- Home

- ❯

- Business

- ❯

- Markets

- ❯

- Indian Stock Market Sector-wise Performance: Which Sector is performed Well Today - December 30, 2025

Highlights

Latest news

Salman Khan’s Battle of Galwan teaser draws criticism from Chinese state media

BJP won't cross 50-mark in Bengal polls, says TMC in response to Amit Shah's 'two-thirds majority' claim

Indian Stock Market Sector-wise Performance: Which Sector is performed Well Today - December 30, 2025

New Year's Eve: Traffic restrictions, parking curbs in Delhi's Connaught Place, India Gate areas

PM Modi voices deep concern over targeting of Putin's residence

Yogi Adityanath calls 2026 'defining year', pitches Uttar Pradesh as AI, tech investment hub

PM Modi meets economists ahead of 2026-27 Budget

Civic polls: BJP, Shiv Sena alliance cracks in Chhatrapati Sambhajinagar, Pune

Indian Stock Market Sector-wise Performance: Which Sector is performed Well Today - December 30, 2025

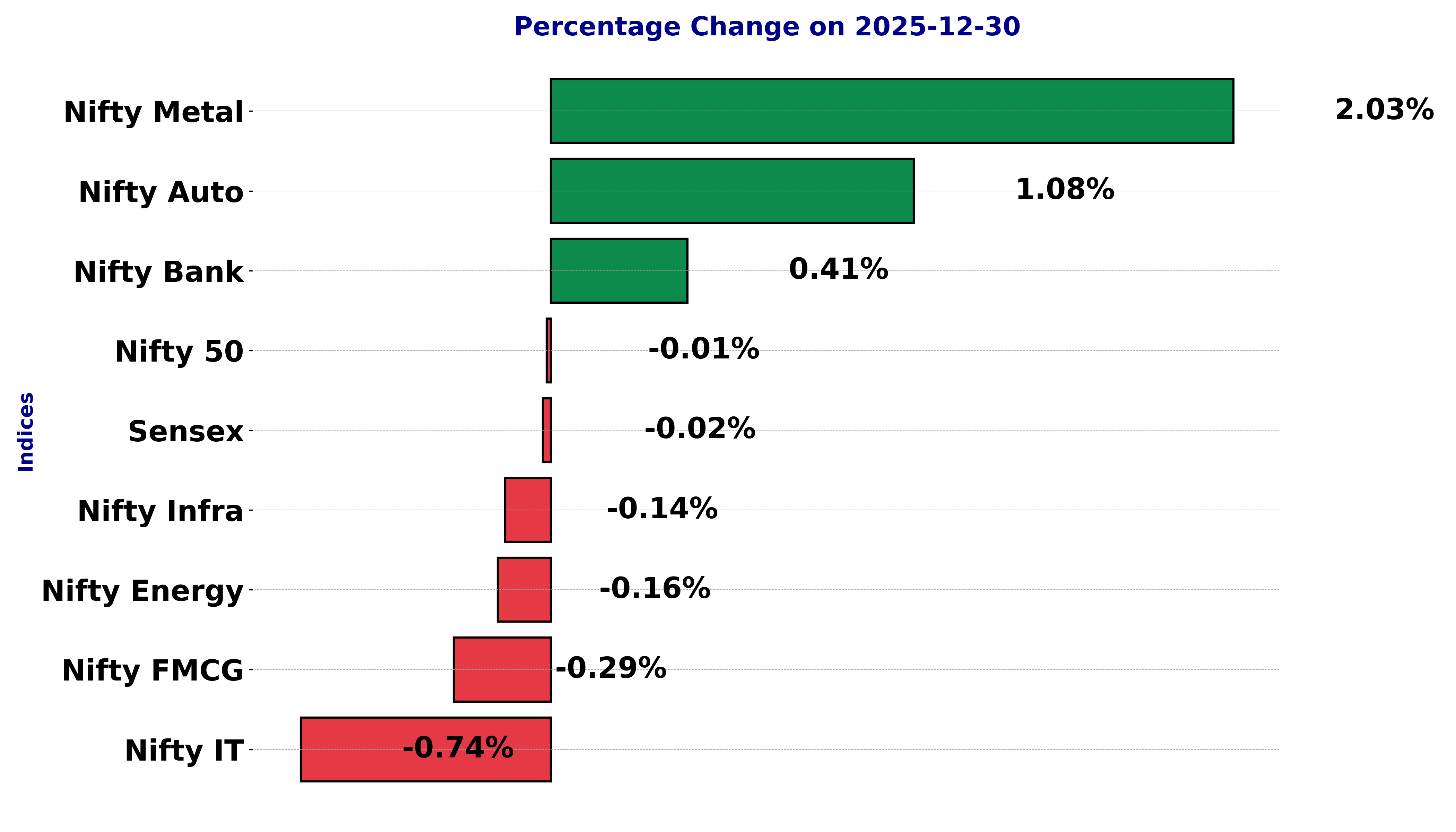

The market exhibited a mixed performance across various indices, with certain sectors standing out due to notable percentage changes. Among these, Nifty Metal emerged prominently with a significant gain of 2.03%. This rise illustrates a robust performance in the metals sector, possibly driven by strong demand and favorable market conditions that could include higher metal prices or positive export data. On the other hand, the BSE Sensex index experienced a minor decline of 0.02%, reflecting a slight bearish sentiment among investors for the broader market. Meanwhile, Nifty Auto showed a positive trend with a 1.08% increase, suggesting heightened investor confidence in the automotive sector, which may be attributed to improved sales figures, new model launches, or supportive government policies. Nifty Energy, however, saw a modest decline of 0.16%, indicating some softness in the energy sector. This could be due to fluctuating oil prices or profit-taking by investors after a previous rally. Similarly, Nifty FMCG recorded a decrease of 0.29%, which might reflect weaker consumer demand or rising input costs affecting profit margins in the fast-moving consumer goods industry. Nifty Infrastructure displayed a slight dip of 0.14%, possibly due to profit-booking or subdued outlook on infrastructure projects. Nifty IT faced the largest drop among the analyzed indices, declining by 0.74%. This could be attributed to market corrections or concerns over IT spending by key clients, resulting in an effect on investor sentiment. Furthermore, Nifty Bank posted a healthy gain of 0.41%, reflecting strength in the banking sector. This increase may signal investor optimism about the financial health of banks, potential interest rate hikes, or encouraging quarterly earnings. The Nifty index itself was almost flat with a minor decrease of 0.01%, showing a mixed reaction from market participants. The move in the index suggests that while certain sectors were buoyant, they were counterbalanced by declines in others. Overall, the mixed results across the indices point to a period of reevaluation among investors. The notable outperformance of Nifty Metal highlights the sector's current attractiveness or underlying strategies that are bearing fruit, whereas the decline in Nifty IT calls for a closer analysis of the sector's challenges.

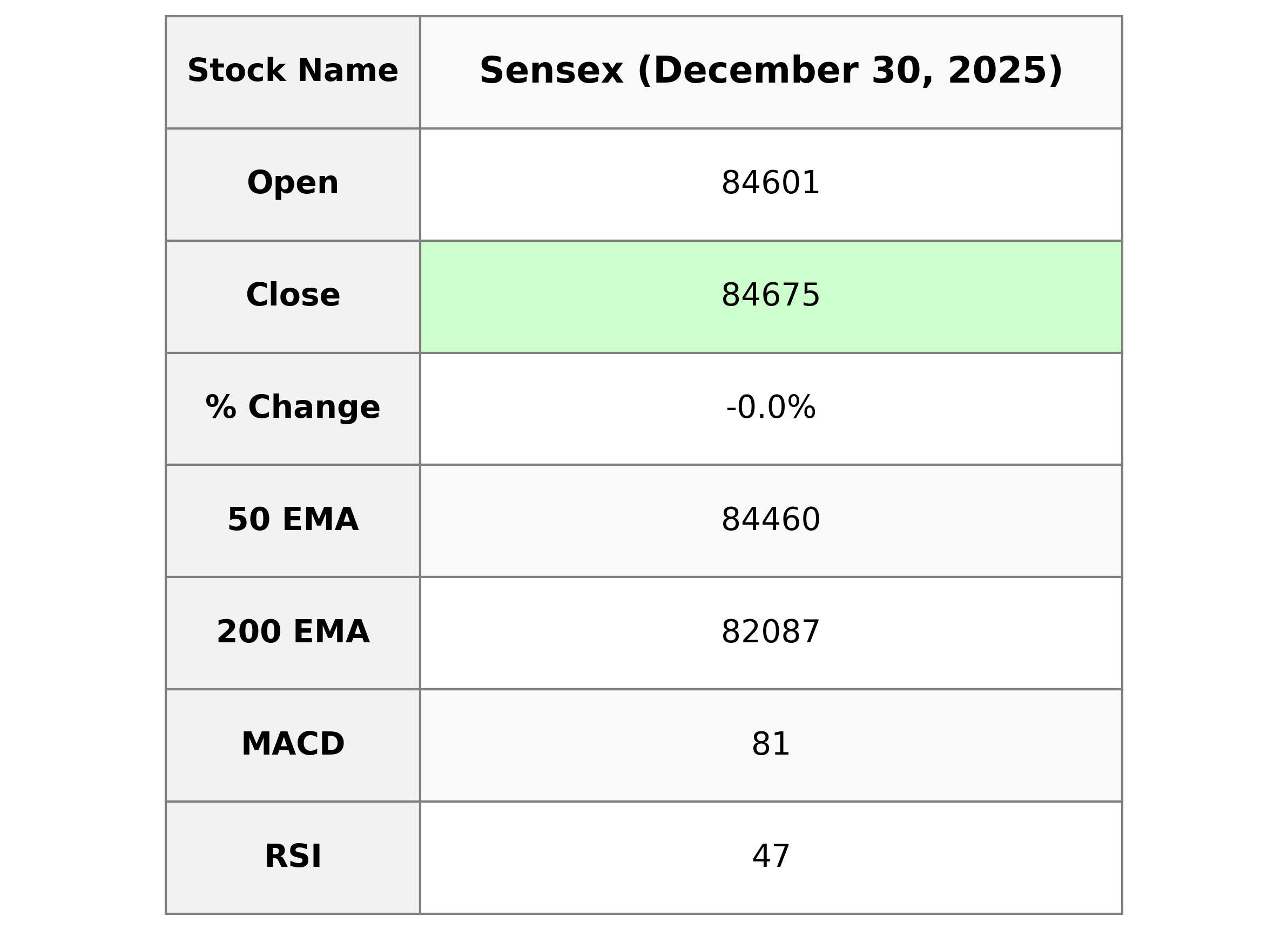

Analysis for Sensex - December 30, 2025

Sensex Performance Summary The Sensex opened at 84,600.99 and closed at 84,675.08, experiencing a slight decline of 0.024% from the previous close of 84,695.54. Despite intra-day fluctuations, with a high of 84,806.99 and a low of 84,470.94, it ended the day with a points change of -20.46. The current RSI of 47.14 suggests a neutral momentum, while influence from short-term EMAs indicates a slightly bearish trend.

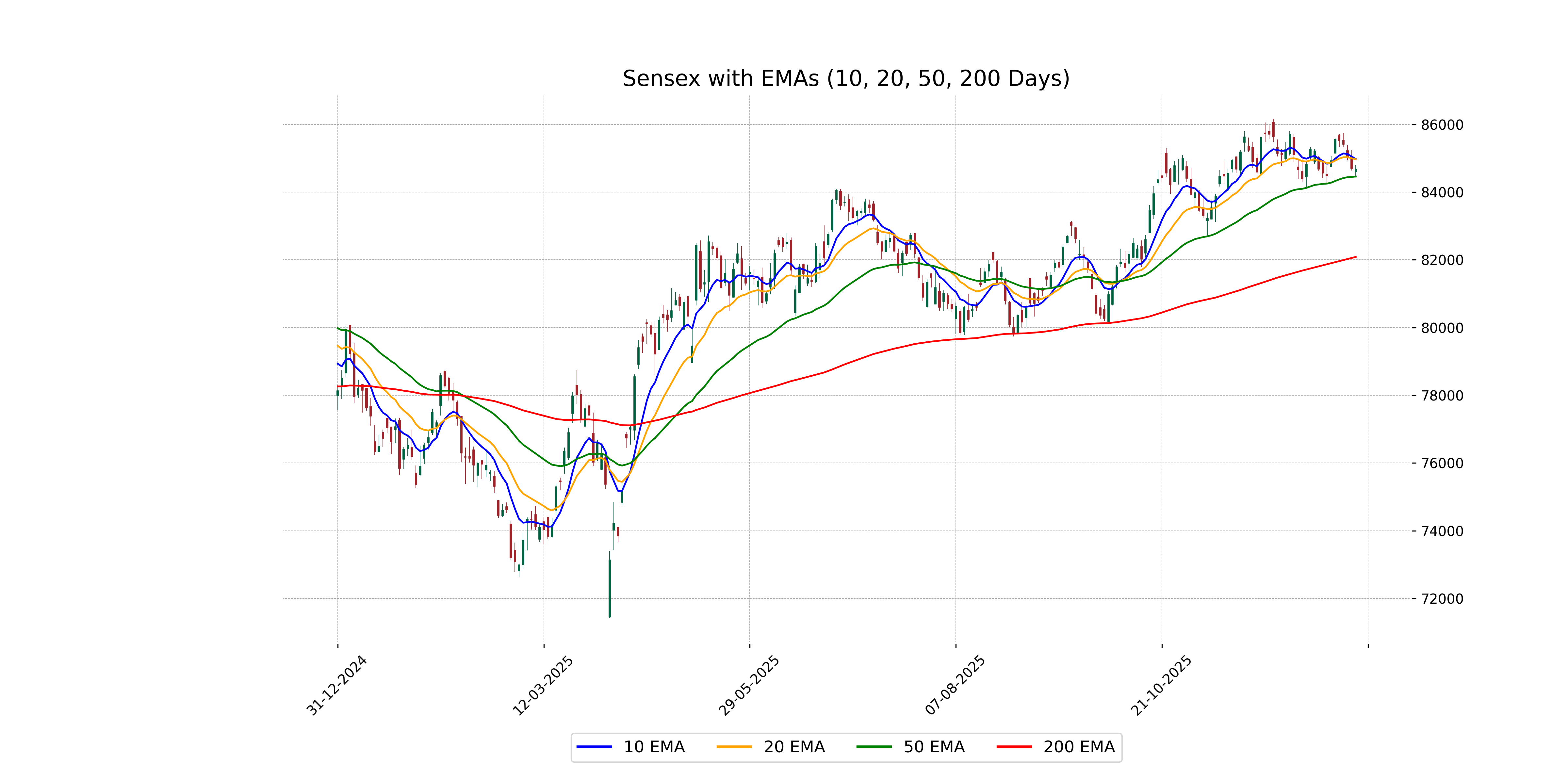

Relationship with Key Moving Averages

Sensex closed at 84,675.08, which is above the 50 EMA of 84,459.87 but below both the 10 EMA of 84,978.77 and the 20 EMA of 84,968.98. This suggests a short-term downtrend relative to the recent averages, though still maintaining a position above the intermediate 50-day EMA.

