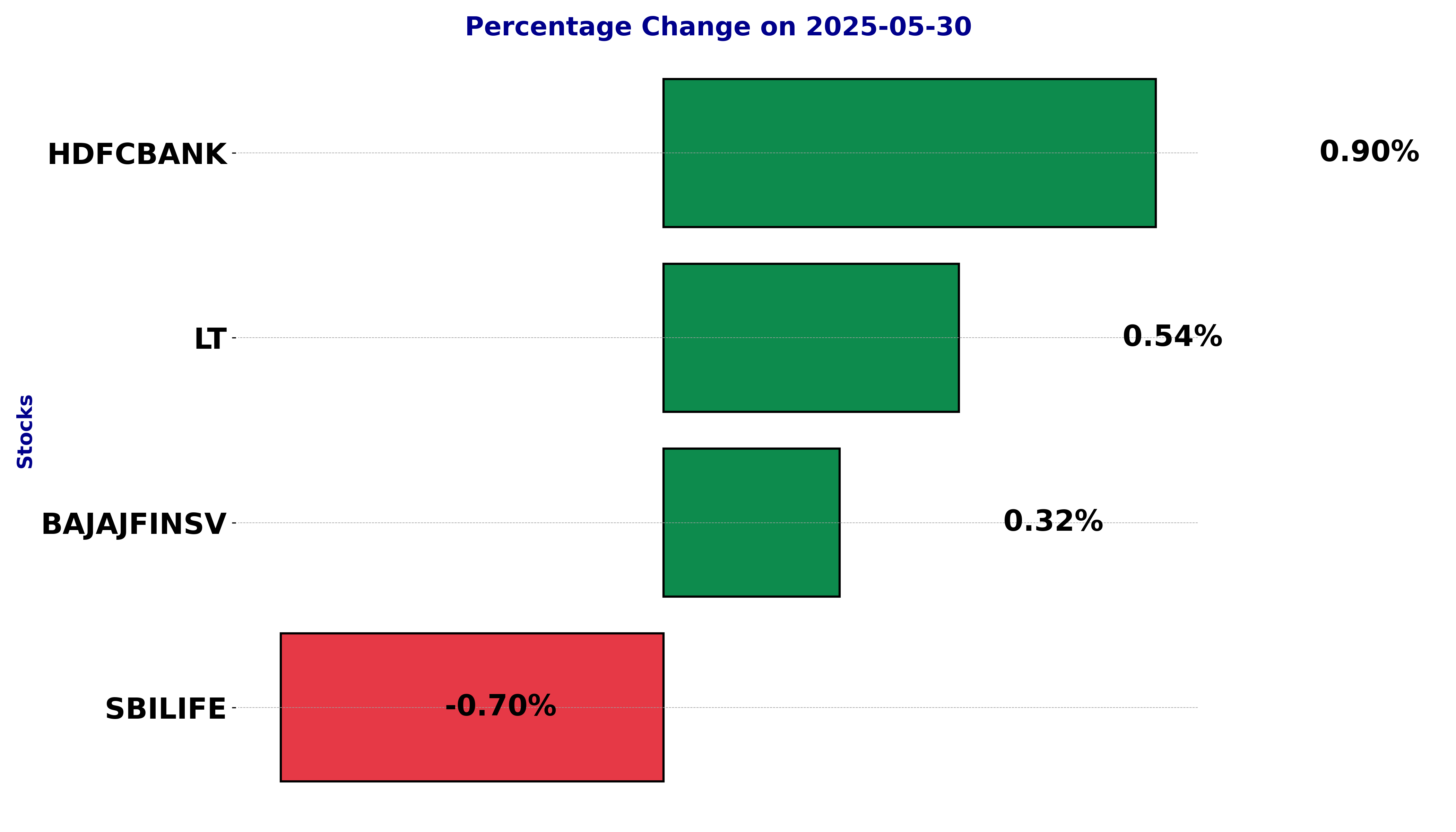

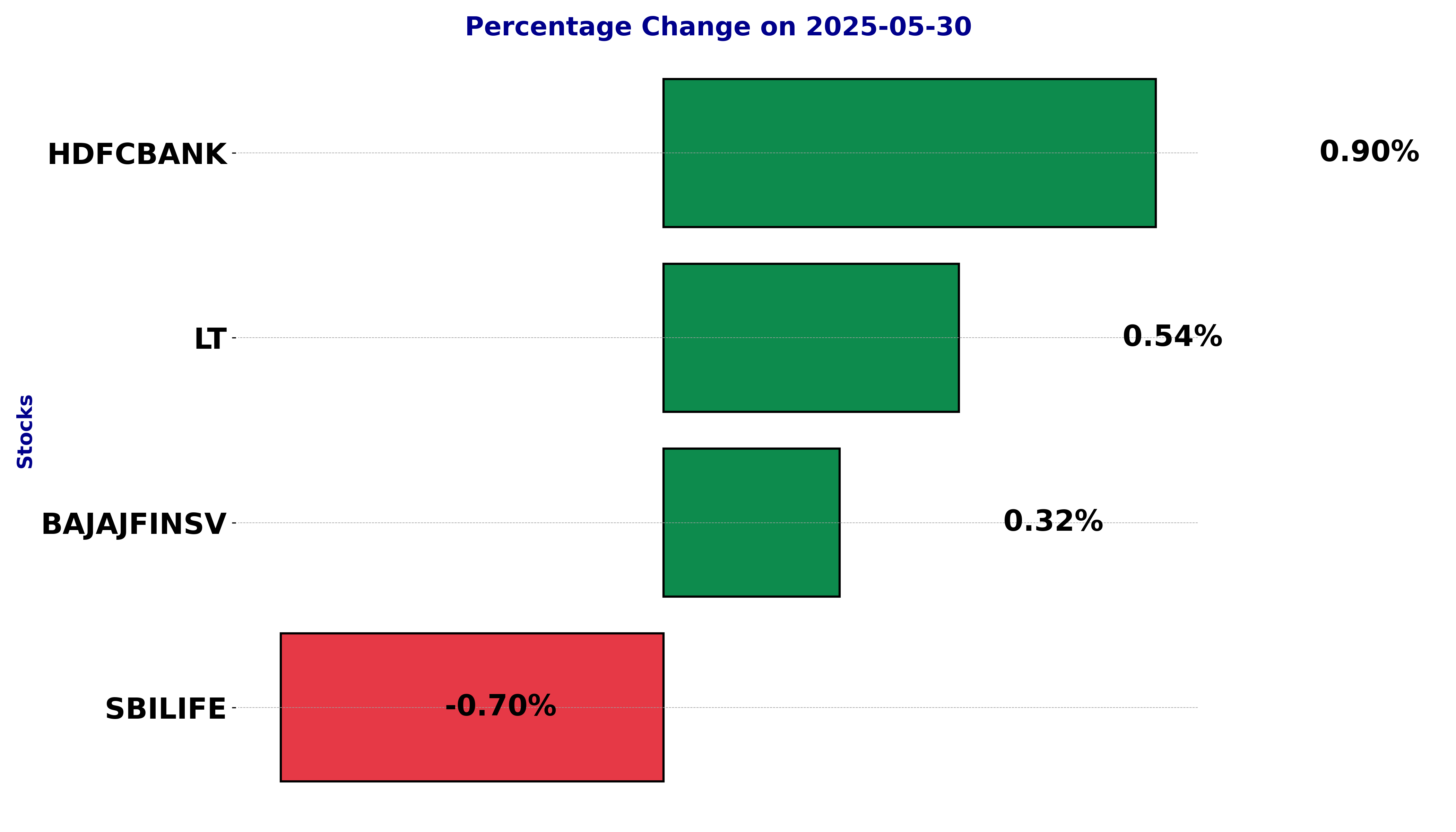

In this article, we will explore the technical indicators of some of the high-performing stocks on the Indian stock market, including BAJAJFINSV, HDFCBANK, LT, and SBILIFE.

By looking at these stocks through the lens of key technical factors, we aim to better understand their price movements, trends, and potential future performance.

