The national stock market indices showed varied performances on February 05, 2025, reflecting the economic sentiment.

In this article, we analyze the performance of key national indices including the Nifty 50,Nifty Bank,Nifty IT,Nifty Auto,Nifty Pharma,Nifty FMCG,Nifty Infra,Nifty Energy and Nifty Metal.

Analysis for Sensex - February 05, 2025

Sensex opened at 78704.60 and closed at 78271.28, registering a percentage change of 1.41% with a points increase of 1084.54 from the previous close. The Relative Strength Index (RSI) is at 56.24, indicating a moderately strong momentum. While the current MACD value is -353.17, it signals a potential bullish trend as it is above the MACD Signal of -637.85.

Relationship with Key Moving Averages

The BSE Sensex closed at 78271.28, which is above both its 50-EMA (78122.65) and 200-EMA (77830.79), indicating a bullish trend. However, it remains below its 10-EMA (77020.79) and 20-EMA (77146.26), suggesting that recent momentum may be weaker.

Moving Averages Trend (MACD)

**MACD Analysis for Sensex:** The MACD value for Sensex is -353.17, which is above the MACD Signal of -637.85. This indicates a potentially bullish trend, as the MACD line has crossed above the signal line, suggesting upward momentum. However, the negative values suggest caution, as the trend could change quickly.

RSI Analysis

The current RSI for Sensex is 56.24, which suggests that the market is in a neutral-relative strength zone. With an RSI under 70, the market isn't overbought, and with a level above 30, it isn't oversold. This indicates neither strong buying nor selling pressure at present.

Analysis for Nifty Auto - February 05, 2025

Nifty Auto opened at 23,551.25 and closed slightly lower at 23,517.10, showing a minor gain with a percentage change of 0.81% from the previous close of 23,327. The index reached a high of 23,646.30 and a low of 23,410.50 during the trading session. The relative strength index (RSI) stands at 59.71, indicating a moderately strong momentum, while the Moving Average Convergence Divergence (MACD) is negative, suggesting potential for bearish trends despite the closing gain.

Relationship with Key Moving Averages

Nifty Auto closed at 23517.10, which is above its 50-day EMA of 23165.34 and its 200-day EMA of 23256.75, indicating a potential uptrend or bullish sentiment. However, it remains significantly above the 10-day EMA of 22832.98 and 20-day EMA of 22813.94, suggesting short-term positive momentum.

Moving Averages Trend (MACD)

The MACD for Nifty Auto is -58.63, with its signal line at -193.47, indicating a potential upward momentum as the MACD line is above the signal line. However, it is still in negative territory, suggesting caution but possible improvement if the current trend continues.

RSI Analysis

Based on the given data, the RSI value for Nifty Auto is approximately 59.72. This suggests that the index is in a neutral zone, slightly approaching overbought conditions. Traders might interpret this as a stable trend with no immediate signals of overbought or oversold conditions.

Analysis for Nifty Energy - February 05, 2025

The Nifty Energy index opened at 33,115.15 and closed at 33,345.45, marking a significant points change of 1,168.05 and a percentage increase of 3.63%. Despite the positive movement, the index's RSI is at 45.91, indicating relatively neutral momentum. The MACD is negative, suggesting a bearish sentiment in the larger trend.

Relationship with Key Moving Averages

The Nifty Energy index closed at 33345.45, below its 50-day EMA of 35174.86 and 200-day EMA of 37615.69, indicating a bearish trend against these longer-term moving averages. However, it closed above its 10-day EMA of 33177.36, showing some short-term strength.

Moving Averages Trend (MACD)

MACD Analysis for Nifty Energy: The MACD for Nifty Energy stands at -704.19 while the MACD Signal is -748.16, indicating a potentially bullish signal as the MACD is above the Signal line. However, the negative values suggest the trend is not entirely positive, and investors should remain cautious.

RSI Analysis

The RSI value for Nifty Energy is 45.91, suggesting that the stock is in a neutral zone, neither overbought nor oversold. This indicates a balanced momentum, providing no strong directional cues at the moment.