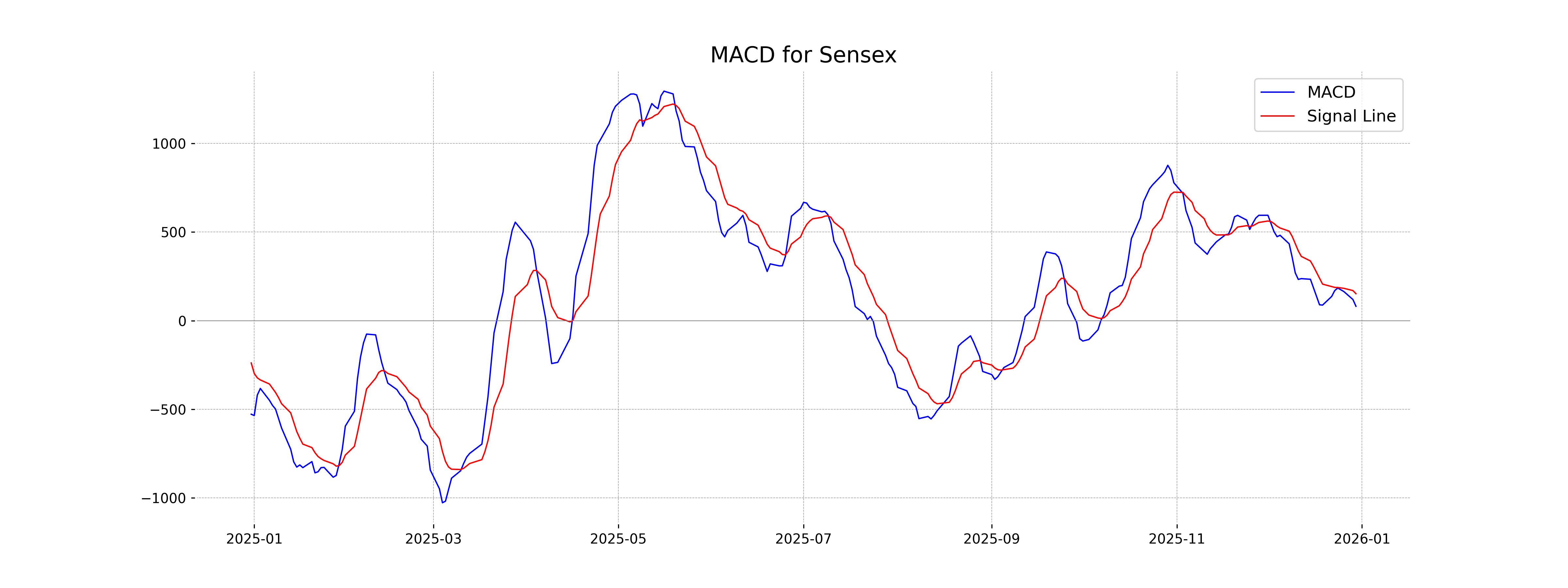

Moving Averages Trend (MACD)

Based on the provided data, the MACD for Sensex is 81.06, which is below the MACD Signal of 152.05. This suggests a potential bearish signal, indicating a downtrend or weakening momentum.

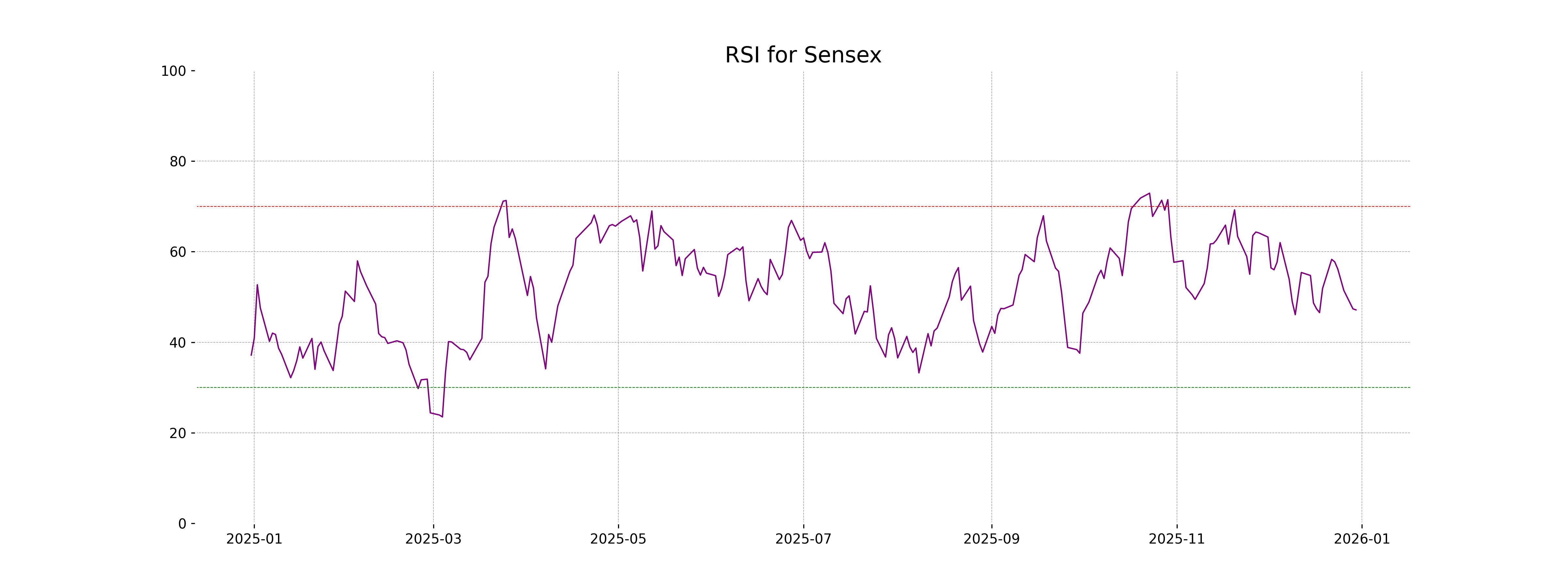

RSI Analysis

The Relative Strength Index (RSI) for Sensex stands at 47.14, indicating that it is in the neutral range. An RSI below 30 typically signals an oversold condition, whereas an RSI above 70 indicates overbought conditions. With the RSI near the middle, the index shows no strong bullish or bearish momentum at the moment.

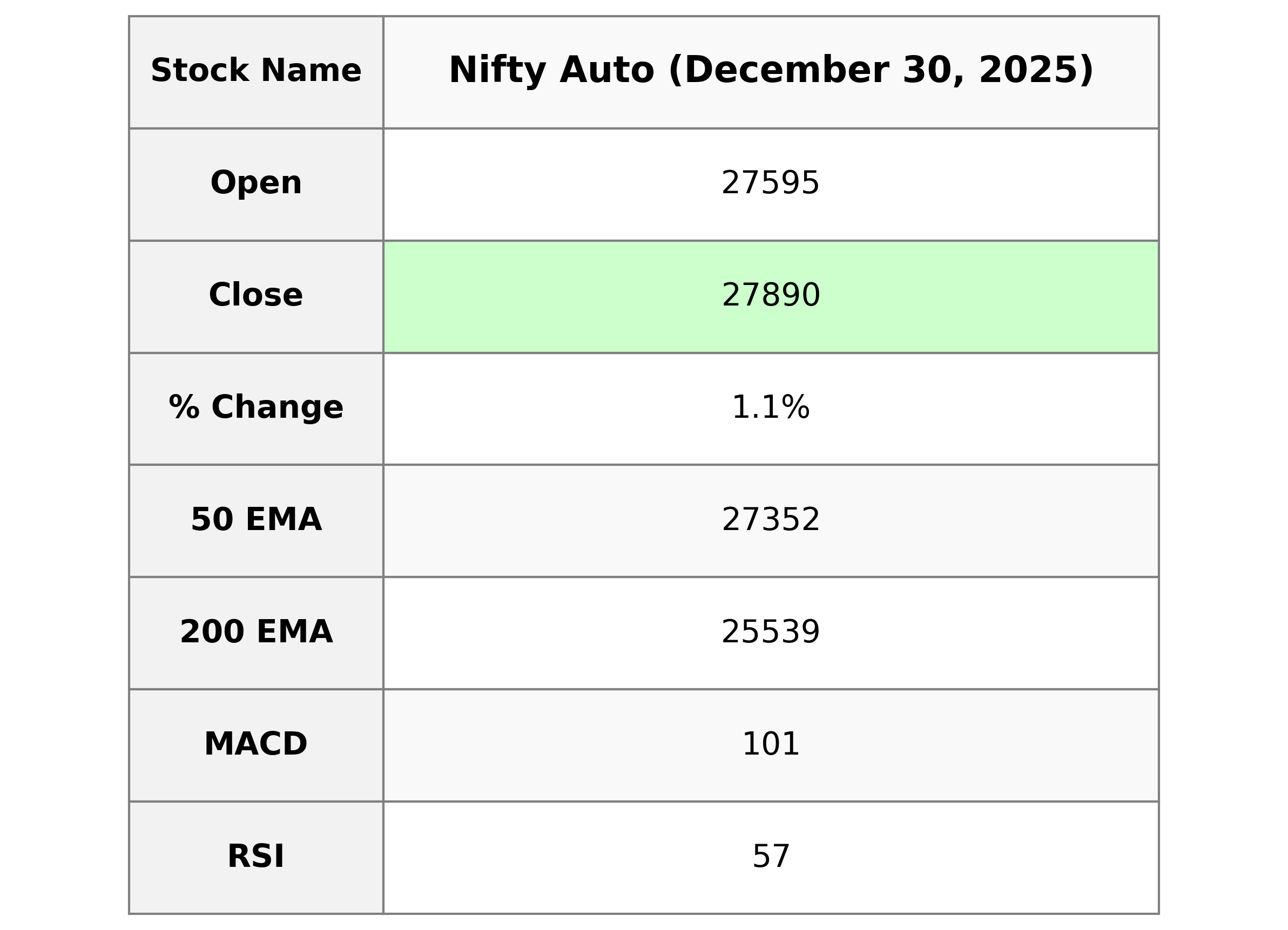

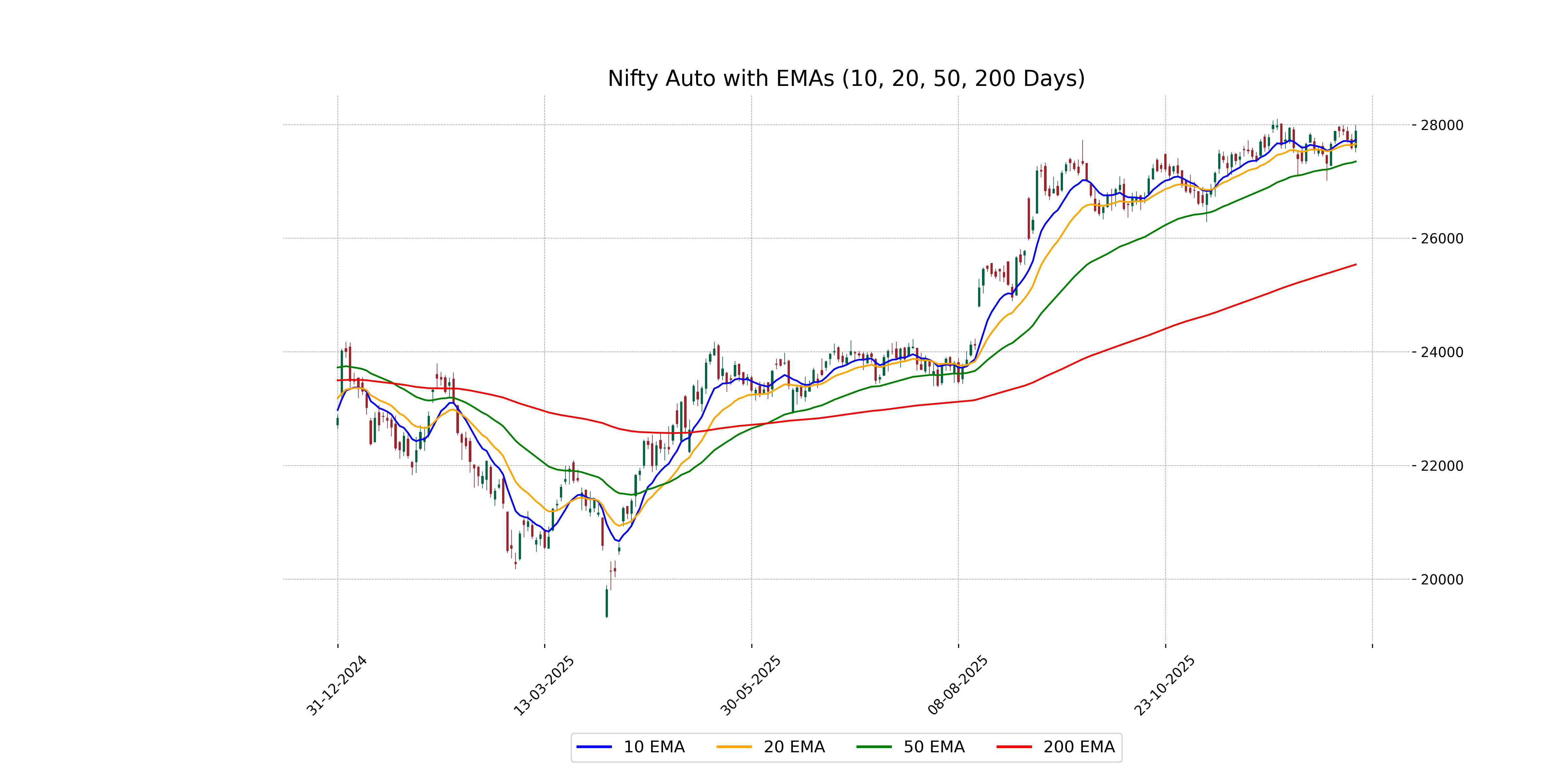

Analysis for Nifty Auto - December 30, 2025

Nifty Auto Performance On the given day, Nifty Auto opened at 27,595.05 and closed at 27,889.65, reflecting a 1.08% increase from the previous close of 27,592.50. The index experienced a notable upwards movement with a points change of 297.15, reaching a high of 27,991.80 and a low of 27,516.85. Key indicators include a 10 EMA of 27,729.01 and a MACD slightly below the signal line, hinting at a consolidation phase.

Relationship with Key Moving Averages

Nifty Auto's closing price of 27,889.65 is above its 10 EMA of 27,729.01, 20 EMA of 27,662.20, and 50 EMA of 27,352.32, indicating a short to medium-term bullish trend. The presence above these key moving averages suggests positive momentum in the stock.

