- Home

- ❯

- Business

- ❯

- Markets

- ❯

- Global stock market indices: How the world markets performed today - 09 July 2025

Highlights

- Major indices hold strong above 20-EMA support

- MACD signals bullish crossover in global markets

- Key resistance levels tested with positive RSI

Latest news

Putin hails Ukraine gains, threatens more, in annual press conference

OnePlus Pad Go 2 Review: No drama, just a good tablet

Parliament Moment: Priyanka Gandhi shares tea with Rajnath Singh. PM Modi and Om Birla

Cold wave deepens in Kashmir as Chillai-Kalan nears, temperatures dip below freezing

Pakistan accuses India of attempting to undermine Indus treaty

Vande Mataram discussion in UP legislature to mark 150th anniversary: Yogi Adityanath

Ashes 2025: Travis Head slams unbeaten 142 to crush England's Ashes hopes

Tipra Motha youth wing protests Bangladesh leader's anti-India remarks in Agartala

Global stock market indices: How the world markets performed today - 09 July 2025

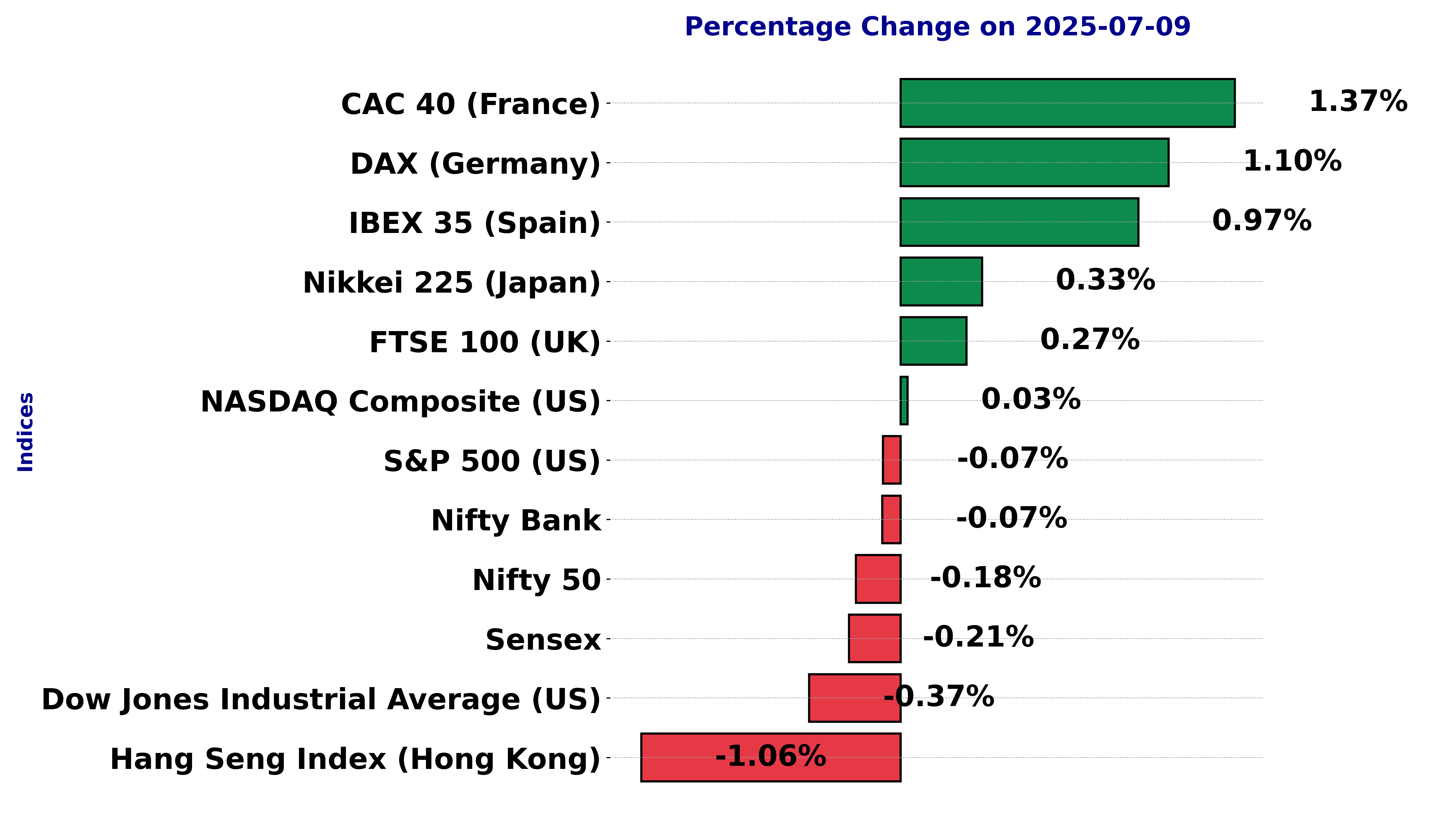

The international stock market indices showed varied performances on July 09, 2025, reflecting the economic sentiment across different regions.

In this article, we analyze the performance of key global indices including the S&P 500, Dow Jones Industrial Average, NASDAQ Composite, FTSE 100, DAX, CAC 40, IBEX 35, Nikkei 225, Hang Seng, Nifty 50, and BSE Sensex.

Analysis for Sensex - July 09, 2025

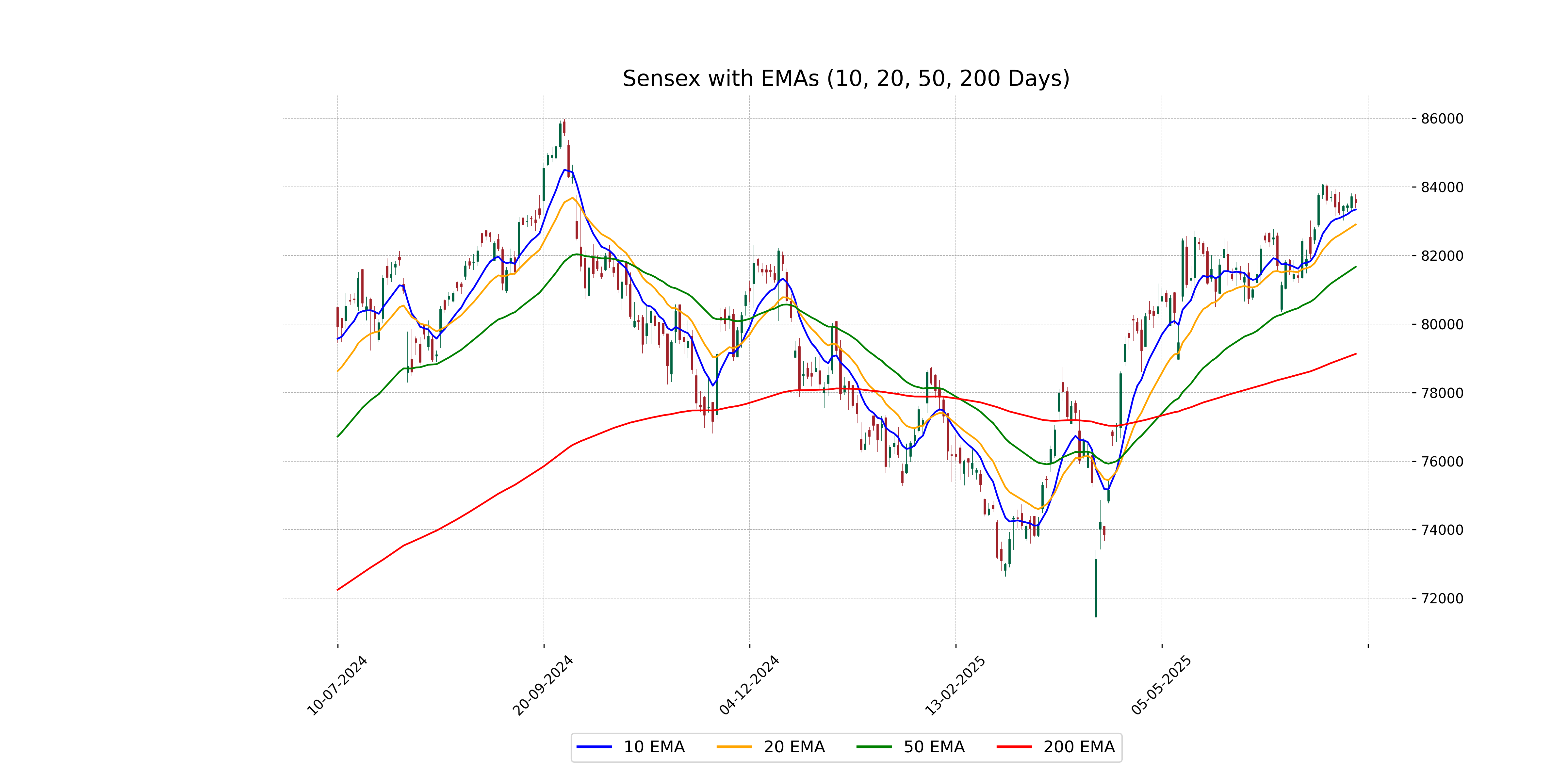

The Sensex opened at 83,625.89 and closed slightly lower at 83,536.08, reflecting a points change of -176.43 and a percentage drop of -0.21%. Key technical indicators show positive momentum with the 50-day EMA at 81,669.11 and a MACD of 598.13, while the volume was not specified.

Relationship with Key Moving Averages

The Sensex closed at 83,536.08, which is above its 50-day EMA of 81,669.11 and its 200-day EMA of 79,128.51, suggesting a prevailing upward trend. However, it is slightly above the 10-day EMA of 83,339.21 and the 20-day EMA of 82,904.12, indicating recent short-term volatility.

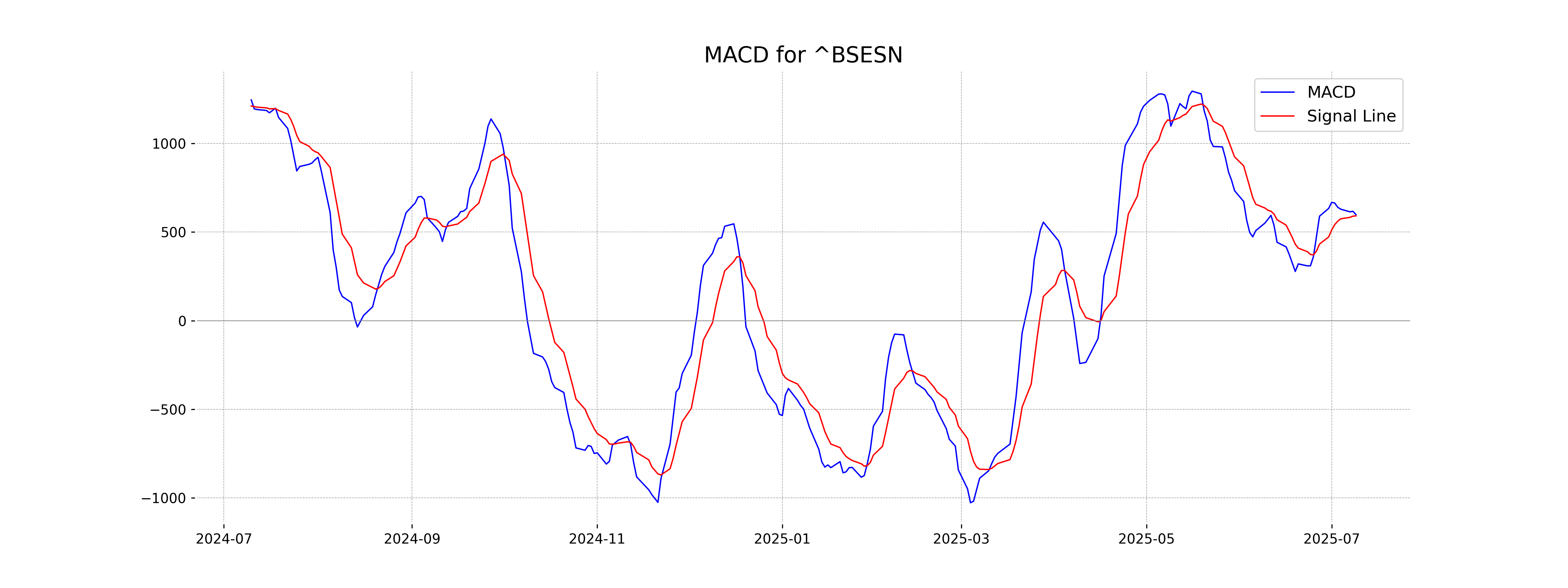

Moving Averages Trend (MACD)

The MACD for Sensex is 598.13 with a signal line of 591.19, indicating a positive divergence. This suggests a potential upward momentum in the price trend. The gap between the MACD and its signal line reflects a short-term bullish sentiment.

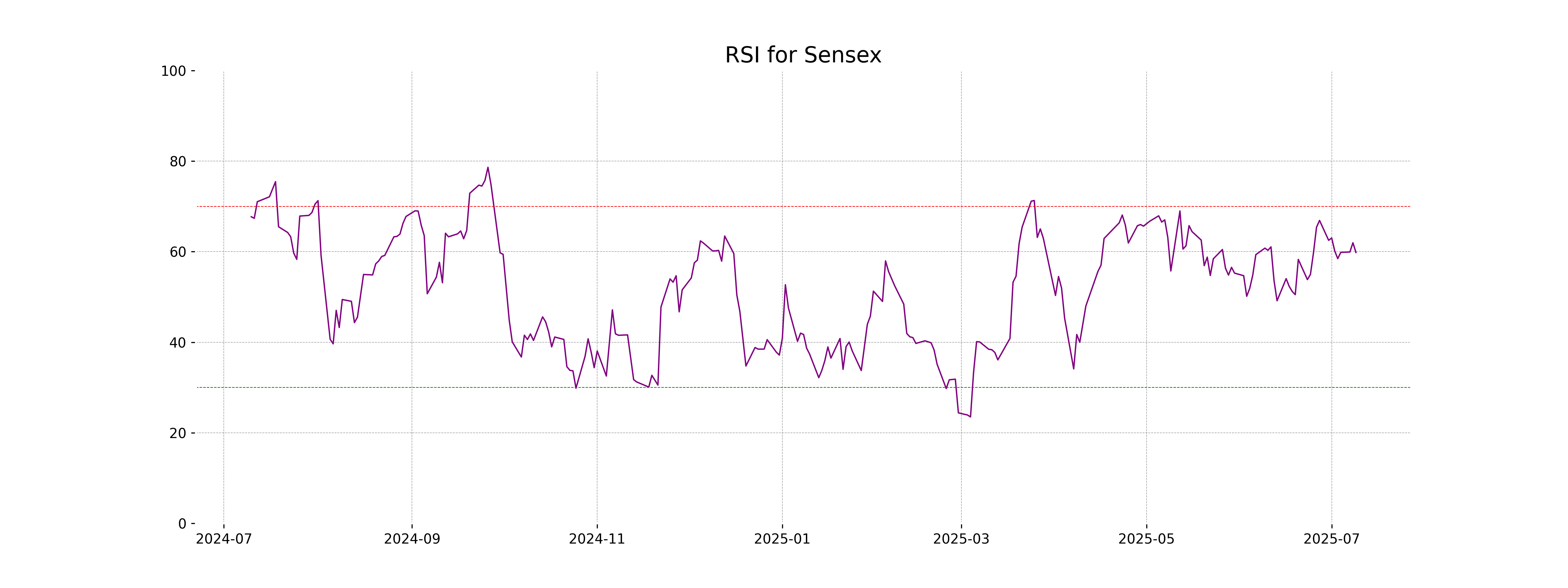

RSI Analysis

The RSI for Sensex is currently 59.82, which indicates a neutral to slightly bullish momentum since it's below the overbought threshold of 70 but above the 50 level. This suggests neither strong selling nor strong buying pressure is present, and the index might continue to exhibit modest upward or sideways movement.

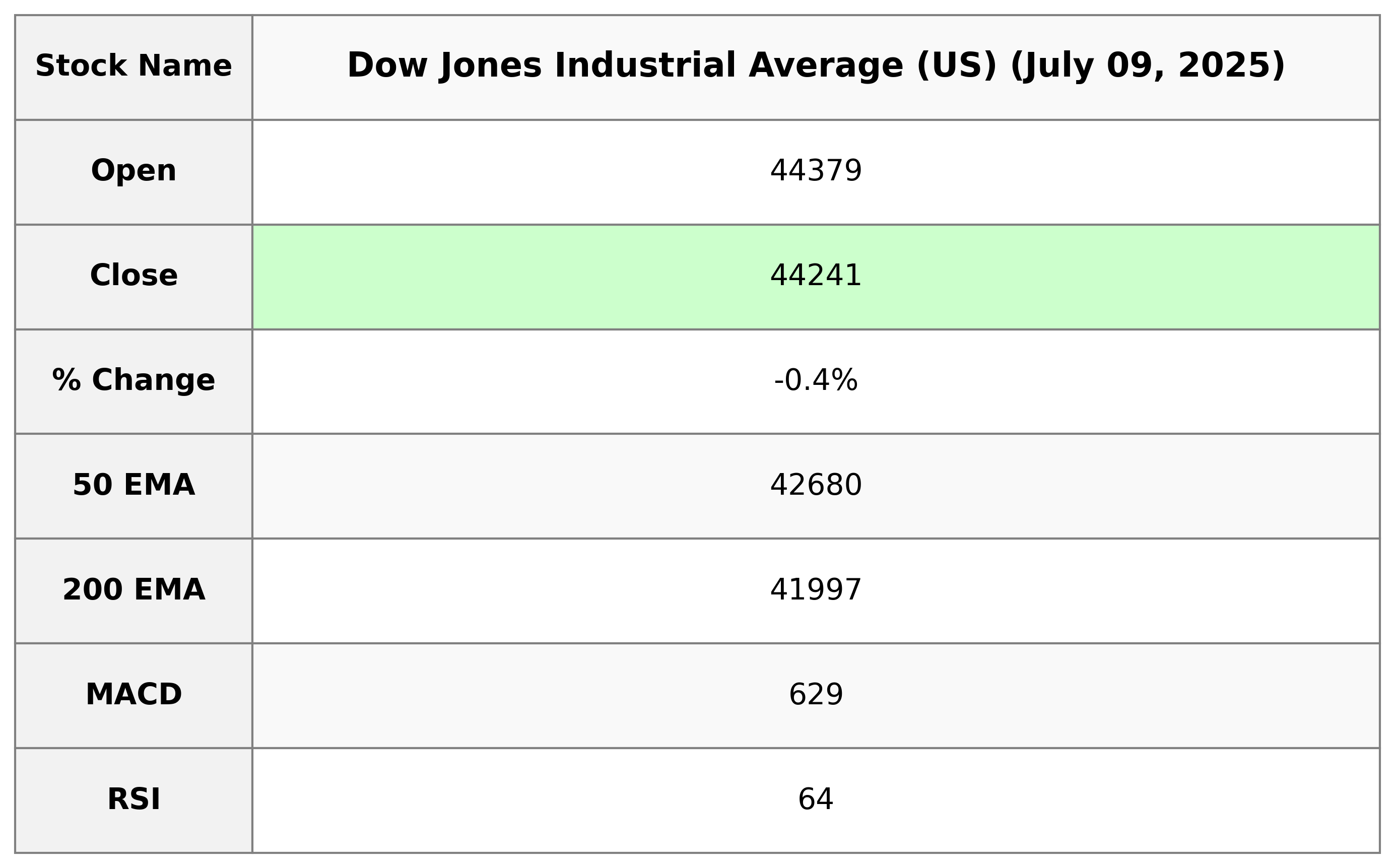

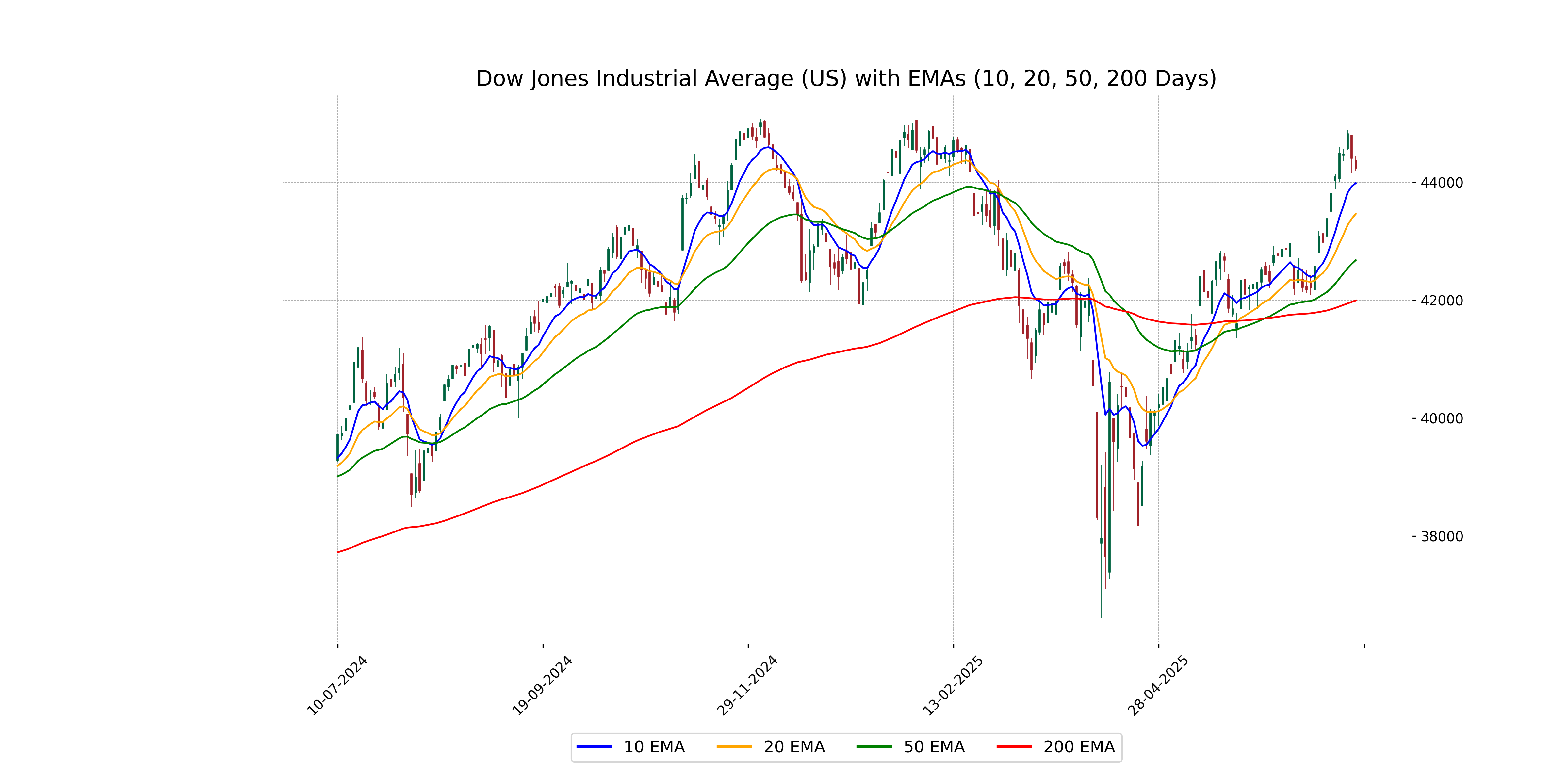

Analysis for Dow Jones Industrial Average (US) - July 09, 2025

The Dow Jones Industrial Average (US) showed a slight decline with a closing value of 44,240.76, down by 165.60 points from the previous close. The index experienced fluctuations within the day's range of 44,201.37 and 44,436.96. Despite this, the 50-day EMA and the 200-day EMA indicate an upward trend, with the RSI suggesting relatively strong momentum at 64.47.

