- Home

- ❯

- Business

- ❯

- Markets

- ❯

- Global stock market indices: How the world markets performed today - 11 June 2025

Highlights

- Sensex, Dow Jones, Hang Seng end higher

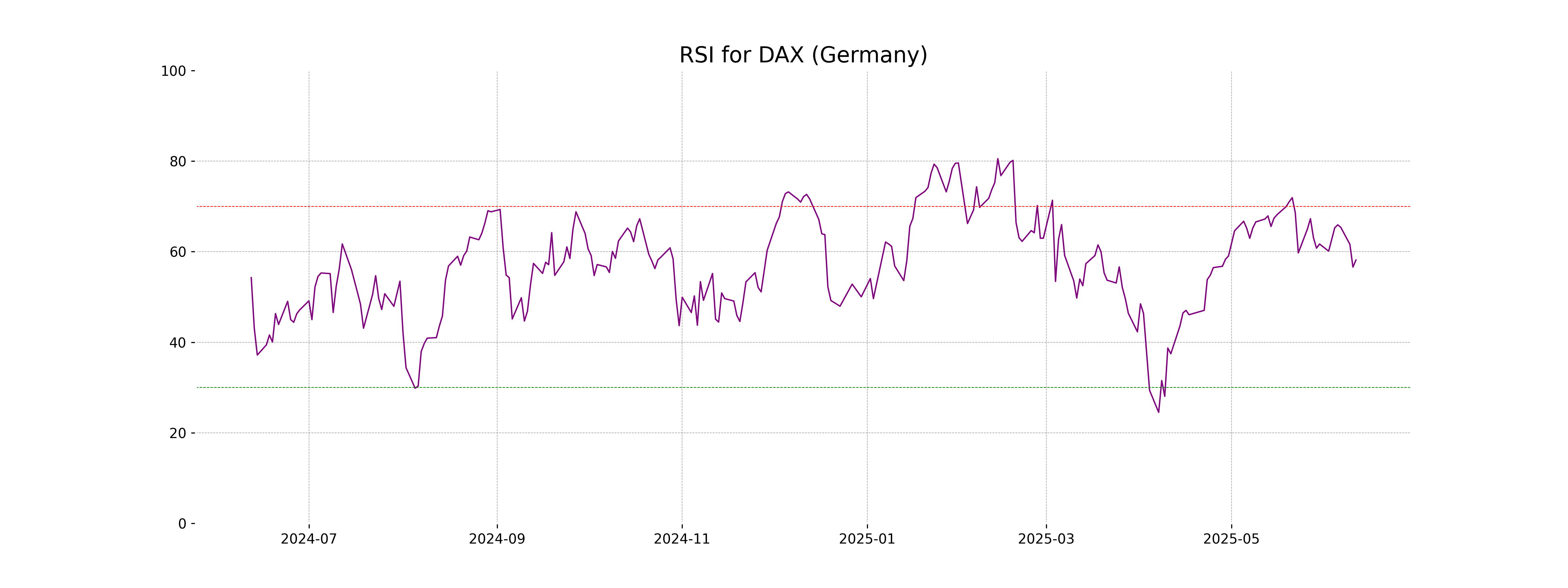

- FTSE 100 nears overbought; DAX shows pressure

- MACD trends mixed; RSI signals cautious optimism

Latest news

Putin hails Ukraine gains, threatens more, in annual press conference

OnePlus Pad Go 2 Review: No drama, just a good tablet

Parliament Moment: Priyanka Gandhi shares tea with Rajnath Singh. PM Modi and Om Birla

Cold wave deepens in Kashmir as Chillai-Kalan nears, temperatures dip below freezing

Pakistan accuses India of attempting to undermine Indus treaty

Vande Mataram discussion in UP legislature to mark 150th anniversary: Yogi Adityanath

Ashes 2025: Travis Head slams unbeaten 142 to crush England's Ashes hopes

Tipra Motha youth wing protests Bangladesh leader's anti-India remarks in Agartala

Global stock market indices: How the world markets performed today - 11 June 2025

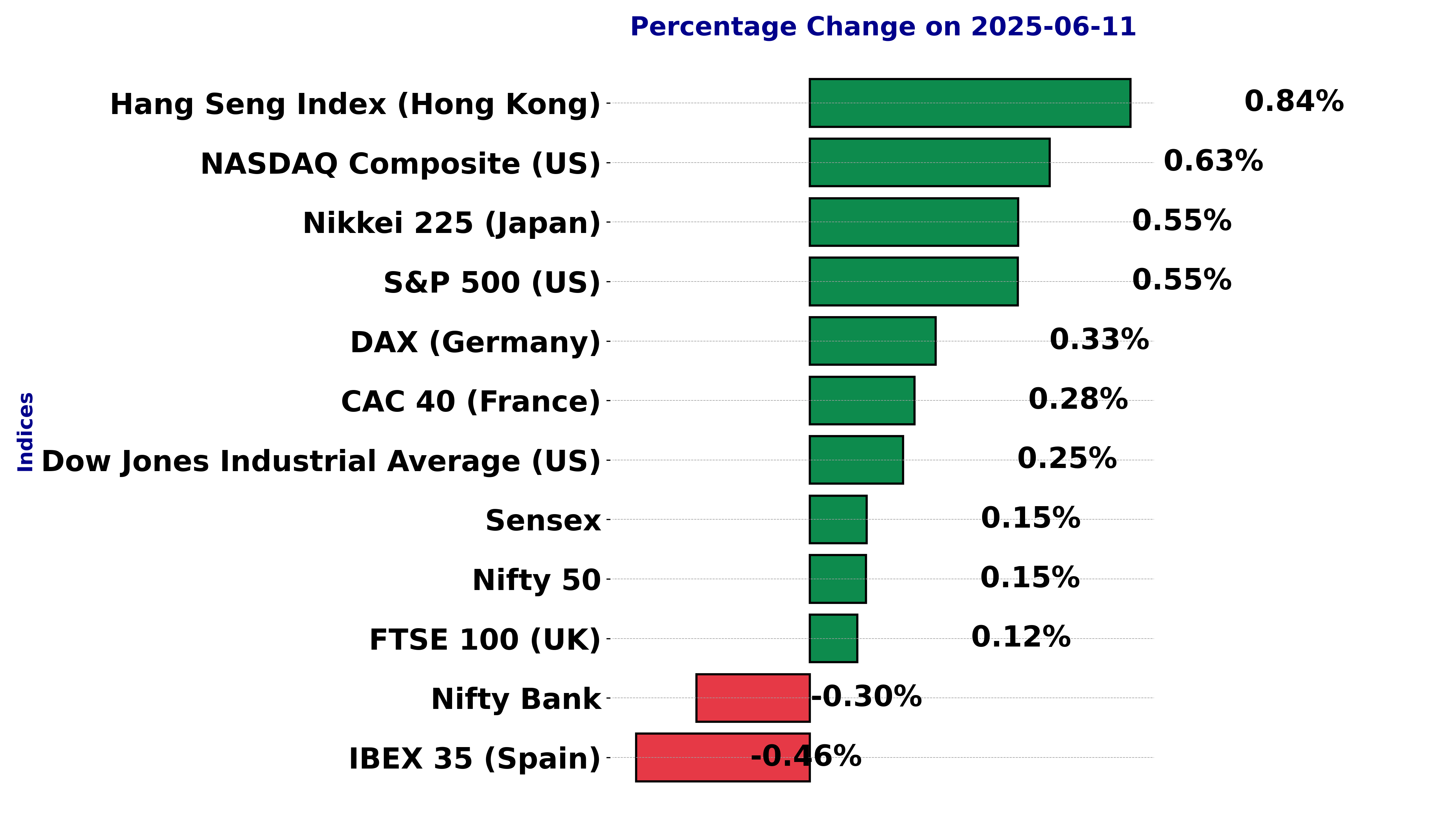

The international stock market indices showed varied performances on June 11, 2025, reflecting the economic sentiment across different regions.

In this article, we analyze the performance of key global indices including the S&P 500, Dow Jones Industrial Average, NASDAQ Composite, FTSE 100, DAX, CAC 40, IBEX 35, Nikkei 225, Hang Seng, Nifty 50, and BSE Sensex.

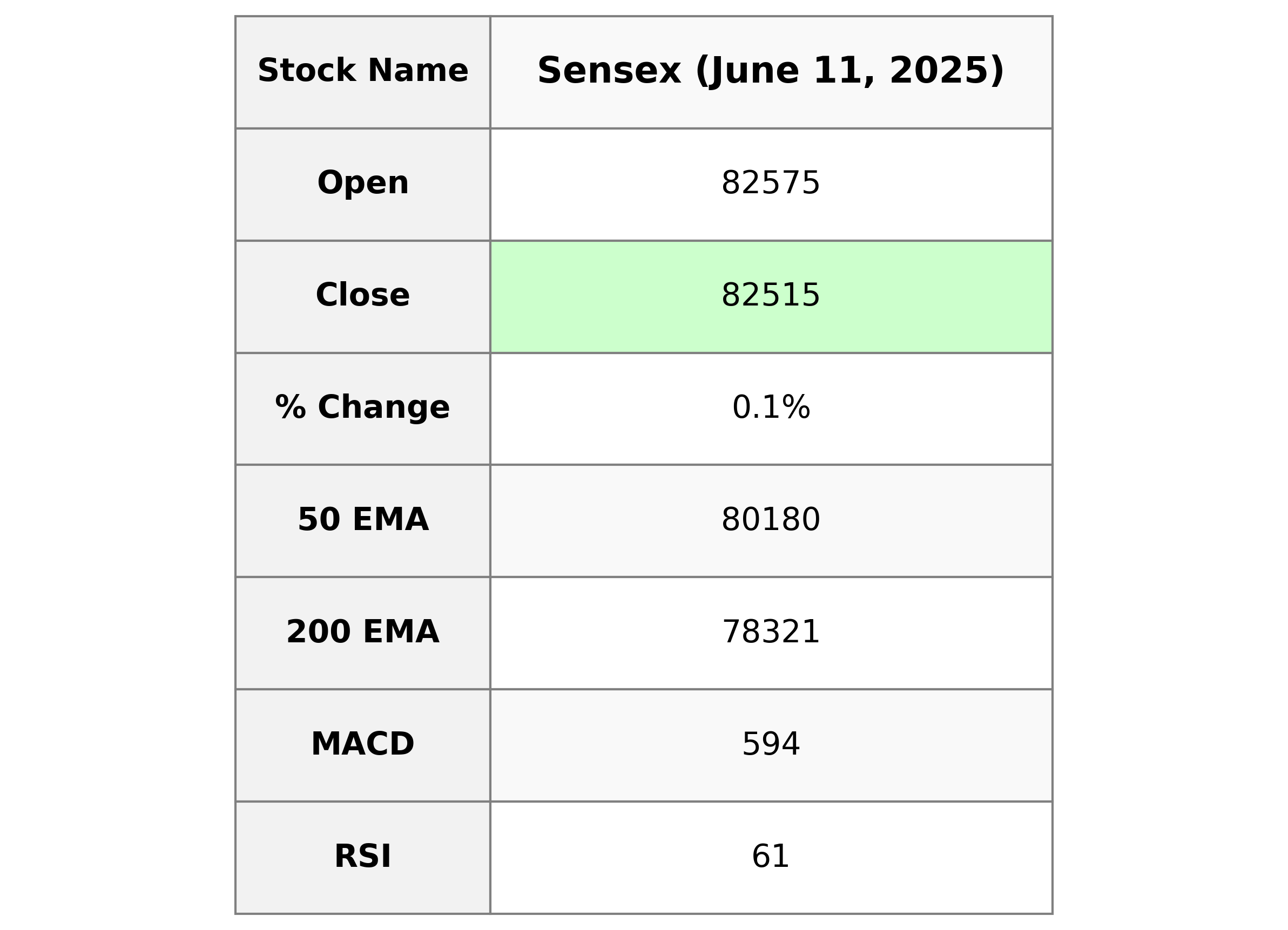

Analysis for Sensex - June 11, 2025

The Sensex opened at 82,574.55, reached a high of 82,783.51, and closed at 82,515.14, indicating a slight gain with a % change of 0.15% from the previous close of 82,391.72. Despite no volume data, the overall market momentum shows a positive trend with RSI at 61.06, suggesting stronger buying signals. The MACD indicates a minor bearish divergence as it is slightly below the MACD Signal.

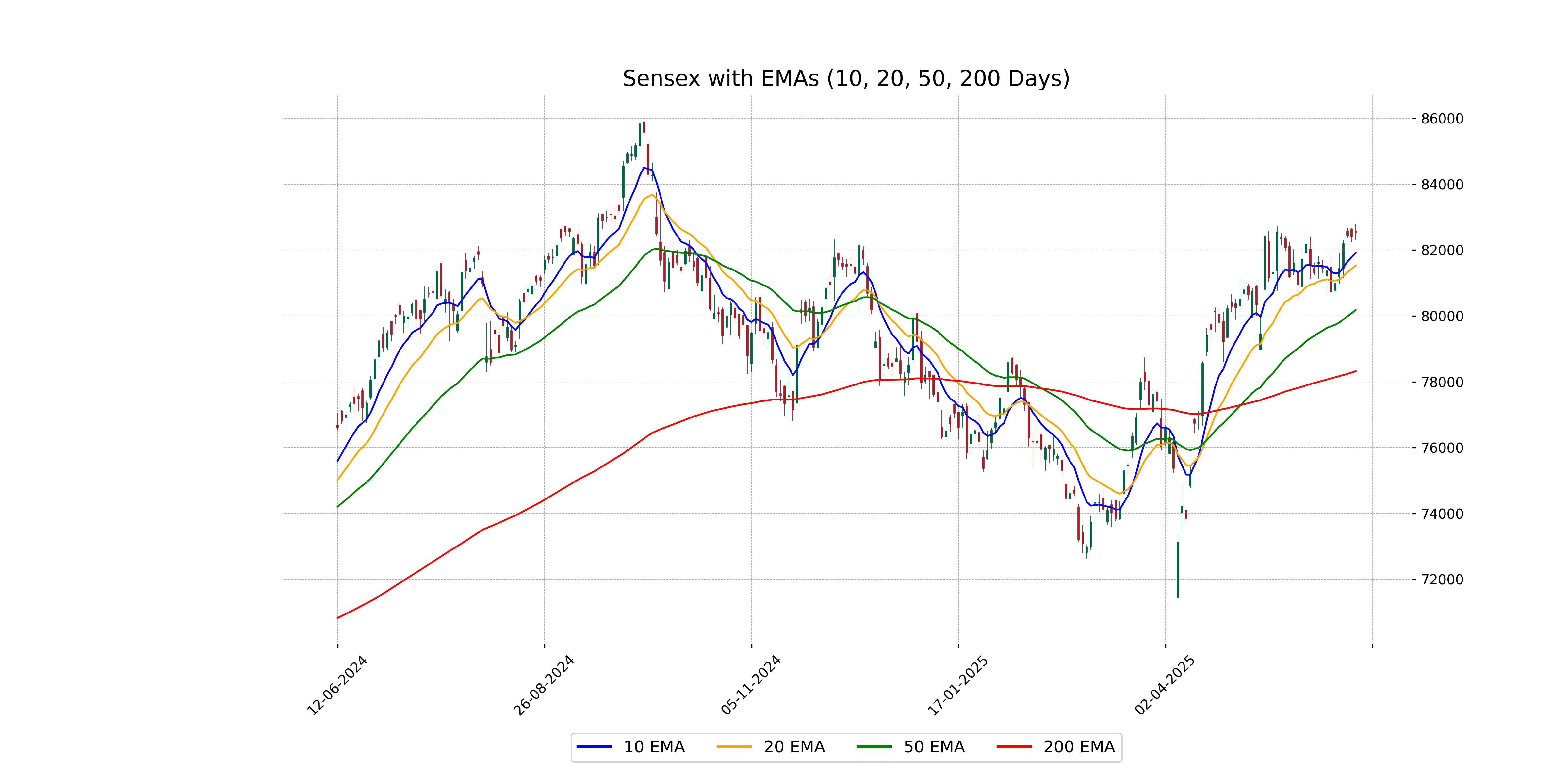

Relationship with Key Moving Averages

The Sensex, with a close of 82,515.14, is trading above its 50-day EMA of 80,179.54 and 200-day EMA of 78,320.99, indicating a bullish trend. Additionally, it is also above the 10-day EMA of 81,917.70 and the 20-day EMA of 81,528.99, suggesting short-term momentum is positive.

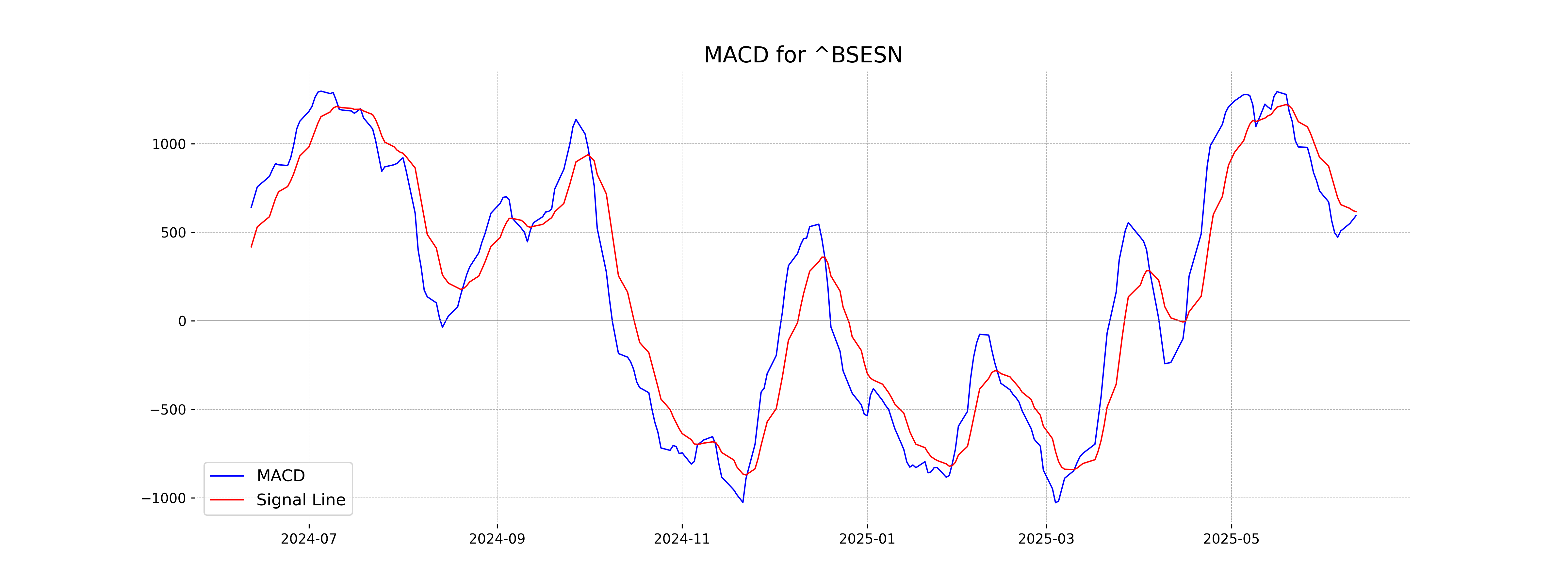

Moving Averages Trend (MACD)

The MACD value for Sensex is 593.841, which is slightly below the MACD Signal line of 617.057, suggesting a potential short-term bearish signal. However, with the RSI at 61.06, the index is still in the bullish zone, indicating mixed momentum.

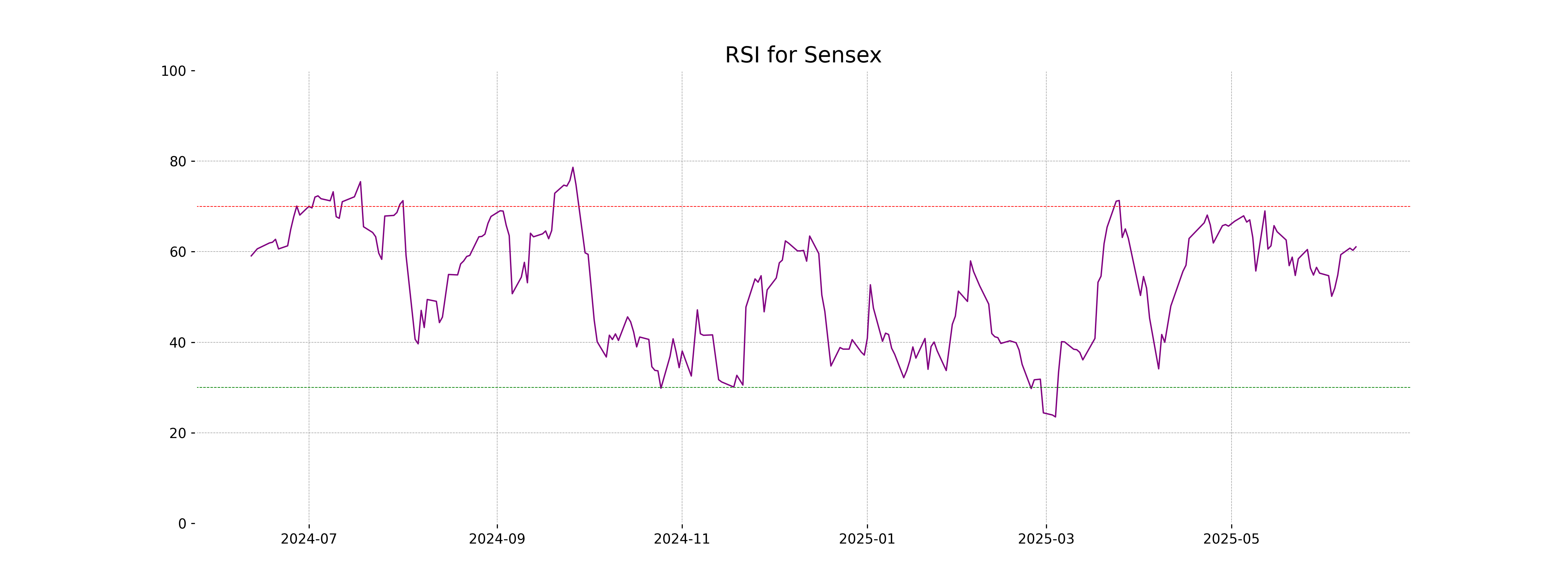

RSI Analysis

Based on the given stock data, the Relative Strength Index (RSI) for Sensex is 61.06, suggesting that the market is in a moderately bullish phase. An RSI above 50 typically indicates positive momentum, though it is not yet in overbought territory, which would be above 70.

