- Home

- ❯

- Business

- ❯

- Markets

- ❯

- Global stock market indices: How the world markets performed today - 11 February 2025

Highlights

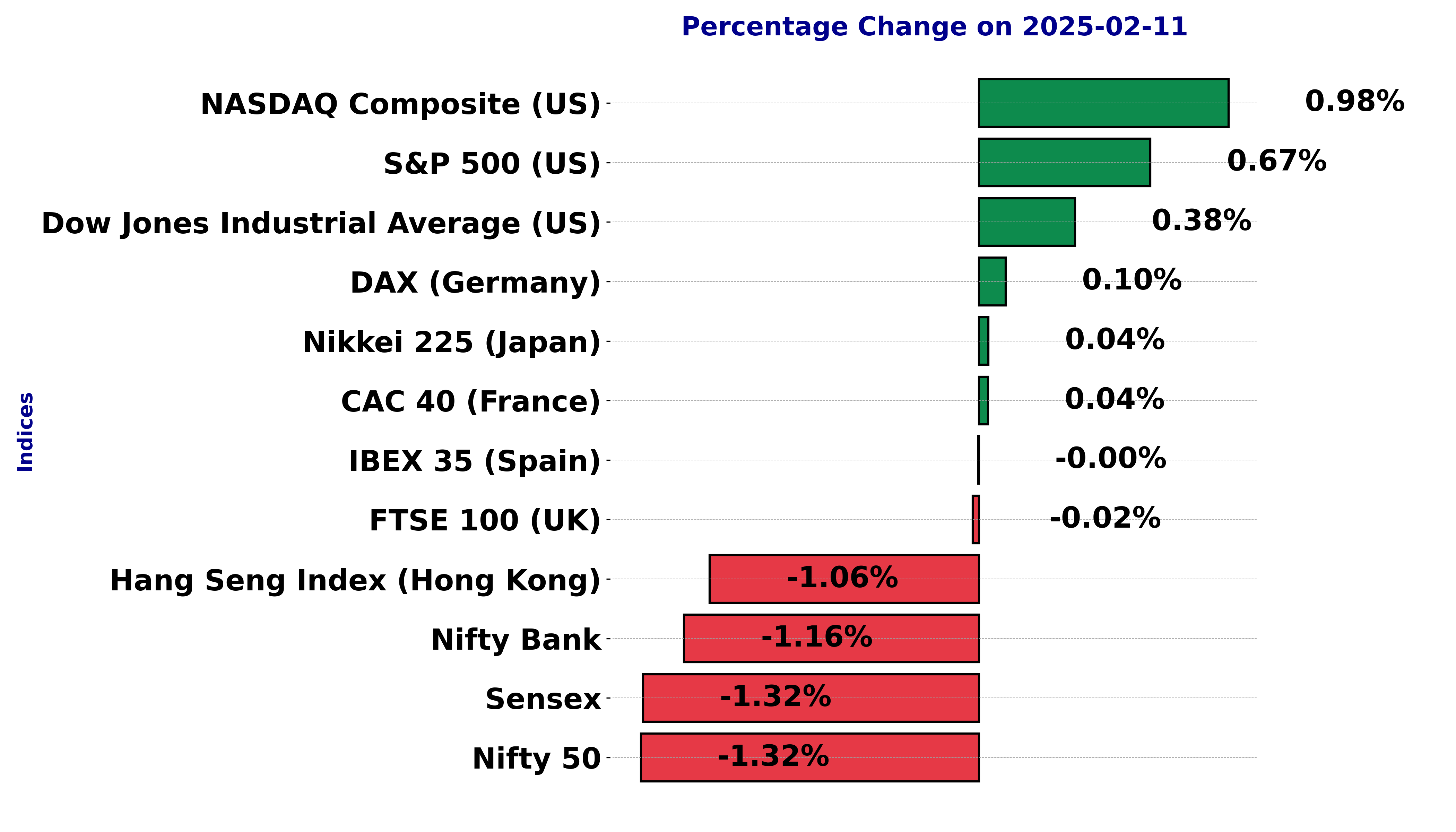

- Mixed sentiment with an evident divergence in performance across different indices

- Investors appeared careful, contrasting bullish and bearish signals

- RSI values helped identify overbought or oversold condition

Latest news

RBI announces Rs 30,000 crore G-Sec underwriting auction, releases OMO purchase results

Sriram Raghavan, Dibakar Banerjee, other filmmakers onboard to judge films at MAMI Mumbai Film Festival 2026

Gold should now be seen more as an "insurance policy", SIP route advisable at current levels: Analysts

AAP MLA Hemant Khava flags poor road conditions, questions toll tax usage in Gujarat

AAP calls Punjab district panchayat win historic, eyes Gujarat local body polls

Gujarat AAP MLA Chaitar Vasava questions police action against tribal villagers in Banaskantha

Sitharaman introduced Securities Markets Code Bill in Lok Sabha, proposes to send it to parliamentary committee

OnePlus 15R review: A clear shift in what the R-series stands for

Global stock market indices: How the world markets performed today - 11 February 2025

The international stock market indices showed varied performances on February 11, 2025, reflecting the economic sentiment across different regions.

In this article, we analyze the performance of key global indices including the S&P 500, Dow Jones Industrial Average, NASDAQ Composite, FTSE 100, DAX, CAC 40, IBEX 35, Nikkei 225, Hang Seng, Nifty 50, and BSE Sensex.

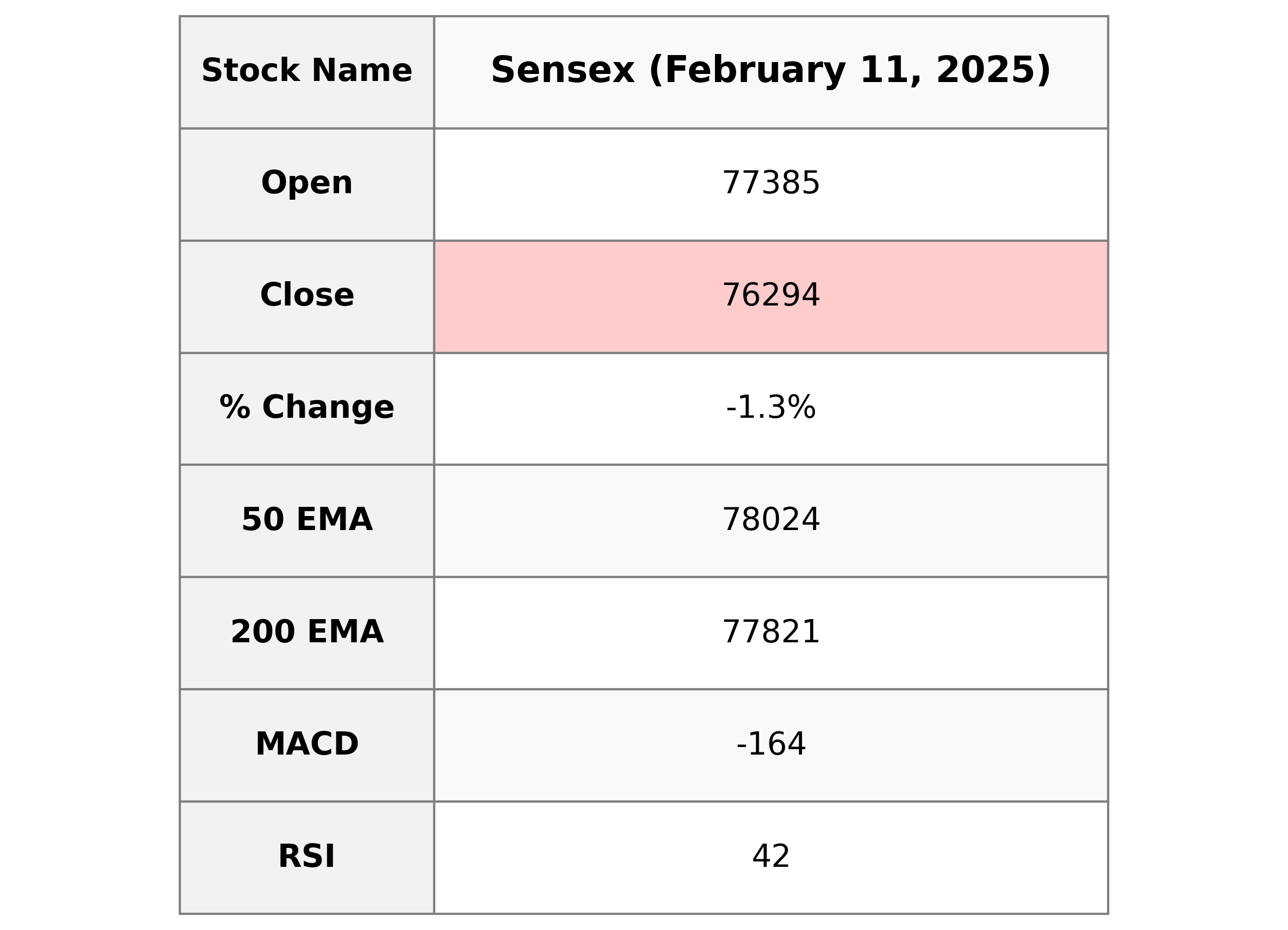

Analysis for Sensex - February 11, 2025

The BSESN opened at 77,384.98 and closed at 76,293.60, experiencing a significant drop with a percentage change of -1.32%, amounting to a loss of 1,018.20 points. The RSI stands at 41.92, indicating a bearish momentum, while the MACD of -163.98 suggests a downward trend, although it is above the MACD Signal line of -292.40.

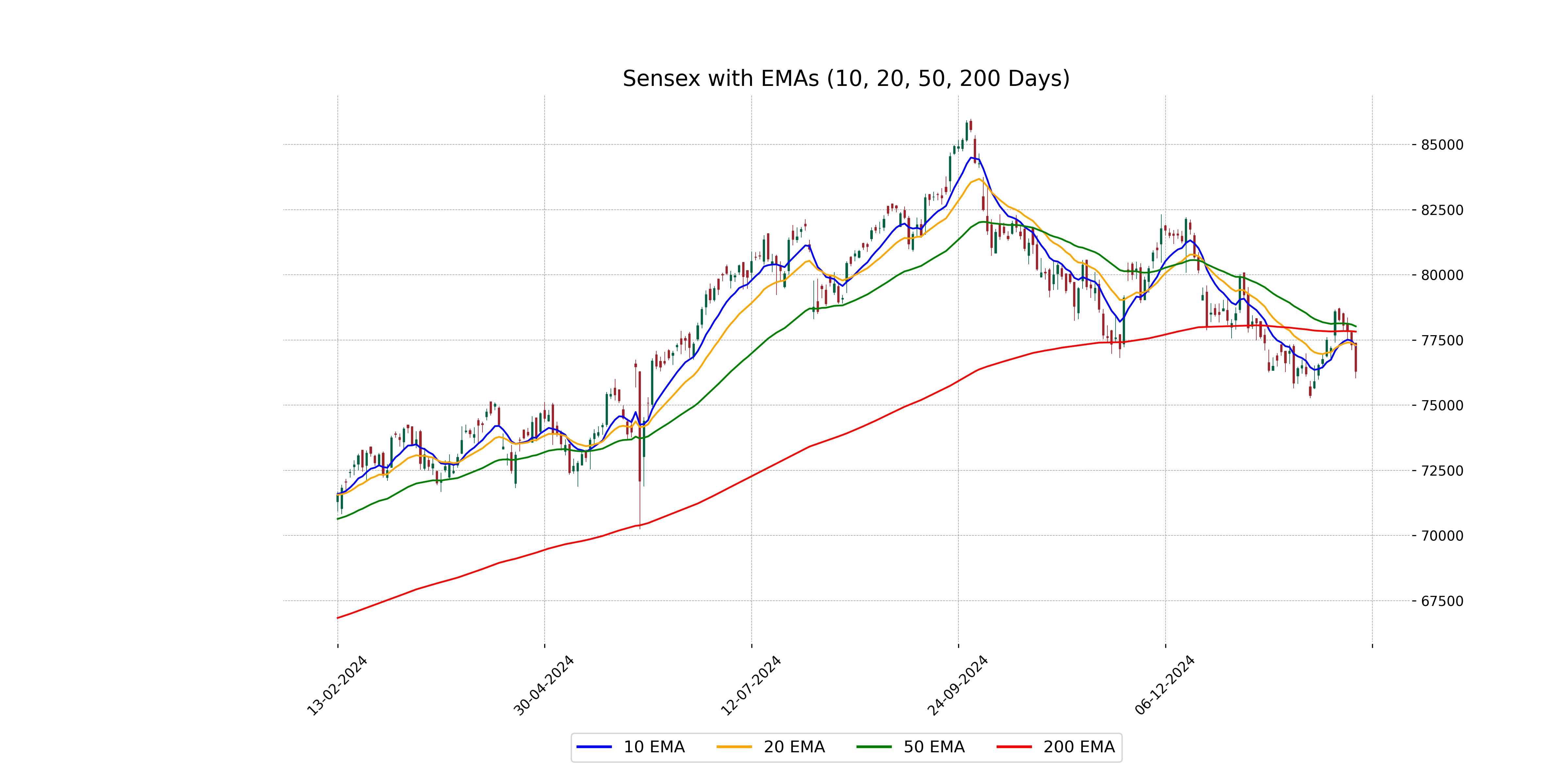

Relationship with Key Moving Averages

The Sensex closed below its 10 EMA (77,260.06) and 20 EMA (77,289.14), indicating short-term bearish momentum. Additionally, closing below the 50 EMA (78,023.63) and 200 EMA (77,821.12) suggests a broader downtrend.

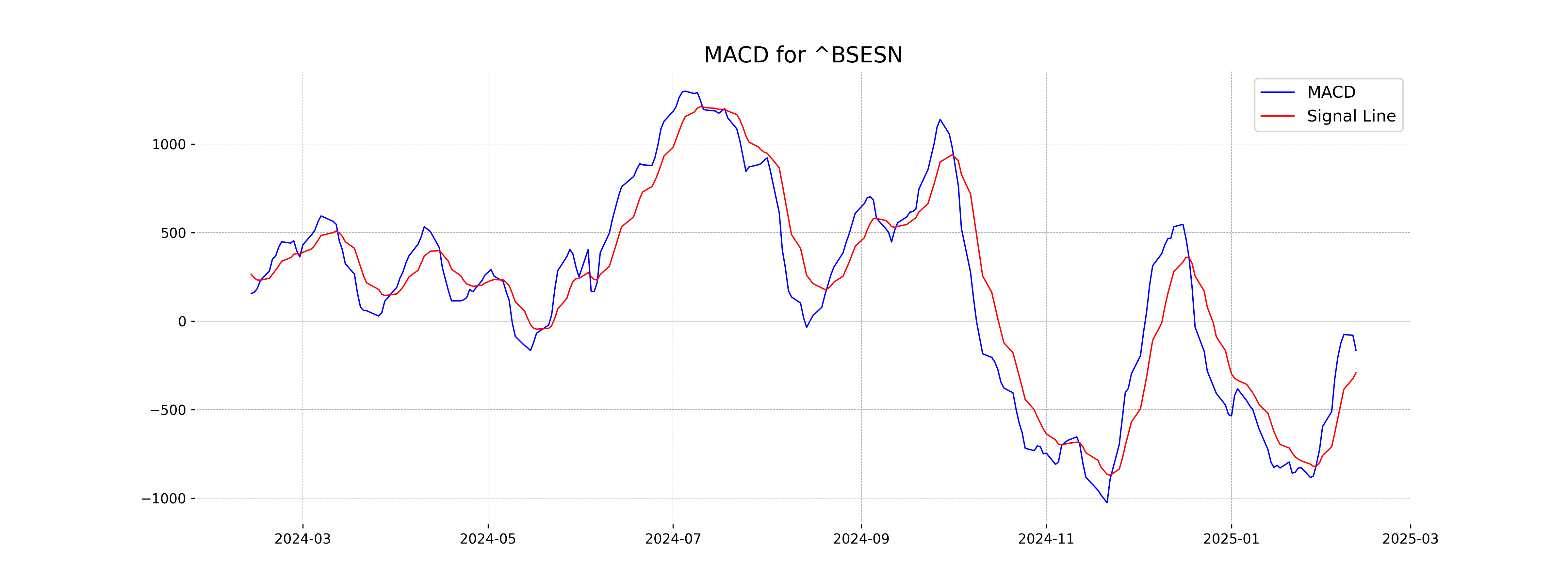

Moving Averages Trend (MACD)

The MACD value for Sensex is -163.98, which is higher than the MACD Signal of -292.40. This indicates potential bullish momentum as the MACD line is crossing above the signal line, though the values are still negative, suggesting overall caution.

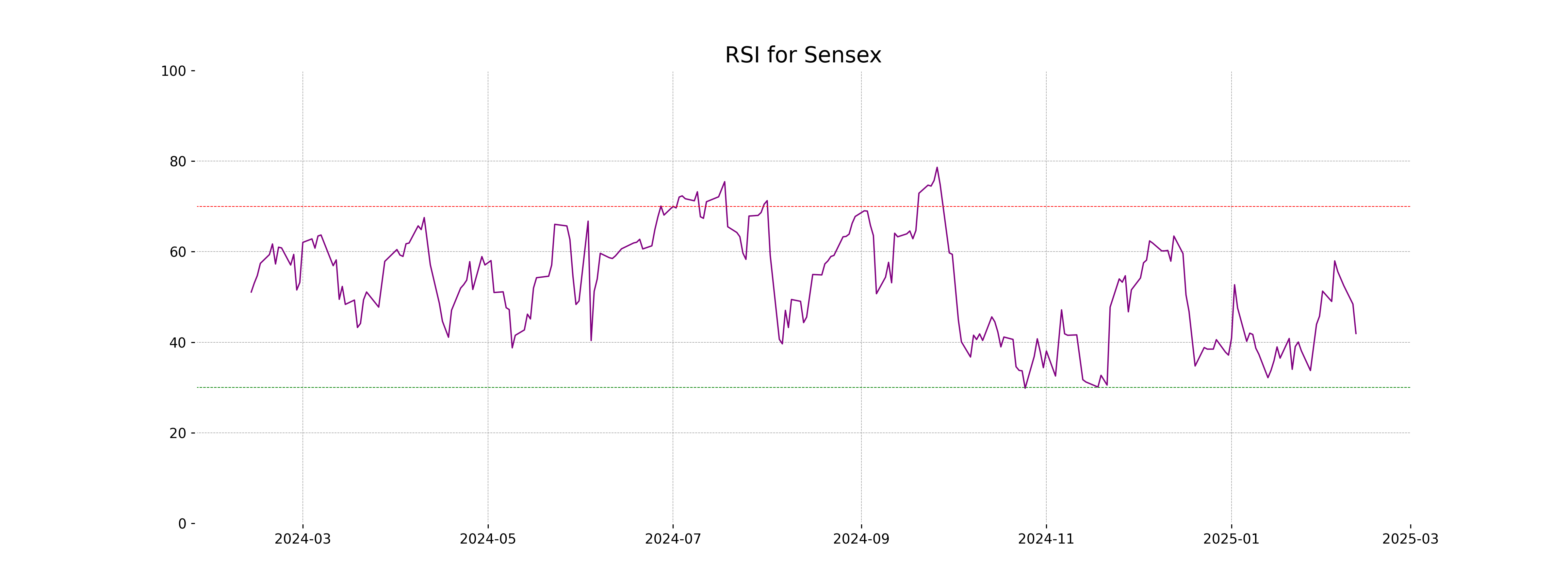

RSI Analysis

The RSI for Sensex is 41.92, which suggests that the index is nearing the oversold territory (below 30) but is not there yet. This indicates that the selling pressure has been high, and it may be approaching a point where a reversal or consolidation could occur.