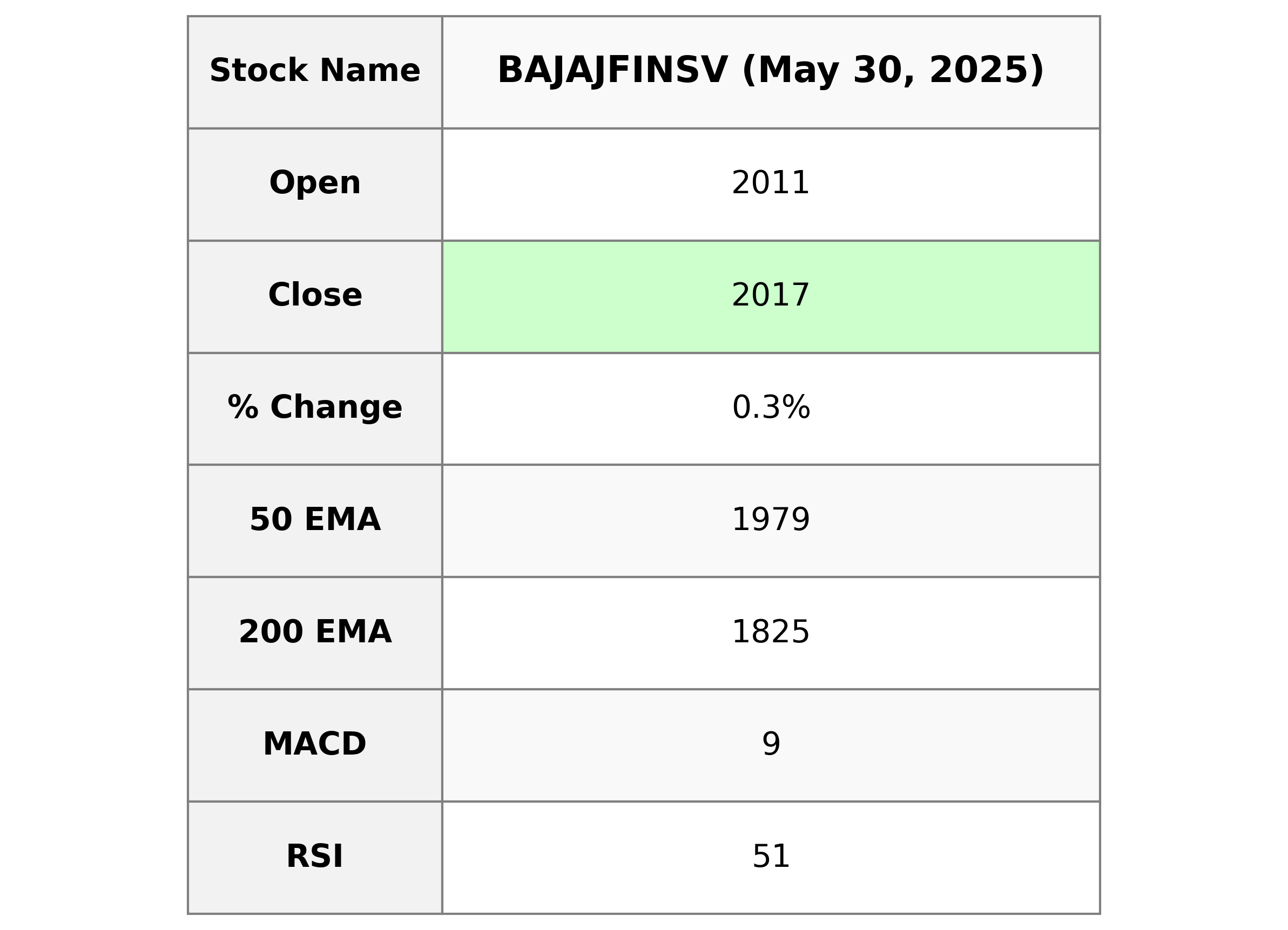

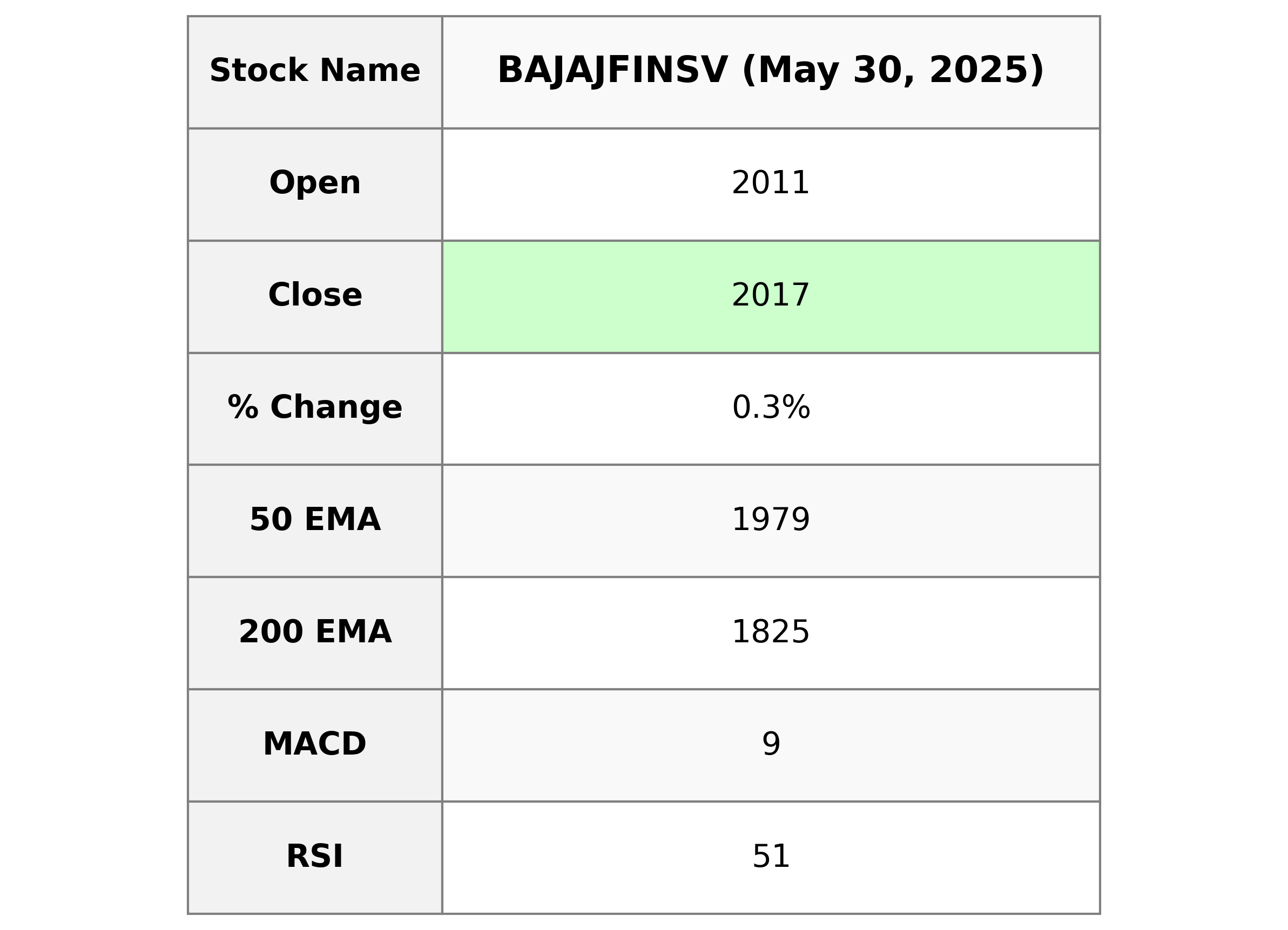

Analysis for Bajaj Finserv - May 30, 2025

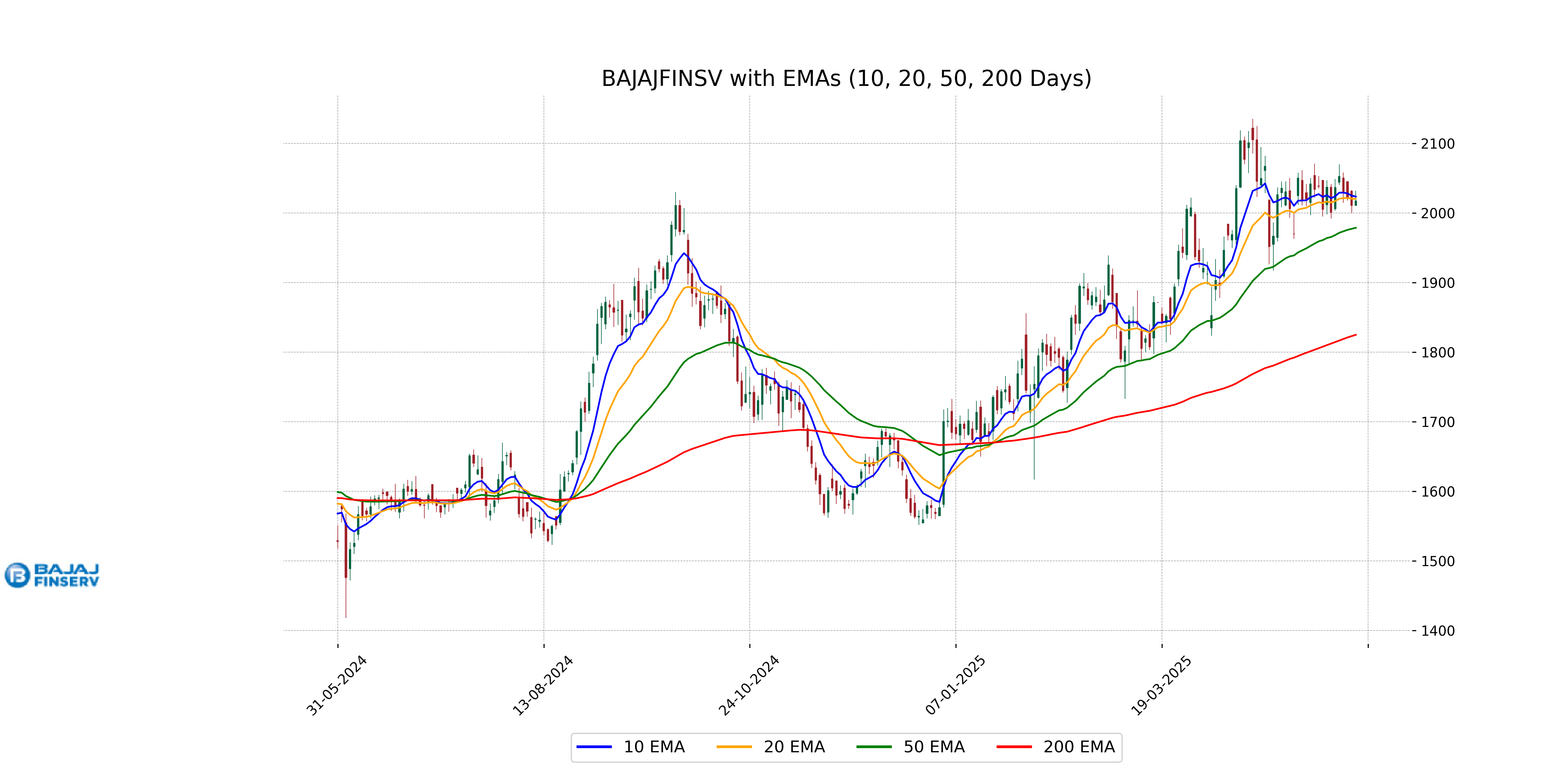

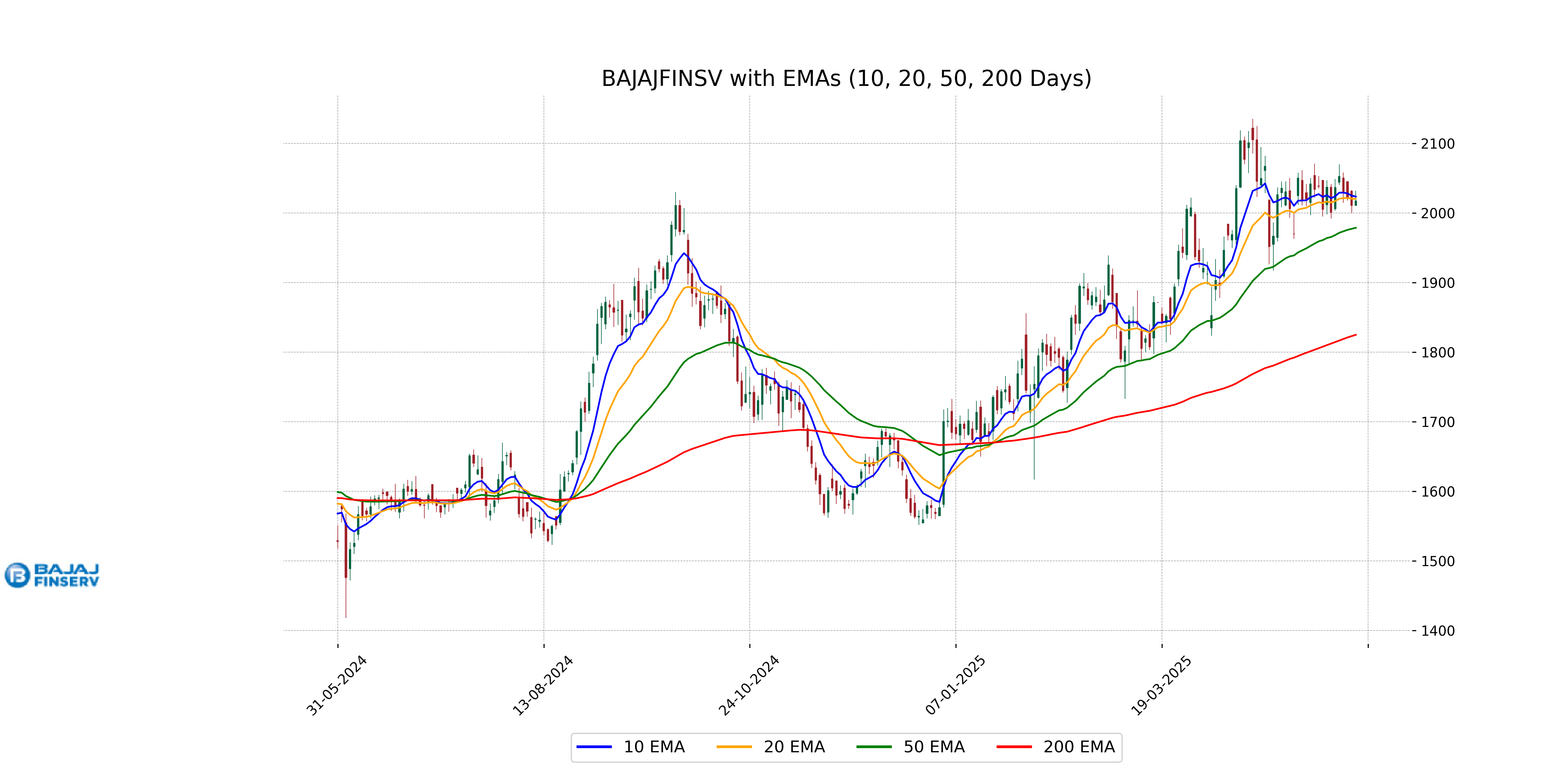

Performance Overview: Bajaj Finserv opened at 2010.90, reaching a high of 2031.70 and closing at 2017.40. This represents a 0.32% increase from the previous close of 2010.90, with a volume of 2,143,916 shares traded. The stock shows a steady upward trend, with a 50-day EMA of 1978.71 surpassing the 200-day EMA of 1824.97, indicating positive momentum in the Financial Services sector in India.

Relationship with Key Moving Averages

The current close of Bajaj Finserv is above its 50 EMA of 1978.71 and 200 EMA of 1824.97, indicating an upward trend when compared to these averages. However, it is below both the 10 EMA of 2023.56 and the 20 EMA of 2020.20, suggesting some recent downward pressure.

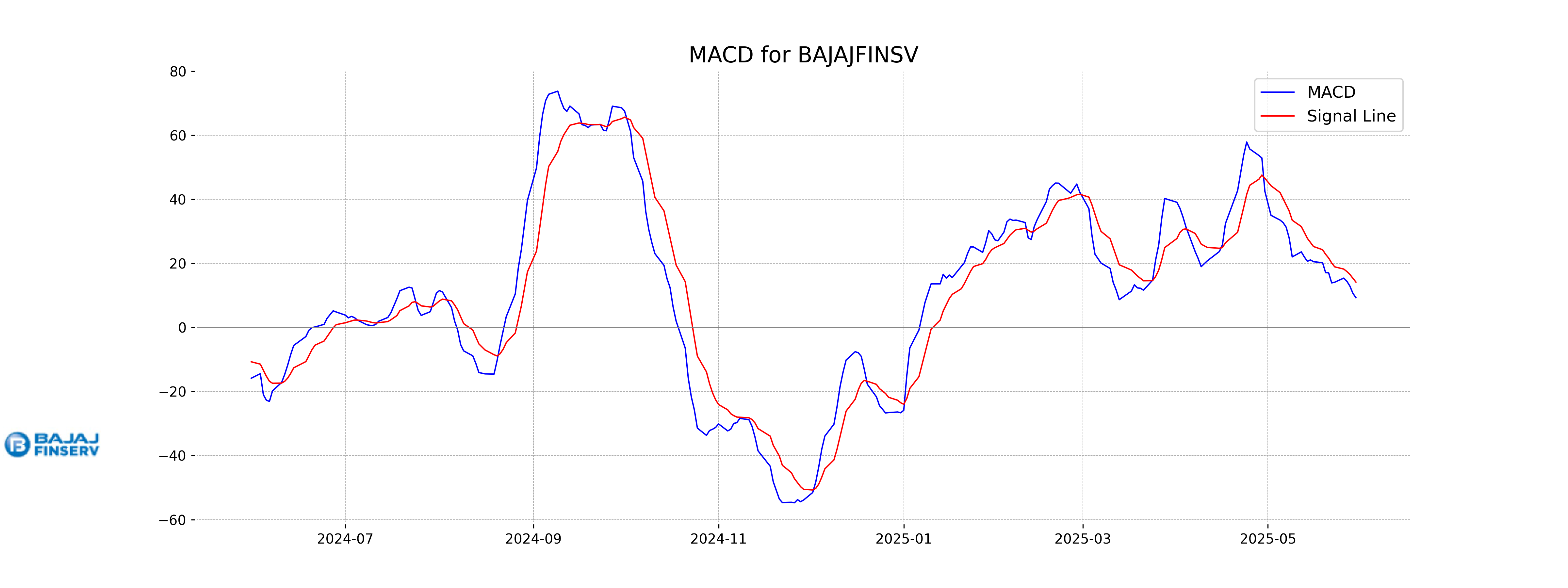

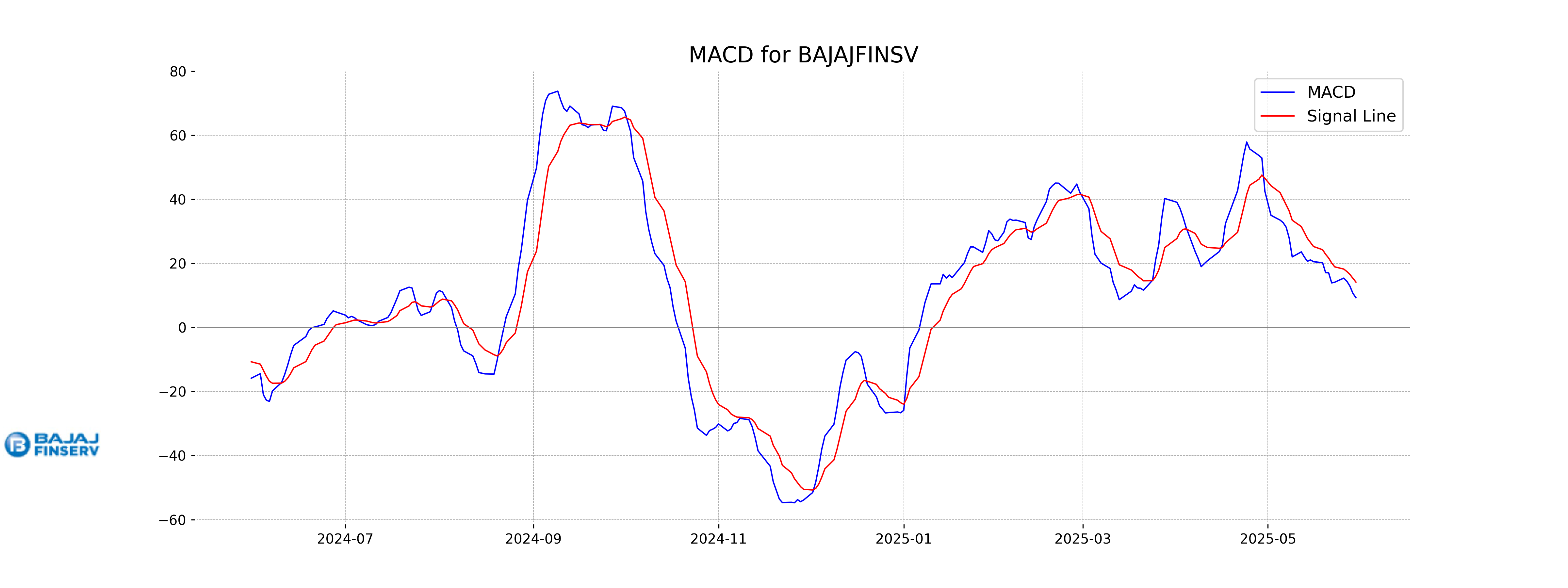

Moving Averages Trend (MACD)

Bajaj Finserv: The MACD value is 9.25, which is below the MACD Signal value of 14.13. This suggests a potentially bearish signal as the MACD line is below the signal line, indicating a possible downward momentum in the stock's price movement.