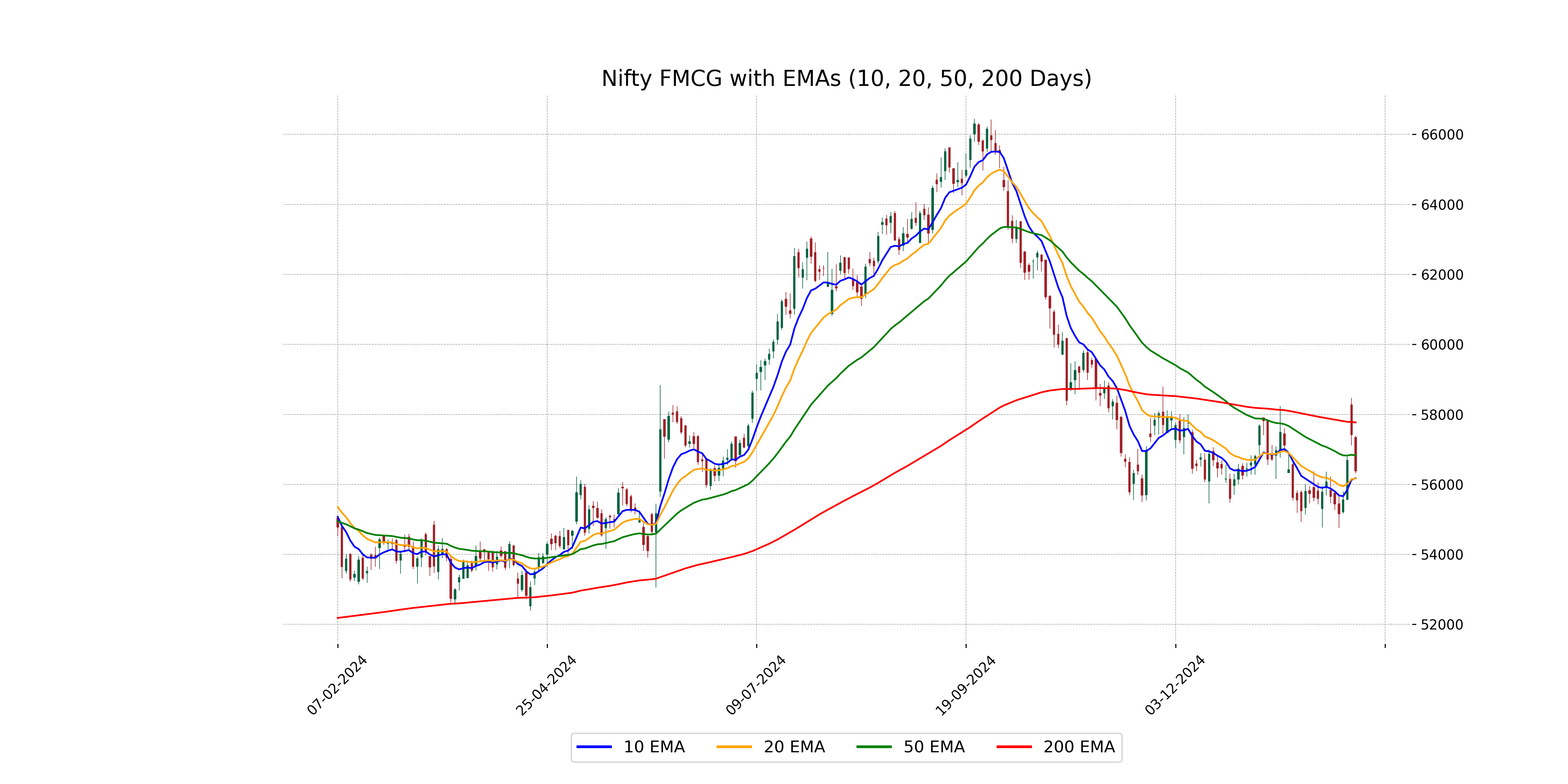

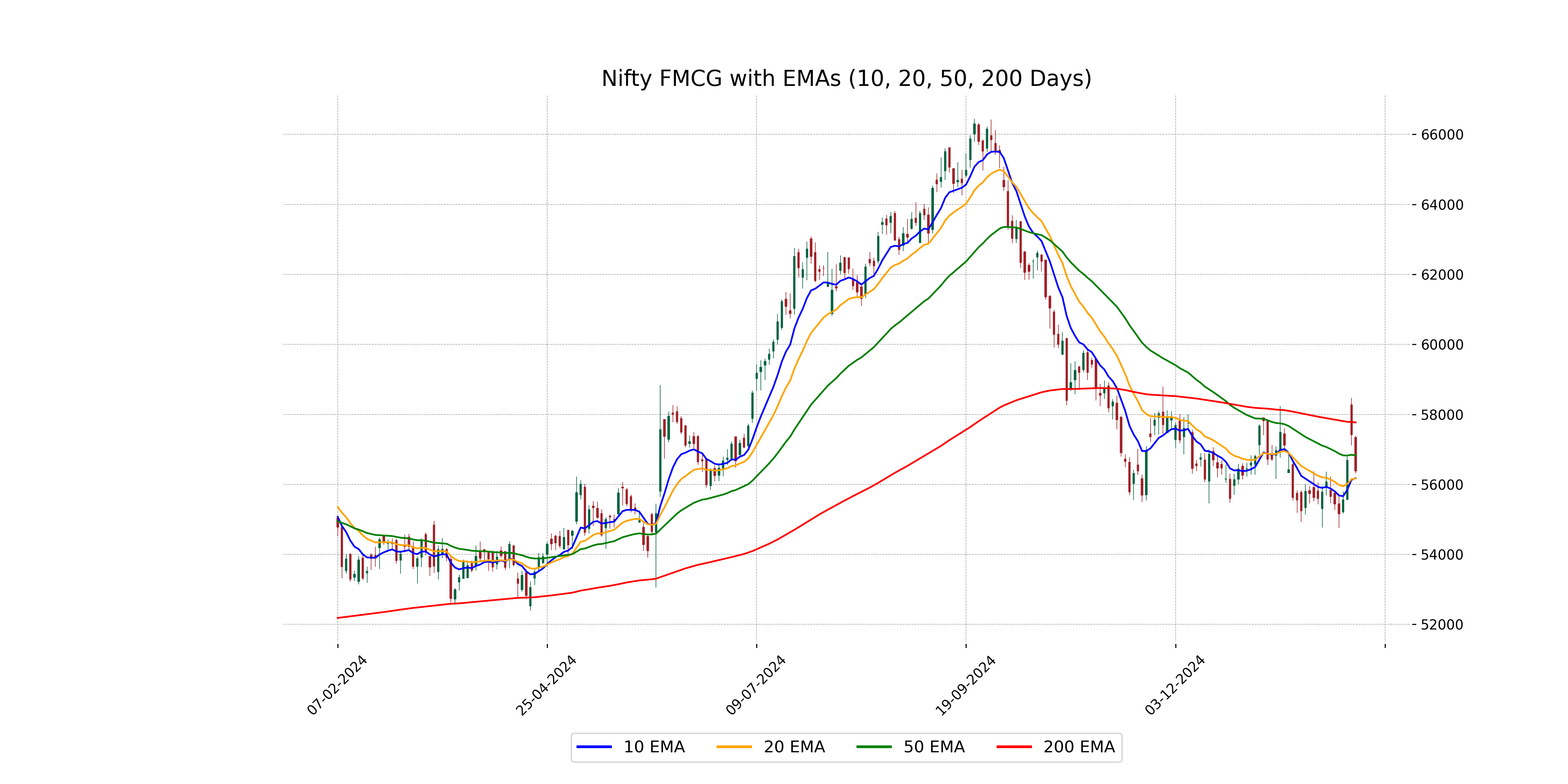

Analysis for Nifty FMCG - February 05, 2025

Nifty FMCG opened at 57339.10 and closed lower at 56383.75, indicating a decrease with a points change of -1035.80. The percentage change was -1.80%, and key moving averages such as the 50 EMA and 200 EMA are at 56828.71 and 57769.98, respectively. The RSI stands at 50.96, suggesting a neutral momentum in the current market trend.

Relationship with Key Moving Averages

The closing price of the Nifty FMCG is below the 50 EMA (56828.71) and significantly below the 200 EMA (57769.98), indicating potential bearish momentum. However, it is above both the 10 EMA (56180.24) and the 20 EMA (56172.31), pointing to short-term support above these levels.