Relationship with Key Moving Averages

The Dow Jones Industrial Average is currently trading below its previous close, with a negative percent change of -0.37%. It is positioned just above its 10-day EMA of 43,986.97 but significantly above its 50-day and 200-day EMAs, indicating a short-term bearish trend while still holding a long-term bullish stance. The RSI at 64.47 suggests the index is nearing overbought territory.

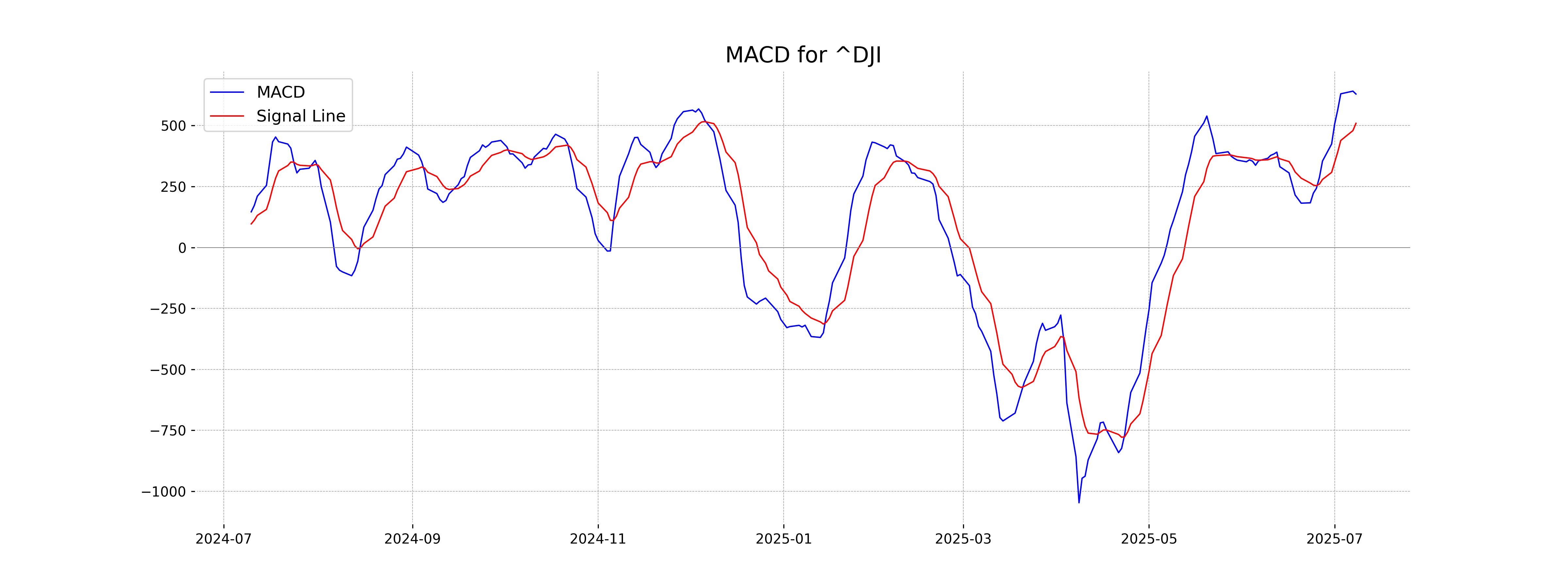

Moving Averages Trend (MACD)

The Dow Jones Industrial Average is currently exhibiting a bullish signal in its MACD analysis, as the MACD line at 629.25 is above the signal line at 509.25. This suggests upward momentum, though investors should monitor for any changes.

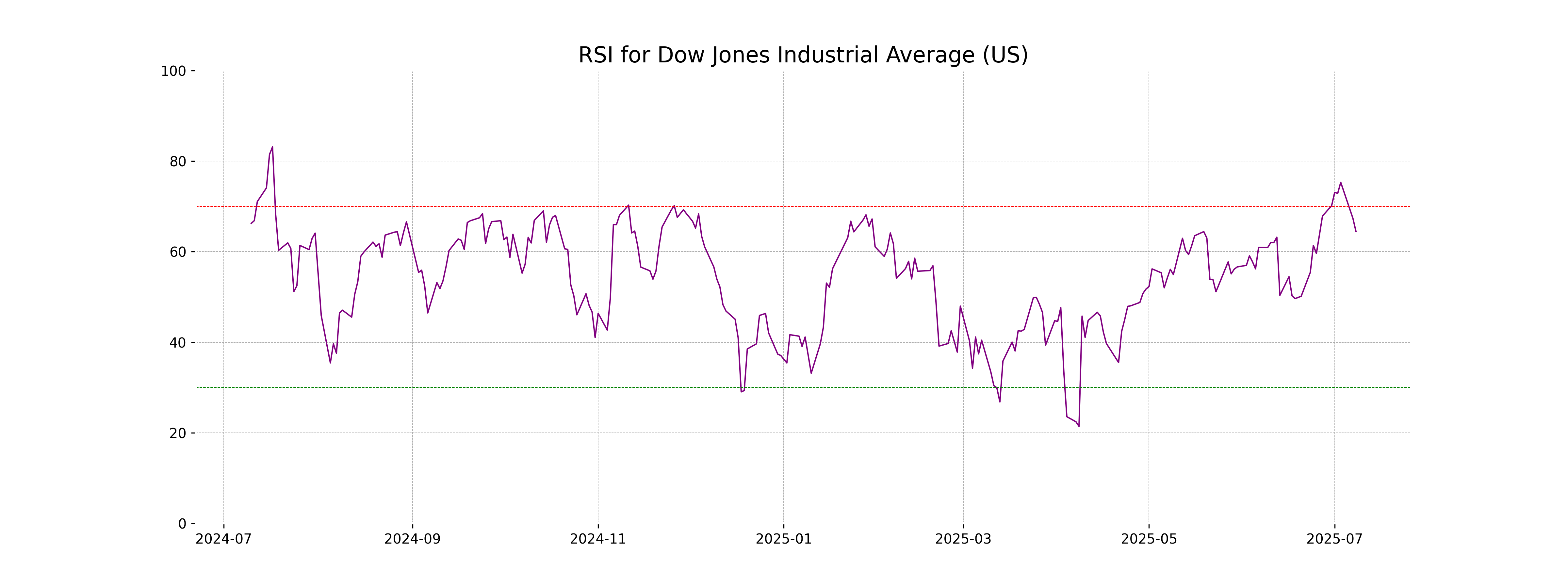

RSI Analysis

The RSI (Relative Strength Index) for the Dow Jones Industrial Average is at 64.47. An RSI closer to 70 typically indicates that the index is nearing overbought conditions, suggesting potential for a price correction or consolidation. This level signals relative strength but approaching cautionary levels for possible trend reversal.

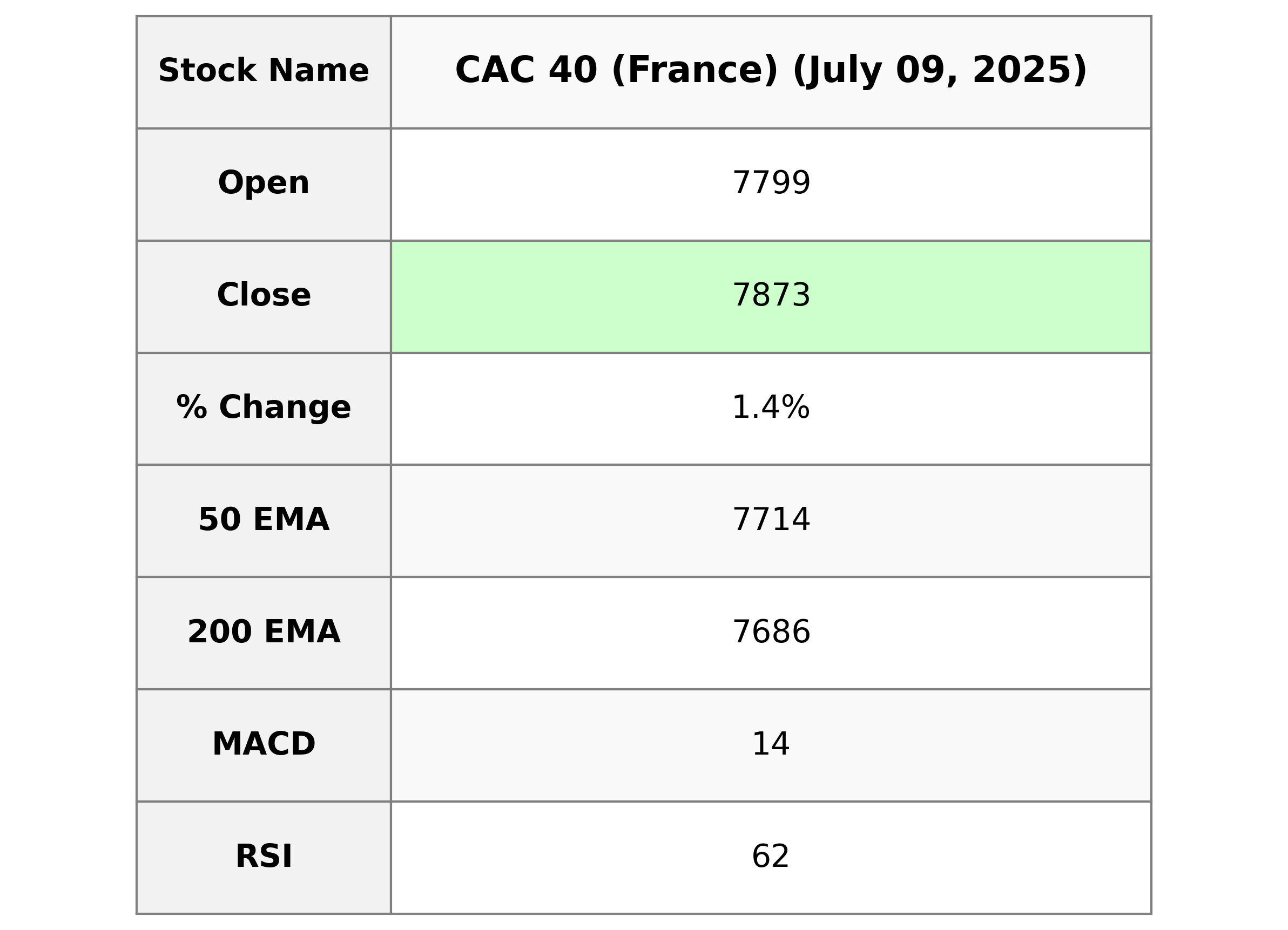

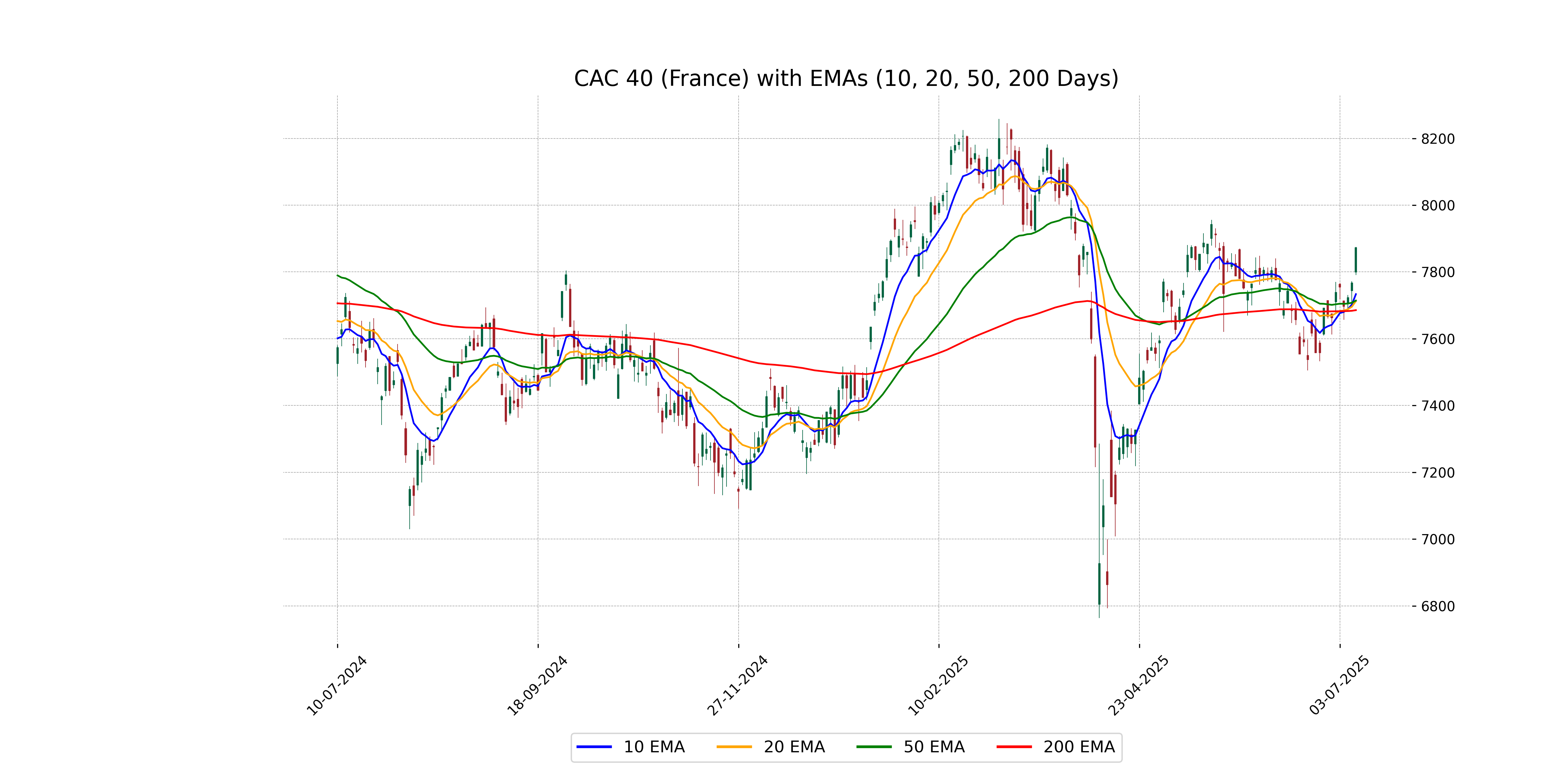

Analysis for CAC 40 (France) - July 09, 2025

CAC 40 (France) Performance: On the trading day, the CAC 40 index opened at 7799.33 and closed higher at 7872.76, marking a positive change of 1.37% from the previous close of 7766.71. The index experienced a high of 7874.72 and a low of 7790.55, reflecting solid buying pressure. Key technical indicators such as an RSI of 62.47 and a MACD of 13.89 suggest bullish momentum in the market.

Relationship with Key Moving Averages

The CAC 40 index is trading above its 50-day and 200-day EMAs, indicating a potential bullish trend. Additionally, with the 10-day and 20-day EMAs also below the current close, the index shows short-term momentum strength.

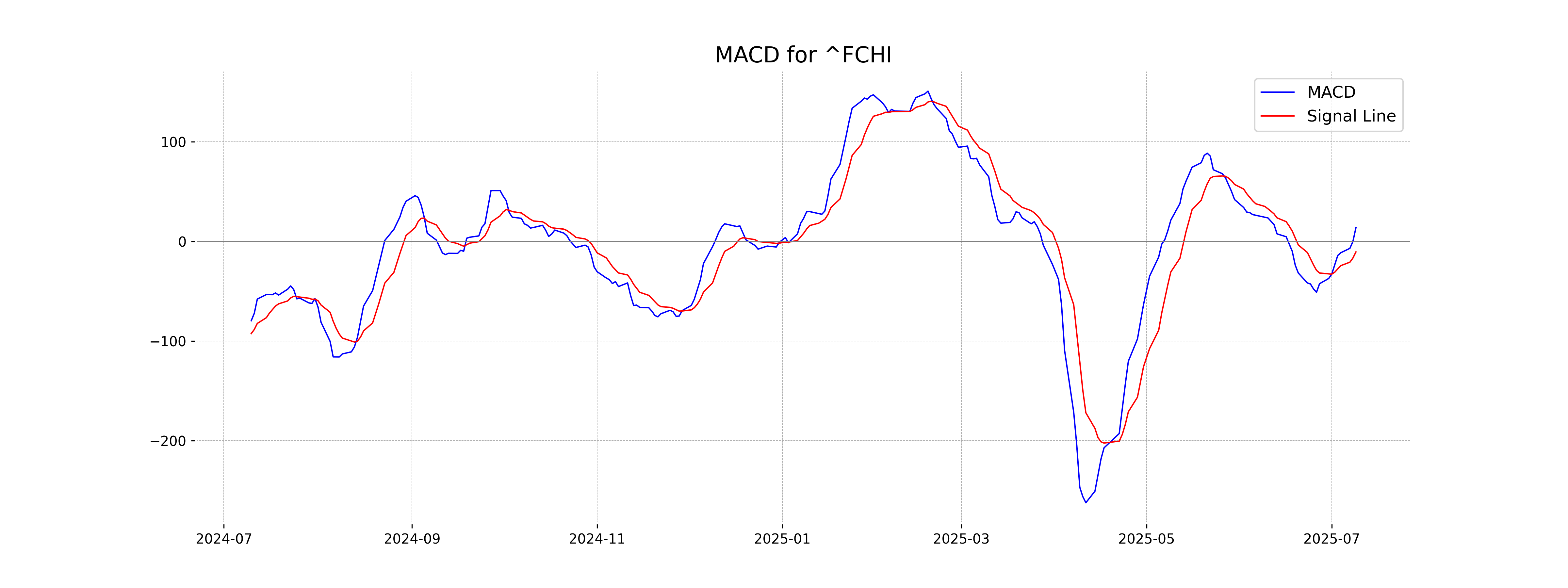

Moving Averages Trend (MACD)

The MACD for CAC 40 is 13.89, with a signal line at -10.64. This indicates a potential bullish trend as the MACD line is well above the signal line, suggesting upward momentum in the CAC 40 index.

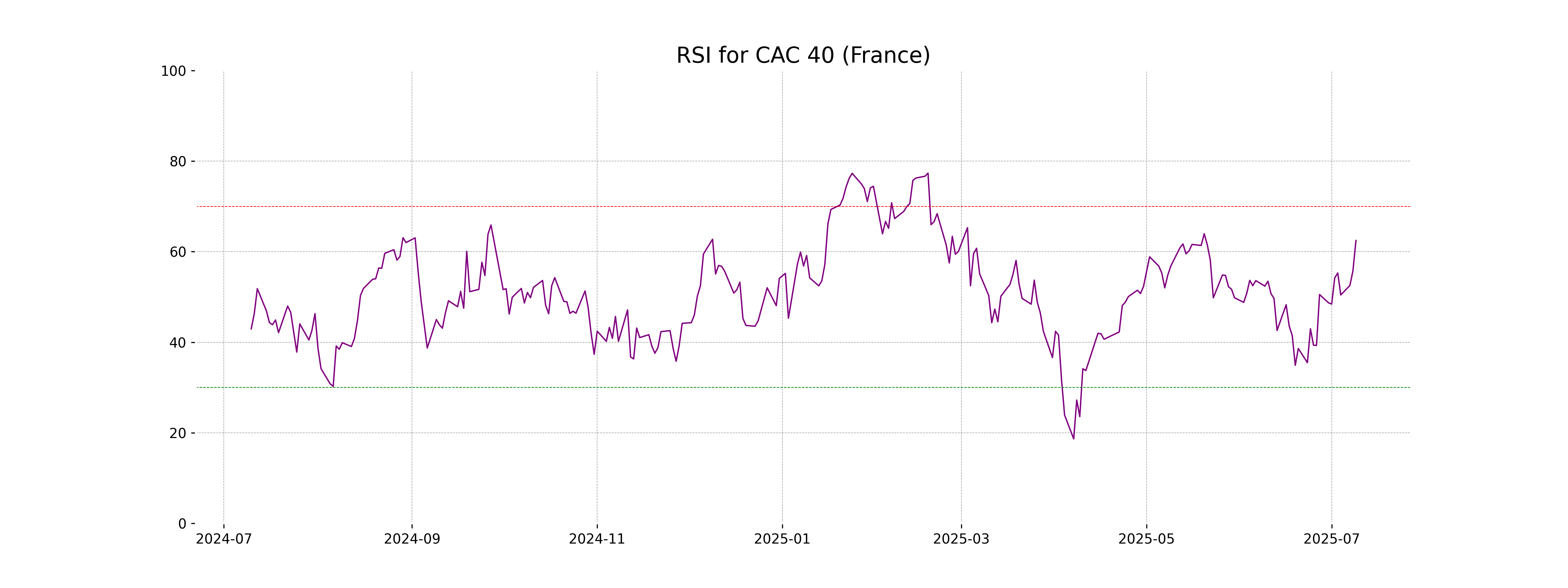

RSI Analysis

The RSI value for CAC 40 (France) is 62.47, indicating that the stock is in the neutral zone but approaching the overbought territory. This suggests a moderate upward momentum, but caution should be exercised if it continues to rise significantly past 70, as it may signal potential overbought conditions.

