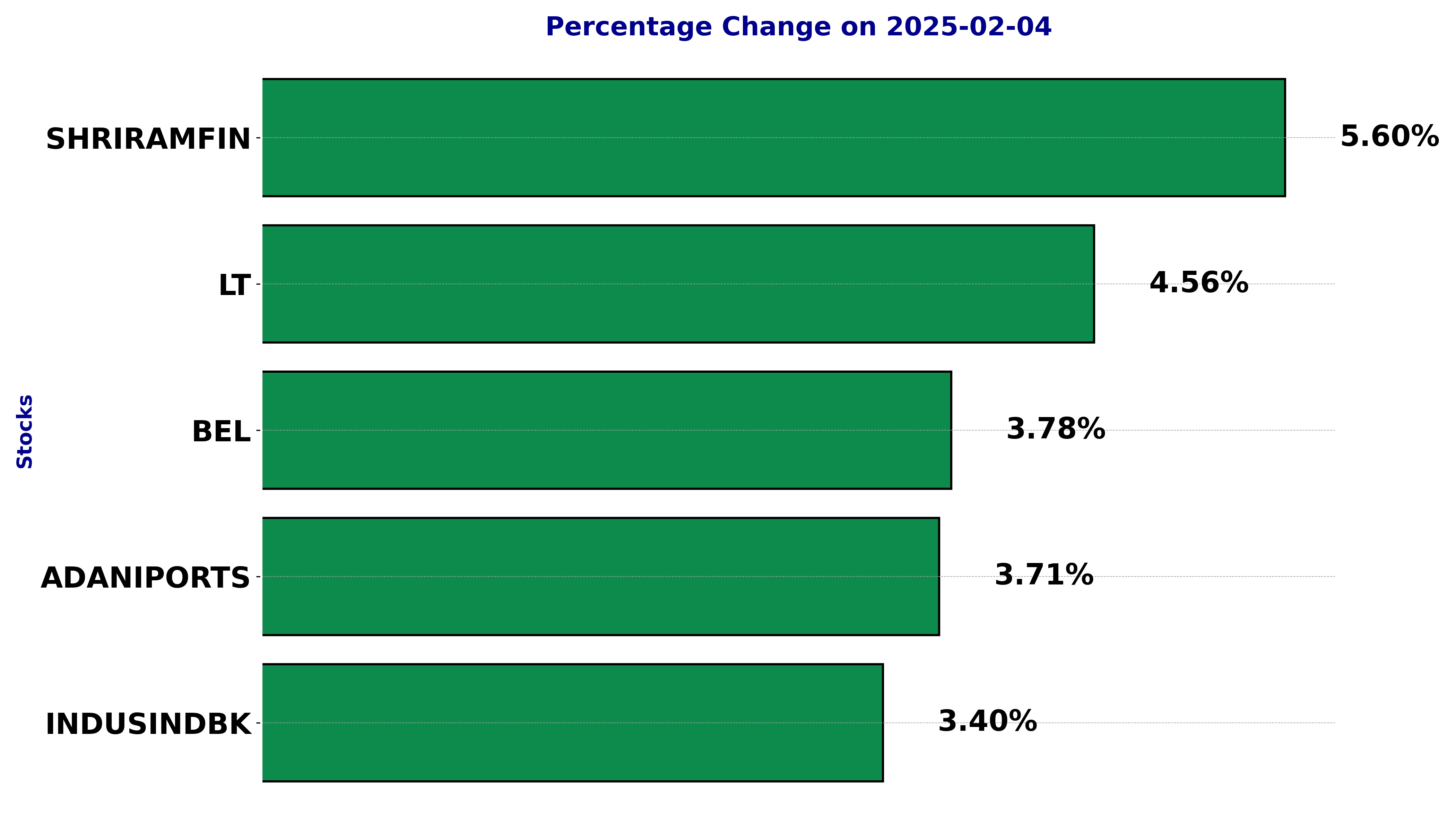

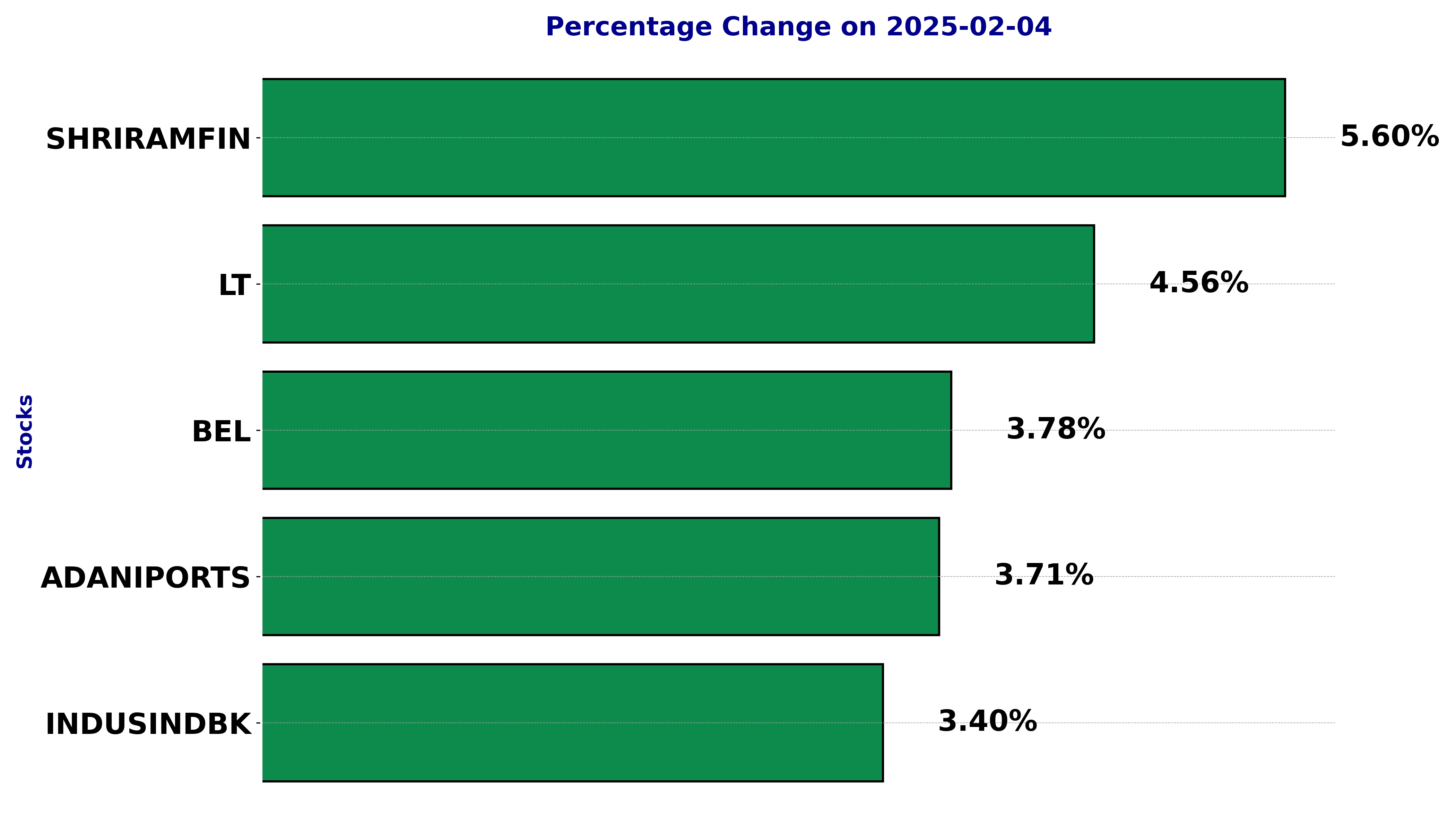

In this article, we will explore the technical indicators of some of the high-performing stocks on the Indian stock market, including ADANIPORTS, BEL, INDUSINDBK, LT, and SHRIRAMFIN.

