- Home

- ❯

- Business,Markets

- ❯

- Markets

- ❯

- Indian Stock Market Sector-wise Performance: Which Sector is performed Well Today - April 14, 2025

Highlights

Latest news

Vijay Hazare trophy: Rohit Sharma smashes 155, enthralls 20,000 fans in Jaipur

India to get three new airlines as Shankh Air, Al Hind Air, FlyExpress receive NOC from government

Delhi HC directs GST Council to meet at earliest, consider lowering GST on air purifiers

Cabinet clears Delhi Metro Phase 5A project worth Rs 12,015 crore

Got apology from Bumrah & Pant; Conrad should've chosen better words: Bavuma reflects on India tour

Virat Kohli goes past Tendulkar to become fastest to 16000 List A runs

Delhi HC expresses displeasure over no tax exemption on air purifiers in 'emergency situation'

Fadnavis mocks Sena (UBT)-MNS alliance, compares hype to Russia-Ukraine peace talks

Indian Stock Market Sector-wise Performance: Which Sector is performed Well Today - April 14, 2025

The stock market witnessed a dynamic session, with numerous sectors and indices showcasing notable performances. Among the indices, the CNX Metal emerged as a standout performer with a remarkable percentage increase of 4.09%. This substantial gain signals a strong rebound in the metal sector, potentially driven by renewed demand anticipation or favorable market conditions. Following closely, the CNX Energy index experienced a significant rise of 2.70%, reflecting positive sentiment in the energy sector. This could be attributed to expectations of increased energy consumption or adjustments in energy policy that may favor the sector. The CNX Auto index also posted a laudable performance, with a 2.03% increase. This uptick might stem from investor optimism regarding automotive sales or advances in automotive technology that could enhance production efficiency. On a similar note, CNX Infrastructure garnered a 2.03% gain. This improvement may indicate increased investment in infrastructure development projects or policy announcements promoting infrastructure growth. The broader NSEI, which represents a wide array of industries, advanced by 1.92%. This rise might reflect overall positive economic indicators or investor confidence in the market's resilience. The BSE Sensex saw a healthy climb of 1.77%, underscoring overall market strength. Contributing factors may include macroeconomic stability or favorable fiscal announcements. The NSE Bank experienced an increase of 1.52%. This could be attributed to strengthening banking operations or regulatory measures that enhance the banking sector's health. In contrast, despite experiencing gains, the CNX FMCG and Nifty IT lagged behind in percentage terms. CNX FMCG rose by 0.86%, suggesting steady consumer demand or resilient supply chain operations. The Nifty IT, with a modest increase of 0.69%, might reflect ongoing technological innovations or digital transformation initiatives that are yet to fully materialize in tangible market gains. Delving into the sectoral impact, the considerable rise in CNX Metal draws attention. The significant 4.09% surge may have resulted from factors such as increased export orders, favorable international commodity prices, or strategic industry initiatives boosting investor confidence. Overall, this day in the market was characterized by robust performances predominantly in metal and energy-related sectors, while other sectors maintained steady growth, reflecting a broadly positive market sentiment. These movements underscore a growing optimism in industry-specific developments and macroeconomic conditions that could propel future market performances.

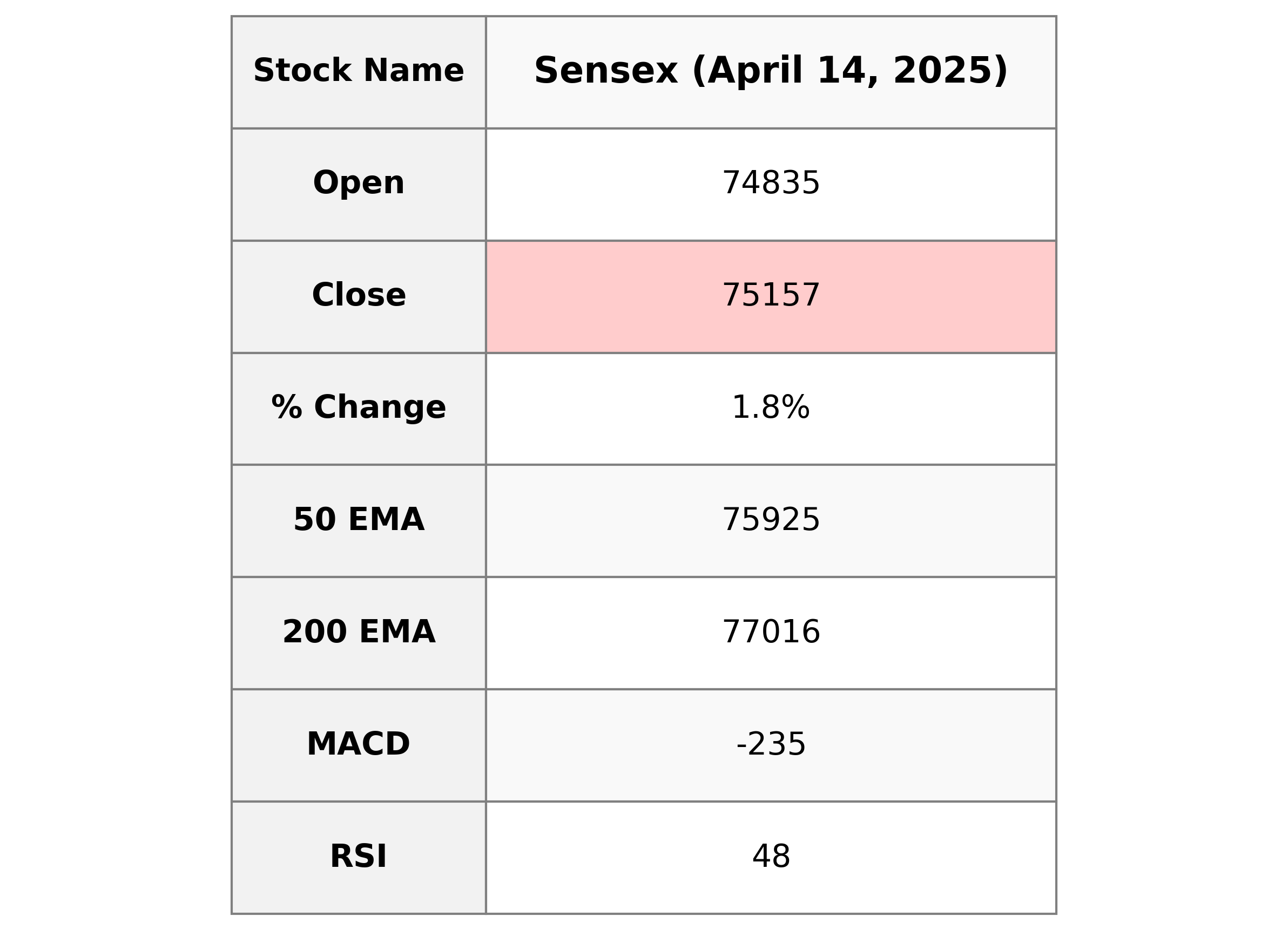

Analysis for Sensex - April 14, 2025

Sensex Performance Description: The Sensex opened at 74,835.49 and closed at 75,157.26, marking an increase of 1.77% from its previous close, with a points change of 1,310.11. The index showed some volatility with a day high of 75,467.33 and a low of 74,762.84. The Relative Strength Index (RSI) stood below 50 at 47.99, suggesting that the market was leaning slightly towards being oversold. Meanwhile, the MACD indicator was negative at -235.20, with the signal line at 17.12, indicating bearish momentum. Despite these mixed technical indicators, the day's movement showed an upward trend.

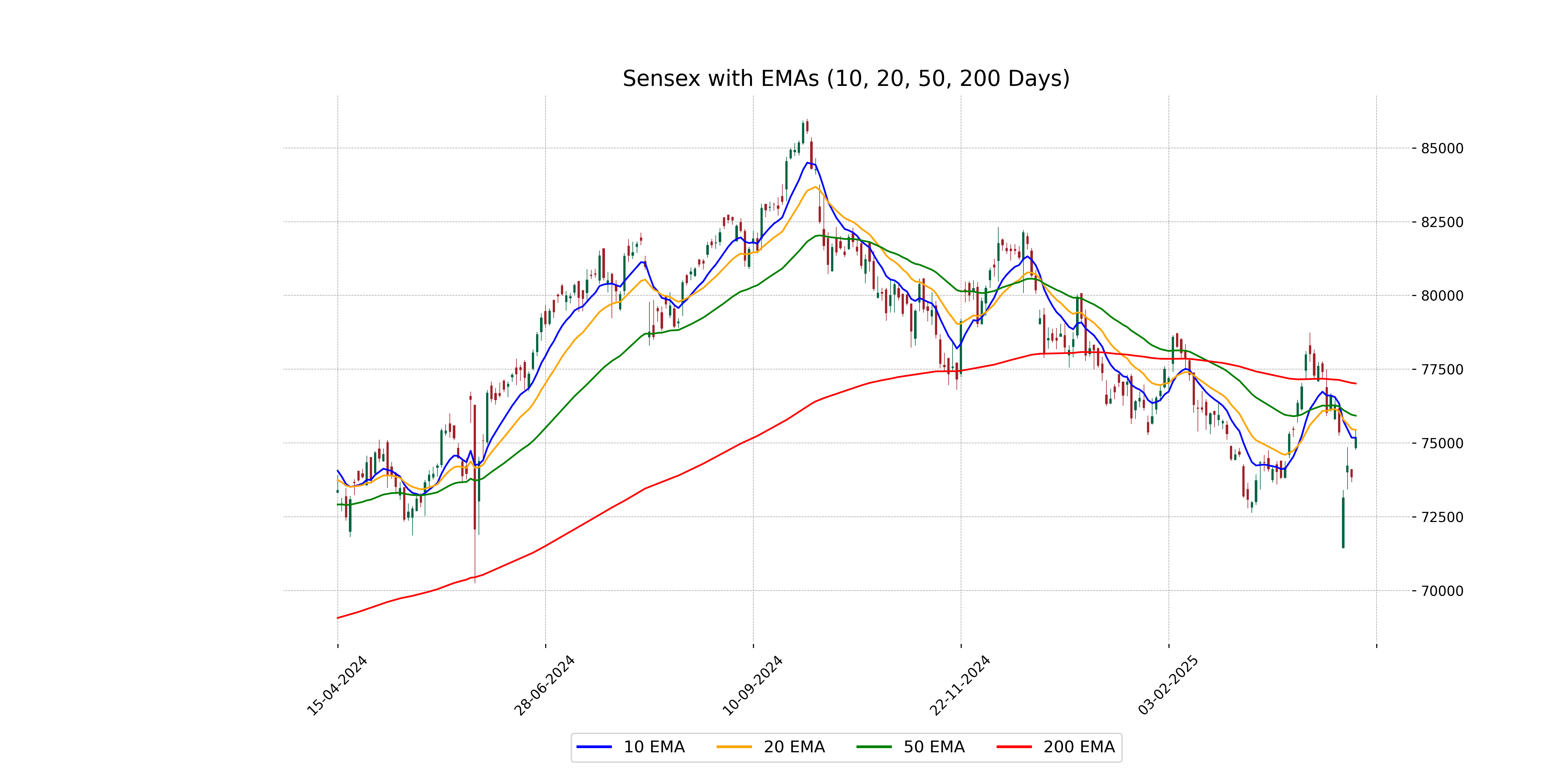

Relationship with Key Moving Averages

The Sensex closed at 75157.26, which is below its 50-day EMA of 75924.84 and substantially below its 200-day EMA of 77015.96, indicating a bearish trend in the short to medium term. However, the close is slightly below the 10-day EMA of 75176.45 and the 20-day EMA of 75443.52, suggesting recent price movements are aligning closer to shorter-term averages.