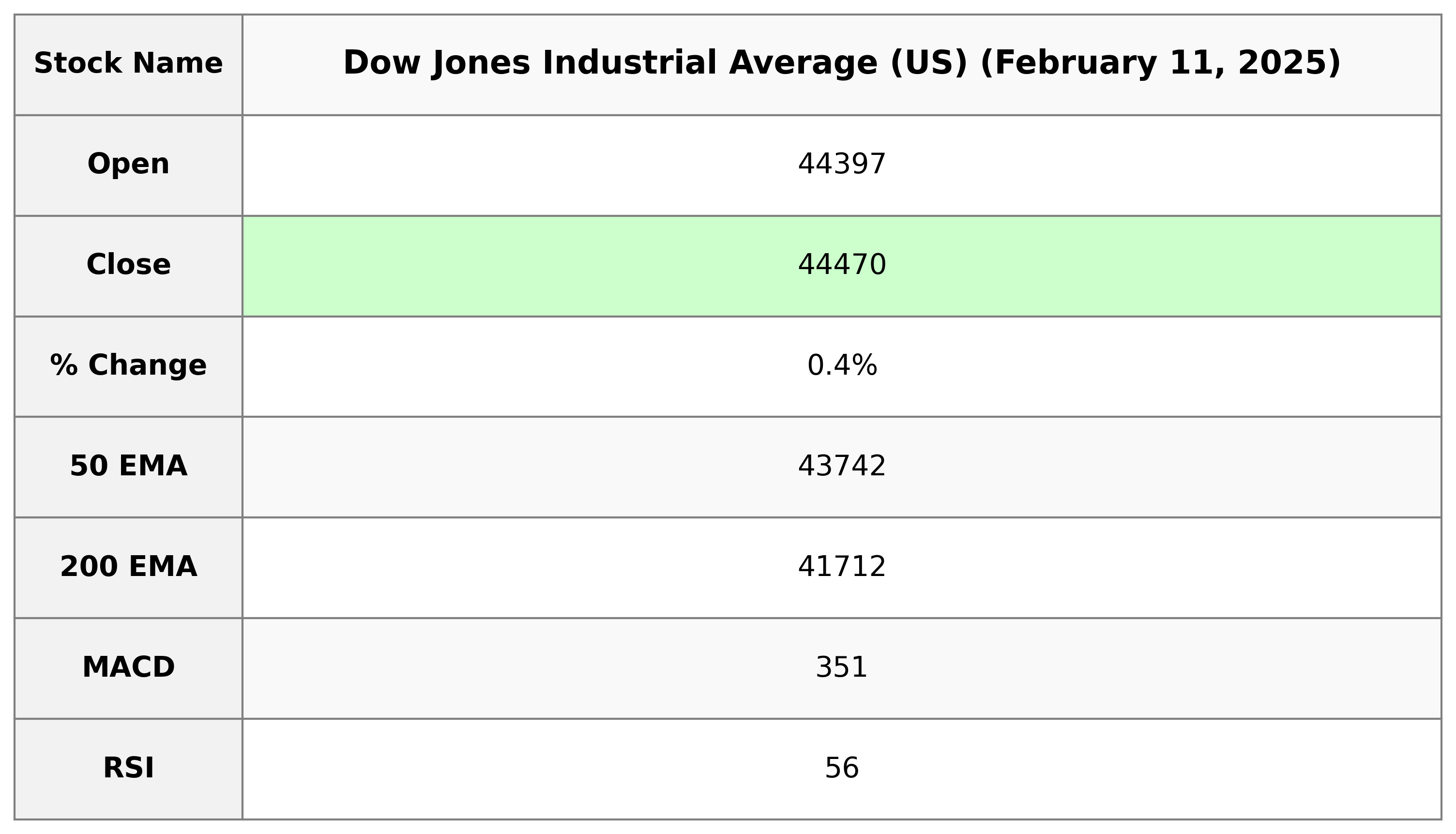

Analysis for Dow Jones Industrial Average (US) - February 11, 2025

The Dow Jones Industrial Average opened at 44,396.92 and closed at 44,470.41, marking a slight increase of 0.38% or 167.01 points from the previous close of 44,303.40. The trading volume was 494.6 million, and it displayed a stable performance with an RSI of 56.28, indicating a neither overbought nor oversold position.

Relationship with Key Moving Averages

The Dow Jones Industrial Average is trading above its 50 EMA and 200 EMA, suggesting a bullish trend in the medium to long term. However, it is slightly below its 10 EMA, indicating possible short-term consolidation or minor retracement. The RSI of 56.28 suggests a neutral to slightly bullish momentum.

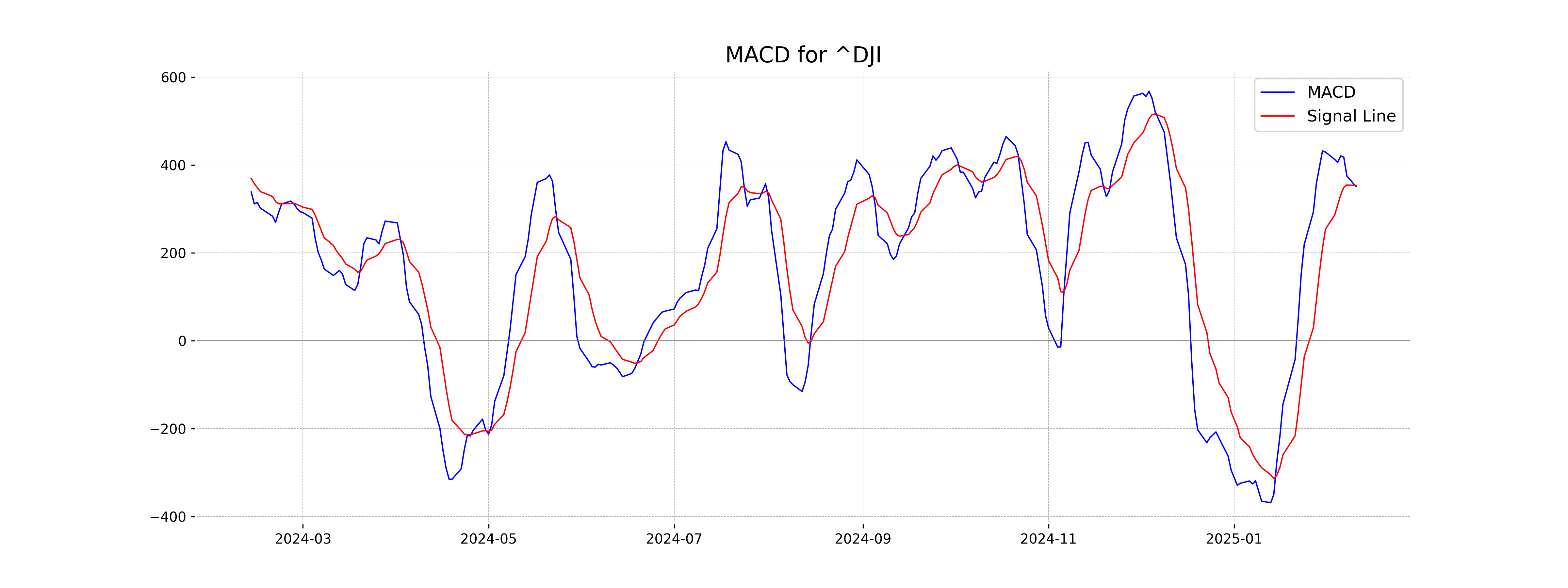

Moving Averages Trend (MACD)

The Dow Jones Industrial Average (US) displays a slightly negative MACD analysis with a MACD of 350.98, which is below the MACD Signal of 353.71. This suggests a potential bearish signal as the MACD line is under the signal line, indicating a potential slowdown in momentum. However, with RSI at 56.28, the index is neither overbought nor oversold.

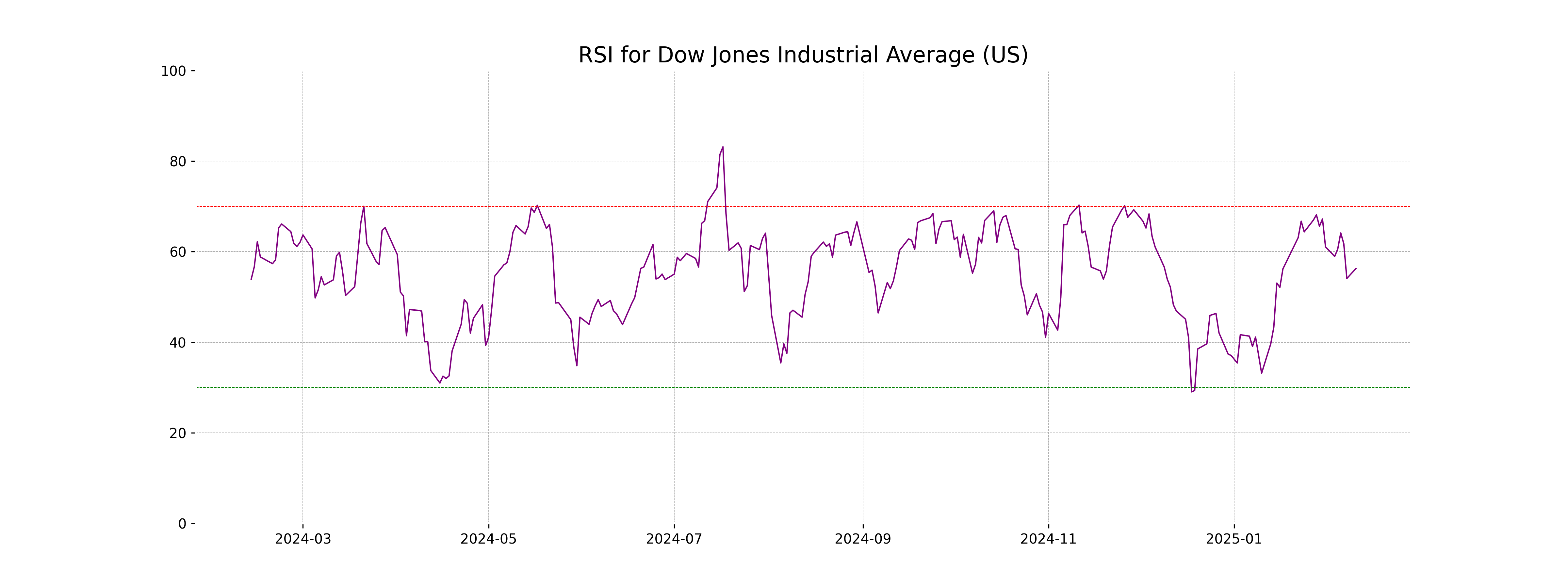

RSI Analysis

The RSI for the Dow Jones Industrial Average stands at 56.28, indicating a neutral position as it's between the typical overbought (>70) and oversold (<30) thresholds. This suggests a balanced momentum with no immediate signals of strong buying or selling pressures.

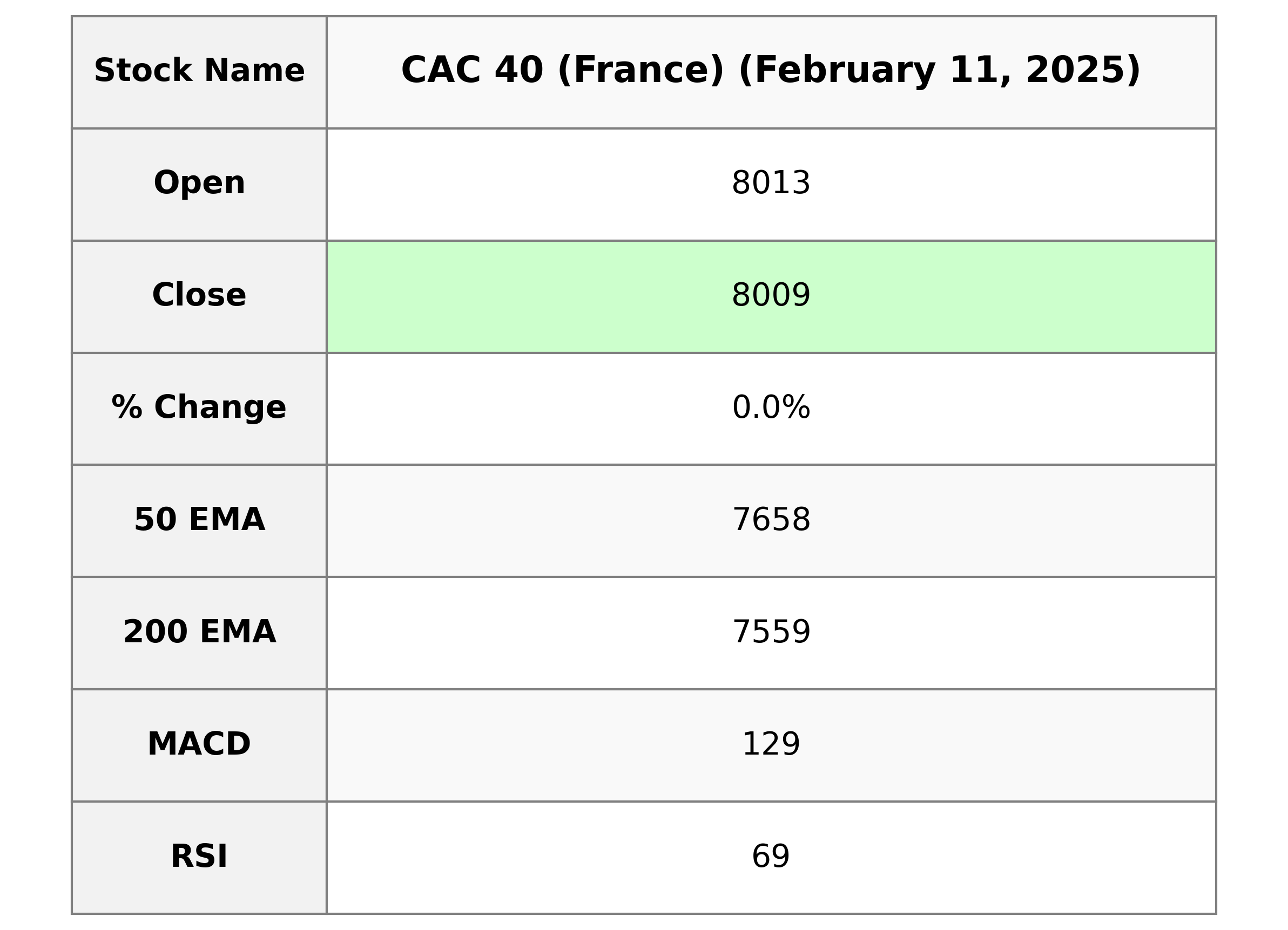

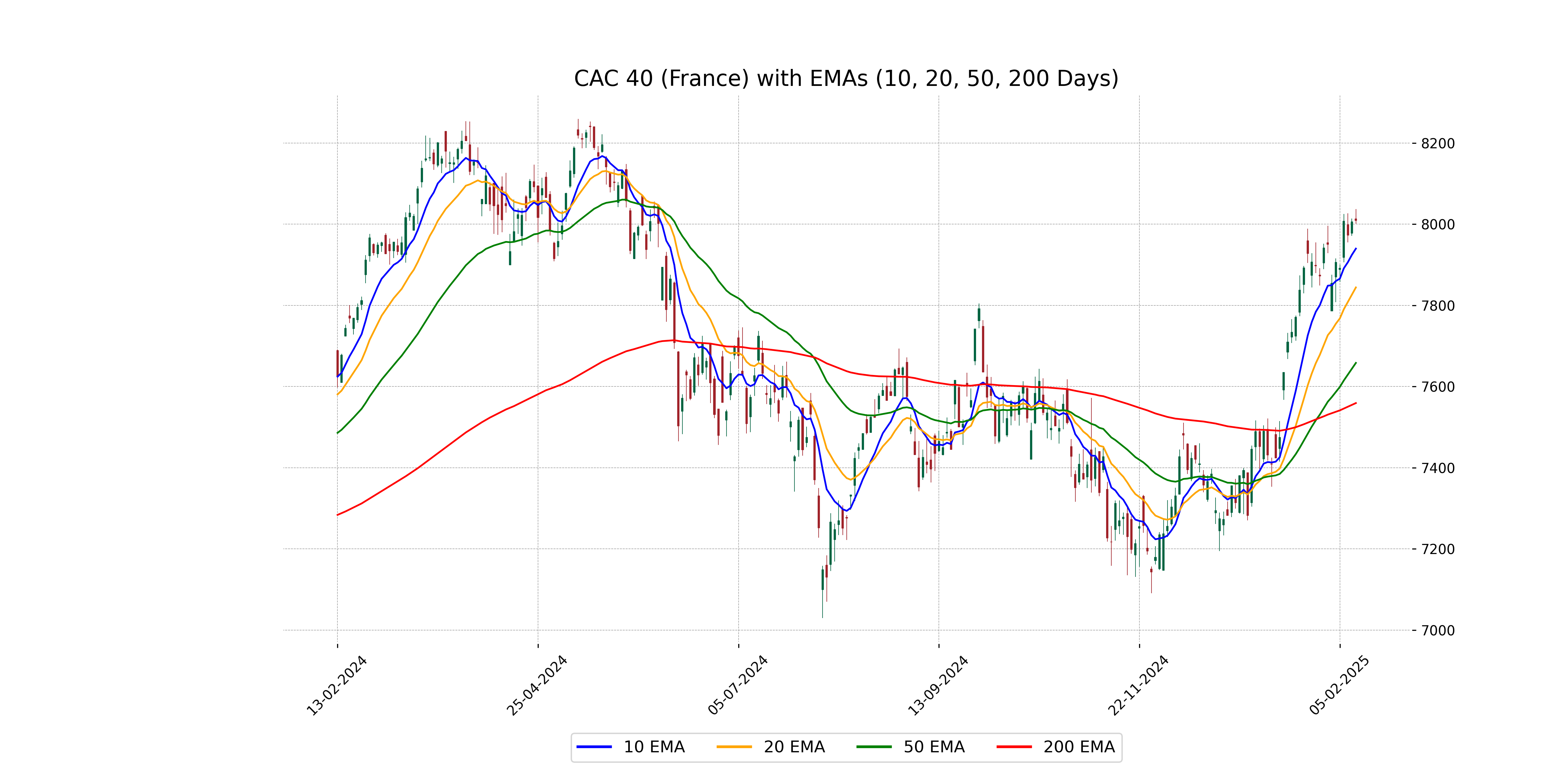

Analysis for CAC 40 (France) - February 11, 2025

The CAC 40 index in France opened at 8013.01, reaching a high of 8037.24 and a low of 8000.82, before closing at 8009.06. The index experienced a slight increase from the previous close at 8006.22, with a percentage change of approximately 0.035%. The RSI value of 69.03 suggests the index is approaching overbought levels, while the MACD is slightly below its signal line, hinting at potential consolidation.

Relationship with Key Moving Averages

The closing price of CAC 40 is 8009.06, which is above its 50-EMA of 7658.32 and 200-EMA of 7559.32, indicating a strong short- to mid-term trend. The price is also above the 10-EMA and 20-EMA, suggesting continued bullish momentum in the near term.

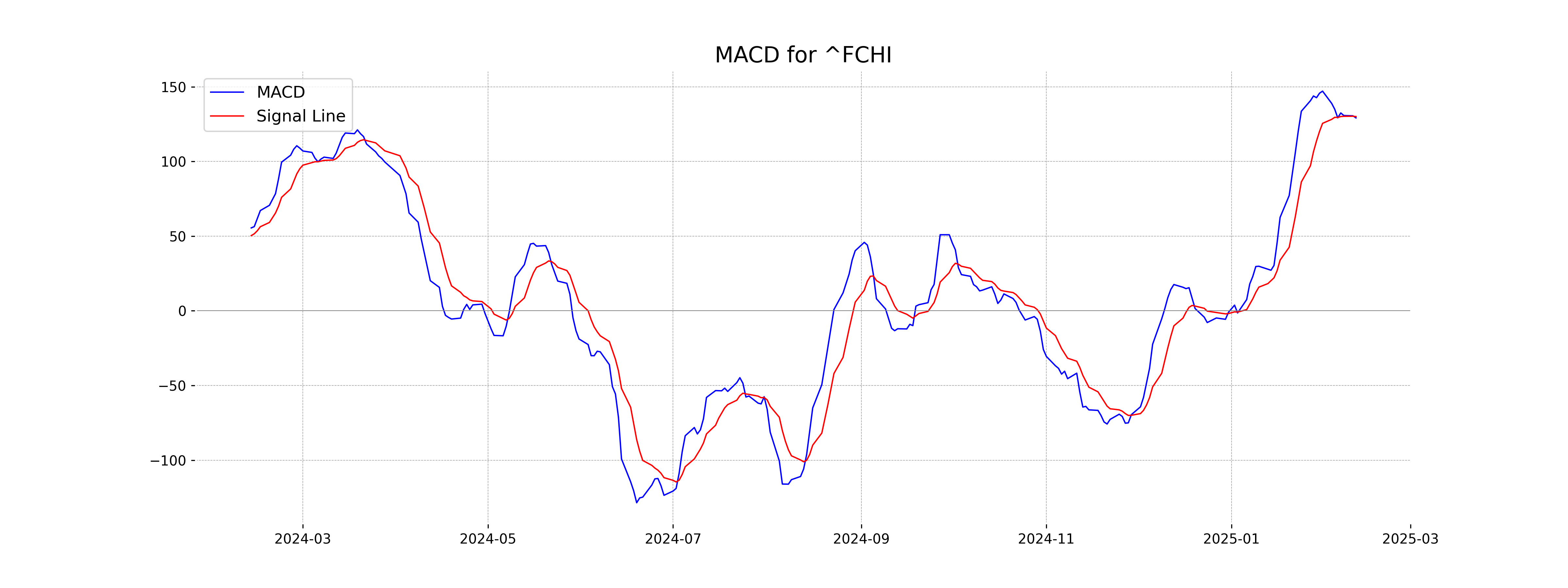

Moving Averages Trend (MACD)

The MACD for CAC 40 (France) is at 129.17, which is slightly below the MACD Signal of 130.07, indicating a potential weakening bullish momentum. With an RSI of 69.03, the index is nearing overbought levels, suggesting caution for traders.