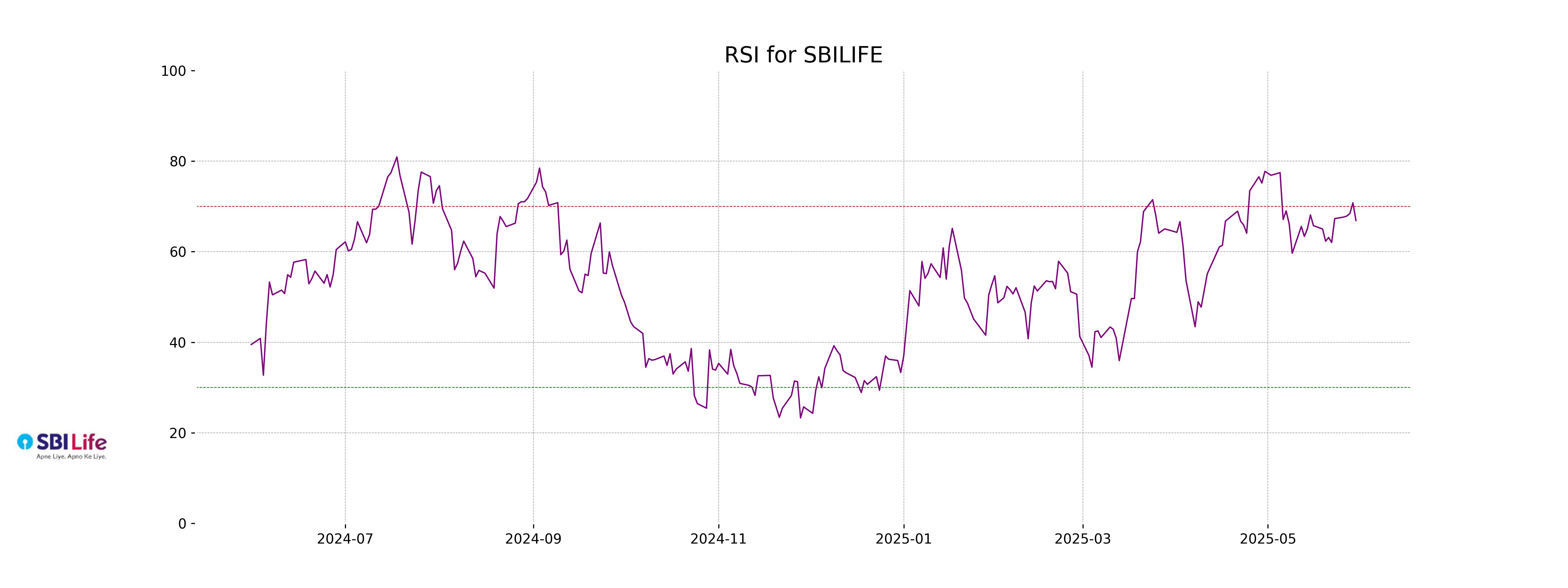

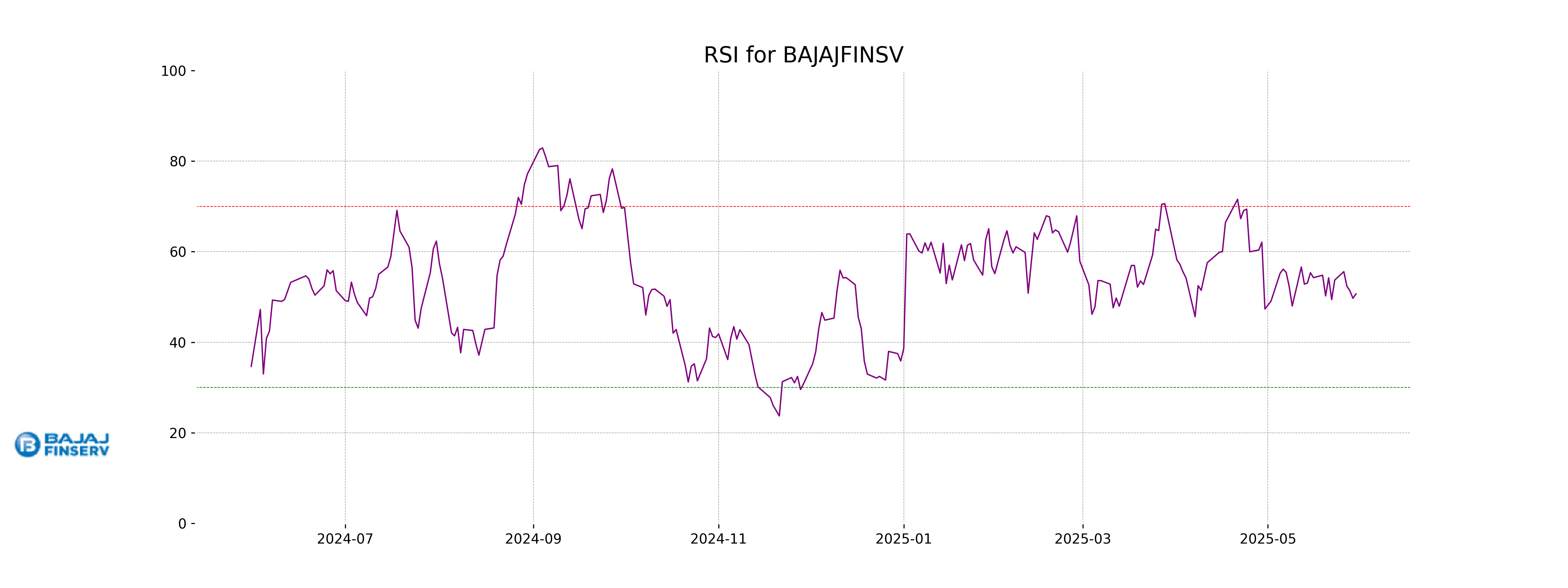

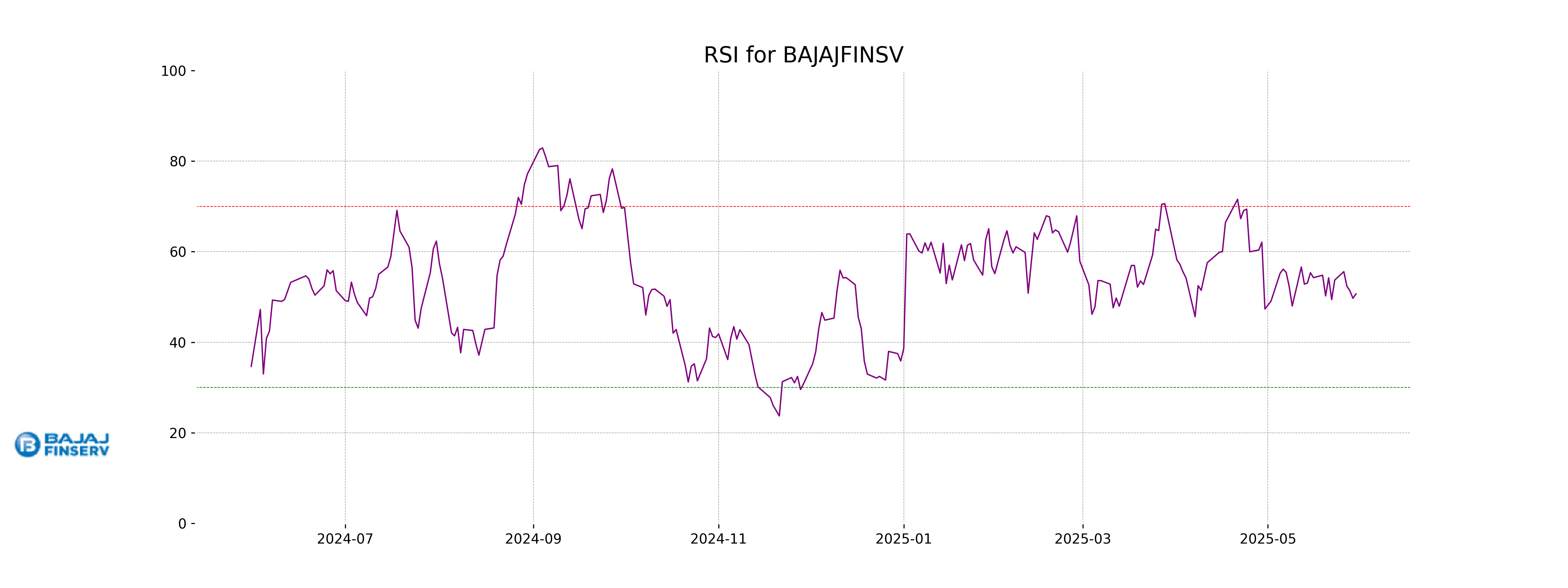

RSI Analysis

The RSI (Relative Strength Index) for Bajaj Finserv is 50.67, which suggests neutral momentum in the stock, indicating it is neither overbought nor oversold at the current price level. This level can suggest potential consolidation or a lack of strong directional movement.