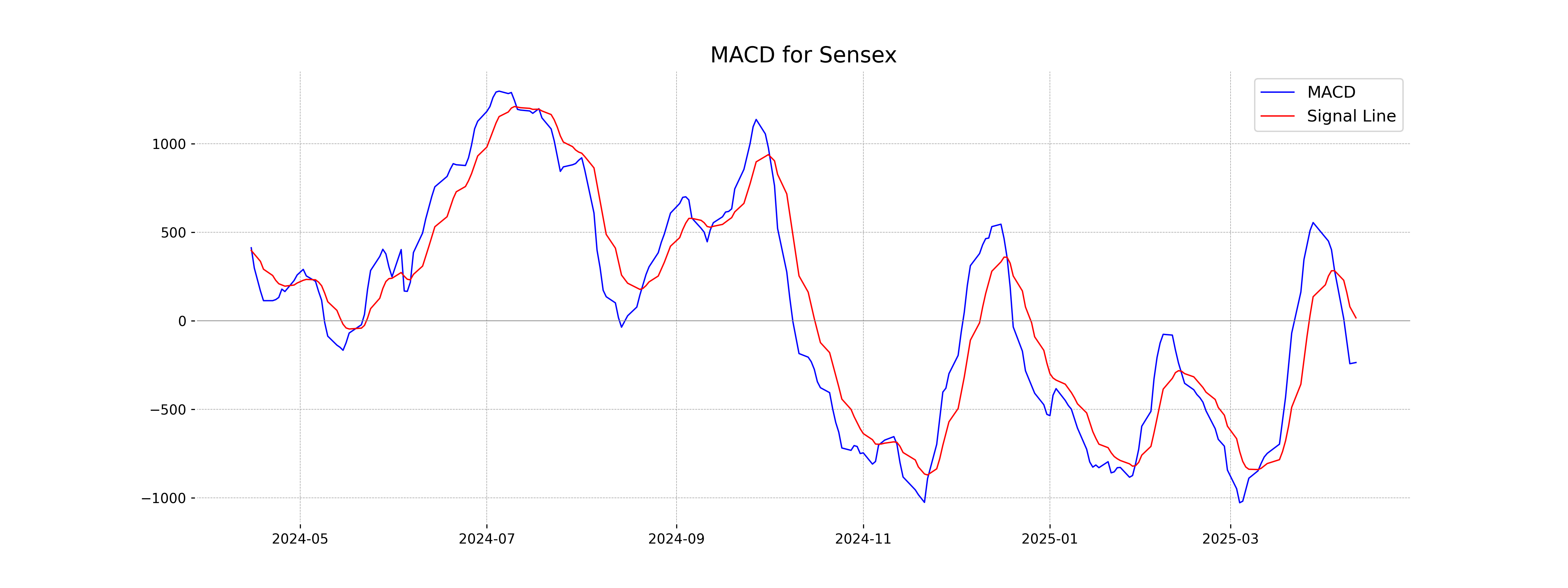

Moving Averages Trend (MACD)

The MACD for Sensex is negative at -235.20, which is below the Signal line of 17.12. This indicates a bearish trend potentially, suggesting that the market momentum is currently weak.

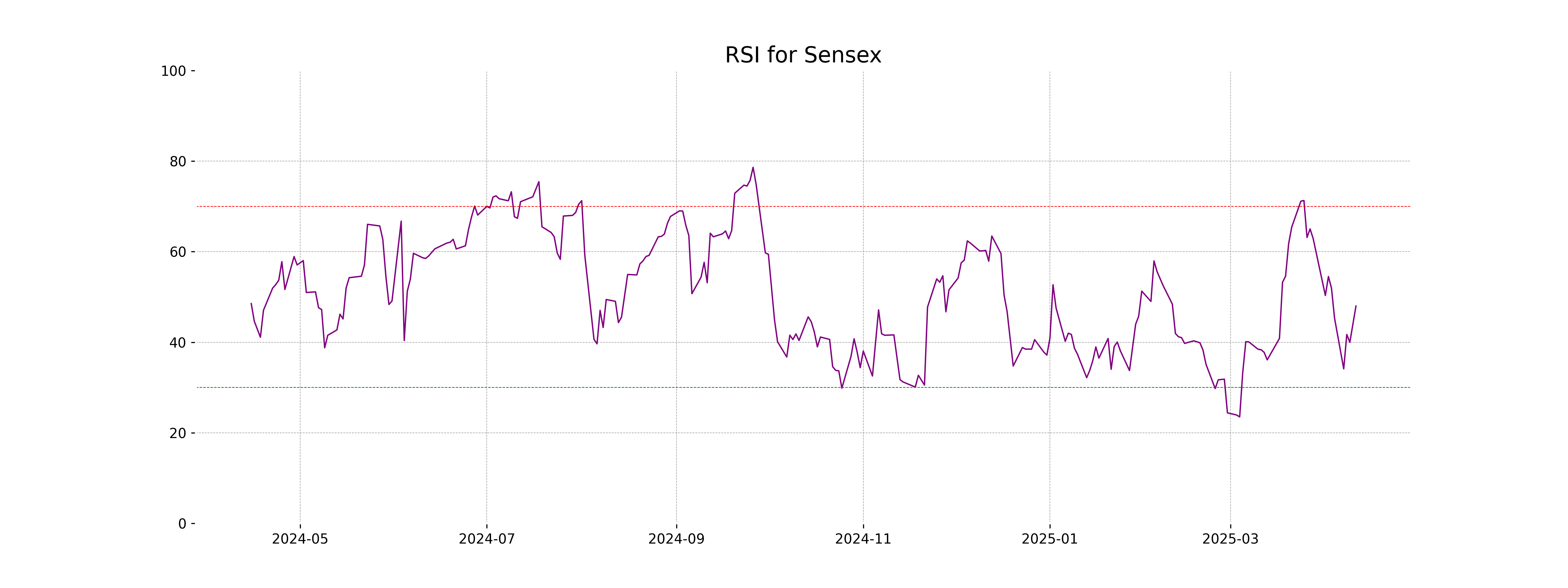

RSI Analysis

The RSI for Sensex is 47.99, indicating a neutral position slightly below the midpoint. This suggests the stock is neither overbought nor oversold, allowing for potential movement in either direction based on market conditions.

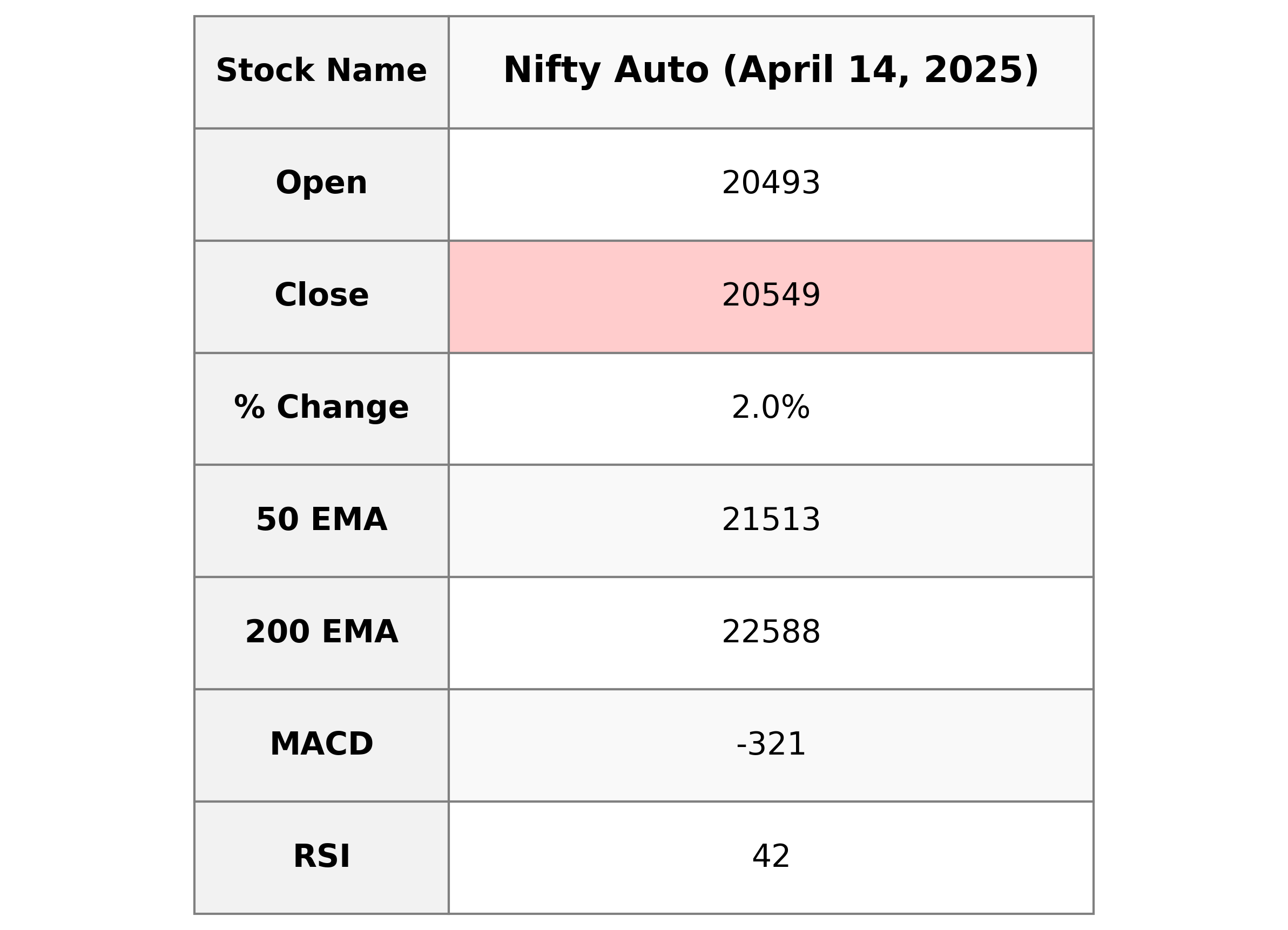

Analysis for Nifty Auto - April 14, 2025

Nifty Auto opening at 20493.05 and closing at 20548.65 indicates a positive trend with a gain of 2.03% or a 408.25 points increase from its previous close of 20140.40. Despite the positive change, its RSI is at 42.26, suggesting a moderately weak momentum and its MACD is negative, indicating a bearish signal. The 50-day and 200-day EMAs are above the current price, showing a longer-term downtrend.

Relationship with Key Moving Averages

The closing price of Nifty Auto at 20548.65 is below its 50 EMA of 21512.80 and 200 EMA of 22587.52, indicating a potential bearish trend. However, it is slightly above the 10 EMA of 20668.46 but below the 20 EMA of 20937.56, suggesting short-term volatility within a larger downtrend pattern.

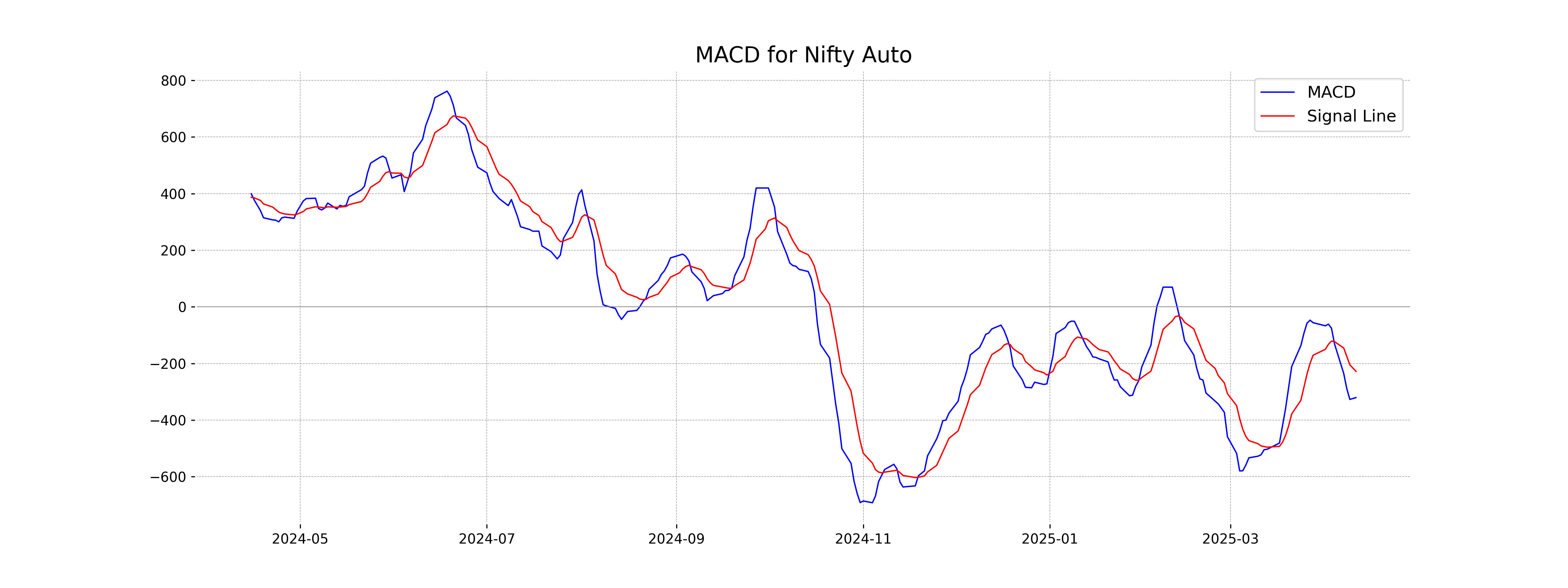

Moving Averages Trend (MACD)

Based on the given MACD analysis for Nifty Auto, the MACD value is -320.71, which is below the MACD Signal line of -227.94. This indicates a bearish signal, suggesting that the stock may experience downward momentum in the short term.