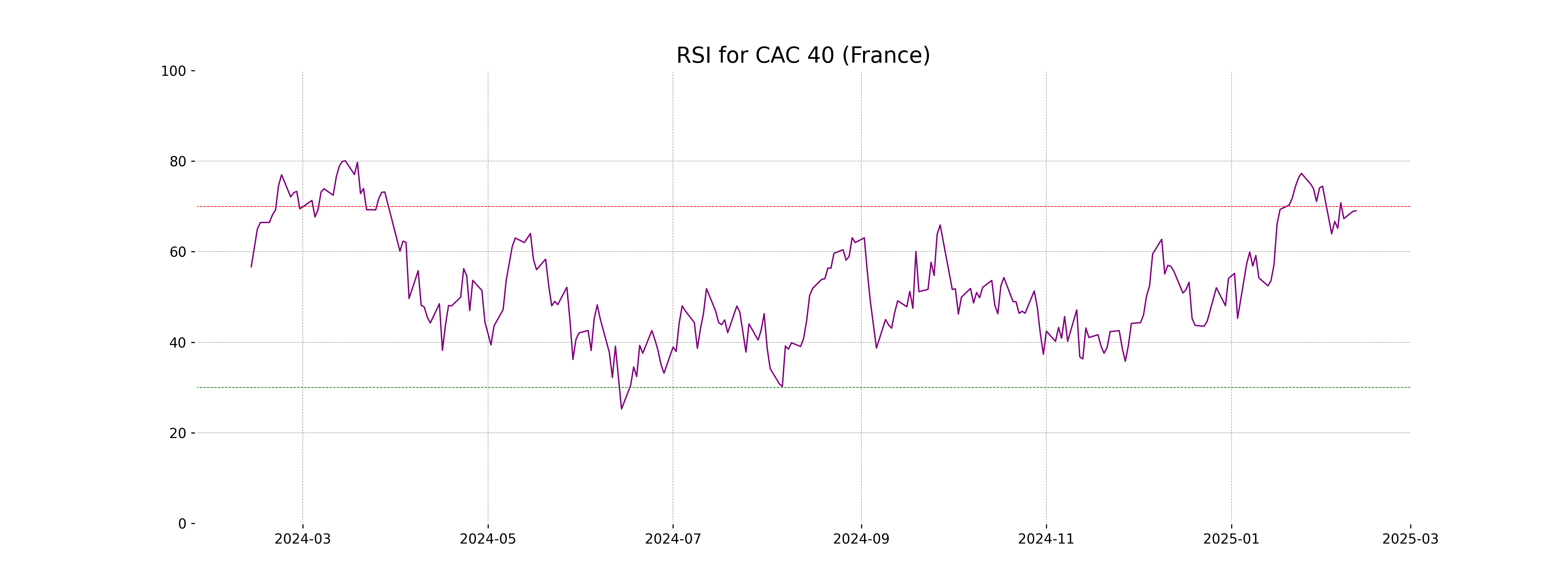

RSI Analysis

The RSI value for CAC 40 (France) is 69.03, indicating it is nearing the overbought territory, as RSI values above 70 typically suggest overbought conditions. This might imply a potential for consolidation or a price correction in the short term if it continues to rise.

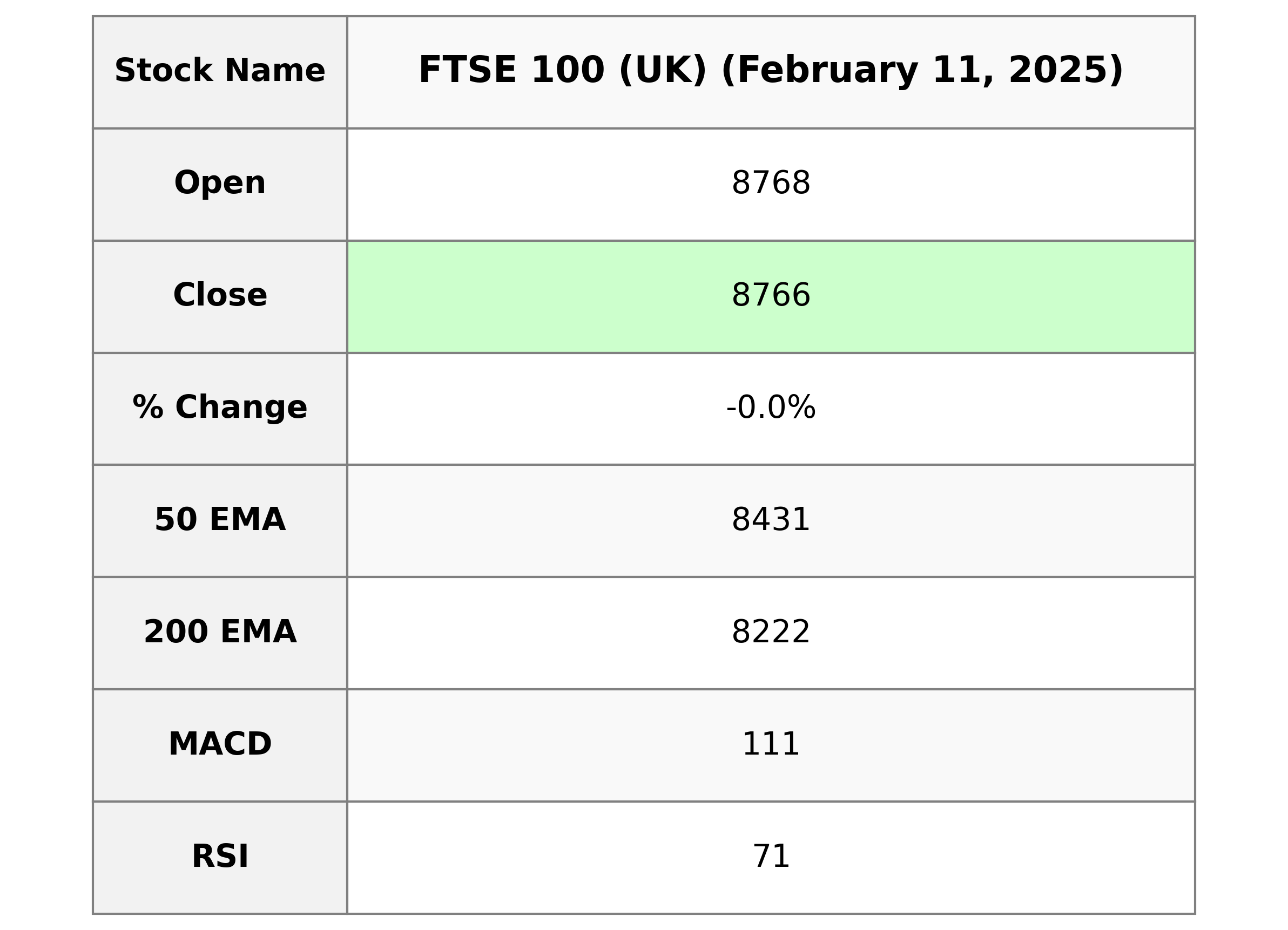

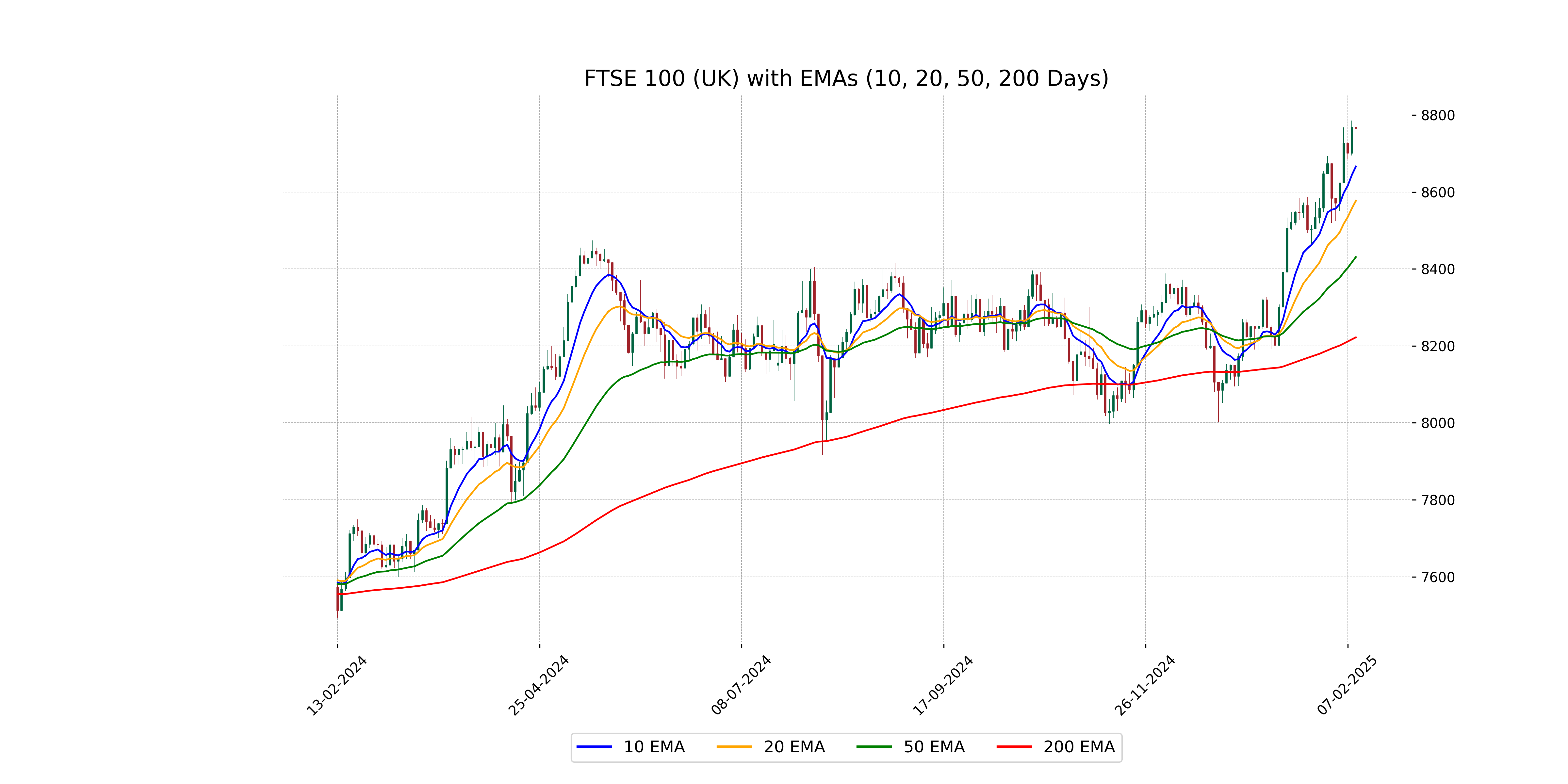

Analysis for FTSE 100 (UK) - February 11, 2025

The FTSE 100 index opened at 8767.80 and closed slightly lower at 8765.66, marking a minor decline of 0.02% with a points change of -2.14. The index exhibits strong momentum with an RSI of 70.84 and MACD above its signal line, suggesting a bullish trend. The absence of trading volume and other fundamental metrics like Market Cap, PE Ratio, and EPS is noted.

Relationship with Key Moving Averages

The closing price of FTSE 100 at 8765.66 is above the 50-day EMA of 8430.93, indicating a bullish trend compared to the medium-term average. Additionally, it is higher than both the 200-day EMA of 8222.15 and the 10-day EMA of 8666.06, suggesting strength in the current price relative to both long-term and short-term trends.

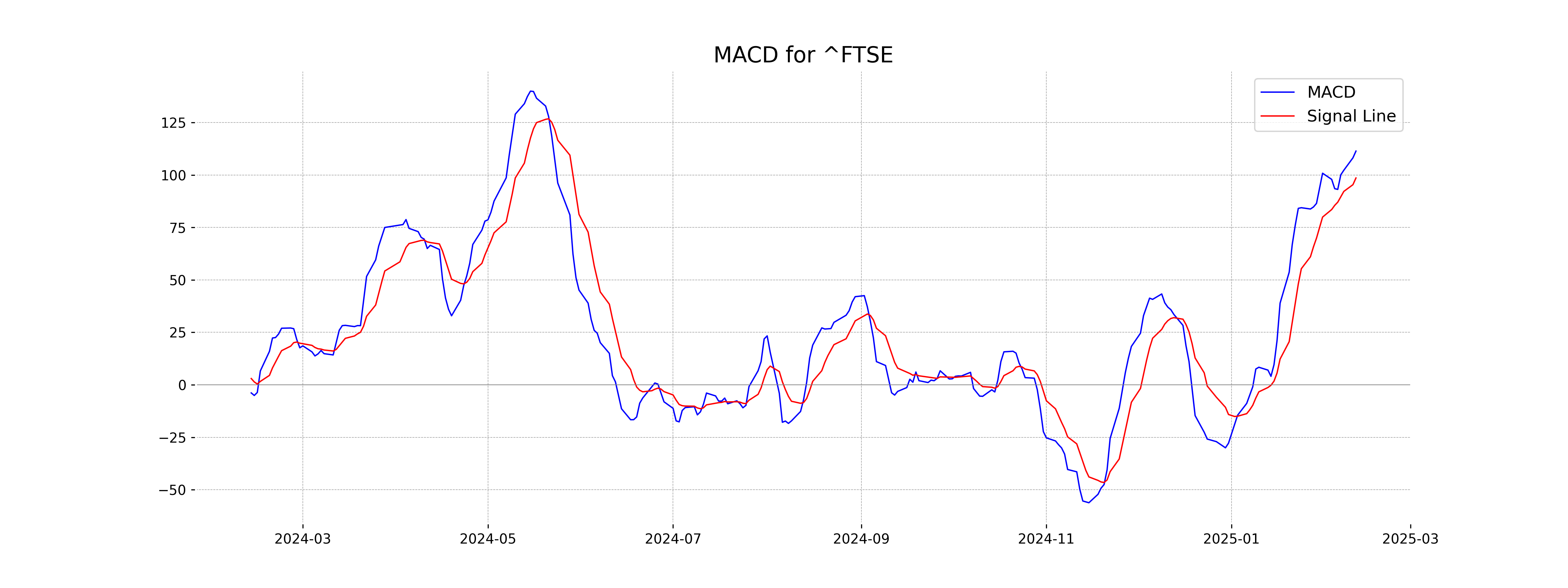

Moving Averages Trend (MACD)

The FTSE 100 shows a bullish signal as the MACD line at 111.41 is above the MACD Signal line at 98.60, suggesting upward momentum. The high RSI value of 70.84 indicates that the index might be overbought, warranting cautiousness from traders.

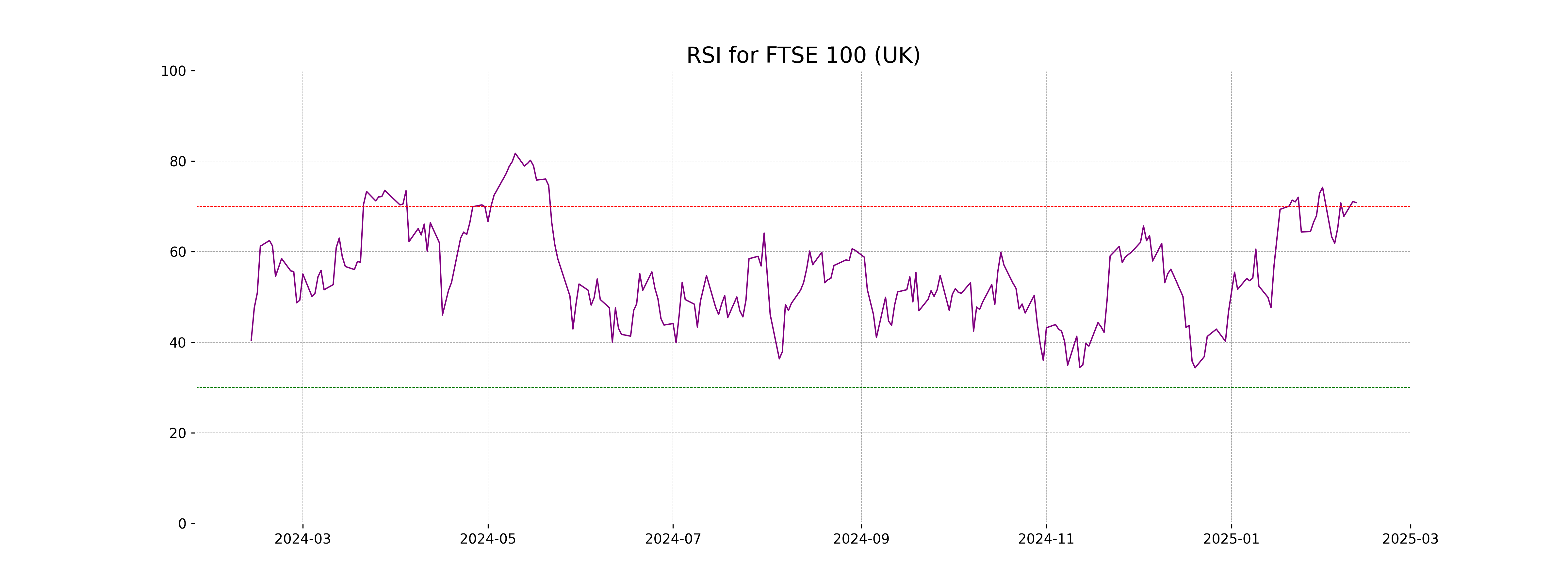

RSI Analysis

The RSI of FTSE 100 (UK) is 70.84, indicating that the index is approaching overbought territory. This suggests potential selling pressure, as values above 70 typically suggest that the stock might be overvalued and due for a pullback.