Analysis for Dow Jones Industrial Average (US) - June 11, 2025

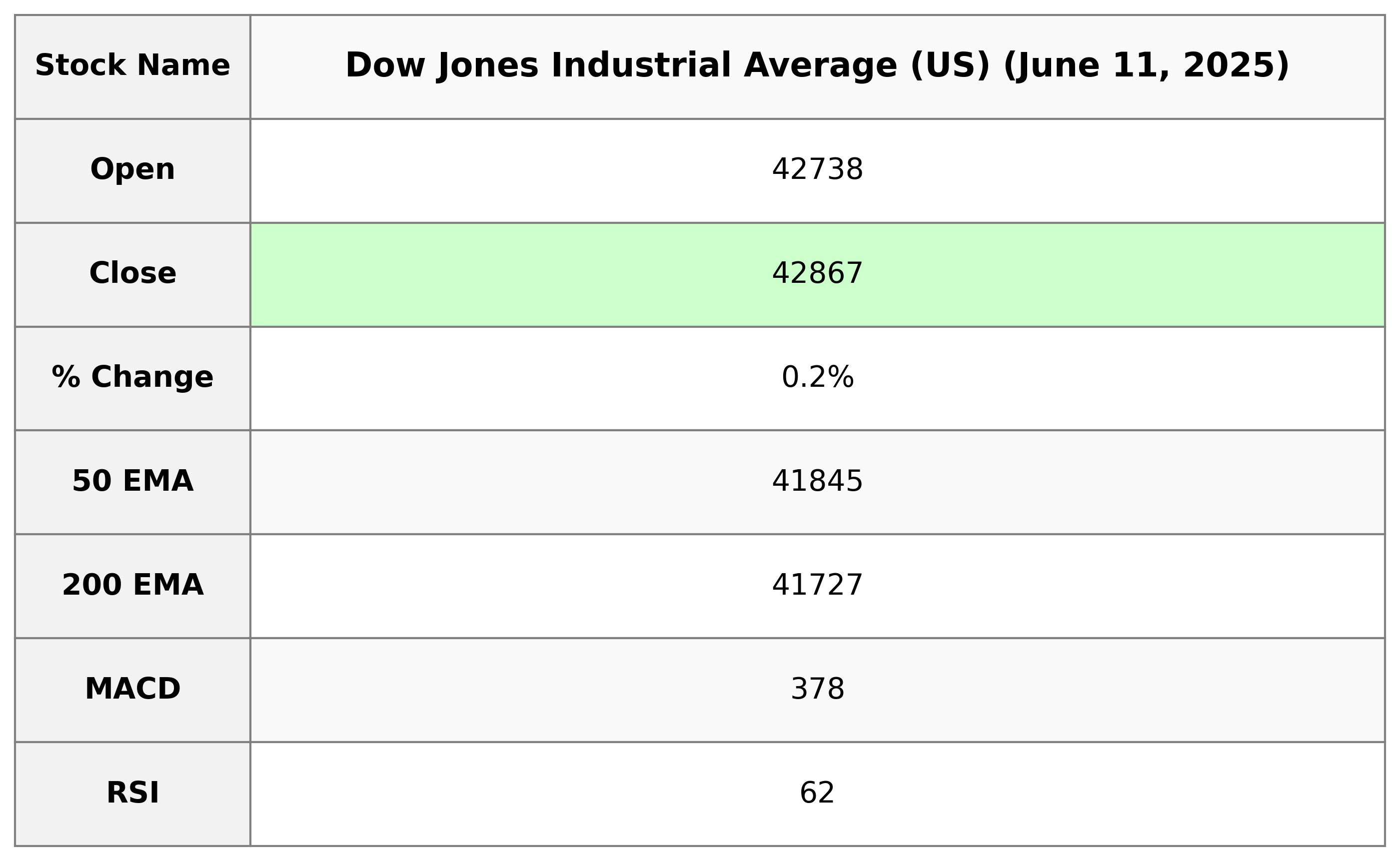

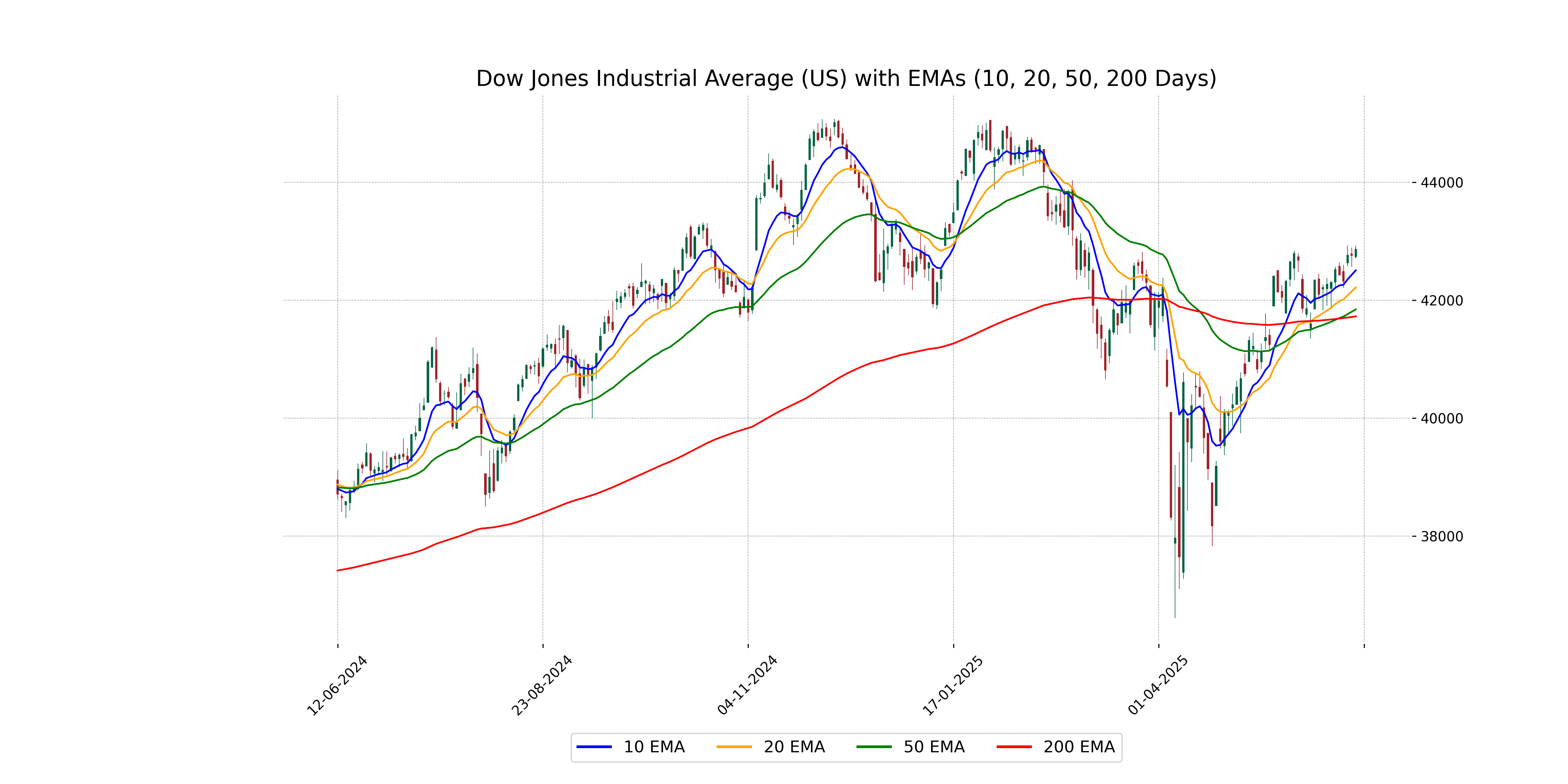

The Dow Jones Industrial Average (US) opened at 42738.27, reached a high of 42925.94, and closed at 42866.87 with a volume of 446.85 million. The index showed a positive change of 0.246%, reflecting a points change of 105.11. Key indicators include an RSI of 62.03, a MACD of 377.94, and it is presently trading above its 50-day and 200-day EMAs.

Relationship with Key Moving Averages

The Dow Jones Industrial Average closed at 42866.87, which is above its 50 EMA and 200 EMA, indicating a potential upward trend. It also lies above the 10 EMA and 20 EMA, suggesting short-term strength. The positive MACD above its signal line confirms bullish momentum.

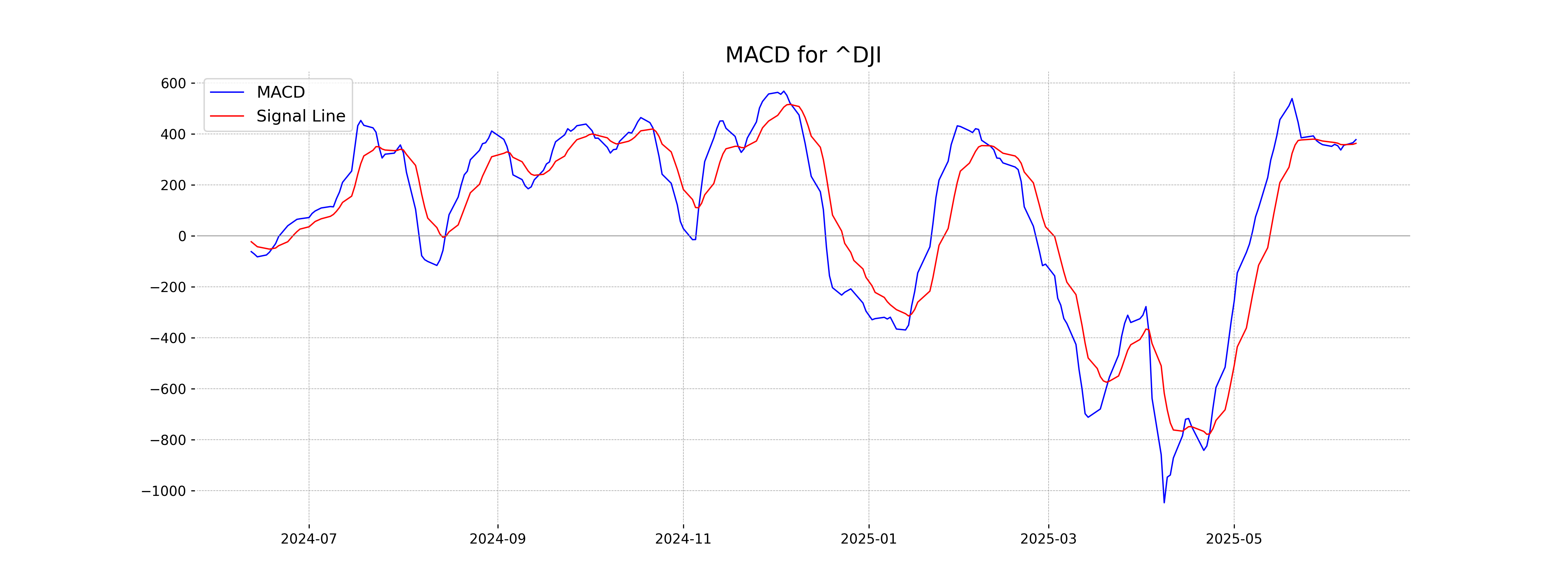

Moving Averages Trend (MACD)

Dow Jones Industrial Average (US) MACD Analysis The MACD for the Dow Jones Industrial Average stands at 377.94, while the MACD Signal is at 363.21. With MACD above the signal line, this indicates a bullish momentum for the index.

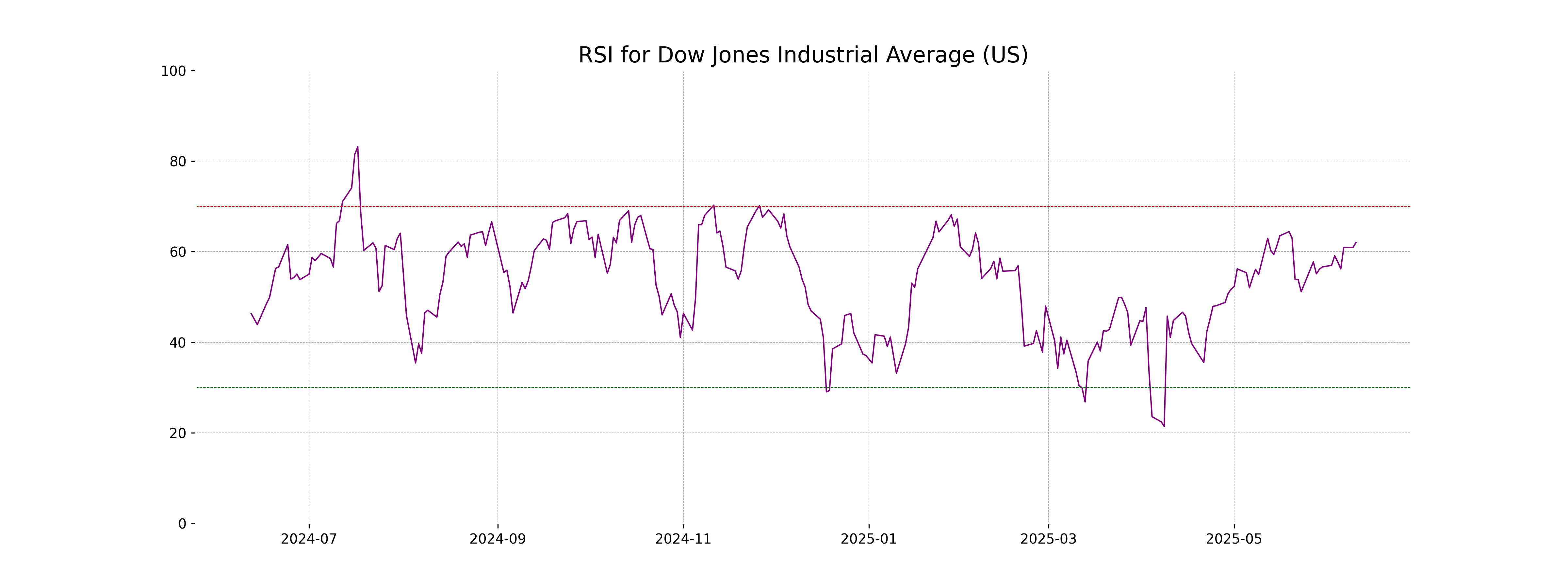

RSI Analysis

RSI Analysis: The Dow Jones Industrial Average shows a Relative Strength Index (RSI) of 62.03, which suggests that the index is approaching overbought territory but is not yet at an extreme level. It indicates a moderately strong momentum, as RSI values above 50 typically reflect bullish conditions.

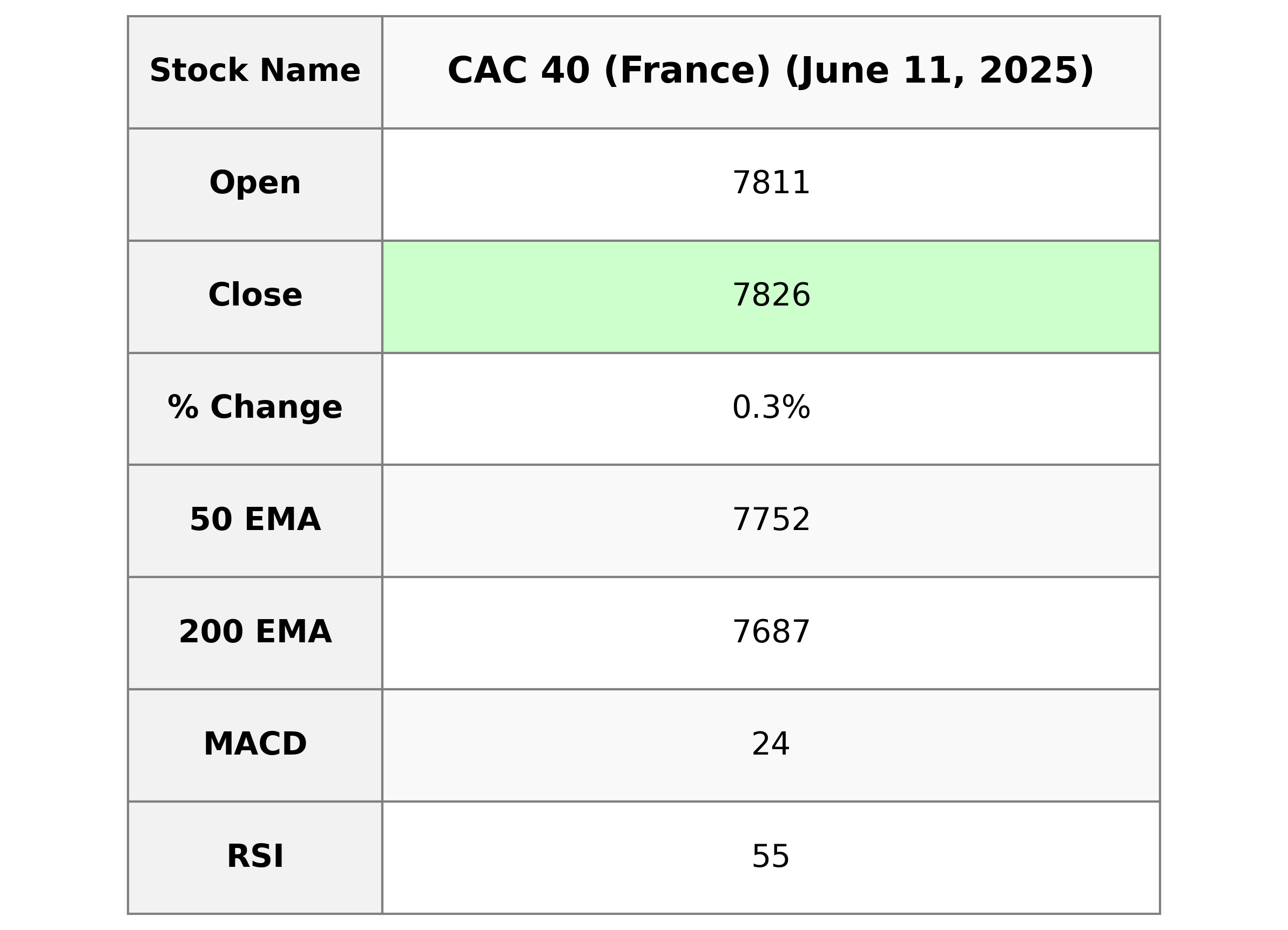

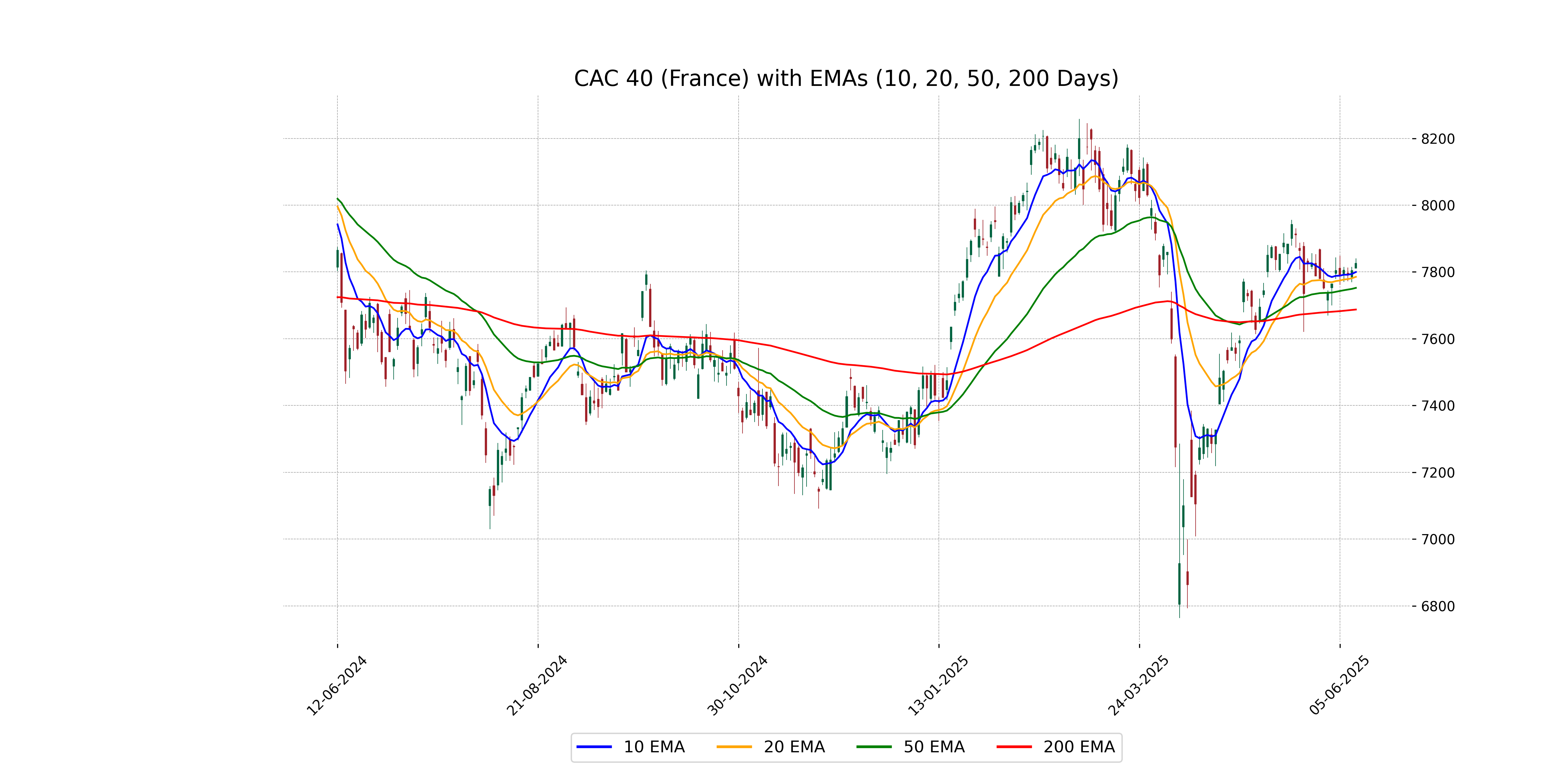

Analysis for CAC 40 (France) - June 11, 2025

CAC 40 (France) Performance: The CAC 40 index opened at 7810.84 and closed at 7825.85, reflecting a slight increase with a 0.28% change and a points gain of 21.52. The Relative Strength Index (RSI) is at 55.32, indicating a generally stable market posture. The 10-day EMA stands at 7799.72, above the 20-day and 50-day EMAs, suggesting a short-term upward trend.