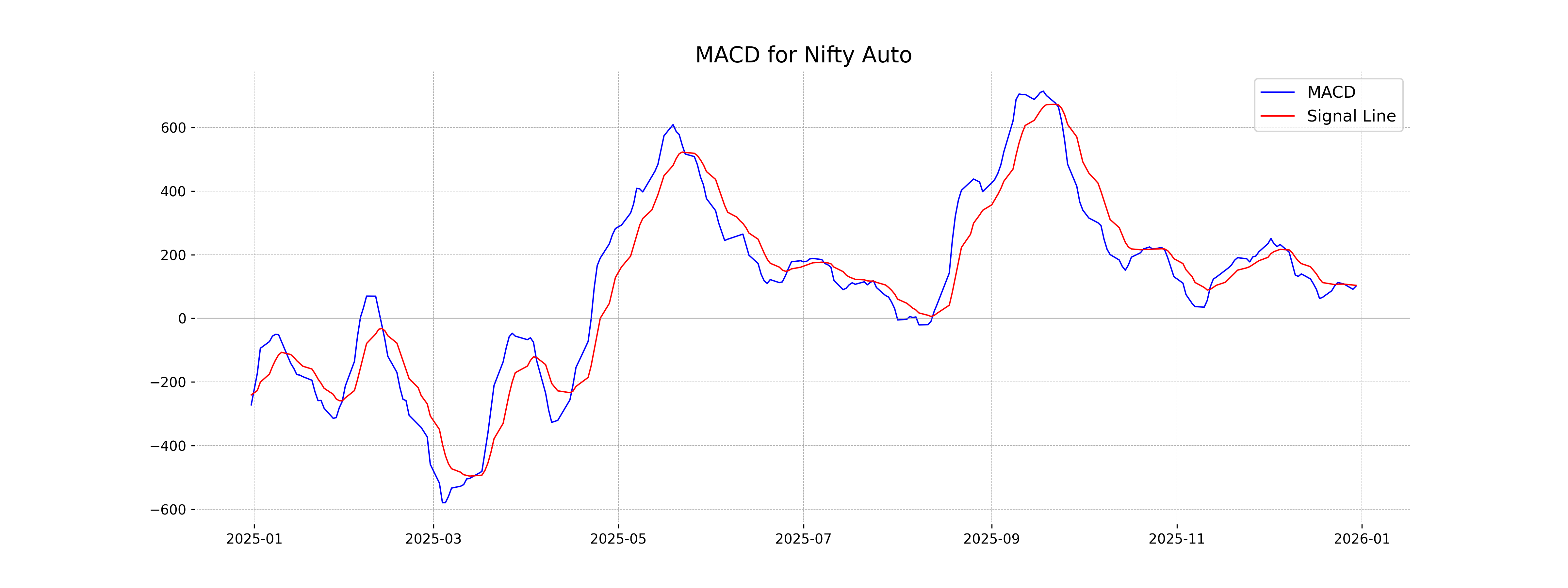

Moving Averages Trend (MACD)

The MACD for Nifty Auto is 100.91, which is slightly below the MACD Signal of 103.55, suggesting a potential bearish crossover or impending bearish trend. However, the RSI at 56.83 indicates a neutral to slightly bullish momentum.

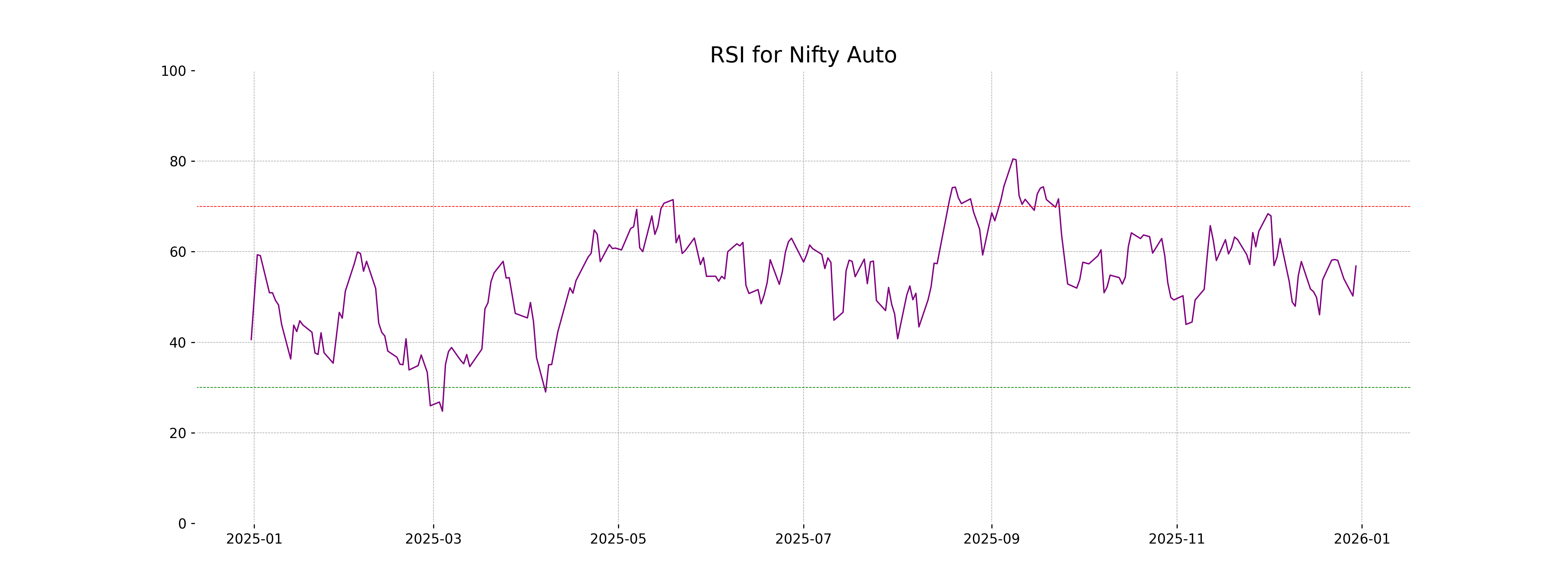

RSI Analysis

RSI Analysis for Nifty Auto: The RSI (Relative Strength Index) for Nifty Auto stands at 56.83, which indicates a neutral position in terms of market momentum. Typically, an RSI above 70 signals overbought conditions, while an RSI below 30 suggests oversold conditions. Currently, Nifty Auto does not exhibit any significant overbought or oversold signals, suggesting balanced market sentiment.

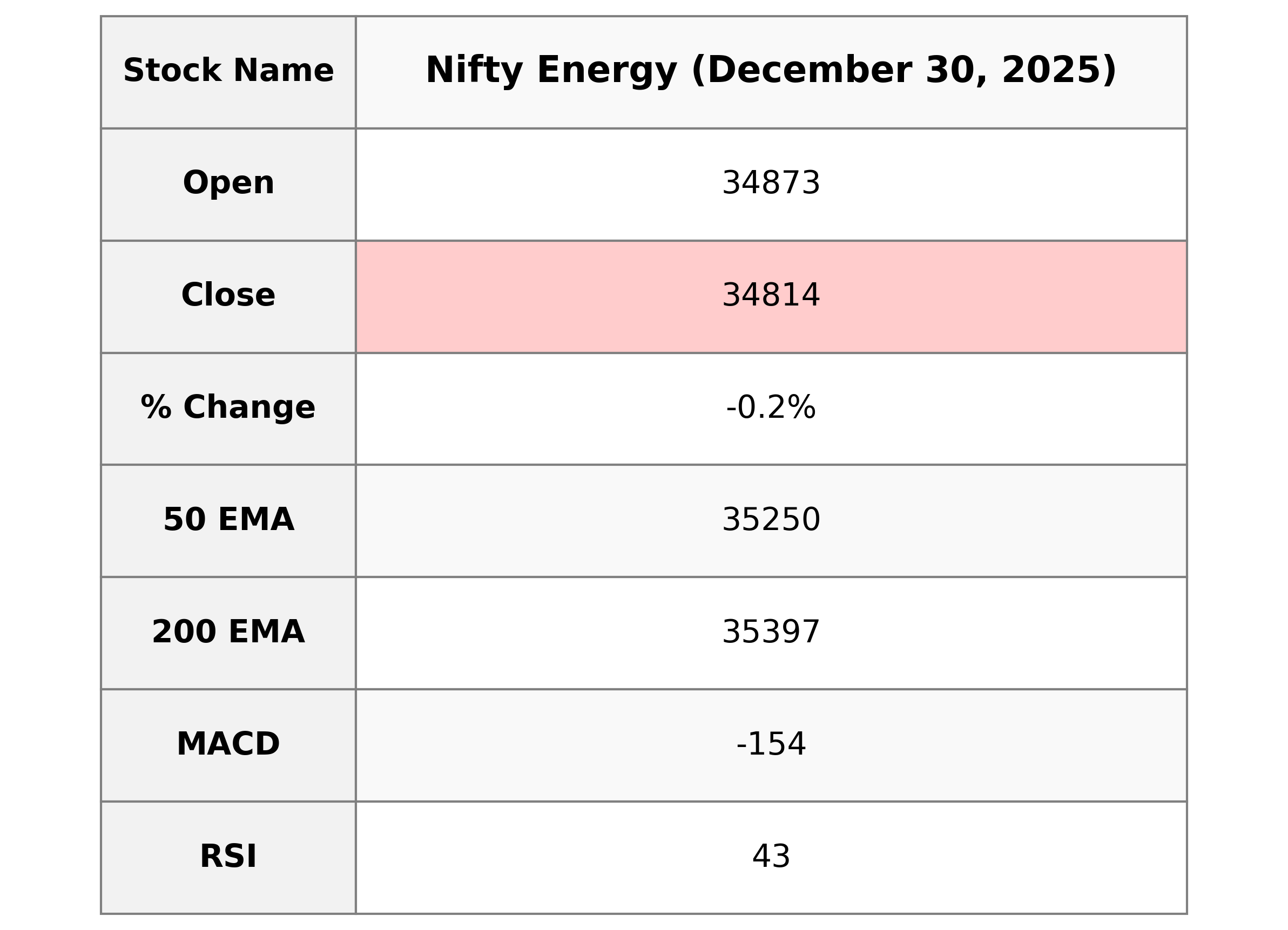

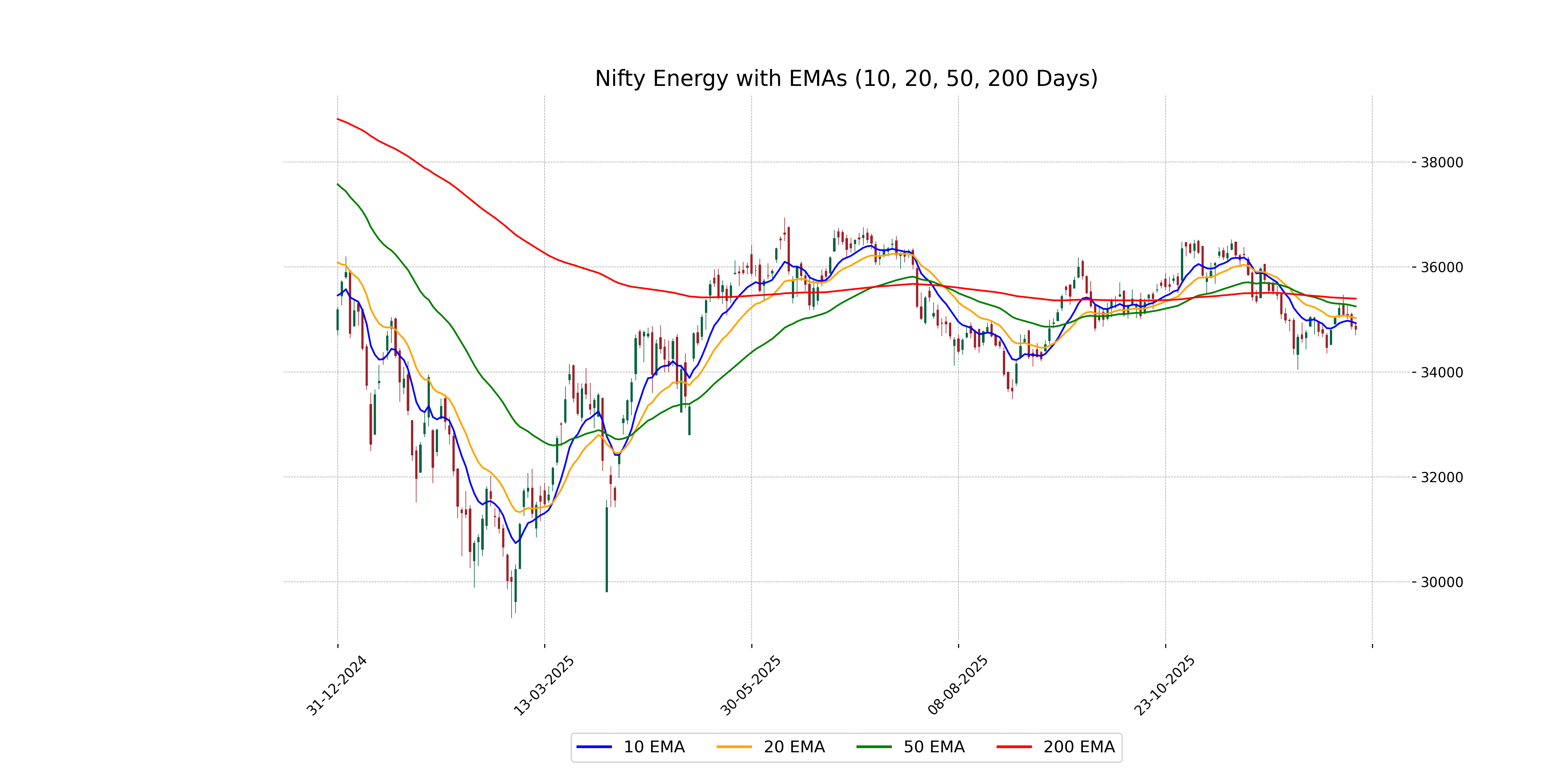

Analysis for Nifty Energy - December 30, 2025

The Nifty Energy index opened at 34,872.80 and closed slightly lower at 34,813.90, marking a decrease of 0.16% or 54.85 points. With its relative strength index (RSI) at 43.47, the index is nearing oversold territory, indicating potential price weakness. The MACD of -154.10 compared to the MACD Signal of -193.44 suggests the bearish momentum might be slowing down.

Relationship with Key Moving Averages

The current closing price of Nifty Energy at 34,813.90 is below its key moving averages. It is significantly under the 50 EMA at 35,250.37 and the 200 EMA at 35,396.87, suggesting a bearish trend. The stock is also under the 10 EMA and 20 EMA, indicating potential continuing downward momentum.

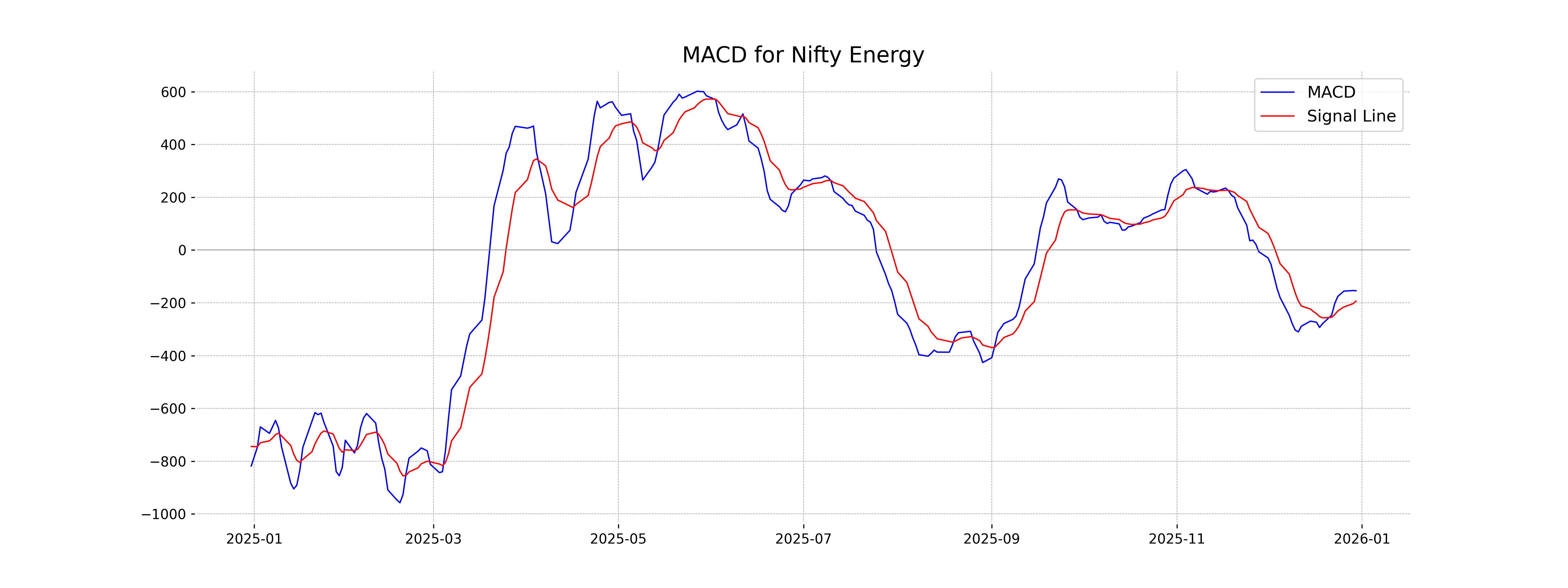

Moving Averages Trend (MACD)

Nifty Energy's MACD indicator is currently at -154.10, which is higher than its Signal line at -193.44. This suggests a potential bullish crossover, indicating that the downward momentum might be slowing. However, the overall trend remains negative, as the MACD is still below the zero line.