Moving Averages Trend (MACD)

The MACD analysis for Nifty FMCG indicates a bearish momentum, as the MACD value of -101.26 is higher than the MACD Signal value of -262.98. This suggests that while the negative momentum is present, it is lessening, potentially indicating a slowing down in the downward trend.

RSI Analysis

The RSI (Relative Strength Index) for Nifty FMCG is 50.96, which is close to the neutral 50 mark. This suggests that the index is neither in an overbought nor oversold condition. Investors might expect a period of consolidation unless other indicators point towards a trend change.

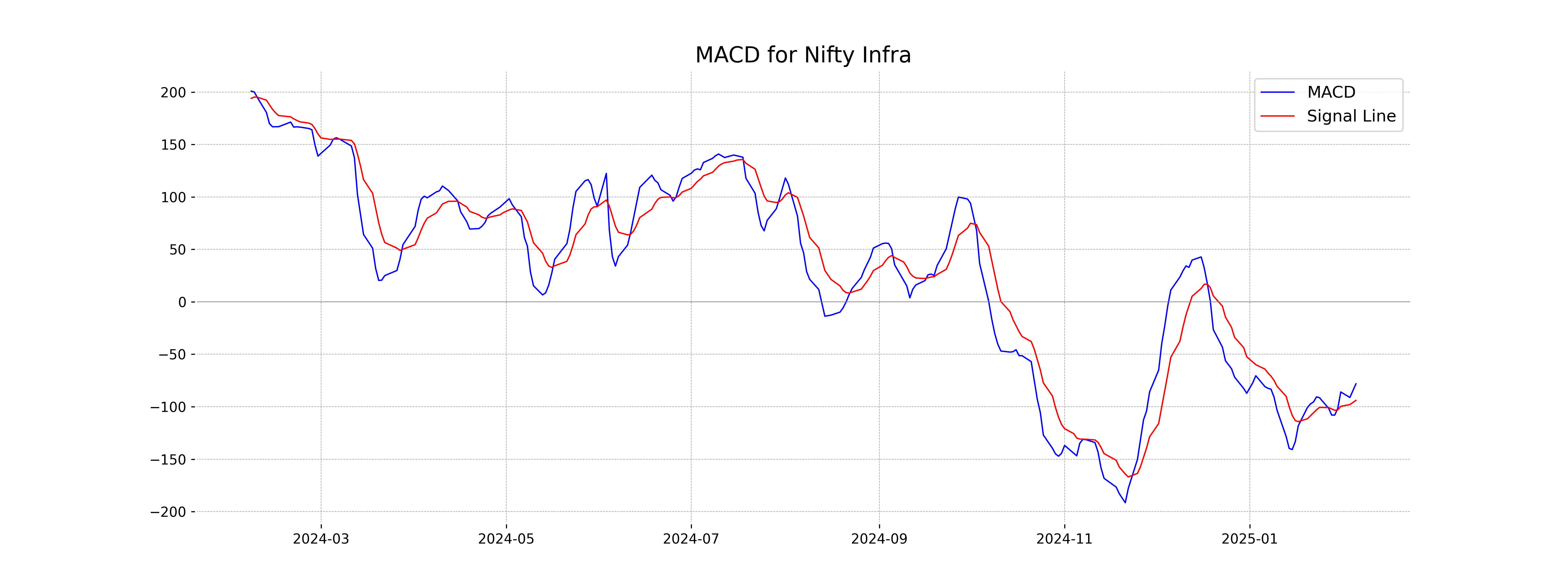

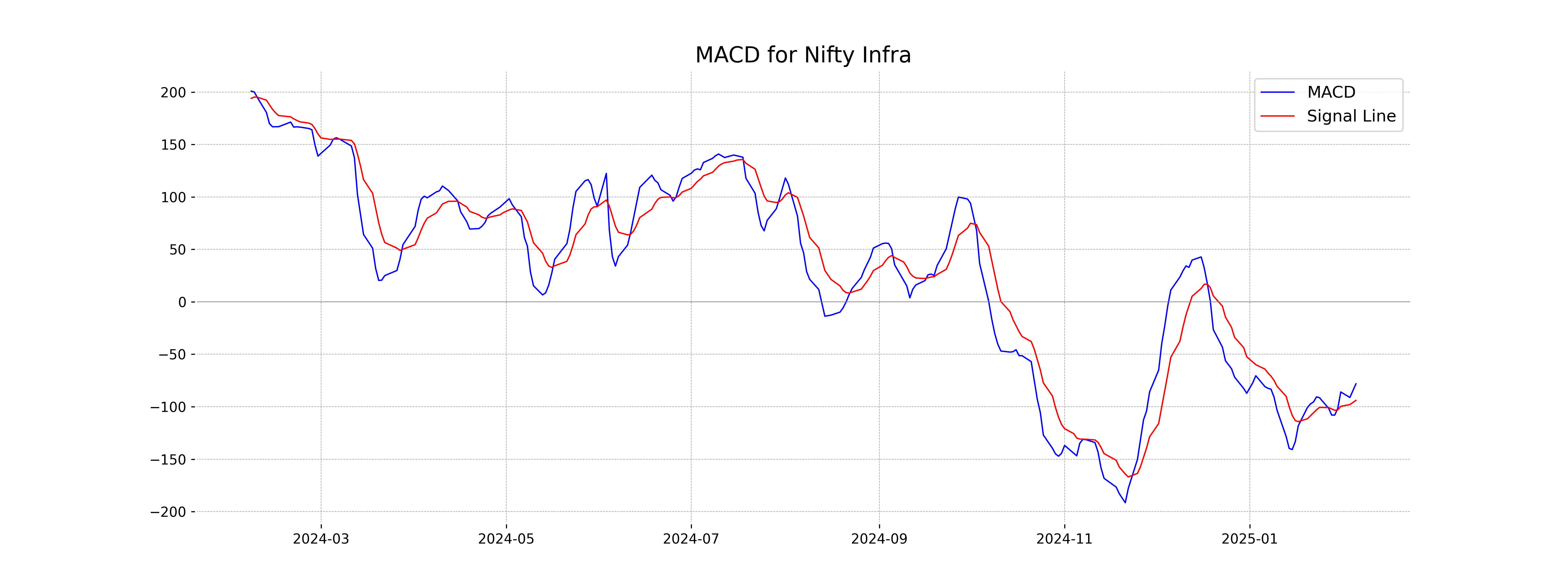

Analysis for Nifty Infra - February 05, 2025

Nifty Infra opened at 8340.90, reached a high of 8373.45, and closed at 8317.25. It experienced a positive change of 2.48%, with a points increase of 201.60 from the previous close of 8115.65. The current RSI is 49.29, indicating neither overbought nor oversold conditions, while the MACD of -78.17 shows a slight bearish trend overall.

Relationship with Key Moving Averages

Nifty Infra closed at 8317.25, which is below both its 50 EMA of 8465.46 and 200 EMA of 8544.61, indicating a bearish sentiment as it is currently trading below these key moving averages. However, it is above its 10 EMA of 8243.84 and 20 EMA of 8292.76, suggesting short-term bullishness.

Moving Averages Trend (MACD)

Nifty Infra: The MACD for Nifty Infra is currently at -78.17, while the MACD Signal is at -93.99. This indicates a bullish crossover is in progress, suggesting a potential uptrend as the MACD is moving closer to crossing above the signal line.

RSI Analysis

The RSI for Nifty Infra stands at 49.29, which suggests that the stock is in a neutral zone, neither overbought nor oversold. This level indicates a balanced demand and supply, and traders might look for other indicators to determine future price movement.

Analysis for Nifty IT - February 05, 2025

Nifty IT opened at 43060.65 and closed at 42888.30, reflecting a positive change from the previous close of 42314.25, with a percentage increase of 1.36% and a points change of 574.05. The current RSI value is 49.19, indicating neutral momentum, while the MACD at -304.31 suggests bearish sentiment compared to its signal line at -329.10.

Relationship with Key Moving Averages

Nifty IT, with a closing value of 42888.30, is trading below its 50 EMA of 43104.18 but above its 10 EMA of 42646.02 and close to its 20 EMA of 42873.42. This suggests mixed momentum with short-term averages providing some support, while the longer-term average indicates a potential resistance level.

