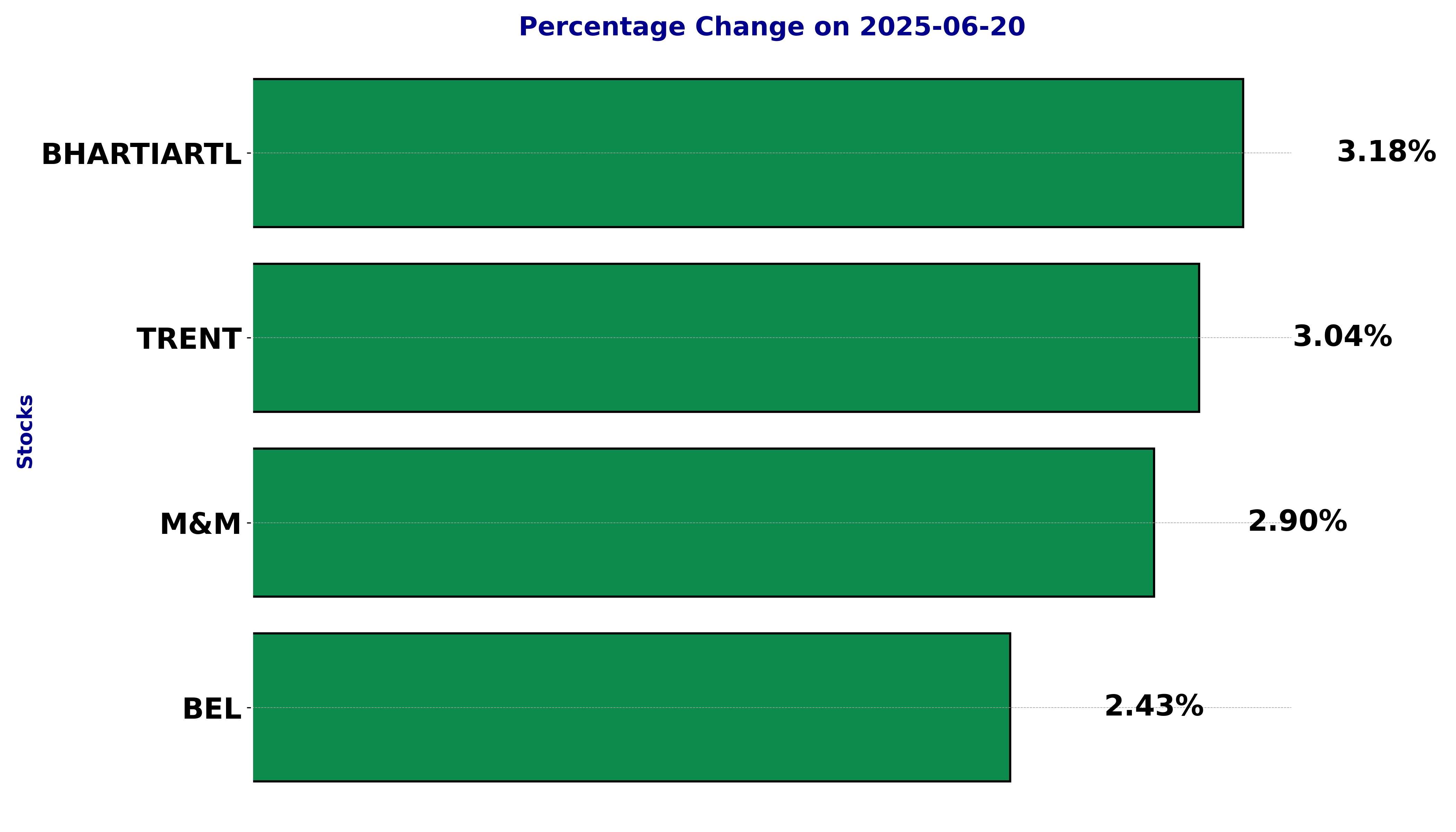

Top 5 Nifty 50 gainers today – June 20, 2025: Biggest stock moves

In this article, we will explore the technical indicators of some of the high-performing stocks on the Indian stock market, including BEL, BHARTIARTL, M&M, and TRENT.