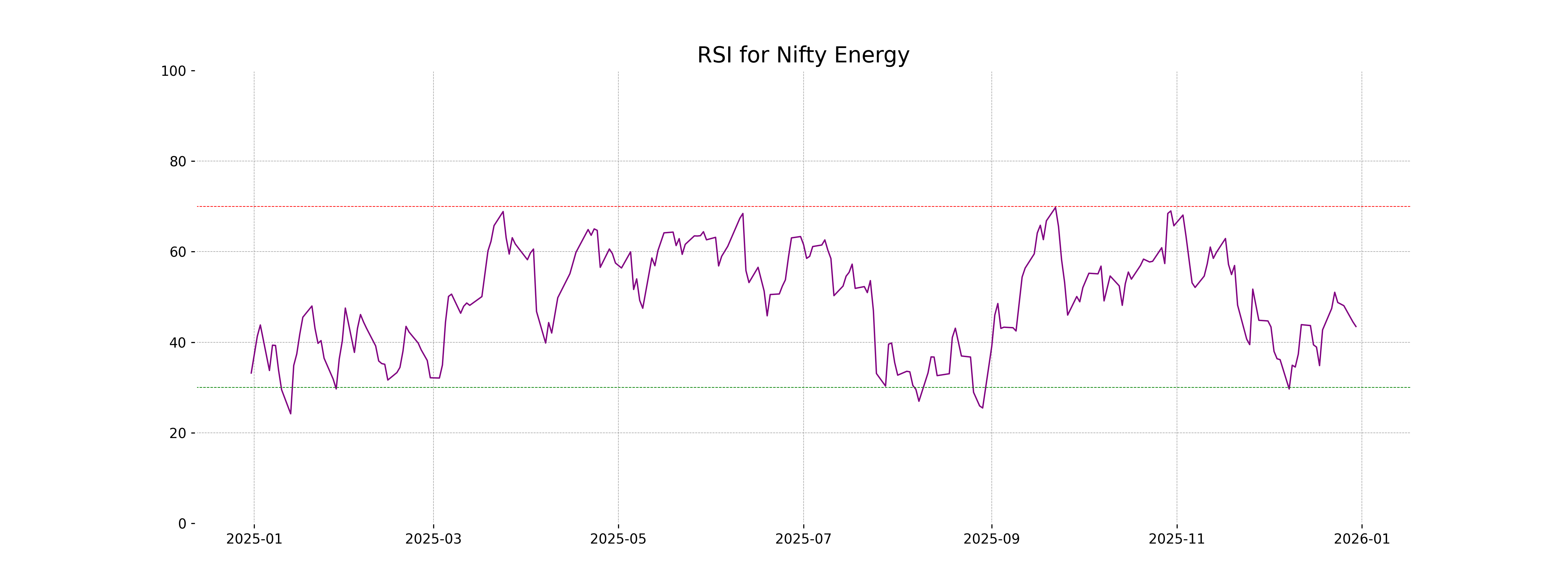

RSI Analysis

Based on the given data, the RSI (Relative Strength Index) for Nifty Energy is 43.47, which suggests that the stock is close to being oversold as it is below 50. Typically, an RSI below 30 indicates an oversold condition, while an RSI above 70 suggests that a stock might be overbought. Hence, Nifty Energy is nearing the lower end, but not yet in the oversold territory.

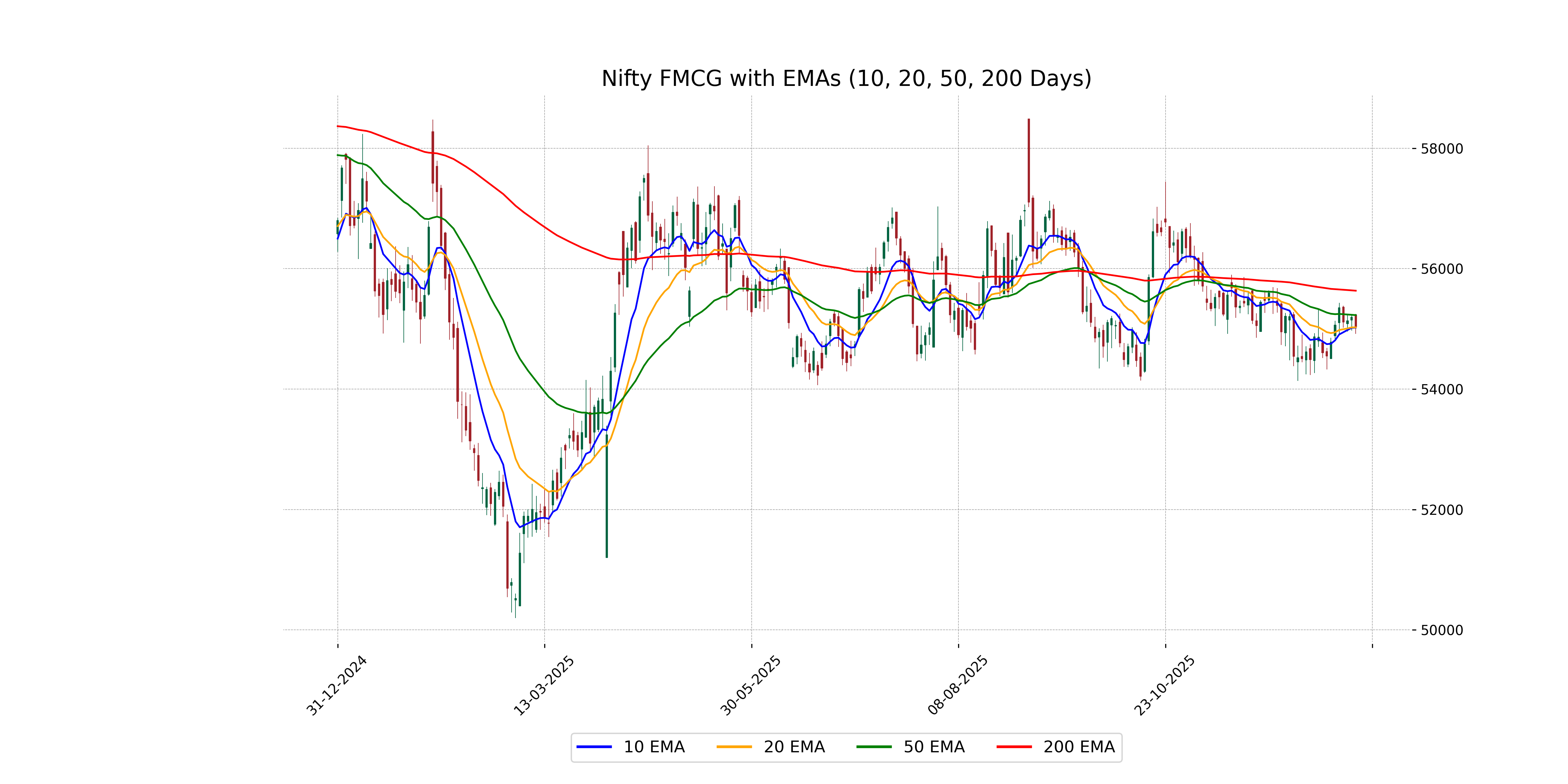

Analysis for Nifty FMCG - December 30, 2025

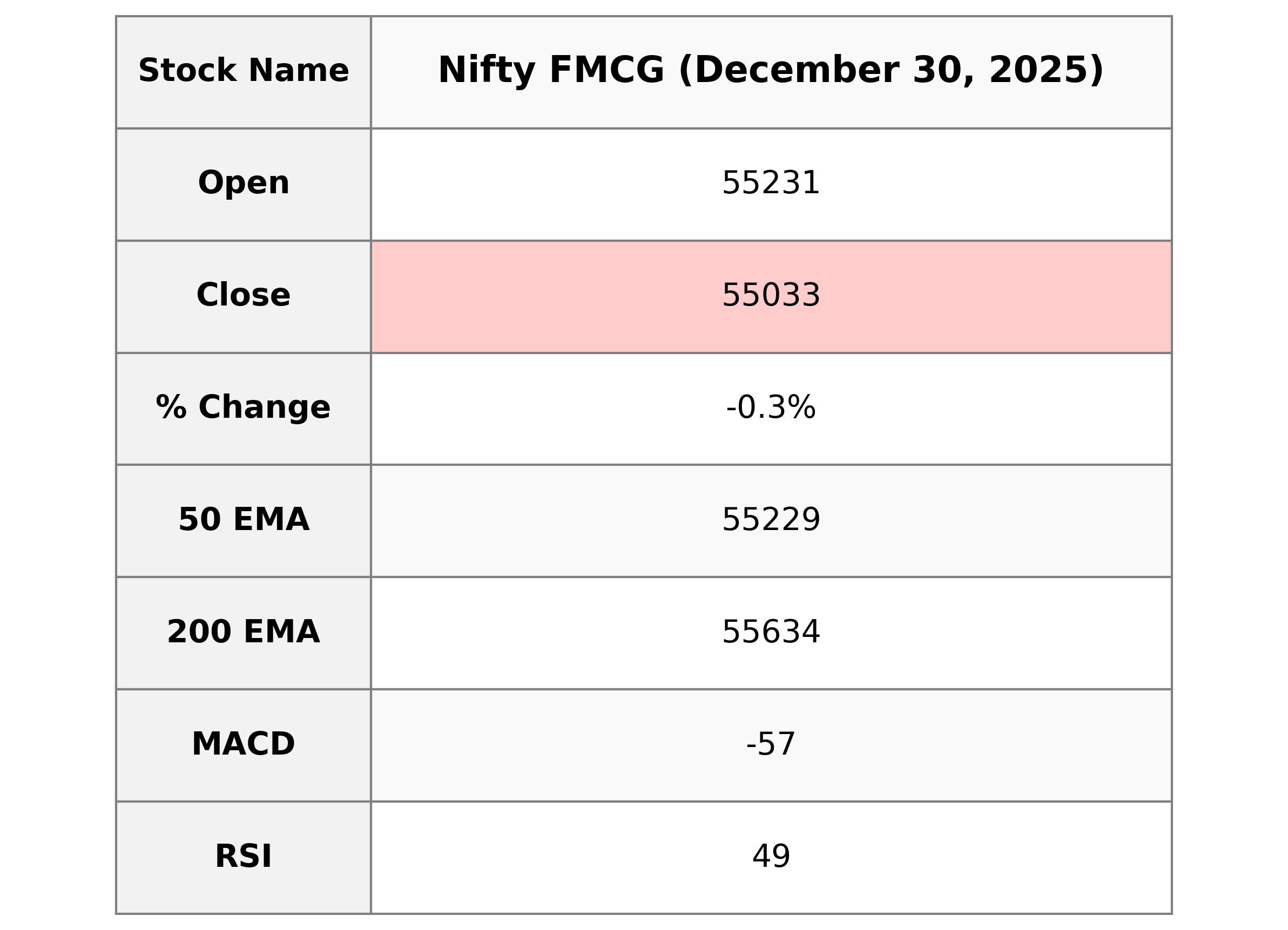

Nifty FMCG opened at 55231.35, reached a high of 55246.95 and a low of 54918.55, ultimately closing at 55033.15. It experienced a decrease from the previous close of 55192.45, with a percentage change of -0.2886% and a points change of -159.30. The 50-day EMA is slightly above the current closing price, indicating a bearish trend, while the RSI of 49.14 suggests neutral momentum.

Relationship with Key Moving Averages

The Nifty FMCG index's closing price of 55033.1484 is below its 50 EMA of 55228.7501 and 200 EMA of 55634.0563, indicating a bearish trend in the short to medium term. However, it is slightly above the 10 EMA and 20 EMA, suggesting potential short-term support around current levels.

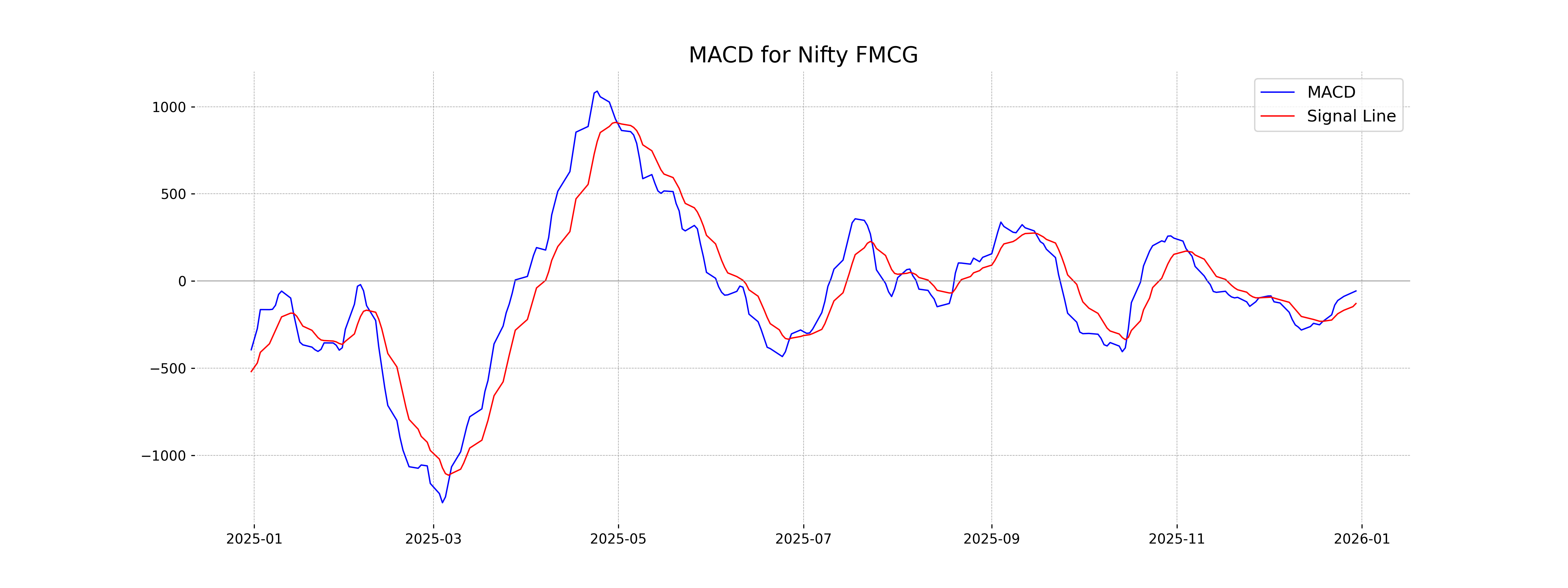

Moving Averages Trend (MACD)

The MACD for Nifty FMCG is currently at -56.90, which is above the MACD Signal of -128.91. This suggests a potentially bullish divergence, indicating possible upward momentum or a reversal upward.

