Highlights

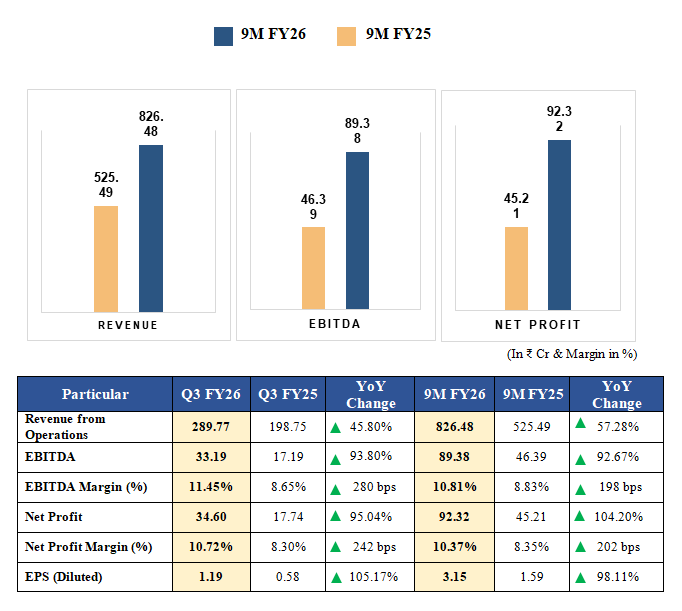

Revenue grew 57.28% YoY. Entered fresh bakery market. Net profit surged 104%.

Latest news

'Spider-Noir' trailer out: Nicolas Cage swings into gritty 1930s detective saga

Fintech Platform Endl Secures 1.5 Million Dollar Investment to Scale Global Payment Infrastructure

Ajay Devgn Turns Narrator for Shatak | Trailer Out Now

Investor concerns over AI Capex returns may grow as Big Tech market leadership weakens: Jefferies

Commerce Secretary meets WTO Director-General to discuss MC14 priorities

Cardi B hits back at Homeland Security over ICE remark, raises Epstein files question

'PM Modi prioritised farmers' interests in US trade agreement': Shivraj Singh Chouhan

CPI new method market additions skewed towards few states, UP, Maharashtra accounts for 43% of new markets: SBI Report

Nurture Well Industries Posts Strong Q3 & 9M FY26 Results; Revenue Up 57.28%, Net Profit Surges 104.20% YoY

Up Next

Nurture Well Industries Posts Strong Q3 & 9M FY26 Results; Revenue Up 57.28%, Net Profit Surges 104.20% YoY

RBI keeps interest rates on hold after US trade deal boosts outlook

RBI proposes to compensate customers up to Rs 25,000 loss due to fraud

RBI raises GDP growth projection of Q1, Q2 of FY27

RBI pauses rate cuts, retains interest rate at 5.25 pc

Rupee jumps 122 paise to close at 90.27 against US dollar on India-US trade deal

More videos

Stock markets cheer India-US trade deal: Sensex, Nifty surge 2.5 pc

UPI transactions hit record high of Rs 230 lakh crore in 2025-26 till Dec: Govt

Explained: India-US trade deal, tariffs and trade benefits

Trade deal with US adds momentum to India's growth ambition: Industry leaders

Rupee jumps 119 paise to 90.30 against the US dollar on India-US trade deal

President Trump announces US-India trade deal, lowers tariffs from 25 pc to 18 pc

Stock markets cheer India-US trade deal: Sensex jumps over 5 pc; Nifty nears all-time high

Sustaining 7–8% growth top priority to create jobs: FM Nirmala Sitharaman

Budget FY27 demonstrates commitment to macro stability: Fitch

STT hike on Futures dampen stock market sentiment; Sensex, Nifty crash nearly 2 pc