By looking at these stocks through the lens of key technical factors, we aim to better understand their price movements, trends, and potential future performance.

Analysis for Adani Ports - February 04, 2025

**Adani Ports Performance:** Adani Ports, trading under the symbol ADANIPORTS.NS, experienced a 3.71% increase in its stock price, rising from a previous close of 1084.85 to a closing price of 1125.10. Despite a positive price movement, the stock currently shows a bearish trend as indicated by a negative MACD value of -24.61. With a 50-day EMA of 1172.29 and a 200-day EMA of 1264.25, the stock is trading lower than its short and long-term averages, suggesting potential resistance and downward pressure. The company's market cap stands at approximately 2.43 trillion INR, with a PE ratio of 24.03, situating it within the Industrials sector, specifically in Marine Shipping, in India.

Relationship with Key Moving Averages

Adani Ports' closing price of 1125.10 is below both its 50 EMA (1172.29) and 200 EMA (1264.25), indicating a bearish trend in the medium to long term. However, the closing price is slightly above the 10 EMA (1100.72) and close to the 20 EMA (1116.42), which may suggest some short-term strength.

Moving Averages Trend (MACD)

For Adani Ports (ADANIPORTS.NS), the MACD value is -24.6095, which is higher than the MACD Signal of -29.1282. This suggests a potential bullish crossover, indicating upward momentum as the MACD is moving closer to its signal line.

RSI Analysis

The RSI (Relative Strength Index) for Adani Ports is 49.07, indicating that the stock is currently in a neutral zone. It suggests that neither buying nor selling pressures are dominant, giving no strong signal in either direction at this moment.

Analysis for Bharat Electronics - February 04, 2025

**Bharat Electronics Limited (BEL.NS)** demonstrated a positive market performance, closing at 284.5 with a 3.77% increase from the previous close. The stock experienced a high trading volume of 29,028,522 shares, indicating significant investor interest. The stock price is above its 50-day and 200-day EMAs, showing a strong short-term bullish trend. The RSI value of 52.46 suggests a neutral momentum, and the company's market capitalization stands at 2,079,632,392,192 INR.

Relationship with Key Moving Averages

Bharat Electronics (BEL.NS) closed at 284.5, which is above its 50-day EMA of 283.97 and 200-day EMA of 272.46, indicating a bullish short to medium-term trend. However, the close is also above the 10-day EMA of 277.64 and 20-day EMA of 278.26, suggesting a recent upward momentum.

Moving Averages Trend (MACD)

For Bharat Electronics (BEL.NS), the MACD value is -2.23 while the MACD Signal is -4.38, indicating a bullish crossover since the MACD line is above the signal line. This suggests potential upward momentum in stock price.

RSI Analysis

For Bharat Electronics (BEL.NS), the RSI (Relative Strength Index) is at 52.46, which indicates a neutral trend. This level suggests that the stock is neither in an overbought nor oversold condition, implying a balanced momentum in the current market situation.

Analysis for IndusInd Bank - February 04, 2025

IndusInd Bank (INDUSINDBK.NS) showed a positive performance with a closing price of 1047.15, reflecting a 3.40% increase from the previous close of 1012.70. The stock traded with high volume of 9,861,117 and had strong indicators like a high RSI of 68.44, suggesting bullish momentum. Despite the positive movement, the 50 EMA at 1001.99 is below the 200 EMA of 1200.52, indicating a medium-term bearish trend.

Relationship with Key Moving Averages

IndusInd Bank's current closing price of 1047.15 is above its 50 EMA (1001.99) and 10 EMA (989.80), indicating a short-term bullish trend. However, it remains below the 200 EMA (1200.52), suggesting the stock is still in an overall bearish long-term trend.