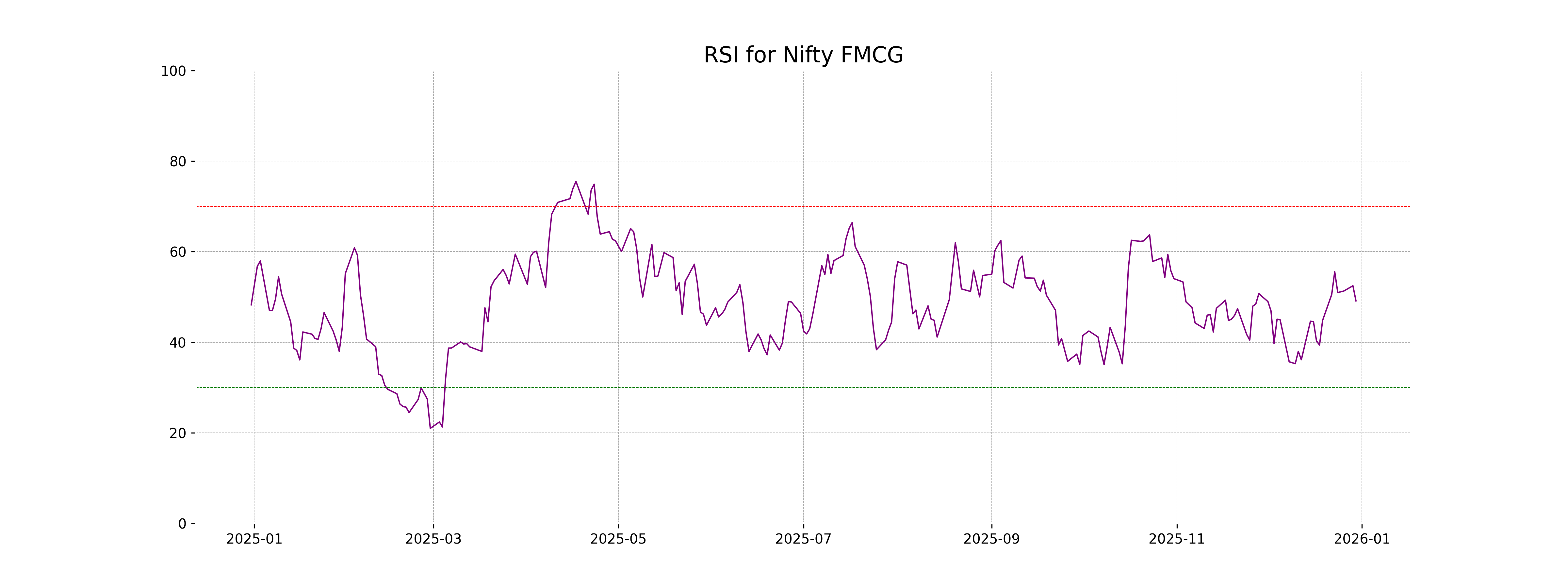

RSI Analysis

The Relative Strength Index (RSI) for Nifty FMCG stands at 49.13, which is near the midpoint of the scale. This indicates that the stock is neither overbought nor oversold, suggesting a neutral momentum in recent trading sessions.

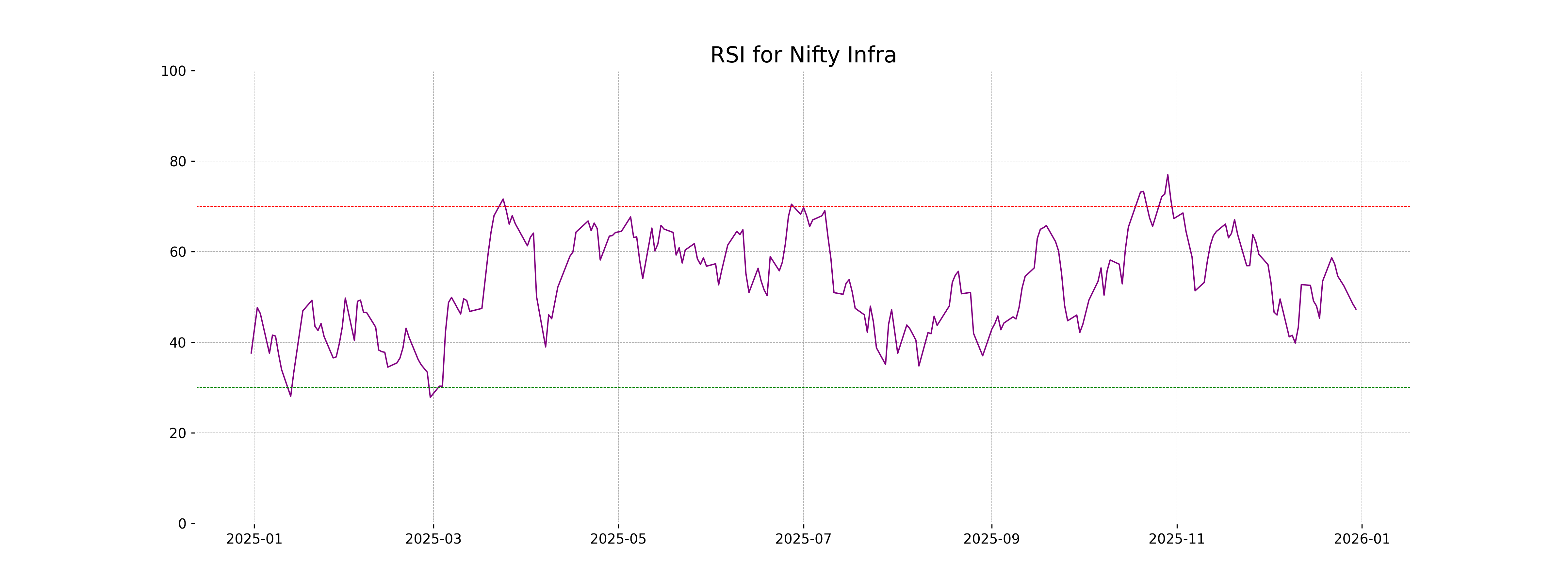

Analysis for Nifty Infra - December 30, 2025

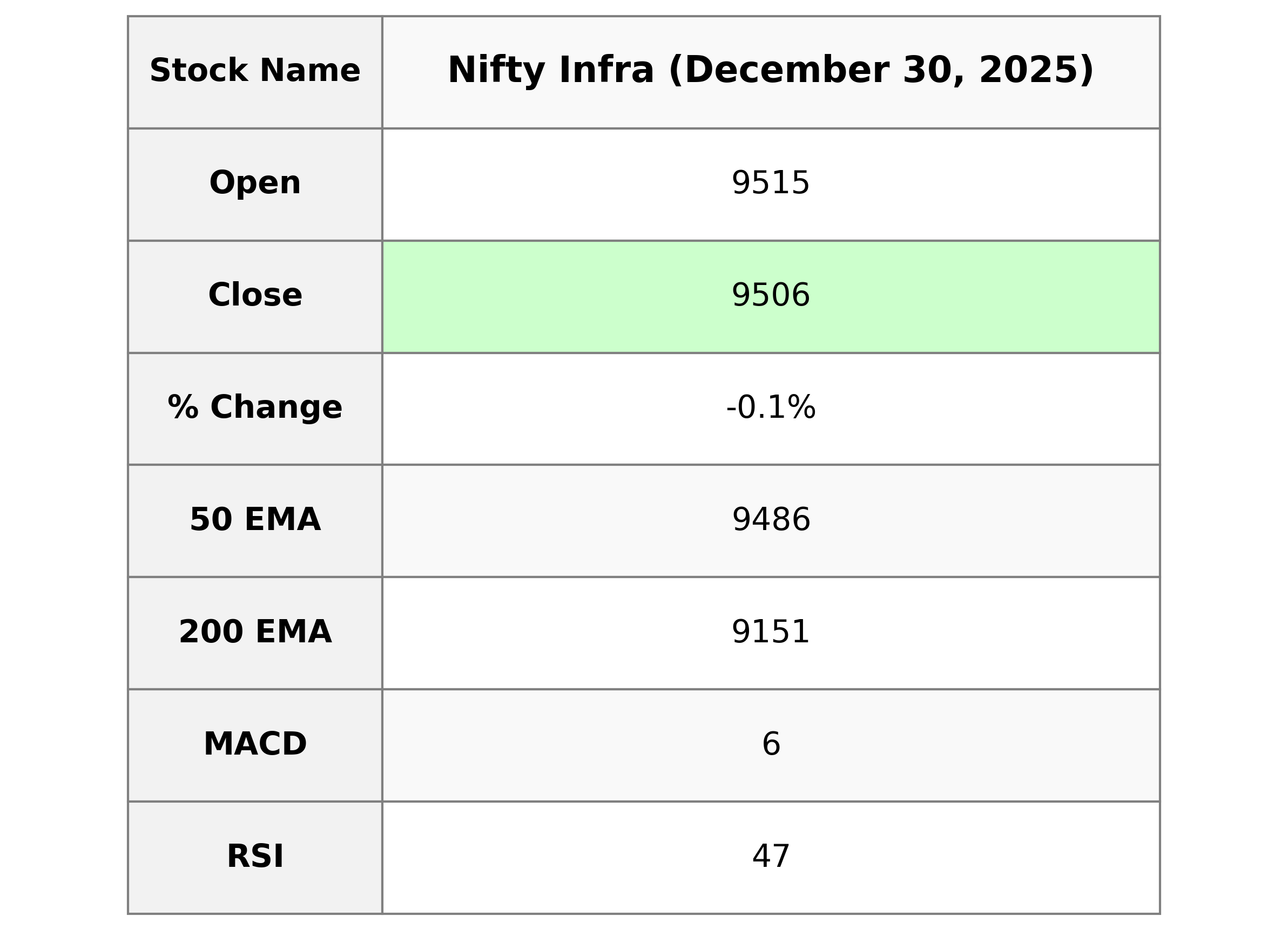

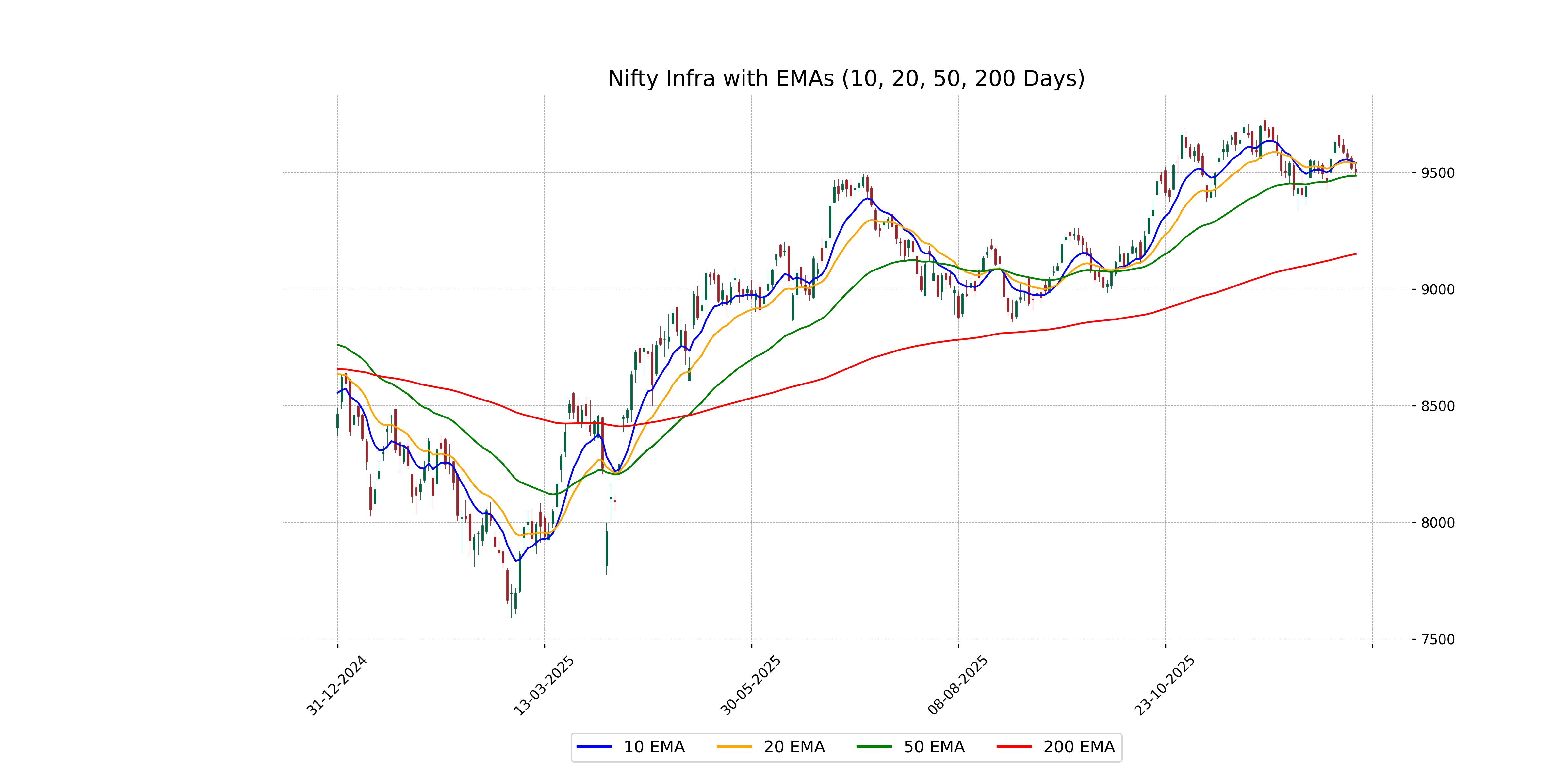

Nifty Infra opened at 9515.05, reaching a high of 9540.65 and a low of 9489.10, closing slightly down at 9505.65 with a percentage change of -0.14%. The 50-Day EMA is 9486.49, while the 200-Day EMA is 9151.10, indicating a relatively stable trend. The RSI is 47.31, suggesting a neutral momentum.

Relationship with Key Moving Averages

Nifty Infra closed at 9505.65, which is slightly above its 50-day EMA of 9486.49 but below both its 10-day EMA of 9541.81 and its 20-day EMA of 9539.85. This indicates a recent decline compared to shorter-term averages, possibly indicating a short-term bearish sentiment.