RSI Analysis

{'Stock Name': 'Nifty Auto', 'RSI Analysis': 'The RSI for Nifty Auto is 42.26, indicating that the stock is currently in a neutral zone, bordering on oversold conditions. This suggests there may be a potential buying opportunity if downward momentum continues.'}

Analysis for Nifty Energy - April 14, 2025

Nifty Energy opened at 32,250.0 and closed at 32,411.1, marking a positive change of approximately 2.70%. The index saw a daily high of 32,454.60 and a low of 31,981.20. The Relative Strength Index (RSI) was at 49.83, indicating a neutral momentum, while the Moving Average Convergence Divergence (MACD) suggested a weak bullish trend.

Relationship with Key Moving Averages

Nifty Energy closed at 32411.1, slightly below the 10-day EMA of 32418.08 and the 20-day EMA of 32454.01, indicating a short-term bearish sentiment. It remains below the 50-day EMA of 32714.68 and significantly below the 200-day EMA of 35626.26, suggesting a longer-term downtrend.

Moving Averages Trend (MACD)

The MACD value for Nifty Energy is 24.66, which is below its MACD Signal of 189.30. This suggests a bearish momentum, as the MACD line is below the signal line, indicating potential weakness in short-term price movement.

RSI Analysis

The Relative Strength Index (RSI) for Nifty Energy is 49.83, which suggests that the stock is in a neutral zone. It indicates that the market for Nifty Energy is neither overbought nor oversold at the moment.

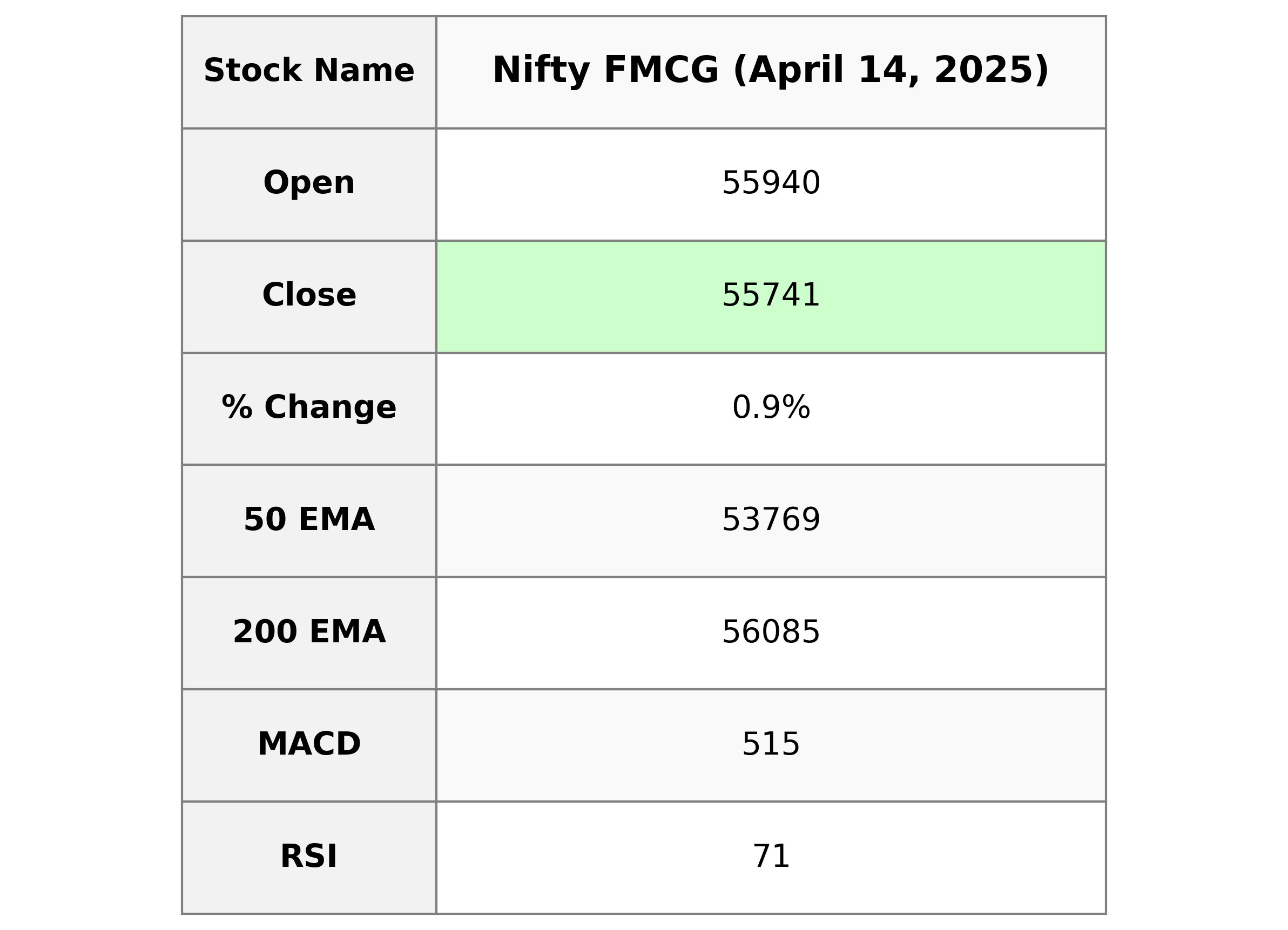

Analysis for Nifty FMCG - April 14, 2025

Nifty FMCG opened at 55,939.55 and closed at 55,741.10 with a positive percentage change of 0.86%, indicating a gain of 476.35 points. The relative strength index (RSI) stands at 70.88, suggesting an overbought condition, while the MACD indicates bullish momentum with a value of 514.85 compared to the signal line at 197.55.

Relationship with Key Moving Averages

The closing price of Nifty FMCG at 55,741.10 is above both its 50-day EMA (53,768.87) and 20-day EMA (53,602.17), but slightly below its 200-day EMA (56,085.05). This indicates a short-term bullish momentum, although still under long-term resistance.

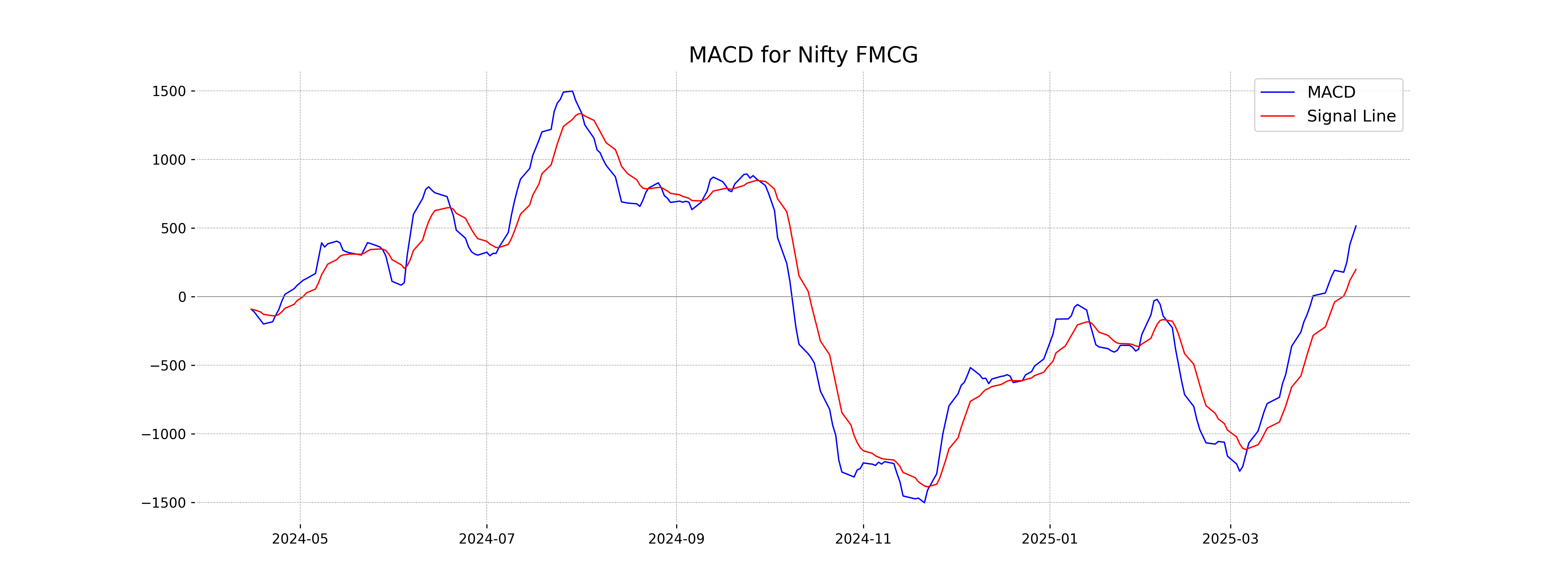

Moving Averages Trend (MACD)

The MACD value for Nifty FMCG is significantly higher than the MACD Signal, indicating strong bullish momentum. With an RSI of 70.88, the index may be overbought, suggesting caution while trading at these levels.

RSI Analysis

The Nifty FMCG index has an RSI value of 70.88, indicating that it is in the overbought territory. This suggests that the index might be due for a correction or a pullback in the near future as buying pressure may have reached a peak.