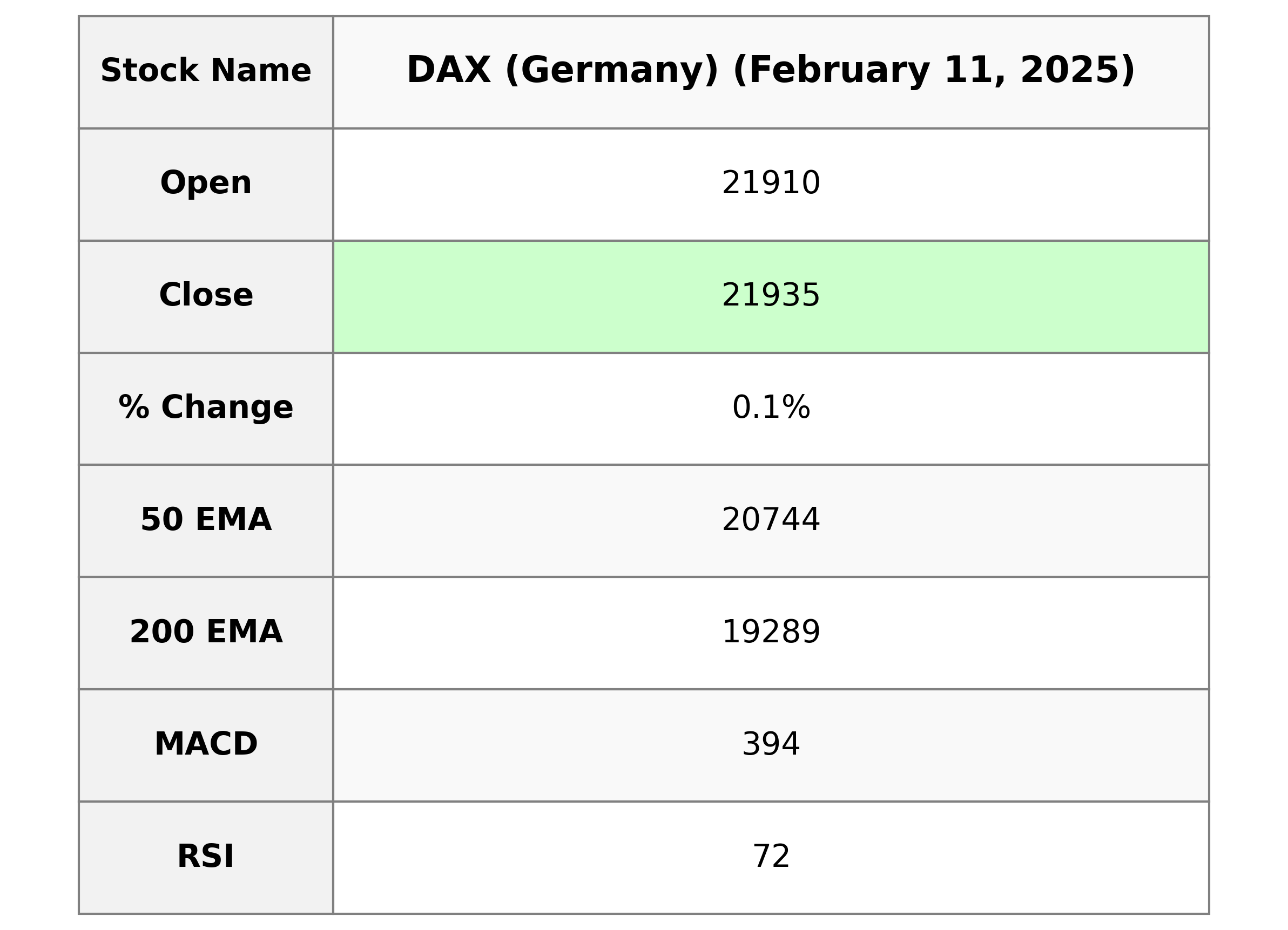

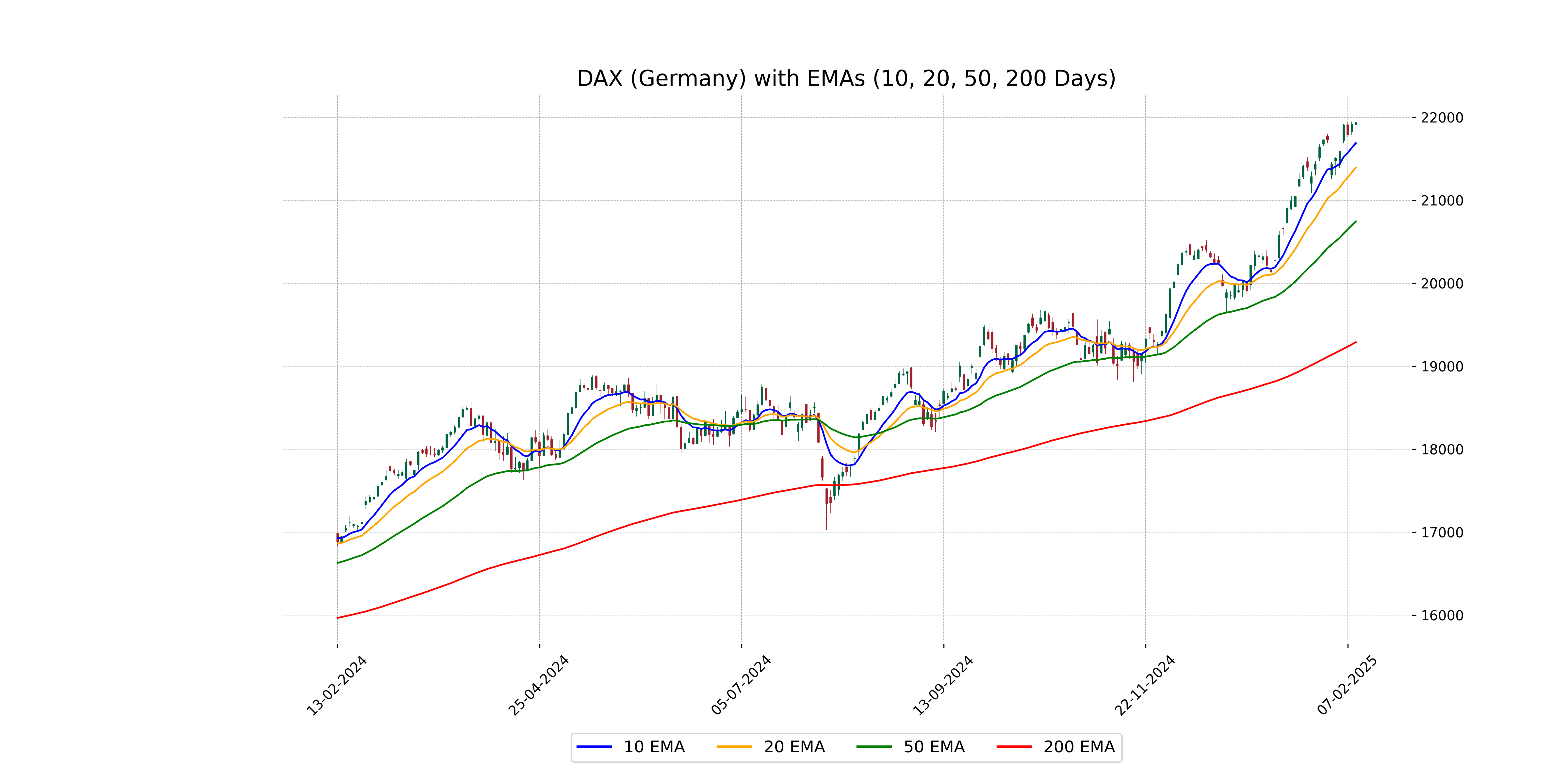

Analysis for DAX (Germany) - February 11, 2025

DAX (Germany) opened at 21,909.96, reaching a high of 21,977.18 and a low of 21,884.38, before closing at 21,934.57. The index experienced a 0.10% increase, with a points change of 22.83 from the previous close of 21,911.74. The RSI is at 72.15, signaling potential overbought conditions.

Relationship with Key Moving Averages

The DAX (Germany) closed above its 10 EMA (21686.90) and 20 EMA (21392.28), indicating a short-term bullish trend. It is also trading significantly above its 50 EMA (20744.16) and 200 EMA (19289.10), suggesting a strong upward momentum over both medium and long-term periods.

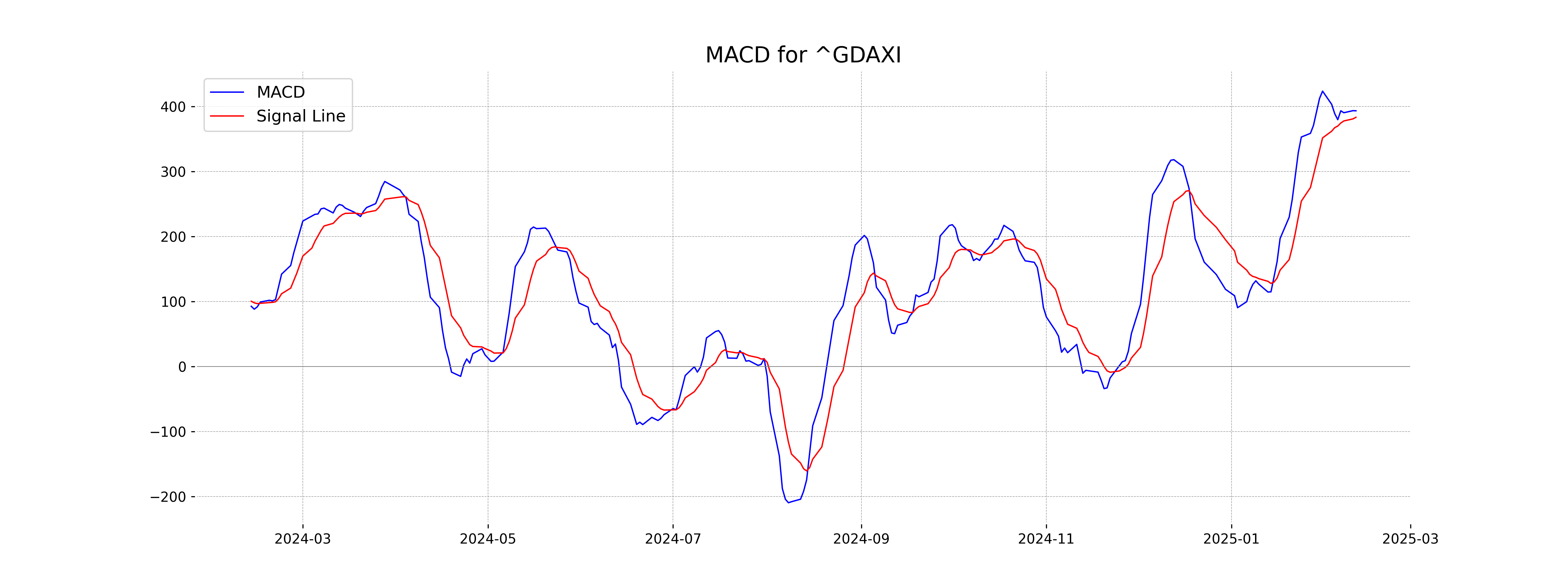

Moving Averages Trend (MACD)

The MACD analysis for DAX (Germany) shows a MACD value of 393.54, which is above the MACD signal line value of 383.57. This indicates a bullish trend, suggesting potential upward momentum in the index.

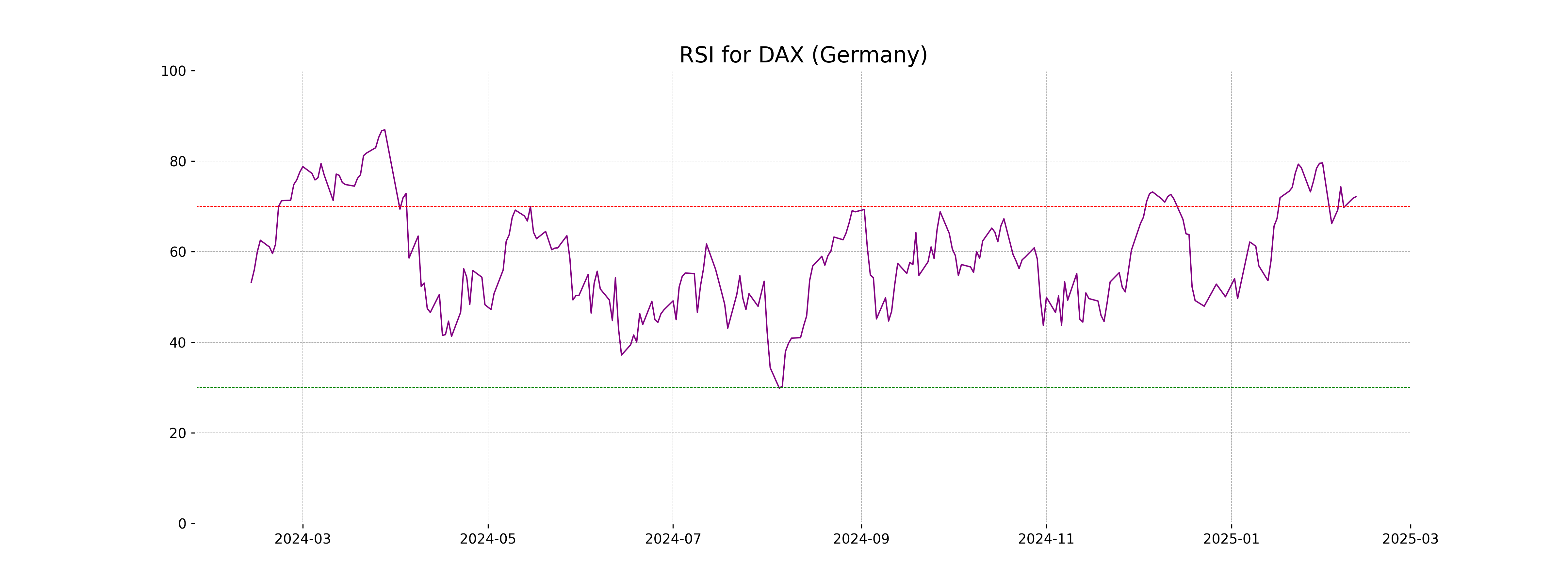

RSI Analysis

The RSI value for the DAX is 72.15, indicating that the index is in an overbought condition, as RSI values above 70 typically suggest such a status. This could imply a potential for a price pullback or correction in the near term.

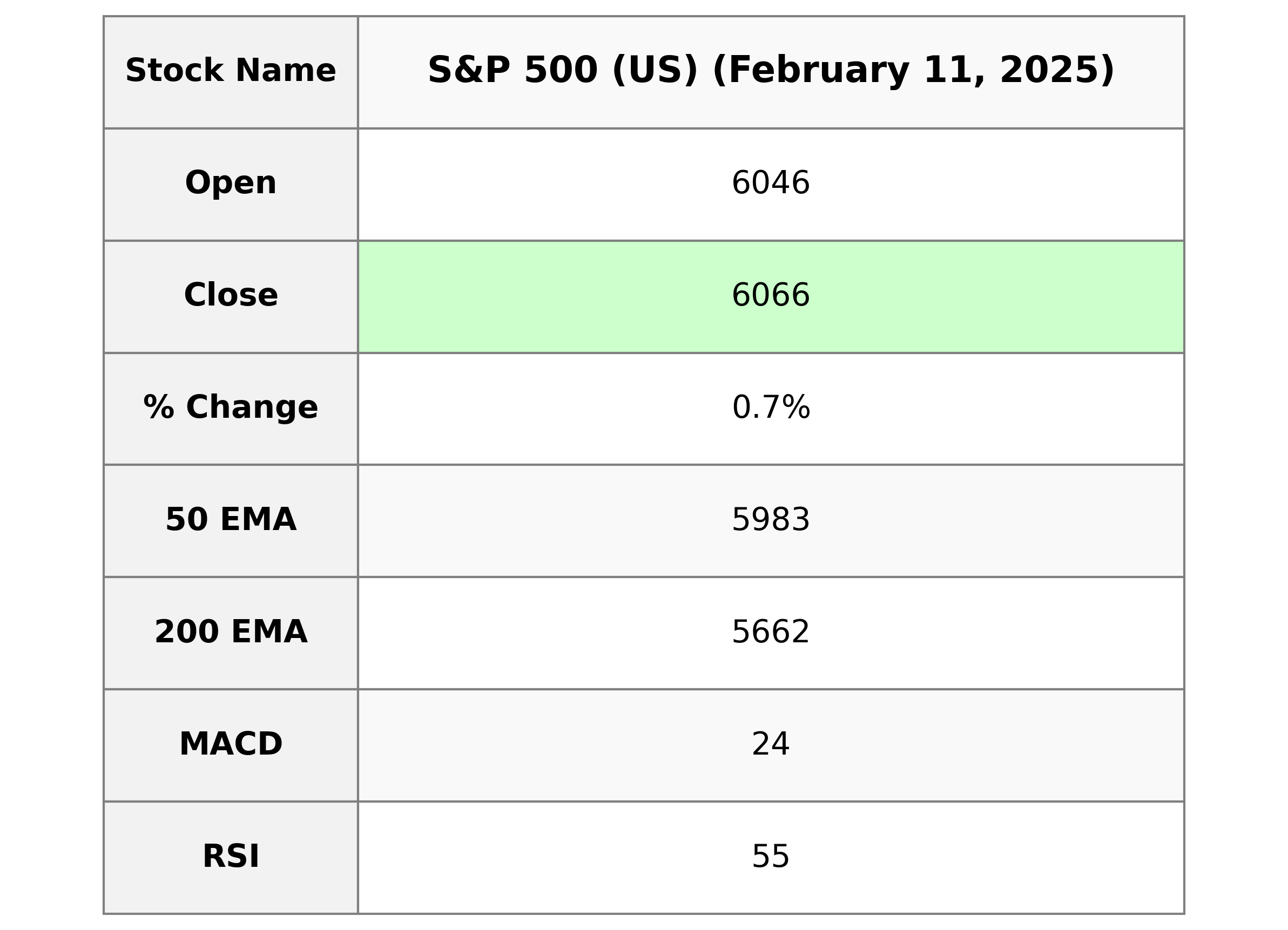

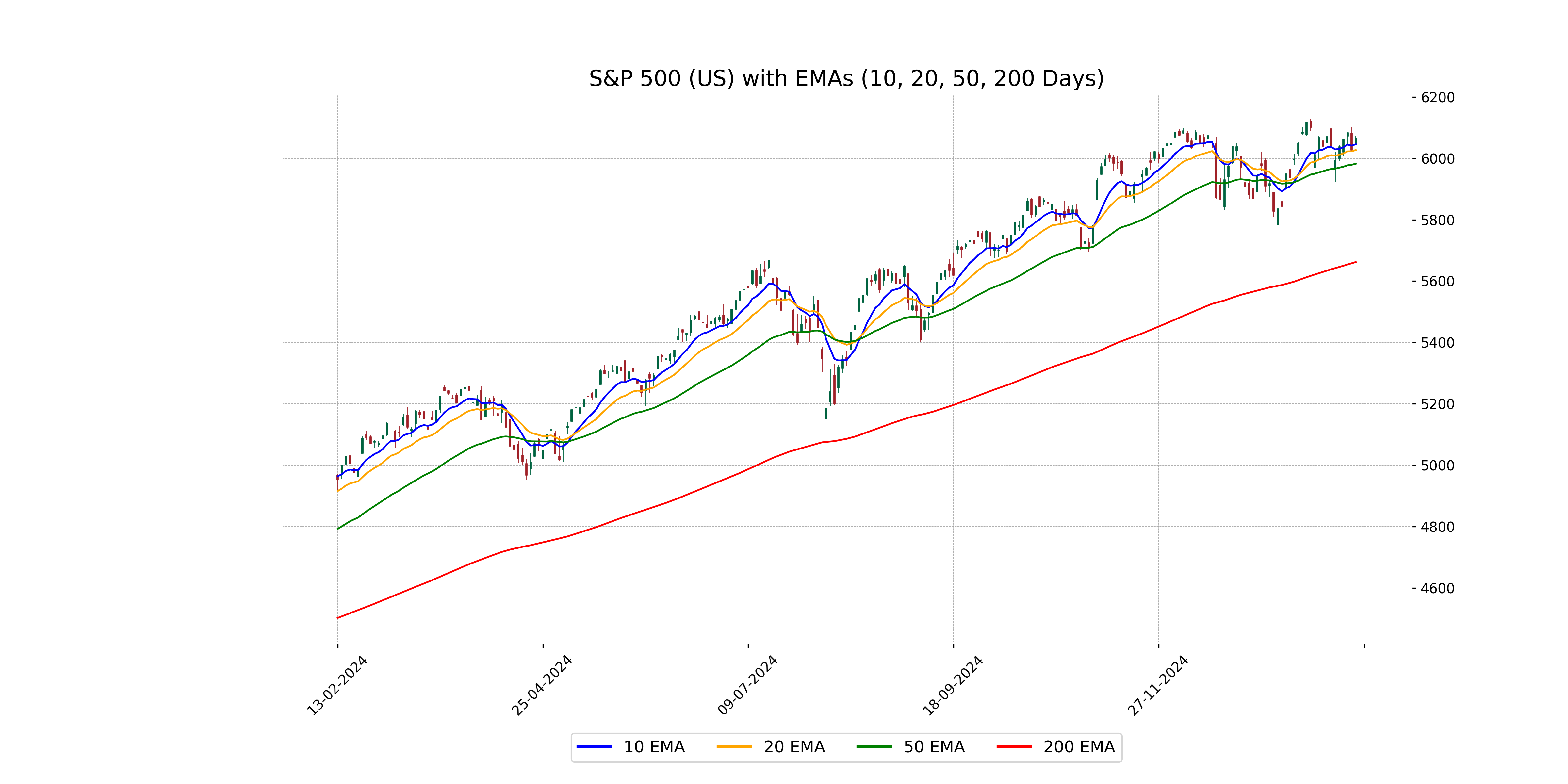

Analysis for S&P 500 (US) - February 11, 2025

The S&P 500 opened at 6046.40 and closed at 6066.44, marking a percentage gain of 0.67% with a points increase of 40.45. The 10-day EMA stands at 6046.06, RSI is at 54.73, and the MACD is slightly above the signal line, indicating a mildly positive momentum in the market.

Relationship with Key Moving Averages

The S&P 500 is currently trading above all its key moving averages: the 50-day EMA of 5982.54, the 200-day EMA of 5662.11, the 10-day EMA of 6046.06, and the 20-day EMA of 6027.15. This suggests bullish momentum as it maintains levels higher than these moving averages.

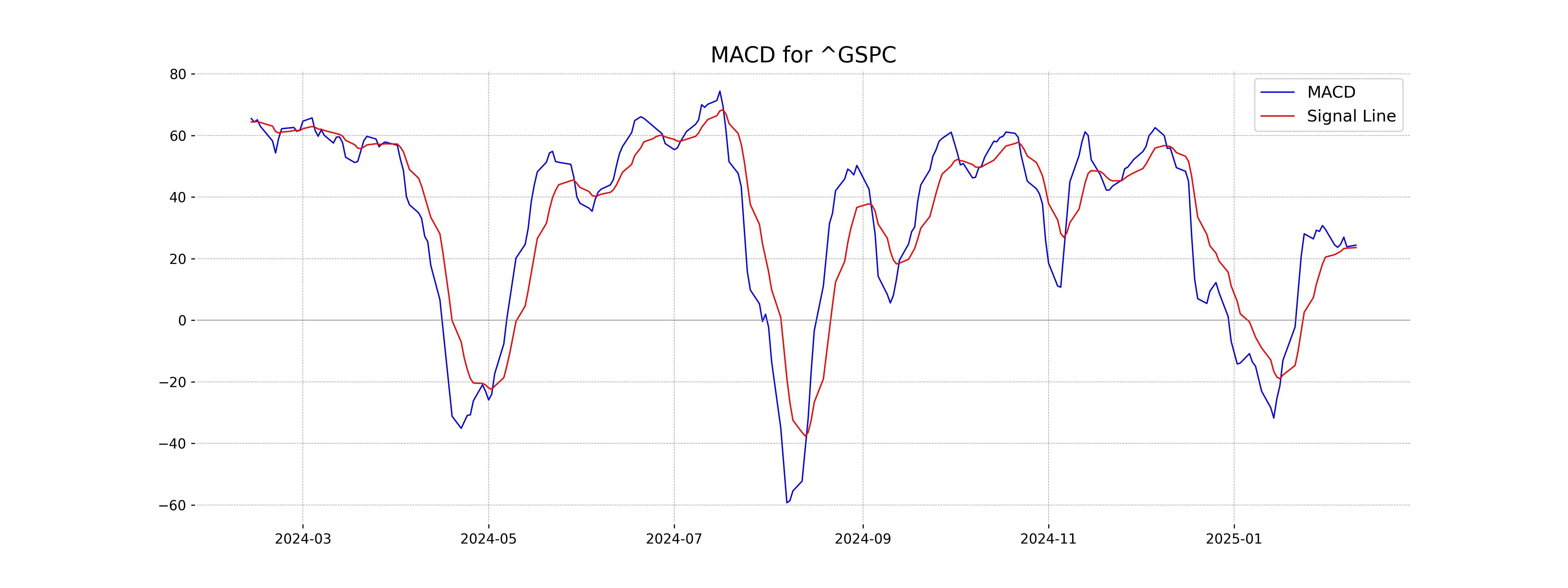

Moving Averages Trend (MACD)

The MACD value for S&P 500 is 24.37, which is higher than the MACD Signal line at 23.59. This indicates a potential bullish trend, suggesting that the momentum might favor upward price movement.