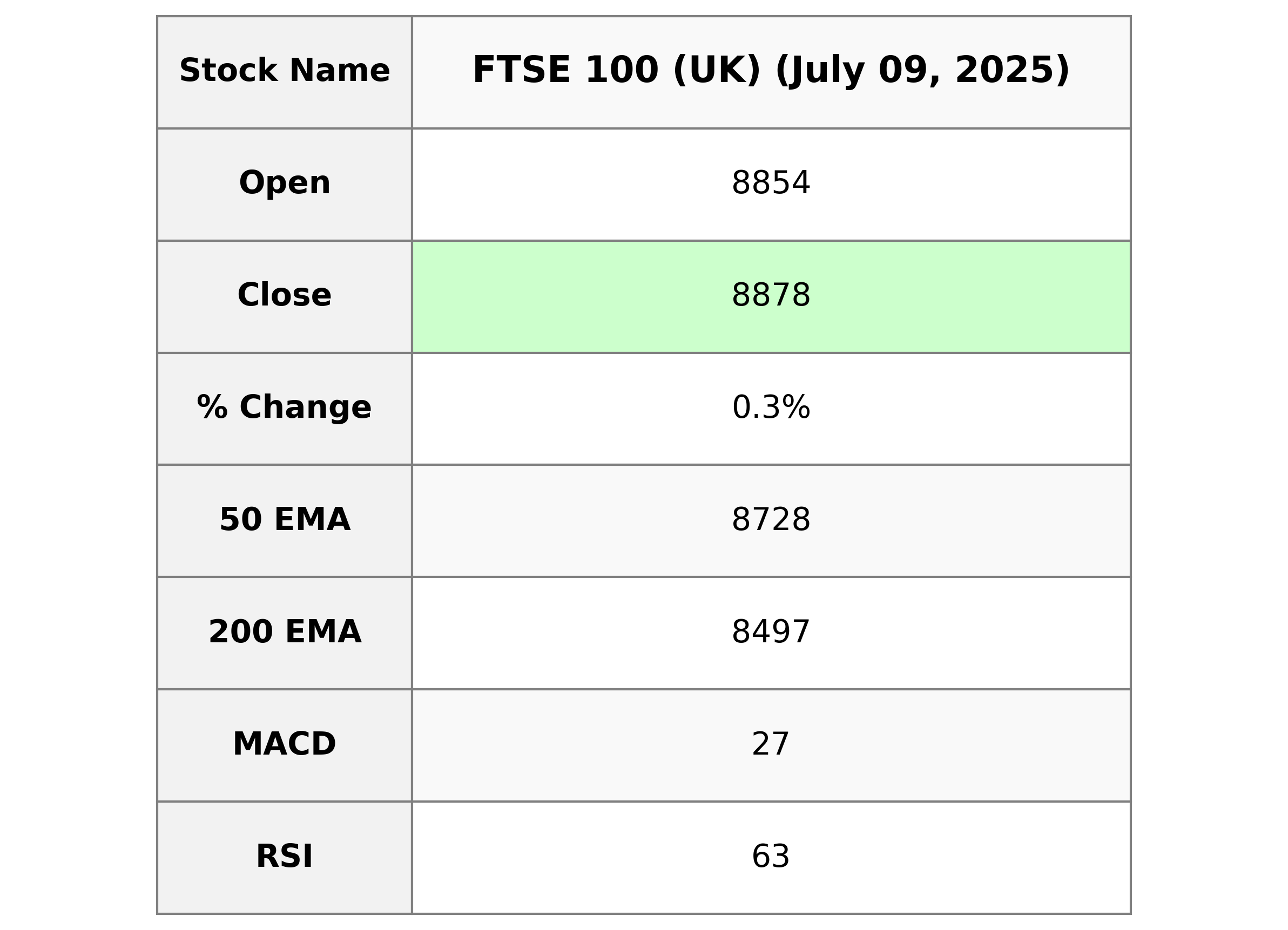

Analysis for FTSE 100 (UK) - July 09, 2025

FTSE 100 (UK) Performance: The FTSE 100 opened at 8854.18 and closed higher at 8878.01, with a high of 8886.99, indicating a slight increase of 0.27% or 23.81 points. Technical indicators like an RSI of 62.68 suggest the index is in a moderately strong position, and the MACD of 27.10 is above the signal line of 24.86, hinting at a potential upward momentum.

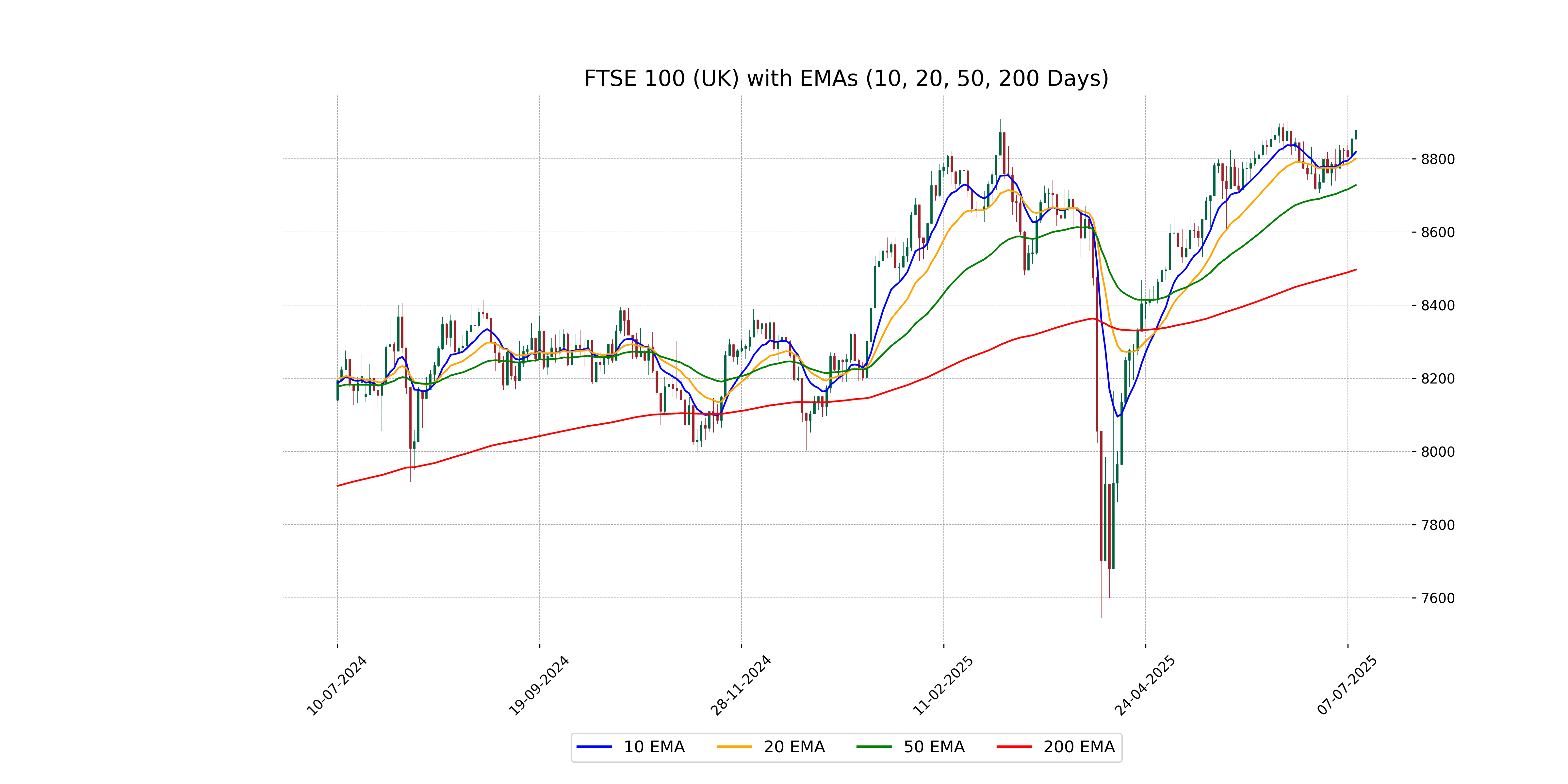

Relationship with Key Moving Averages

FTSE 100 is trading above the 10 EMA of 8818.96, indicating short-term bullish momentum. It also remains above the 20 EMA of 8800.84, as well as the 50 EMA of 8728.16 and 200 EMA of 8497.12, suggesting a strong upward trend in both the mid-term and long-term perspectives.

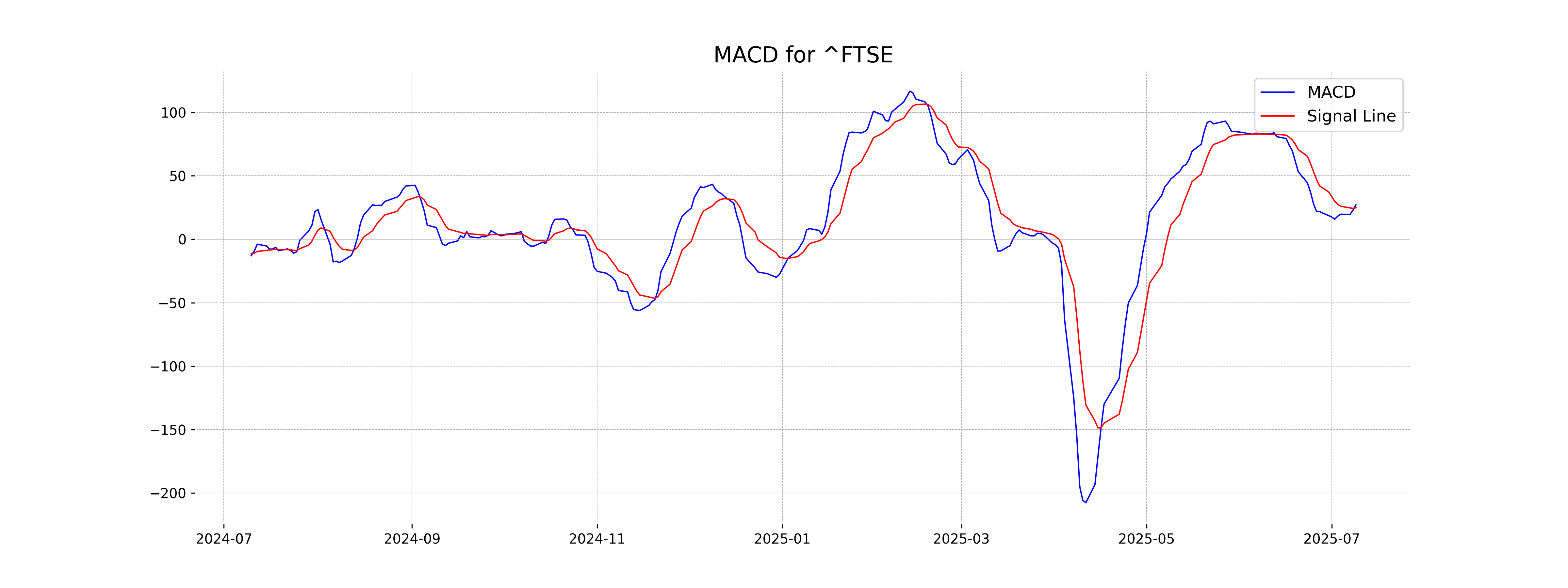

Moving Averages Trend (MACD)

The MACD analysis for FTSE 100 indicates a positive outlook as the MACD line (27.10) is above the MACD Signal line (24.86). This suggests a bullish momentum in the market, implying potential for further upside movement.

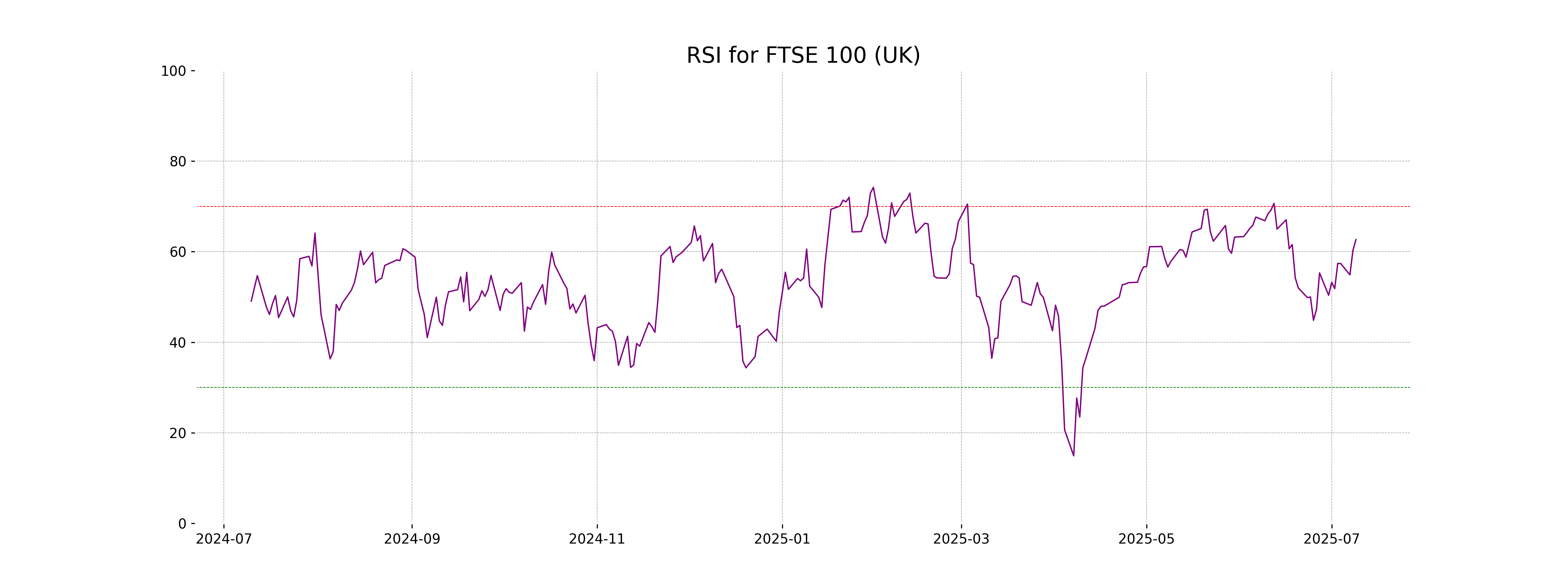

RSI Analysis

RSI Analysis for FTSE 100: With an RSI of 62.68, the FTSE 100 is in a neutral to slightly overbought zone. This suggests that the stock may continue its upward trend, but caution is advised as it approaches overbought conditions.

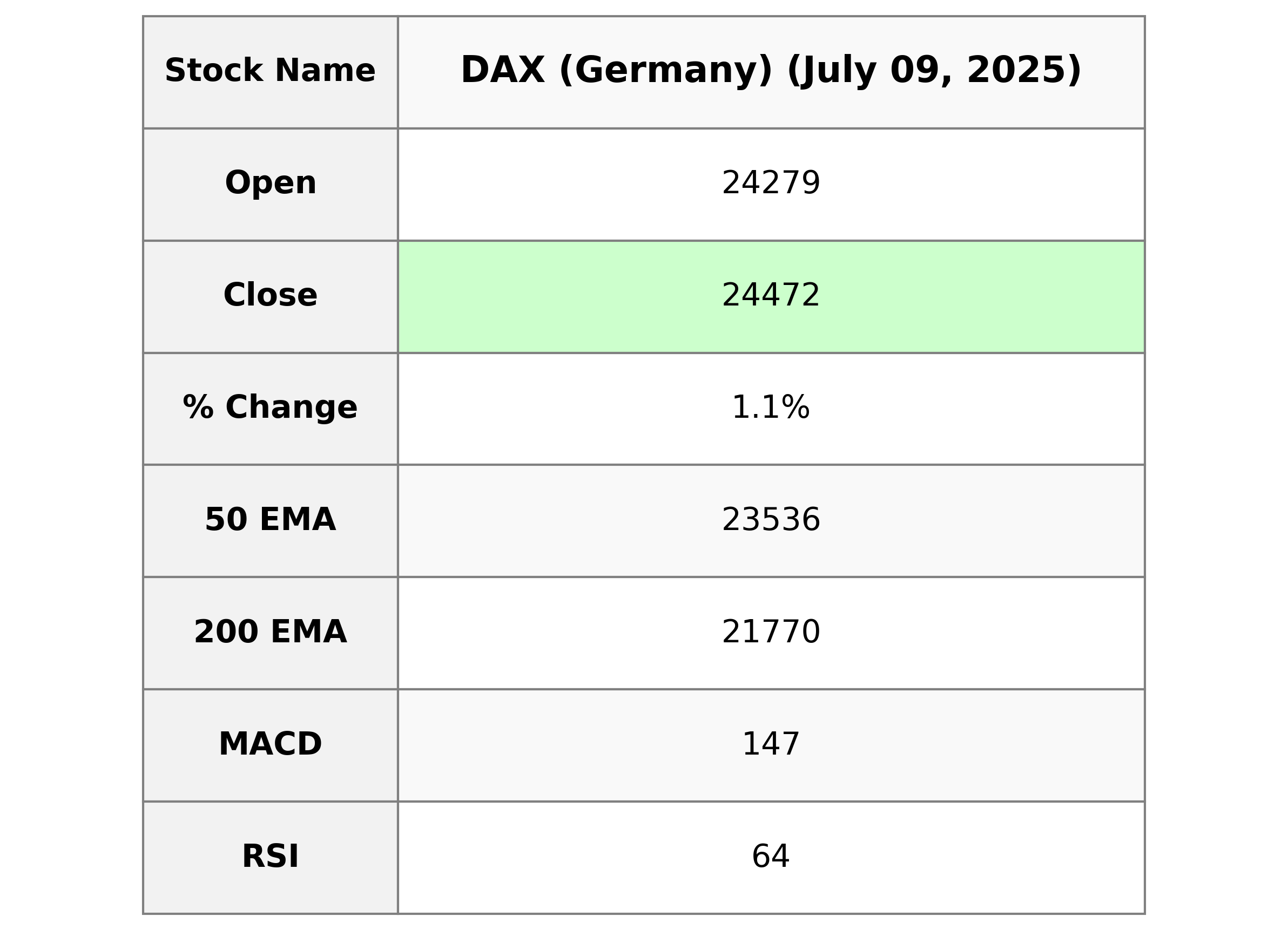

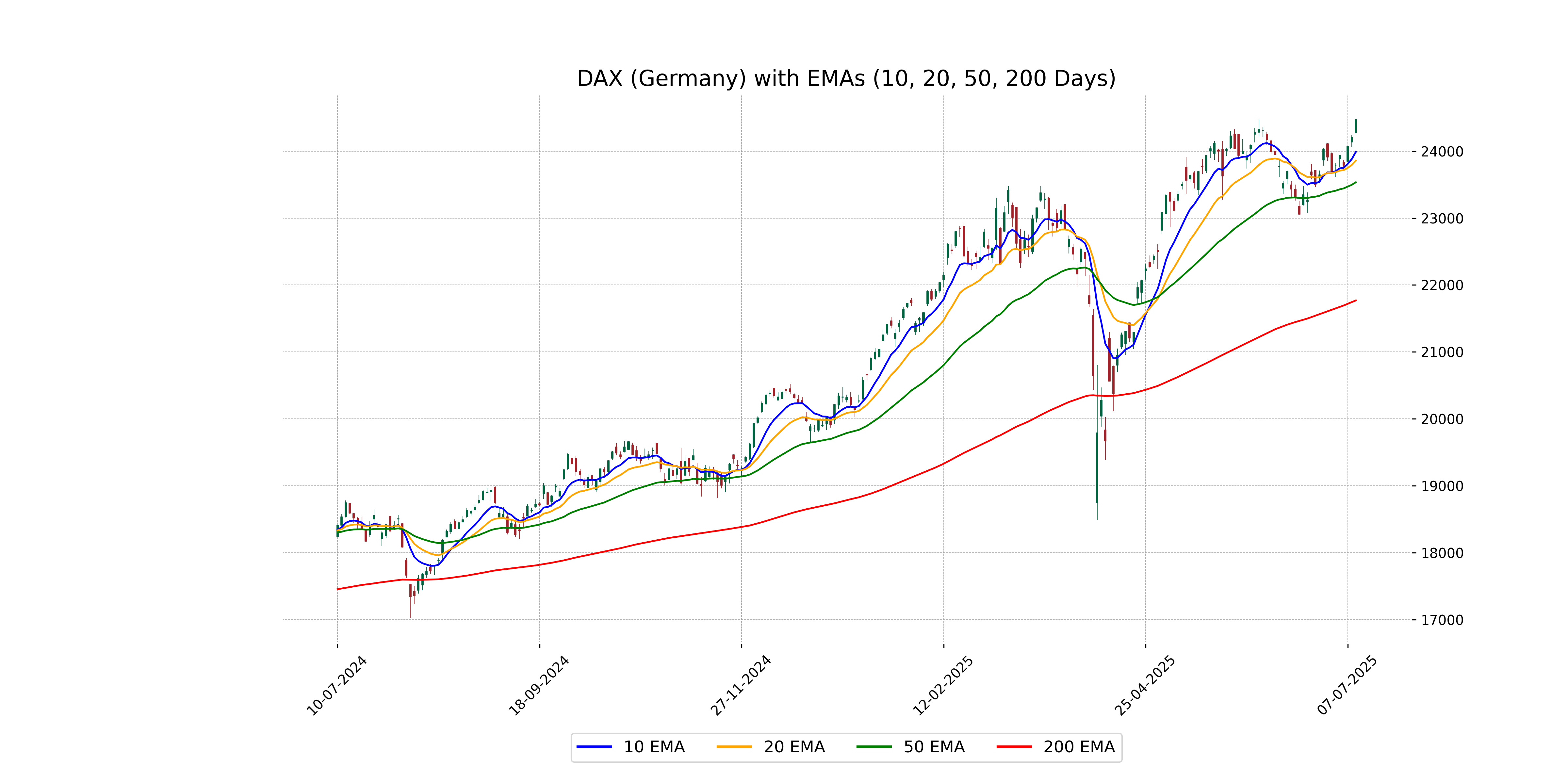

Analysis for DAX (Germany) - July 09, 2025

The DAX (Germany) index opened at 24,278.89 and closed higher at 24,472.05, showing a gain of 265.14 points or approximately 1.10%. The RSI is at 63.52, indicating a moderately strong momentum, while the MACD is above the signal line, suggesting a bullish trend.