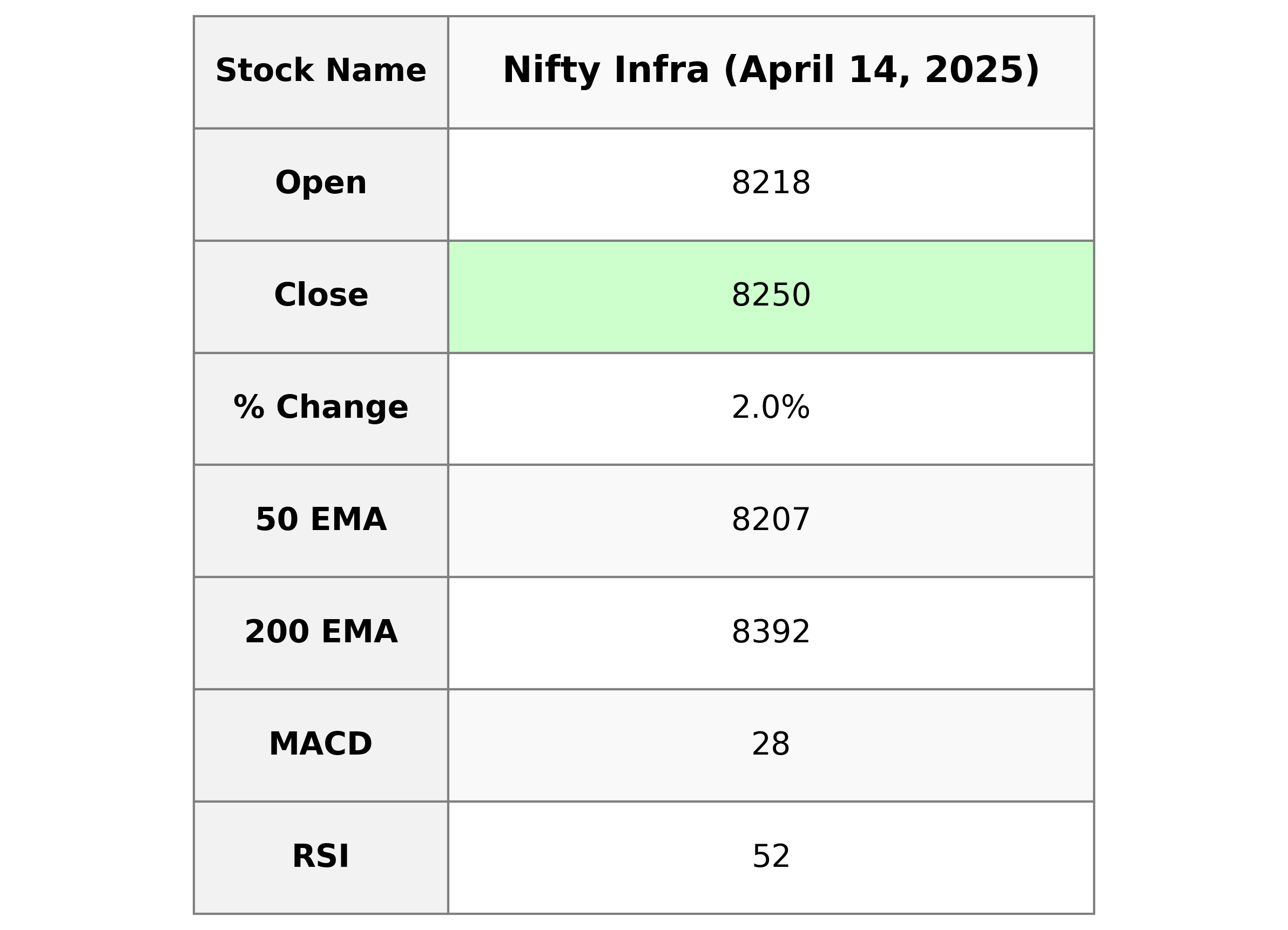

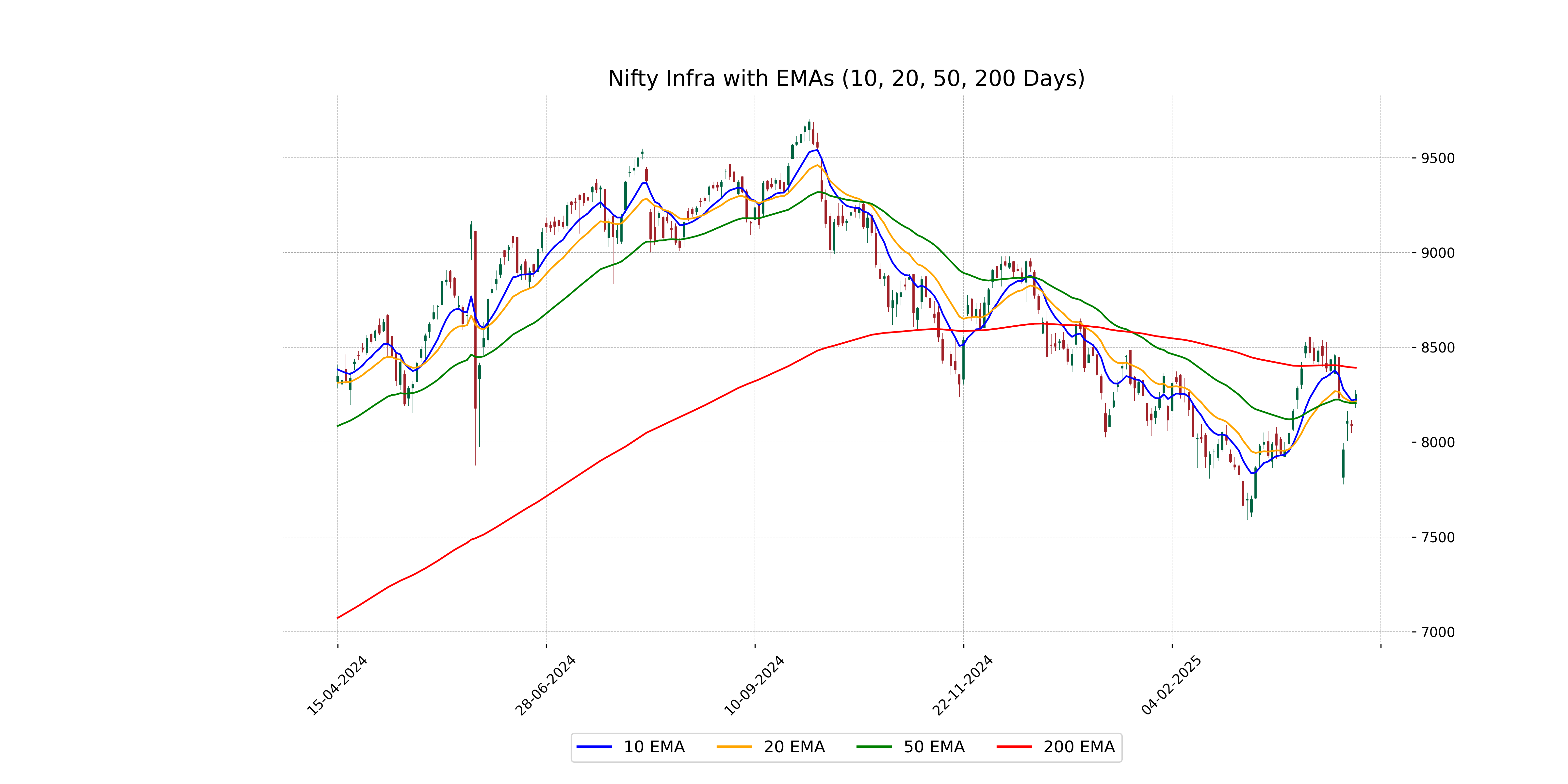

Analysis for Nifty Infra - April 14, 2025

Nifty Infra Performance: Nifty Infra opened at 8218.15 and closed at 8250.15, showing a percentage change of 2.03% with a positive points change of 163.90. The Relative Strength Index (RSI) stands at 52.14, indicating a neutral trend. The MACD is positive but below the signal line, suggesting potential for upward movement.

Relationship with Key Moving Averages

Nifty Infra closed at 8250.15, which is above the 50 EMA of 8206.81 and below the 200 EMA of 8392.07. The index is also slightly above the 10 EMA of 8225.11 and the 20 EMA of 8214.51, suggesting a short-term upward movement.

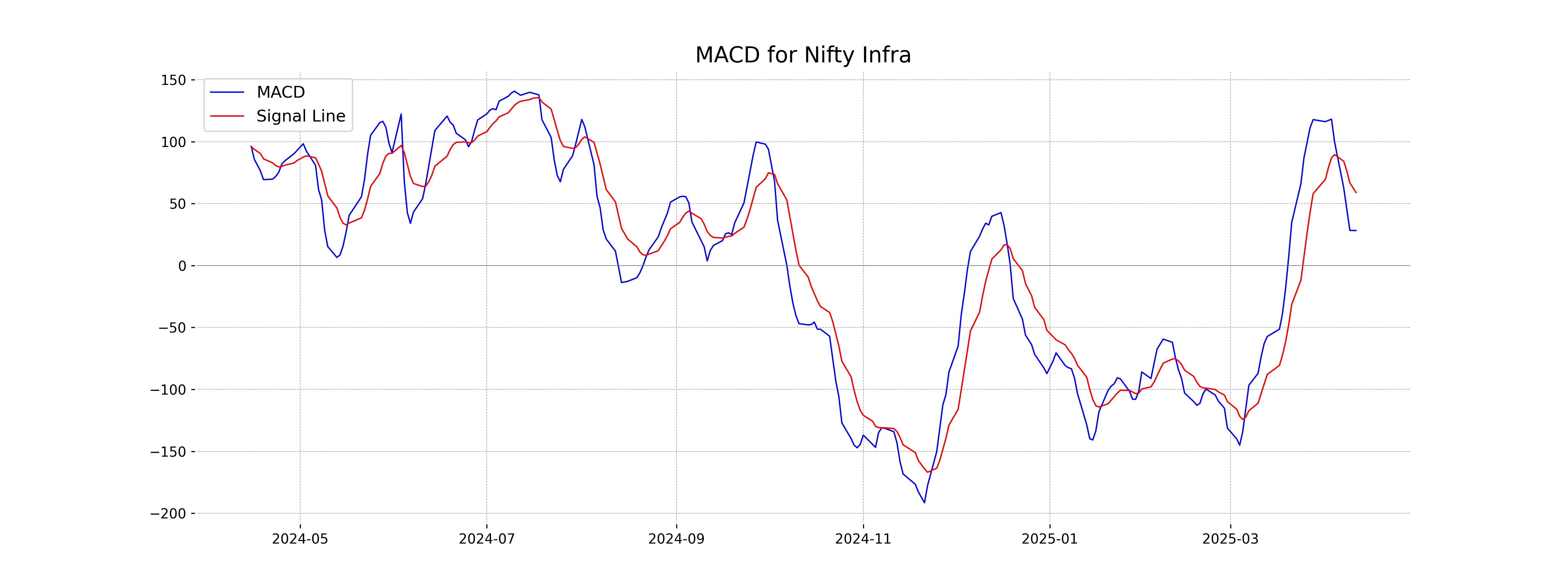

Moving Averages Trend (MACD)

The MACD for Nifty Infra is 28.29, which is below the MACD Signal of 59.04, indicating a potential bearish trend. However, the positive 2.03% change in price suggests recent upward momentum, warranting close monitoring for further trend confirmation.

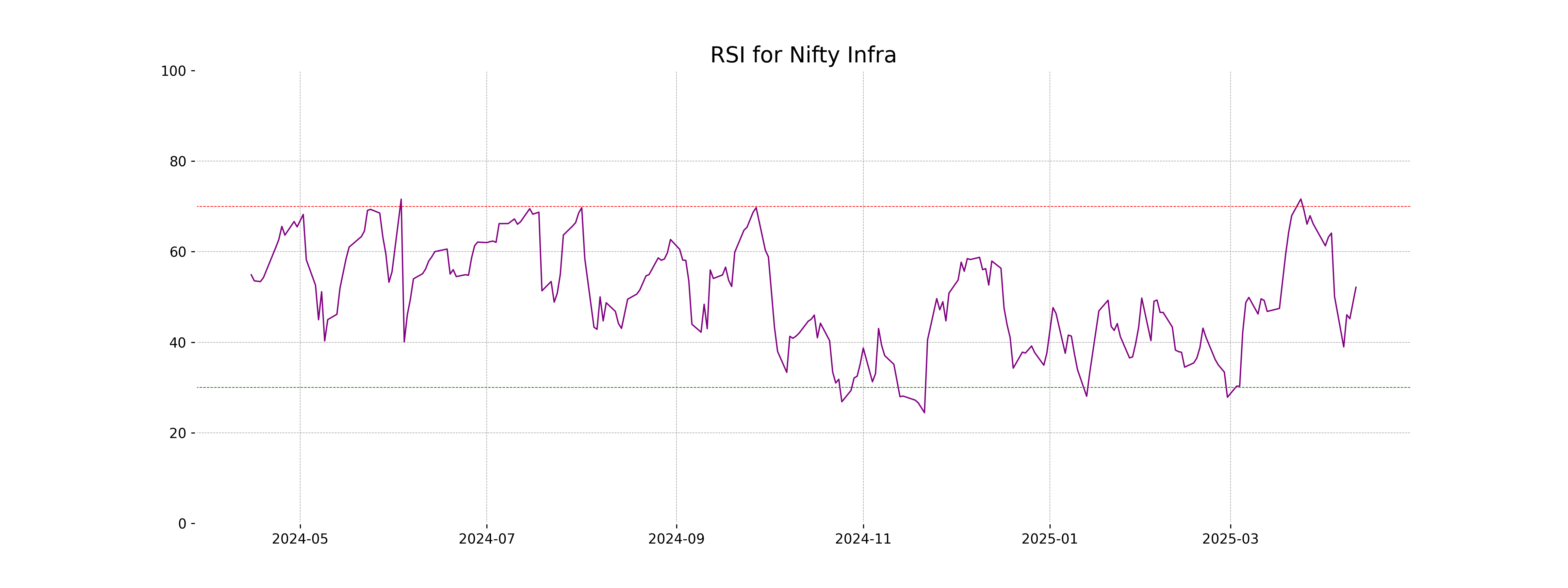

RSI Analysis

Nifty Infra's RSI is at 52.14, indicating a neutral position without clear overbought or oversold signals. This suggests a balanced sentiment in the market, with neither strong bullish nor bearish momentum currently evident.