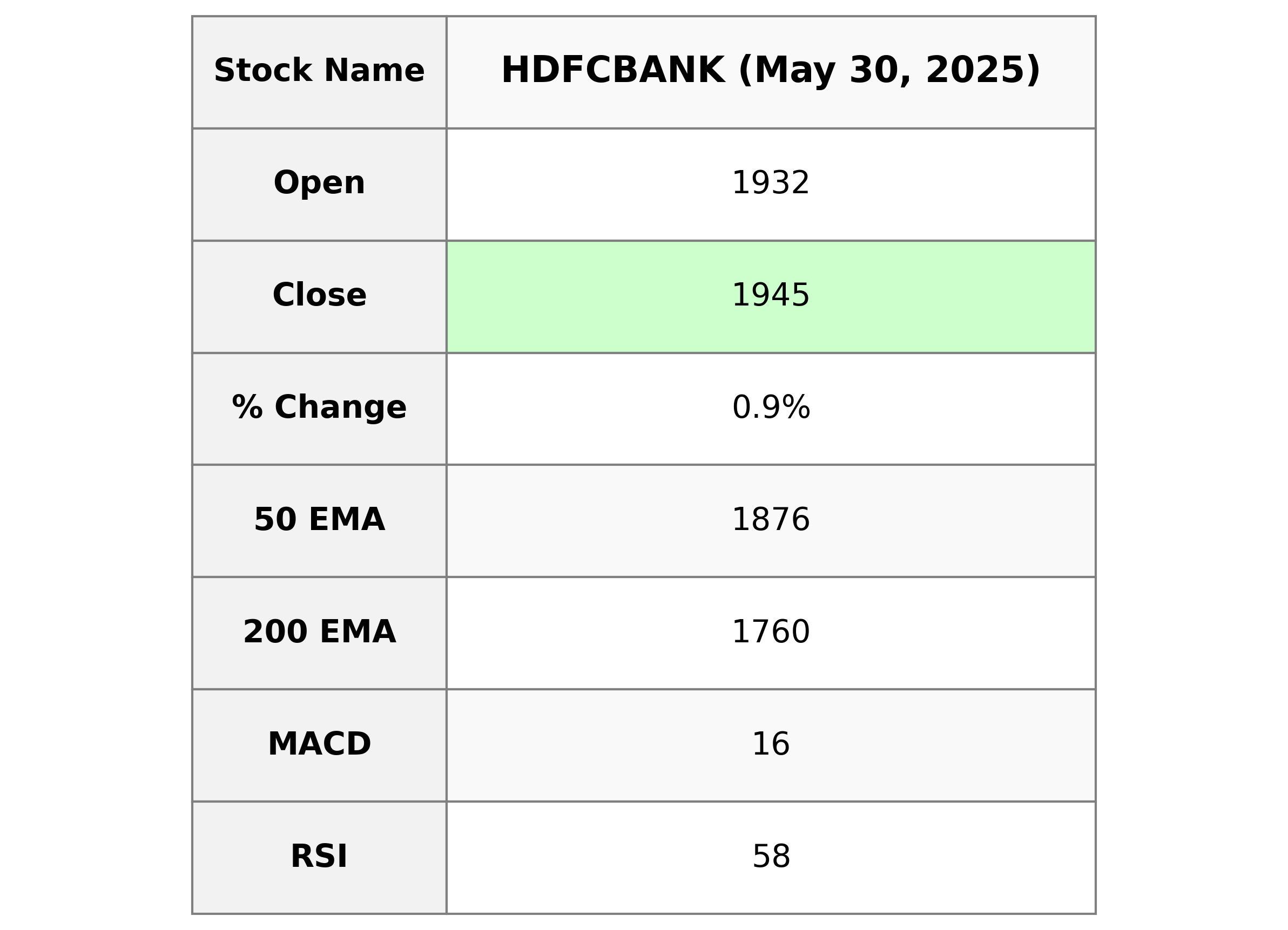

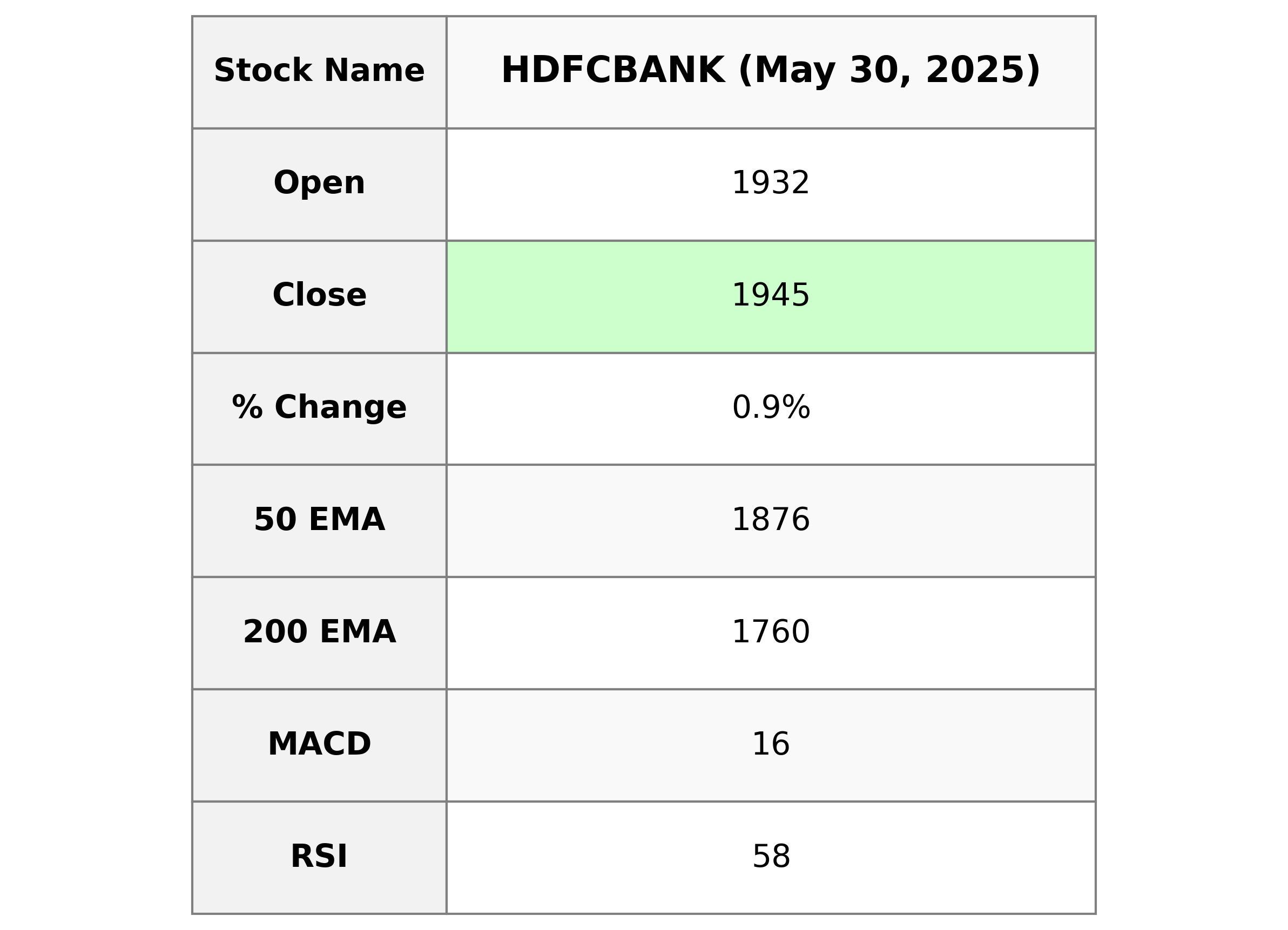

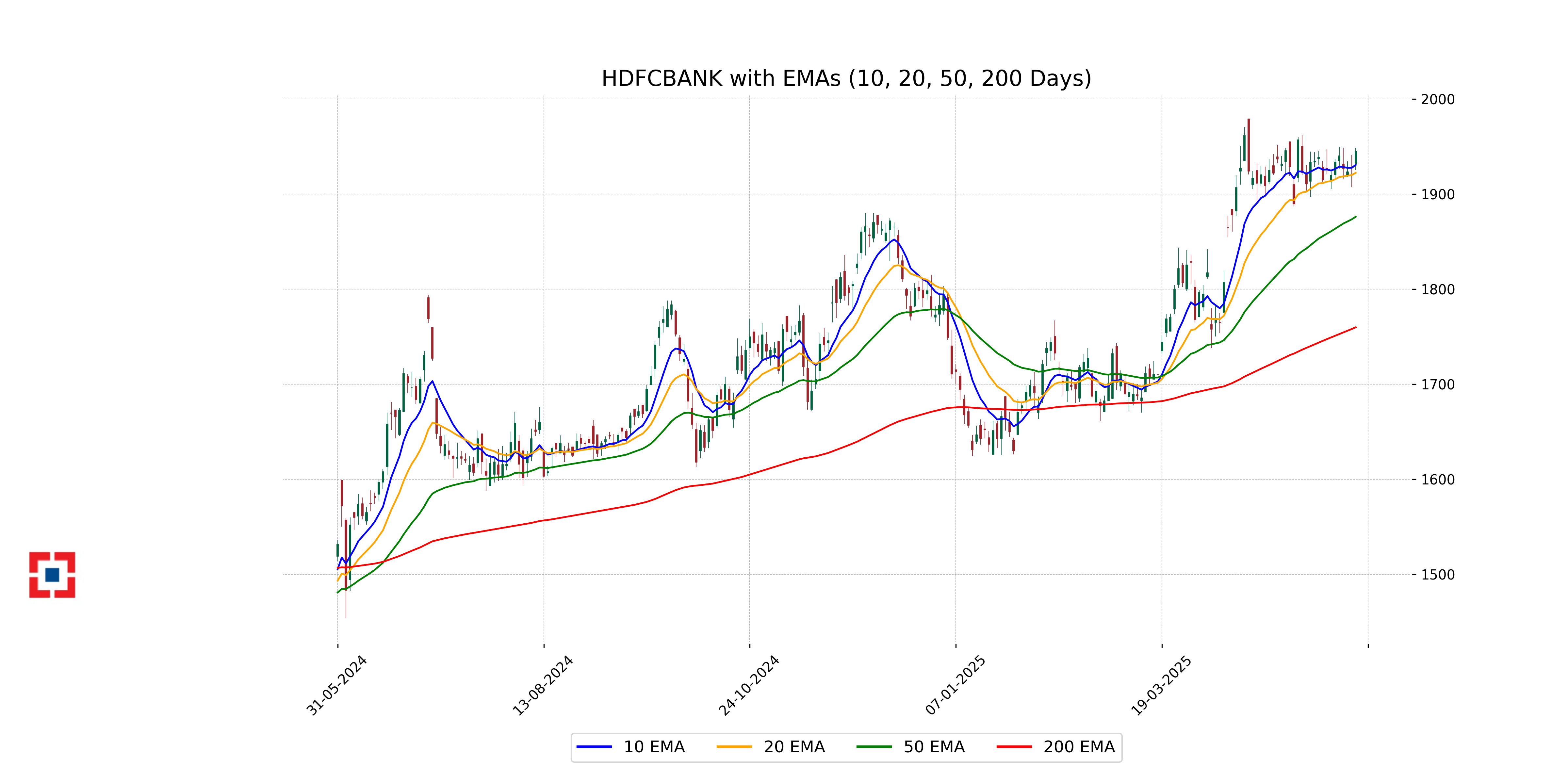

Analysis for HDFC Bank - May 30, 2025

HDFC Bank Performance: HDFC Bank reported a closing price of 1944.90, marking a gain of 0.90% from the previous close. The trading volume was significant, with 14,373,444 shares exchanged. With a PE Ratio of 21.06, the stock reflects steady performance, supported by a relatively strong RSI of 58.13, indicating moderate buying pressure.

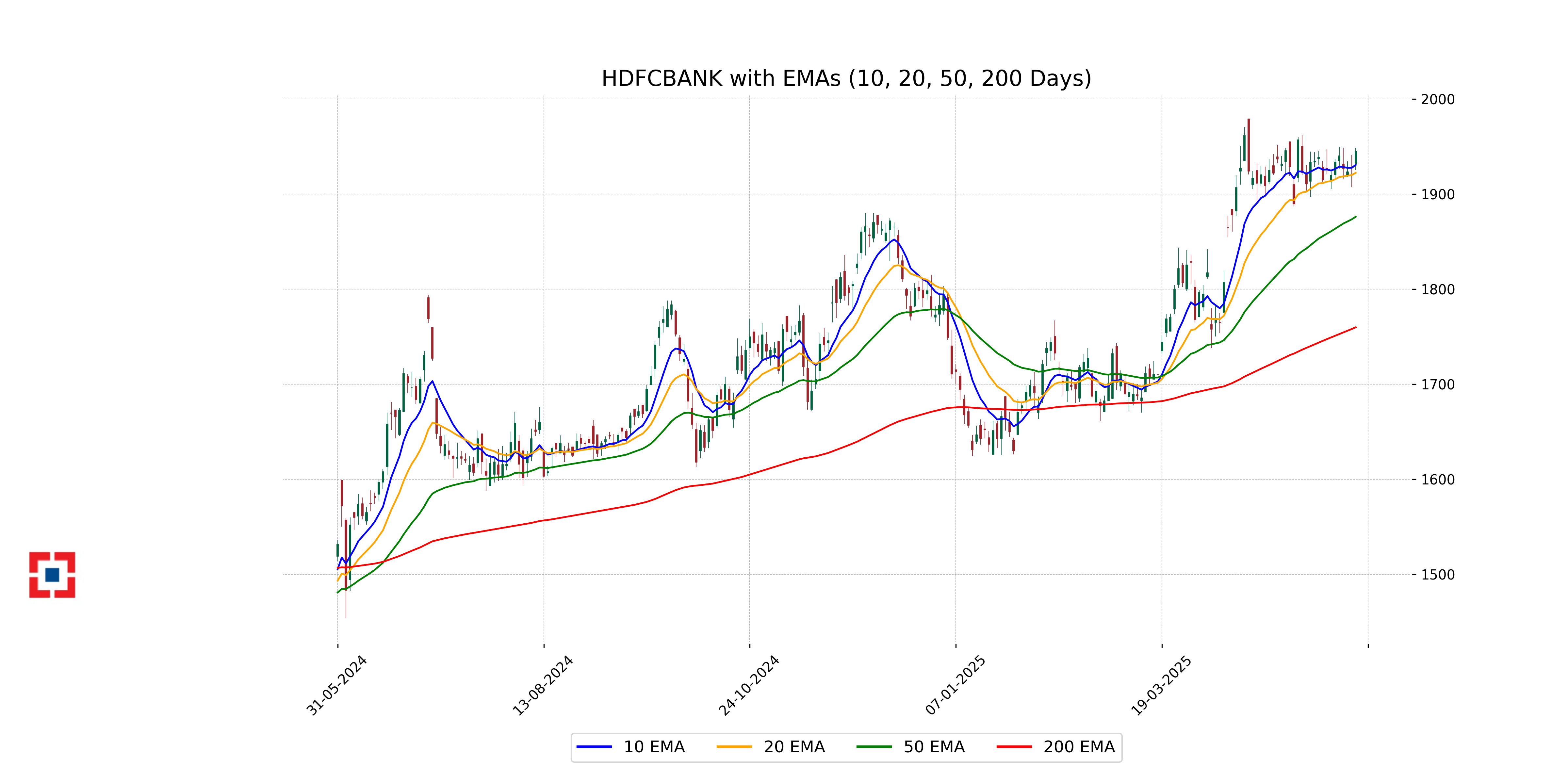

Relationship with Key Moving Averages

HDFC Bank closed at 1944.90, which is above its 50-day EMA of 1876.13 and its 200-day EMA of 1759.81, indicating a potential bullish trend. Additionally, the closing price is slightly above the 10-day EMA of 1930.67 and the 20-day EMA of 1922.32, suggesting recent upward momentum.

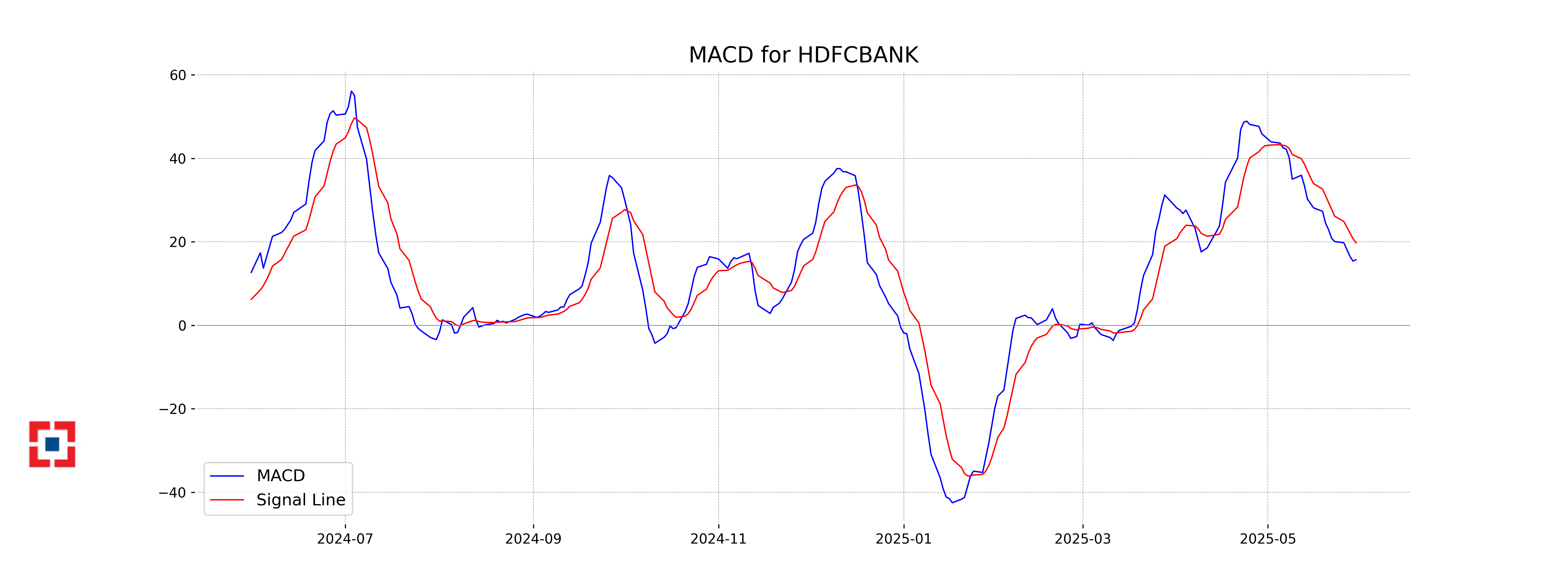

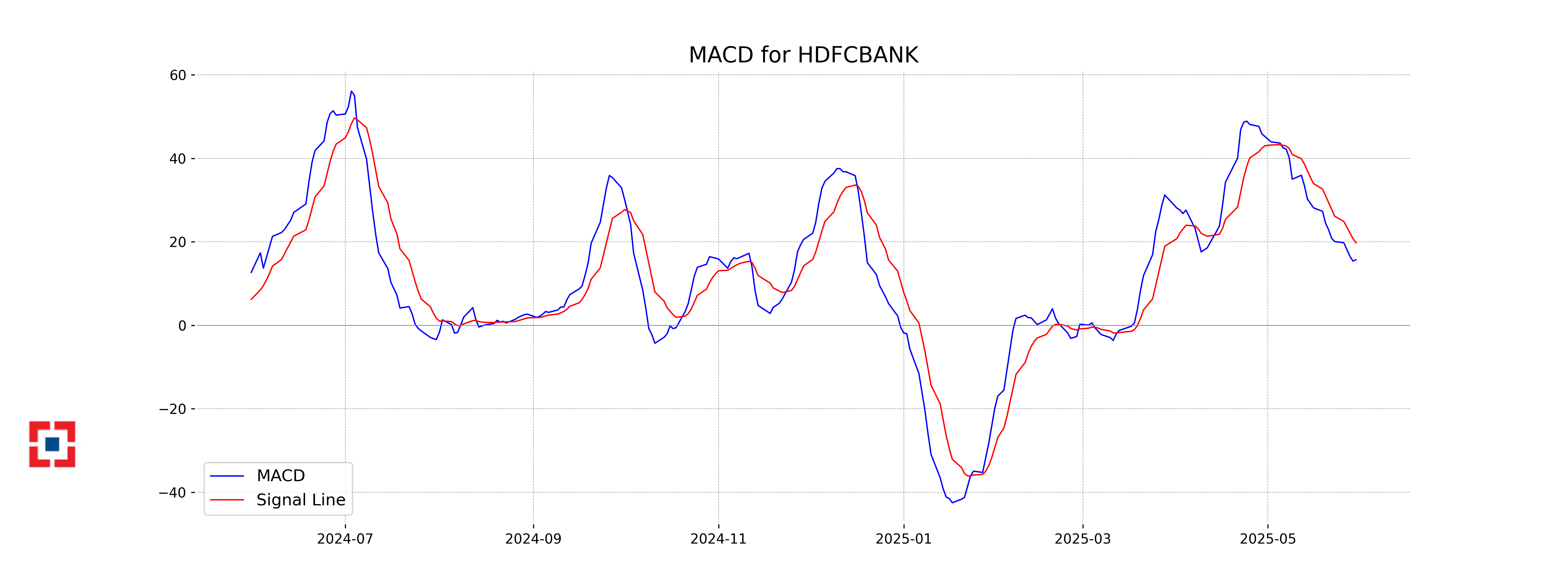

Moving Averages Trend (MACD)

The MACD value for HDFC Bank is 15.70, which is below the MACD Signal line at 19.78. This suggests a bearish signal, indicating potential downward momentum as the MACD line is trending below the signal line. However, monitoring changes is recommended as it can quickly shift with new market dynamics.