Relationship with Key Moving Averages

DAX (Germany) is trading above its key moving averages, indicating bullish momentum. The closing price of 24472.05 is above the 10 EMA of 23989.44, the 20 EMA of 23858.70, the 50 EMA of 23535.68, and the 200 EMA of 21770.02, suggesting strong upward trends in both short-term and long-term perspectives.

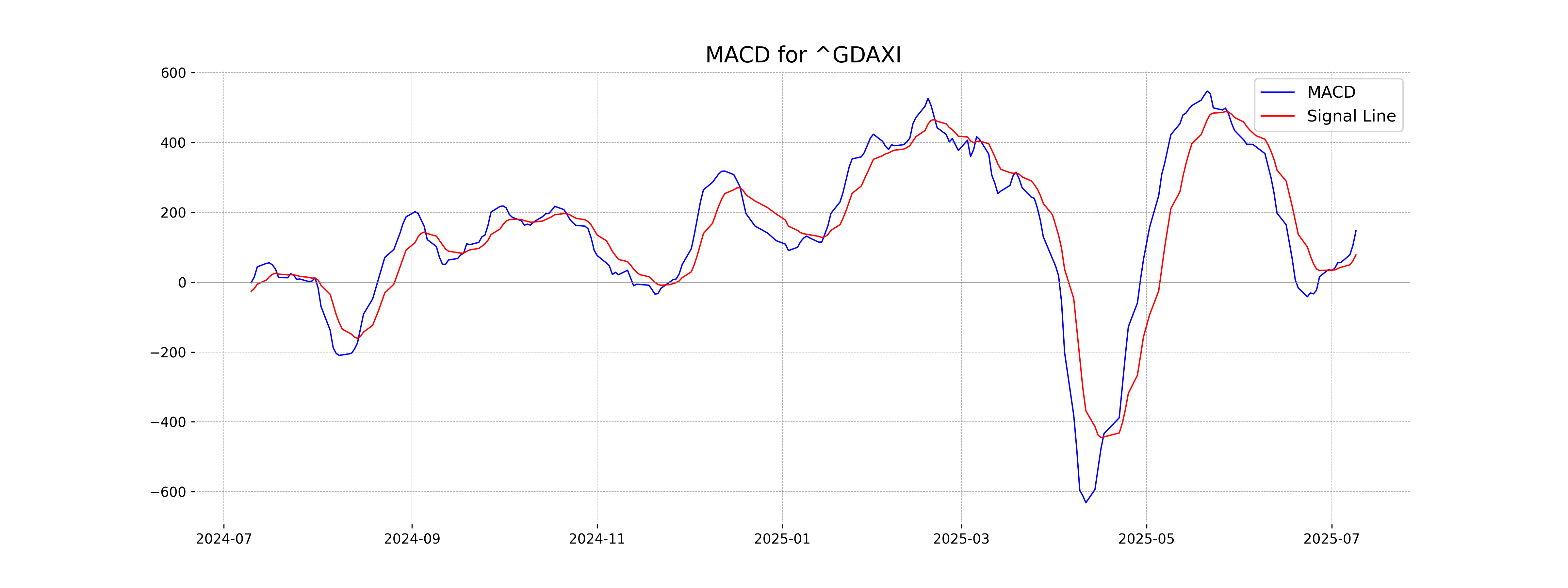

Moving Averages Trend (MACD)

DAX (Germany): The MACD value of 147.01 is significantly higher than the MACD Signal of 78.12, indicating a bullish momentum. This suggests that the DAX index is currently experiencing a positive upward trend.

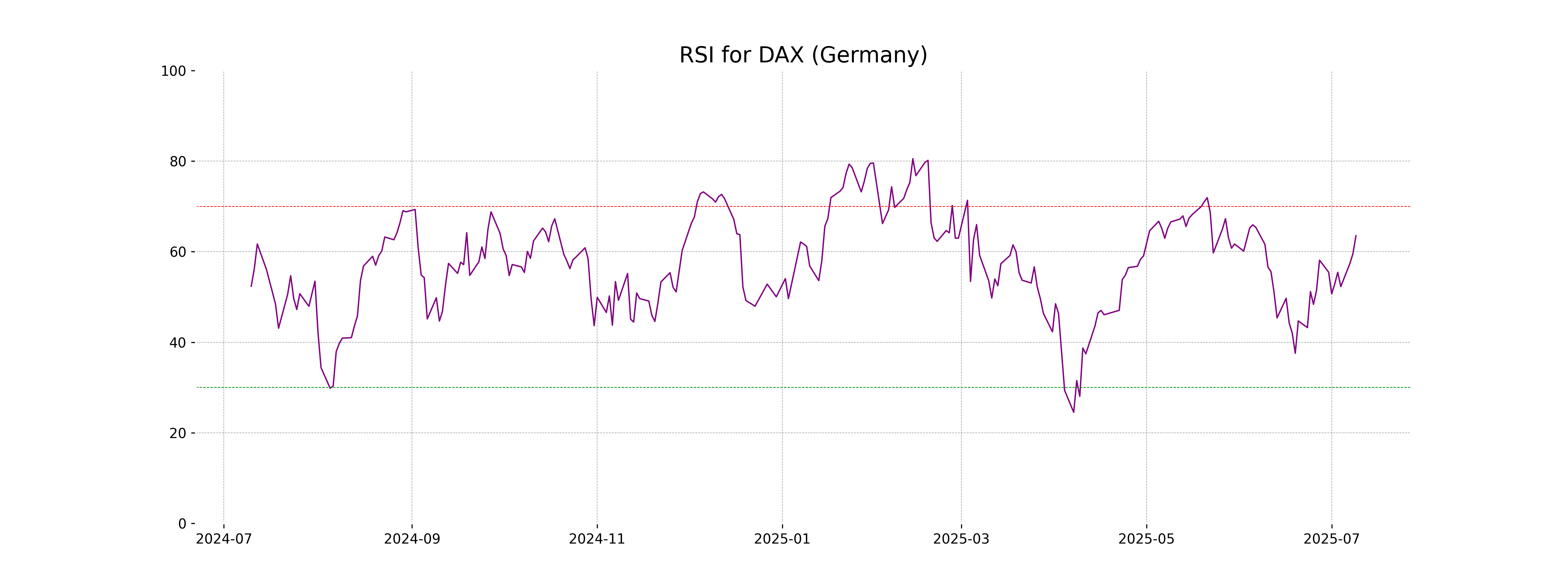

RSI Analysis

RSI Analysis for DAX (Germany): The Relative Strength Index (RSI) for DAX is 63.52, which suggests that the index is approaching the overbought range. This indicates that the index has witnessed significant gains recently, and there may be potential for a pullback or consolidation if the RSI moves further into the overbought territory above 70.

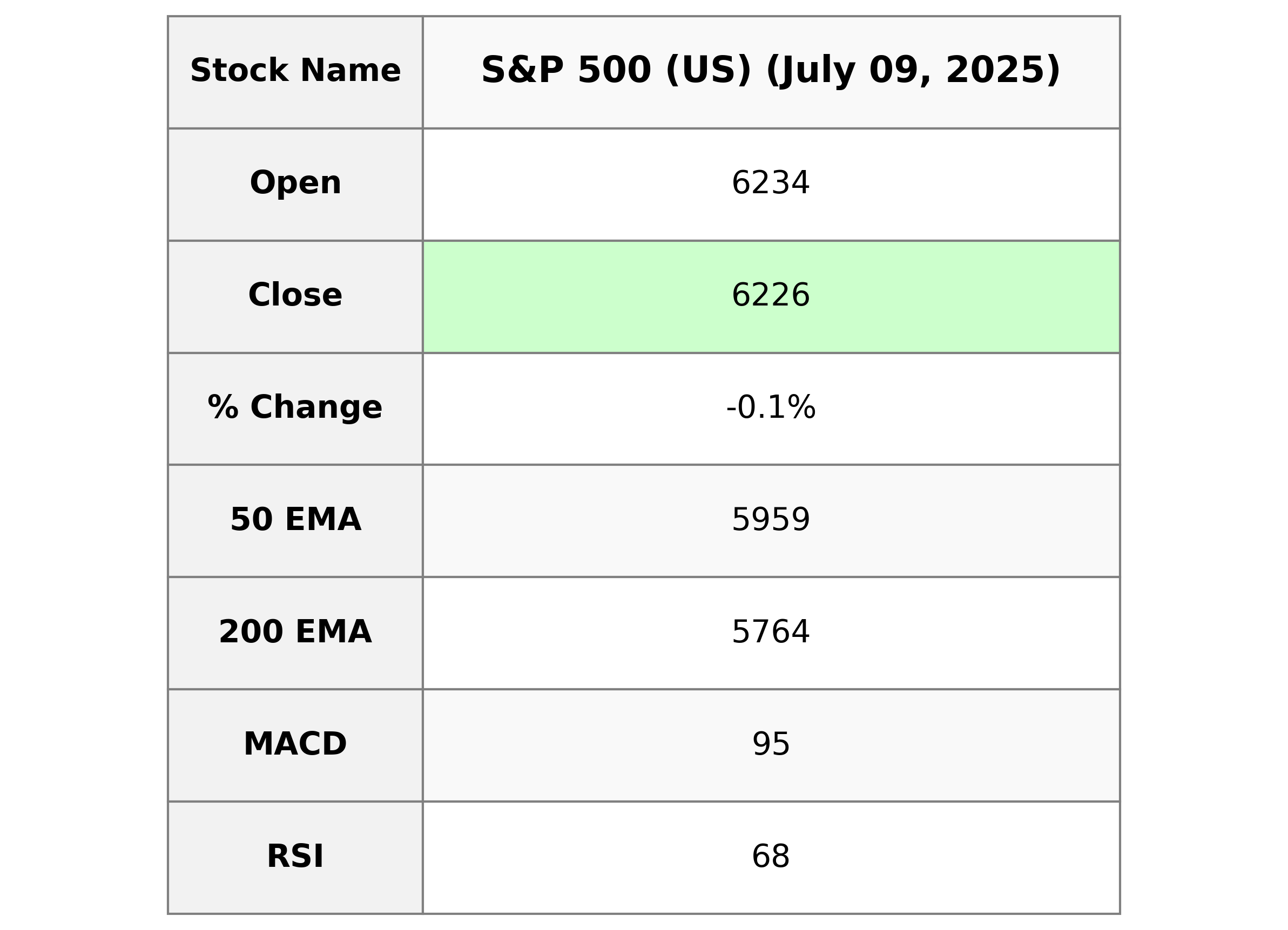

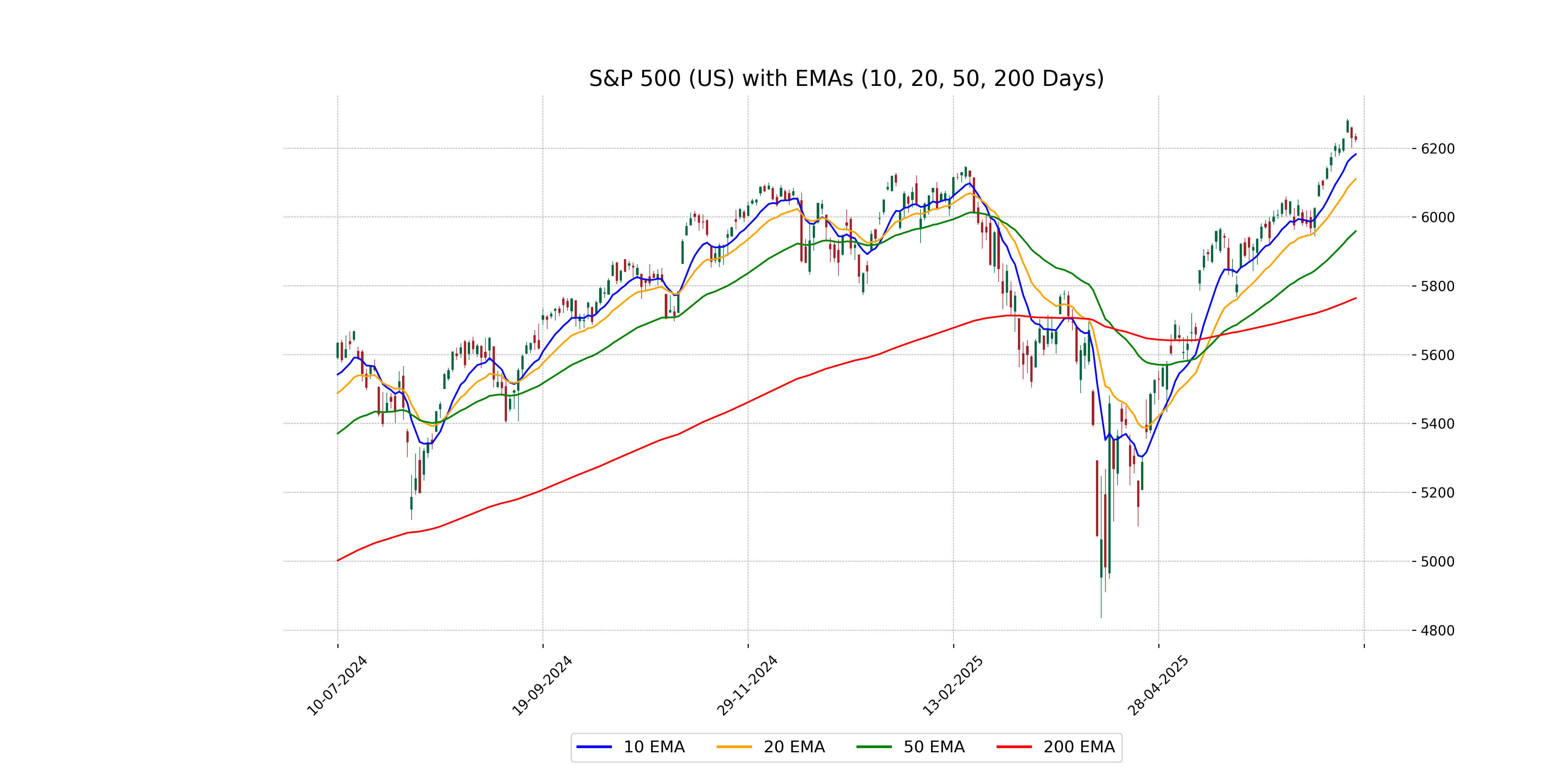

Analysis for S&P 500 (US) - July 09, 2025

S&P 500 (US) Performance Overview: On this trading day, the S&P 500 opened at 6234.03 and closed slightly lower at 6225.52, marking a small decrease of 0.07% with a points change of -4.46 from the previous close of 6229.98. The RSI value stands at 67.73, indicating a relatively strong market position. The MACD's positive difference from the signal line suggests continuing upward momentum.

Relationship with Key Moving Averages

The S&P 500 (US) closed at 6225.52, which is above its 50-day EMA of 5958.79 and its 200-day EMA of 5764.11, indicating a current upward trend in comparison to these moving averages. However, it is below its 10-day EMA of 6182.59, suggesting short-term consolidation or minor correction.

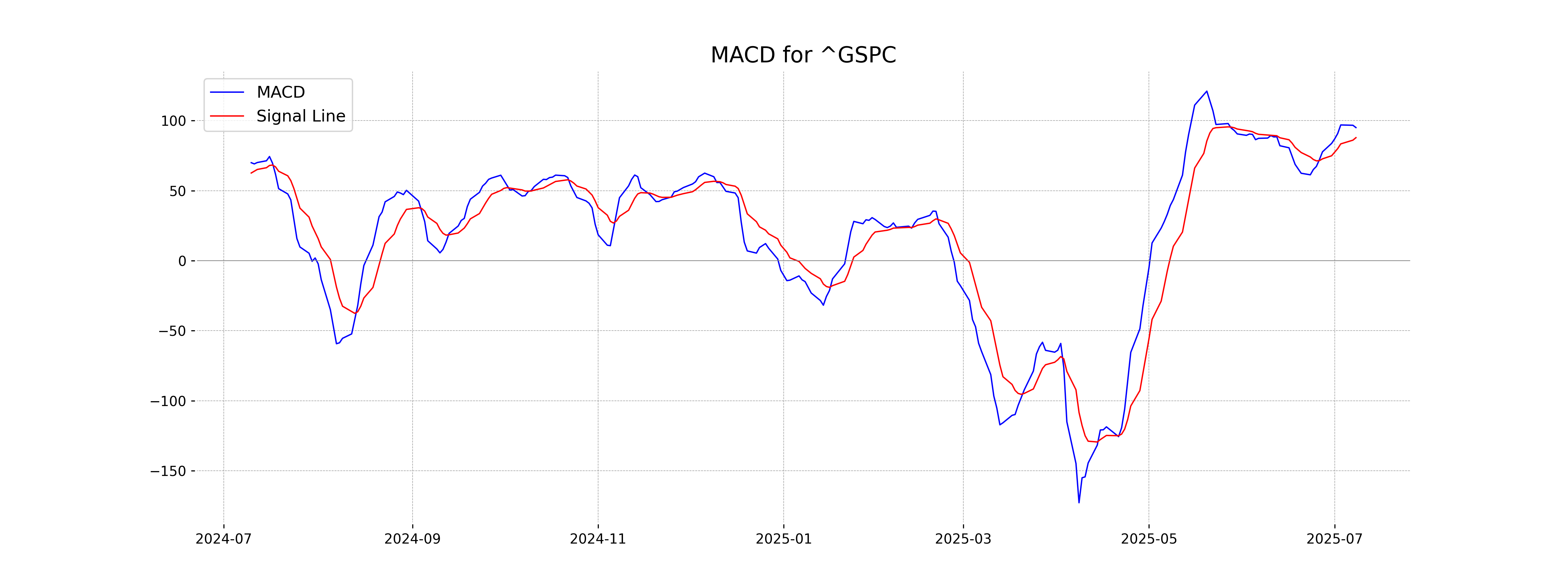

Moving Averages Trend (MACD)

The MACD for S&P 500 is 95.06, with a MACD Signal of 87.87, indicating a bullish trend as the MACD is above the signal line. This suggests continuing upward momentum in the index.