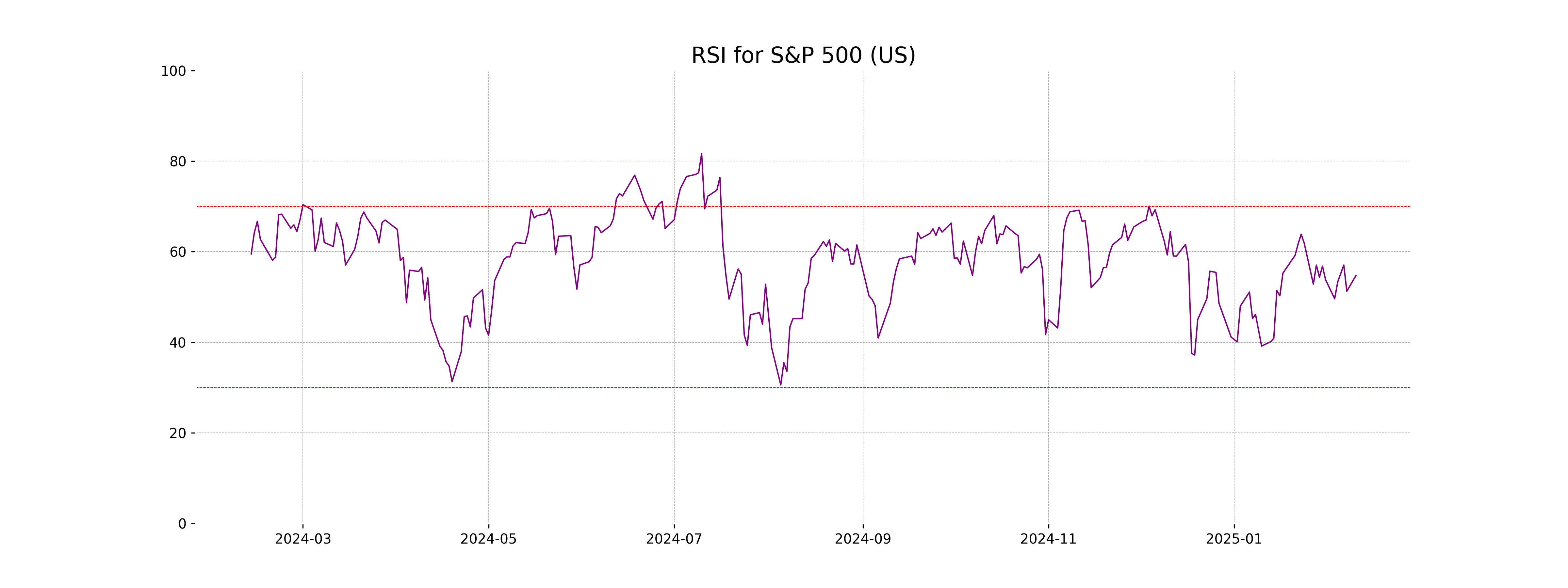

RSI Analysis

The RSI for S&P 500 is currently 54.73, indicating a neutral momentum, as it is neither in the overbought (>70) nor oversold (<30) range. This suggests that the market could be trading relatively sideways or is in a mild uptrend.

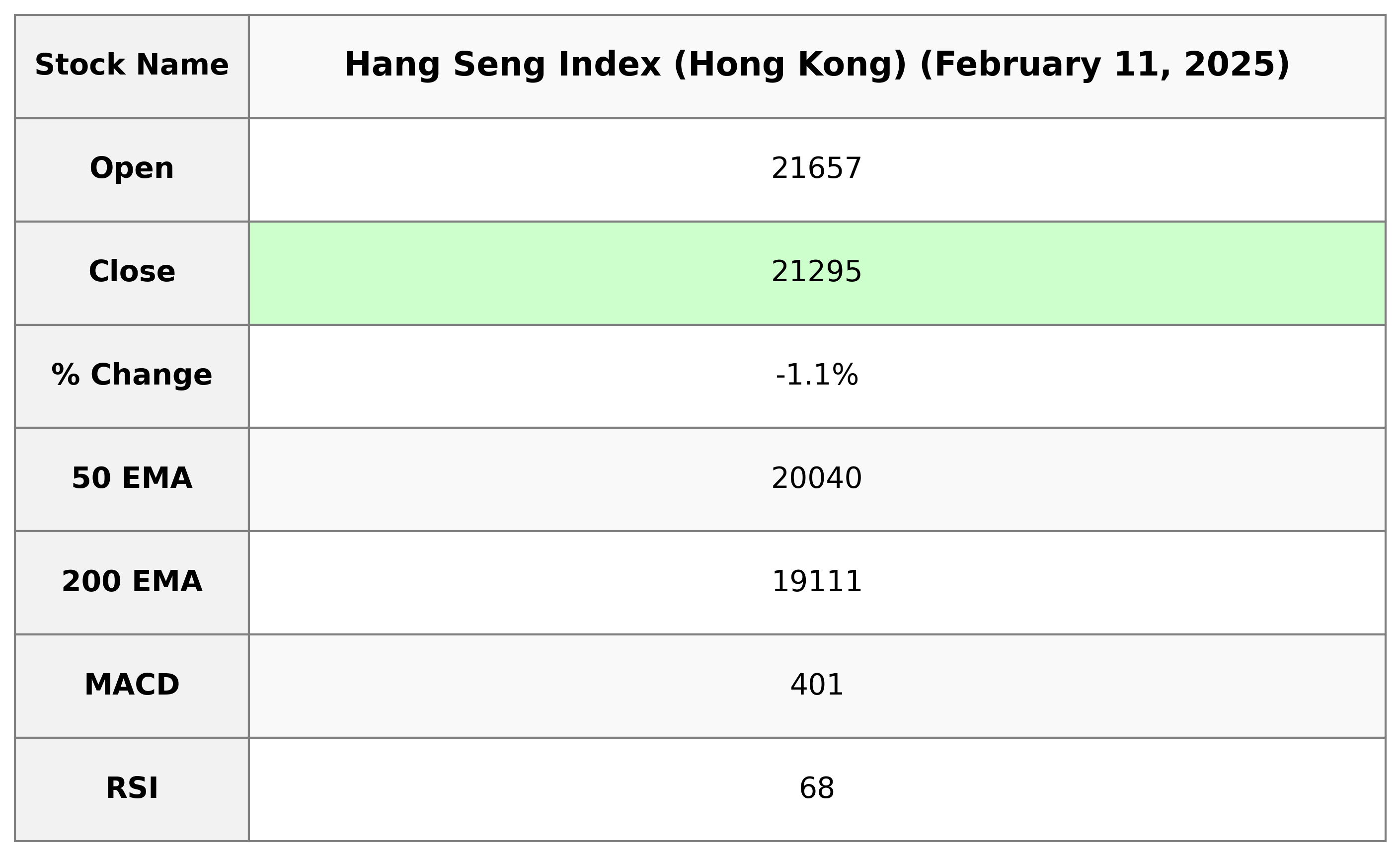

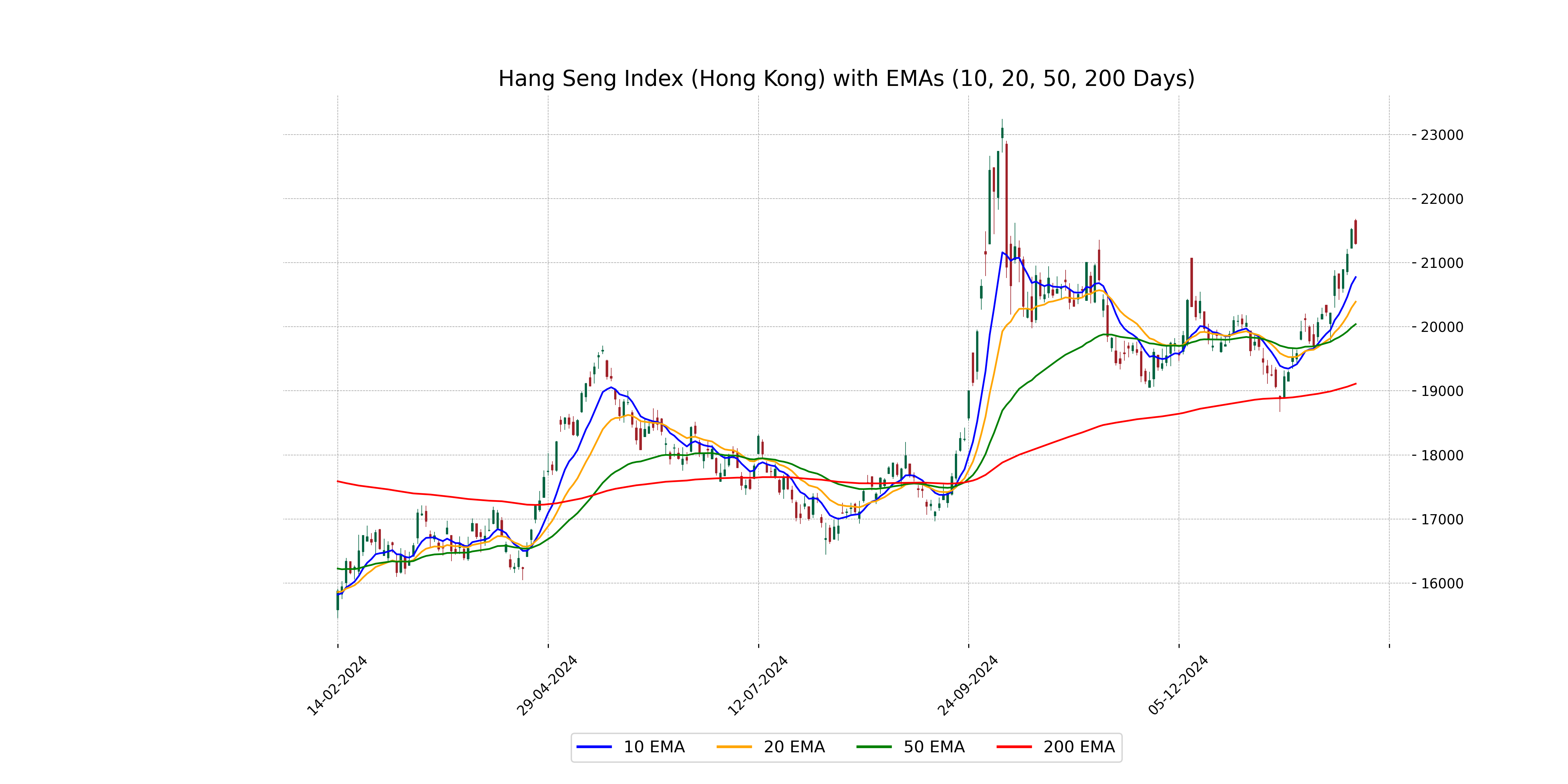

Analysis for Hang Seng Index (Hong Kong) - February 11, 2025

The Hang Seng Index opened at 21,656.82 and closed at 21,294.86, with a high of 21,682.41 and a low of 21,279.37. The index experienced a decline of approximately 1.05%, corresponding to a decrease of 227.12 points compared to the previous close of 21,521.98. The RSI stands at 68.21, indicating a relatively strong market, while the MACD of 401.10 suggests a bullish trend above the signal line of 234.22. No volume data was provided for this index.

Relationship with Key Moving Averages

The Hang Seng Index is currently closing at 21,294.86, above its 50-day EMA of 20,040.45 and 200-day EMA of 19,111.36, indicating a bullish trend in both short-term and long-term perspectives. Additionally, it is positioned above the 10-day EMA of 20,774.82 and the 20-day EMA of 20,390.83, suggesting strong recent upward momentum.

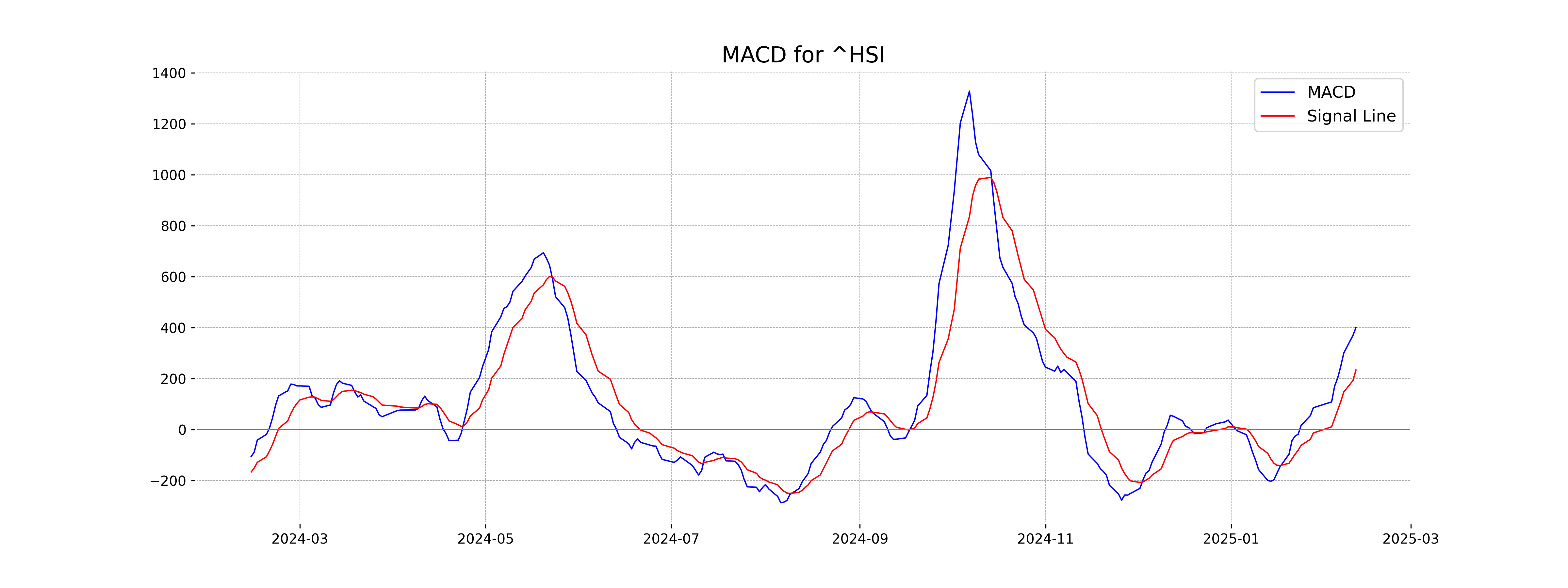

Moving Averages Trend (MACD)

The Hang Seng Index is exhibiting bullish momentum, indicated by the MACD line being above the MACD Signal line (401.10 vs. 234.22). The positive difference suggests potential upward movement, although market conditions and other indicators should also be considered.

RSI Analysis

Based on the stock data, the Relative Strength Index (RSI) for the Hang Seng Index (Hong Kong) is 68.21. This value indicates that the index is nearing the overbought territory, which generally begins at an RSI of 70, suggesting potential for a reversal or consolidation.