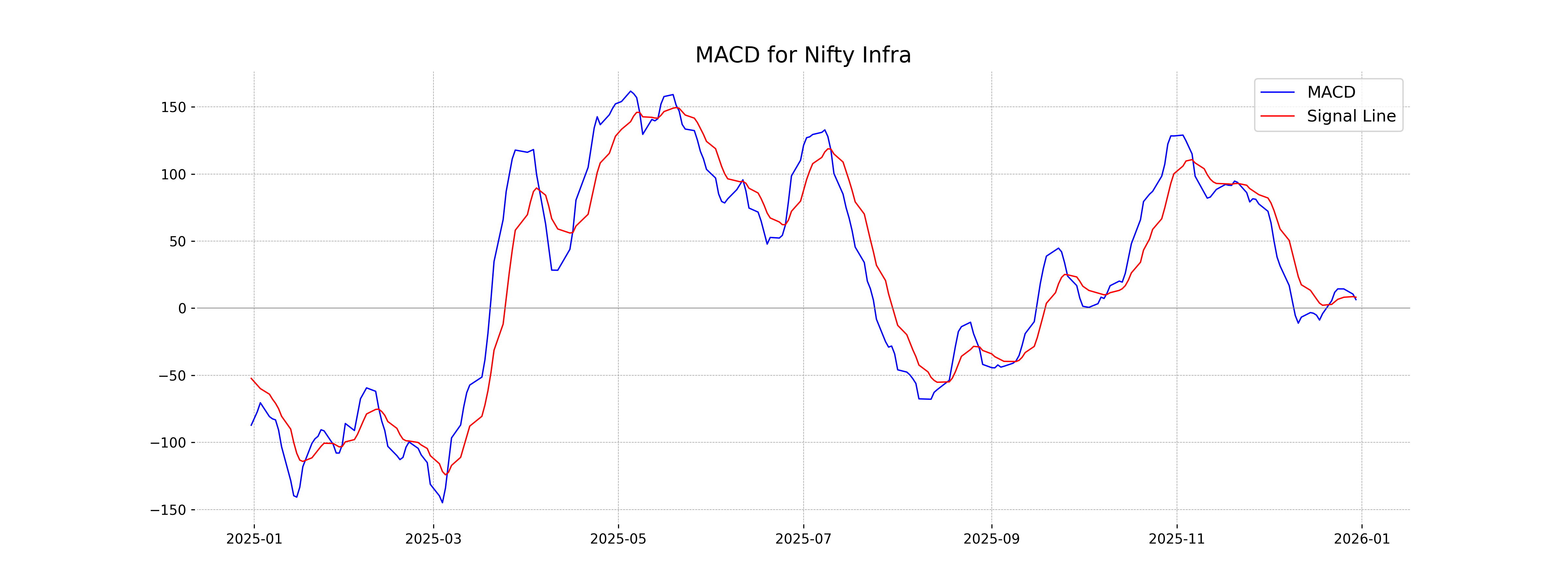

Moving Averages Trend (MACD)

MACD Analysis for Nifty Infra: The MACD value of 6.37 is slightly below the MACD Signal line at 8.17, suggesting a bearish signal. This indicates that the momentum might be weakening and there could be a potential downtrend if the stock continues to trade below the signal line.

RSI Analysis

The Relative Strength Index (RSI) for Nifty Infra is at 47.31, indicating a neutral momentum as it is approaching the midpoint of 50. This suggests that the stock is neither overbought nor oversold and currently experiencing balanced market conditions.

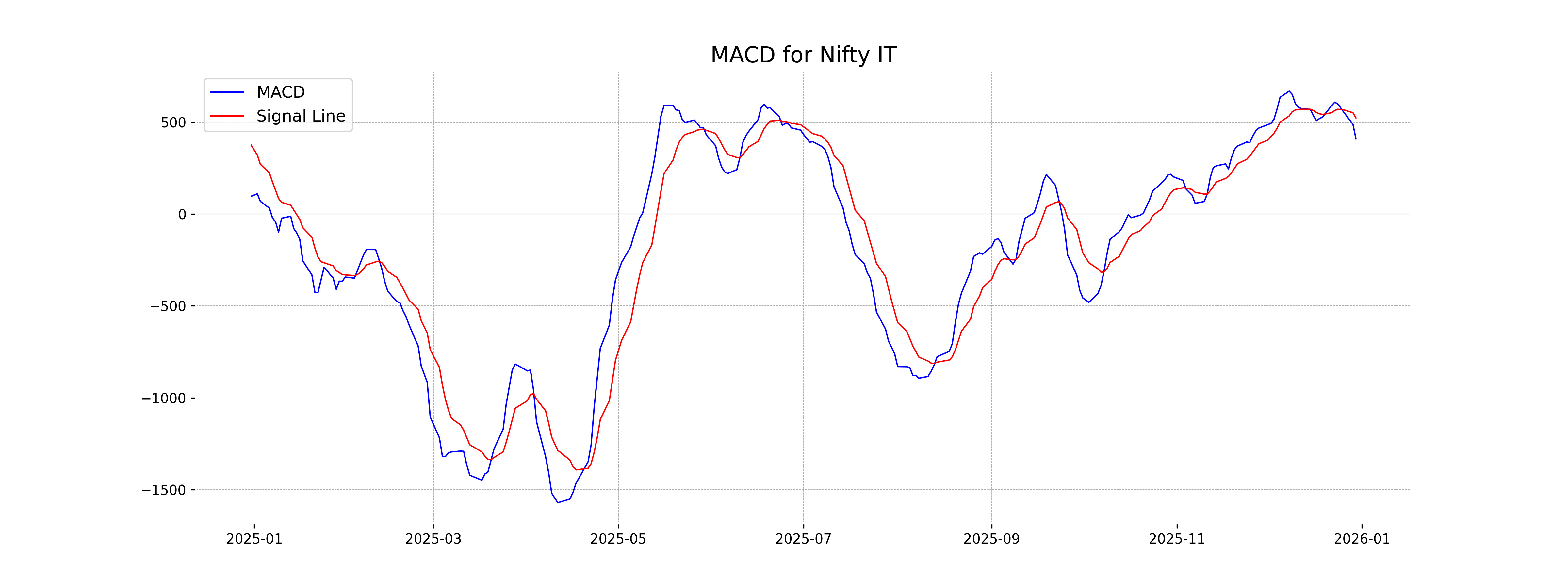

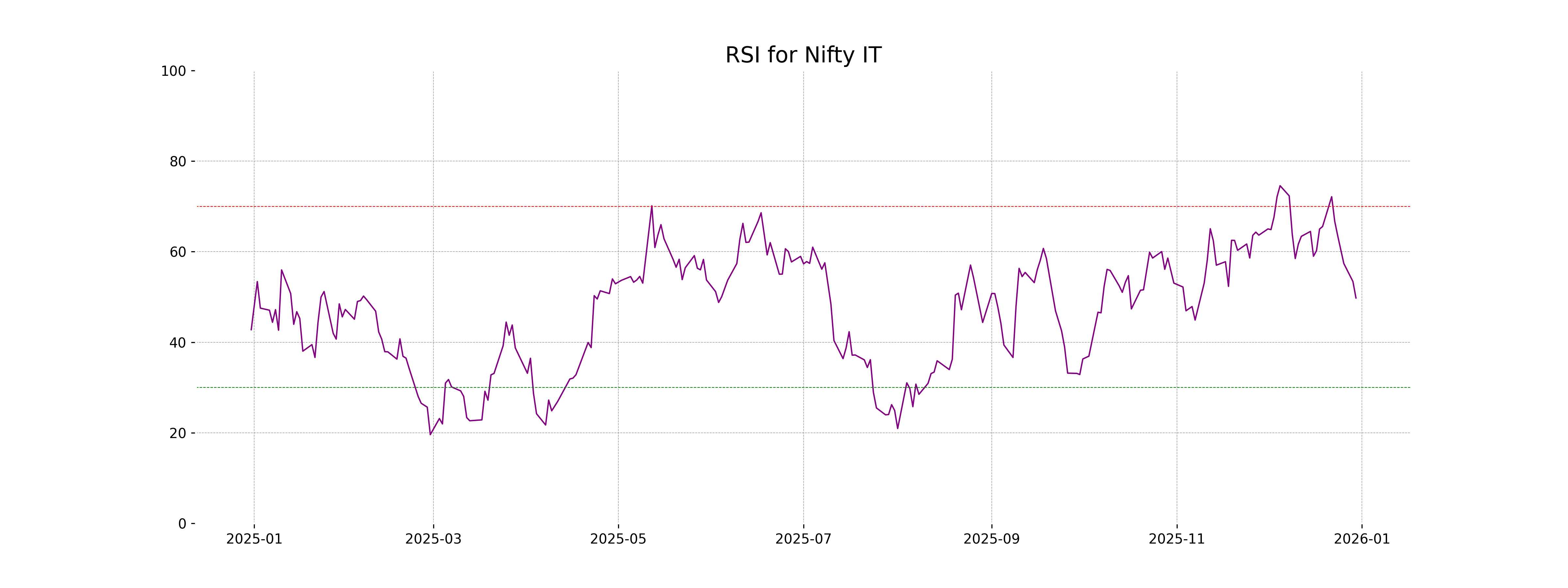

Analysis for Nifty IT - December 30, 2025

Nifty IT opened at 38,281.55 and closed at 37,998.60, marking a decline of approximately 0.74% from the previous close of 38,282.70. The RSI stands at 49.77, indicating a nearly neutral momentum, while the MACD suggests a bearish crossover as it's below the signal line.

Relationship with Key Moving Averages

Nifty IT closed at 37,998.60, which is below its 10 EMA of 38,486.06 and slightly above its 50 EMA of 37,410.36, indicating short-term weakness but maintaining strength over the medium term. The index is also above the 200 EMA of 37,157.95, suggesting a positive long-term trend.

Moving Averages Trend (MACD)

The MACD for Nifty IT is at 408.62, while the MACD Signal line is at 522.30, indicating a bearish crossover where the MACD line is below the Signal line. This suggests potential bearish momentum or weakening trend for Nifty IT.

RSI Analysis

The Relative Strength Index (RSI) for Nifty IT stands at approximately 49.77, which suggests a neutral momentum without indicating any overbought or oversold conditions. This level is close to 50, typically reflecting balance between buying and selling pressures.

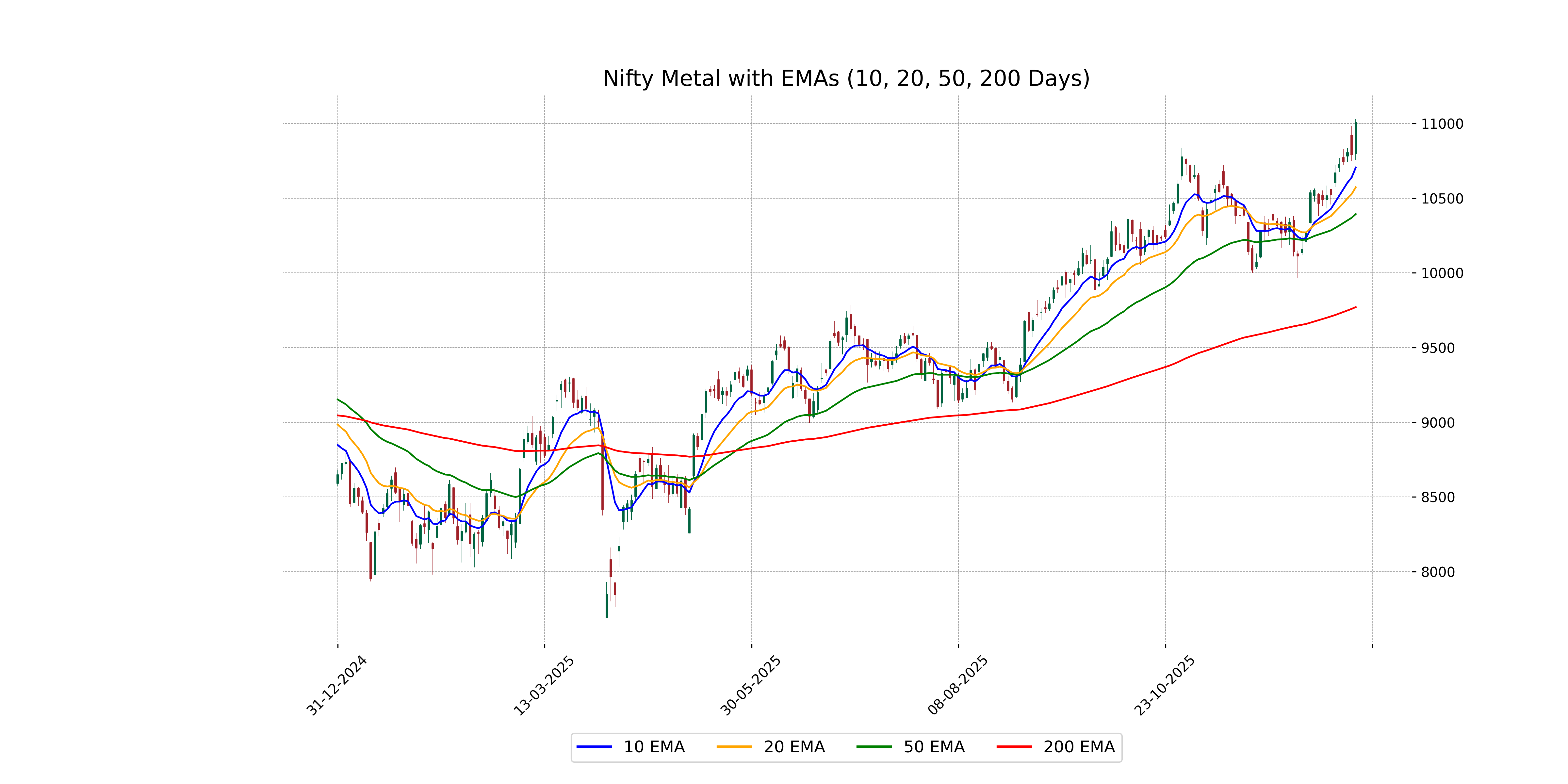

Analysis for Nifty Metal - December 30, 2025

Nifty Metal opened at 10797.0 and closed at 11007.65, marking a positive change of 2.03% or 218.55 points from its previous close of 10789.10. The index traded between a high of 11029.65 and a low of 10755.30. With an RSI of 73.96, it indicates that the index is in an overbought condition.

Relationship with Key Moving Averages

The Nifty Metal index is trading significantly above its key moving averages, with the close at 11007.65 being above the 10 EMA of 10705.01, the 20 EMA of 10572.72, the 50 EMA of 10393.66, and the 200 EMA of 9771.11. This suggests a strong upward trend in the index.

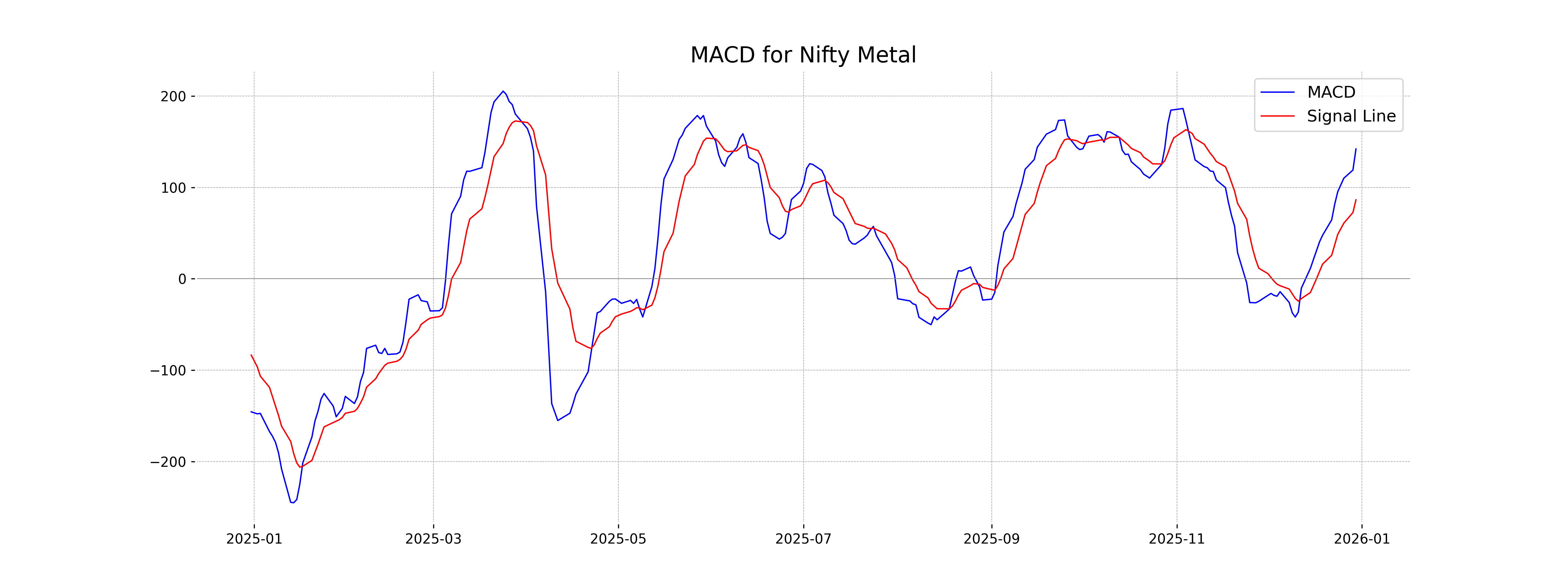

Moving Averages Trend (MACD)

The MACD for Nifty Metal stands at 142.14, while the MACD Signal line is at 86.47. With the MACD being higher than the Signal line, it indicates a potential bullish momentum, suggesting upward price movement.