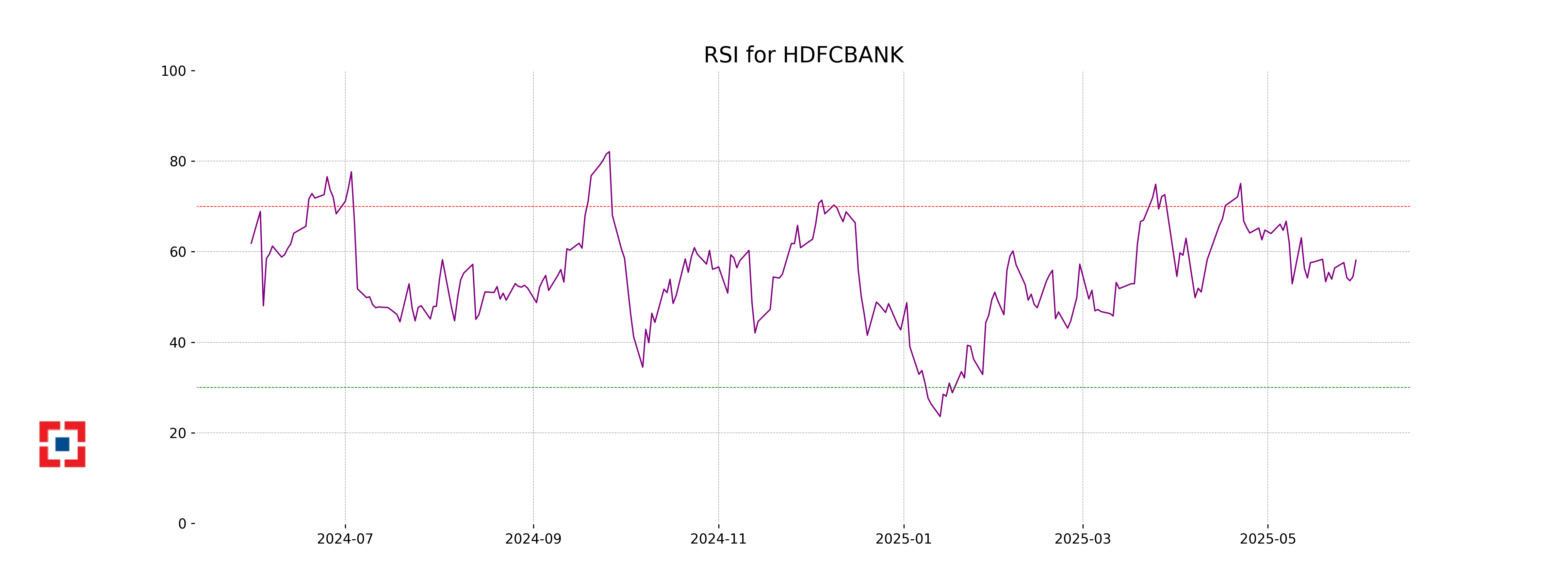

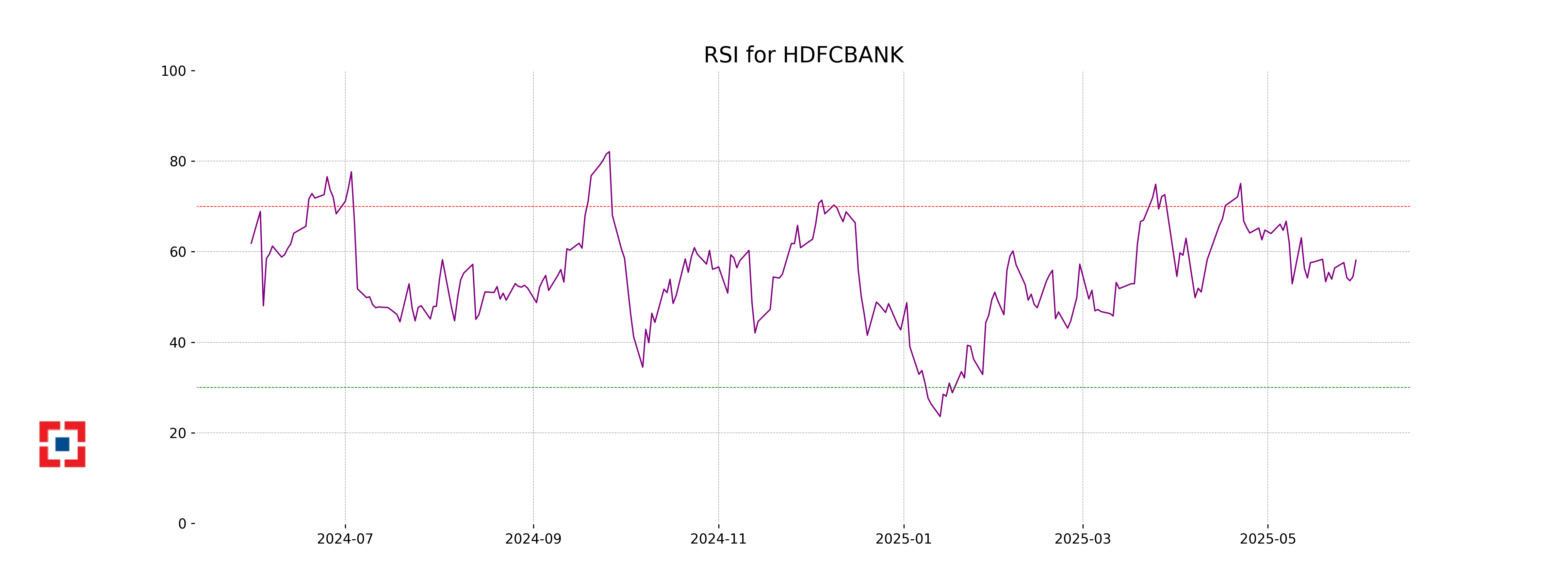

RSI Analysis

The Relative Strength Index (RSI) for HDFC Bank is currently at 58.13, which is below the overbought threshold of 70. This suggests that the stock is in a neutral zone, not indicating significant overbought or oversold conditions. It implies a balanced buying and selling pressure in the market.