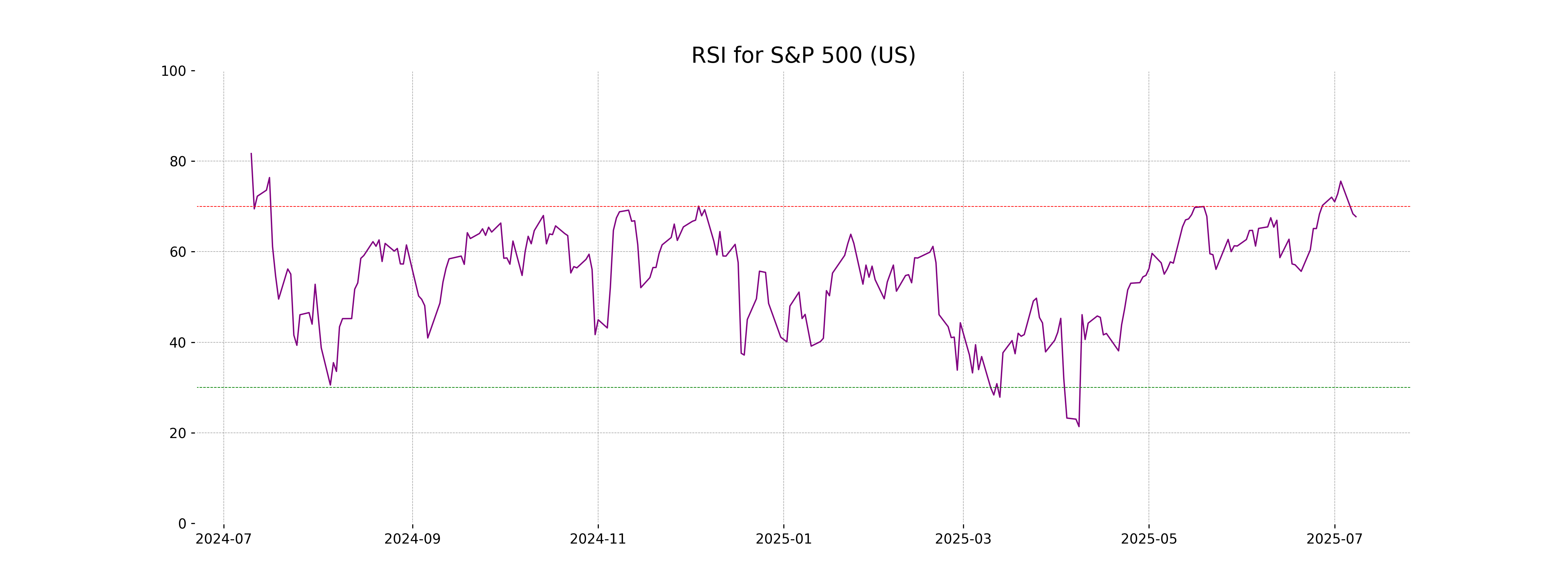

RSI Analysis

The RSI value for S&P 500 (US) is 67.73, which indicates that the stock is approaching the overbought territory. This suggests that buying pressure has been relatively strong, and caution should be exercised as it nears the overbought threshold of 70.

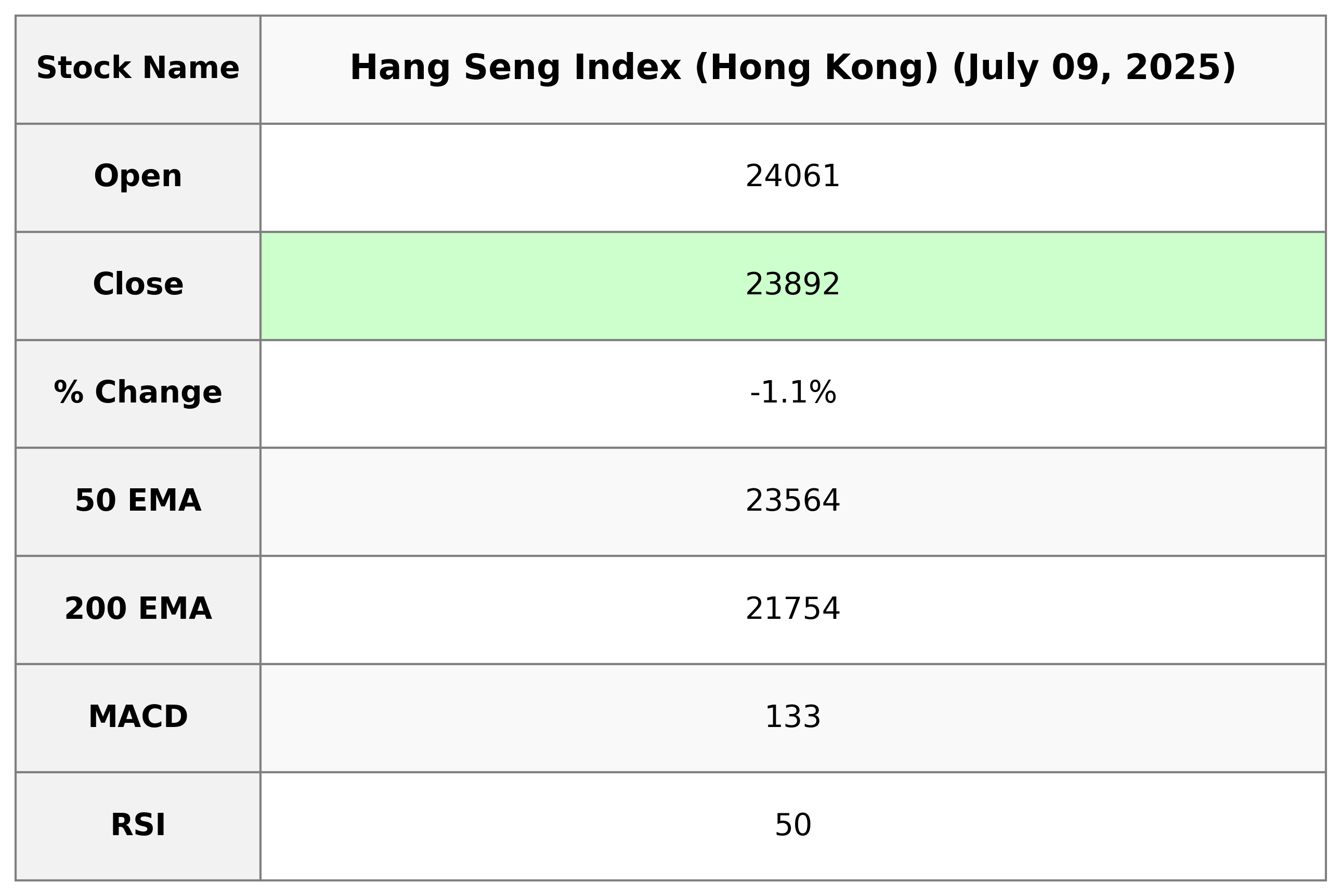

Analysis for Hang Seng Index (Hong Kong) - July 09, 2025

The Hang Seng Index opened at 24061.08, reaching a high of the same value, before closing slightly lower at 23892.32, marking a decline of 1.06% from the previous close. The index experienced a points change of -255.75, with its 50-day and 200-day EMAs at 23564.45 and 21753.60, respectively. The RSI suggests a neutral position at 50.47, while MACD indicates a bearish crossover with a value of 132.55 against the signal of 180.13.

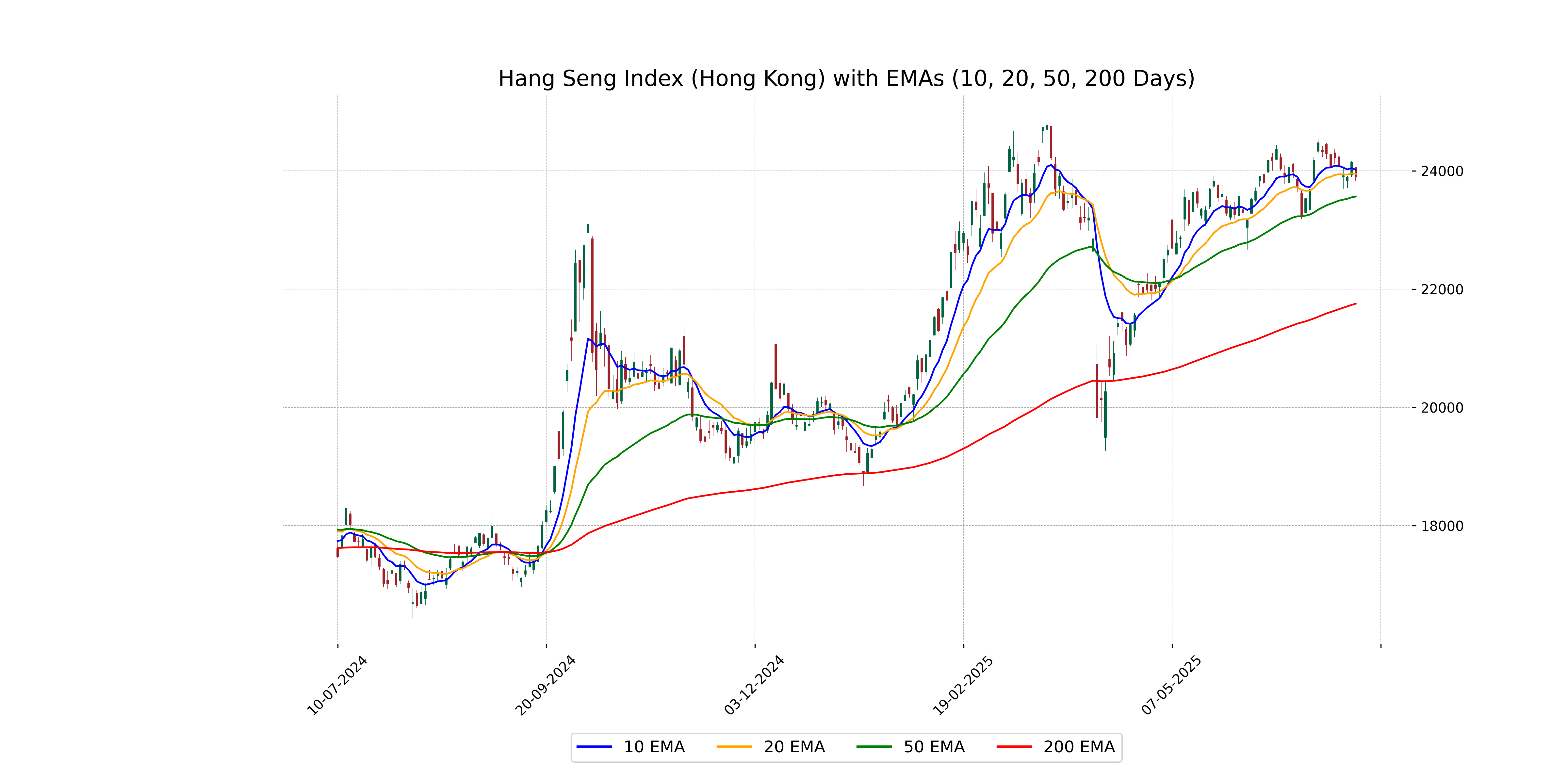

Relationship with Key Moving Averages

The Hang Seng Index closed at 23,892.32, which is above its 50-day EMA of 23,564.45 and significantly above its 200-day EMA of 21,753.60, suggesting medium-term strength despite short-term volatility. Currently, the index is below its 10-day EMA of 24,017.62 but close to its 20-day EMA of 23,949.06, indicating a recent downtrend in the short term.

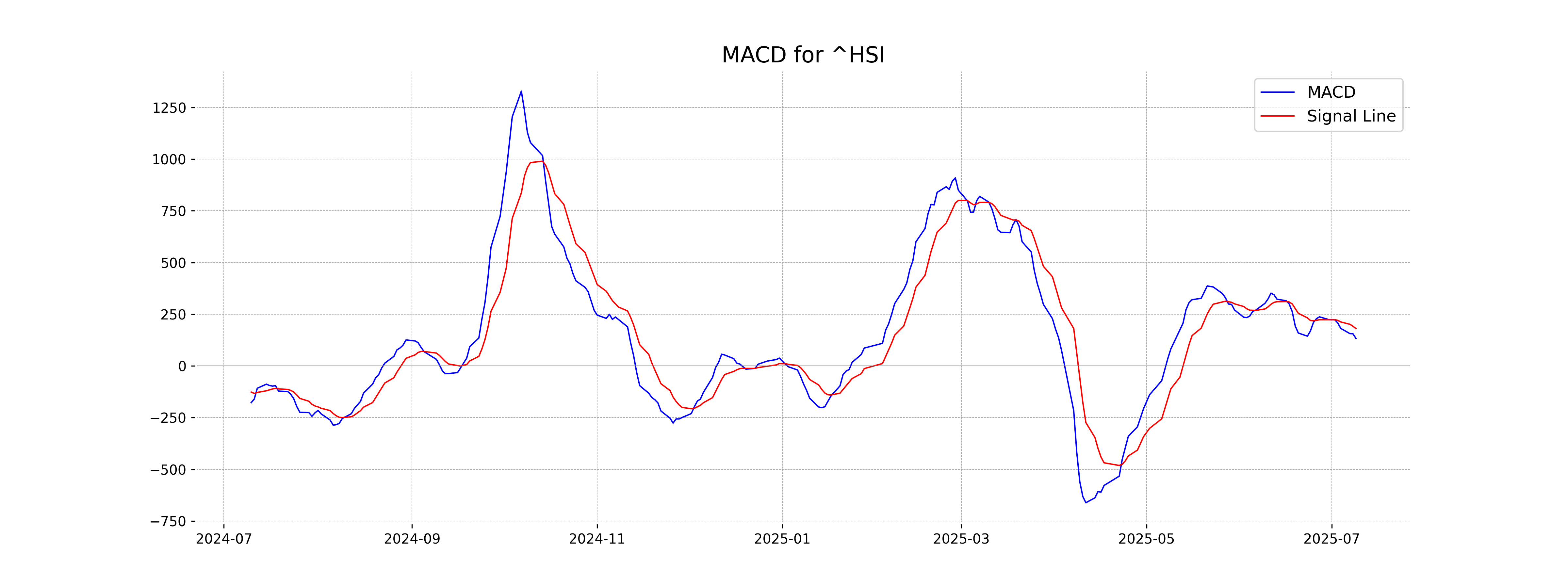

Moving Averages Trend (MACD)

The MACD for the Hang Seng Index shows a value of 132.55, while the MACD Signal line is at 180.13. This indicates a bearish signal as the MACD is below the signal line, suggesting potential downward momentum.

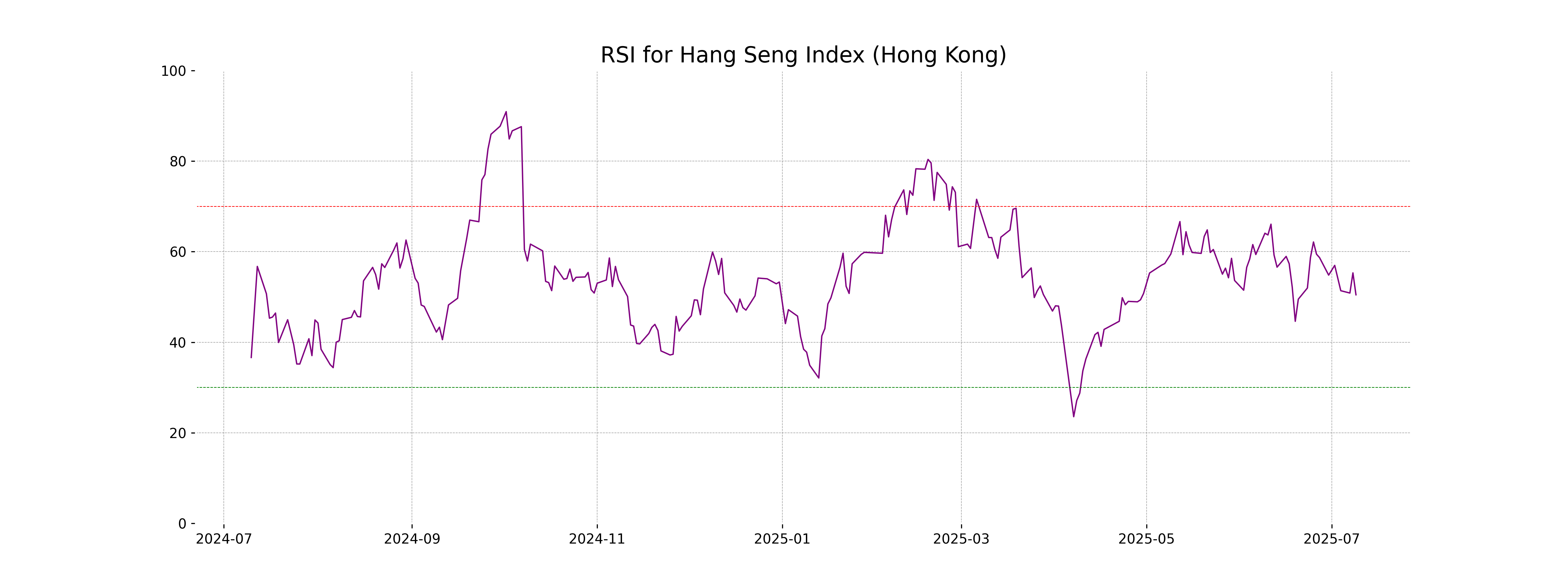

RSI Analysis

RSI Analysis for Hang Seng Index (Hong Kong): The Relative Strength Index (RSI) is at 50.47, suggesting a neutral momentum in the market. This indicates that the Hang Seng Index is neither overbought nor oversold, potentially pointing to a period of consolidation or a balanced demand and supply for the stocks within the index.

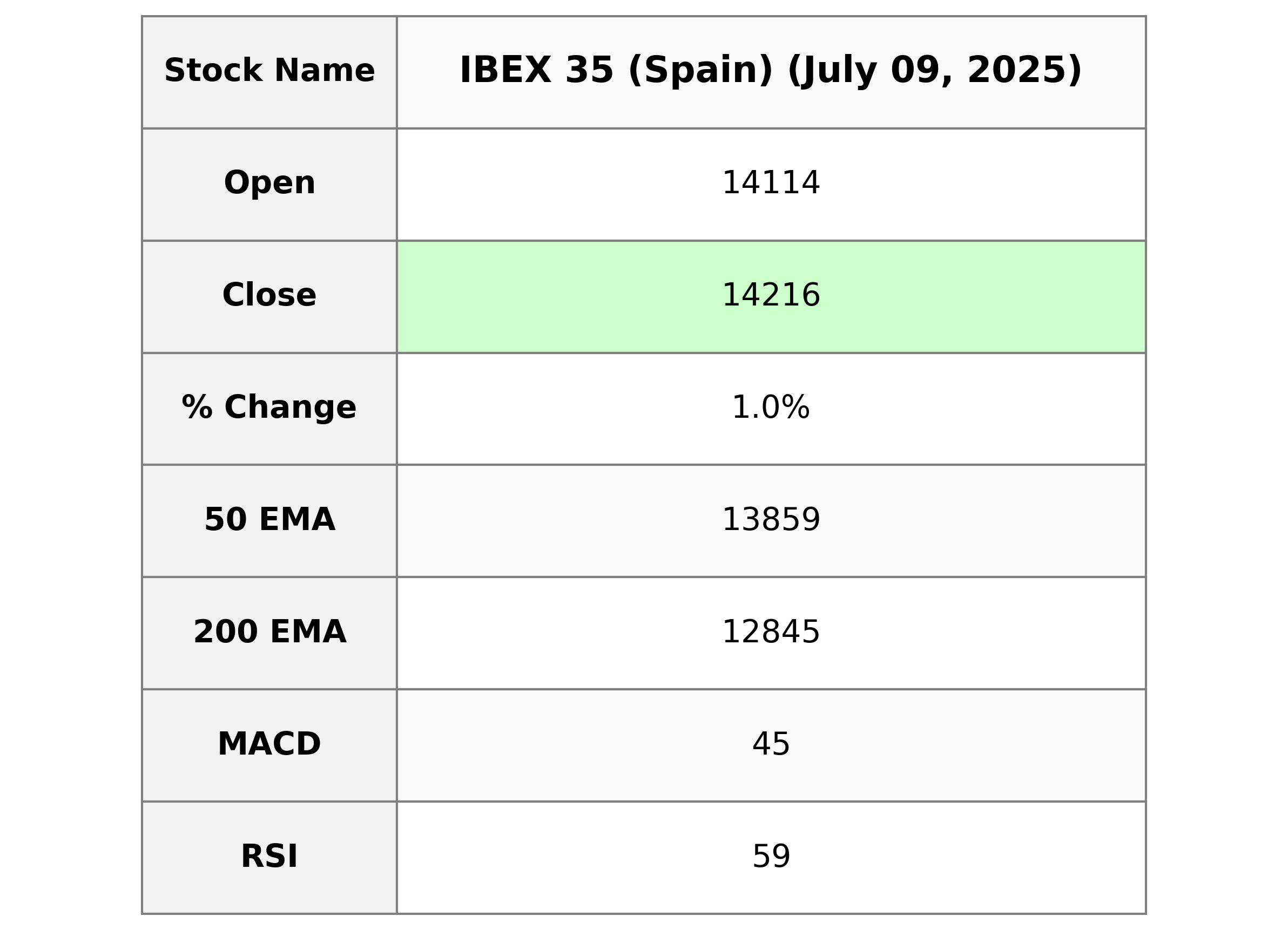

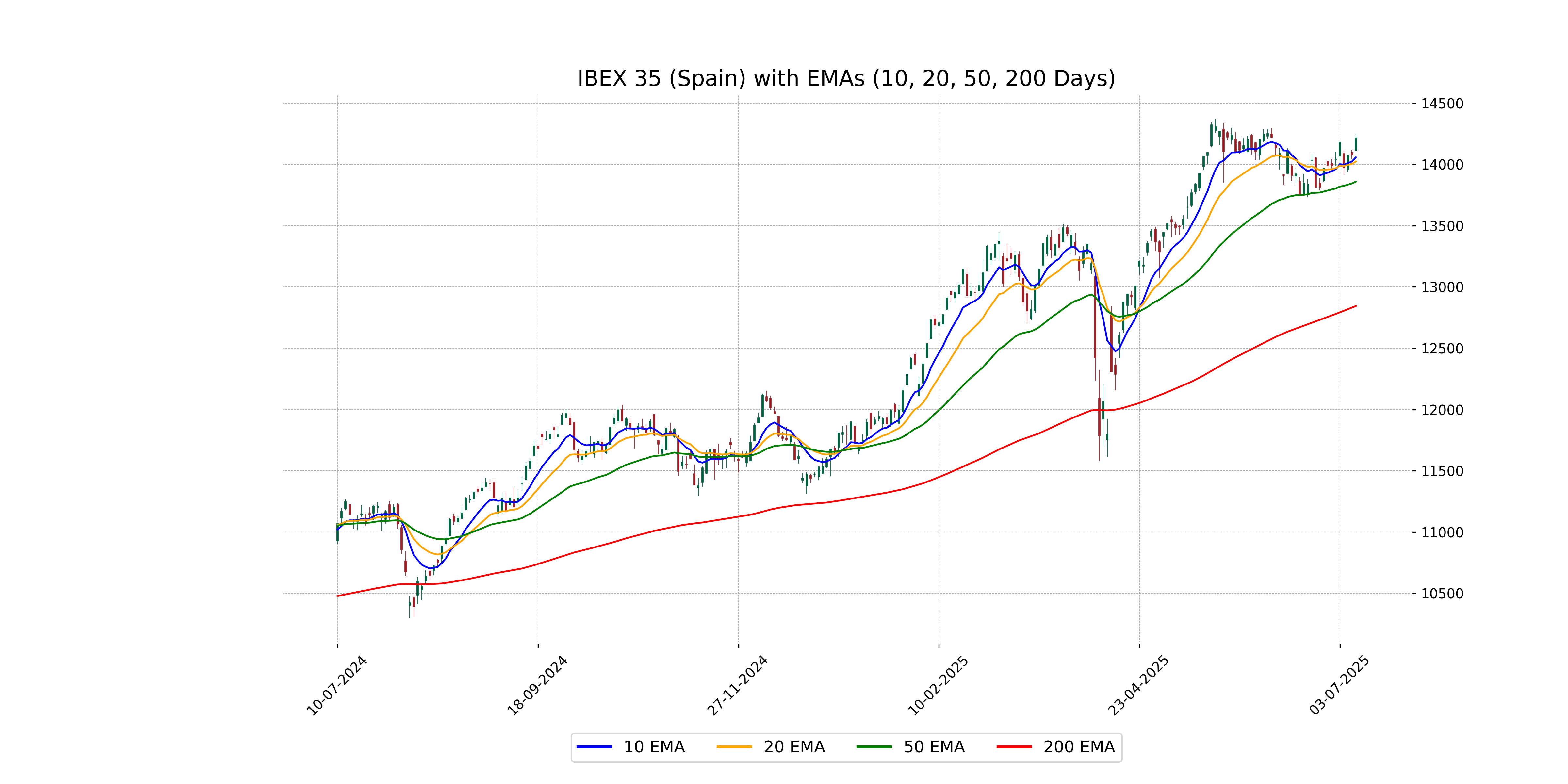

Analysis for IBEX 35 (Spain) - July 09, 2025

IBEX 35 opened at 14113.5 and closed at 14216.30, marking a positive change of 0.97% with a points increase of 136.80. The index saw a high and low of 14246.90 and 14113.5, respectively. The 50 EMA at 13859.27 and 200 EMA at 12844.78 indicate a strong upward trend supported by a bullish MACD crossover, with the MACD at 44.61 against the signal of 27.83. The RSI stands at 58.54, indicating moderate momentum. Volume traded was 45388044.