Moving Averages Trend (MACD)

The MACD value of -304.31 indicates that the momentum for Nifty IT is currently in the bearish phase since it is below the MACD Signal line of -329.10. However, the slight positive difference suggests potential convergence, indicating that bearish momentum might be weakening.

RSI Analysis

The RSI for Nifty IT is 49.19, indicating that it is currently in the neutral zone. A reading around 50 suggests a balance between buying and selling pressures, with no strong trends towards being overbought or oversold.

Analysis for Nifty Metal - February 05, 2025

Nifty Metal opened at 8313.75 and closed higher at 8427.10, marking a 3.33% increase from the previous close of 8155.15. The index's technical indicators show that the 10-day EMA is lower than both the 50-day and 200-day EMAs, suggesting a potential short-term recovery amidst longer-term pressures. With an RSI of 48.34, the index is nearing neutral momentum, while the MACD indicates a bearish sentiment with its negative value.

Relationship with Key Moving Averages

The closing price of Nifty Metal at 8427.10 is below its 50-day EMA of 8676.21 and 200-day EMA of 8875.94, indicating a potential downward trend relative to these key moving averages. However, it is above the 10-day EMA of 8340.66 and close to the 20-day EMA of 8415.53, suggesting some short-term upward momentum.

Moving Averages Trend (MACD)

Based on the given data, the Nifty Metal index displays a MACD value of -119.37, which is above the MACD Signal level of -139.97. This suggests a potential bullish trend as the MACD line is starting to close the gap with the signal line, indicating a possible reversal from the current trend.

RSI Analysis

The RSI for Nifty Metal is 48.34, which indicates a neutral market condition. It suggests that the index is neither overbought nor oversold, implying a balanced momentum without strong upward or downward pressure.

Analysis for Nifty Bank - February 05, 2025

Nifty Bank showed a positive performance with a 2.30% increase, closing at 50343.05, a gain of 1132.5 points from the previous close of 49210.55. The index traded between a high of 50522.15 and a low of 50215.45, indicating strong upward momentum. The RSI value of 55.89 suggests mild bullish sentiment, while the MACD indicates an improving trend with a less negative value compared to the signal line.

Relationship with Key Moving Averages

Nifty Bank closed at 50343.05, above its 50-day EMA of 50233.83 and significantly above the 200-day EMA of 50216.69, indicating a bullish short-term trend. The close is also above the 10-day and 20-day EMAs, further suggesting short-term bullish momentum.

Moving Averages Trend (MACD)

The MACD for Nifty Bank is showing a value of -321.35, which is above the MACD Signal line at -579.00. This suggests a potential bullish crossover, indicating a positive momentum or a possible upward movement in the near-term. Additionally, the RSI is at 55.89, which supports a neutral to slightly bullish outlook.

RSI Analysis

The Relative Strength Index (RSI) for Nifty Bank is 55.89, which suggests a neutral zone, indicating neither overbought nor oversold conditions. This level is close to 50, suggesting that the price movements may continue to follow a balanced trend in the near term unless driven by significant market changes.

Analysis for Nifty 50 - February 05, 2025

Nifty 50 opened at 23801.75 and closed at 23696.30, showing a percentage change of 1.44% with a points change of 335.25. The index traded within a high of 23807.30 and a low of 23680.45. It is currently above its 50-day and 200-day EMA, with an RSI of 55.89, indicating a moderately strong momentum.

Relationship with Key Moving Averages

The Nifty 50 closed at 23696.30, which is above the 50 EMA of 23668.67 and the 200 EMA of 23622.36, indicating a potential upward trend as it is trading above key moving averages. However, the close is below the 10 EMA of 23327.04 and the 20 EMA of 23363.27, which may suggest some short-term bearish signals.

Moving Averages Trend (MACD)

The MACD for Nifty 50 is -104.00, which is above the MACD Signal of -188.12, indicating a potential bullish crossover. This suggests a possible upward momentum or reversal in the market trend.

RSI Analysis

The RSI value for Nifty 50 is 55.89, which indicates a neutral position. It is neither in the overbought (above 70) nor the oversold (below 30) territory, suggesting a balanced market momentum without strong upward or downward pressure.