Relationship with Key Moving Averages

The closing price of CAC 40 is 7825.85, which is above its 50-day EMA of 7752.20 and 200-day EMA of 7687.36, indicating a potential bullish trend. It is also above the 10-day EMA of 7799.72 and the 20-day EMA of 7785.28, suggesting short-term momentum is strong.

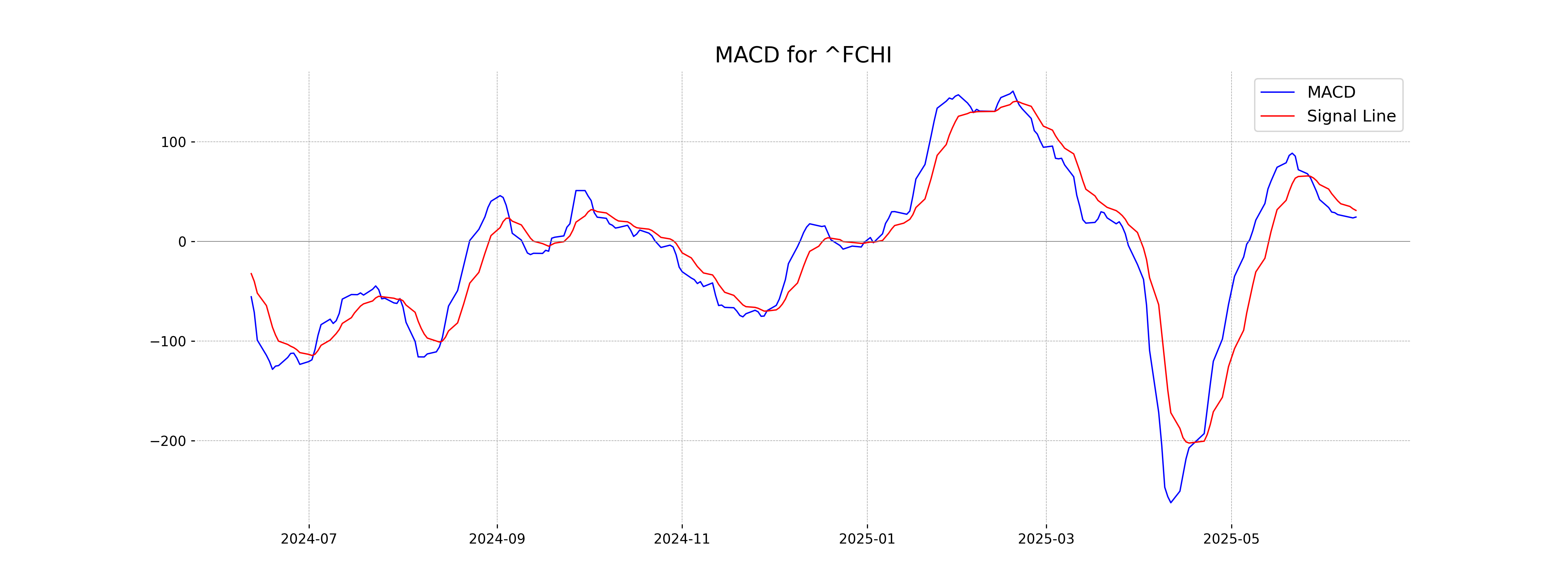

Moving Averages Trend (MACD)

The MACD for CAC 40 is 24.36, which is below the MACD Signal line at 31.04. This indicates a possible bearish trend, suggesting that the momentum may be slowing down. Investors should monitor this closely for any potential reversal or further decline.

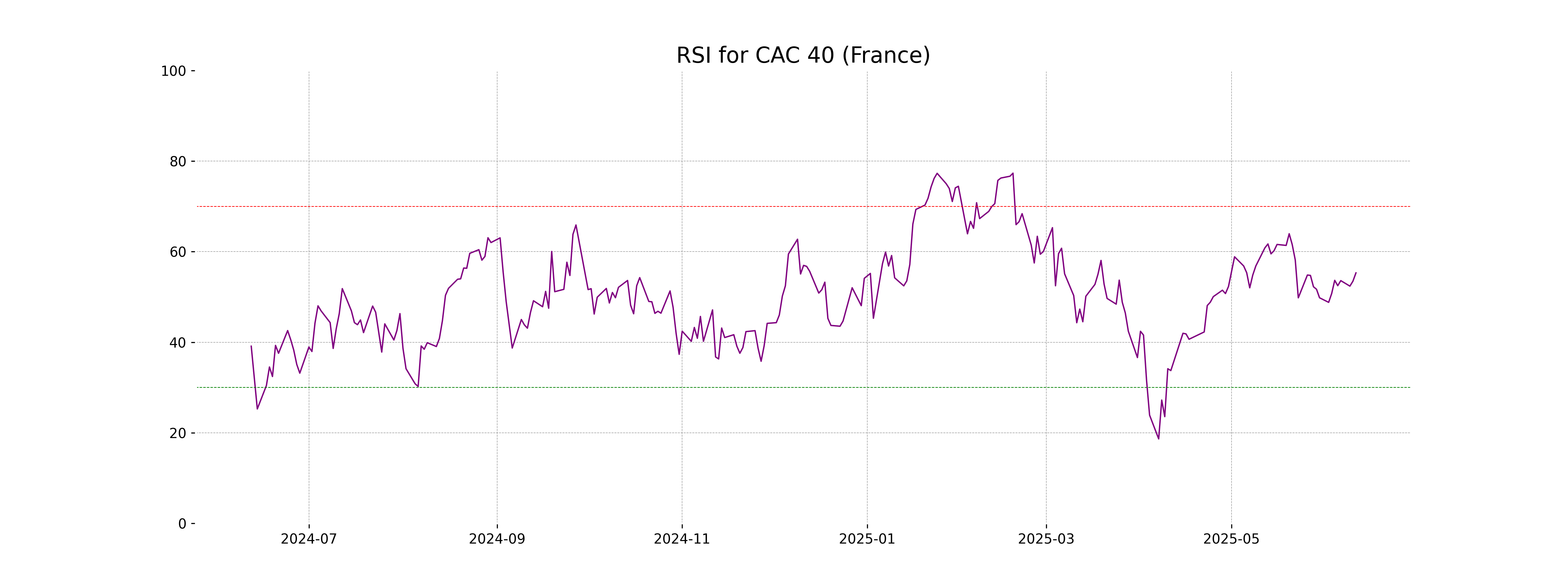

RSI Analysis

Relative Strength Index (RSI) Analysis for CAC 40 (France): The RSI for CAC 40 is currently at 55.32, suggesting neutral momentum. With a value below 70, the index is neither in the overbought nor the oversold territory, indicating moderate buying and selling pressure.

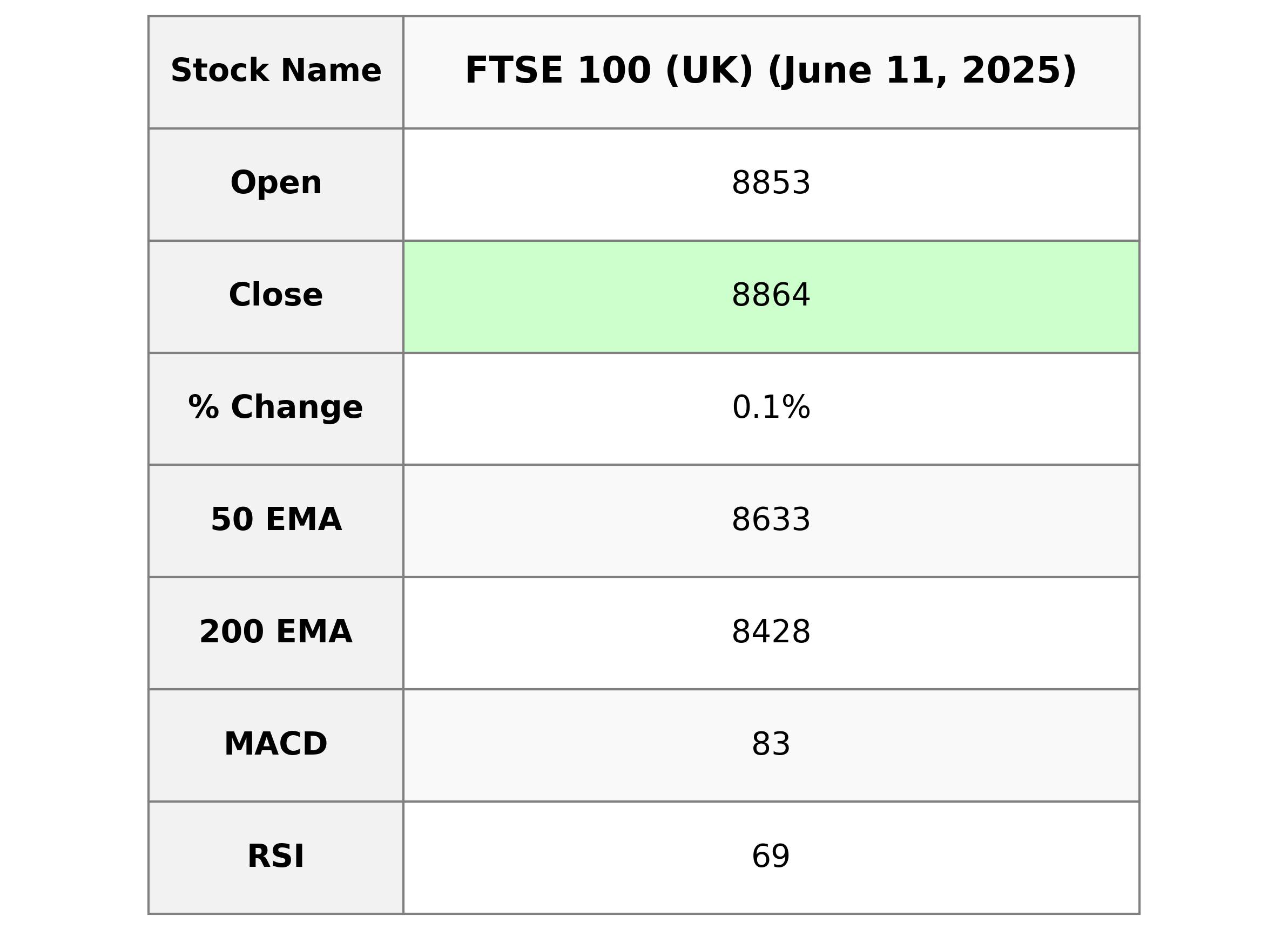

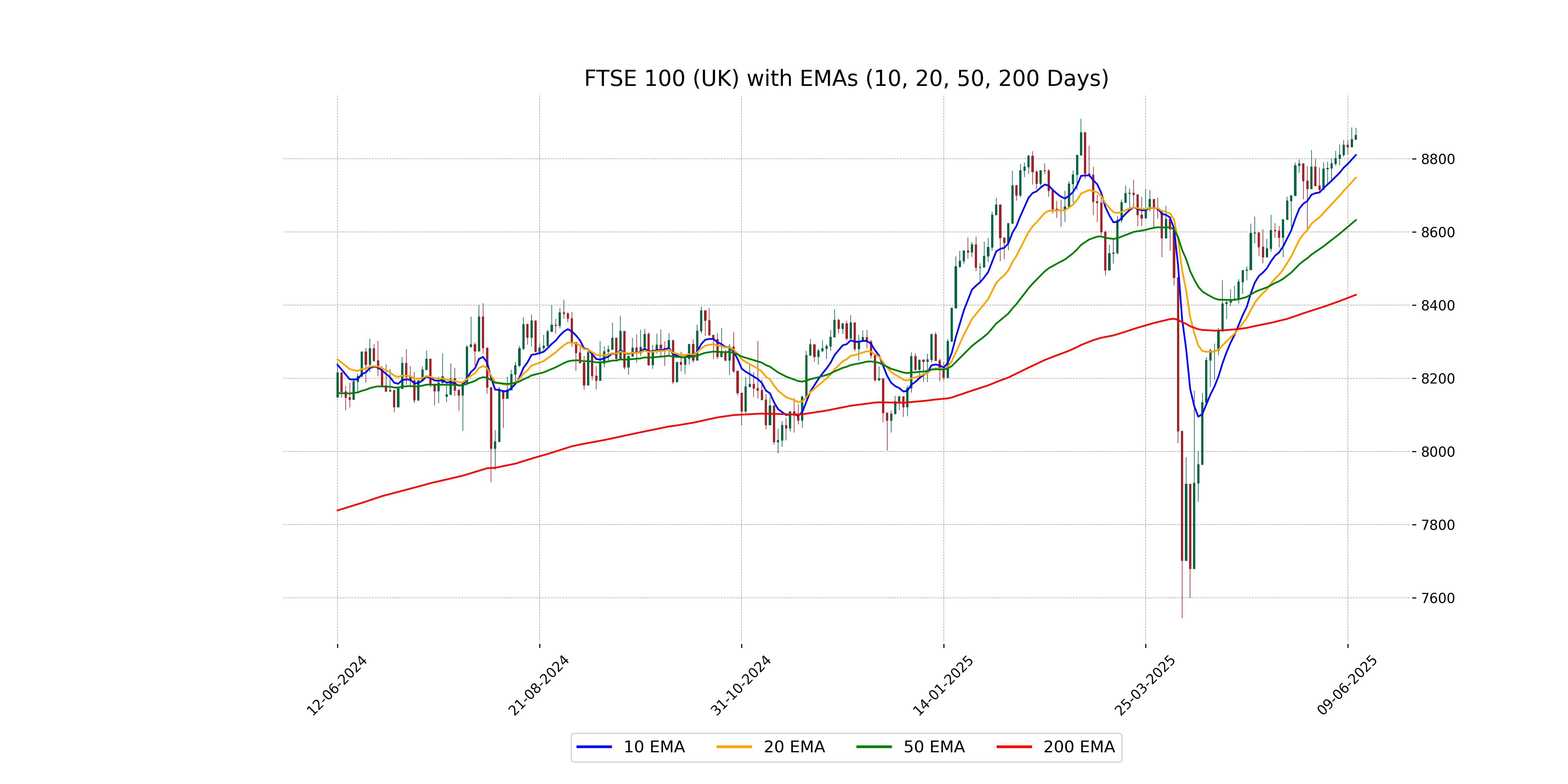

Analysis for FTSE 100 (UK) - June 11, 2025

FTSE 100 (UK) opened at 8853.08 and closed at 8864.15, marking a 0.12% increase compared to the previous close, with a points change of 11.05. The RSI is at 69.16, indicating the index is nearing overbought levels, while the MACD slightly exceeds the signal line, hinting at positive momentum.

Relationship with Key Moving Averages

FTSE 100 is currently trading above its key moving averages, indicating a bullish trend. The latest close of 8864.15 is above the 10-day EMA of 8810.28, the 50-day EMA of 8632.55, and the 200-day EMA of 8428.29, suggesting positive momentum.

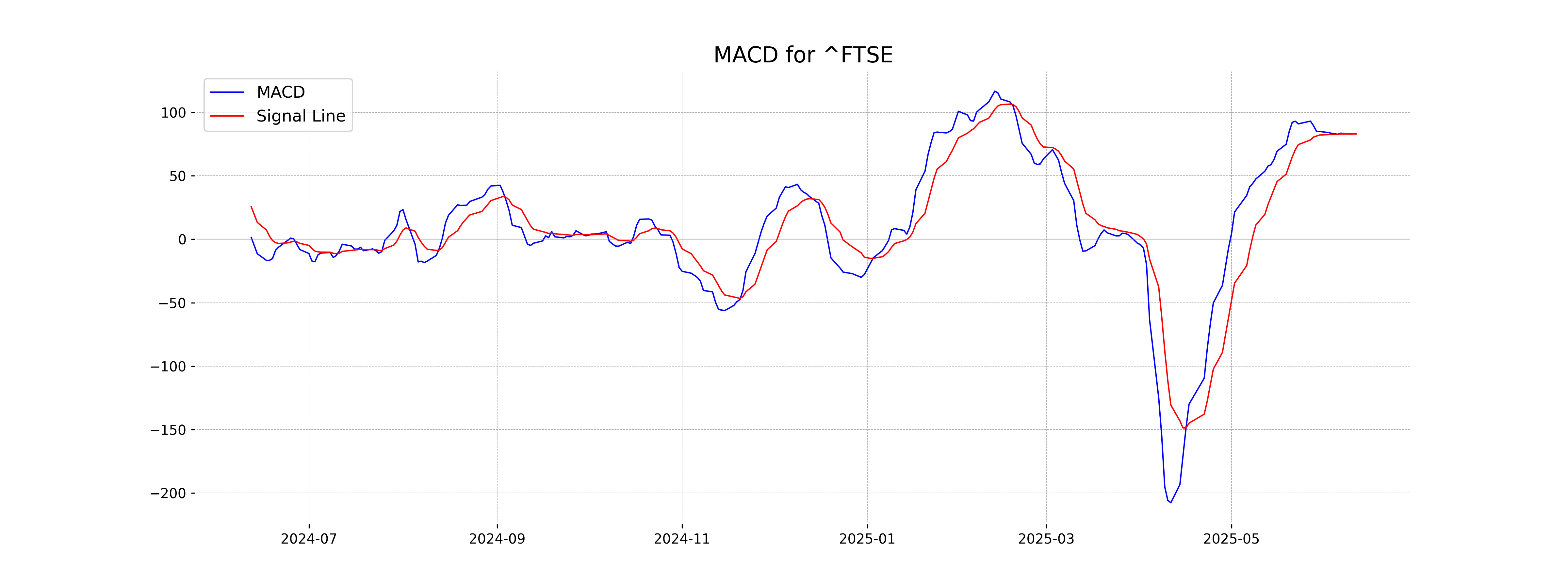

Moving Averages Trend (MACD)

The MACD for FTSE 100 is slightly above the MACD Signal (83.10 vs. 82.98), indicating a bullish momentum. This suggests that the price may continue to rise if the trend persists.

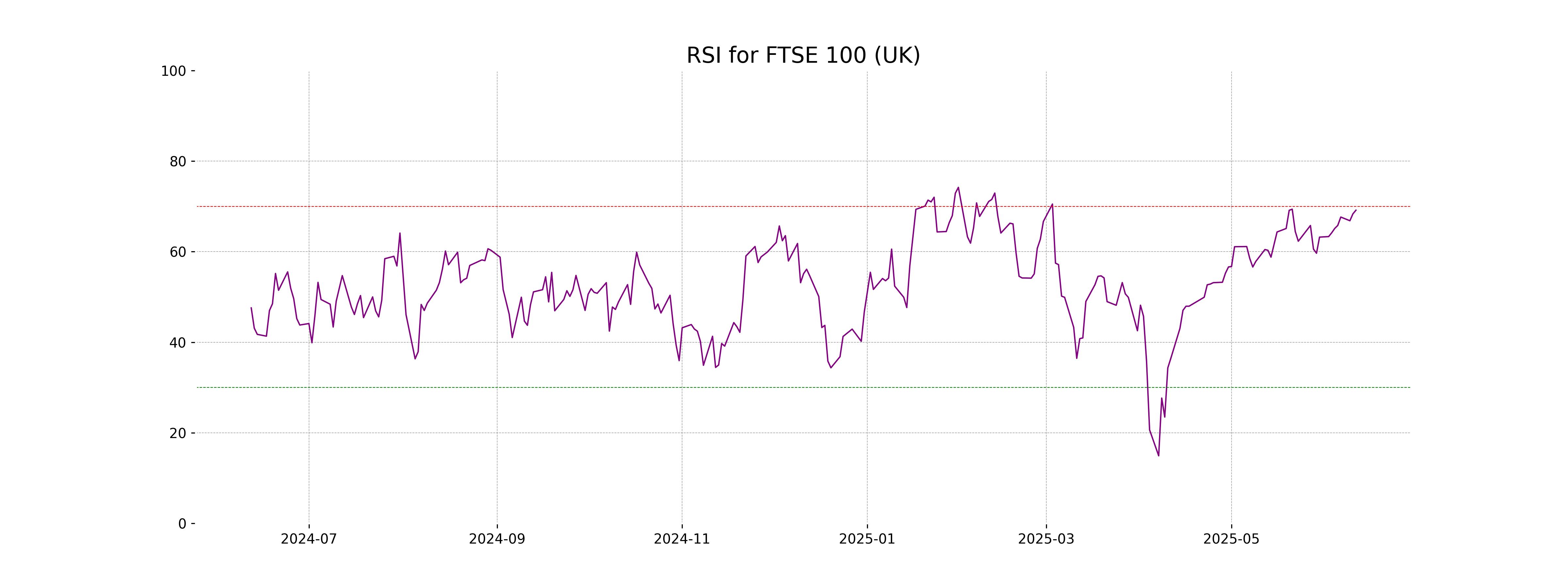

RSI Analysis

The RSI for FTSE 100 is 69.16, indicating it is approaching overbought territory. This suggests that the index might be subject to a potential pullback if the RSI continues to rise.