Relationship with Key Moving Averages

The IBEX 35 is currently trading above its 10, 20, and 50-day EMAs, suggesting a short-term bullish trend. With all three EMAs below the current close, this reflects positive price momentum. Additionally, the index's performance surpasses its 200-day EMA, indicating longer-term strength.

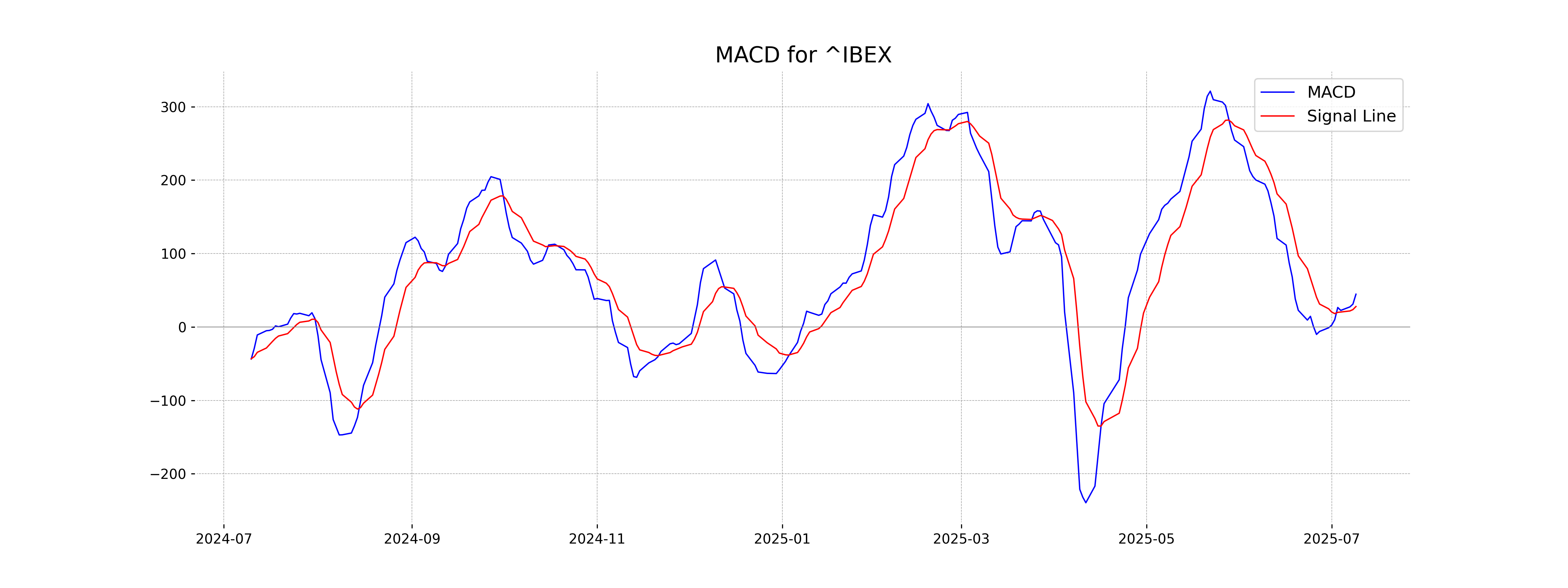

Moving Averages Trend (MACD)

MACD Analysis for IBEX 35 (Spain): The MACD value of 44.61 is significantly above the signal line value of 27.83, indicating a strong bullish momentum for the IBEX 35 index. This suggests potential continued upward price movement in the near term.

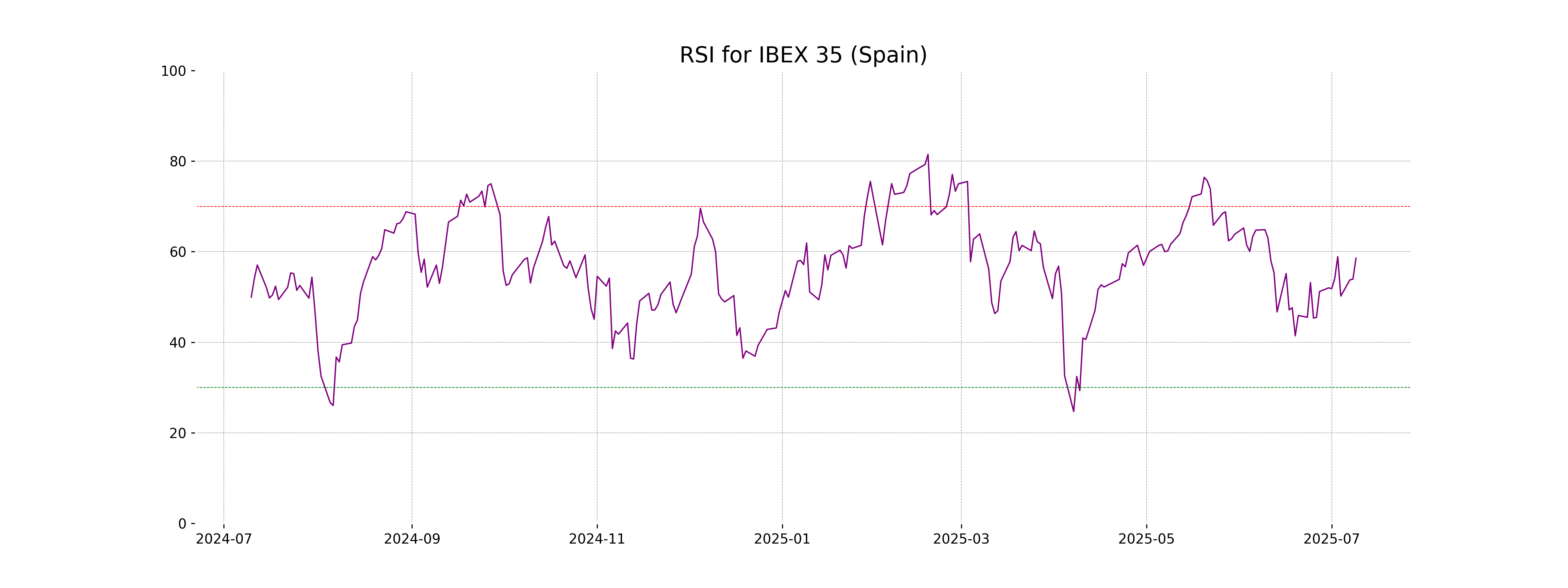

RSI Analysis

The RSI for IBEX 35 stands at 58.54, indicating a neutral stance but leaning towards the bullish side as it's approaching the overbought threshold of 70. This suggests that while there is buying interest, it is not yet in the overbought territory, allowing potential for further upward movement.

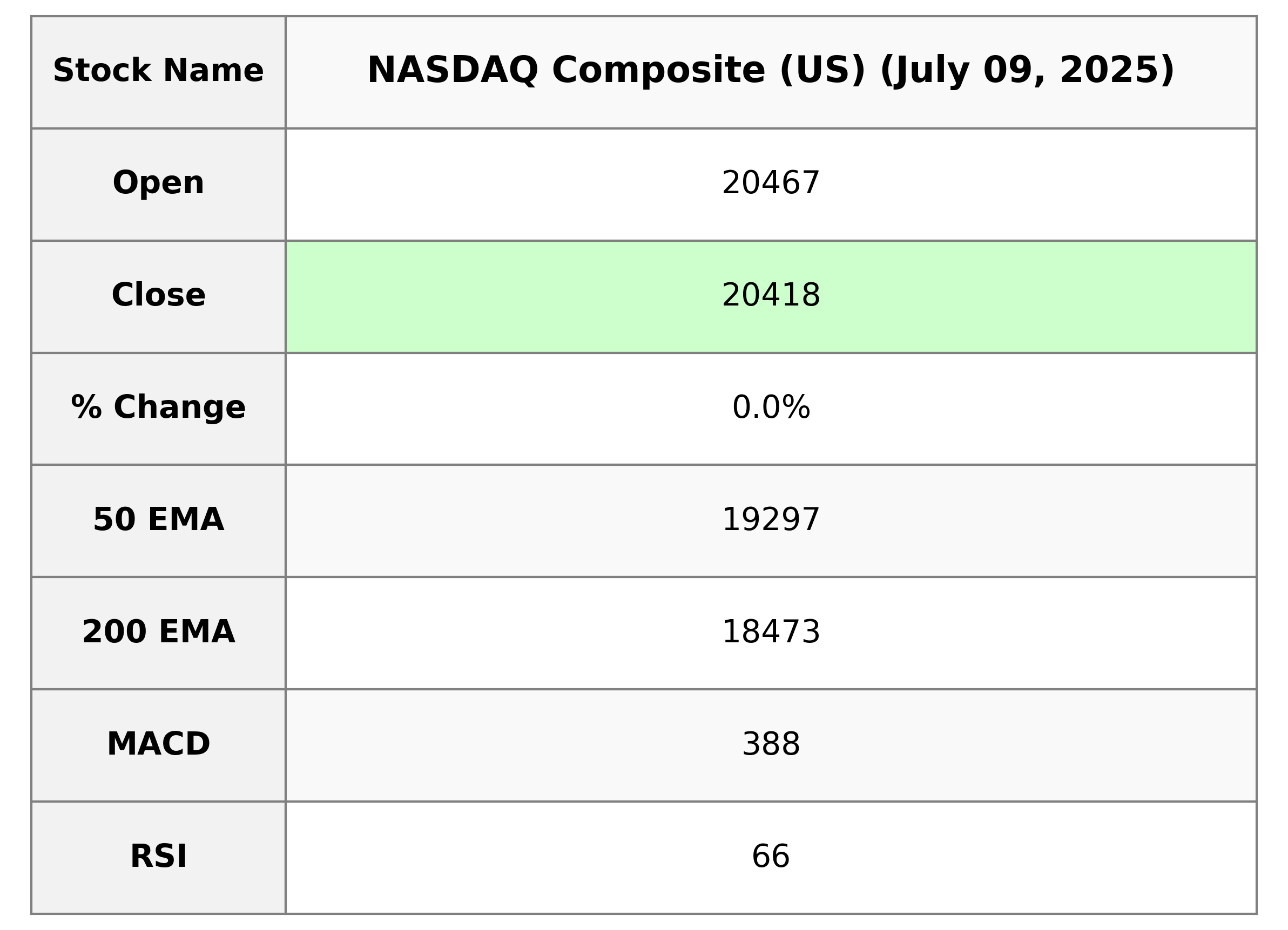

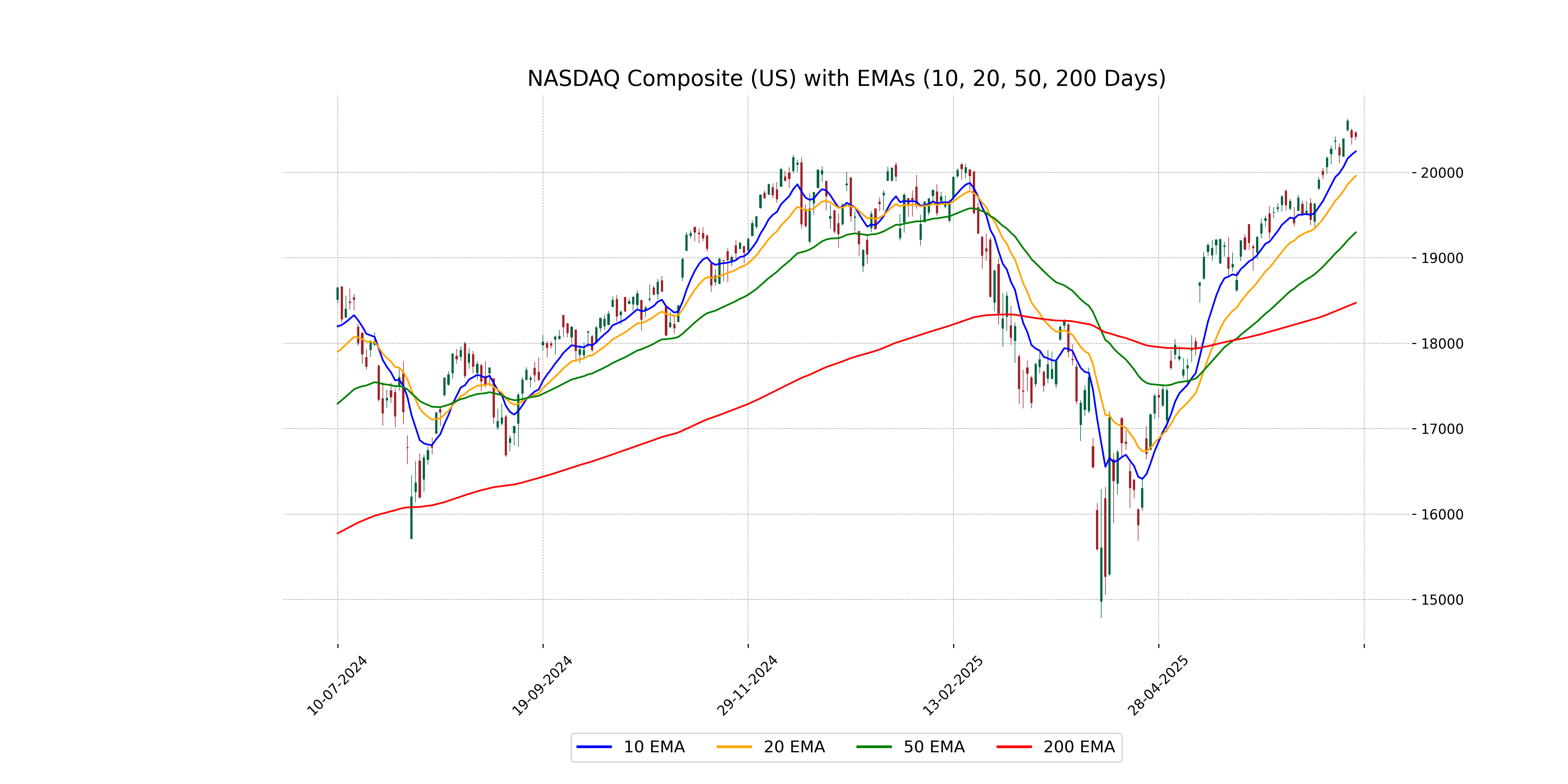

Analysis for NASDAQ Composite (US) - July 09, 2025

The NASDAQ Composite (US) opened at 20,466.93 and closed at 20,418.46, marking a slight gain from the previous close with a percentage change of 0.03%. The index saw a high of 20,480.89 and a low of 20,377.36, with a substantial trading volume of 8.44 billion. Technical indicators show the index above its 50-day and 200-day EMAs, and an RSI of 66.35 suggests a bullish momentum.

Relationship with Key Moving Averages

The NASDAQ Composite is currently trading above its key moving averages, indicating a positive trend. The current closing price of 20418.46 is above the 10-EMA of 20245.93, the 20-EMA of 19960.82, the 50-EMA of 19297.23, and the 200-EMA of 18473.08, demonstrating a bullish momentum in the market.

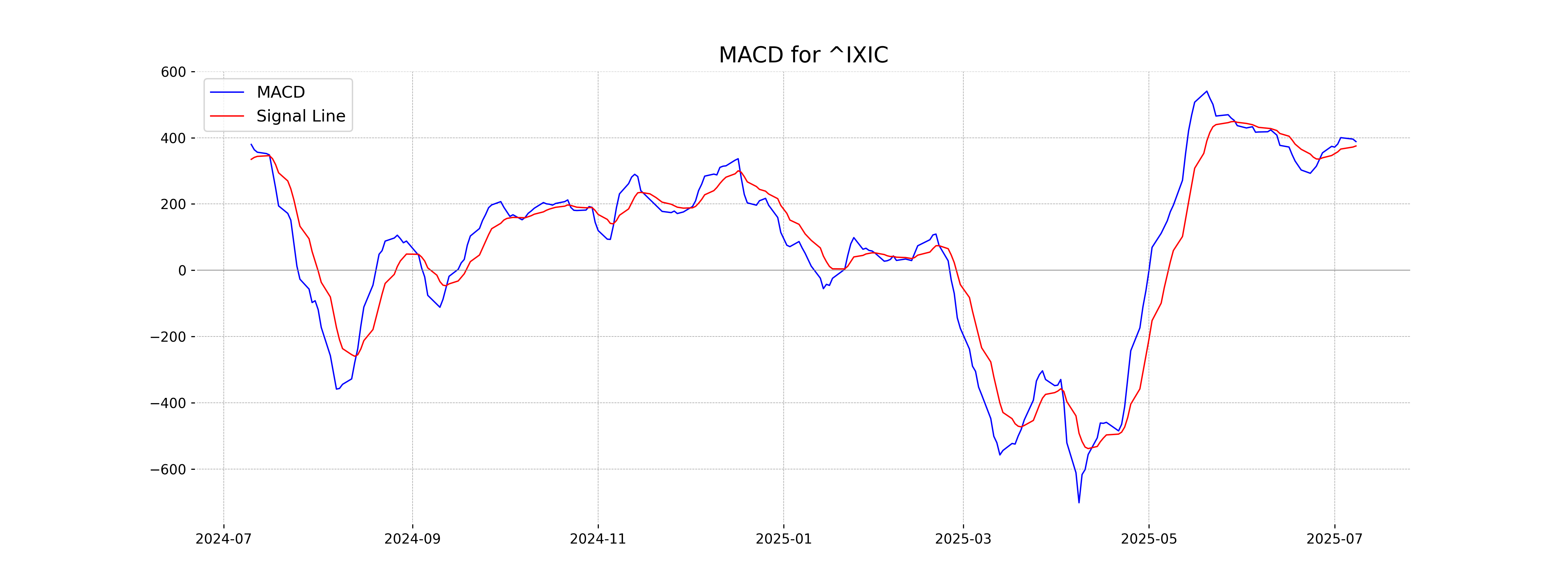

Moving Averages Trend (MACD)

The NASDAQ Composite shows a positive trend in its MACD analysis, with a MACD value of 388.31, which is above the MACD Signal line of 375.08. This indicates a potential bullish momentum in the market.

