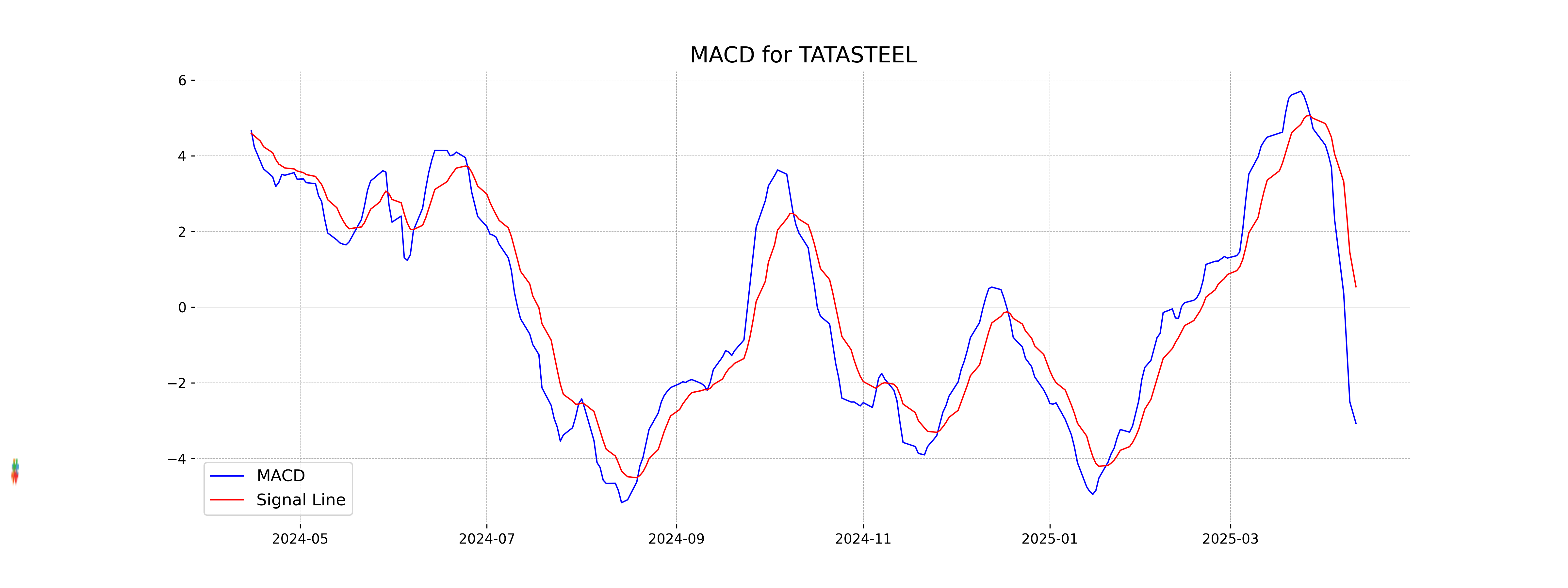

MACD Analysis for Tata Steel:

The MACD for Tata Steel is -3.073, which indicates a bearish momentum as it is below the MACD Signal line of 0.537. This suggests that the stock might be experiencing downward pressure currently.