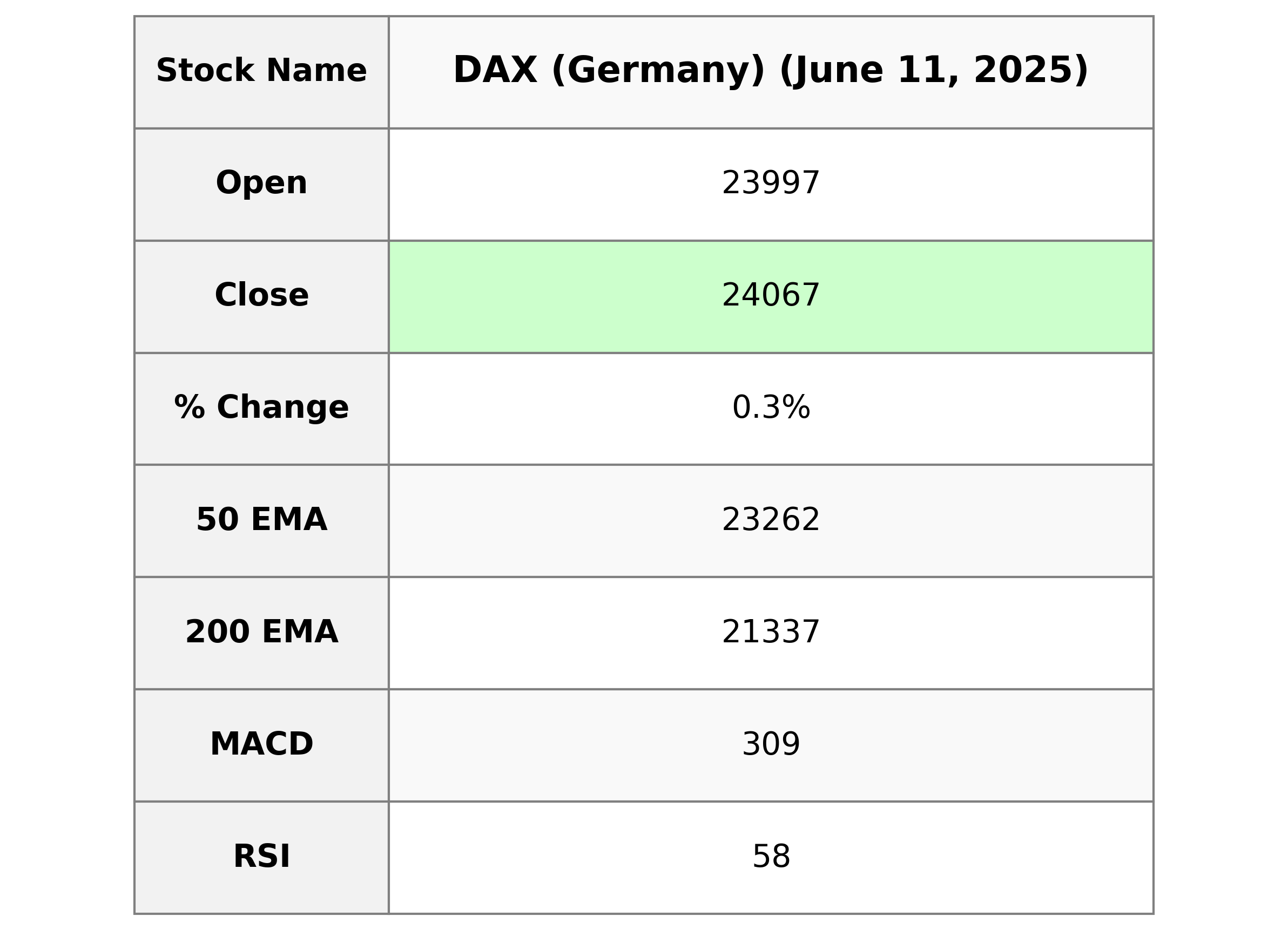

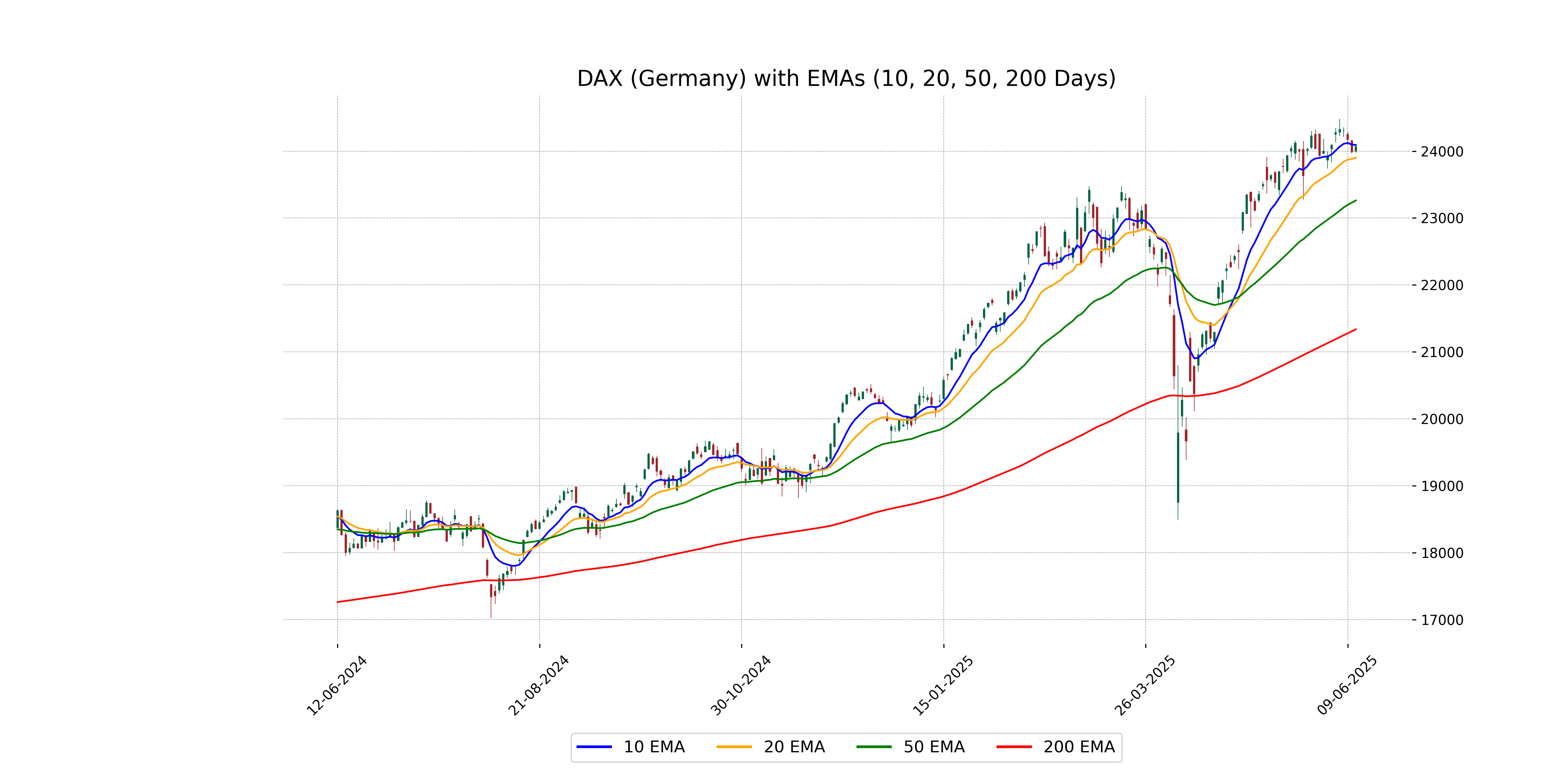

Analysis for DAX (Germany) - June 11, 2025

The DAX (Germany) showed a slight gain as evidenced by a 0.33% increase, closing at 24067.03, which is 79.47 points higher than the previous close. The RSI indicates moderate strength at 58.16, with the MACD below the MACD Signal suggesting a potential weakening trend.

Relationship with Key Moving Averages

The DAX (Germany) closed at 24067.03, slightly below its 10-day EMA of 24091.67, indicating short-term pressure, but it remains above both the 50-day EMA of 23262.22 and the 200-day EMA of 21337.47, suggesting a generally strong bullish trend when considering longer time frames.

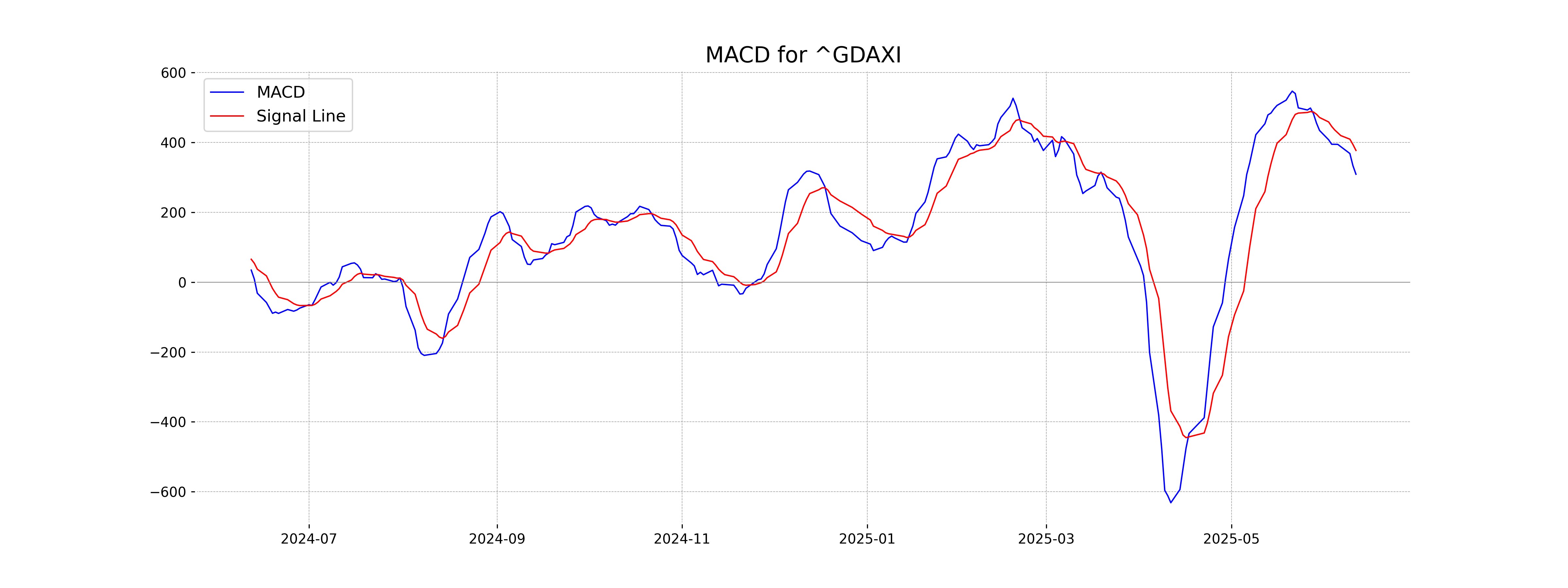

Moving Averages Trend (MACD)

The MACD for DAX is 309.08, which is below the MACD Signal of 377.27. This suggests a potential bearish sentiment, as the MACD line crossing below the signal line can indicate a possible downward momentum. However, further analysis and confirmation with other indicators are recommended for more precise insights.

RSI Analysis

The Relative Strength Index (RSI) for DAX (Germany) is 58.16, indicating a moderately bullish momentum. An RSI between 50 and 70 suggests that the index is gaining strength but hasn't reached overbought conditions yet.

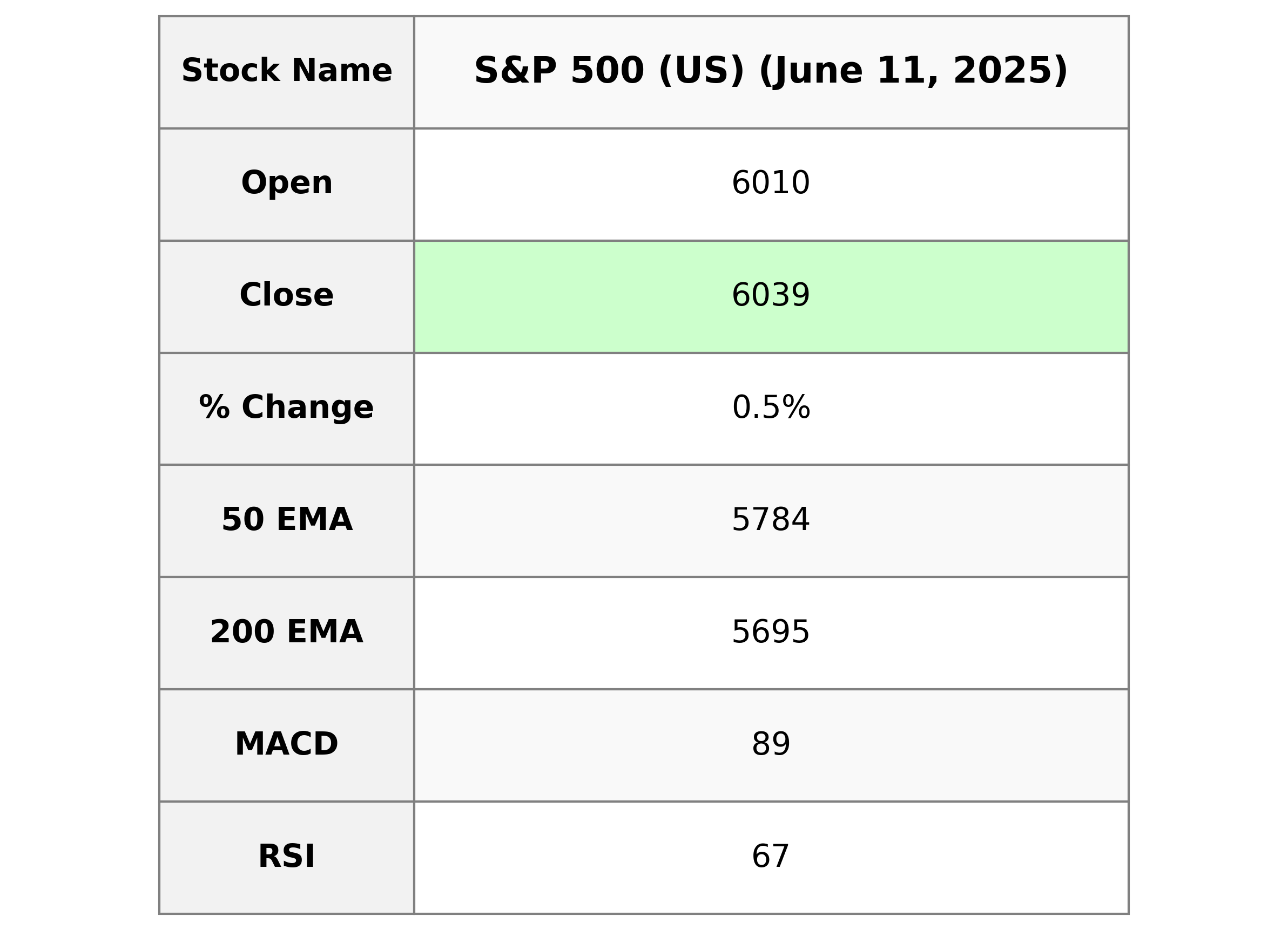

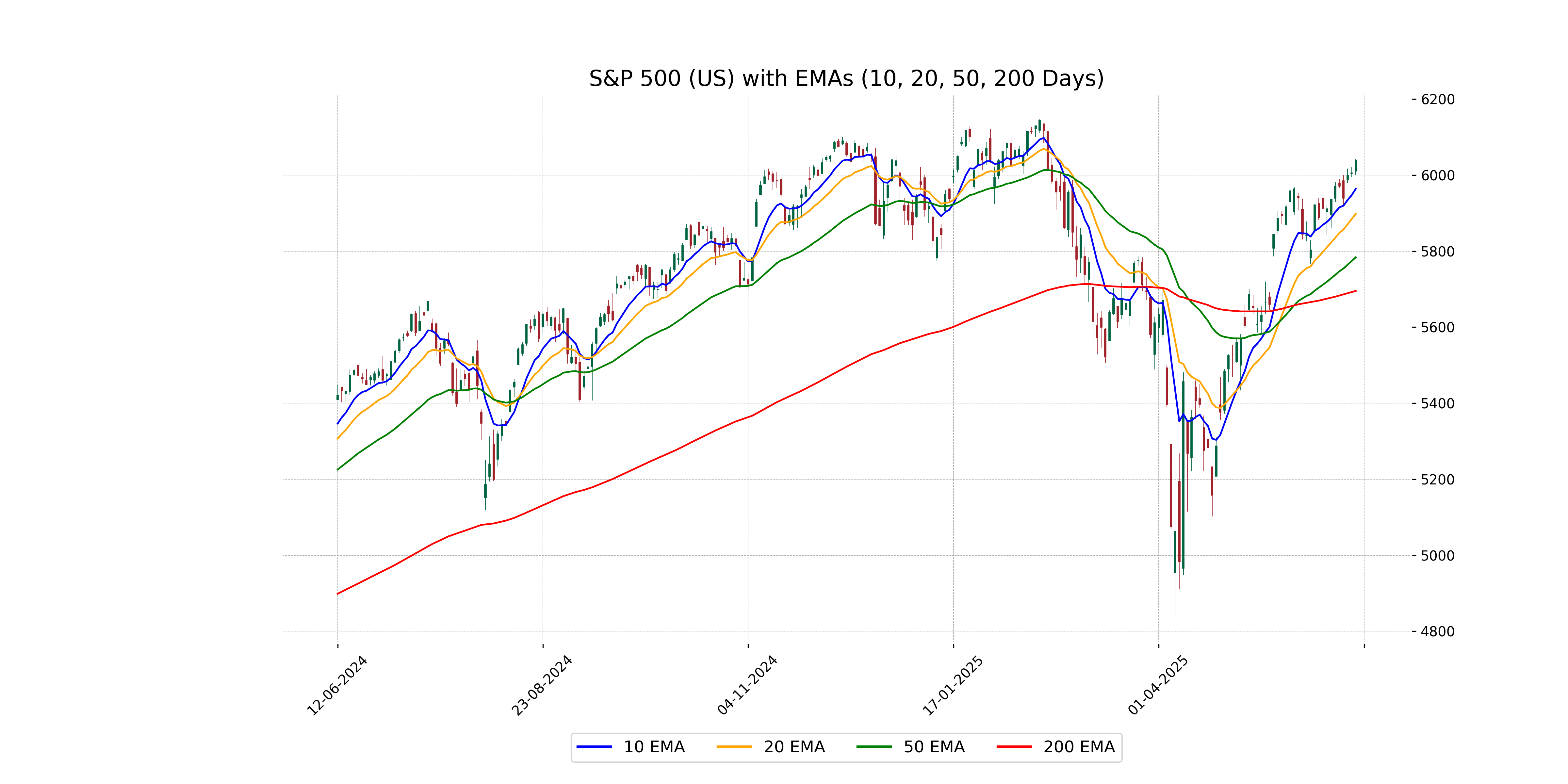

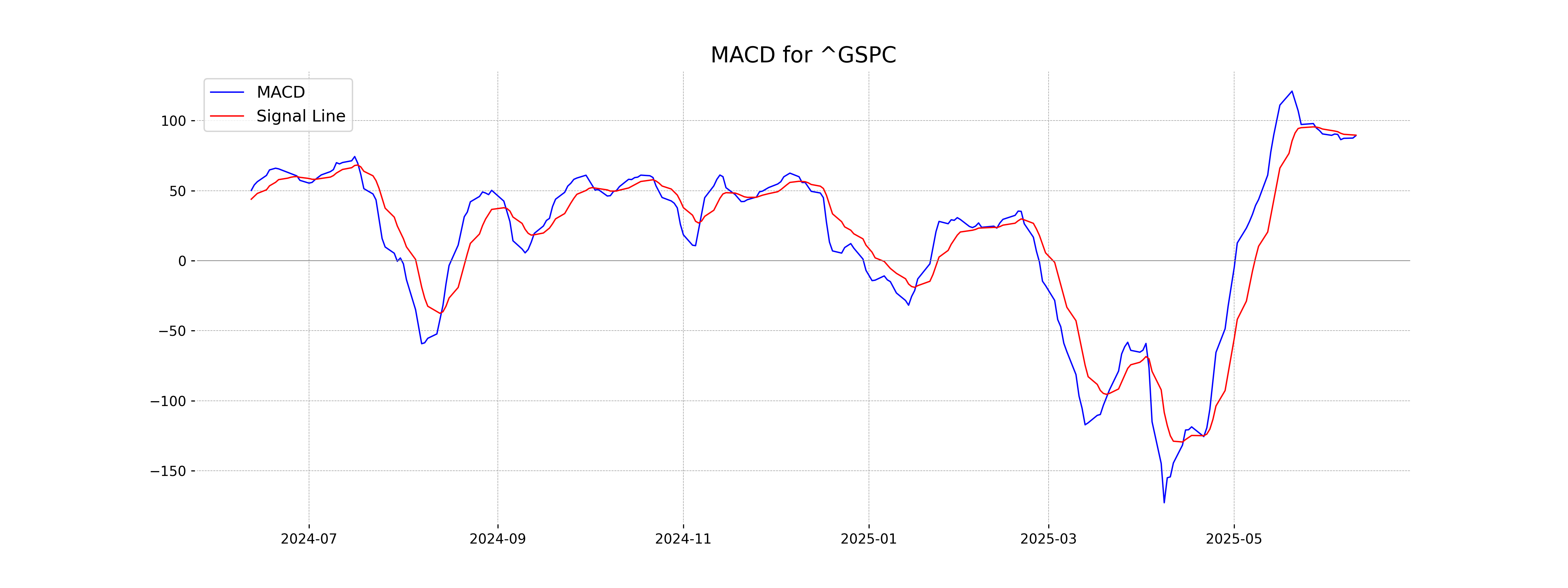

Analysis for S&P 500 (US) - June 11, 2025

The S&P 500 (US) opened at 6009.91, with a high of 6043.01 and a close of 6038.81. The index saw a positive percent change of 0.55% with a points increase of 32.93 from the previous close of 6005.88. Its RSI stands at 67.50, indicating relatively strong buying interest.