Analysis for HCL Technologies - May 30, 2025

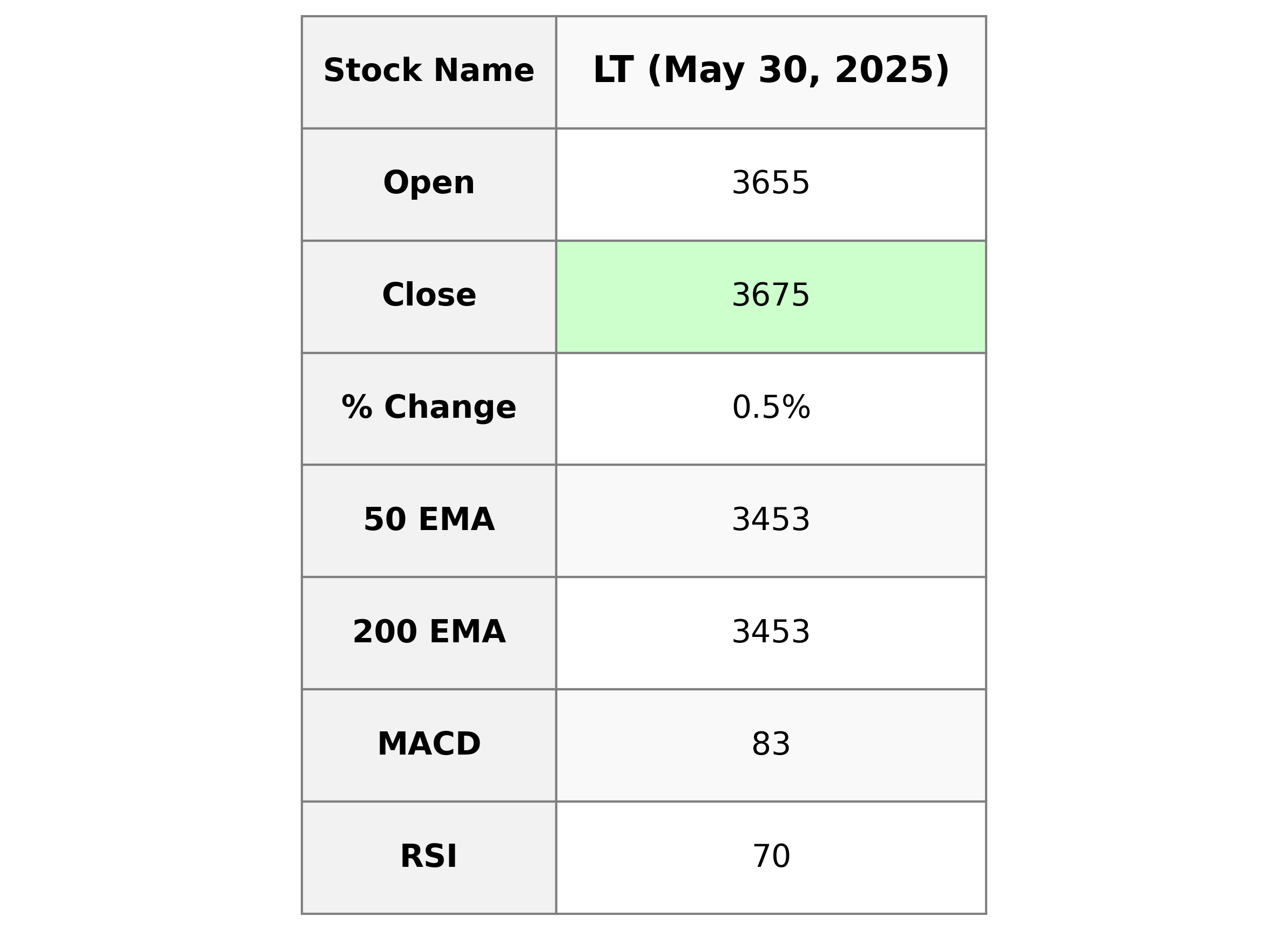

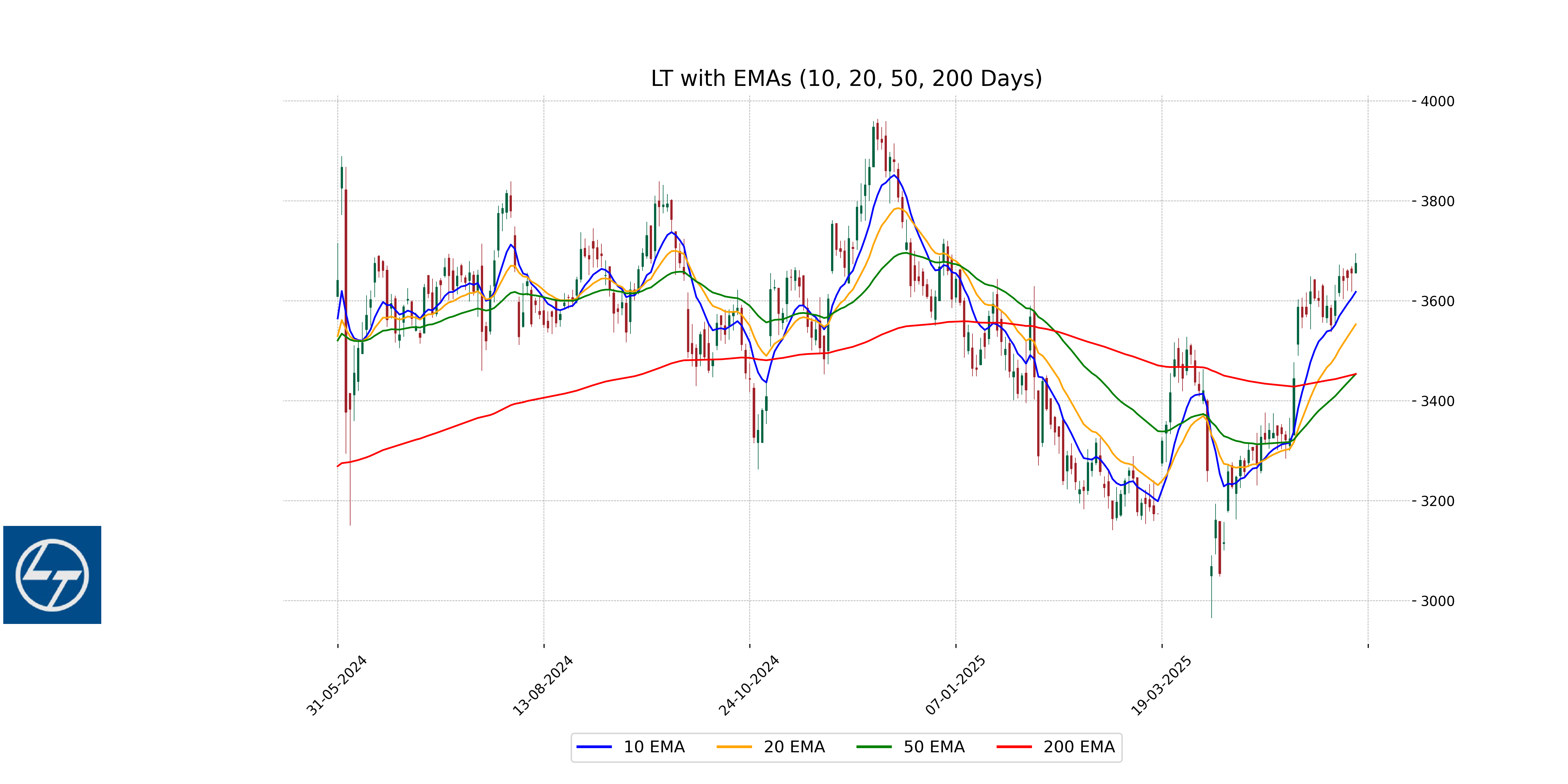

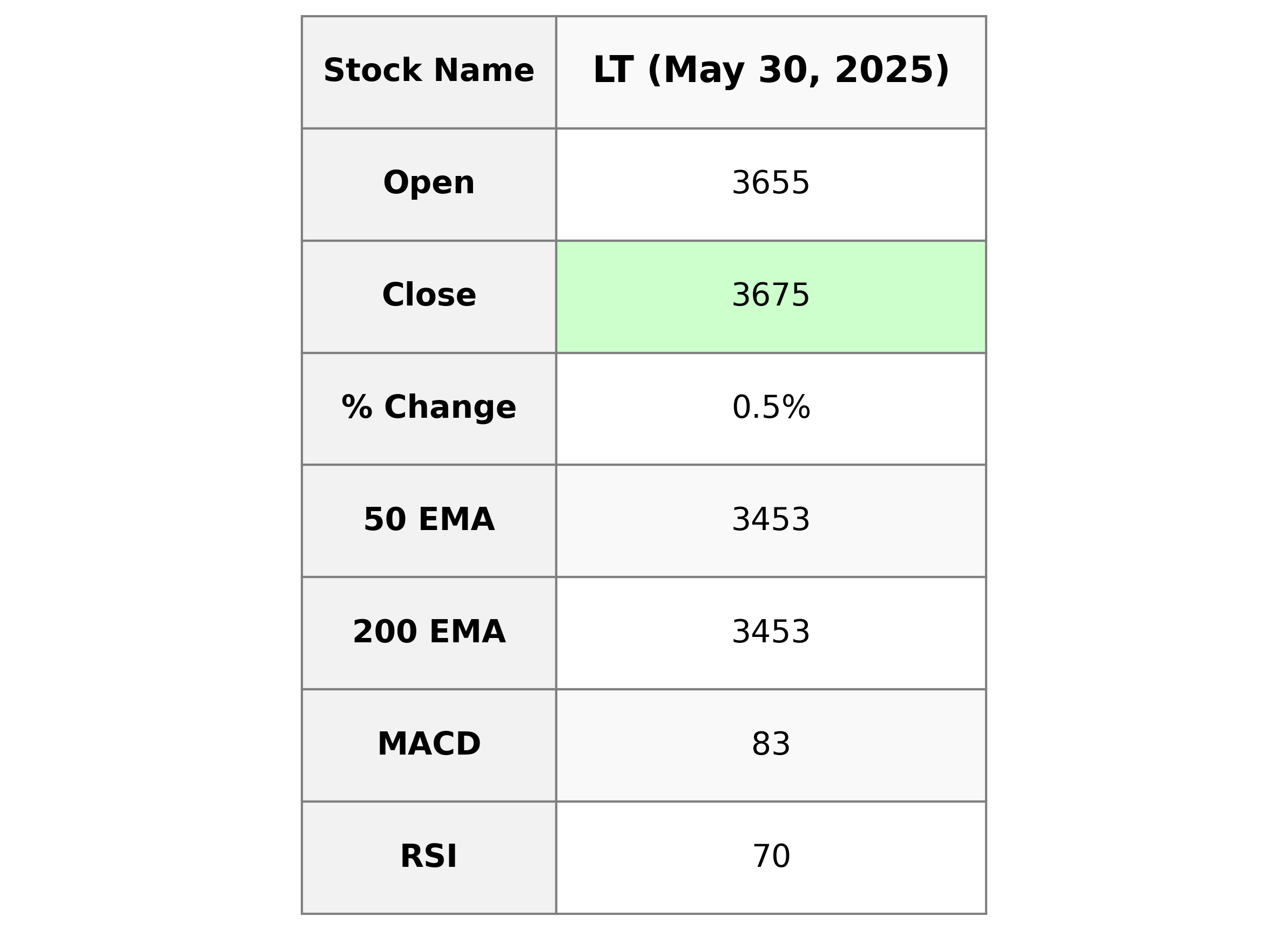

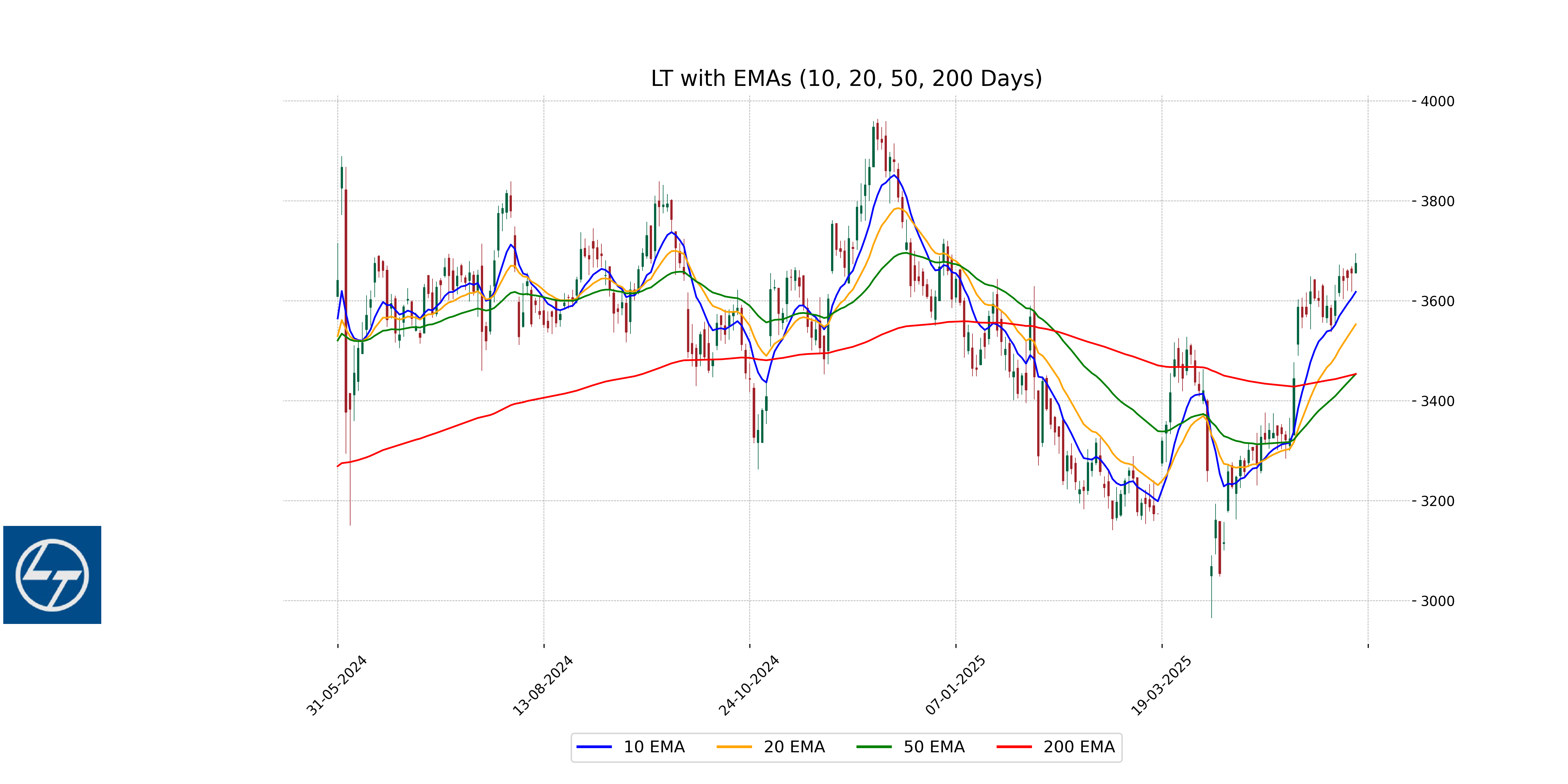

### Stock Details - Open: 3655.30 - High: 3695.00 - Low: 3654.50 - Close: 3675.10 - Previous Close: 3655.30 - % Change: 0.54% - Points Change: 19.80 - Volume: 2,571,065 - 50 EMA: 3453.44 - 200 EMA: 3453.40 - 10 EMA: 3617.75 - 20 EMA: 3552.77 - RSI: 69.67 - MACD: 82.99 - MACD Signal: 78.03 - Market Cap: 5,054,291,509,248 - PE Ratio: 33.63 - EPS: 109.29 - Sector: Industrials - Industry: Engineering & Construction - Country: India ### Performance Summary The company's stock showed a positive performance, opening at 3655.30 and closing at 3675.10, resulting in a minor upward change of 0.54%. Significant technical indicators like EMA and RSI suggest a strong market position, with a notable market cap showcasing its industry presence in India.

Relationship with Key Moving Averages

Larsen & Toubro is trading above its 50-day and 200-day EMAs, suggesting a strong upward trend. Its current price of 3675.10 is also above the 10-day and 20-day EMAs, indicating recent positive momentum in the Industrials sector within Engineering & Construction.

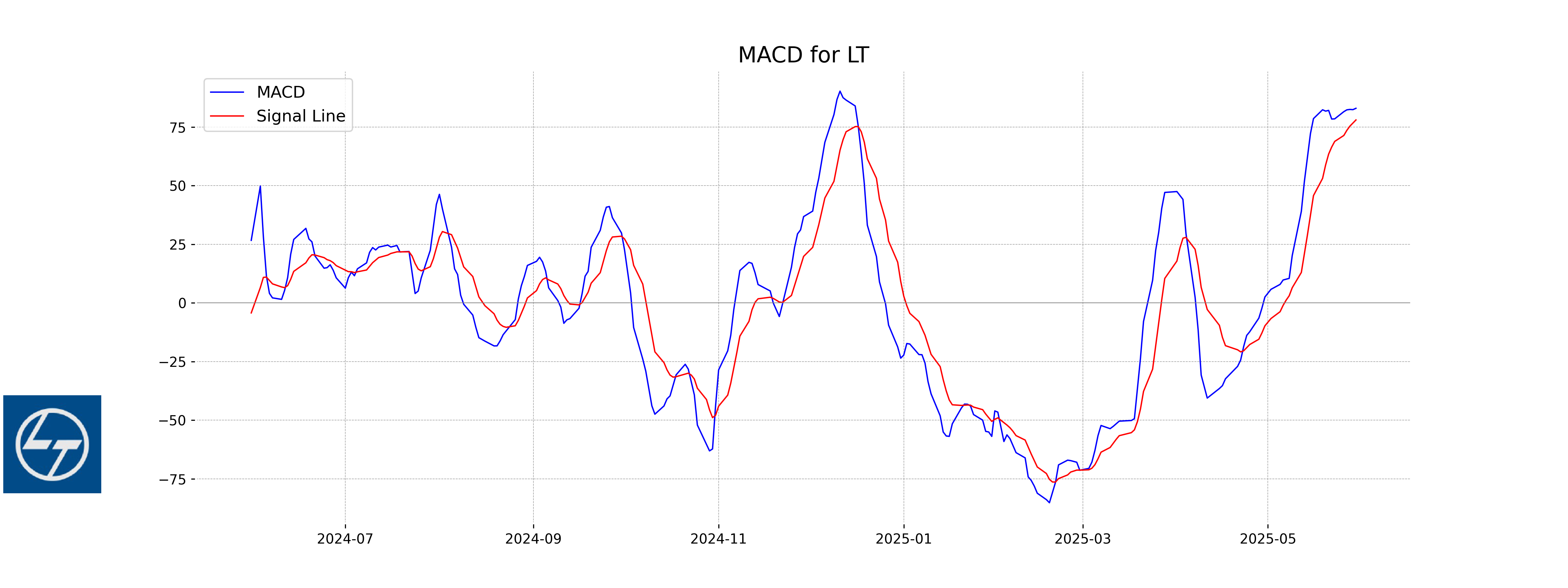

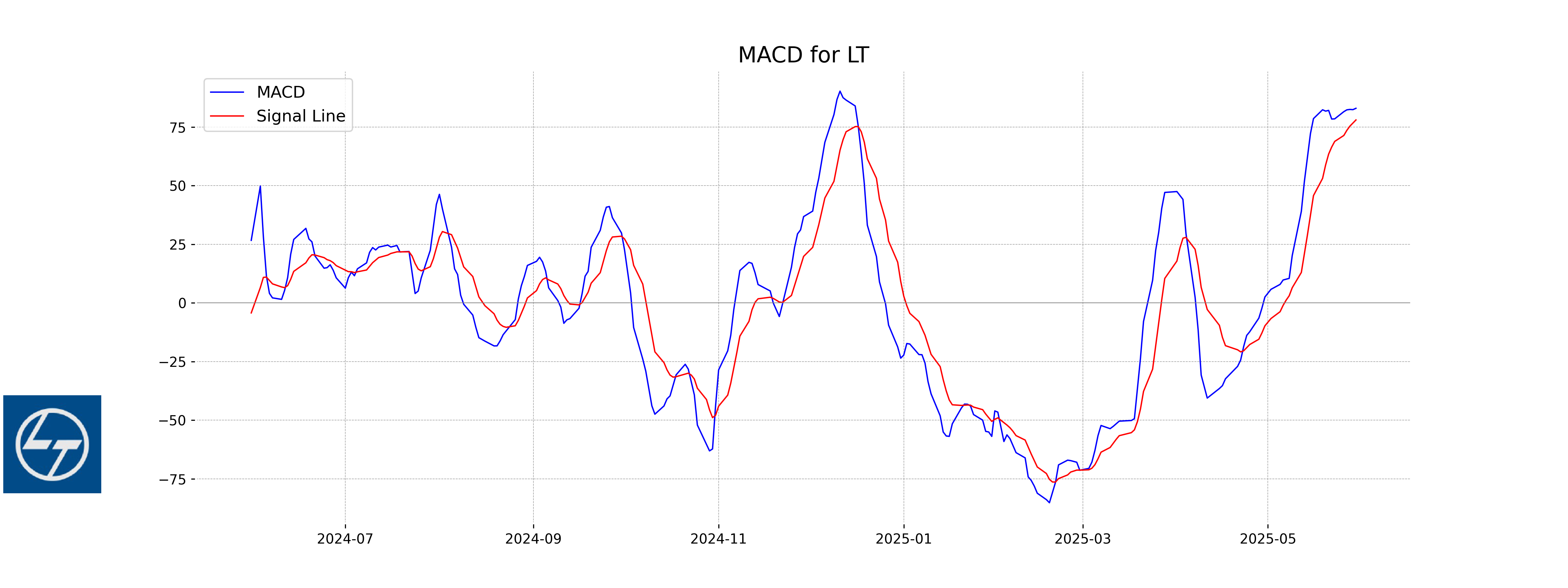

Moving Averages Trend (MACD)

HCL Technologies MACD Analysis: The MACD (Moving Average Convergence Divergence) for HCL Technologies is an important indicator used to identify changes in the strength, direction, momentum, and duration of a trend. If the MACD line is above the signal line, it may indicate a bullish trend, whereas a MACD below the signal line may suggest a bearish trend. Make sure to compare the MACD with historical data for more accurate analysis.