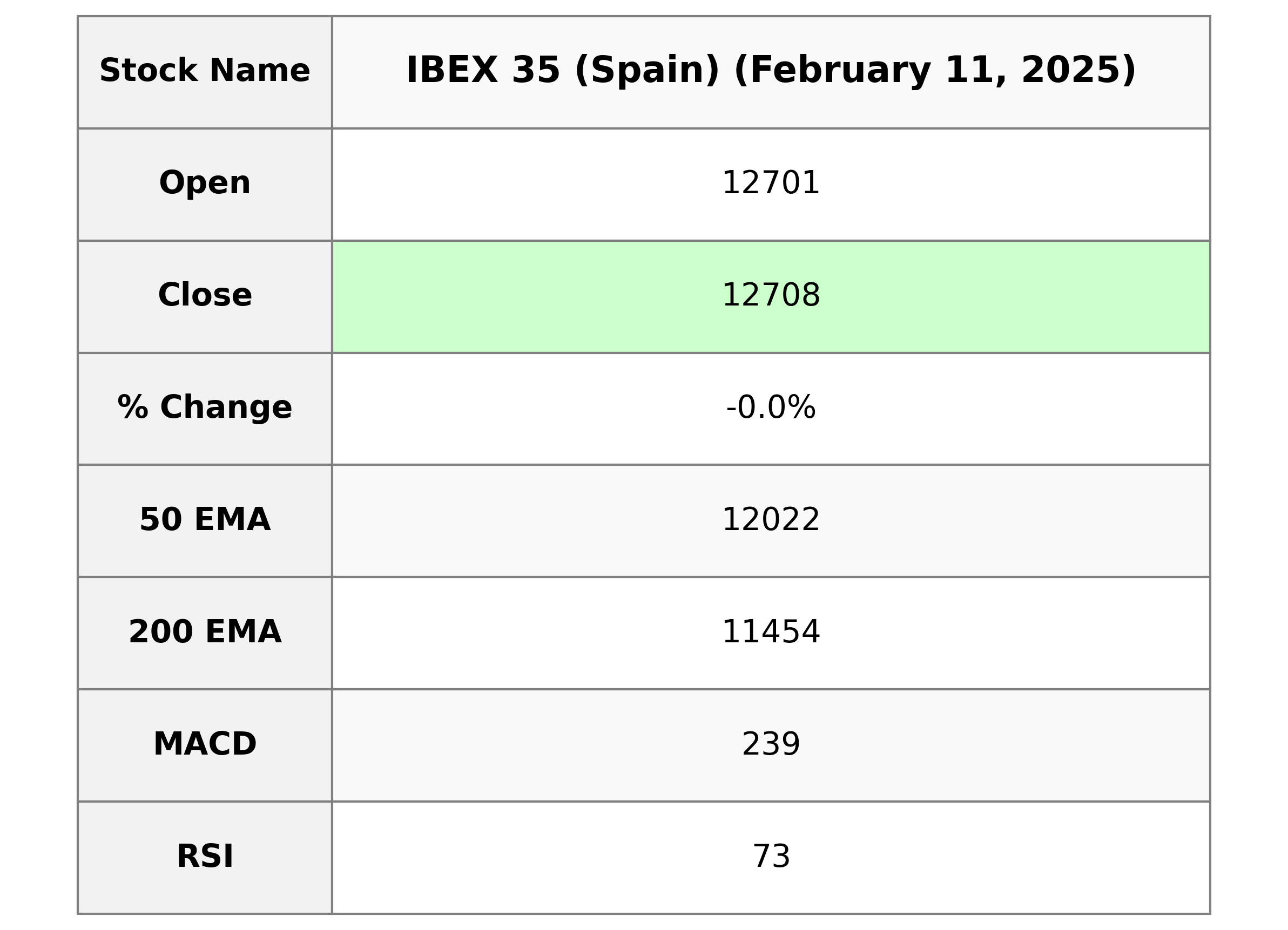

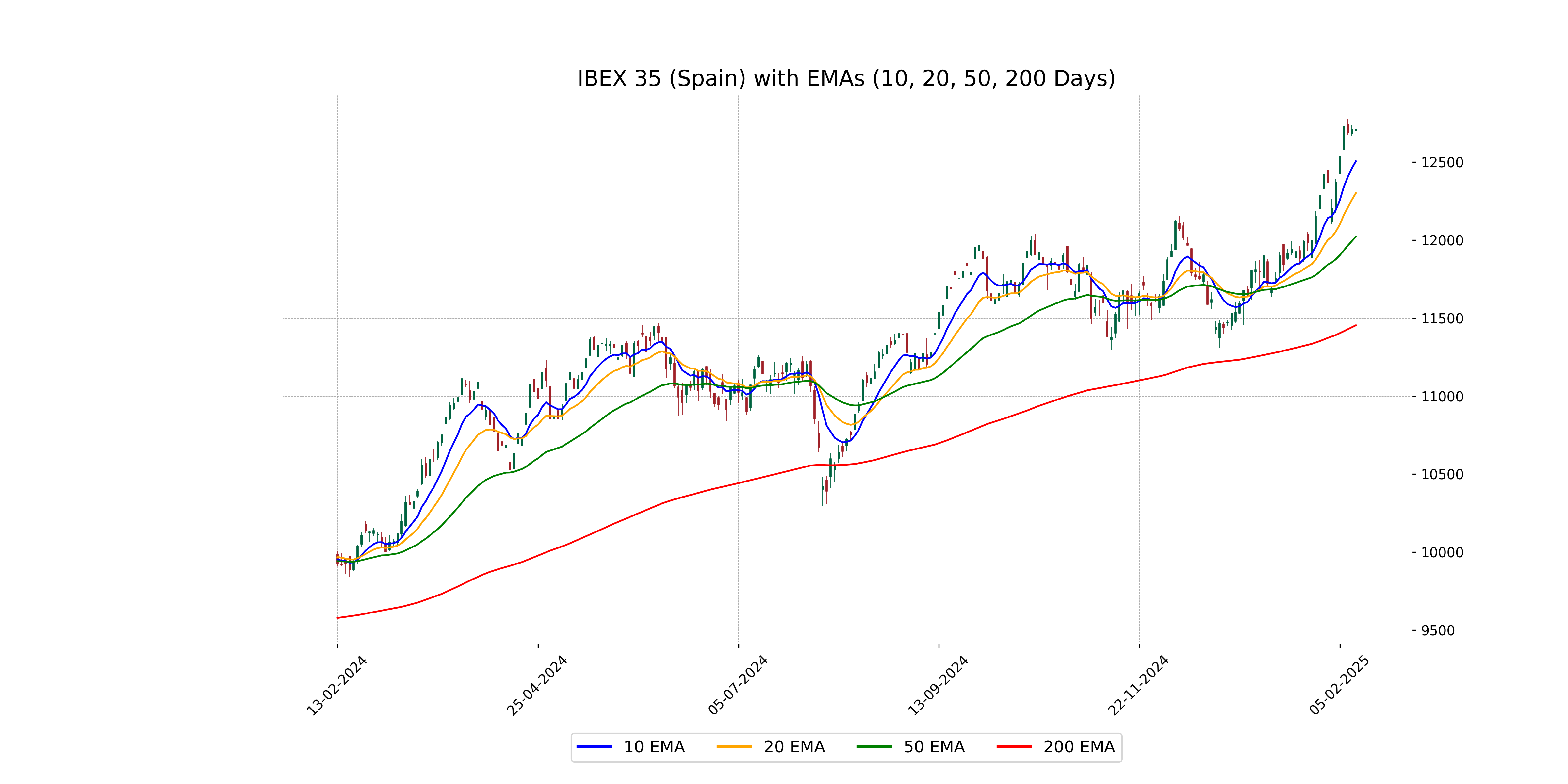

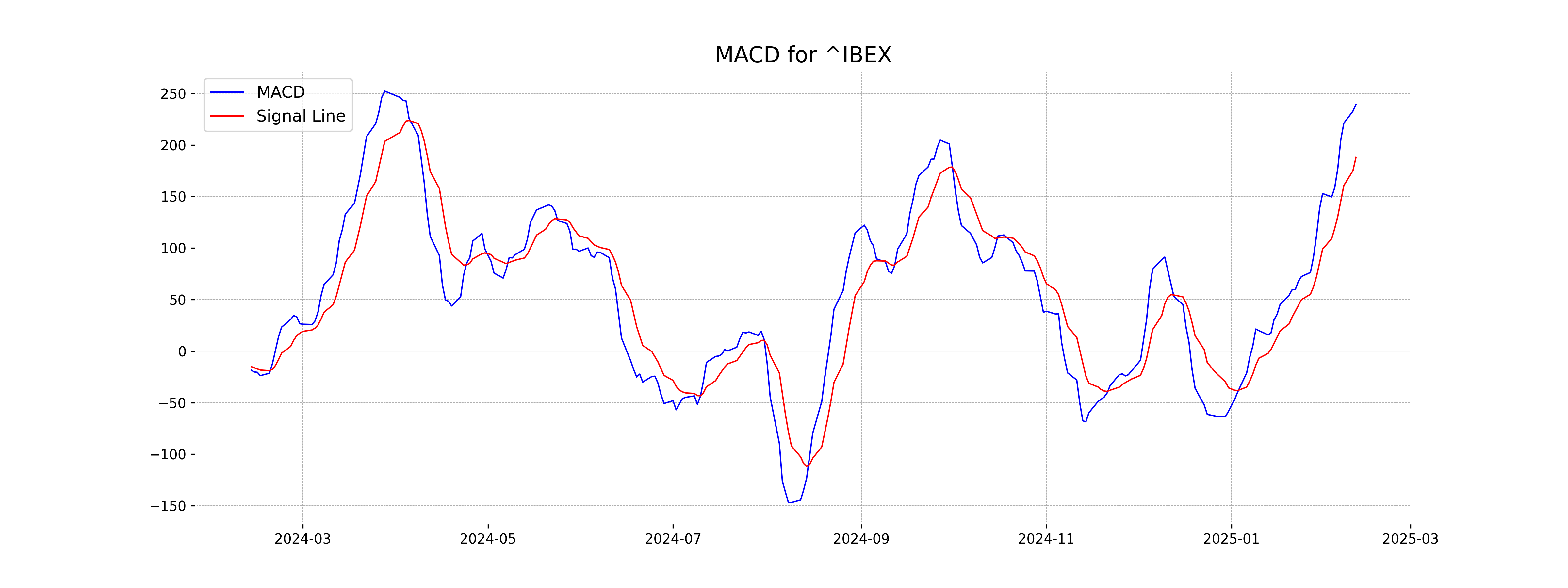

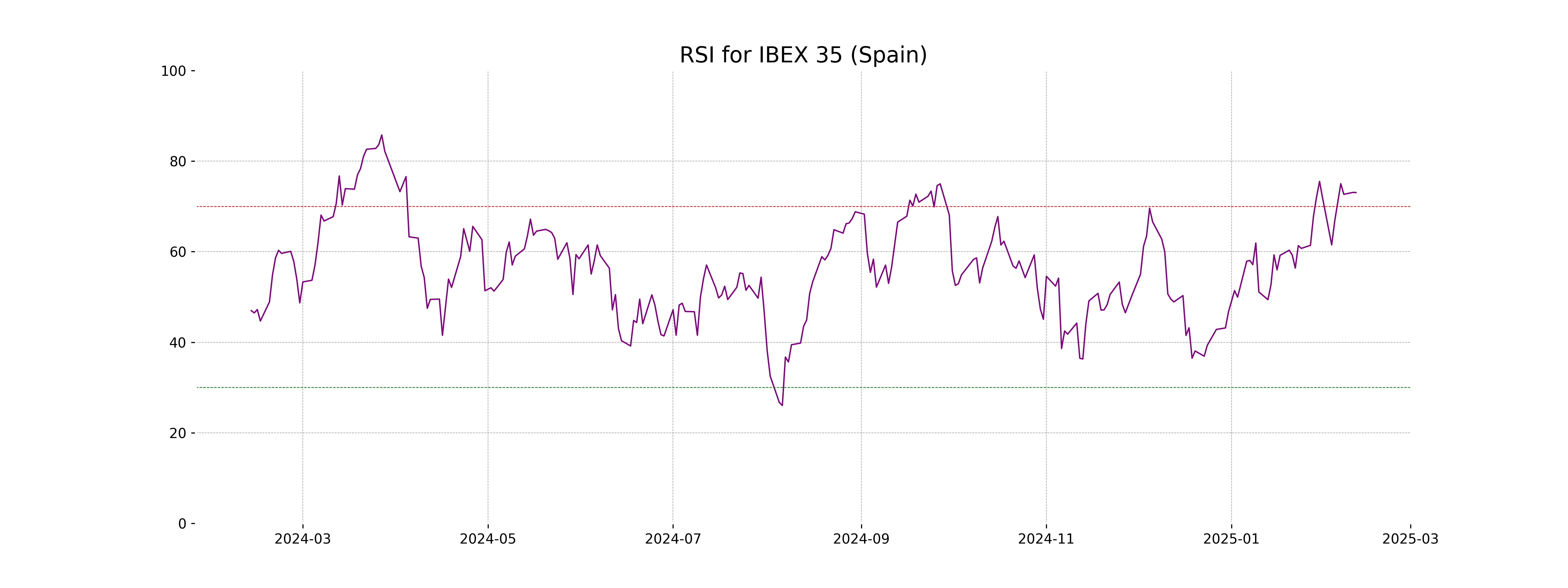

Analysis for IBEX 35 (Spain) - February 11, 2025

The IBEX 35 index opened at 12,700.70 and closed slightly lower at 12,708.40, showing a minor percentage change of -0.0031%. The index has a high RSI of 73.07, indicating it is in overbought territory. The current metrics suggest it is above the 50-day (12,022.05) and 200-day (11,453.86) exponential moving averages, showing a strong upward trend.

Relationship with Key Moving Averages

The IBEX 35 (Spain) is currently trading above its 10-day EMA of 12505.39, 20-day EMA of 12301.05, 50-day EMA of 12022.05, and 200-day EMA of 11453.86, indicating a strong upward trend in the short to long term despite a slight drop today.

Moving Averages Trend (MACD)

The MACD for IBEX 35 shows a value of 239.24 with a signal line at 187.86, indicating a positive momentum as the MACD line is above the signal line. This bullish signal suggests that the recent upward trend could continue if the momentum persists.

RSI Analysis

The current RSI for the IBEX 35 index is 73.07, indicating that it is in the overbought territory. This suggests that the index may be experiencing a higher buying pressure, and a potential price correction could be expected in the near term.

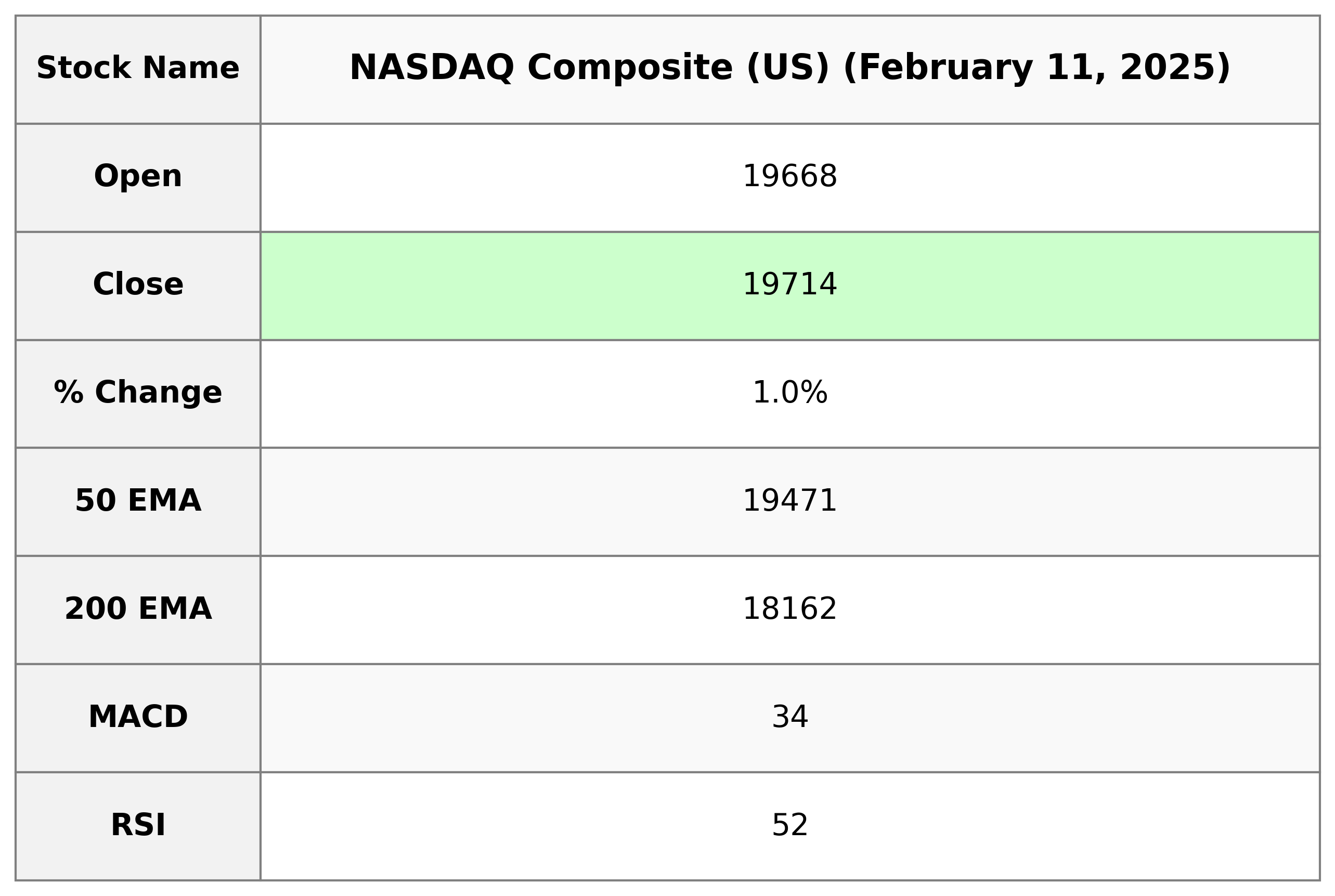

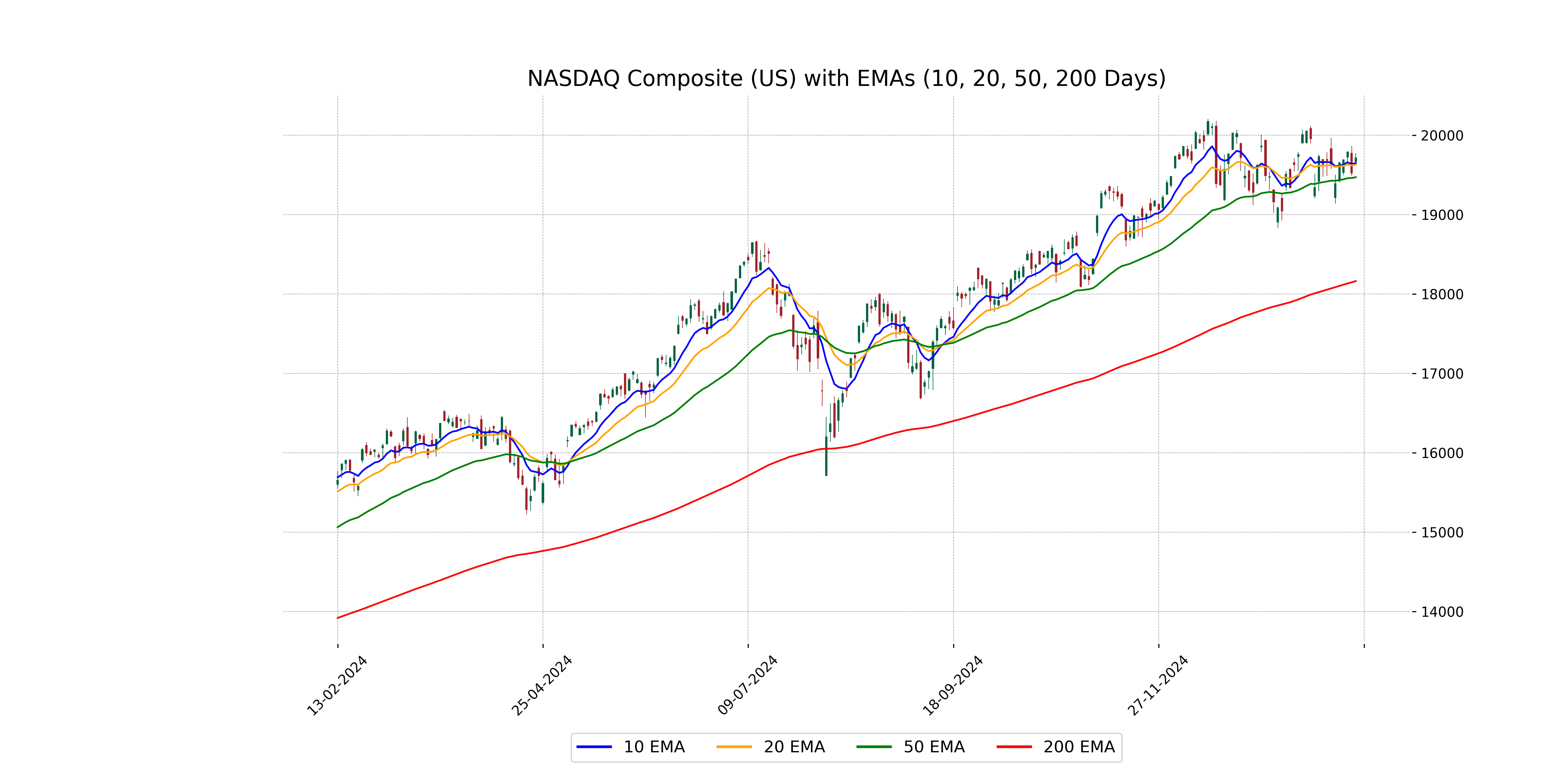

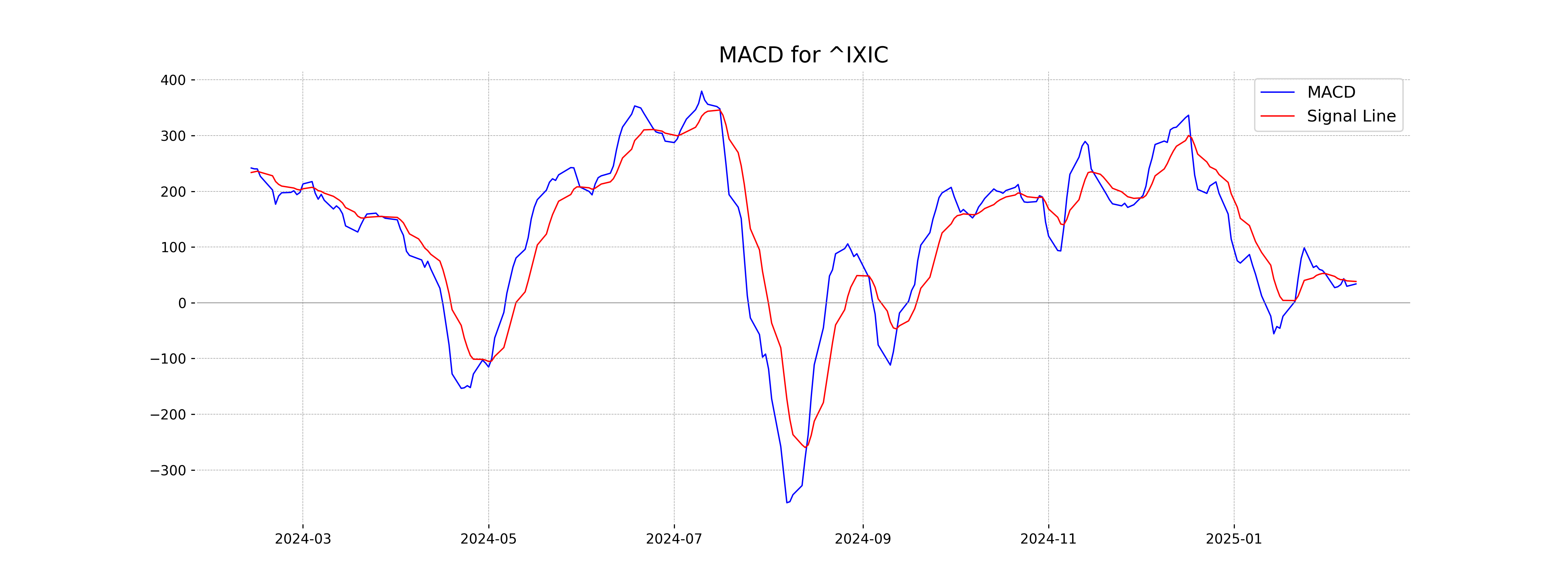

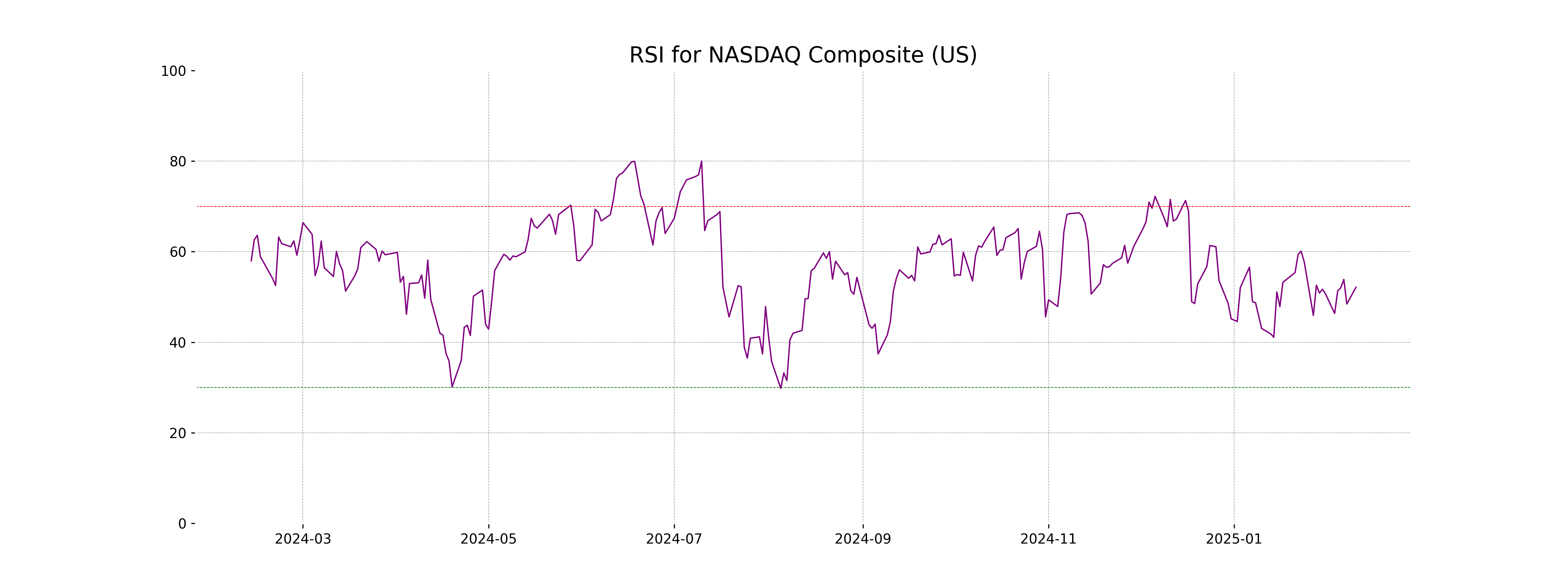

Analysis for NASDAQ Composite (US) - February 11, 2025

The NASDAQ Composite (US) opened at 19,668.18 and closed at 19,714.27, marking a 0.98% increase with a points change of 190.87. The trading volume was 9.53 billion, and key moving averages indicate a positive momentum, with a 50-day EMA of 19,471.25 and a MACD slightly below its signal.