Relationship with Key Moving Averages

The S&P 500 is trading above its key moving averages: the 50-day EMA (5783.83) and the 200-day EMA (5695.30), indicating a bullish trend. Additionally, it is above the 10-day EMA (5963.89) and the 20-day EMA (5898.08), suggesting a recent upward momentum.

Moving Averages Trend (MACD)

The MACD for the S&P 500 is slightly below its signal line, with a MACD value of 89.35 compared to a MACD Signal of 89.65. This indicates a potential bearish momentum as the MACD line is turning downward.

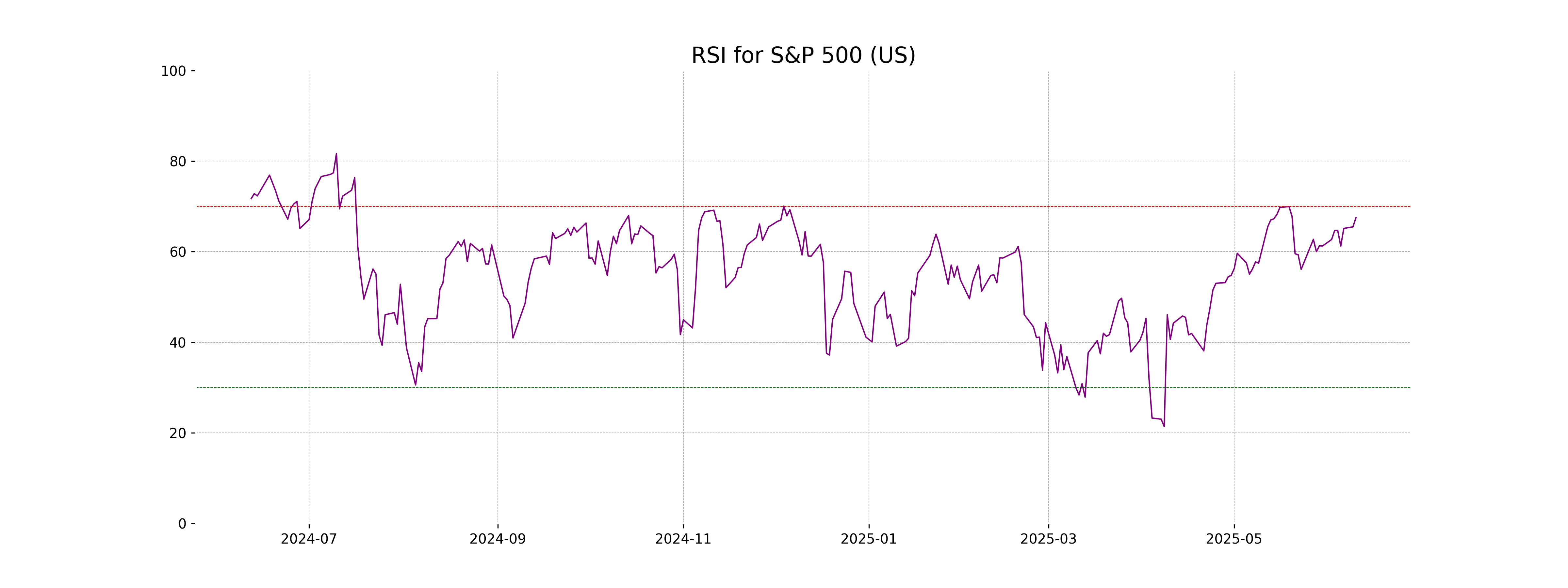

RSI Analysis

The Relative Strength Index (RSI) for S&P 500 (US) is 67.50, indicating that the stock is approaching overbought territory. An RSI above 70 typically signals overbought conditions, suggesting potential for a price correction if the trend persists.

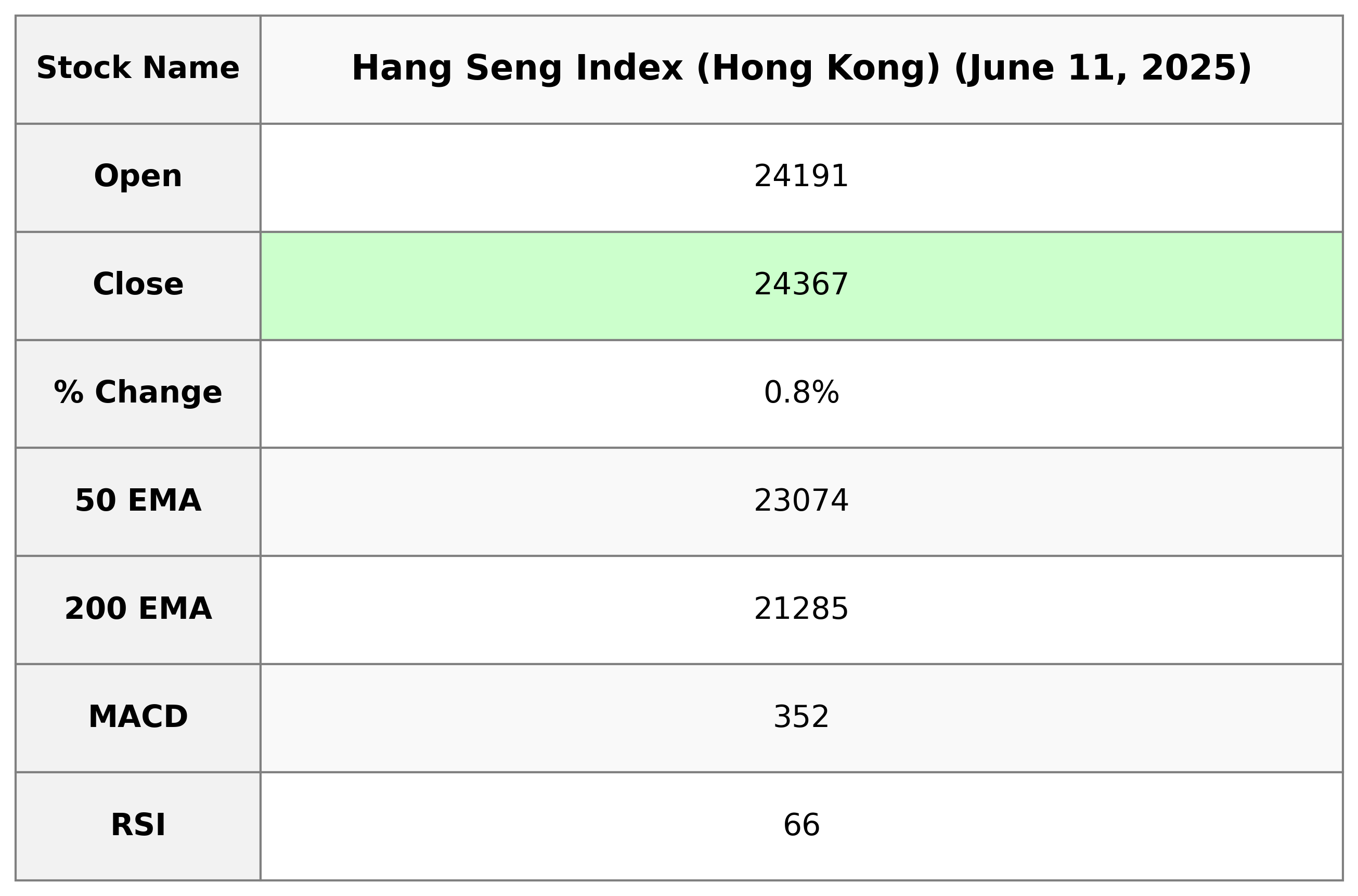

Analysis for Hang Seng Index (Hong Kong) - June 11, 2025

The Hang Seng Index (Hong Kong) opened at 24,191.32 and closed at 24,366.94, marking an increase of approximately 0.84%. It saw a high of 24,439.35 and a low of 24,179.35 during the trading session. The index displayed a positive momentum with a points change of 204.07, indicative of bullish sentiment, supported by a MACD greater than its signal and an RSI of 66.07, suggesting the index is nearing overbought levels.

Relationship with Key Moving Averages

The closing price of the Hang Seng Index is above key moving averages, with the close at 24366.94 compared to the 50 EMA of 23074.42, 200 EMA of 21285.42, 10 EMA of 23872.71, and 20 EMA of 23589.46. This suggests a bullish trend.

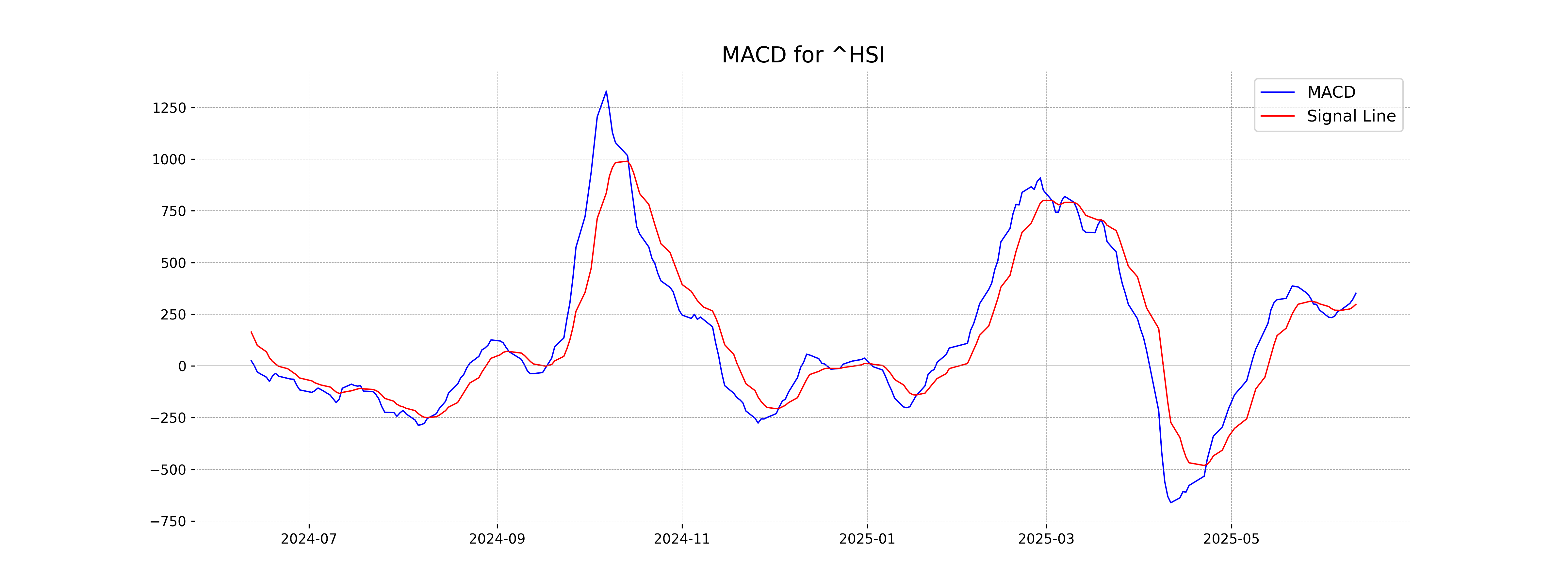

Moving Averages Trend (MACD)

The MACD value for the Hang Seng Index is 351.69, with a signal line of 298.17. This suggests a bullish momentum as the MACD line is above the signal line, which could indicate potential upward movement in the stock price.

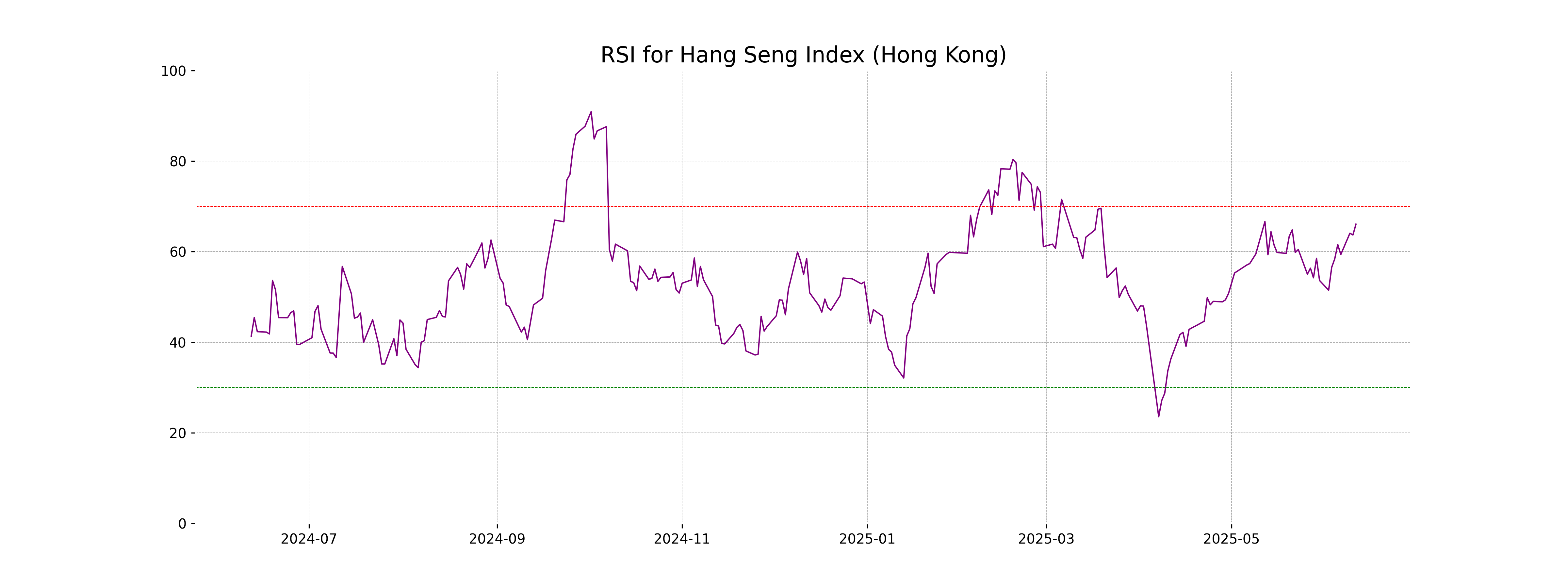

RSI Analysis

The RSI value for the Hang Seng Index is 66.07, which indicates that the index is approaching the overbought territory. An RSI above 70 typically suggests that a stock or index may be overvalued and a reversal or pullback could be imminent, while a value below 30 suggests it may be undervalued. Currently, 66.07 suggests bullish momentum but is nearing overbought levels.

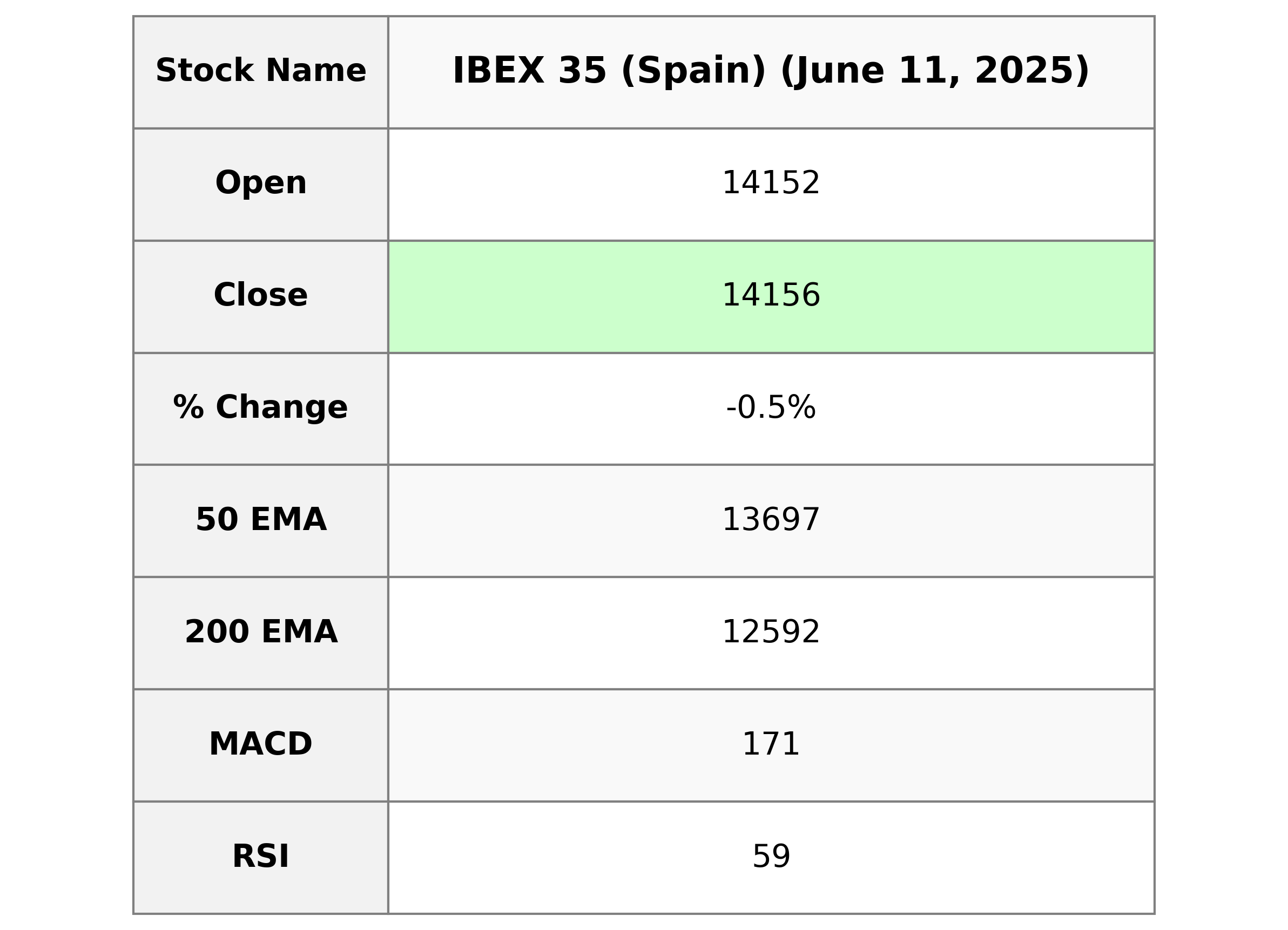

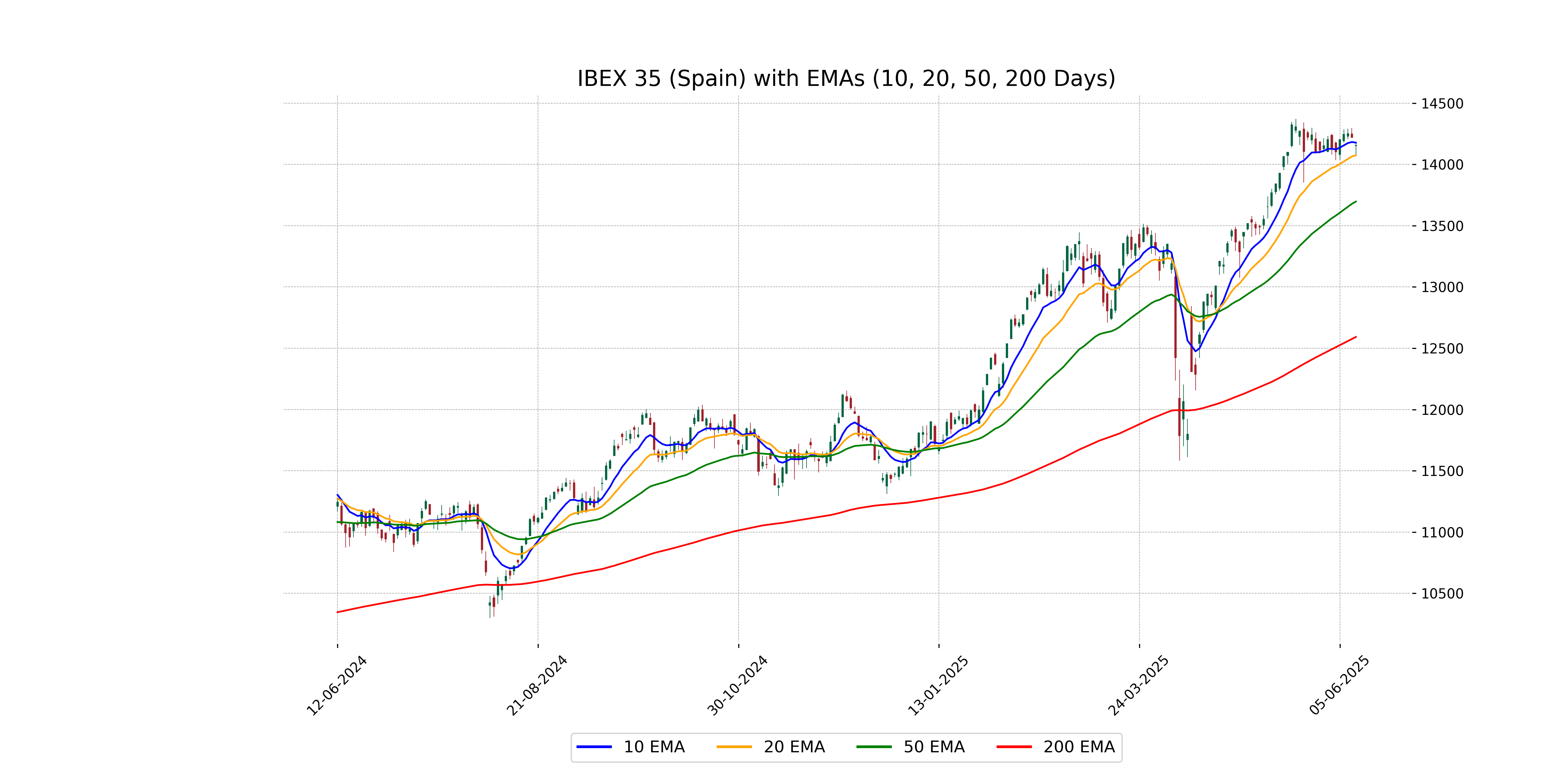

Analysis for IBEX 35 (Spain) - June 11, 2025

The IBEX 35 index opened at 14,152 and closed slightly lower at 14,156, which is a decrease of approximately 0.46% or 65.1 points from the previous close. The RSI value is 59.08, indicating a moderately strong trend, while the MACD suggests bearish momentum as it is below the MACD signal line. Trading volume was around 24,082,740 shares.