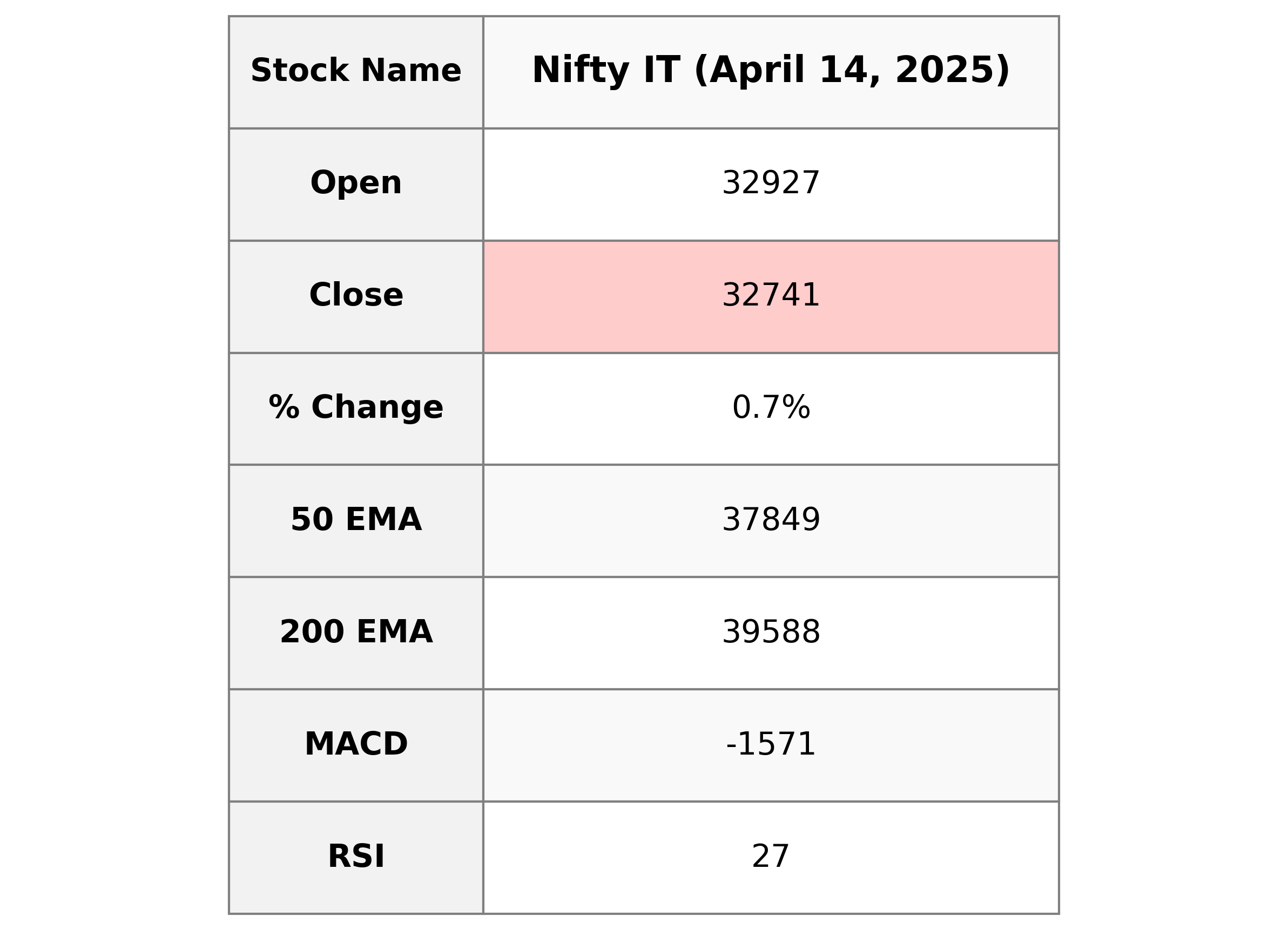

Analysis for Nifty IT - April 14, 2025

Nifty IT Performance Description: The Nifty IT index opened at 32,926.65 and closed at 32,740.85, marking a slight percentage increase of approximately 0.69%. The index's RSI stands at 26.95, suggesting it is in the oversold territory. The MACD line is below the MACD signal line, indicating a bearish trend. Overall, the Nifty IT showed a positive points change of 223.5 but remains under pressure with its current technical indicators.

Relationship with Key Moving Averages

The closing price of Nifty IT is below its 50-day EMA, 20-day EMA, and 10-day EMA, indicating a bearish sentiment in the short to medium term. Additionally, it's well below the 200-day EMA, suggesting a longer-term downtrend.

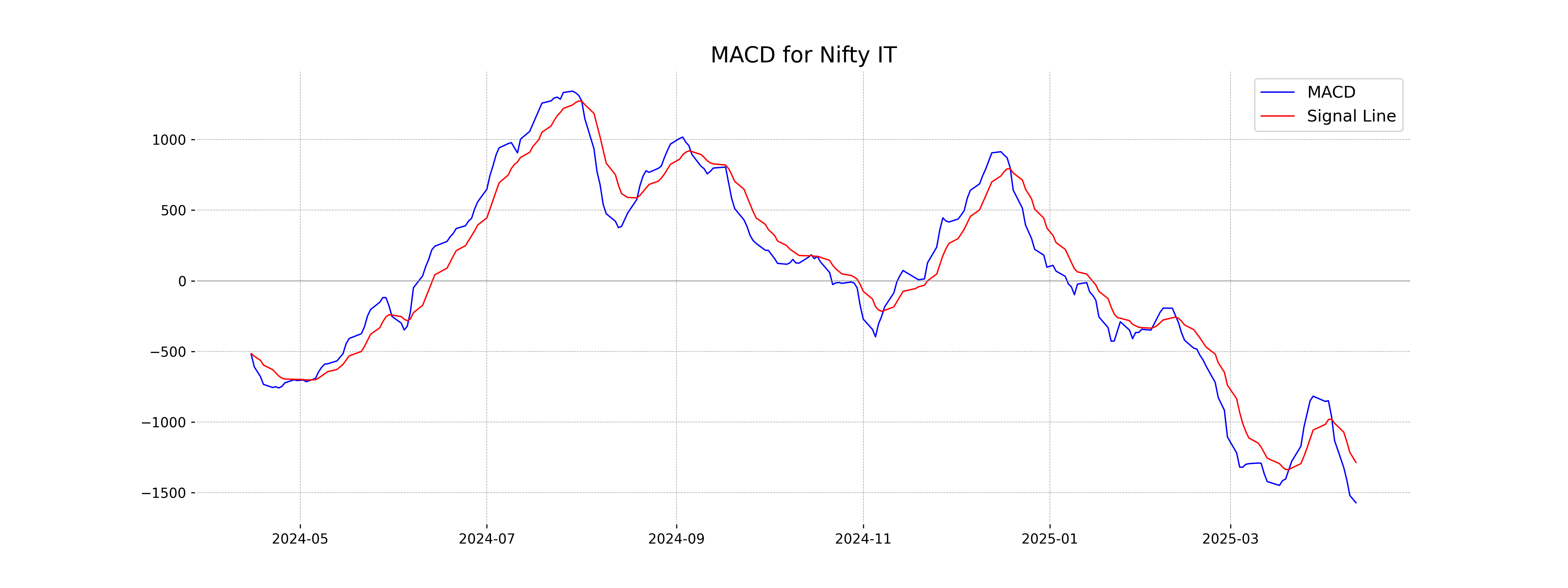

Moving Averages Trend (MACD)

The Nifty IT index is experiencing bearish momentum as indicated by the MACD value of -1571.42, which is below the MACD Signal of -1286.08. This divergence suggests continued downward pressure in the short term, as the MACD line is deeper into negative territory.

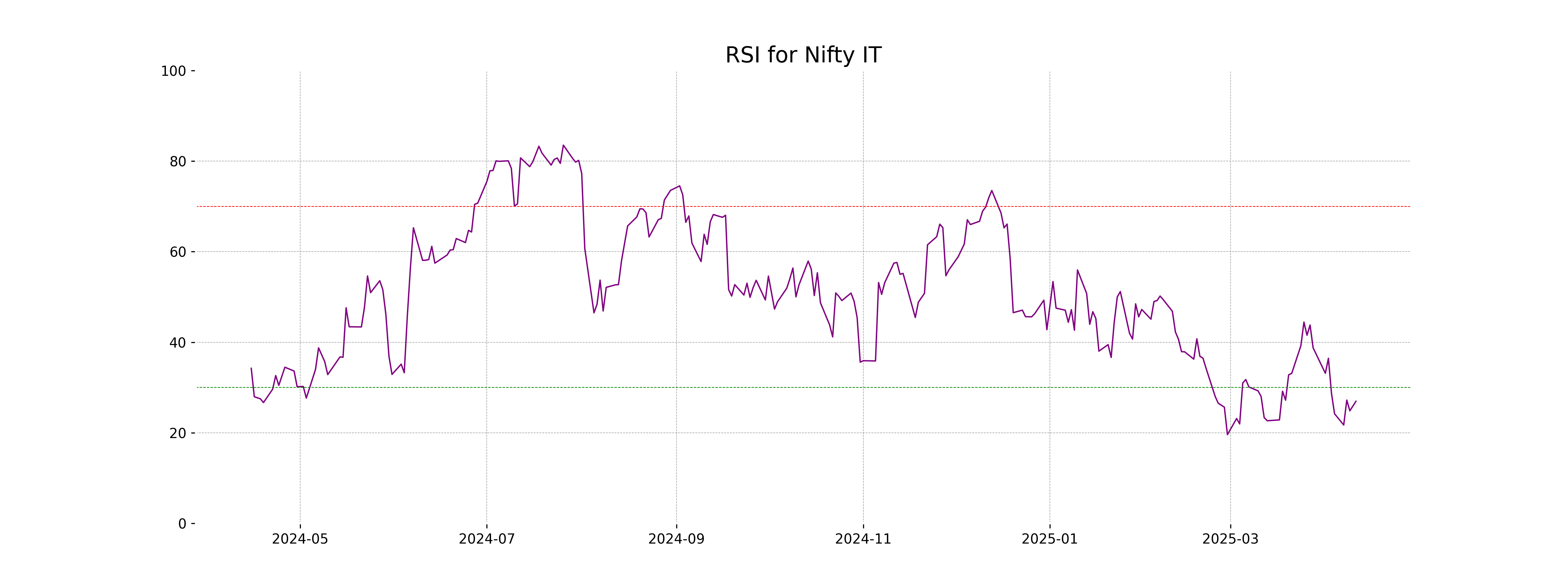

RSI Analysis

RSI Analysis: The current RSI for Nifty IT is 26.95, which falls below the typical oversold threshold of 30. This indicates that the index may be undervalued and could potentially be due for a price correction or rebound if buying interest increases.