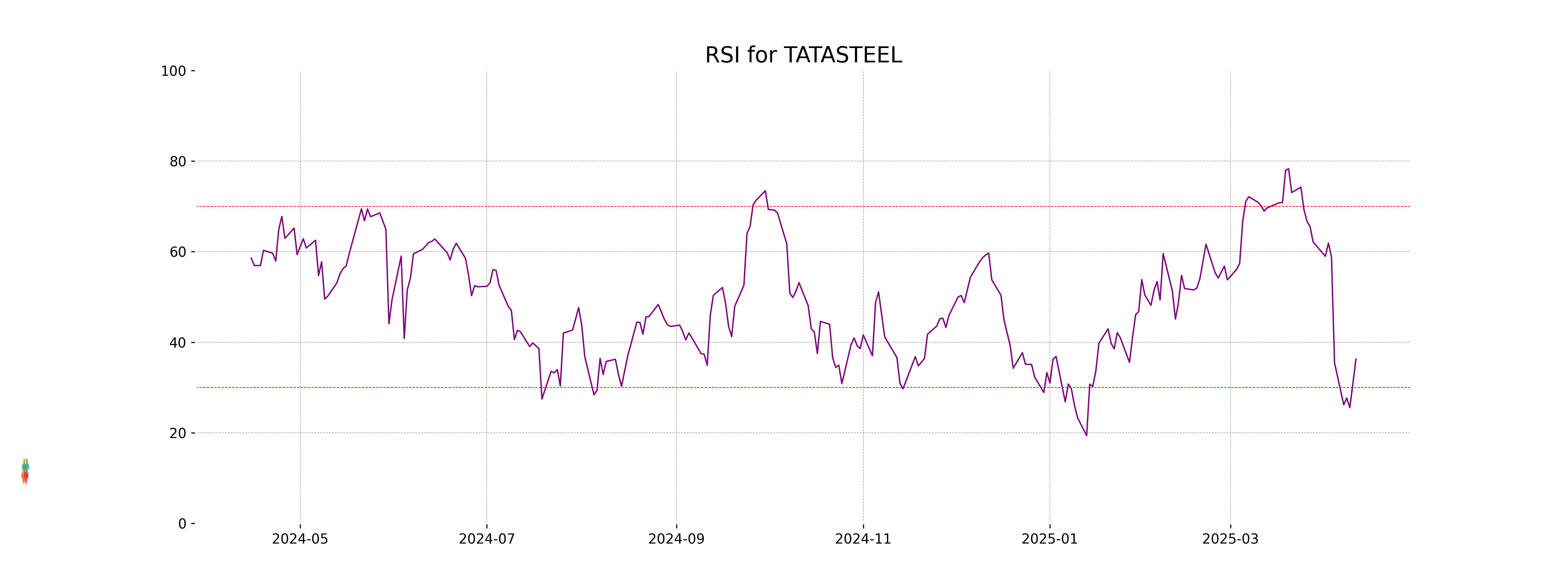

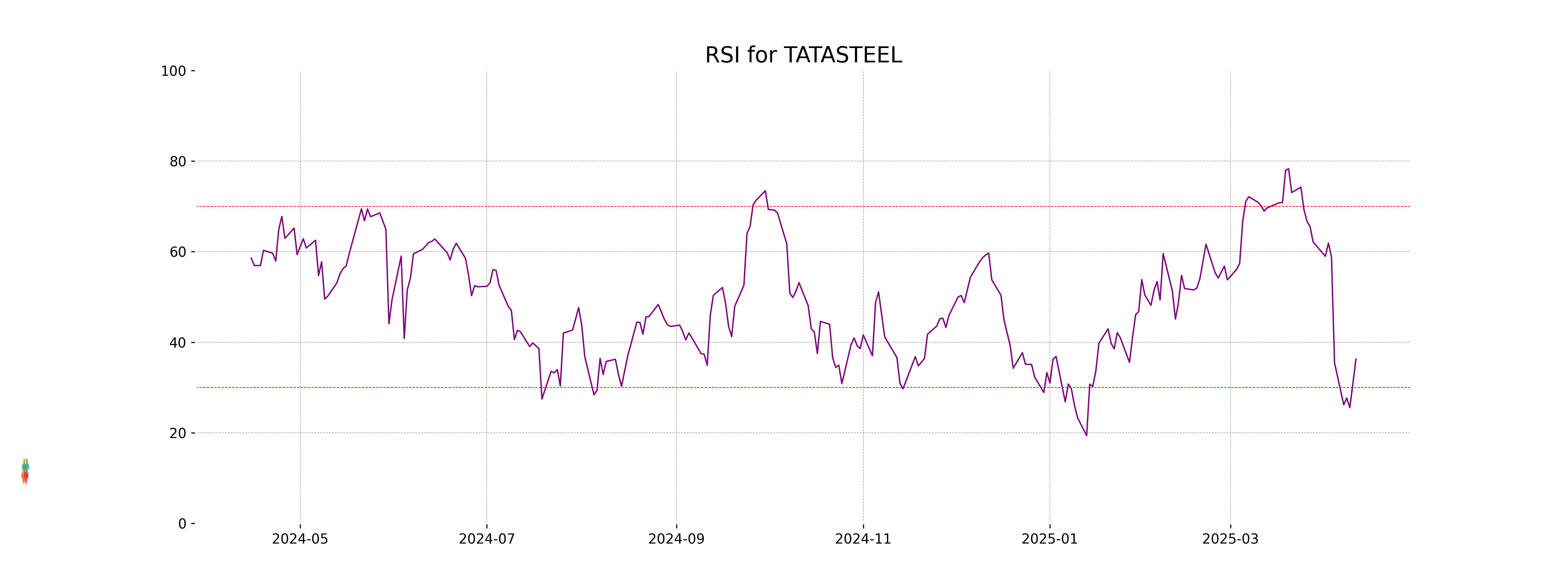

RSI Analysis

The RSI of Tata Steel is 36.27, indicating that the stock is approaching the oversold territory, as RSI values below 30 typically signify that a stock may be undervalued. This suggests potential buying interest may emerge if the downtrend continues.