Relationship with Key Moving Averages

The NASDAQ Composite opened above both the 50-day and 200-day EMAs, indicating a positive short-term and long-term trend. The closing price was also above the 10-day and 20-day EMAs, suggesting a potential continuation of the uptrend. The MACD being above its signal line supports this bullish sentiment.

Moving Averages Trend (MACD)

The MACD for NASDAQ Composite is at 33.83, while the MACD Signal is at 38.23, indicating a bearish crossover. This suggests that there might be a potential downtrend or a slowdown in upward momentum in the short term.

RSI Analysis

The RSI for NASDAQ Composite is 52.14, which indicates a neutral market sentiment. Since RSI values above 70 denote overbought conditions and below 30 indicate oversold conditions, the current level suggests that the index is not exhibiting extreme trading behaviors.

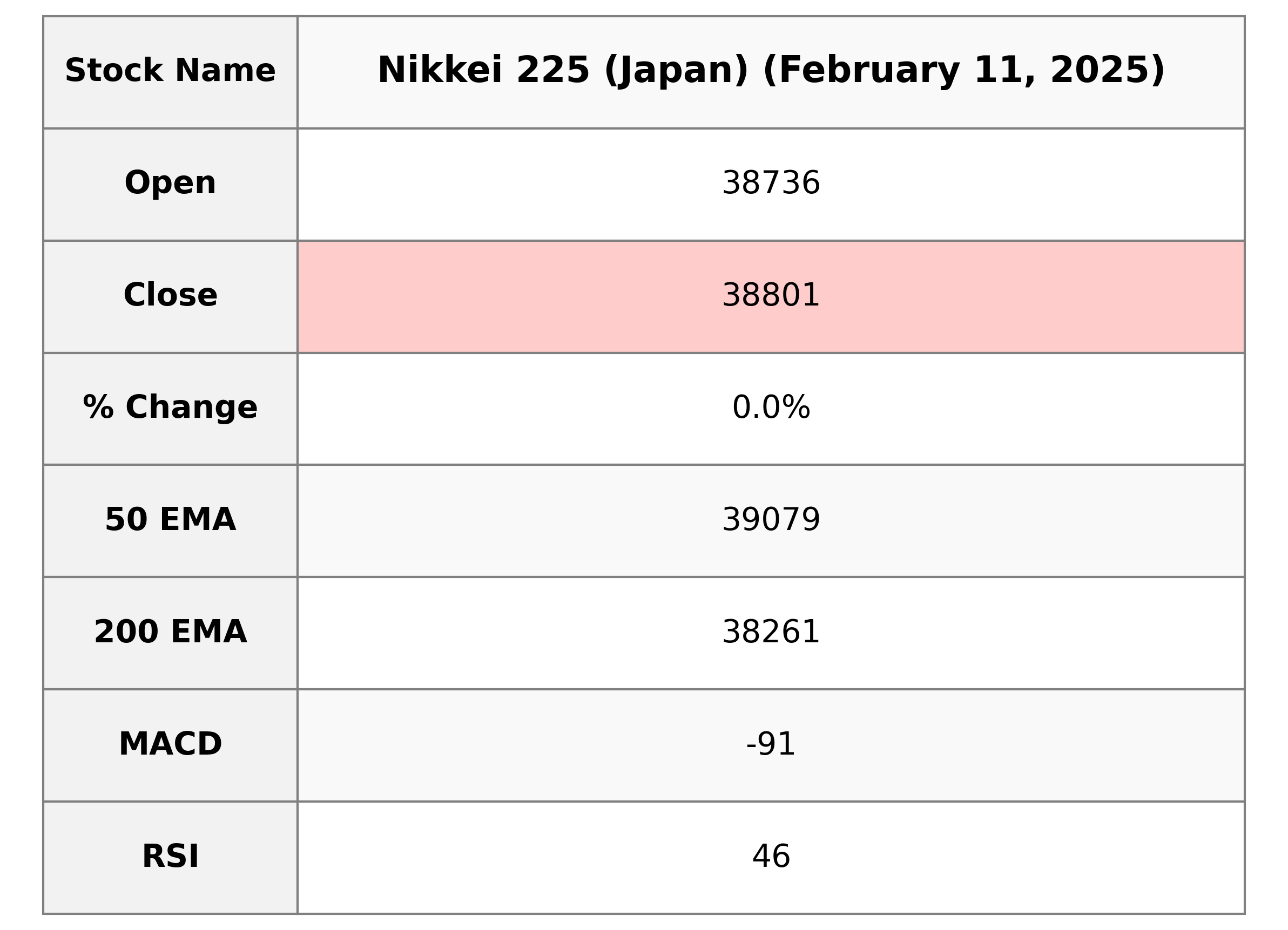

Analysis for Nikkei 225 (Japan) - February 11, 2025

The Nikkei 225 index opened at 38,736.37, with a high of 38,895.74 and a low of 38,606.32, before closing at 38,801.17. There was a slight percentage change of 0.036% and a points change of 14.15. The relative strength index (RSI) stands at 45.79, indicating neutral momentum, while the MACD is -90.94, below the signal line of -25.64, suggesting bearish sentiment.

Relationship with Key Moving Averages

The closing price of Nikkei 225 (Japan) at 38801.171875 is below its 50 EMA of 39078.8387 and its 10 EMA of 38999.6686, suggesting a potential downtrend or consolidation phase. However, it remains above the 200 EMA of 38261.0455, indicating a generally upward trend over the longer term.

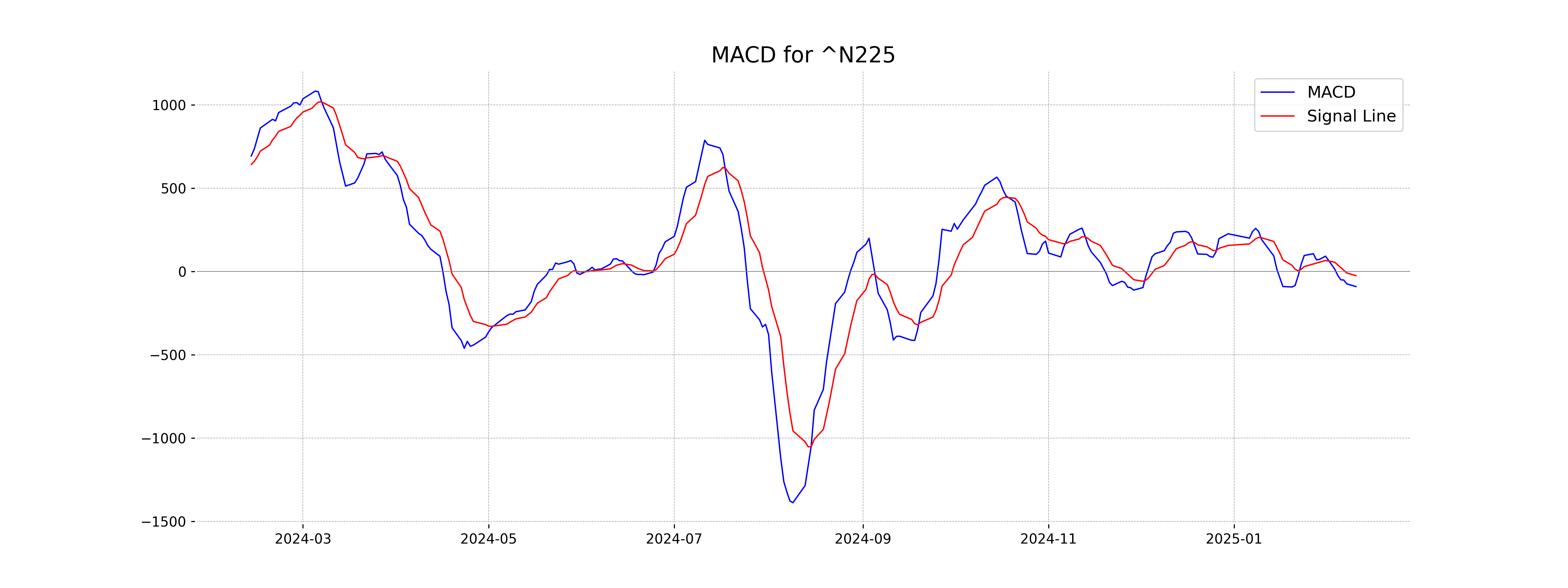

Moving Averages Trend (MACD)

**MACD Analysis for Nikkei 225 (Japan):** The MACD value is -90.94, which is below the MACD signal line at -25.64, indicating a potential bearish trend. This suggests that the Nikkei 225 may experience downward momentum in the short term.

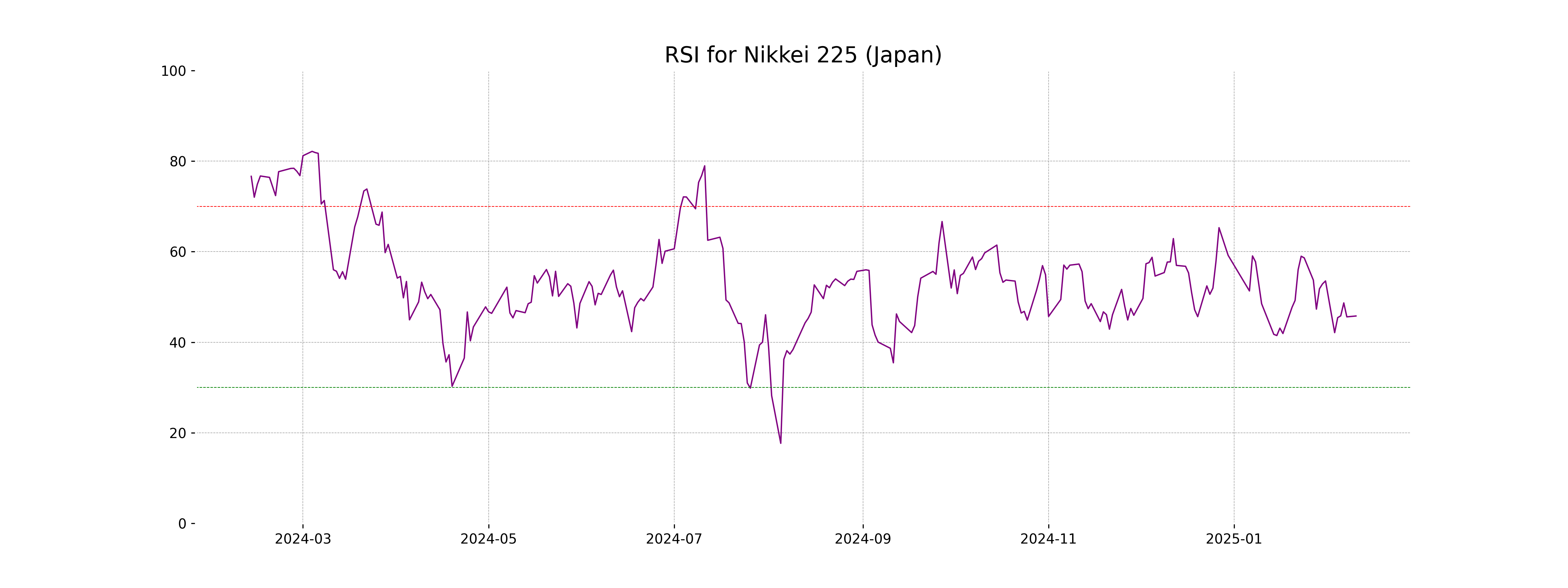

RSI Analysis

The Relative Strength Index (RSI) for Nikkei 225 stands at 45.79, indicating a neutral stance as it resides between the generally oversold level of 30 and overbought level of 70. This suggests that the market is neither in the overbought nor oversold condition, reflecting a balanced momentum in the recent price action.