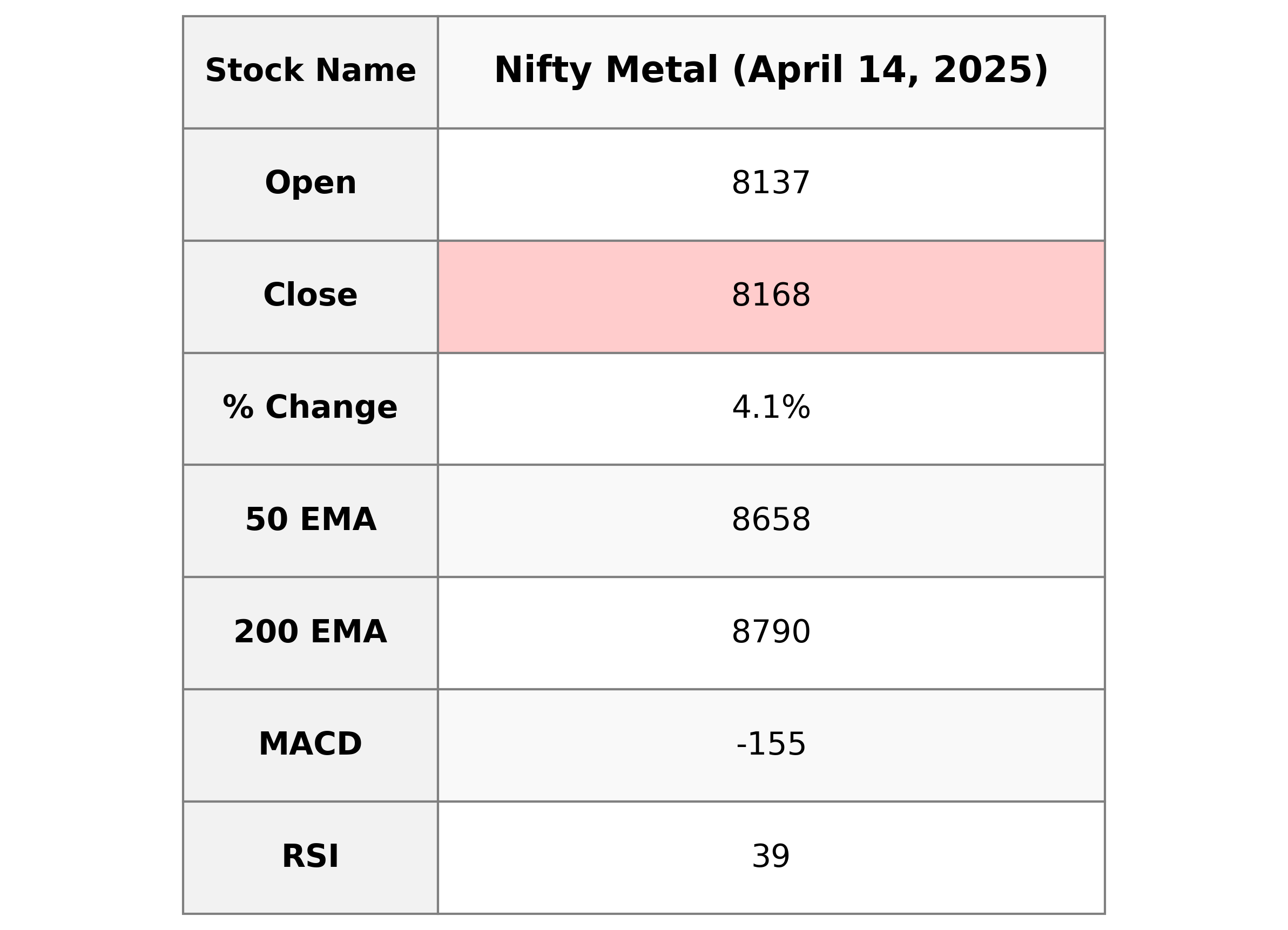

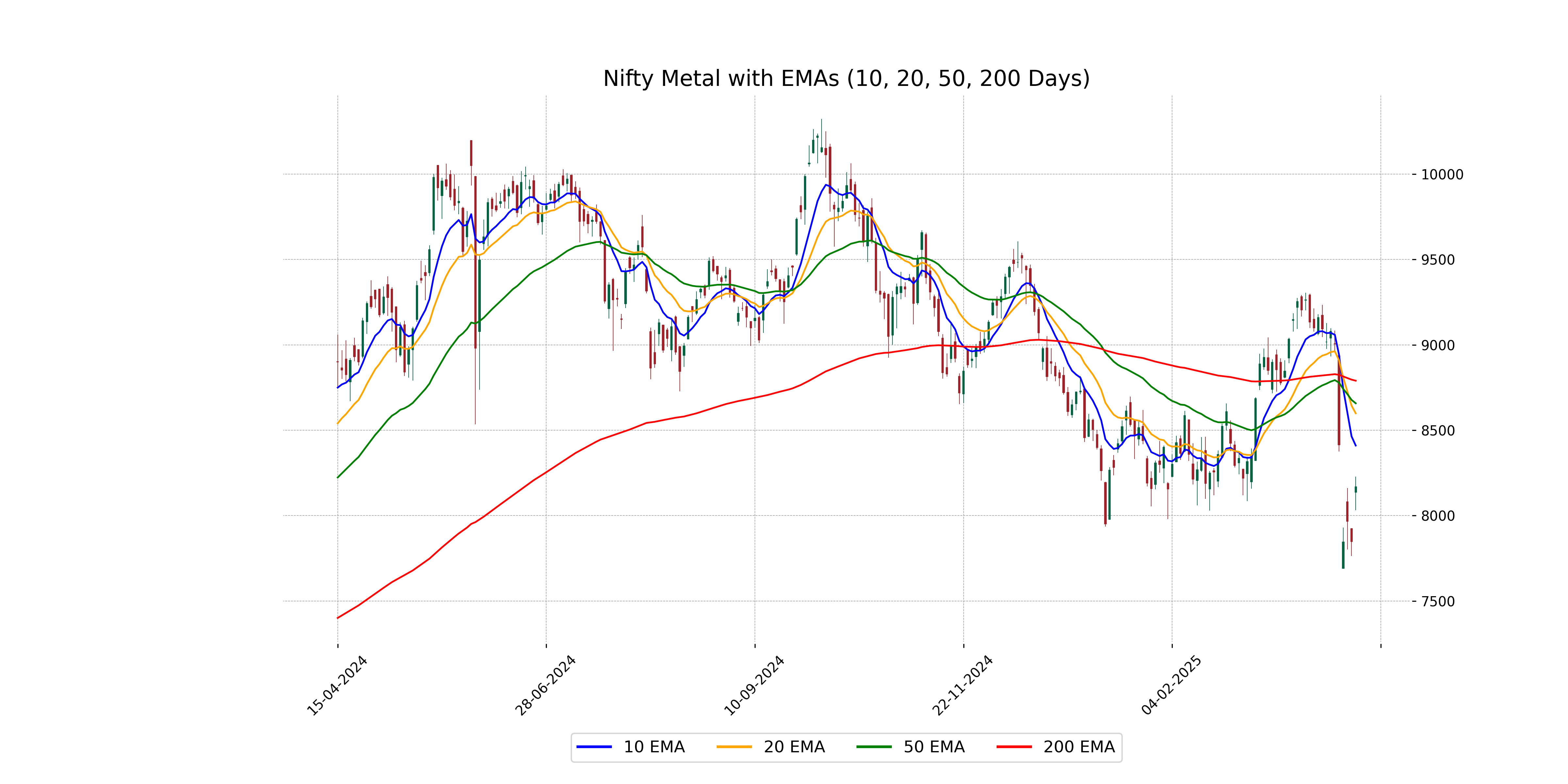

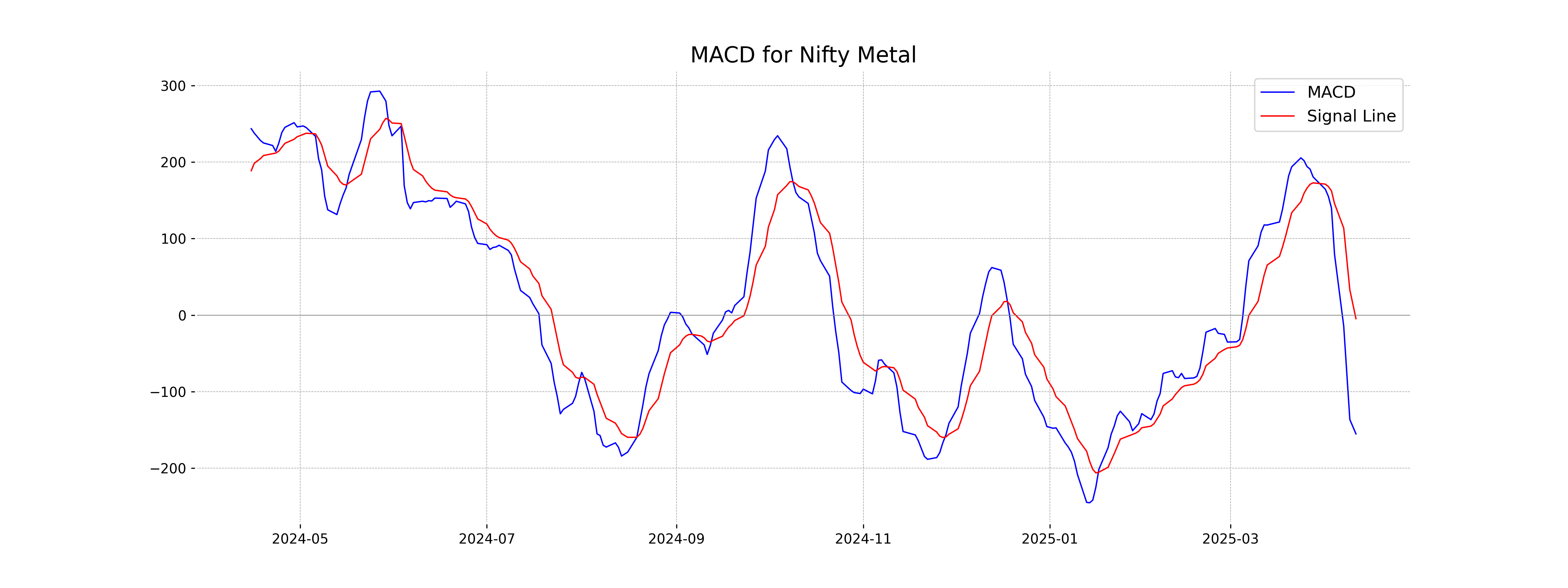

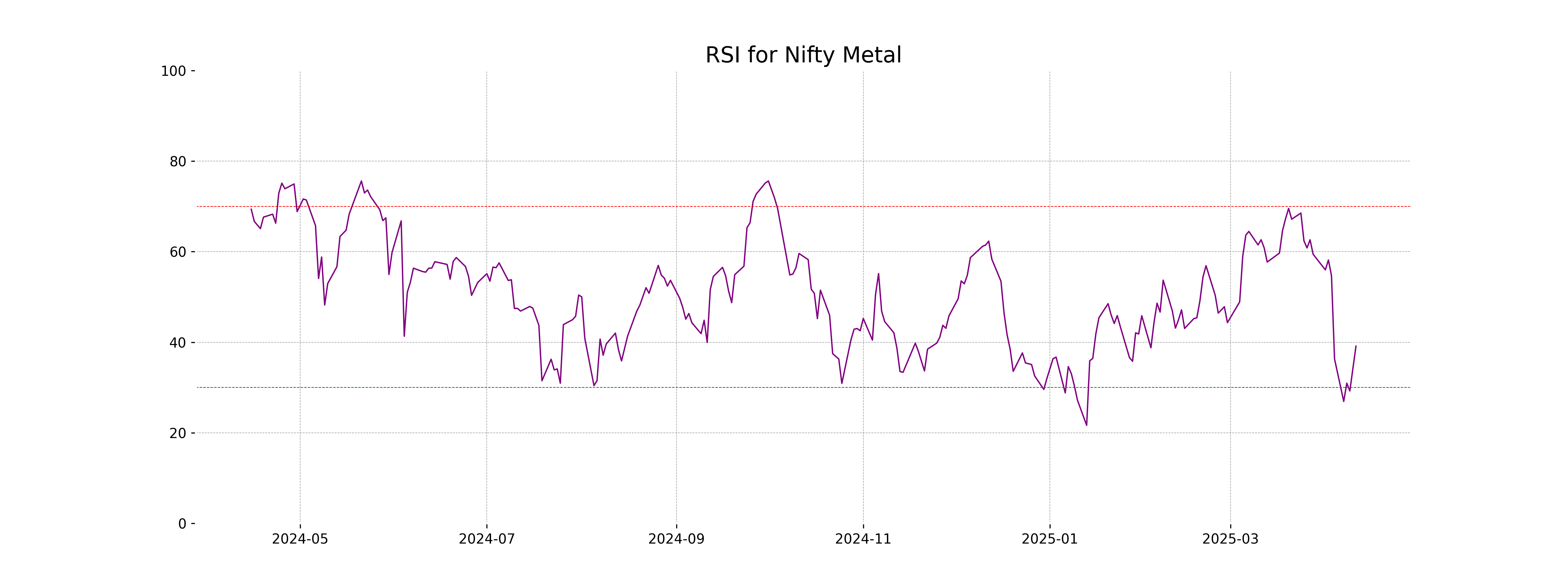

Analysis for Nifty Metal - April 14, 2025

Nifty Metal opened at 8136.80 and closed at 8168.30, marking a significant increase of 4.09% from its previous close of 7847.50. This change reflects an upward movement of 320.80 points, with a trading volume of 1,768,000. However, the Relative Strength Index (RSI) at 39.13 indicates it is nearing an oversold region, and the MACD value of -155.22, below the signal line of -4.68, suggests a bearish trend may persist despite the recent gains.

Relationship with Key Moving Averages

Nifty Metal is trading below its key moving averages, with the current close of 8168.30 significantly beneath the 50 EMA at 8657.57 and the 200 EMA at 8789.92. This indicates a bearish trend as the index remains under these longer-term moving averages.

Moving Averages Trend (MACD)

The MACD for Nifty Metal is -155.22, which is significantly below the MACD Signal of -4.68. This indicates a strong bearish sentiment. The negative MACD value suggests that the recent price momentum has weakened, and the stock may continue to face downward pressure in the near term.

RSI Analysis

The Relative Strength Index (RSI) for Nifty Metal is 39.13, which typically suggests that the index is approaching oversold conditions. When RSI is below 30, it is generally considered oversold, and it indicates that the index may be undervalued in the short term. Further monitoring would be required to determine if the trend continues towards overbought or stays in oversold territory.