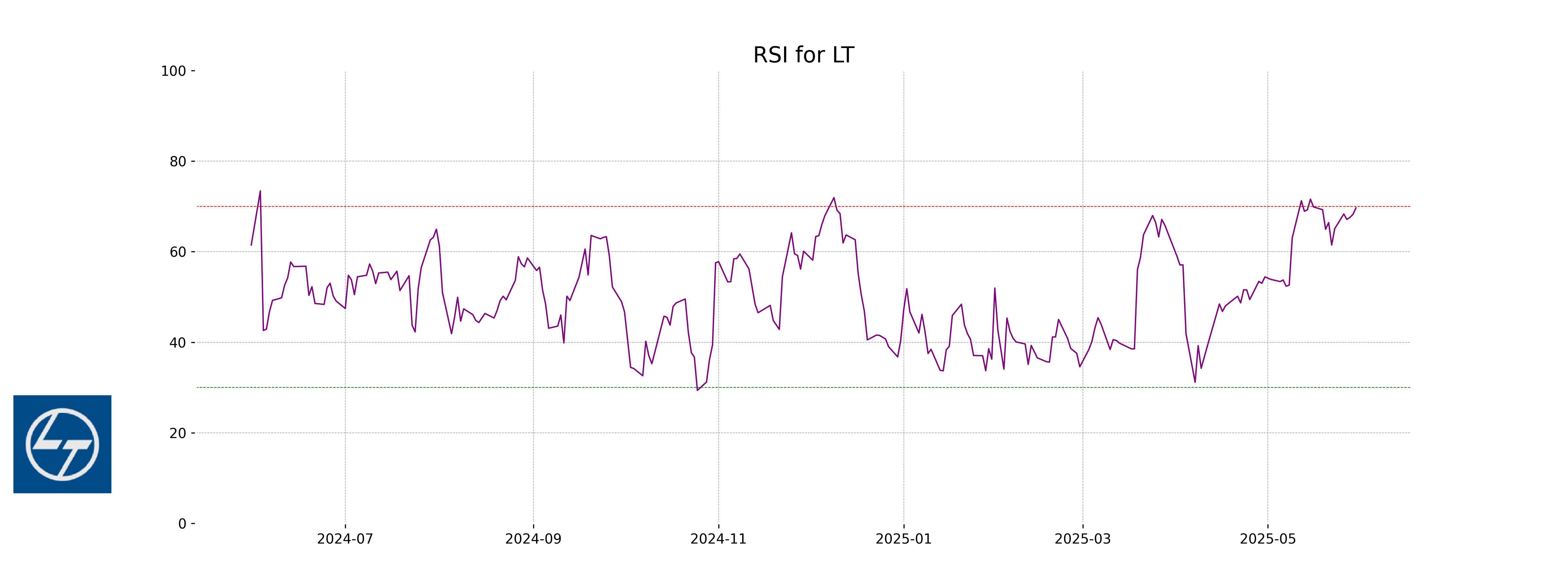

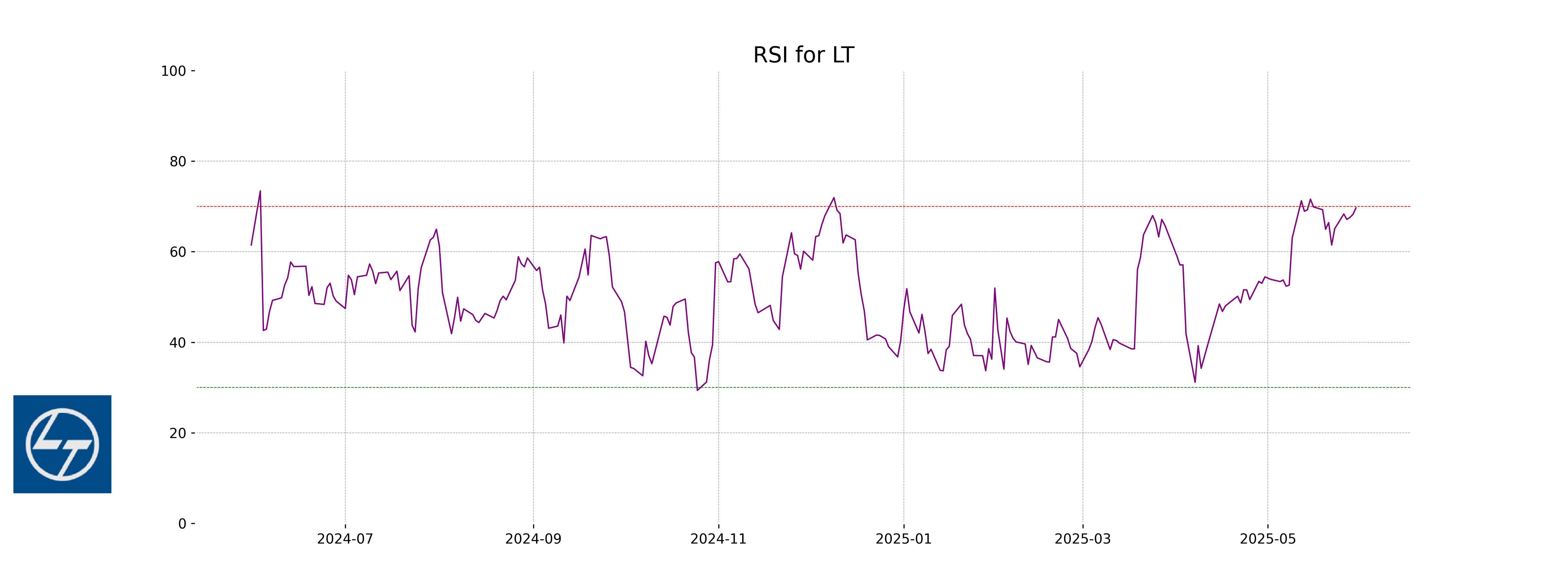

RSI Analysis

HCL Technologies exhibits an RSI of 69.67, indicating that the stock is approaching overbought conditions, as RSI values above 70 typically suggest. It may experience a slowdown if buying pressure decreases.