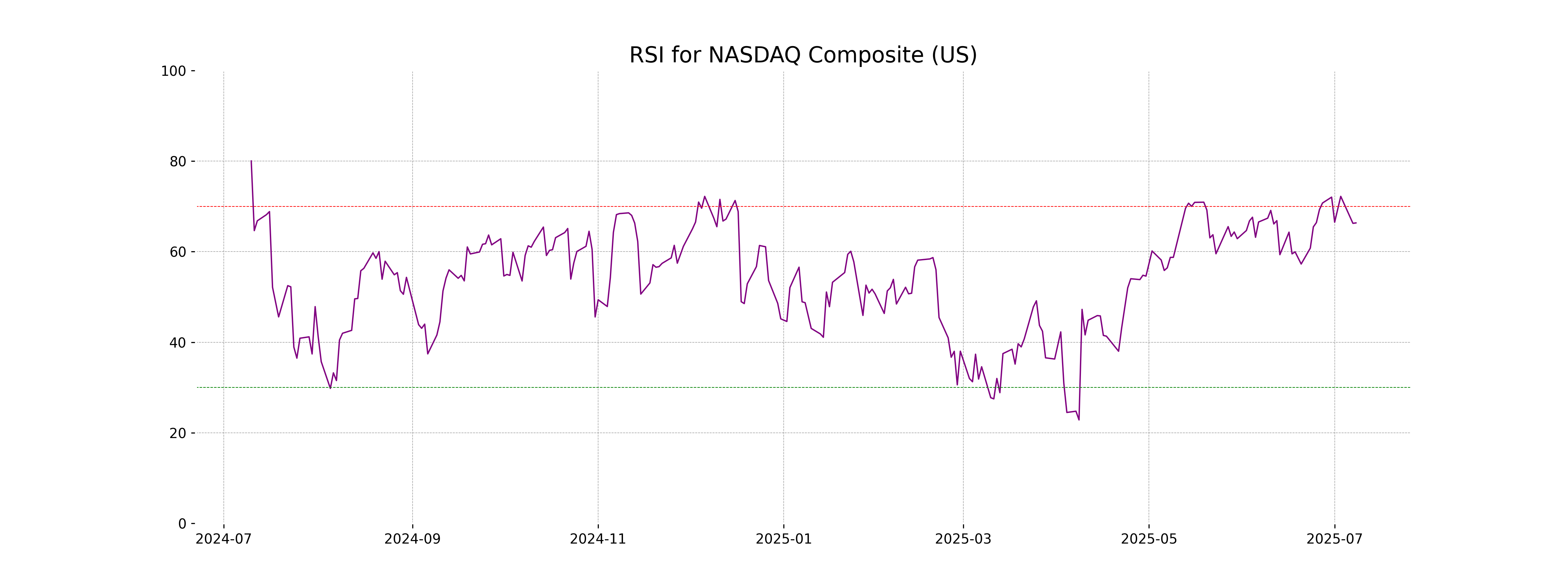

RSI Analysis

The current RSI for the NASDAQ Composite (US) is 66.35, which suggests that the index is nearing the overbought territory, typically considered above 70. This could indicate potential for a price correction, although the trend may still sustain in the short term.

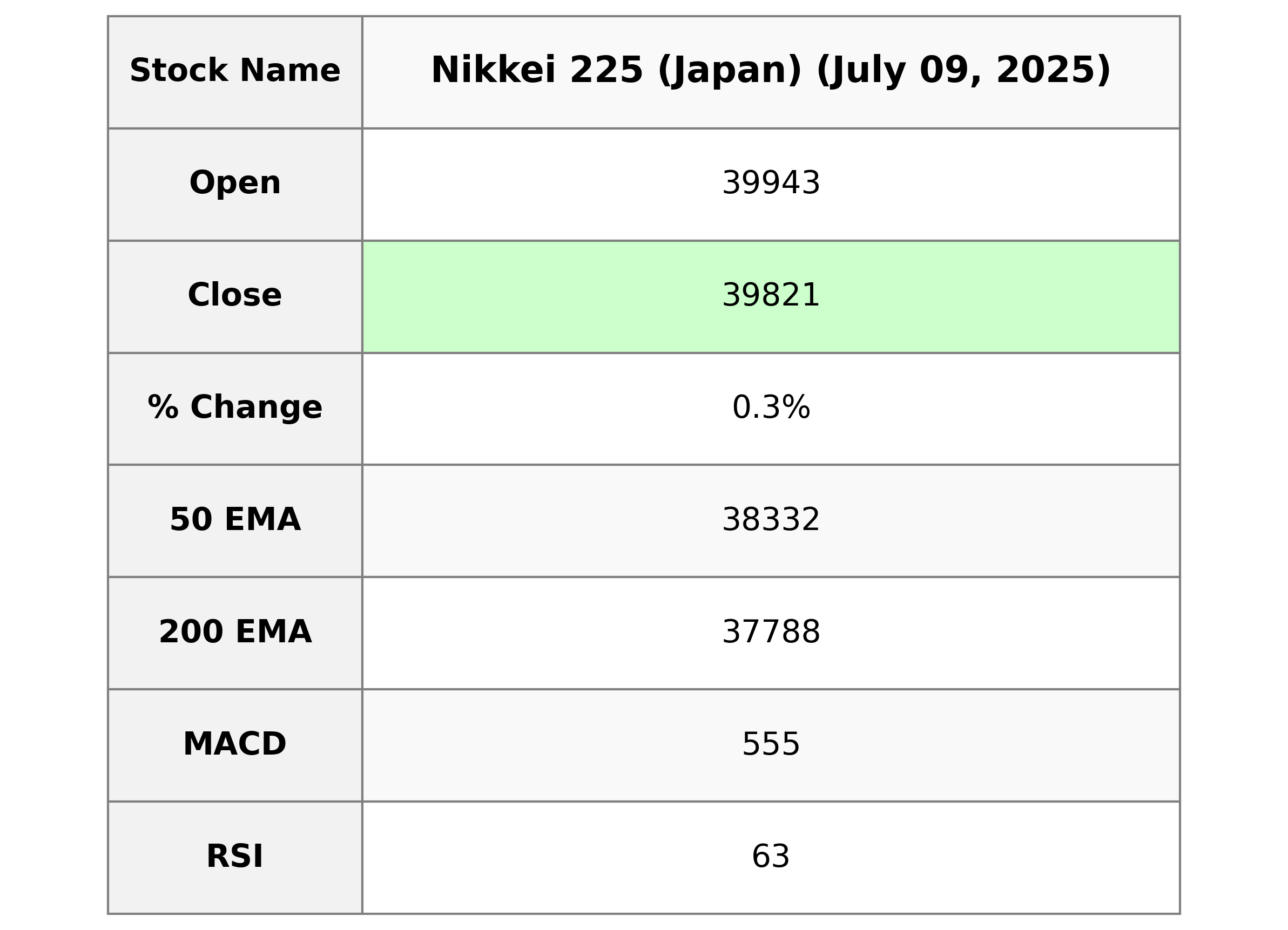

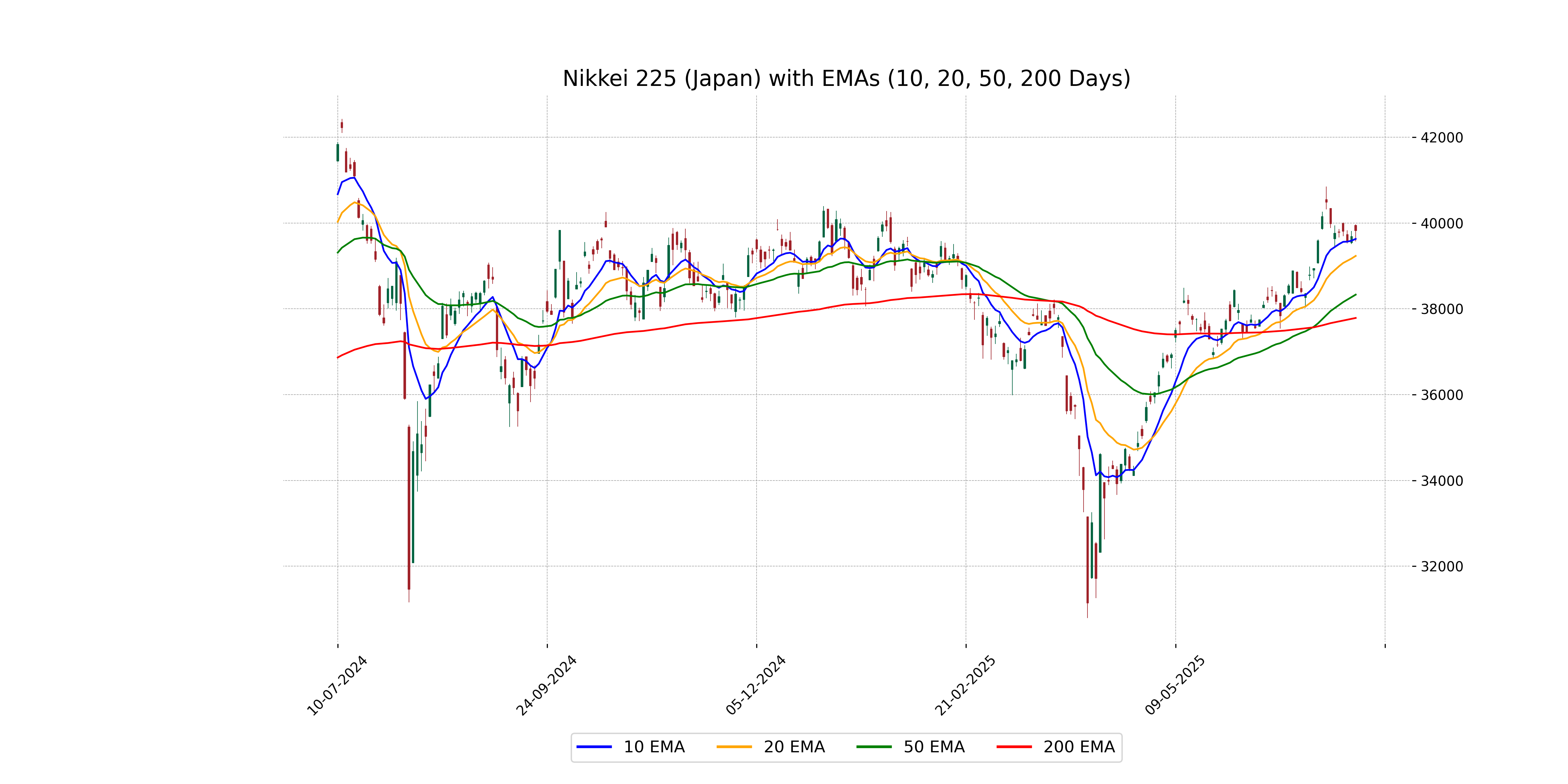

Analysis for Nikkei 225 (Japan) - July 09, 2025

Nikkei 225 (Japan) opened at 39,942.80 and closed at 39,821.28, gaining 0.33% from its previous close of 39,688.81, with a points increase of 132.47. The indices' RSI is 62.67, indicating a relatively strong momentum, while the MACD and MACD Signal are close, suggesting a hold in the current trend.

Relationship with Key Moving Averages

Nikkei 225 is trading above its 50-day and 200-day EMAs, with a current price of 39821.28125 compared to the 50-EMA at 38332.0733 and the 200-EMA at 37787.8263, indicating a bullish trend. Additionally, it is slightly above the 10-EMA of 39631.7731 and the 20-EMA of 39234.9453, suggesting short-term bullish momentum.

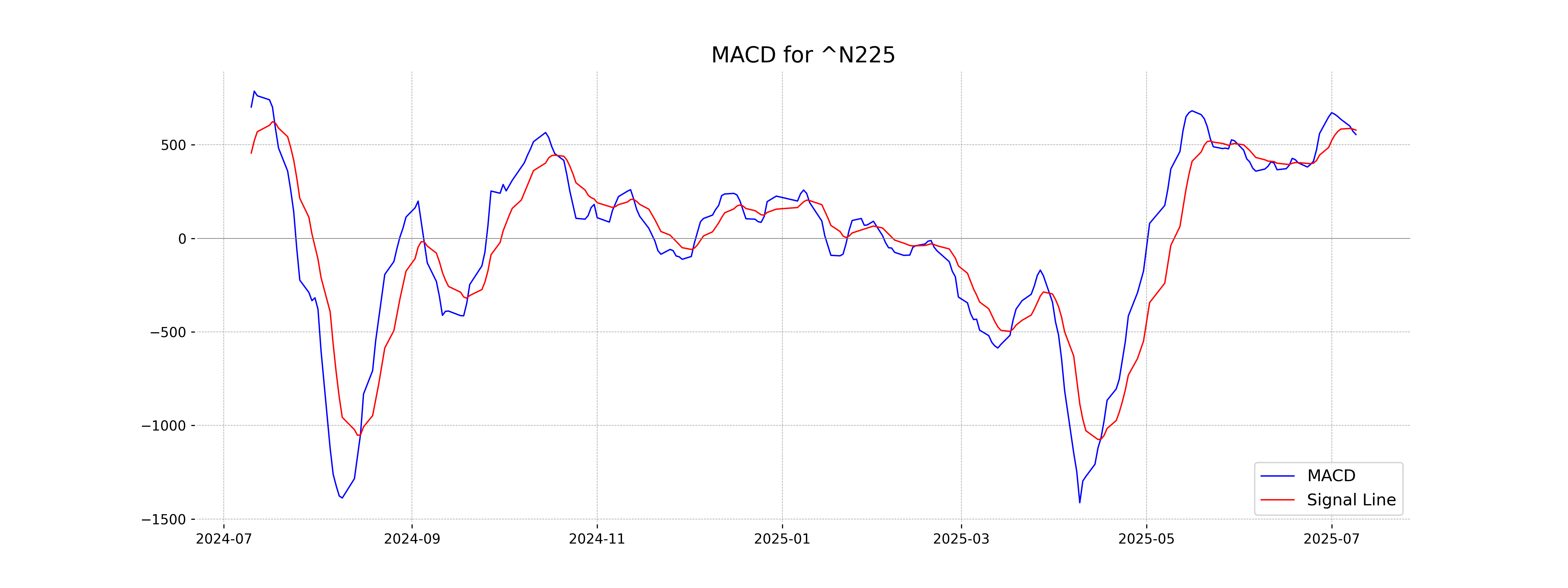

Moving Averages Trend (MACD)

Nikkei 225 is showing a slight bearish momentum with the MACD at 554.89, which is below the MACD Signal line at 578.50. This suggests that the recent upward movement may face resistance, and caution is advised for short-term traders.

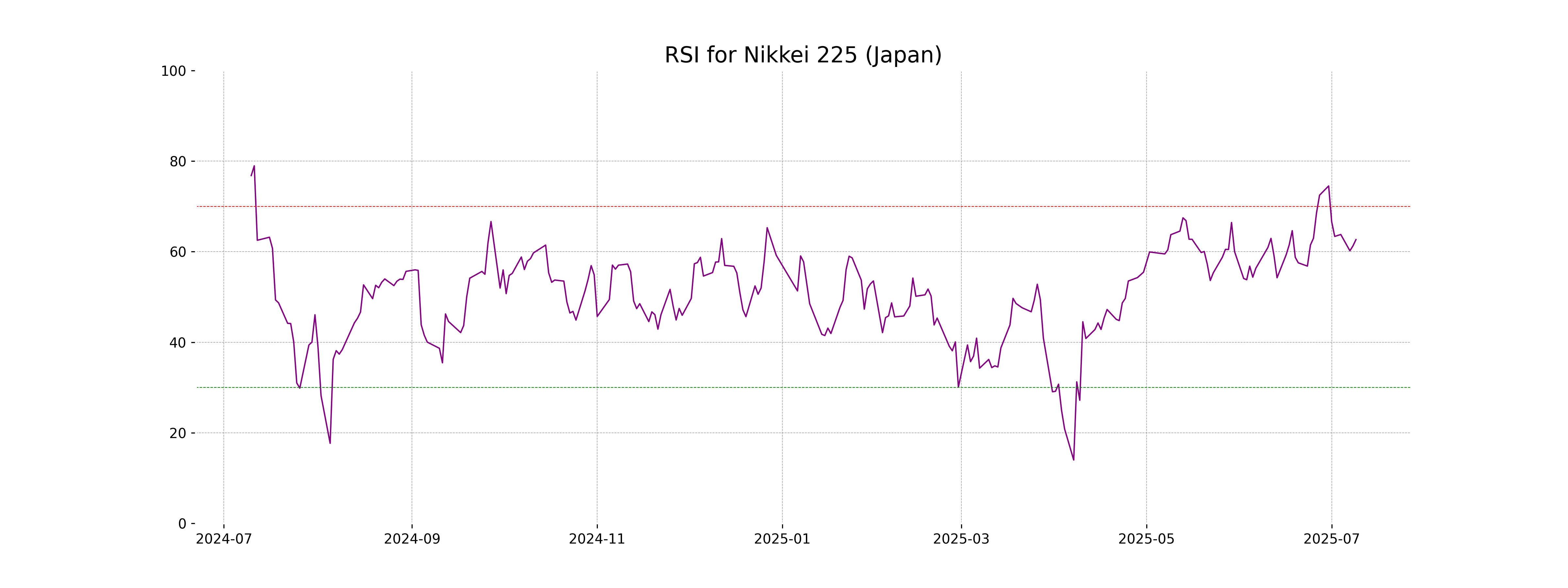

RSI Analysis

Based on the stock data for Nikkei 225, the RSI value of 62.67 indicates a neutral to slightly bullish momentum. The RSI is approaching the overbought threshold of 70, suggesting that while the index is not yet overbought, it could be nearing that level if the upward trend continues.

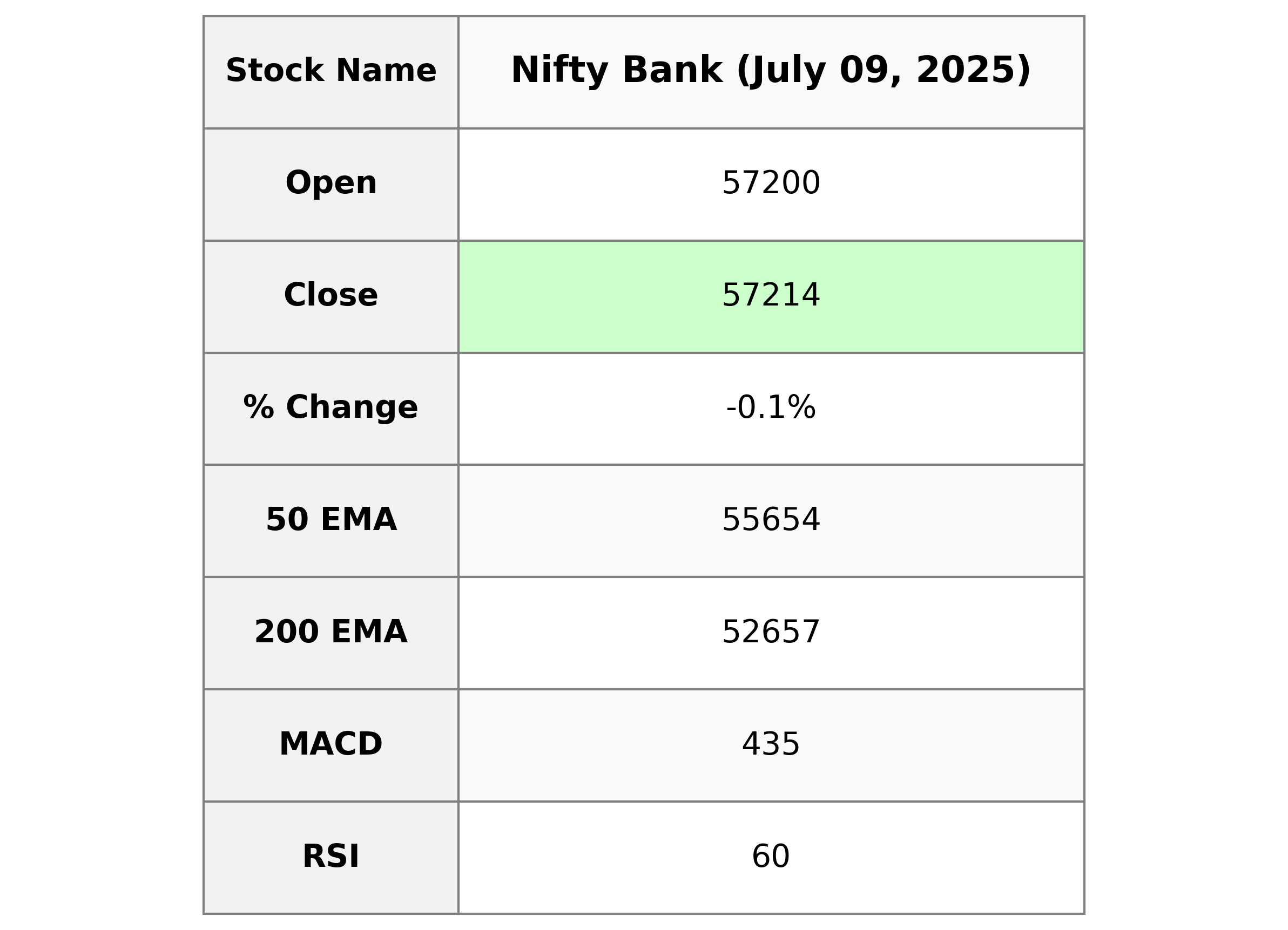

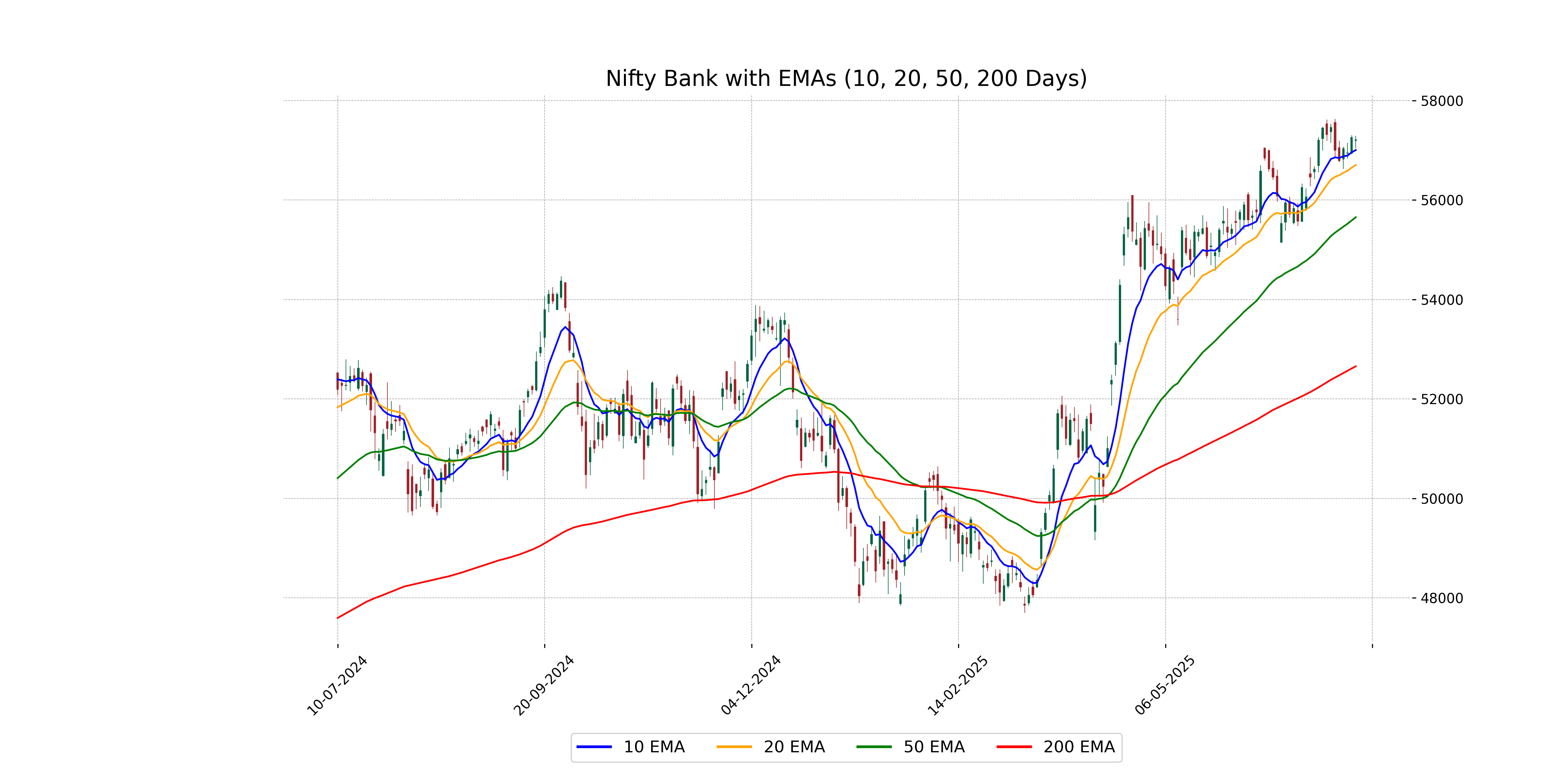

Analysis for Nifty Bank - July 09, 2025

Nifty Bank opened at 57199.75 and closed slightly lower at 57213.55, with a minor change of -0.07%, losing 42.75 points compared to the previous close of 57256.30. The RSI is 60.45, indicating a relatively strong position, while the MACD is slightly below its signal line, pointing to a potential weakening in momentum. The stock's 50 EMA and 200 EMA values suggest an overall upward trend when compared to shorter-term moving averages.