Relationship with Key Moving Averages

IBEX 35 opened and closed above its 50-day EMA of 13,697.16, indicating a potentially bullish short-term trend. However, the close was slightly below the 10-day EMA of 14,178.13, which might suggest a short-term resistance. The index also remained well above the longer-term 200-day EMA of 12,592.05, confirming a positive long-term trend.

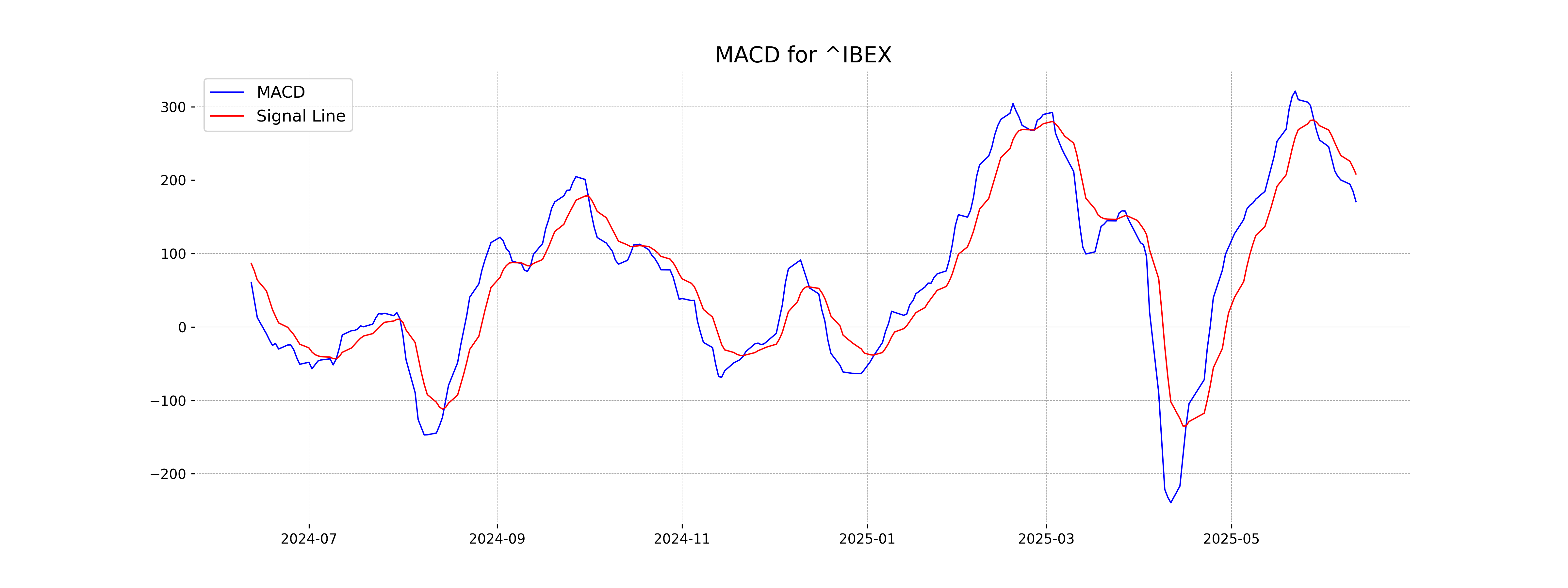

Moving Averages Trend (MACD)

The MACD value for IBEX 35 is 170.80, which is below its MACD Signal line of 208.26, suggesting a potential bearish indication. This could mean the index might experience downward momentum in the short term.

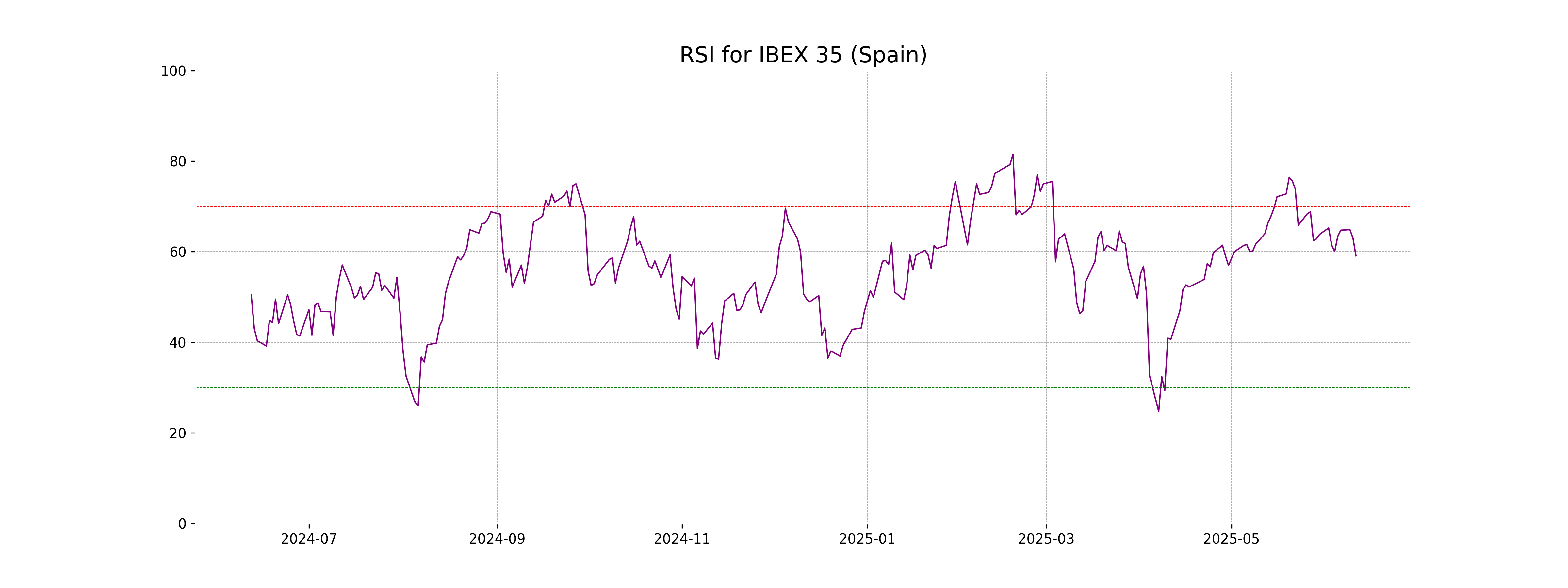

RSI Analysis

The IBEX 35 index currently has an RSI of 59.08, which suggests it is near the neutral zone but tending towards being overbought. This level does not indicate an immediate strong buy or sell signal but suggests watching for overbought conditions as it approaches higher RSI values.

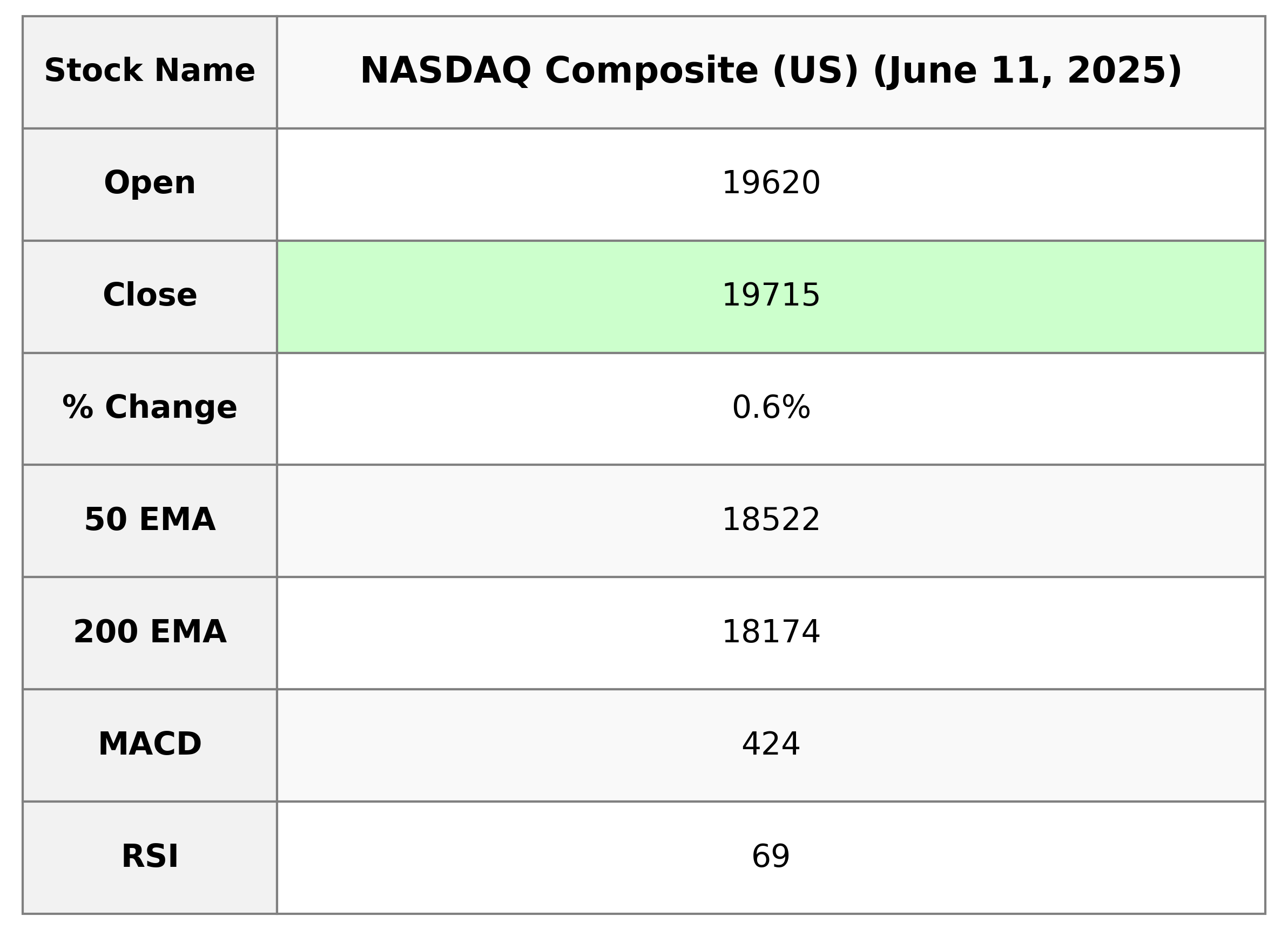

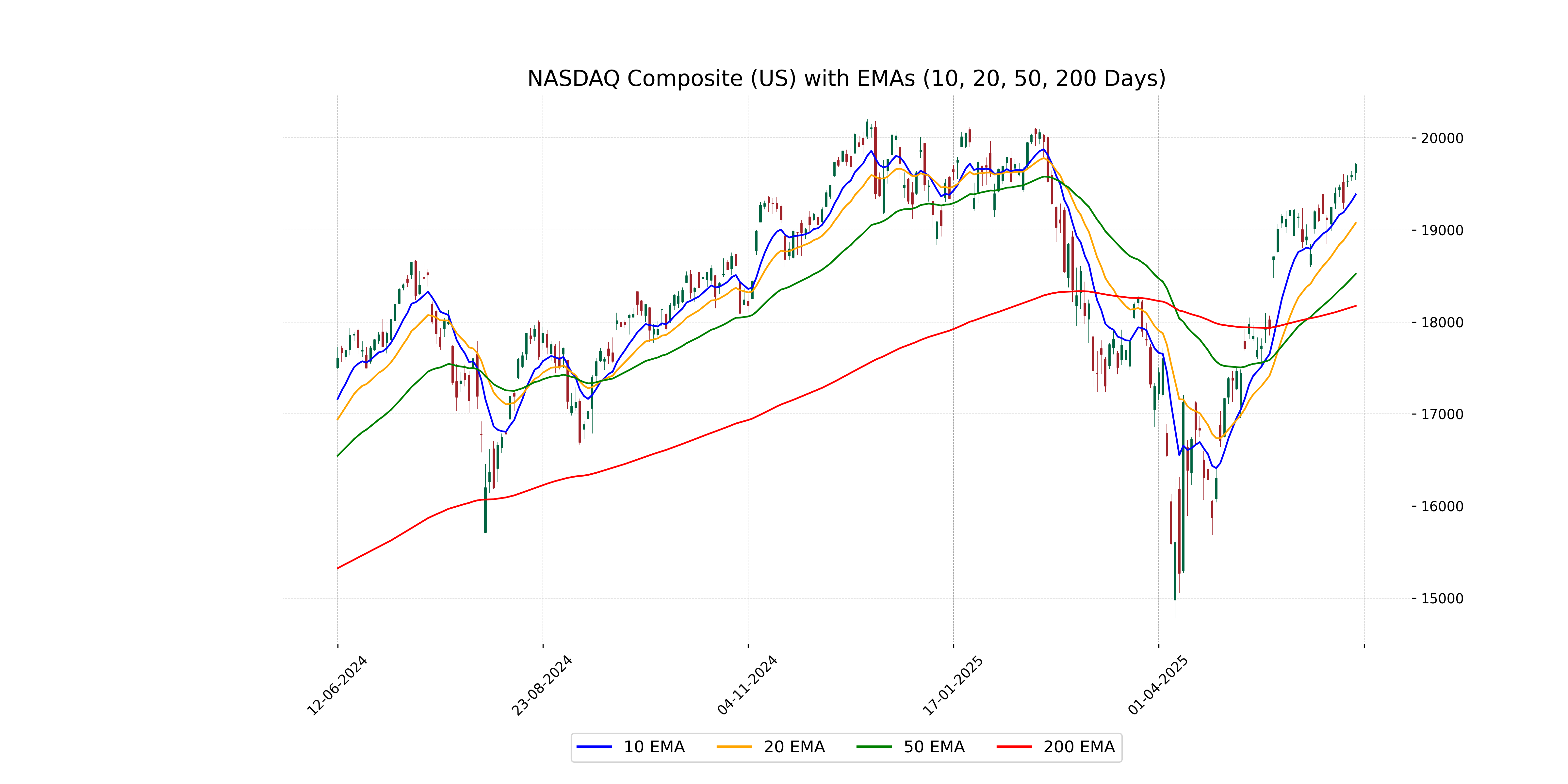

Analysis for NASDAQ Composite (US) - June 11, 2025

NASDAQ Composite (US) Performance: The NASDAQ Composite saw a positive movement with a % change of 0.63%, closing at 19,714.99 after an increase of 123.75 points from the previous close. The volume of shares traded was 11,221,560,000, indicating strong investor activity. The relative strength index (RSI) is at 69.11, suggesting the index is nearing an overbought condition.

Relationship with Key Moving Averages

The NASDAQ Composite shows a strong upward momentum, as its current close of 19,714.99 is above the 10 EMA, 20 EMA, 50 EMA, and 200 EMA, all indicating a potential continuation of the bullish trend. Additionally, with an RSI of 69.11, the index is nearing overbought conditions, suggesting caution.

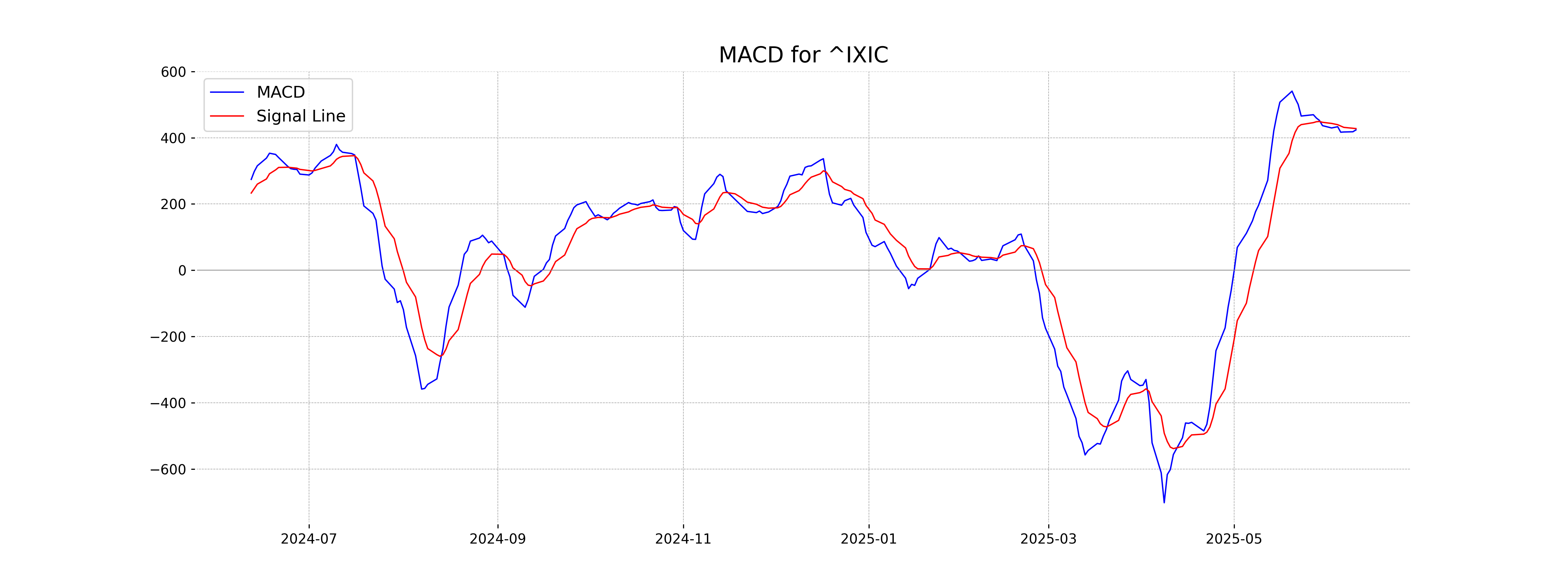

Moving Averages Trend (MACD)

For the NASDAQ Composite (US), the MACD is 423.63, which is slightly below the MACD Signal of 427.58. This indicates a potential slowing of upward momentum. Monitoring upcoming price movements could provide further insight into the trend direction.

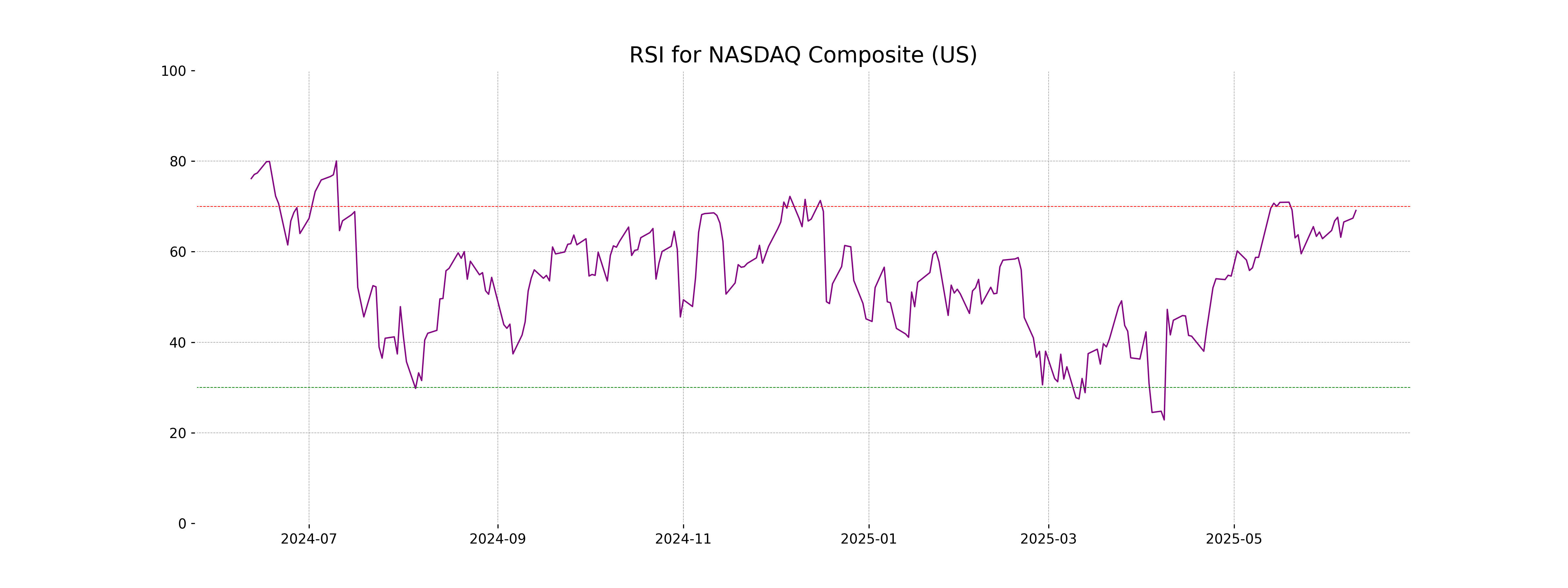

RSI Analysis

The NASDAQ Composite's RSI is 69.11, indicating that the index is close to being overbought, as RSI values above 70 often suggest overbought conditions. This could signal a potential pullback if the upward momentum slows.