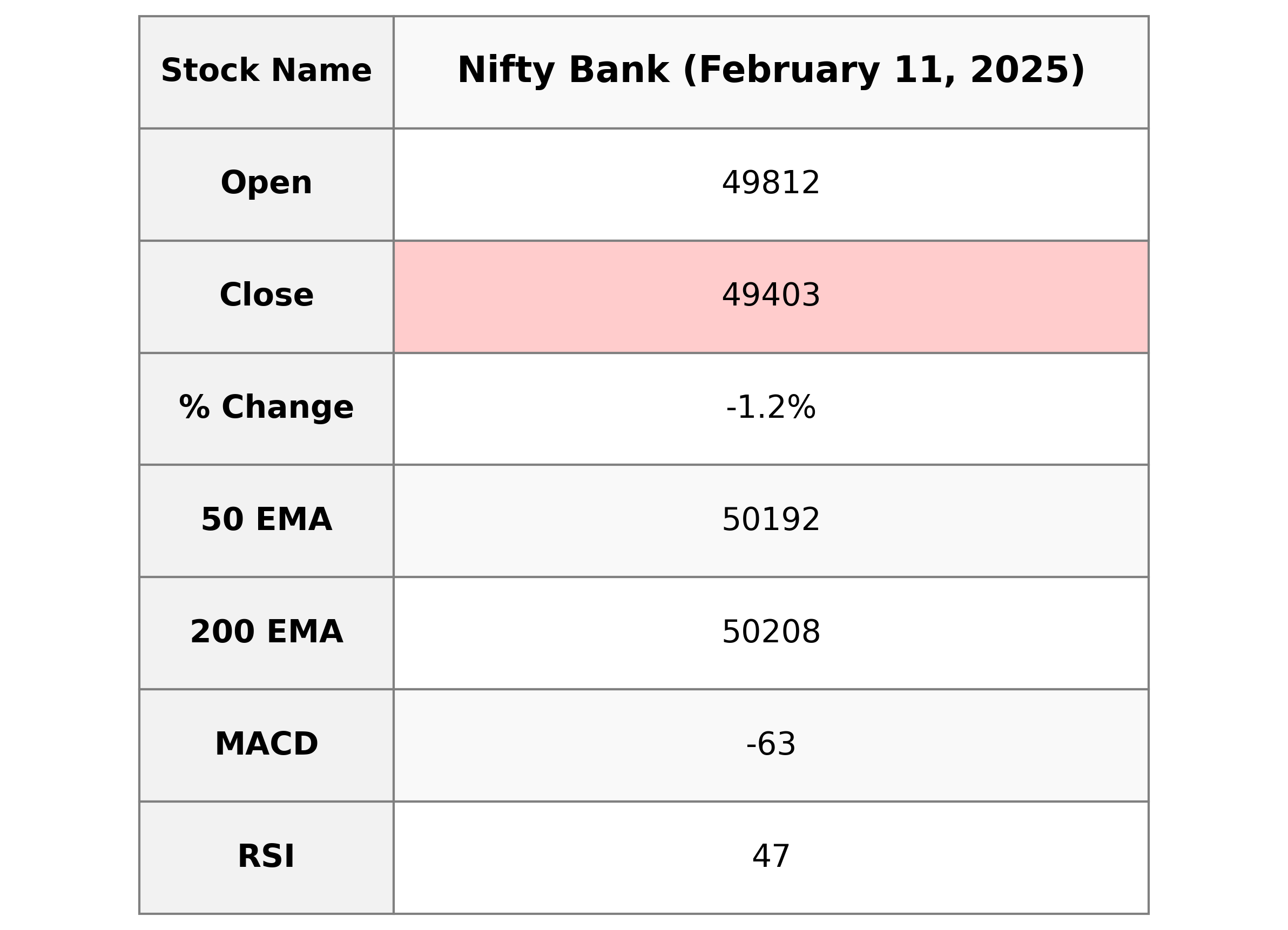

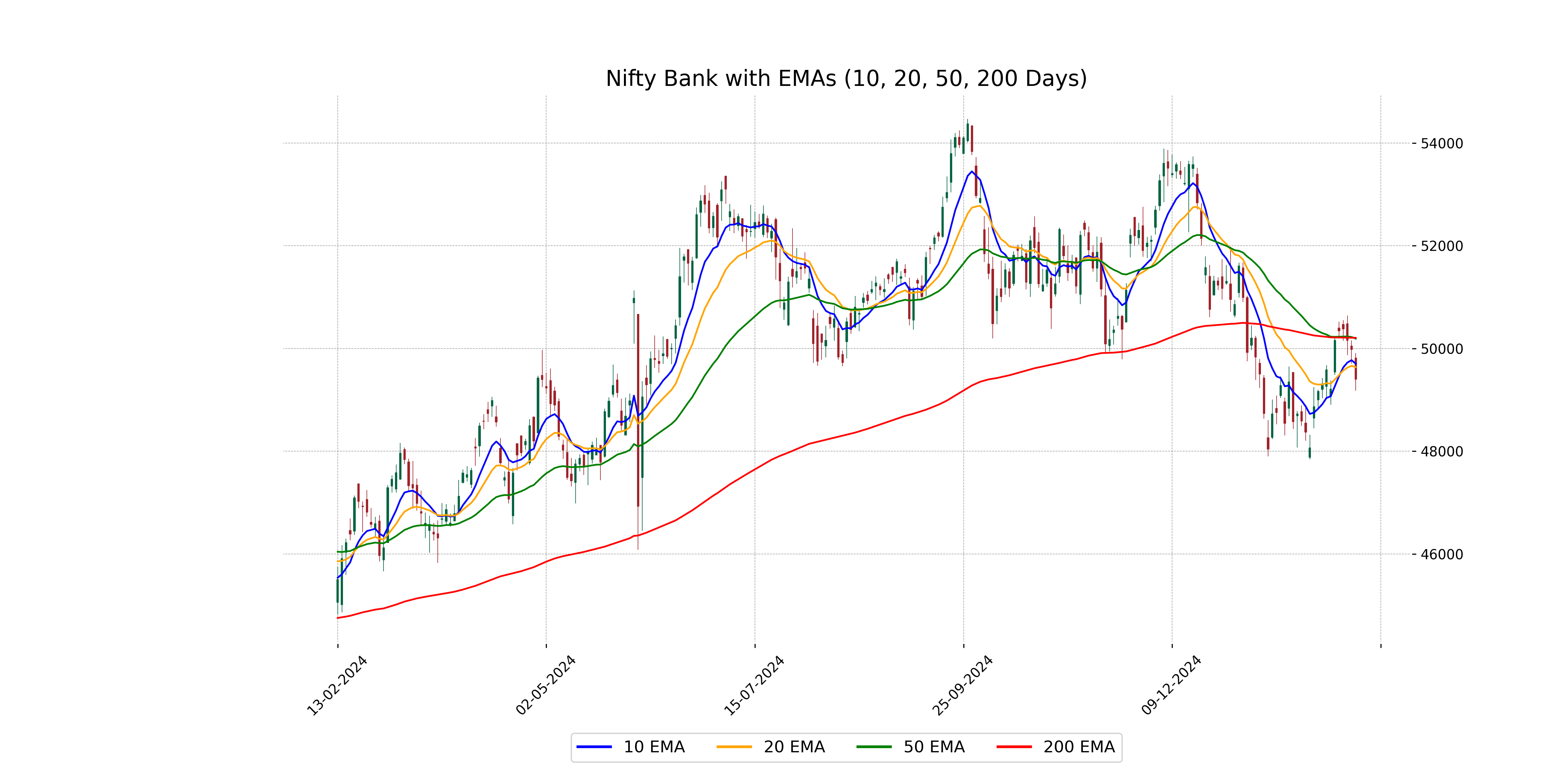

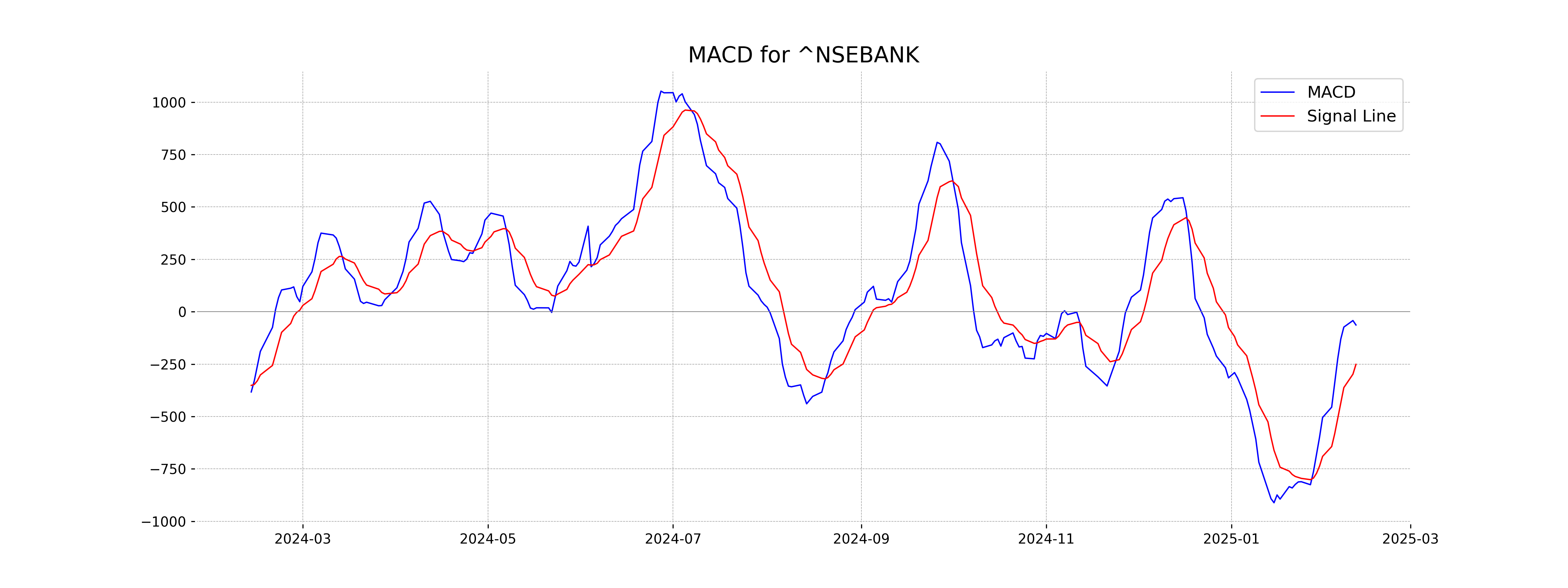

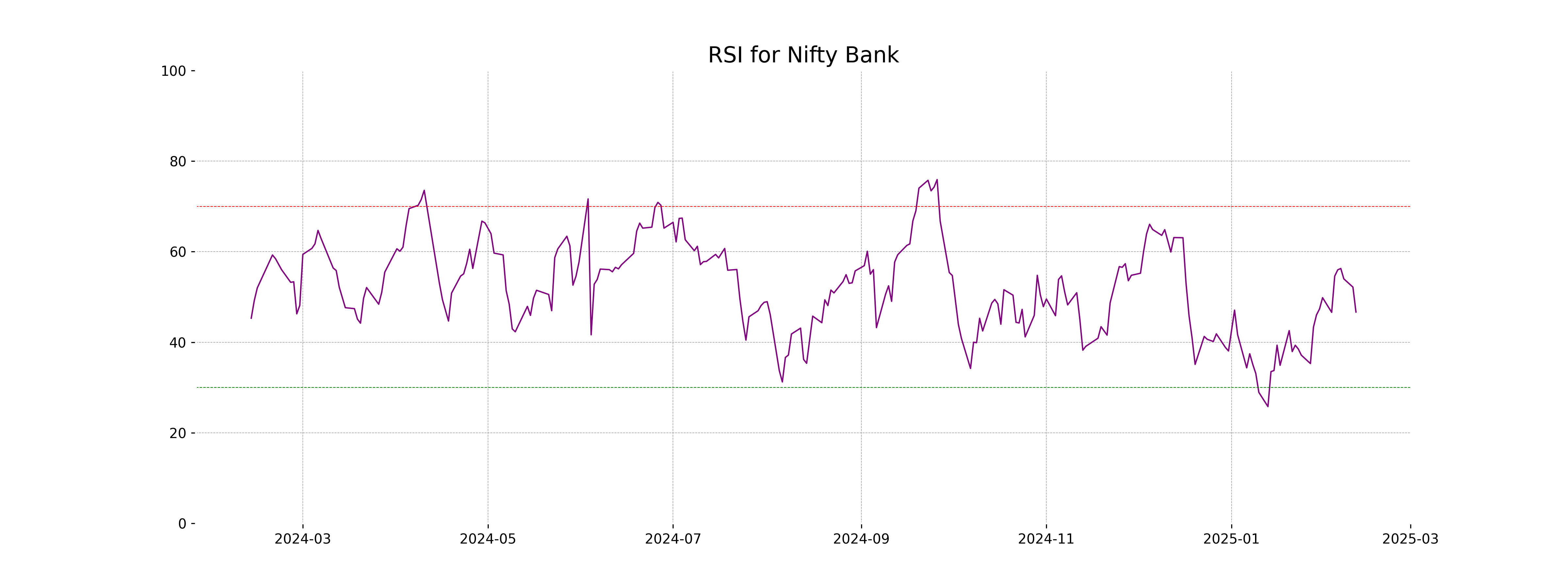

Analysis for Nifty Bank - February 11, 2025

Nifty Bank opened at 49812.15 and closed at 49403.40, experiencing a decline of 1.16% with a points drop of 577.60. The RSI indicator is at 46.66, suggesting a neutral trend; meanwhile, both the MACD and MACD Signal indicate a bearish sentiment. The stock is trading below its short, medium, and long-term EMAs, with a particularly notable gap from the 50 and 200 EMAs.

Relationship with Key Moving Averages

The Nifty Bank is currently trading below its key moving averages, with its last closing price of 49,403.40 being lower than the 50 EMA of 50,191.89, the 200 EMA of 50,207.52, the 10 EMA of 49,705.23, and the 20 EMA of 49,636.35. This indicates a bearish short-term trend as the index is below the critical average benchmarks.

Moving Averages Trend (MACD)

The MACD value for Nifty Bank is -63.35, which is above the MACD Signal value of -251.24. This indicates a possible bullish trend, suggesting that the stock might be gaining momentum. However, the negative MACD still suggests overall bearish conditions, and investors should proceed cautiously.

RSI Analysis

The RSI value for Nifty Bank is 46.66, indicating that the stock is in the neutral zone, neither overbought nor oversold. Traders generally interpret an RSI below 30 as a potential buying opportunity and above 70 as a potential selling point; thus, Nifty Bank's current RSI suggests neither extreme condition.

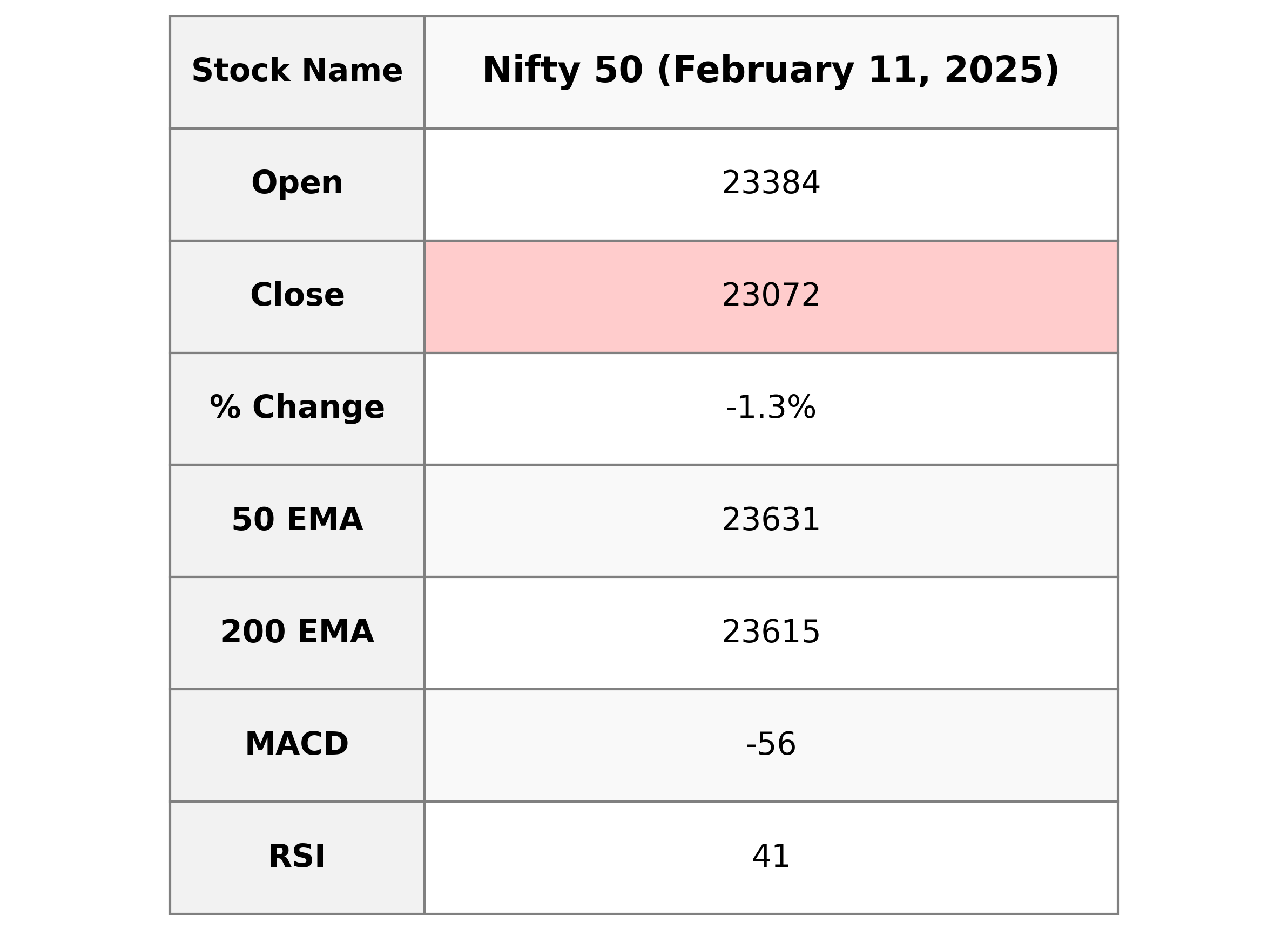

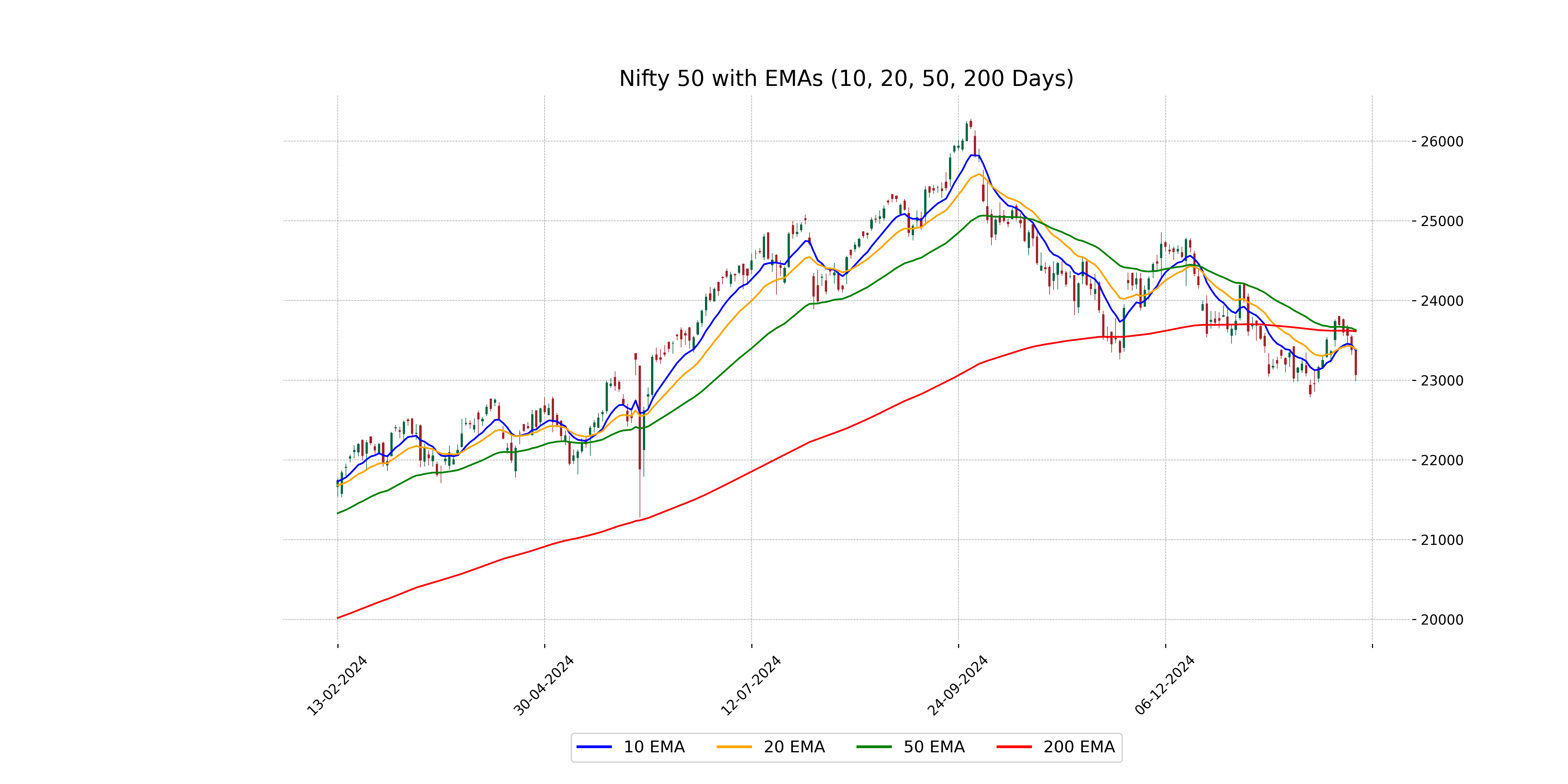

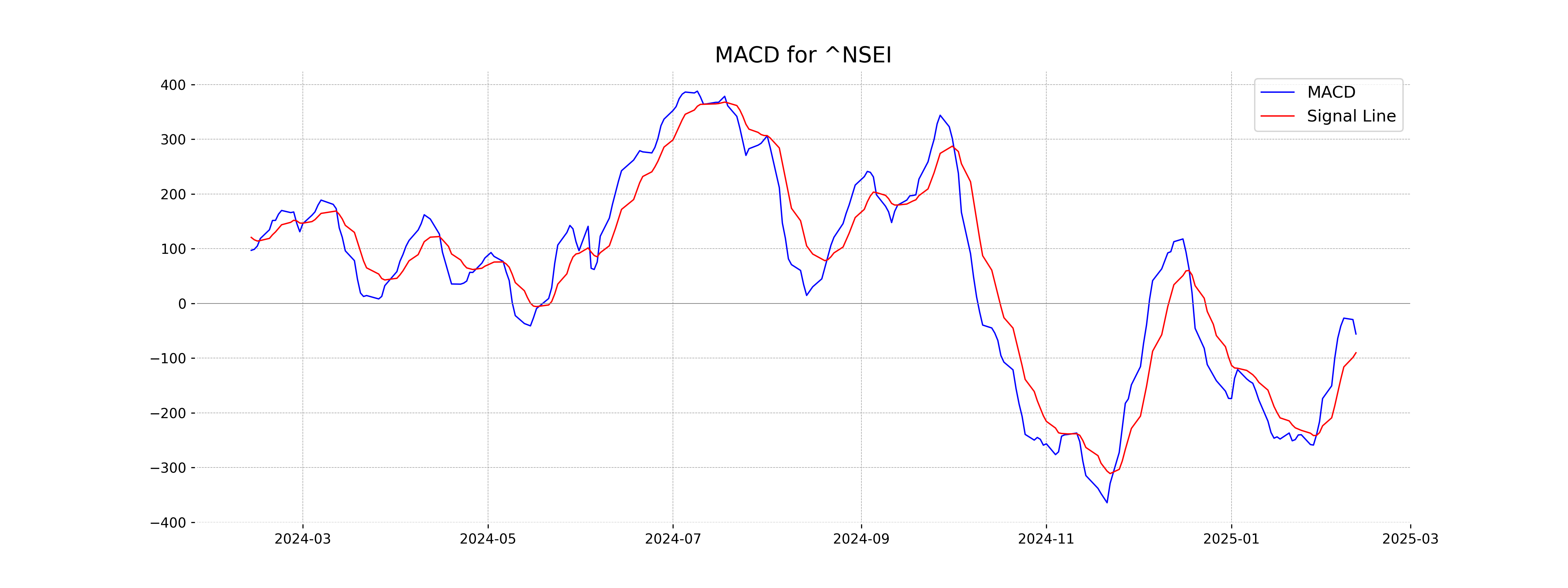

Analysis for Nifty 50 - February 11, 2025

Nifty 50 opened at 23383.55 and closed at 23071.80, marking a decline of approximately 1.32% with a points change of -309.80. The Relative Strength Index stands at 41.42, suggesting weakness. The current levels are below both the 50-day and 200-day EMAs, indicating a bearish trend.

Relationship with Key Moving Averages

The current close of Nifty 50 at 23,071.80 is below all its key moving averages, indicating a bearish trend. Specifically, it is below the 10 EMA of 23,377.56, the 20 EMA of 23,393.08, the 50 EMA of 23,630.54, and the 200 EMA of 23,615.16. This suggests bearish momentum and a potential continuation of downward movement unless supported by other technical indicators.

Moving Averages Trend (MACD)

The MACD value for Nifty 50 is -55.91 while the MACD Signal is -90.21, indicating that the MACD line is above the signal line. This suggests a potential bullish signal, as the MACD line crossing above the signal line is often interpreted as a sign of upward momentum.

RSI Analysis

**RSI Analysis for Nifty 50**: The RSI for Nifty 50 is 41.42, which suggests that it is in a neutral zone. Typically, an RSI below 30 is considered to indicate that a stock is oversold, while an RSI above 70 indicates it is overbought. Therefore, Nifty 50 is not currently in an oversold or overbought condition.

ADVERTISEMENT

Up Next

Global stock market indices: How the world markets performed today - 11 February 2025

Rupee breaches 91-mark against US dollar for first time in intra-day trade

Microsoft commits USD 17.5 billion investment in India: CEO Satya Nadella

CBI books Anil Ambani's son, Reliance Home Finance Ltd. in Rs 228 crore bank fraud case

RBI raises FY26 GDP growth projection to 7.3 pc

RBI trims policy interest rate by 25bps to 5.25pc, loans to get cheaper

More videos

Rupee slumps to all-time low of 90.25 against US dollar in intra-day trade

Reliance completes merger of Star Television Productions with Jiostar

India to lead emerging market growth with 7pc GDP rise in 2025: Moody’s

Nifty hits record high after 14 months; Sensex nears all-time peak

Reliance stops Russian oil use at its only-for-export refinery to comply with EU sanctions

ED attaches fresh assets worth over Rs 1,400 cr in case against Anil Ambani's Reliance Group

India signs one-year deal to import 2.2 million tonnes of LPG from US

India International Trade Fair begins at Pragati Maidan amid tight security

Stock markets decline in initial trade on foreign fund outflows, weak Asian peers

Amazon to lay off 30,000 office workers amid AI-driven cost cuts