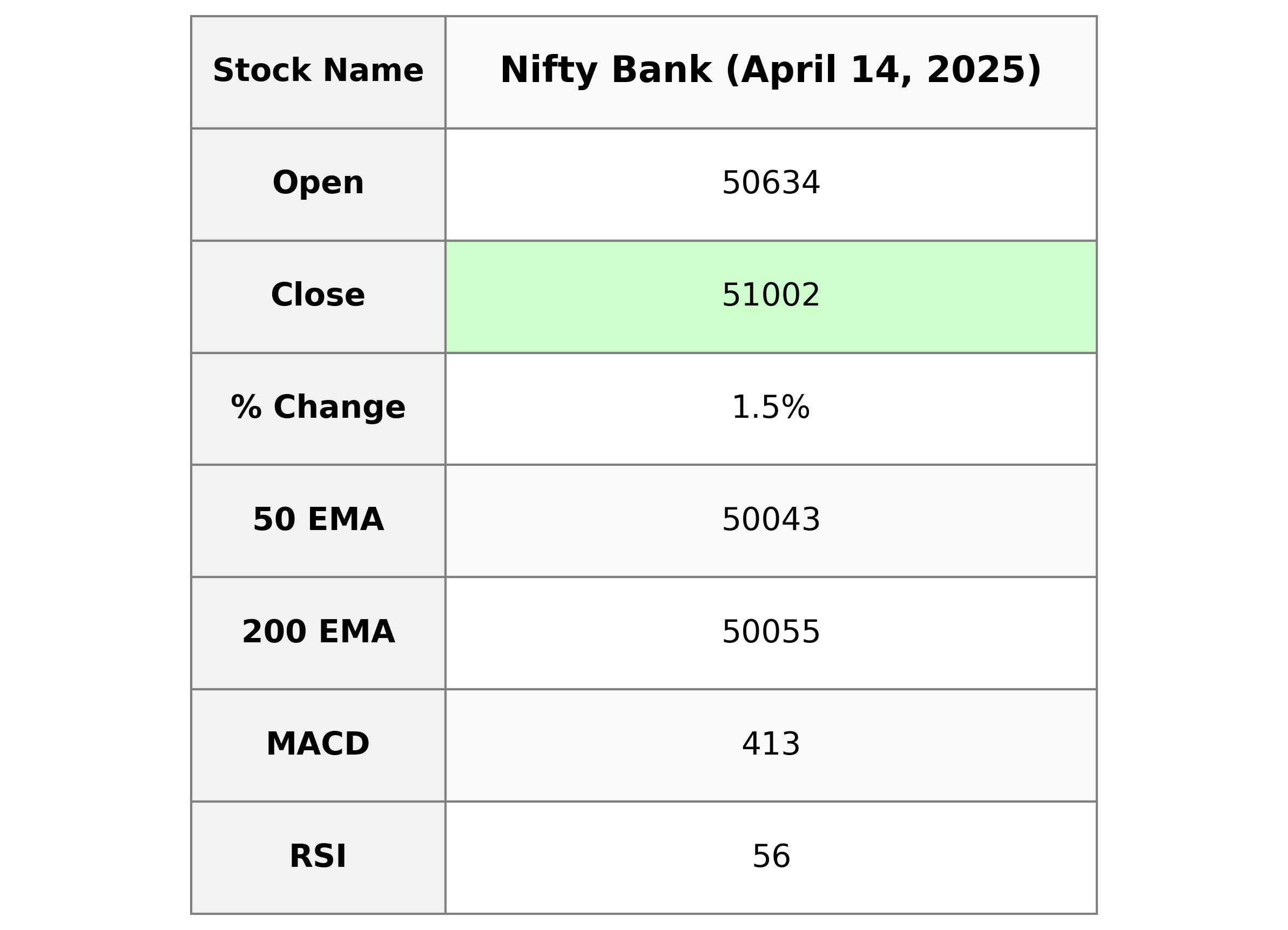

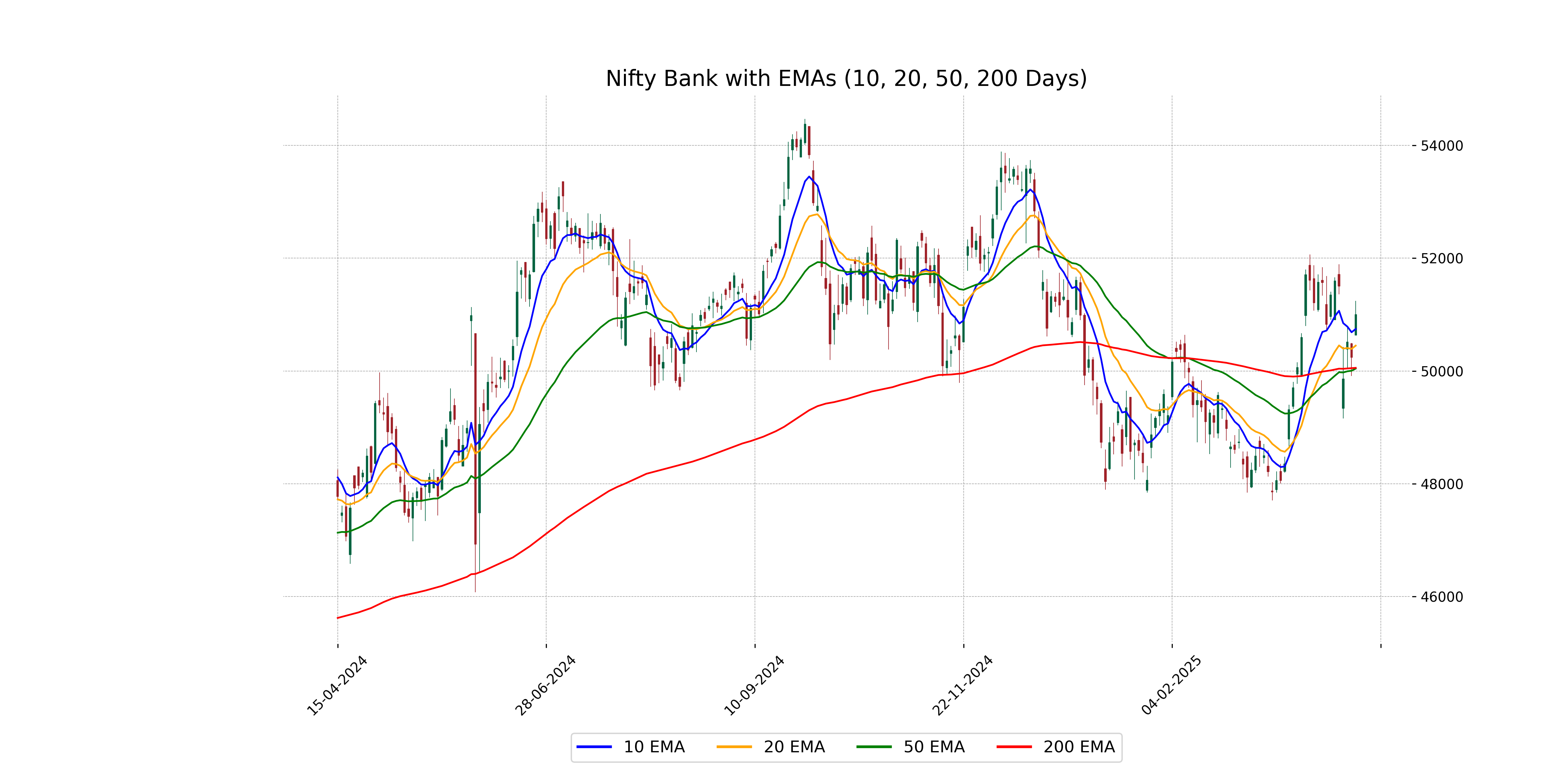

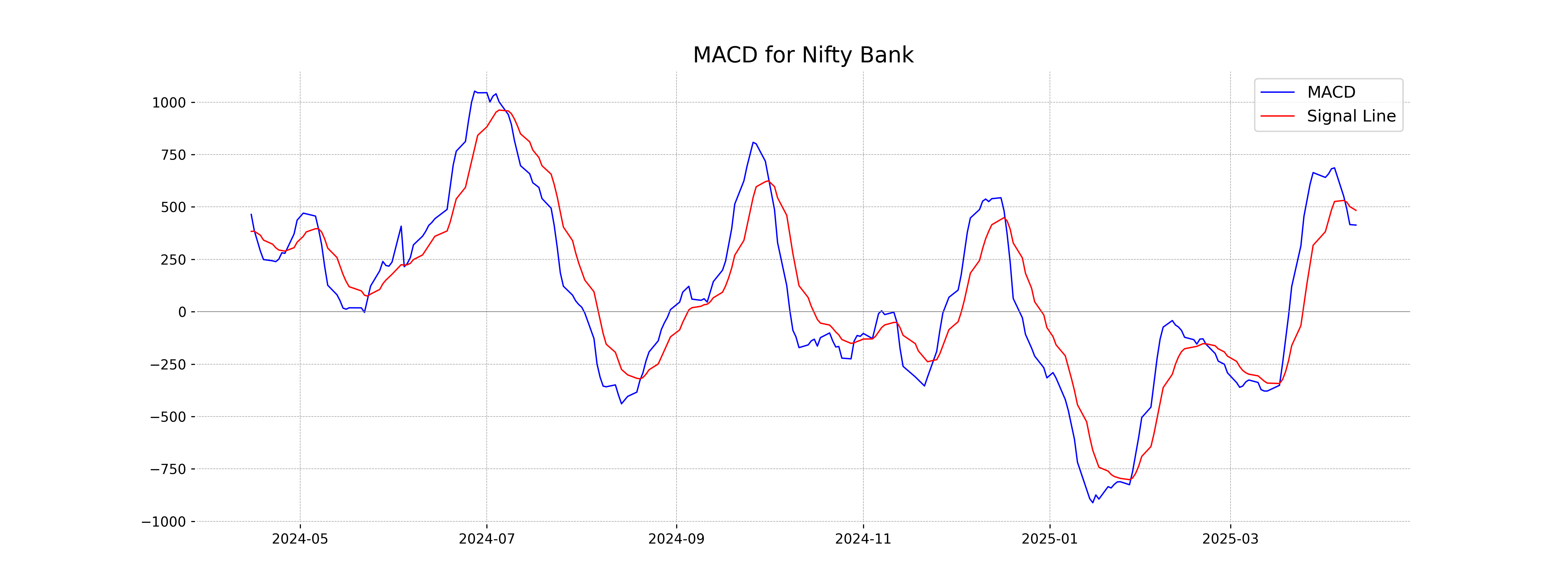

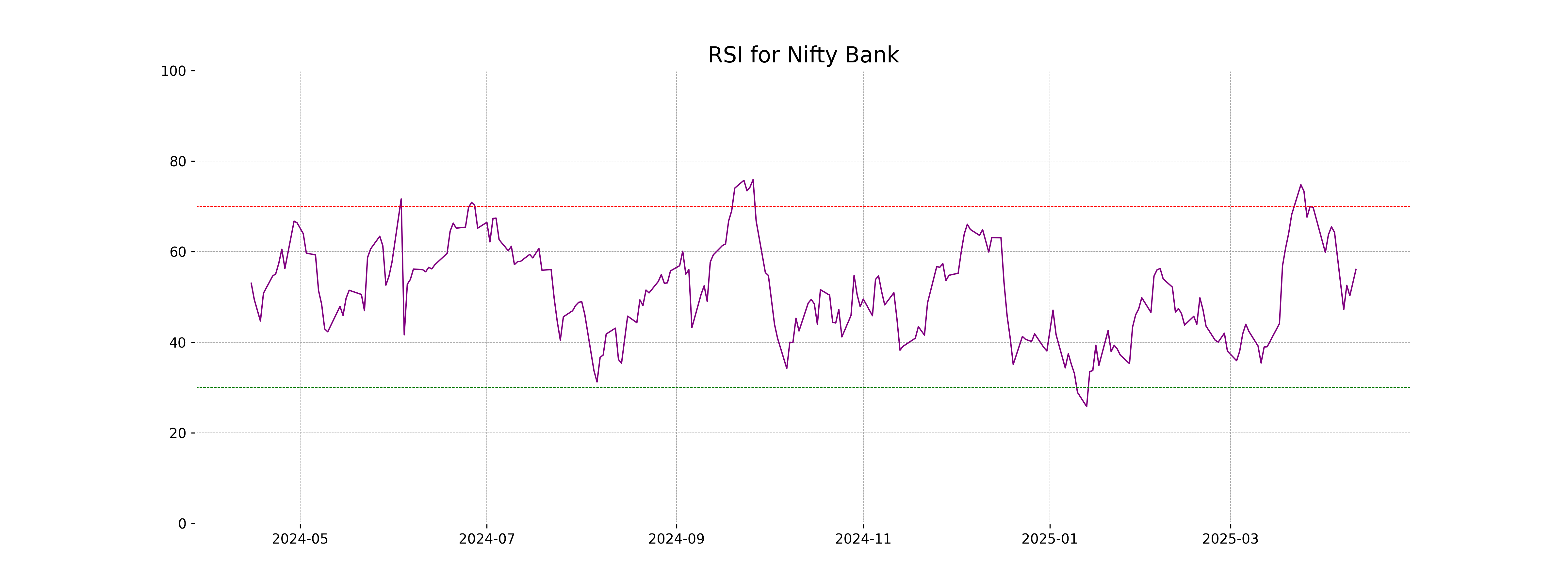

Analysis for Nifty Bank - April 14, 2025

The Nifty Bank index opened at 50,634.10 and closed at 51,002.35, marking a positive change of 1.52% from the previous close of 50,240.15. The trading volume was 140,000 with the index reaching a high of 51,244.70 during the session. The RSI level is recorded at 56.08, indicating moderate momentum.

Relationship with Key Moving Averages

The current close of Nifty Bank at 51002.3515625 is above the 50 EMA, 200 EMA, and 10 EMA, indicating a bullish trend in both short and long-term averages. The price is also above the 20 EMA, reinforcing upward momentum.