Relationship with Key Moving Averages

The Nifty Bank's current closing price of 57213.55 is above its 50-EMA of 55654.20 and 200-EMA of 52657.03, indicating a short-term bullish trend. Additionally, it is slightly above the 10-EMA of 57004.70 and the 20-EMA of 56704.09, suggesting recent upward momentum.

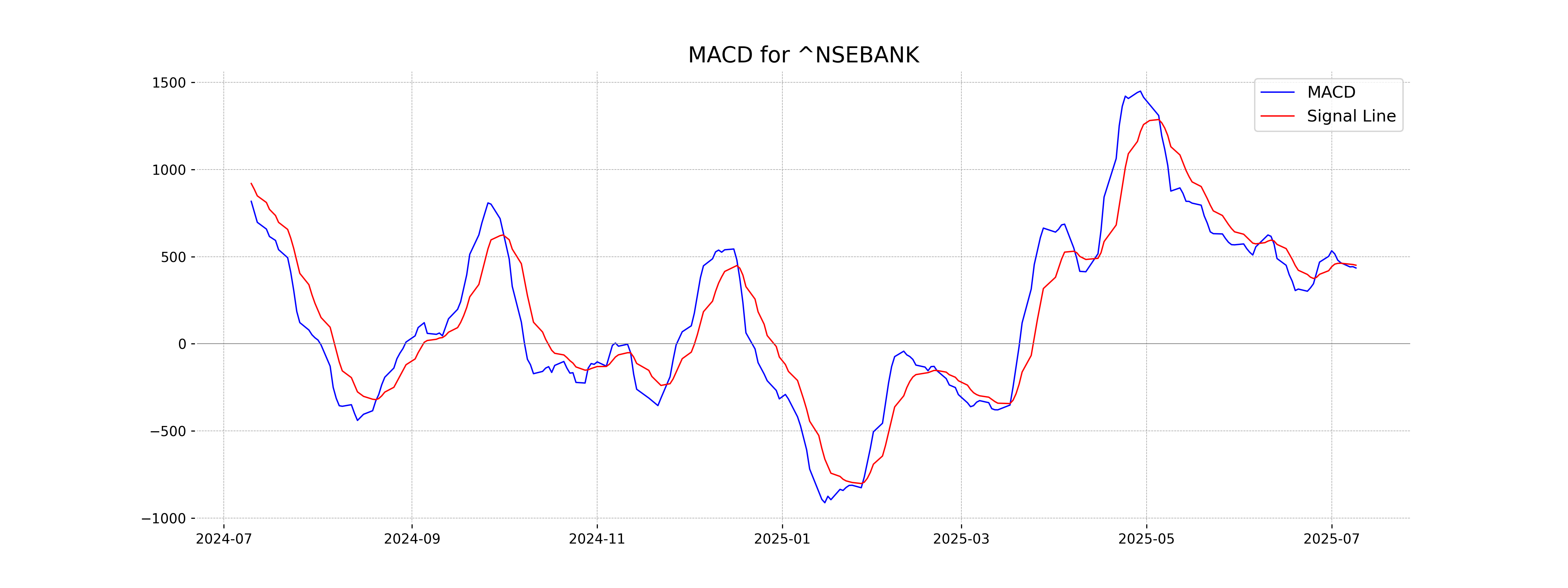

Moving Averages Trend (MACD)

Nifty Bank's MACD is 434.812, which is below the MACD Signal of 450.821, indicating a potential bearish trend or weakening momentum. This suggests that traders should be cautious about potential downward movement in the short term.

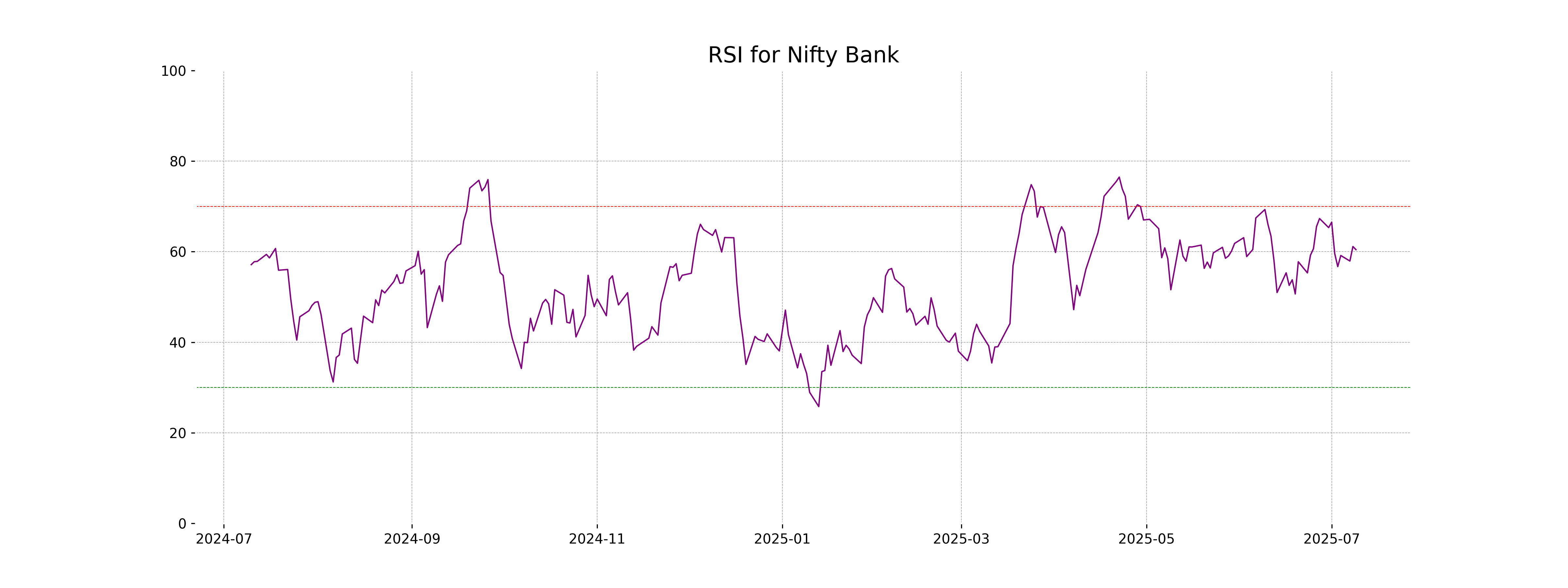

RSI Analysis

The RSI (Relative Strength Index) for Nifty Bank is 60.45, indicating a moderately strong position, as it is above the midpoint of 50. This suggests that while the stock has some upward momentum, it is not yet in overbought territory, typically marked by readings above 70.

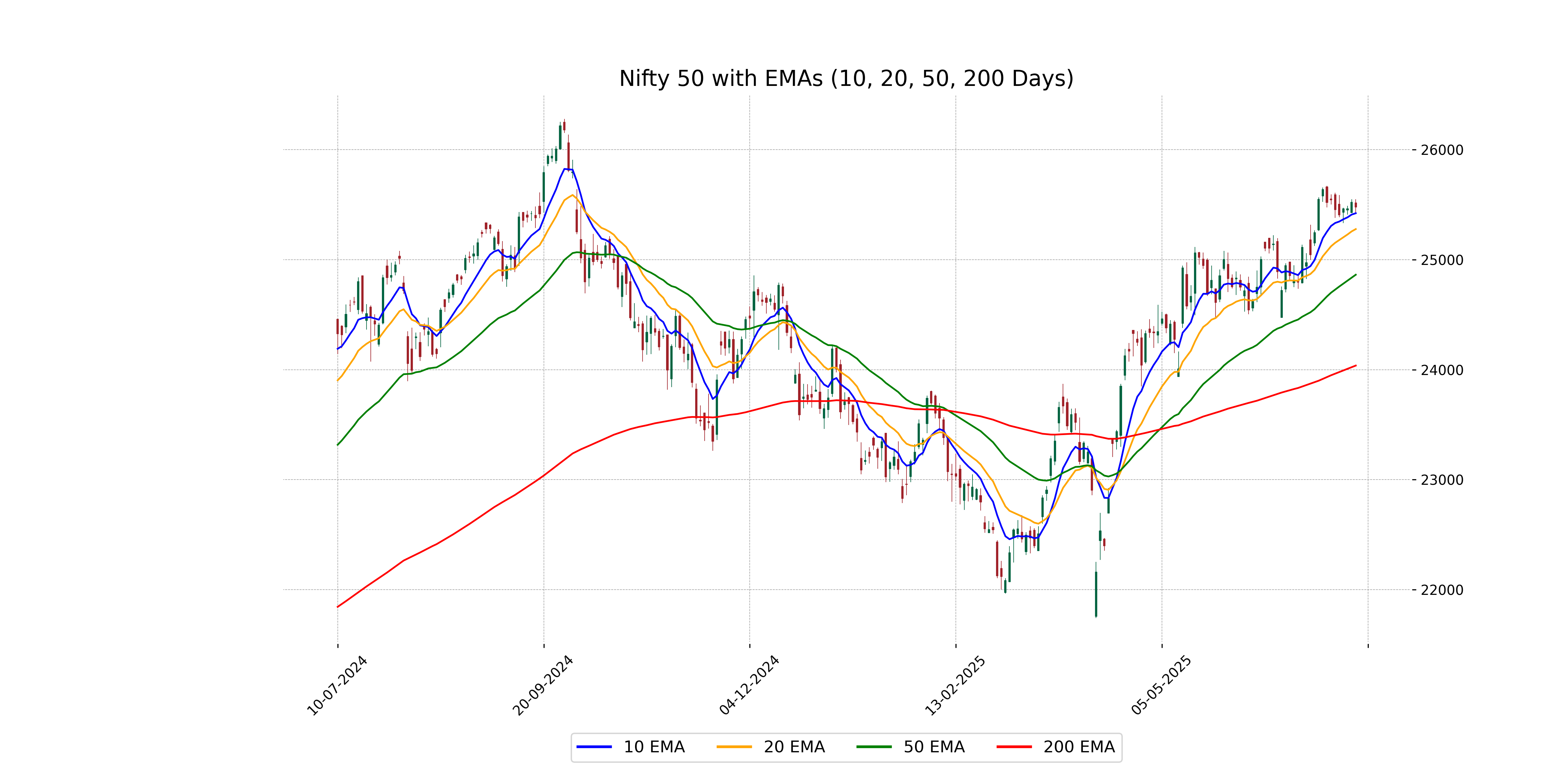

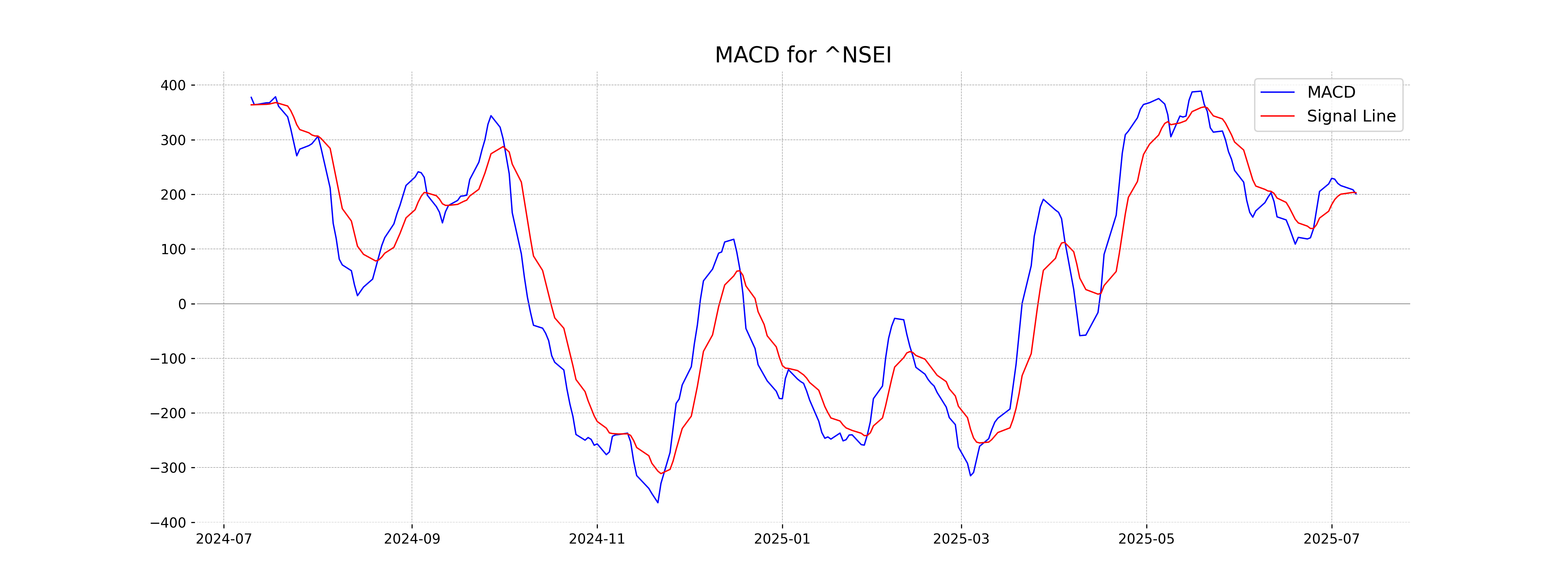

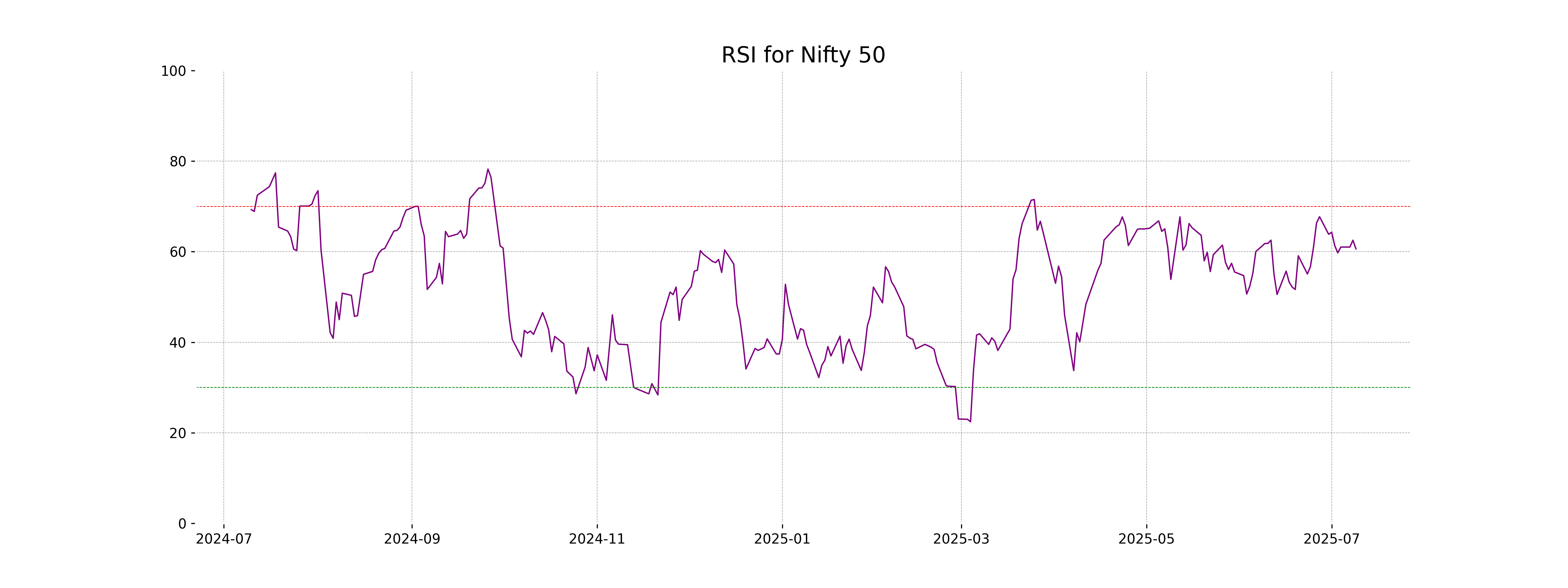

Analysis for Nifty 50 - July 09, 2025

Nifty 50 opened at 25,514.60 with a high of 25,548.70 and closed at 25,476.10, showing a slight decline compared to the previous close of 25,522.50. The index experienced a percentage change of -0.18%, decreasing by 46.40 points. The RSI of 60.61 indicates a relatively neutral momentum, while the MACD slightly trails its signal line at 200.92 versus 203.08.

Relationship with Key Moving Averages

The current closing price of Nifty 50 at 25,476.10 is above the 50 EMA (24,862.59) and the 200 EMA (24,037.00), indicating a strong upward trend. However, it is slightly above the 10 EMA (25,421.32) and relatively close to the 20 EMA (25,277.22), suggesting a consolidation phase around the short-term averages.

Moving Averages Trend (MACD)

The Nifty 50 shows a MACD value of 200.92 with a MACD Signal of 203.08, indicating a slight bearish momentum as the MACD is below the signal line. This could suggest potential short-term downward pressure in the index if the trend persists.

RSI Analysis

The relative strength index (RSI) for Nifty 50 is 60.61, indicating that the index is neither overbought nor oversold. An RSI value between 30 and 70 typically suggests that the stock or index is trading in a neutral zone, with no immediate overbought or oversold conditions.

ADVERTISEMENT

Up Next

Global stock market indices: How the world markets performed today - 09 July 2025

Rupee breaches 91-mark against US dollar for first time in intra-day trade

Microsoft commits USD 17.5 billion investment in India: CEO Satya Nadella

CBI books Anil Ambani's son, Reliance Home Finance Ltd. in Rs 228 crore bank fraud case

RBI raises FY26 GDP growth projection to 7.3 pc

RBI trims policy interest rate by 25bps to 5.25pc, loans to get cheaper

More videos

Rupee slumps to all-time low of 90.25 against US dollar in intra-day trade

Reliance completes merger of Star Television Productions with Jiostar

India to lead emerging market growth with 7pc GDP rise in 2025: Moody’s

Nifty hits record high after 14 months; Sensex nears all-time peak

Reliance stops Russian oil use at its only-for-export refinery to comply with EU sanctions

ED attaches fresh assets worth over Rs 1,400 cr in case against Anil Ambani's Reliance Group

India signs one-year deal to import 2.2 million tonnes of LPG from US

India International Trade Fair begins at Pragati Maidan amid tight security

Stock markets decline in initial trade on foreign fund outflows, weak Asian peers

Amazon to lay off 30,000 office workers amid AI-driven cost cuts