Moving Averages Trend (MACD)

IndusInd Bank's MACD is showing a value of 7.73, which is above the MACD Signal line of -2.87. This suggests a bullish trend, indicating potential upside momentum in the stock price.

RSI Analysis

The RSI (Relative Strength Index) for IndusInd Bank is 68.44. This value suggests that the stock is nearing overbought territory, indicating potential caution for investors, as it approaches the threshold commonly associated with overbought conditions, which is 70.

Analysis for HCL Technologies - February 04, 2025

**Stock Symbol:** LT.NS **Opening Price:** 3316.0 INR **Closing Price:** 3439.15 INR **Day's Range:** 3307.25 - 3449.0 INR **Change:** 4.56% (149.95 points) **Volume:** 4,742,187 shares **Exponential Moving Averages:** - **50-day EMA:** 3562.53 - **200-day EMA:** 3540.70 - **10-day EMA:** 3446.30 - **20-day EMA:** 3489.98 **Technical Indicators:** - **RSI:** 45.34 - **MACD:** -56.24 - **MACD Signal:** -52.05 **Market Capitalization:** 4,729,450,528,768 INR **PE Ratio:** 33.95 **EPS:** Data not available **Sector:** Industrials **Industry:** Engineering & Construction **Country:** India Larsen & Toubro Ltd. (LT.NS) saw a notable price increase, closing at 3439.15 INR, up by 4.56%, with significant trading volume. However, its technical indicators, including a negative MACD, suggest mixed signals, possibly indicating a period of uncertainty or impending change in momentum.

Relationship with Key Moving Averages

The stock for Larsen & Toubro (LT.NS) closed below the 50-day EMA (3562.53) and the 200-day EMA (3540.70), indicating potential bearish sentiment in the short to medium term. Additionally, it closed near the 10-day EMA (3446.30), suggesting short-term resistance.

Moving Averages Trend (MACD)

I'm unable to provide any specific MACD analysis for HCL Technologies as the data given is for Larsen & Toubro (LT.NS). However, if you have HCL Technologies' MACD data, I can help you analyze it. Please provide the necessary data points.

RSI Analysis

Based on the data provided, for stock symbol LT.NS, the RSI (Relative Strength Index) is 45.34. An RSI below 30 is typically considered oversold, while an RSI above 70 is considered overbought. An RSI around 45 suggests that the stock is neither overbought nor oversold, indicating neutral market momentum.