Moving Averages Trend (MACD)

Based on the data for Nifty Bank, the MACD line is at 413.26, while the MACD Signal line is at 483.66, indicating that the MACD line is below the signal line. This suggests a bearish trend, as it might indicate a potential decrease in price momentum. However, with the MACD just below the signal, traders may look for future crossover opportunities.

RSI Analysis

The RSI value for Nifty Bank is 56.08, indicating a neutral market condition. This suggests that the stock is neither overbought nor oversold at the moment. Traders might perceive this level as an opportunity to observe for potential trends or changes.

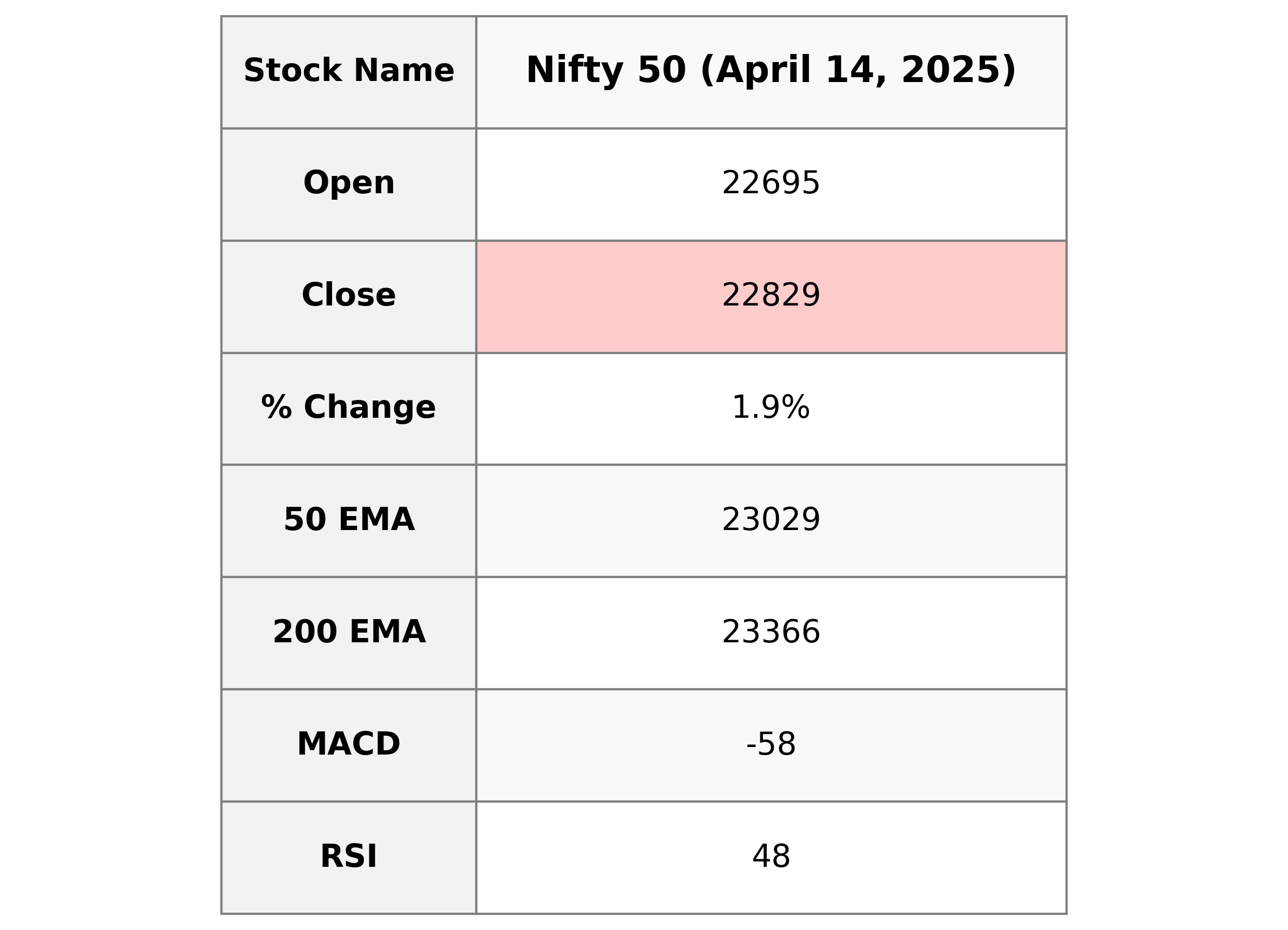

Analysis for Nifty 50 - April 14, 2025

Nifty 50 opened at 22695.40 and closed higher at 22828.55, marking a gain of 1.92% or 429.40 points. Despite the positive close, the MACD is negative, indicating potential bearish momentum, while the RSI is near neutral at 48.35. The index is trading below its 50-day EMA of 23028.87, suggesting a short-term downtrend.

Relationship with Key Moving Averages

The Nifty 50 closed at 22828.55, which is below its 50 EMA of 23028.87 and 200 EMA of 23365.99, indicating a bearish trend in the short to medium term. However, it is slightly below the 10 EMA of 22833.98 and the 20 EMA of 22907.79, suggesting possible short-term consolidation near current levels.

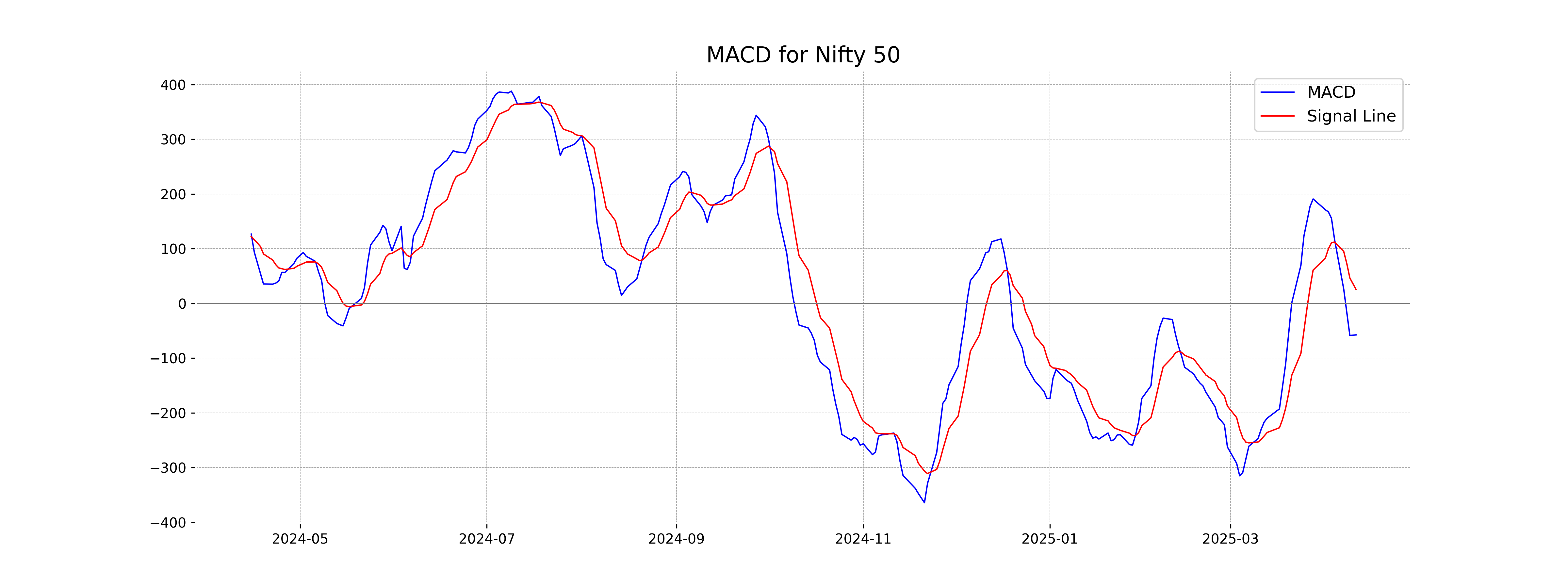

Moving Averages Trend (MACD)

Nifty 50's MACD value of -57.55 with a signal line at 25.79 suggests a bearish trend as the MACD line is significantly below the signal line. This indicates downward momentum, and traders might interpret this as a sell signal unless other indicators suggest a potential reversal.

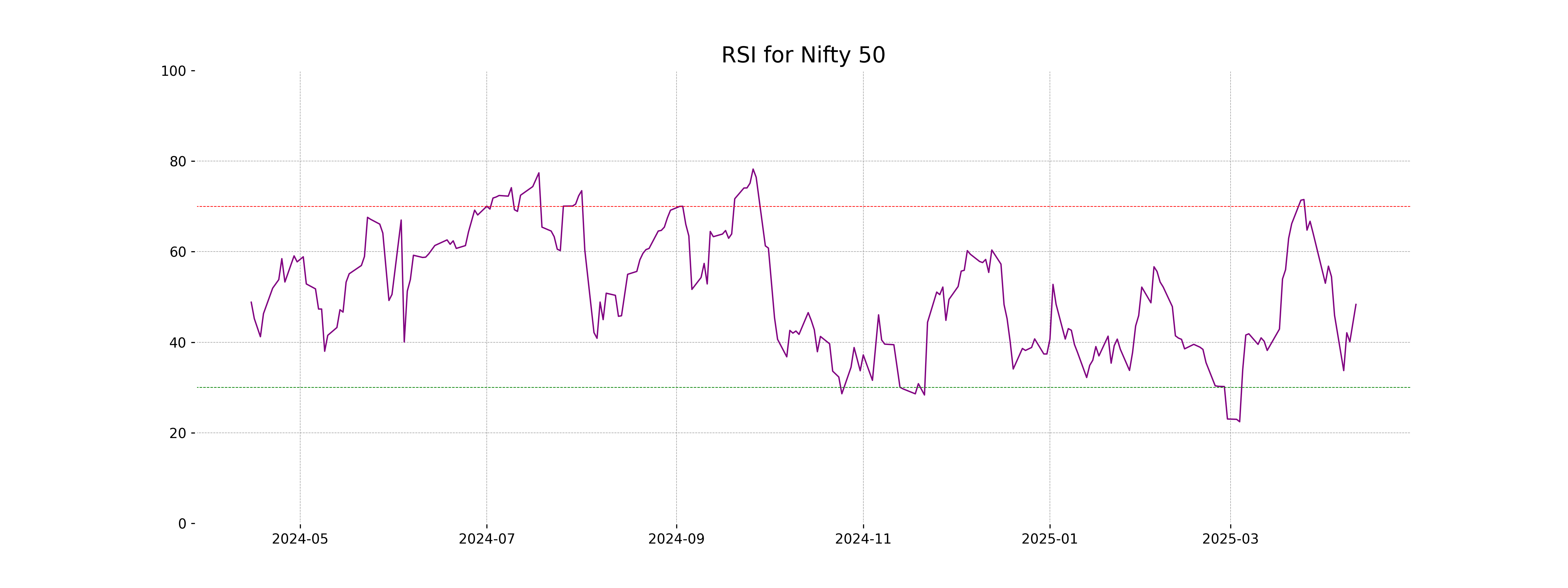

RSI Analysis

Nifty 50 RSI Analysis: The Relative Strength Index (RSI) for Nifty 50 is at 48.35, indicating that it is in the neutral zone. This suggests a balanced sentiment in the market without being overbought or oversold. Investors may look for a more decisive RSI move for stronger directional cues.

ADVERTISEMENT

Up Next

Indian Stock Market Sector-wise Performance: Which Sector is performed Well Today - April 14, 2025

New Zealand commits USD 20 bn investment in India under FTA in 15 yrs; on lines of EFTA pact

India, New Zealand conclude FTA talks; pact to offer duty-free access, USD 20 bn FDI

FTA with New Zealand to significantly deepen bilateral economic engagement: Govt

Rupee breaches 91-mark against US dollar for first time in intra-day trade

Microsoft commits USD 17.5 billion investment in India: CEO Satya Nadella

More videos

CBI books Anil Ambani's son, Reliance Home Finance Ltd. in Rs 228 crore bank fraud case

RBI raises FY26 GDP growth projection to 7.3 pc

RBI trims policy interest rate by 25bps to 5.25pc, loans to get cheaper

Rupee slumps to all-time low of 90.25 against US dollar in intra-day trade

Reliance completes merger of Star Television Productions with Jiostar

India to lead emerging market growth with 7pc GDP rise in 2025: Moody’s

Nifty hits record high after 14 months; Sensex nears all-time peak

Reliance stops Russian oil use at its only-for-export refinery to comply with EU sanctions

ED attaches fresh assets worth over Rs 1,400 cr in case against Anil Ambani's Reliance Group

India signs one-year deal to import 2.2 million tonnes of LPG from US