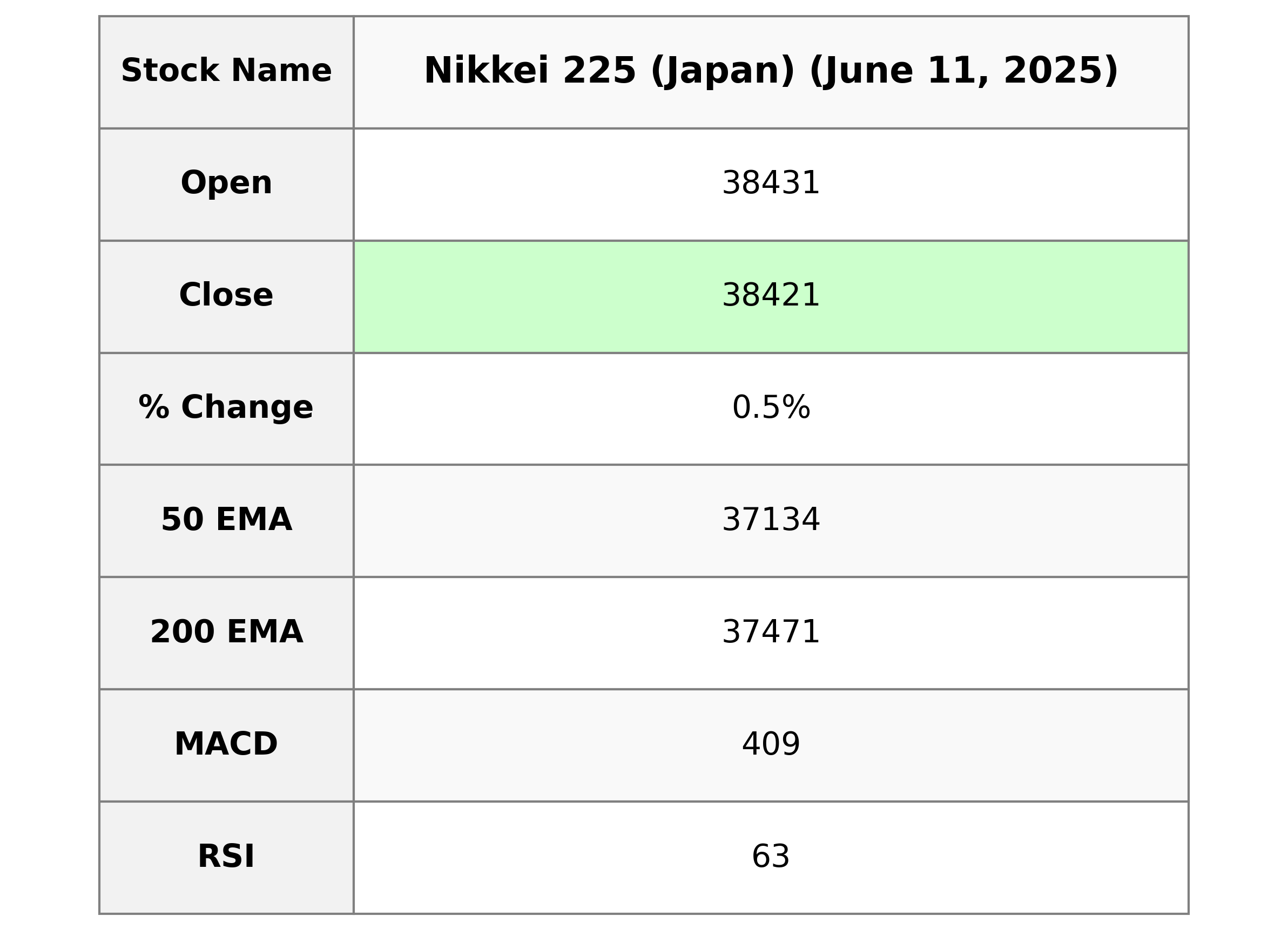

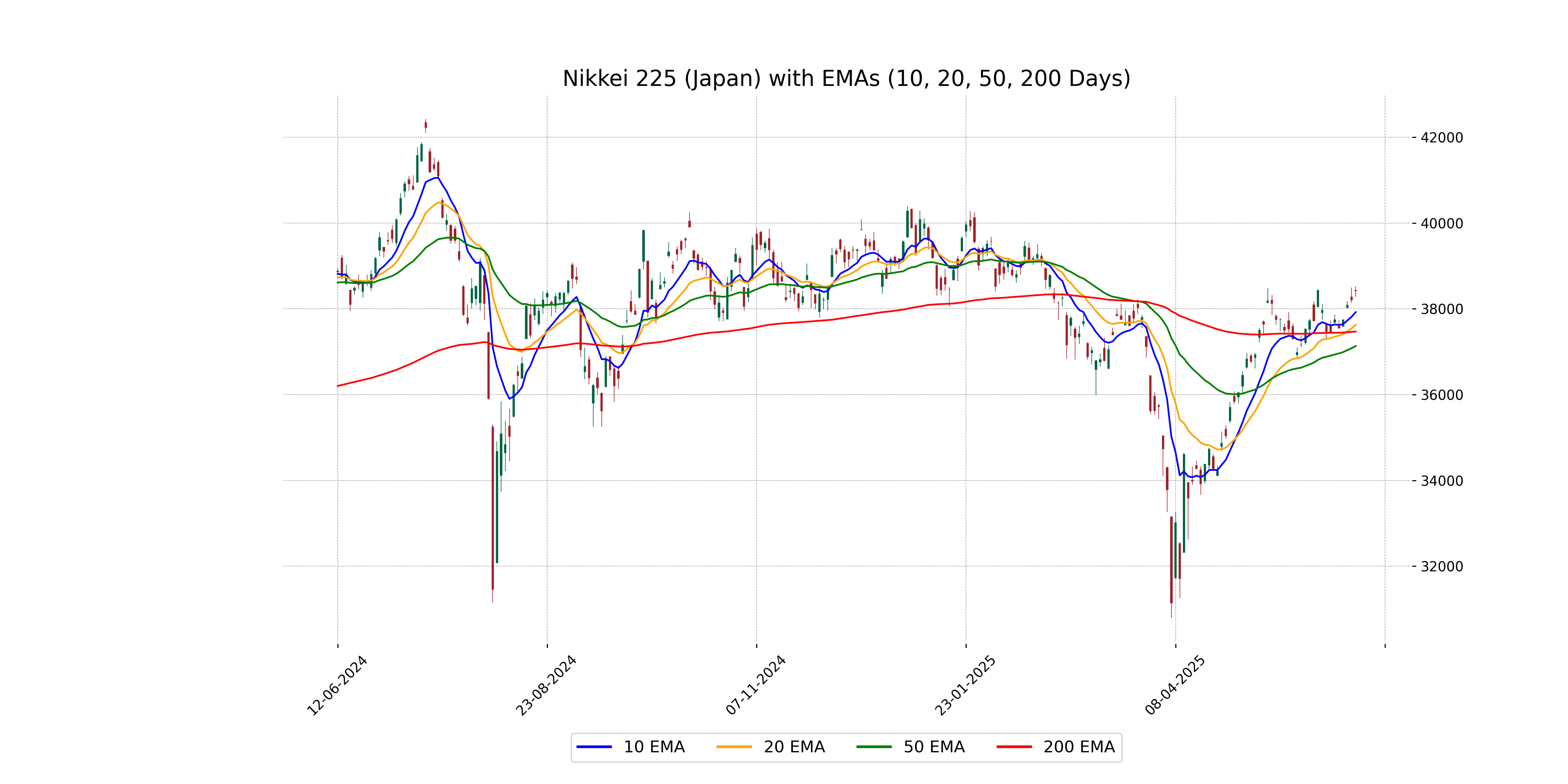

Analysis for Nikkei 225 (Japan) - June 11, 2025

Nikkei 225 (Japan) opened at 38431.10, reaching a high of 38529.64 and a low of 38288.28, before closing at 38421.19. The index experienced a percent change of 0.55% with a 209.68 points increase from the previous close of 38211.51. The RSI stands at 62.94, indicating a possibly overbought condition.

Relationship with Key Moving Averages

The Nikkei 225 is currently trading above its 10-day, 20-day, 50-day, and 200-day exponential moving averages, indicating a strong upward momentum. With a closing price of 38,421.19, it surpasses the 50 EMA (37,133.52) and 200 EMA (37,471.02), suggesting strong bullish sentiments in the market.

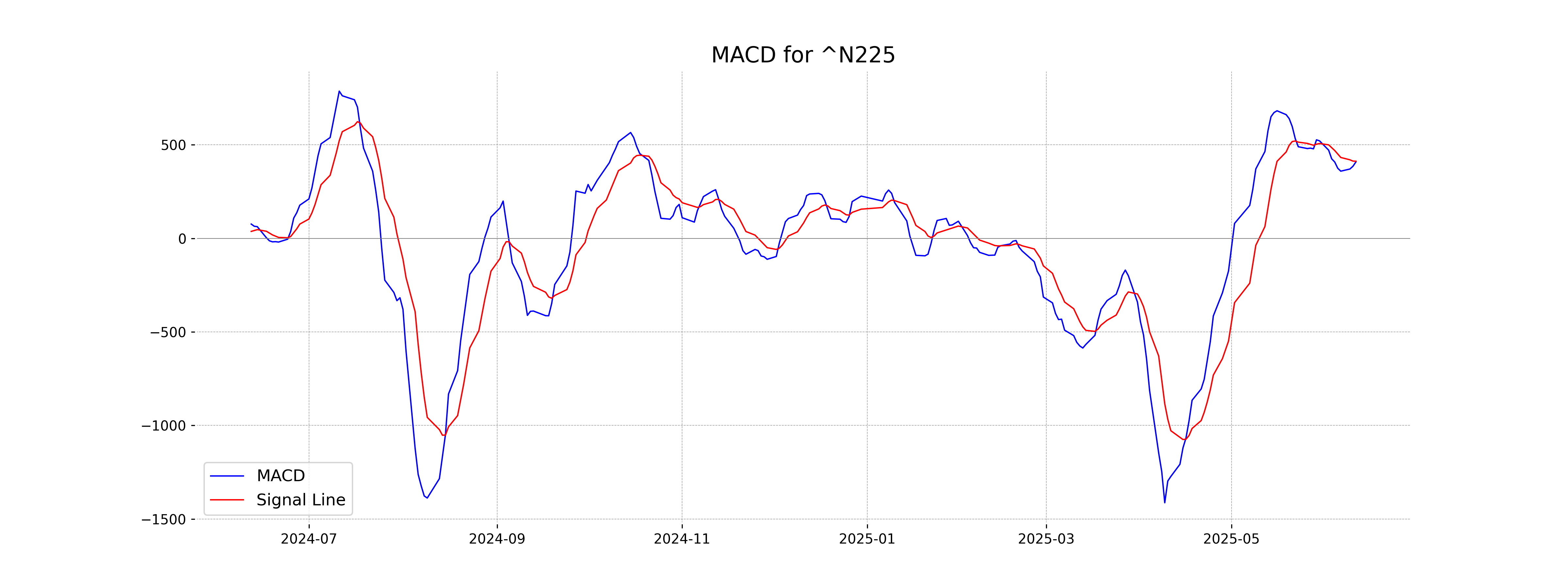

Moving Averages Trend (MACD)

The MACD value of 408.80 compared to the MACD Signal of 412.13 for Nikkei 225 indicates that it may be in a slightly bearish phase since the MACD is below the signal line. However, the difference is minimal, suggesting potential consolidation or a pending reversal.

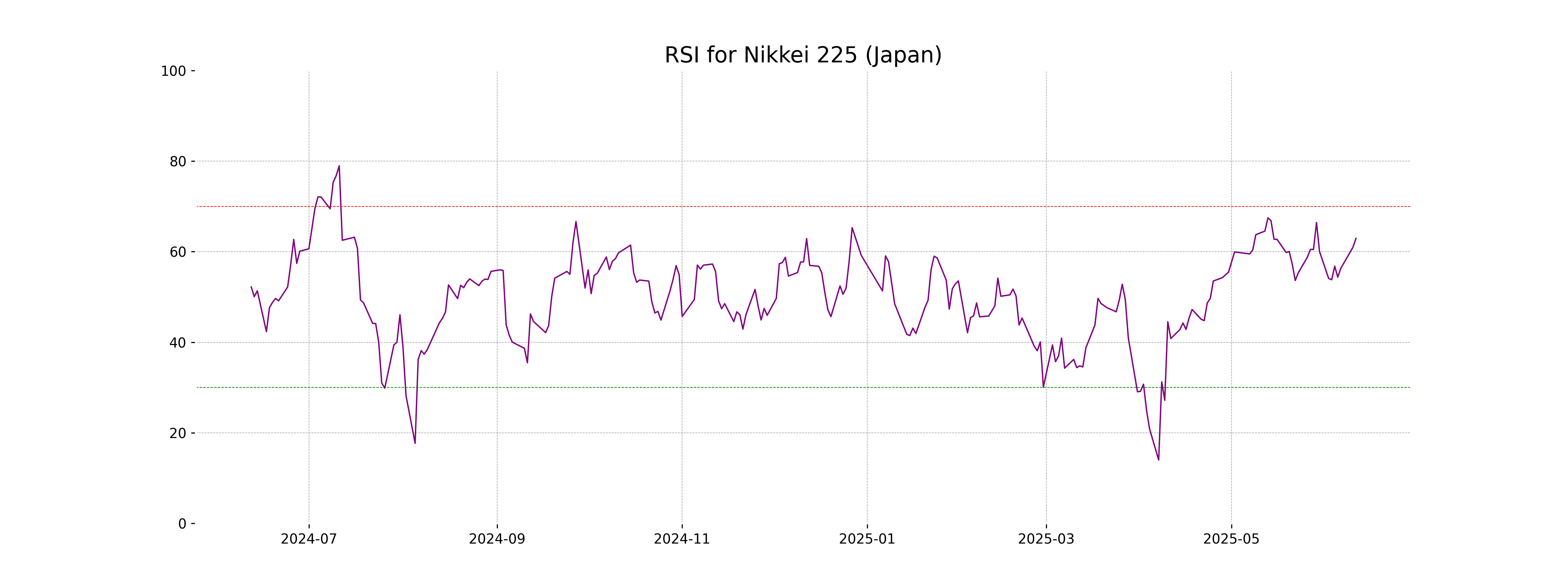

RSI Analysis

The RSI for the Nikkei 225 is 62.94, which indicates that the index is nearing an overbought condition. With the RSI close to 70, there could be a potential for a price pullback if upward momentum weakens.

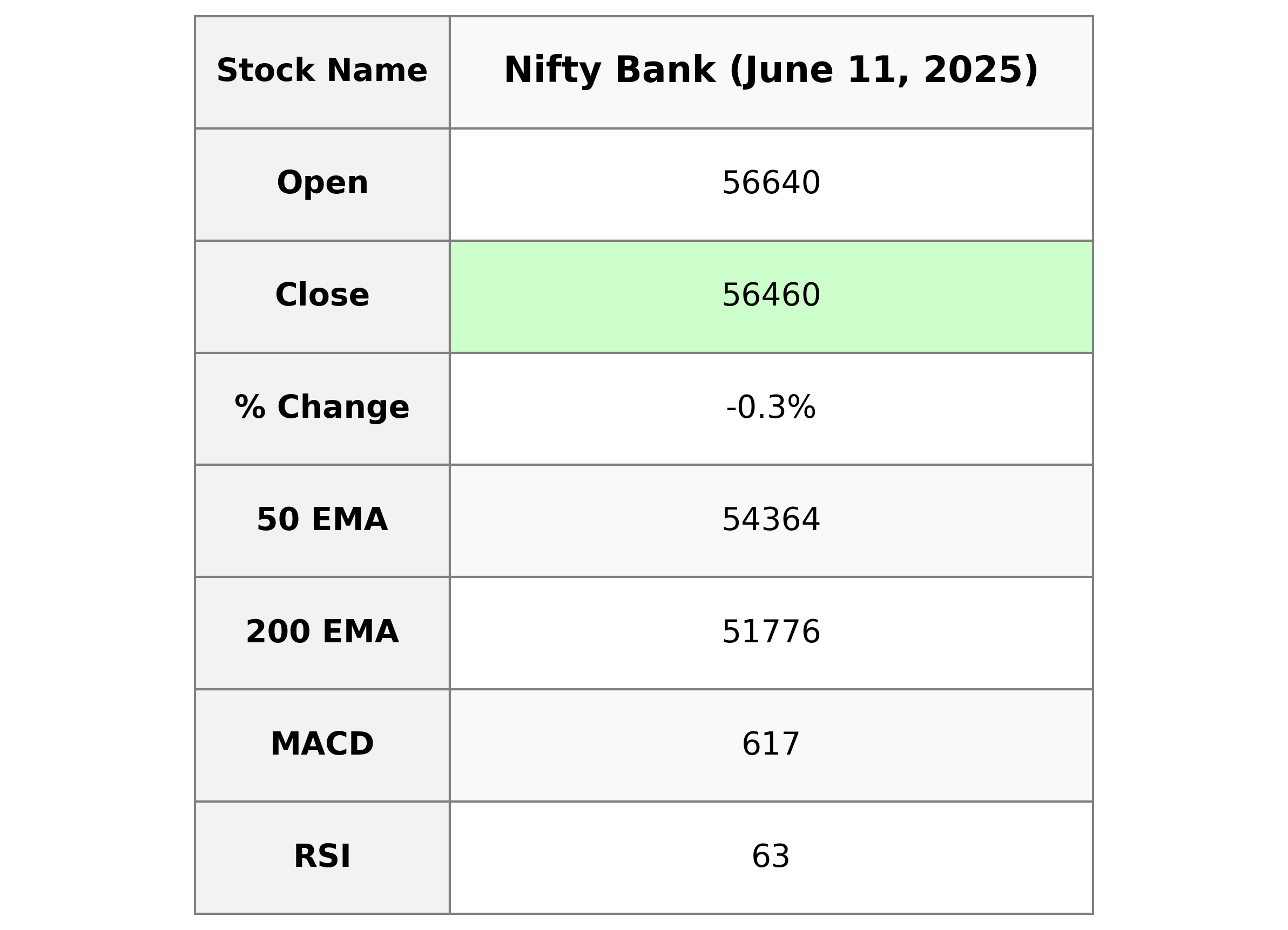

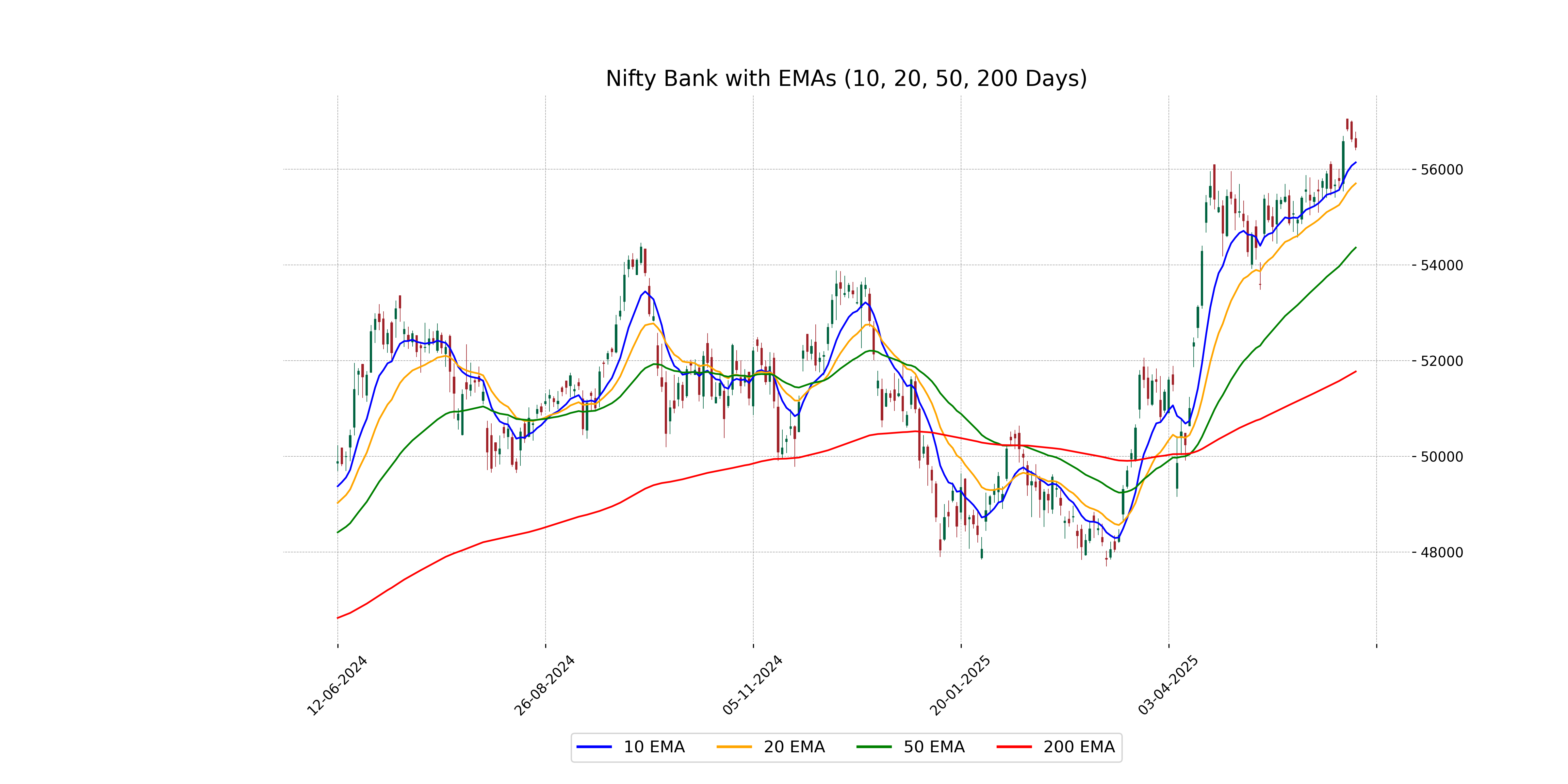

Analysis for Nifty Bank - June 11, 2025

The Nifty Bank index opened at 56,639.85 and closed at 56,459.75, showing a slight decline of 0.30% with a points change of -169.35. The index's RSI is 63.43, indicating a moderately strong trend, while its MACD value of 616.52 suggests a positive momentum compared to the MACD signal of 594.46.