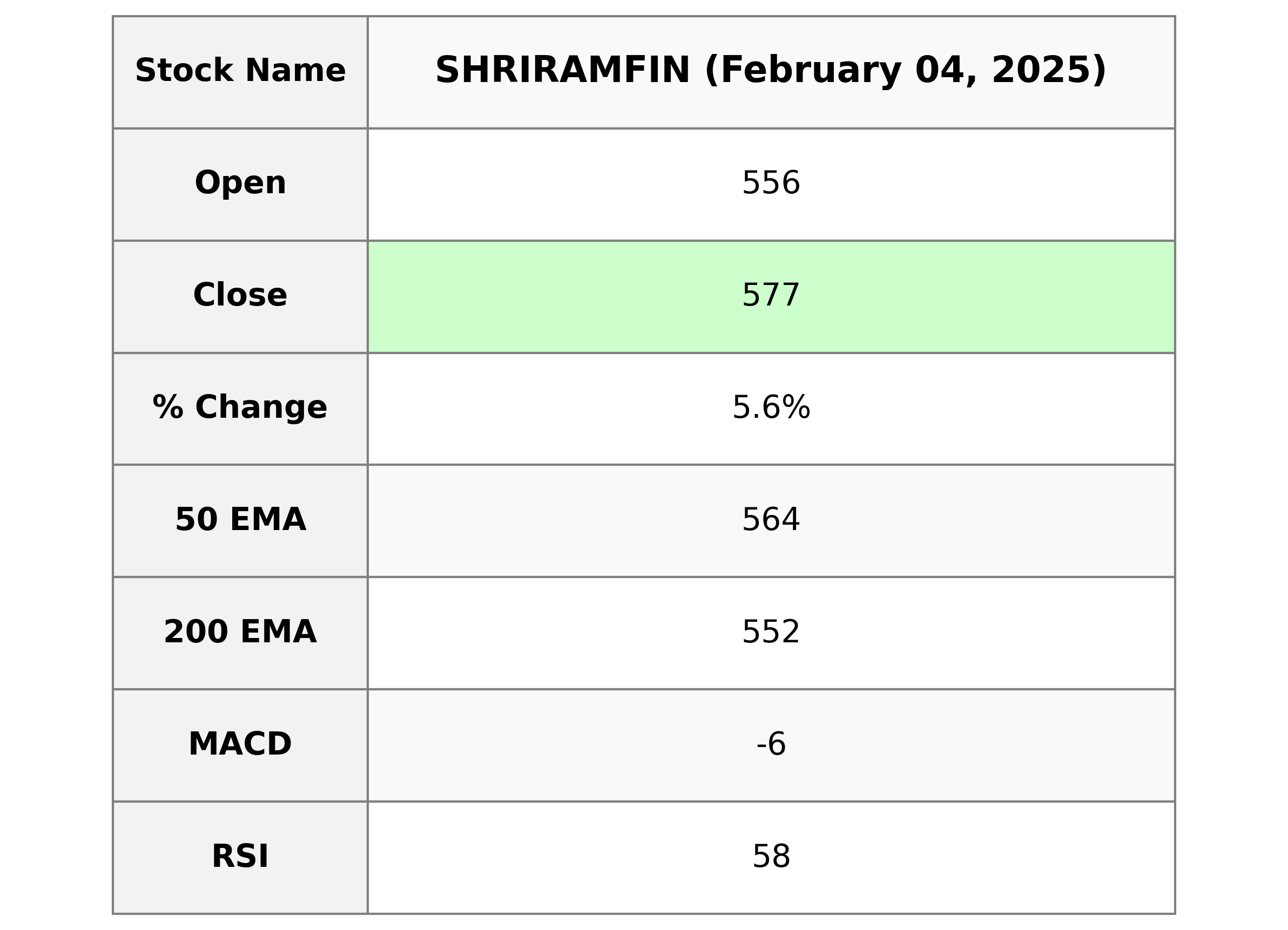

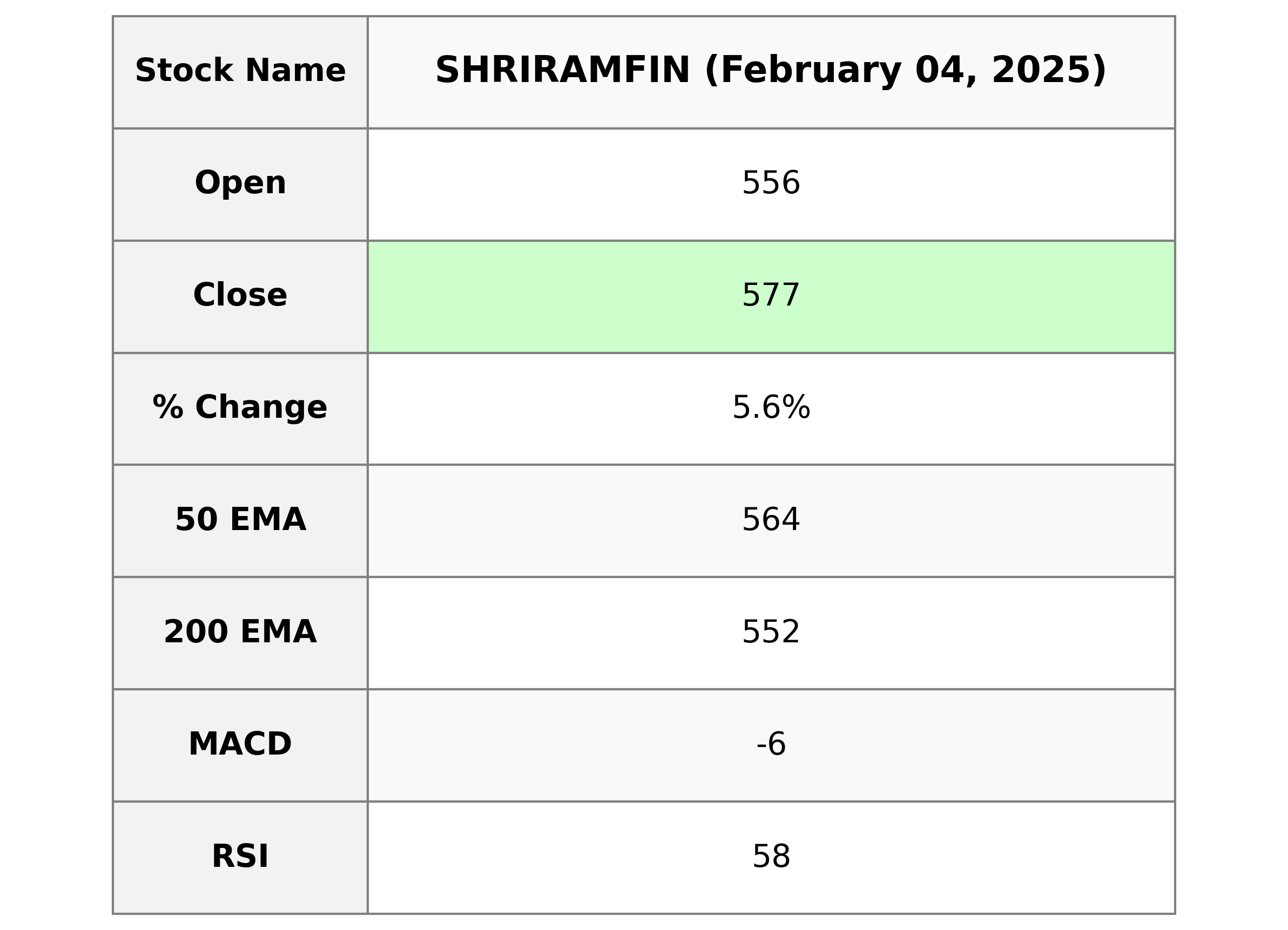

Analysis for Shriram Finance - February 04, 2025

**Stock Symbol:** SHRIRAMFIN.NS **Performance Summary:** Shriram Finance has shown a significant increase today, with a close price of 576.75, reflecting a 5.60% change from its previous close of 546.15. The trading volume was substantial, with over 12 million shares exchanged. The company's price performance is well above its 50 and 200 EMA, indicating a strong upward trend, supported by a healthy RSI of 57.74.

Relationship with Key Moving Averages

The closing price of Shriram Finance at 576.75 is above its 50-day EMA (564.33) and significantly above its 10-day (543.48) and 20-day EMAs (544.88), indicating a positive short-term trend. It's also over the 200-day EMA (551.66), suggesting a long-term bullish trend.

Moving Averages Trend (MACD)

**MACD Analysis for Shriram Finance:** The MACD value for Shriram Finance is -6.24, while the MACD Signal is lower at -12.87. This indicates a bullish crossover, suggesting potential positive momentum as the MACD is moving towards crossing above the signal line.

RSI Analysis

The RSI (Relative Strength Index) for Shriram Finance is at 57.74, indicating a neutral to slightly bullish momentum. RSI values between 50 and 70 suggest that the stock is neither overbought nor oversold and could potentially continue its current trend.