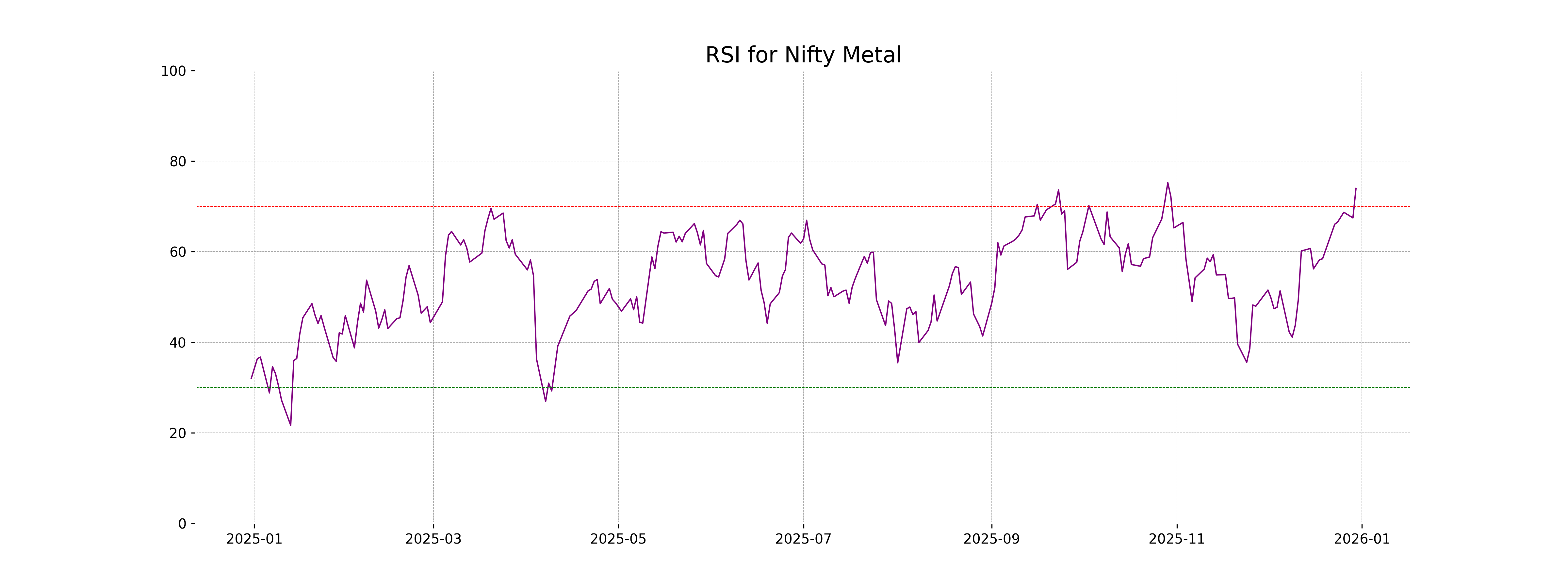

RSI Analysis

The RSI for Nifty Metal stands at 73.96, indicating that the index is in the overbought territory. This suggests that the price might be due for a correction or a period of consolidation. Traders should be cautious, as overbought conditions often lead to price pullbacks.

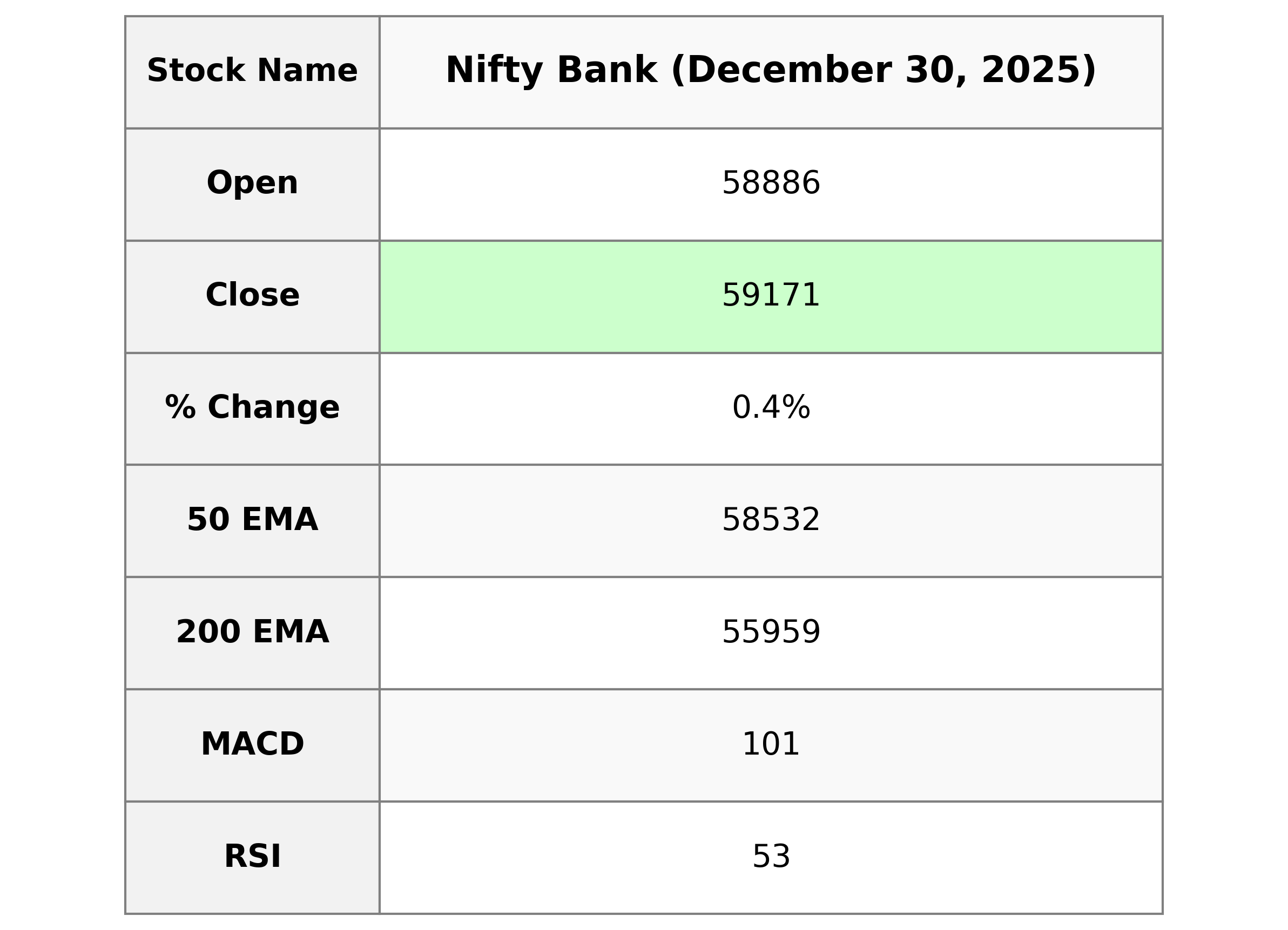

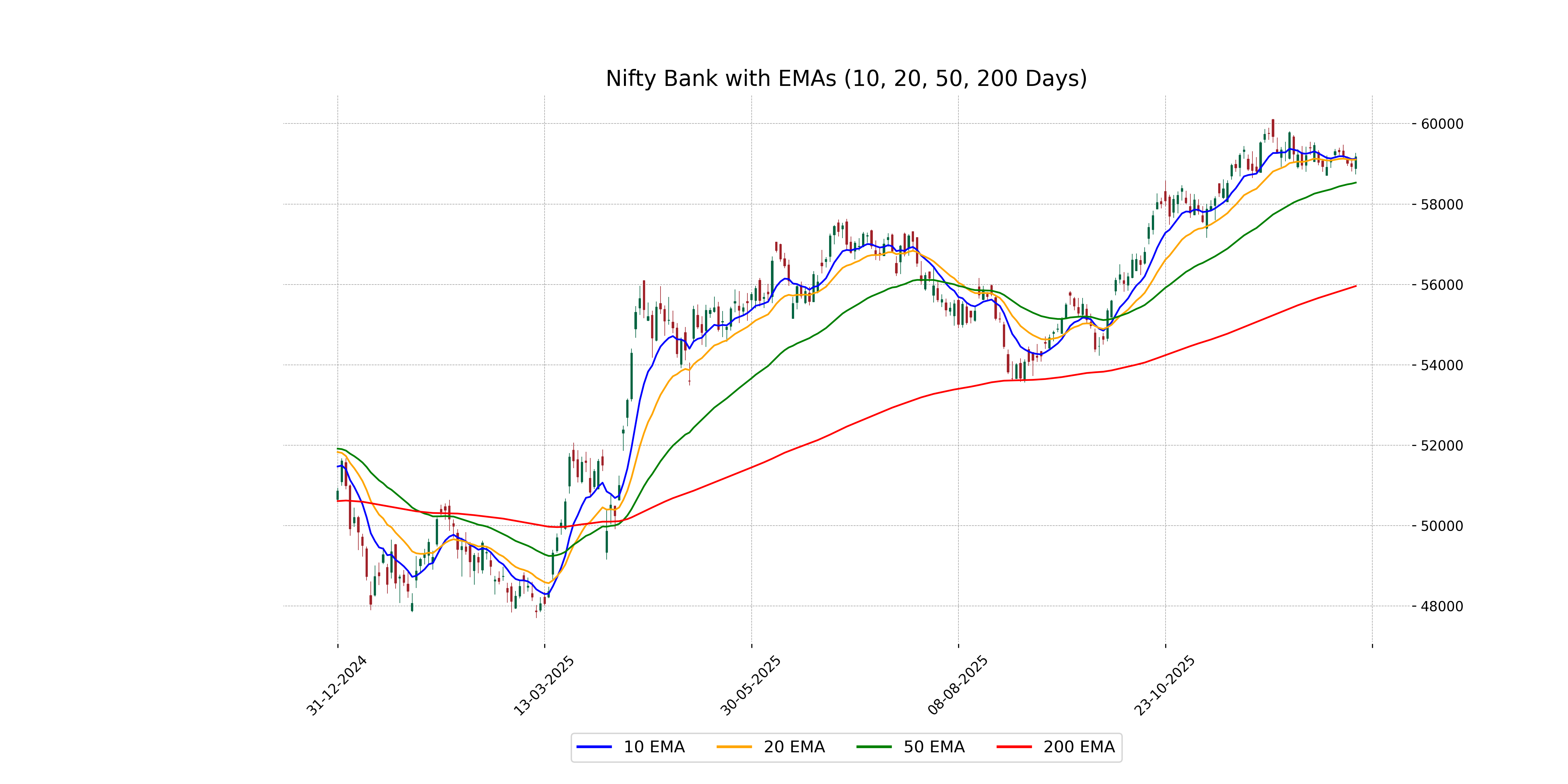

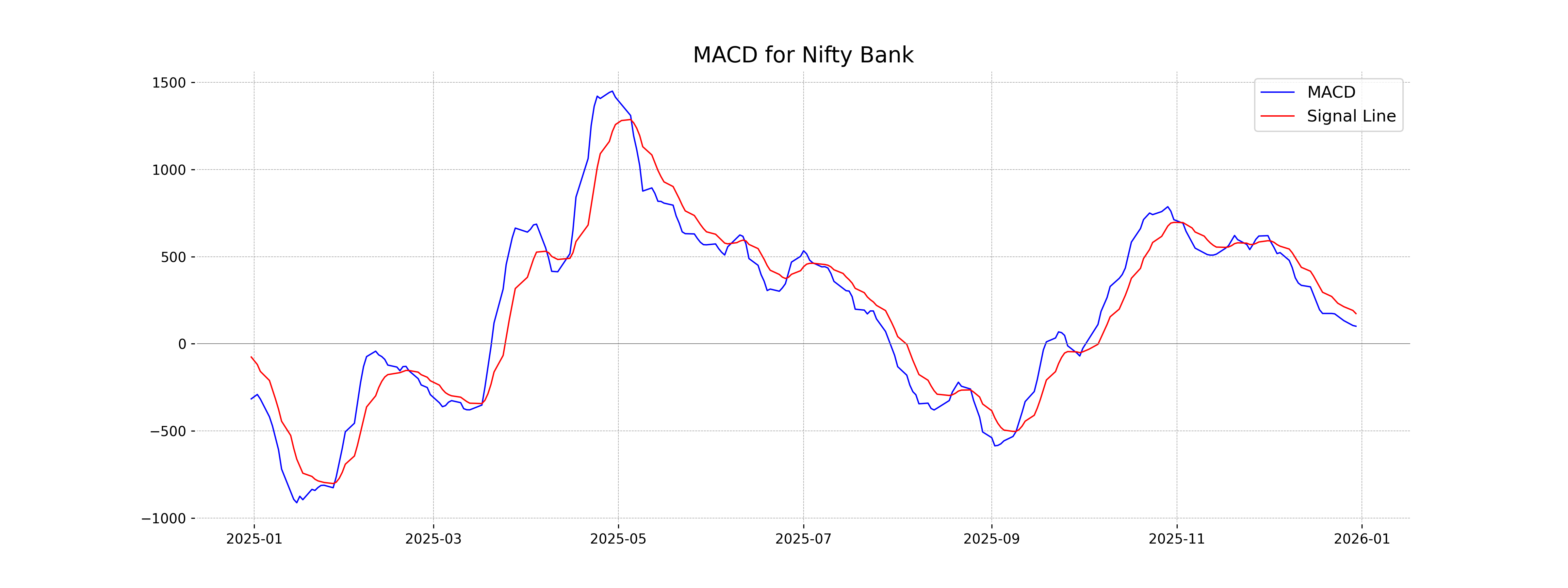

Analysis for Nifty Bank - December 30, 2025

The Nifty Bank index opened at 58,885.95 and closed at 59,171.25, showing a positive change of 0.41%, equivalent to a gain of 238.90 points. The movement indicates a moderate upward trend, with the RSI reflecting a neutral 53.25. The index is trading above its 50-day and 200-day EMAs, signifying a strong performance relative to these averages.

Relationship with Key Moving Averages

Nifty Bank's closing price at 59171.25 is above its 50 EMA of 58532.38, suggesting a bullish trend over the medium term. The 10 EMA at 59125.31 and 20 EMA at 59105.97 are also lower than the closing price, indicating recent strength in the index's performance.