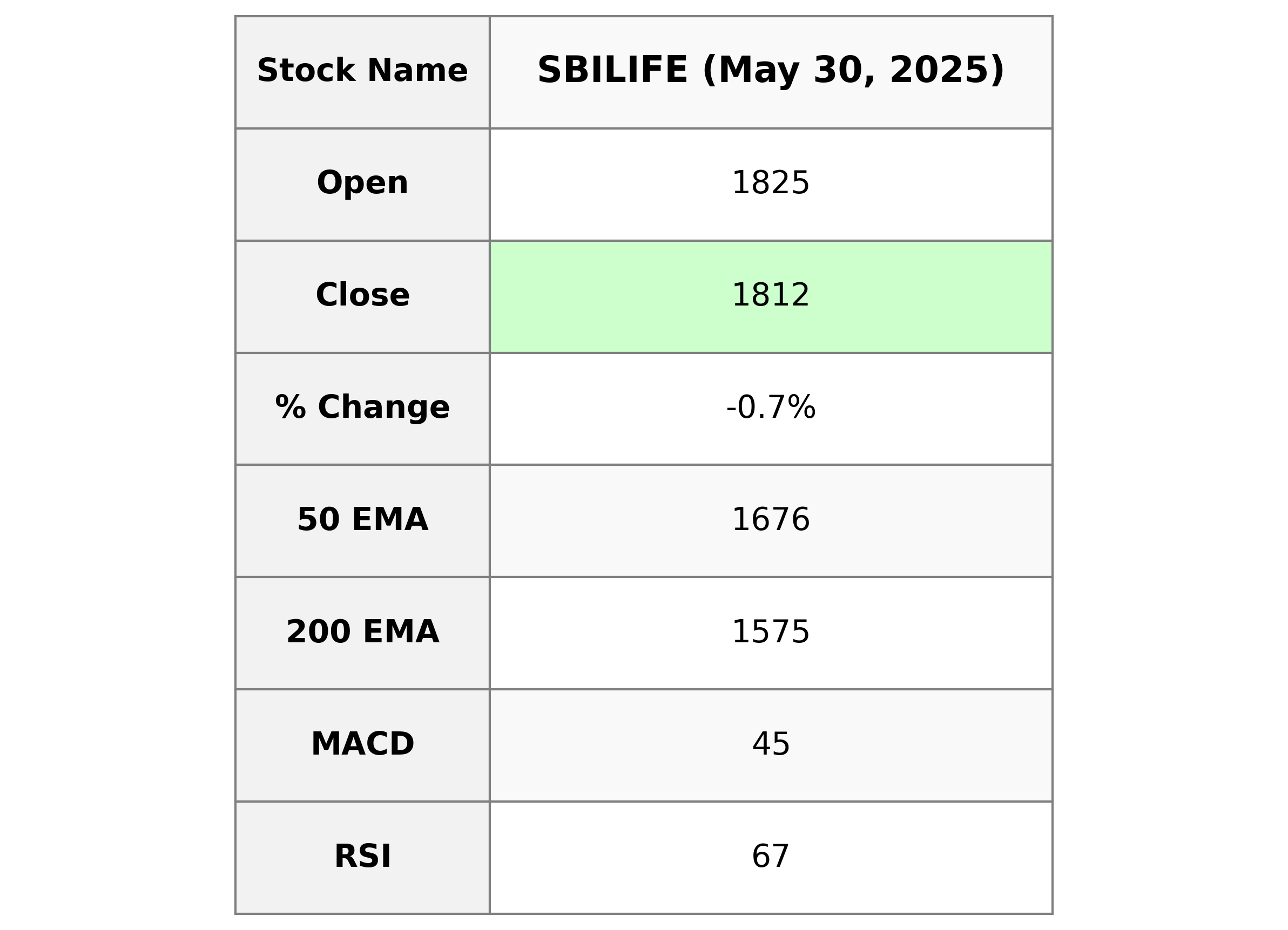

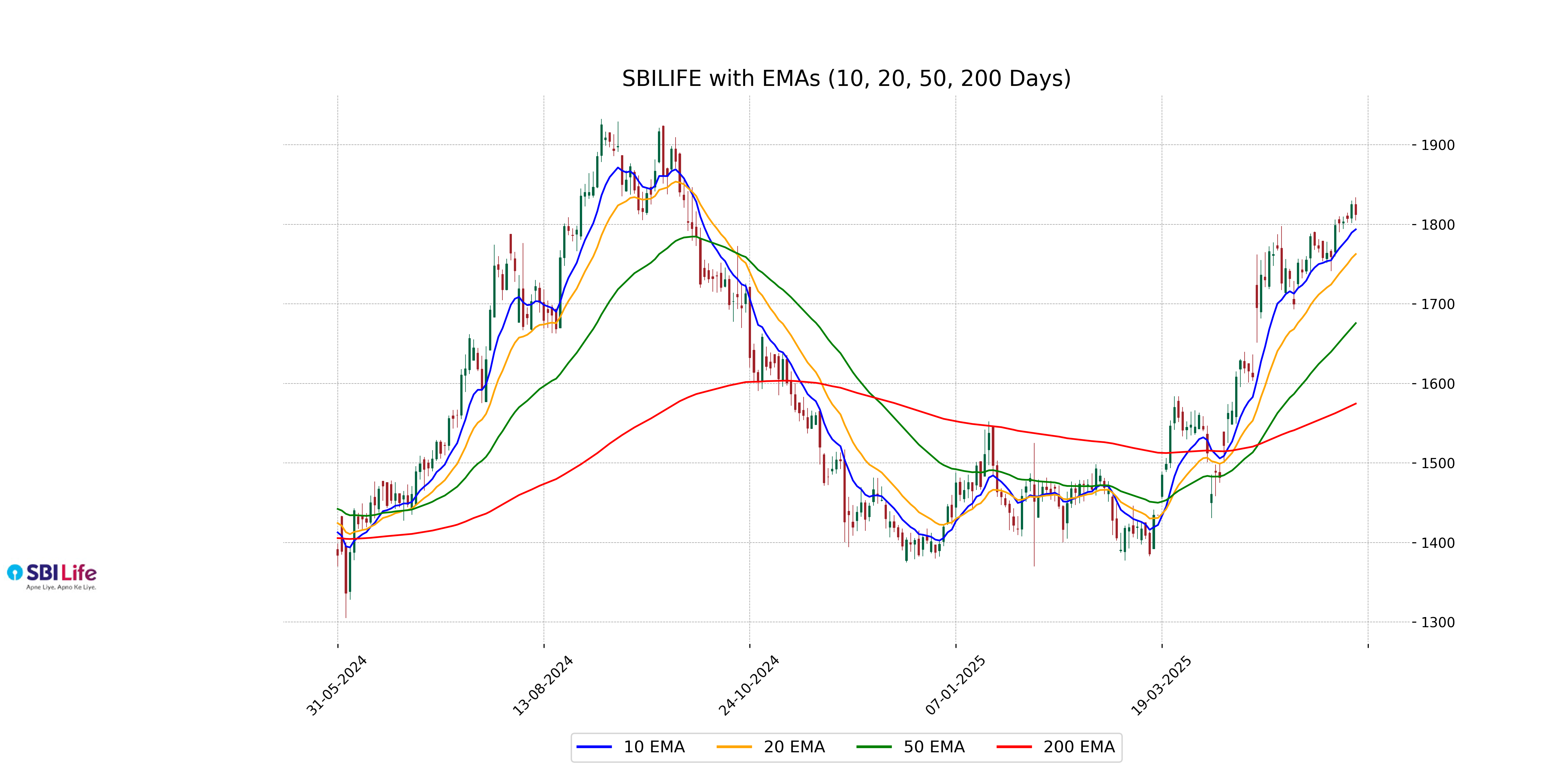

Analysis for SBI Life - May 30, 2025

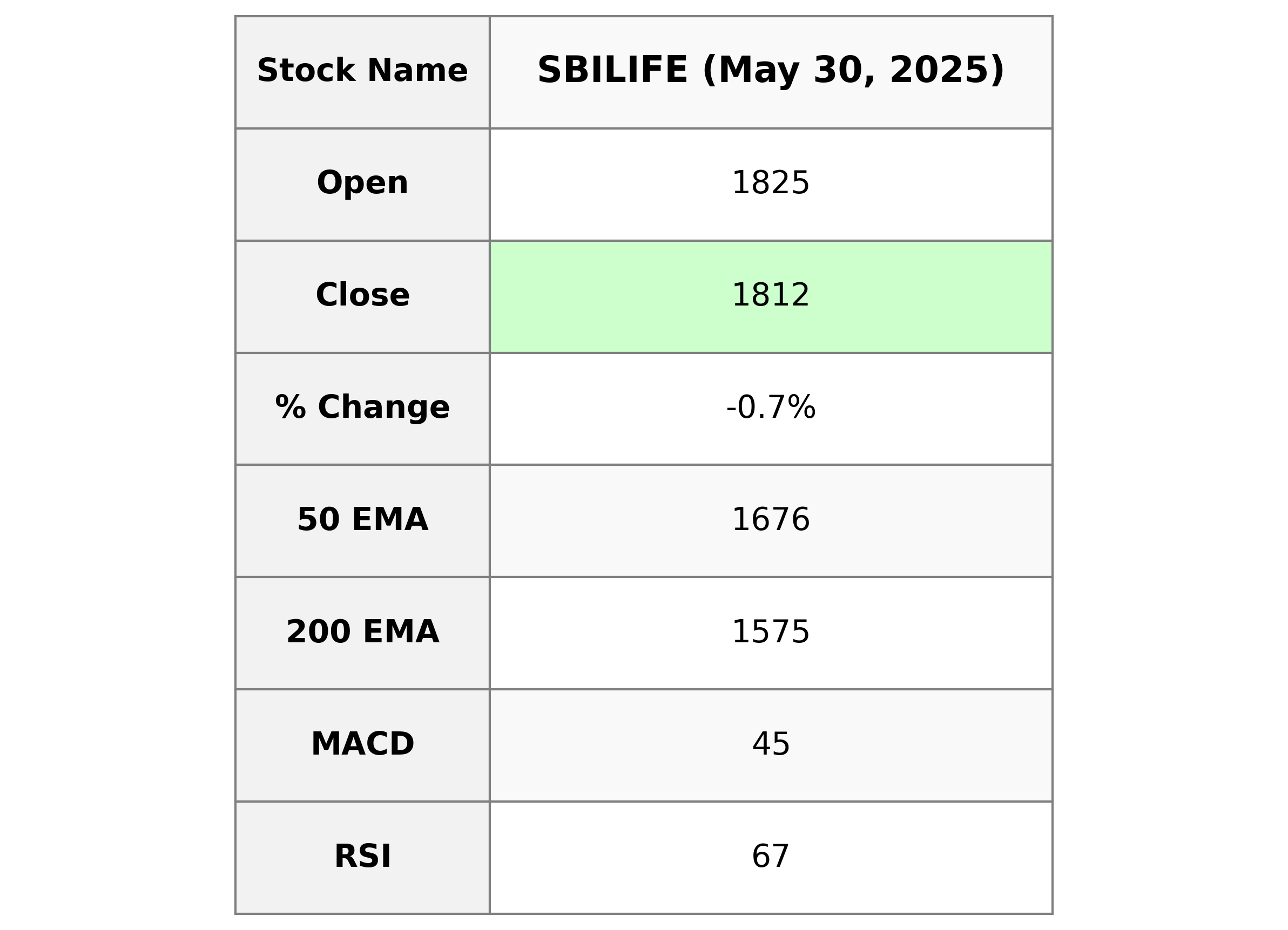

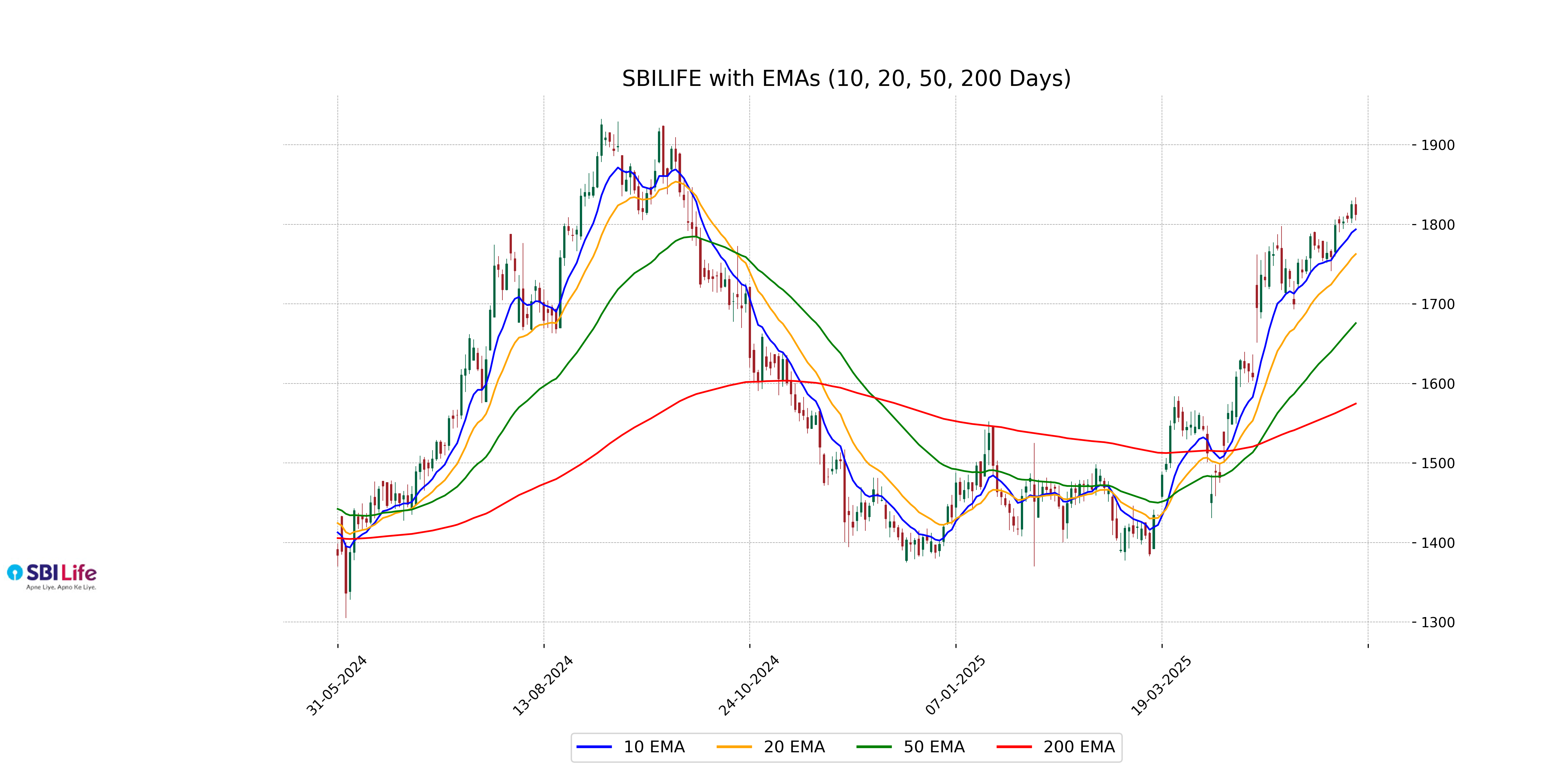

SBI Life performance on the reported day showed a slight decline with the stock closing at 1812.20, down from the previous close of 1825.00, marked by a percentage change of -0.70%. The trading volume was noted at 1,364,236 shares. The stock maintains a strong position in its sector, Financial Services, with a P/E ratio of 75.23 and an EPS of 24.09, reflecting robust earnings within the Indian Life Insurance industry.

Relationship with Key Moving Averages

SBI Life's current closing price of 1812.20 is above its 10-day EMA of 1793.62 and significantly higher than the 50-day EMA of 1675.76 and the 200-day EMA of 1574.63. This indicates a short-term upward momentum, despite being slightly lower than the previous close.

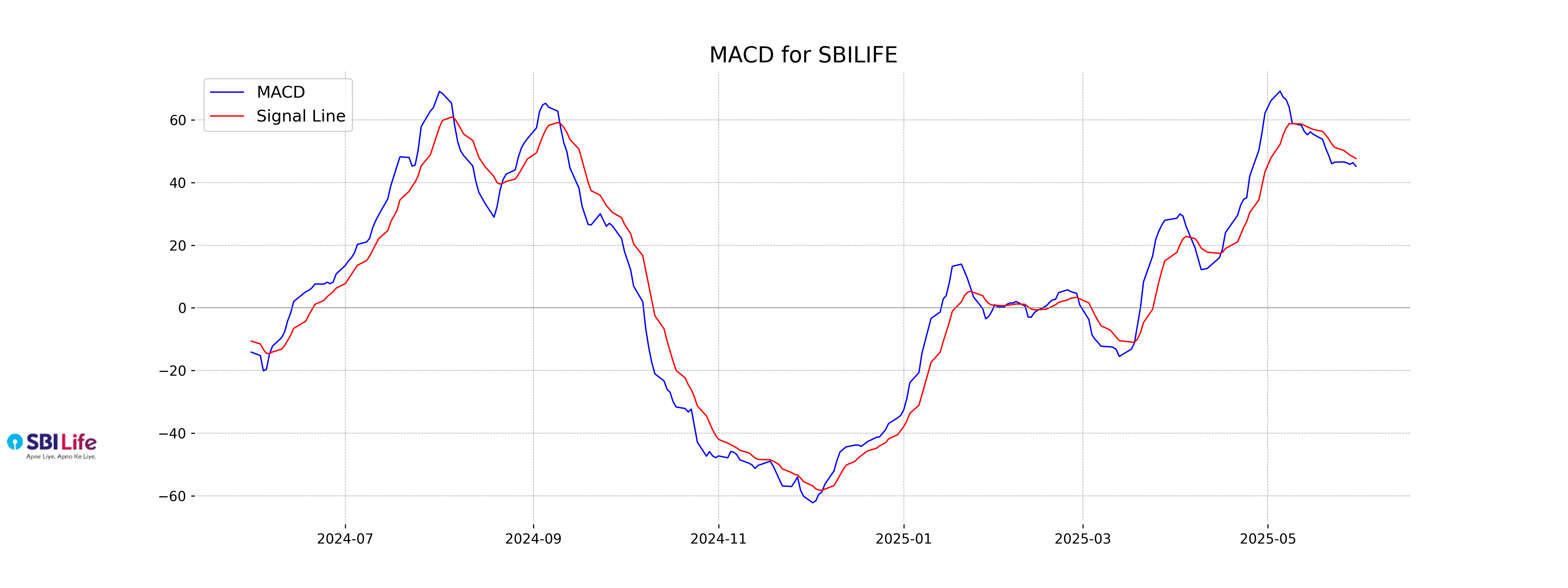

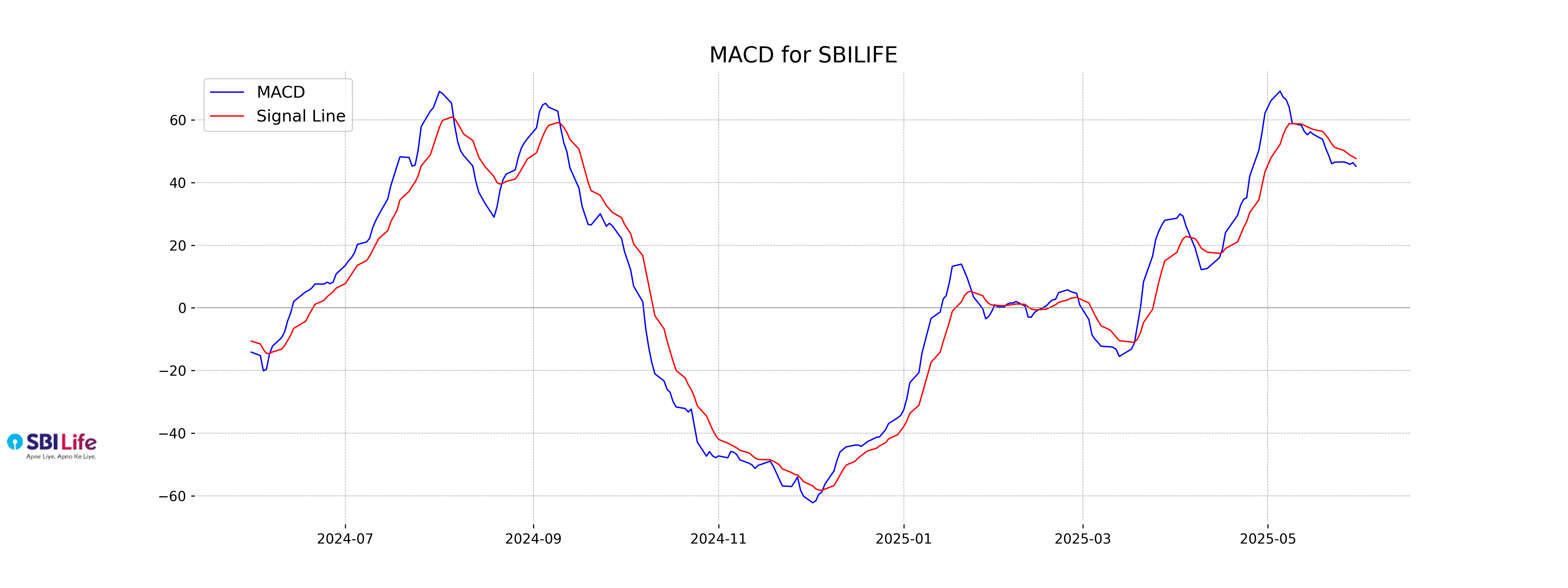

Moving Averages Trend (MACD)

MACD Analysis for SBI Life: The MACD value of 45.18 is below the MACD Signal line value of 47.63, indicating a potential bearish crossover. This suggests that the stock might experience downward momentum in the short term.

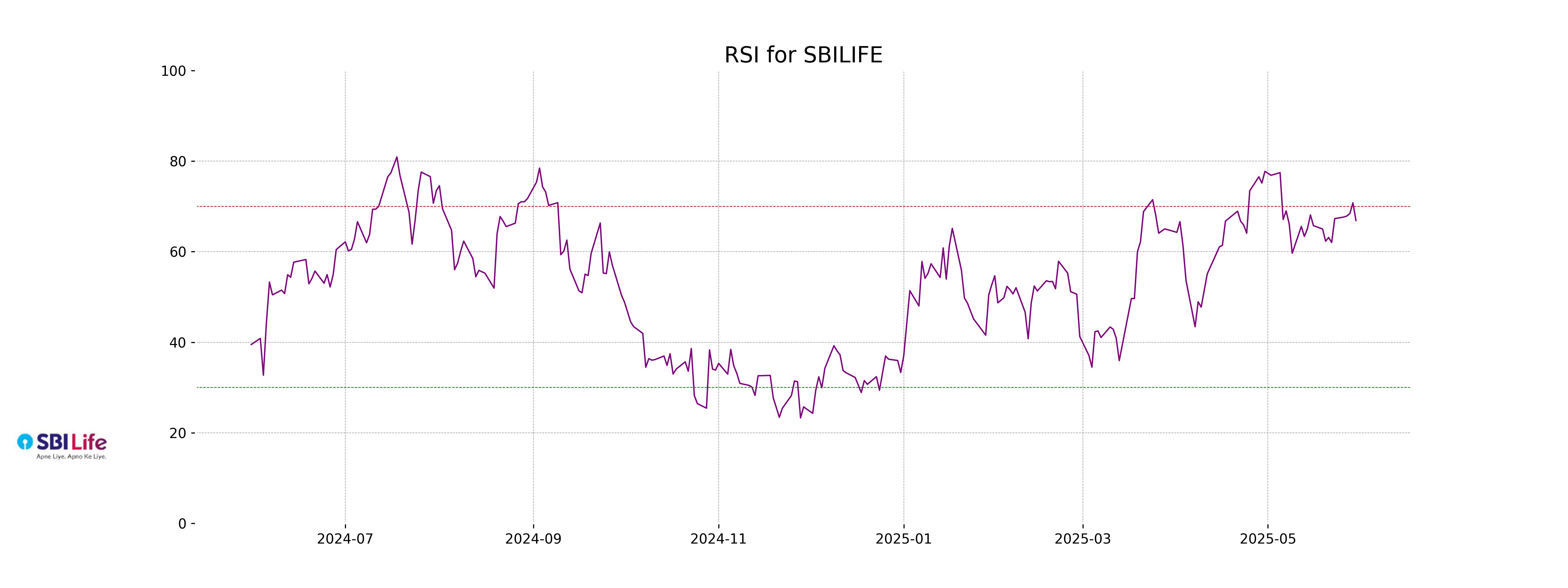

RSI Analysis

SBI Life currently has an RSI of 66.88, indicating a moderately strong momentum. The RSI is close to the overbought threshold of 70, suggesting that the stock may experience a price consolidation or a minor pullback in the near term. However, it's not yet in the overbought zone.