Relationship with Key Moving Averages

The Nifty Bank index closed at 56,459.75, which is below its 10-day EMA of 56,143.55 but above its 50-day EMA of 54,363.51 and 200-day EMA of 51,775.61. This suggests short-term weakness while still maintaining an overall positive trend in the medium to long term.

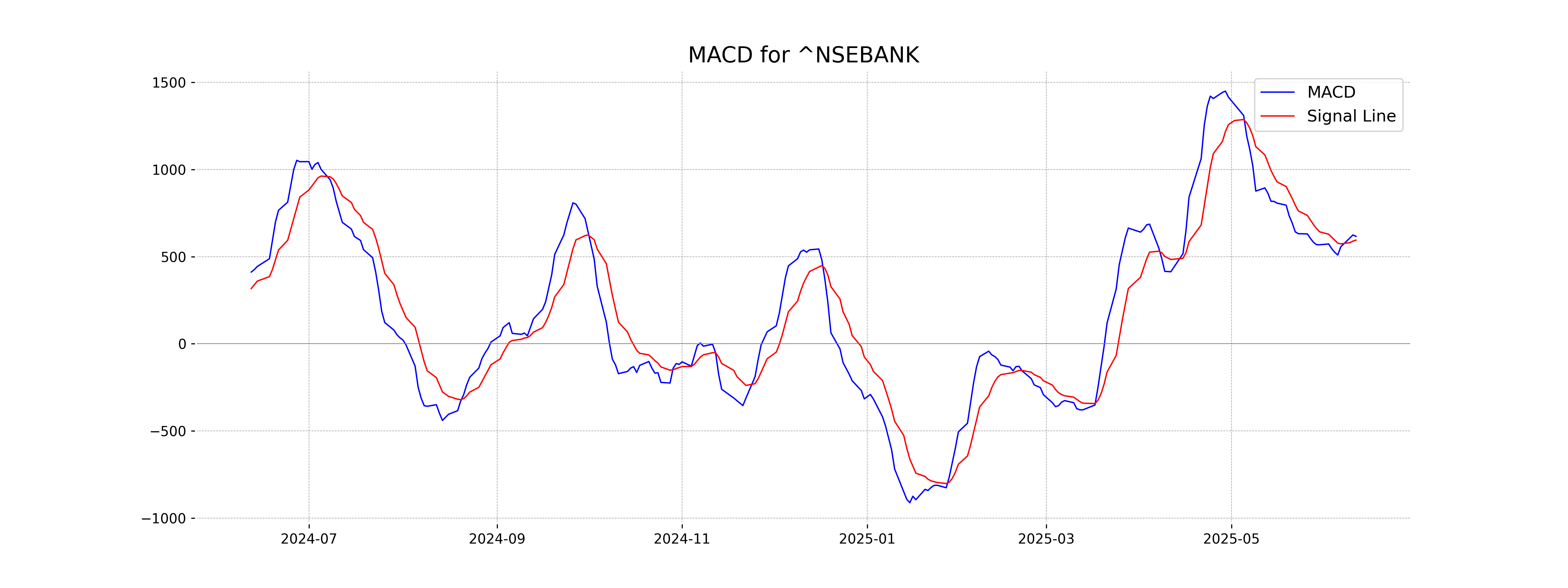

Moving Averages Trend (MACD)

The MACD for Nifty Bank is at 616.52, with a MACD Signal of 594.46, indicating a positive crossover. This suggests a bullish momentum, as the MACD line is above the Signal line.

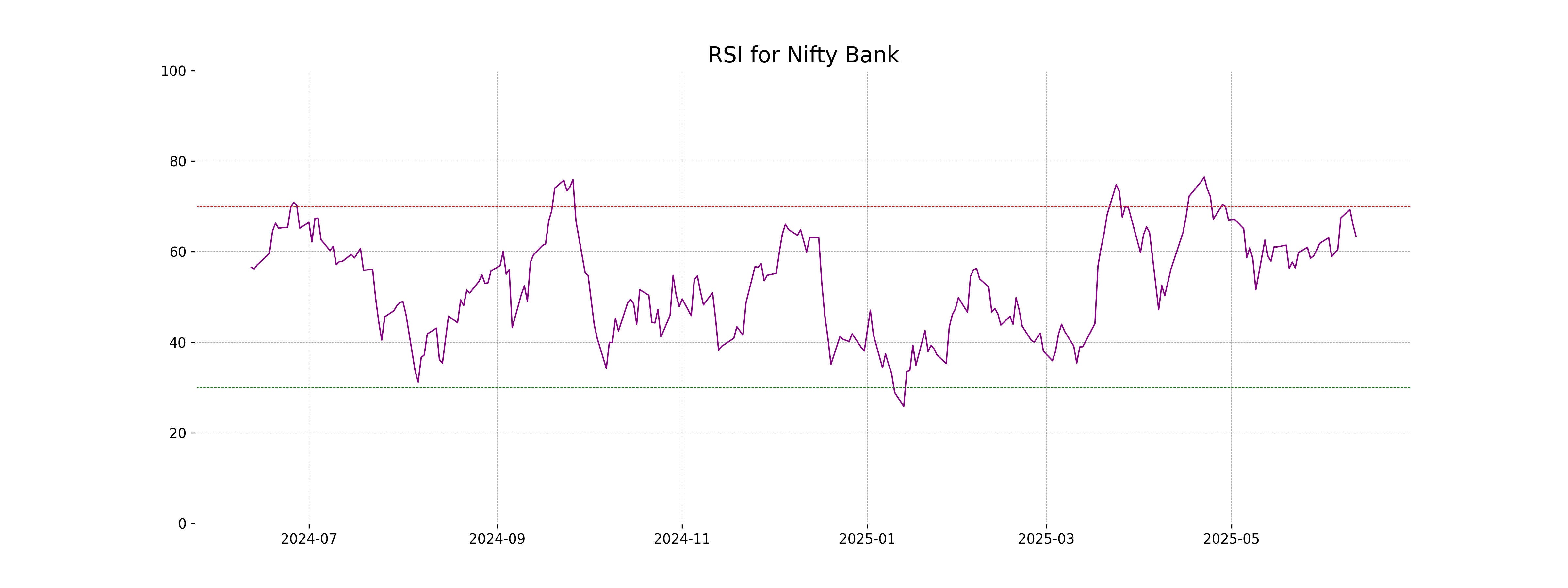

RSI Analysis

The Relative Strength Index (RSI) for Nifty Bank is 63.43, suggesting that the stock is closer to being overbought than oversold. While it is not in extreme levels, it indicates positive momentum but investors should monitor closely for any signs of reversal.

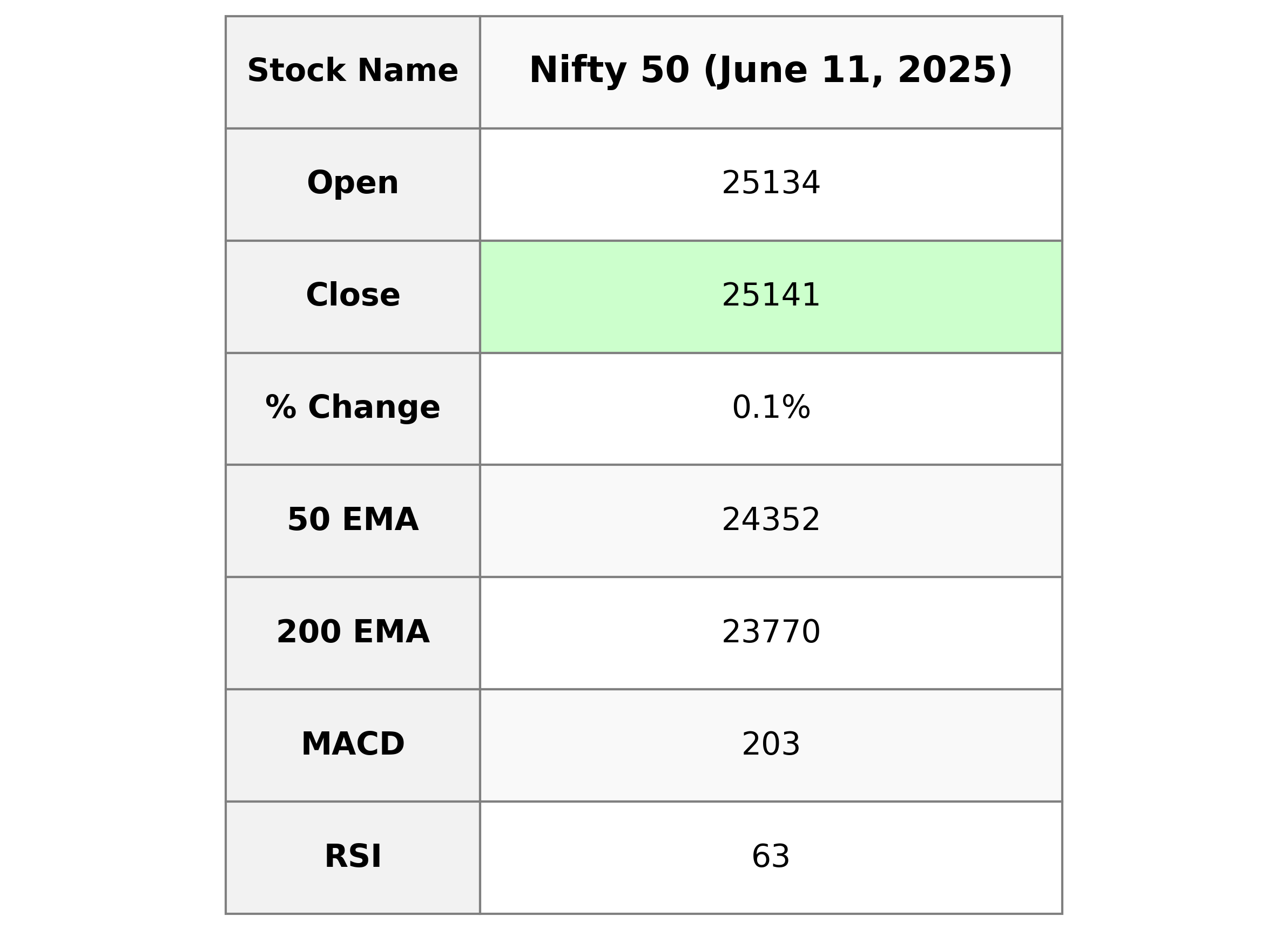

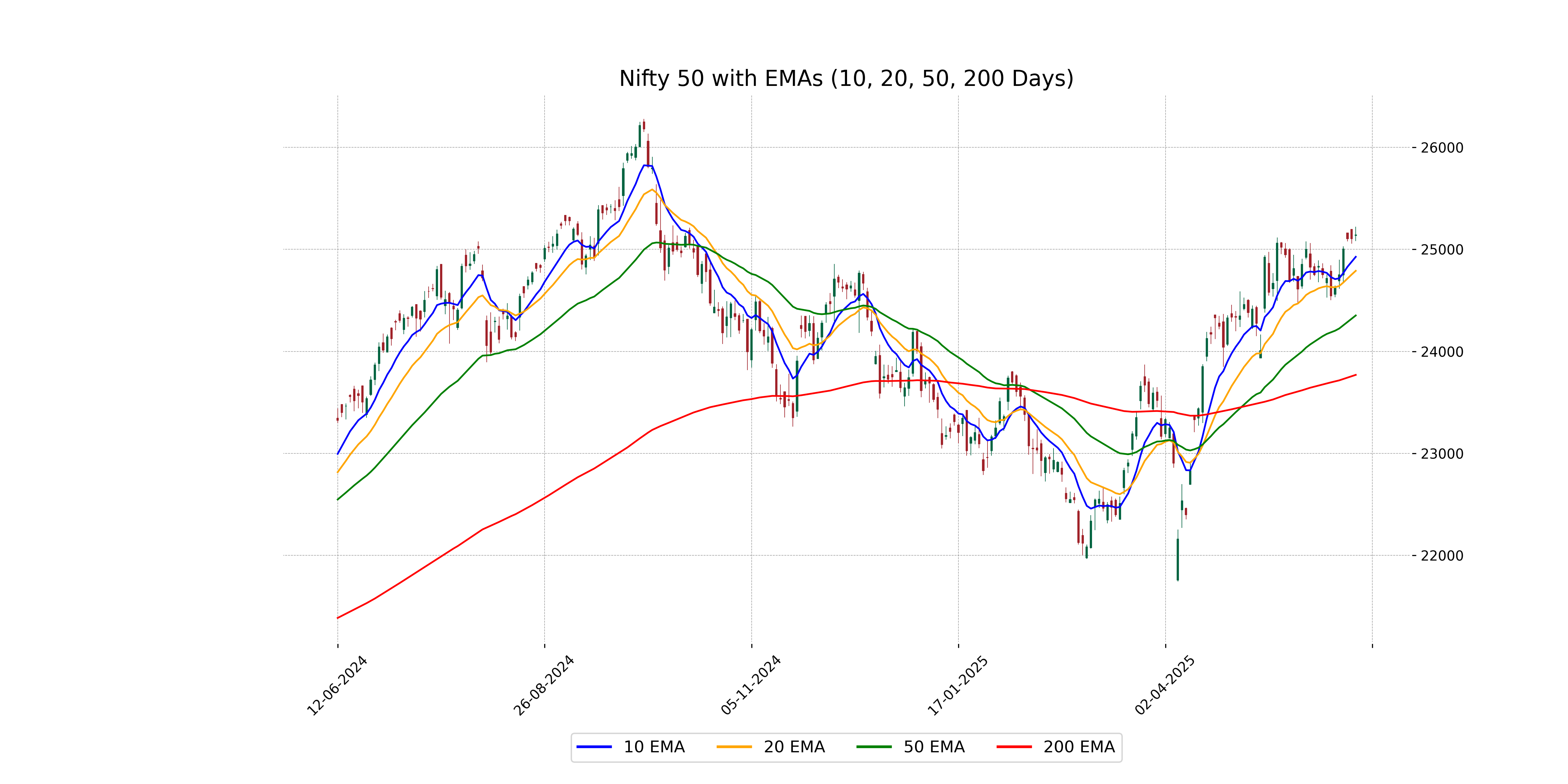

Analysis for Nifty 50 - June 11, 2025

Nifty 50 opened at 25,134.15, reached a high of 25,222.40, and closed at 25,141.40, marking a 0.15% increase from the previous close. The RSI indicates a moderately strong position at 62.54, and the MACD shows a slight negative divergence from its signal line.

Relationship with Key Moving Averages

The current close of Nifty 50 at 25,141.40 is above its 50 EMA of 24,352.03 and 200 EMA of 23,769.63, indicating a bullish trend. It is also slightly above the 10 EMA of 24,926.81 and 20 EMA of 24,789.68, suggesting short-term bullish momentum.

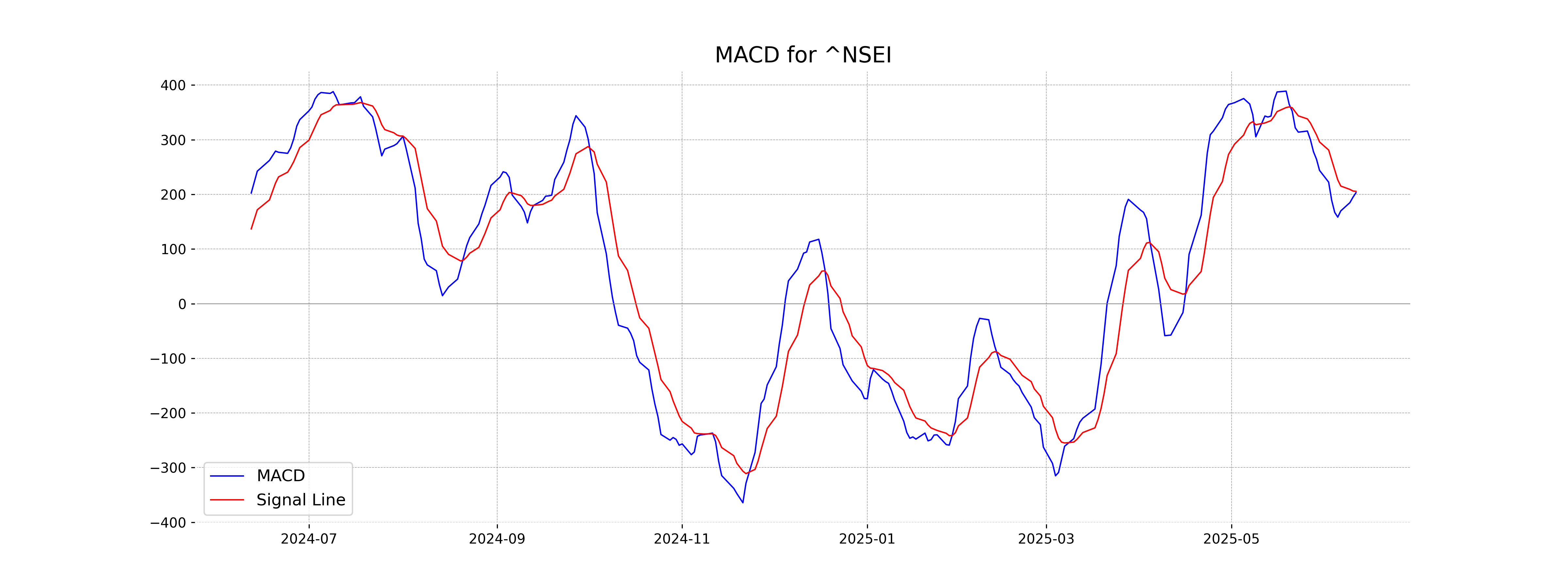

Moving Averages Trend (MACD)

The MACD value for Nifty 50 is 202.99, which is slightly below the MACD Signal of 205.59. This can indicate a potential bearish signal as the MACD line is crossing below the signal line. However, the difference is minimal, suggesting that the momentum might not be strong.

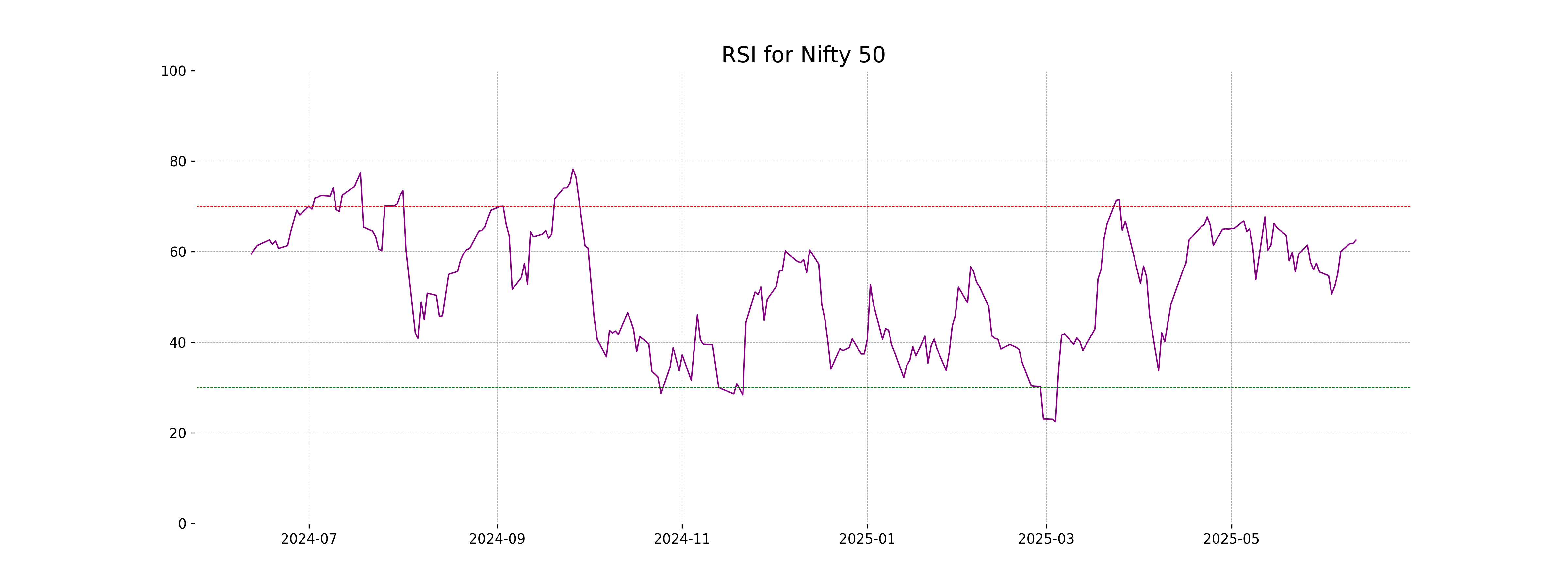

RSI Analysis

The Relative Strength Index (RSI) for Nifty 50 is at 62.54, which indicates a moderately strong upward momentum approaching overbought conditions. Typically, an RSI above 70 may suggest that the asset is overbought, while an RSI below 30 indicates it may be oversold.

ADVERTISEMENT

Up Next

Global stock market indices: How the world markets performed today - 11 June 2025

Rupee breaches 91-mark against US dollar for first time in intra-day trade

Microsoft commits USD 17.5 billion investment in India: CEO Satya Nadella

CBI books Anil Ambani's son, Reliance Home Finance Ltd. in Rs 228 crore bank fraud case

RBI raises FY26 GDP growth projection to 7.3 pc

RBI trims policy interest rate by 25bps to 5.25pc, loans to get cheaper

More videos

Rupee slumps to all-time low of 90.25 against US dollar in intra-day trade

Reliance completes merger of Star Television Productions with Jiostar

India to lead emerging market growth with 7pc GDP rise in 2025: Moody’s

Nifty hits record high after 14 months; Sensex nears all-time peak

Reliance stops Russian oil use at its only-for-export refinery to comply with EU sanctions

ED attaches fresh assets worth over Rs 1,400 cr in case against Anil Ambani's Reliance Group

India signs one-year deal to import 2.2 million tonnes of LPG from US

India International Trade Fair begins at Pragati Maidan amid tight security

Stock markets decline in initial trade on foreign fund outflows, weak Asian peers

Amazon to lay off 30,000 office workers amid AI-driven cost cuts