Moving Averages Trend (MACD)

Based on the MACD analysis for Nifty Bank, the MACD line (100.88) is below the MACD Signal line (173.23), indicating a bearish signal. This suggests that the stock might be experiencing a downtrend or is losing momentum in the current uptrend.

RSI Analysis

The RSI for Nifty Bank is at 53.25, indicating a neutral state in the market as it is close to the midpoint of the typical RSI range (30-70). This suggests that the index is neither overbought nor oversold, providing no strong signal for significant upward or downward momentum at this time.

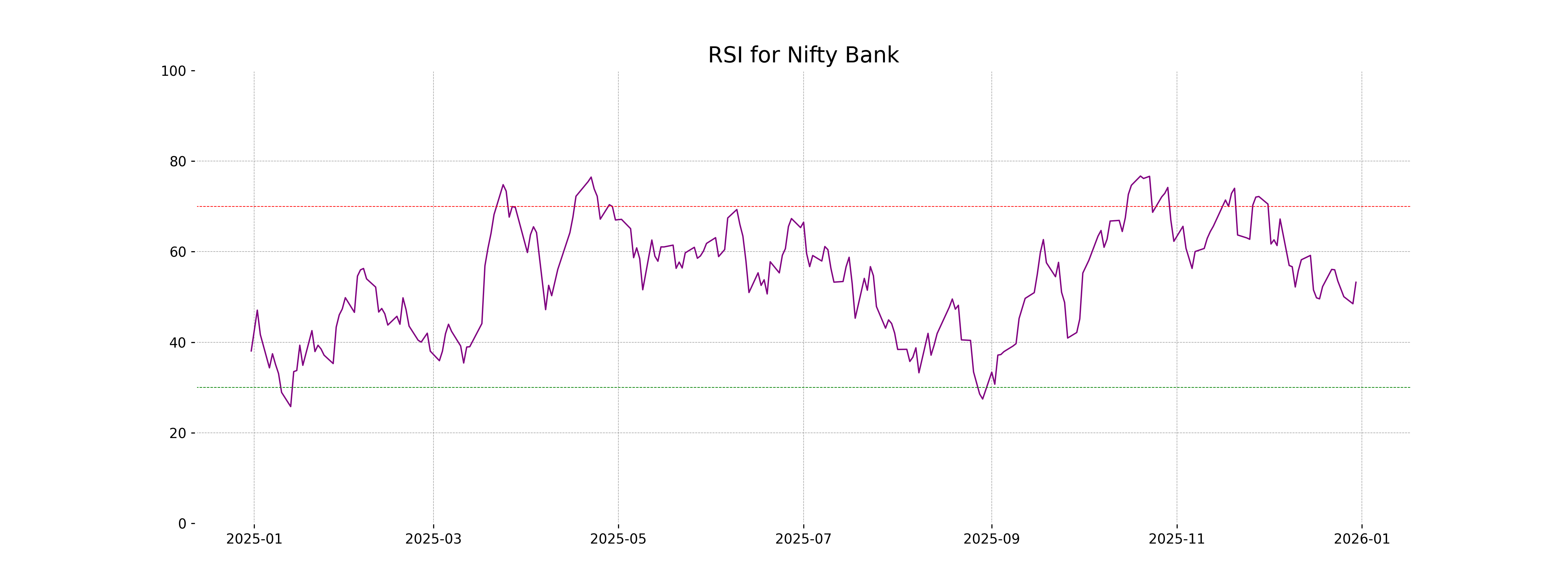

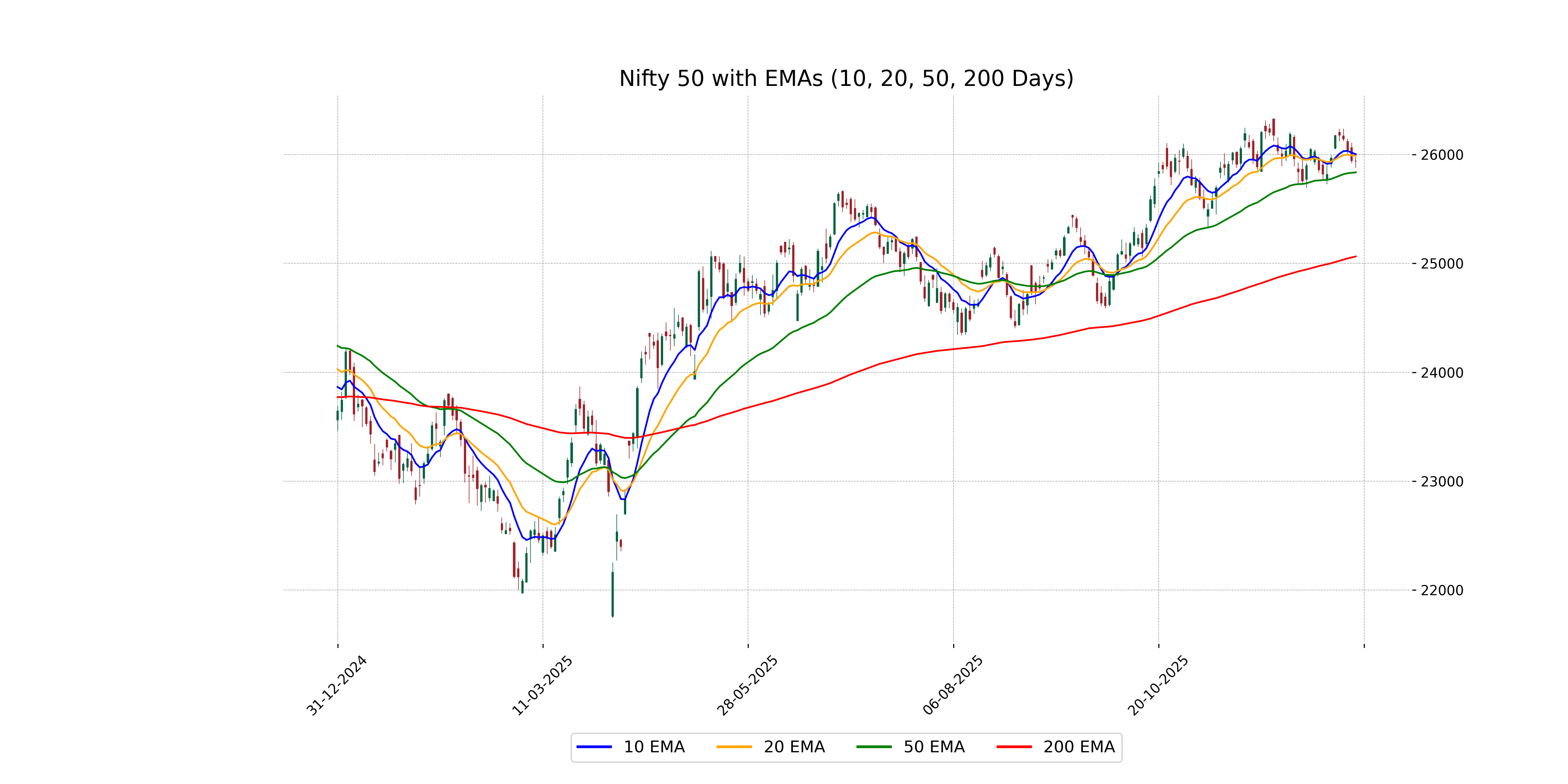

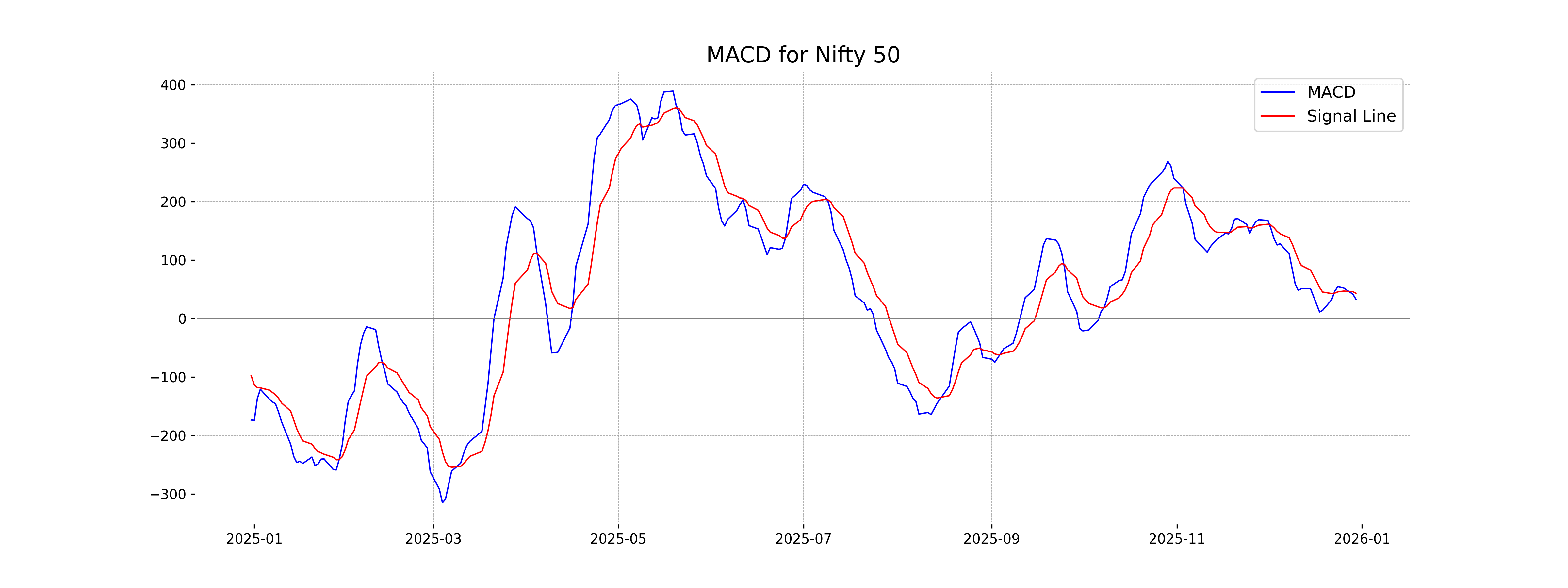

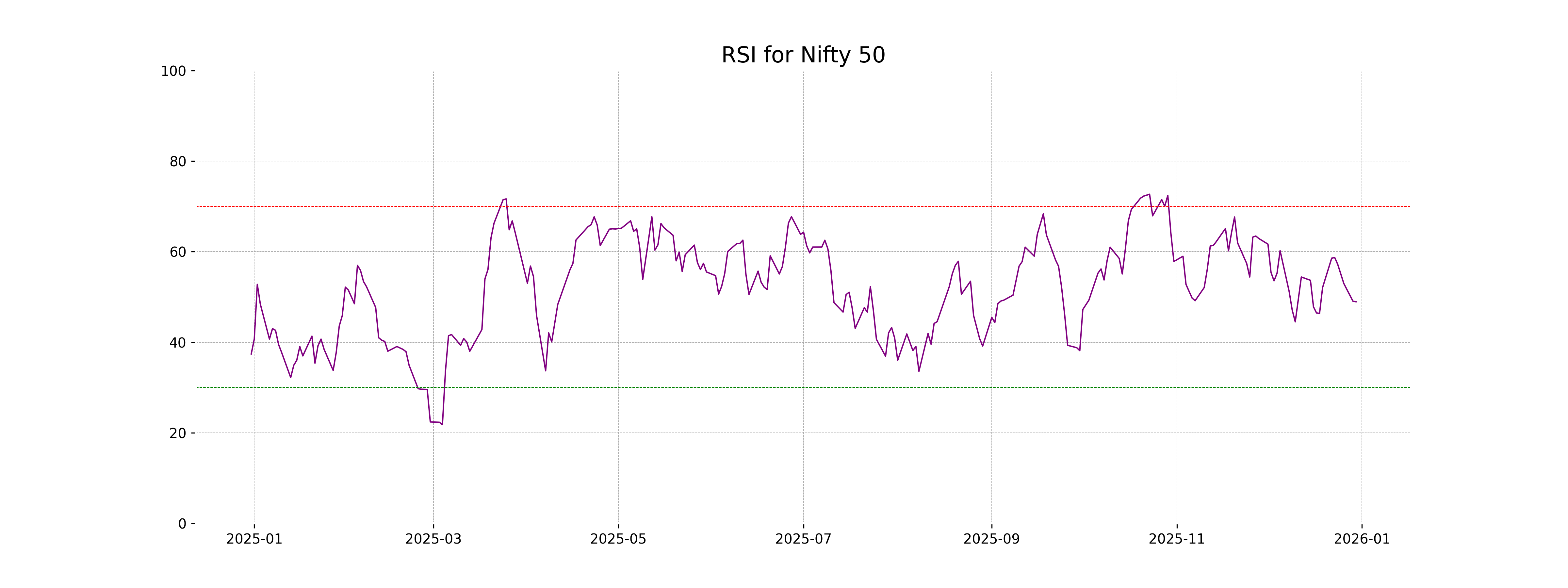

Analysis for Nifty 50 - December 30, 2025

The Nifty 50 opened at 25,940.90 and closed slightly lower at 25,938.85, reflecting a marginal decline of -0.01% with a points change of -3.25. The key technical indicators show that the 10-day EMA is higher than the closing price, and the RSI is at 48.93, indicating a neutral momentum.

Relationship with Key Moving Averages

The Nifty 50 index closed at 25938.85, just below its 10-day EMA (26002.34) and 20-day EMA (25987.67), indicating a short-term downward momentum. However, it remains above the 50-day EMA (25836.30) and significantly above the 200-day EMA (25063.39), suggesting long-term bullishness is still intact despite the recent dip.

Moving Averages Trend (MACD)

The MACD value for Nifty 50 is 32.74, which is below the MACD Signal line of 43.28. This suggests a bearish signal, indicating potential downward momentum. The MACD histogram is negative, reinforcing the bearish outlook.

RSI Analysis

The RSI for Nifty 50 is 48.93, indicating a neutral position as it is close to the mid-point of the RSI scale, which ranges from 0 to 100. This suggests there is no significant overbought or oversold condition currently.

ADVERTISEMENT

Up Next

Indian Stock Market Sector-wise Performance: Which Sector is performed Well Today - December 30, 2025

India revamps tax regime in 2025, new I-T Act to take effect from April 1

New Zealand commits USD 20 bn investment in India under FTA in 15 yrs; on lines of EFTA pact

India, New Zealand conclude FTA talks; pact to offer duty-free access, USD 20 bn FDI

FTA with New Zealand to significantly deepen bilateral economic engagement: Govt

Rupee breaches 91-mark against US dollar for first time in intra-day trade

More videos

Microsoft commits USD 17.5 billion investment in India: CEO Satya Nadella

CBI books Anil Ambani's son, Reliance Home Finance Ltd. in Rs 228 crore bank fraud case

RBI raises FY26 GDP growth projection to 7.3 pc

RBI trims policy interest rate by 25bps to 5.25pc, loans to get cheaper

Rupee slumps to all-time low of 90.25 against US dollar in intra-day trade

Reliance completes merger of Star Television Productions with Jiostar

India to lead emerging market growth with 7pc GDP rise in 2025: Moody’s

Nifty hits record high after 14 months; Sensex nears all-time peak

Reliance stops Russian oil use at its only-for-export refinery to comply with EU sanctions

ED attaches fresh assets worth over Rs 1,400 cr in case against Anil Ambani's Reliance Group