By looking at these stocks through the lens of key technical factors, we aim to better understand their price movements, trends, and potential future performance.

Analysis for Bharat Electronics - June 20, 2025

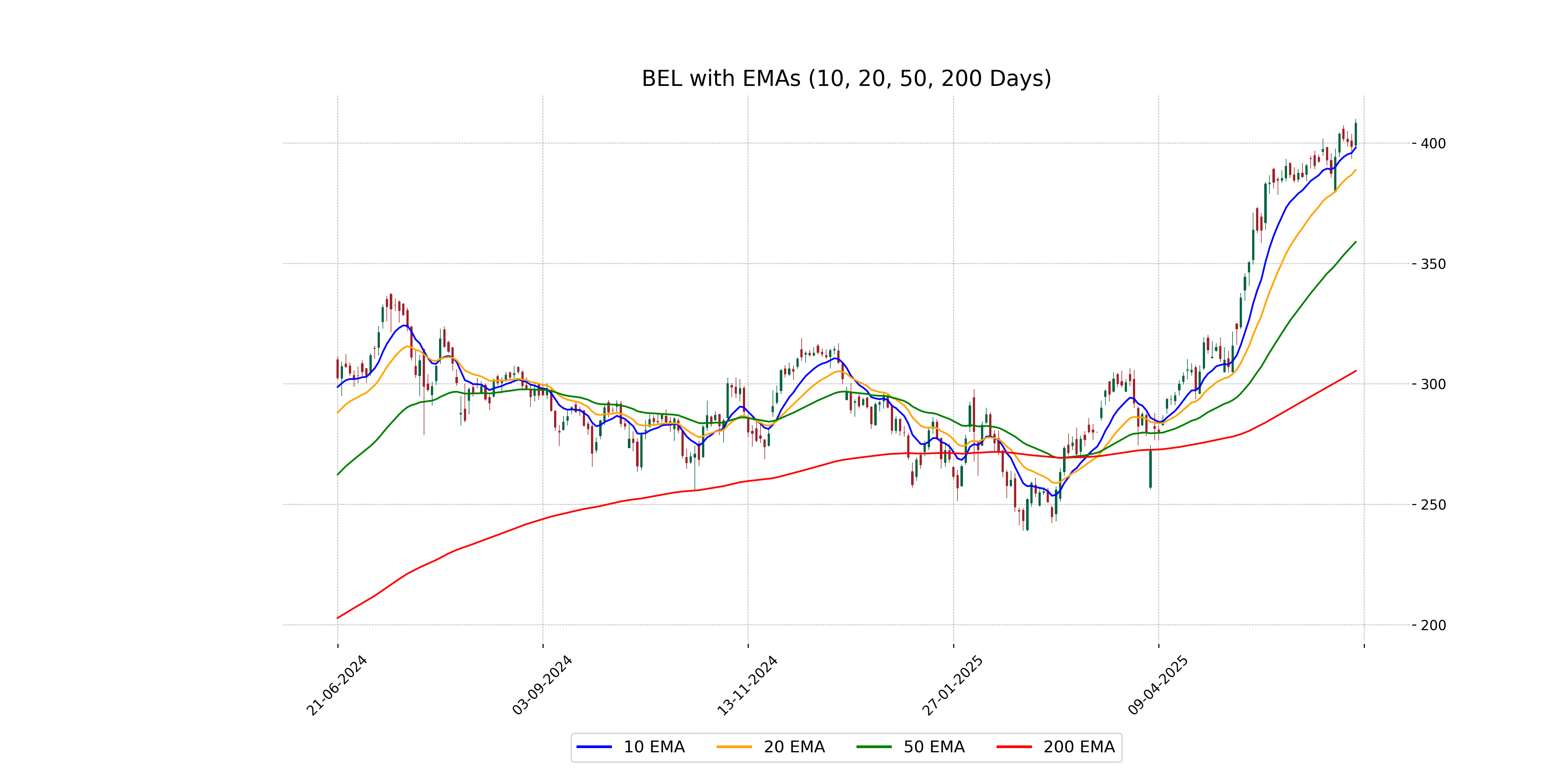

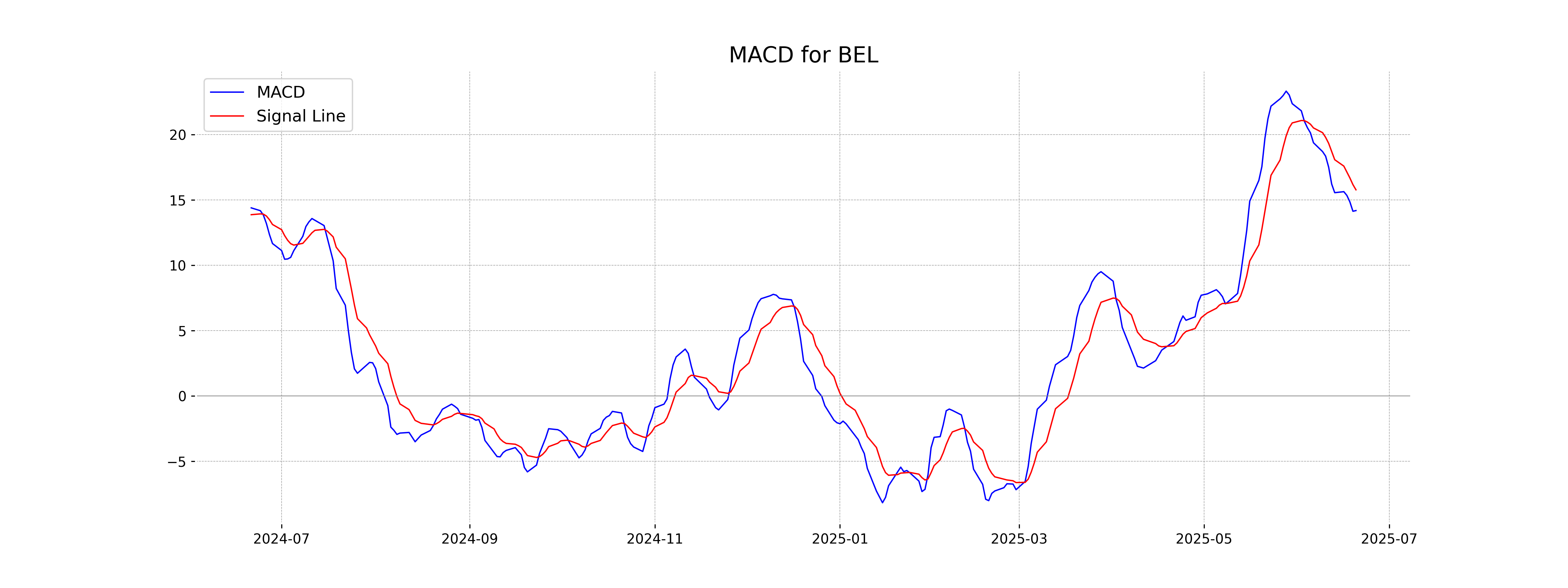

Bharat Electronics reported a strong performance with a closing price of 408.25 INR, marking a 2.43% increase from the previous close. The stock's notable growth is supported by high trading volume and a bullish RSI of 72.85, indicating positive momentum. The company operates in the Industrials sector, specifically in Aerospace & Defense, and is trading significantly above both its 50-day and 200-day EMAs, highlighting strong market sentiment.

Relationship with Key Moving Averages

Bharat Electronics' current closing price of 408.25 is above all its key moving averages, with a 50-day EMA at 359.00, a 20-day EMA at 388.92, and a 10-day EMA at 398.17, indicating a strong bullish trend. The close is also significantly higher than the 200-day EMA of 305.45, suggesting long-term upward momentum.

Moving Averages Trend (MACD)

MACD Analysis for Bharat Electronics: Bharat Electronics' MACD (14.18) is currently below the MACD Signal Line (15.77), indicating a potential sell signal as momentum may be slowing down. However, with its RSI at 72.85, the stock appears to be overbought, suggesting caution for potential investors.

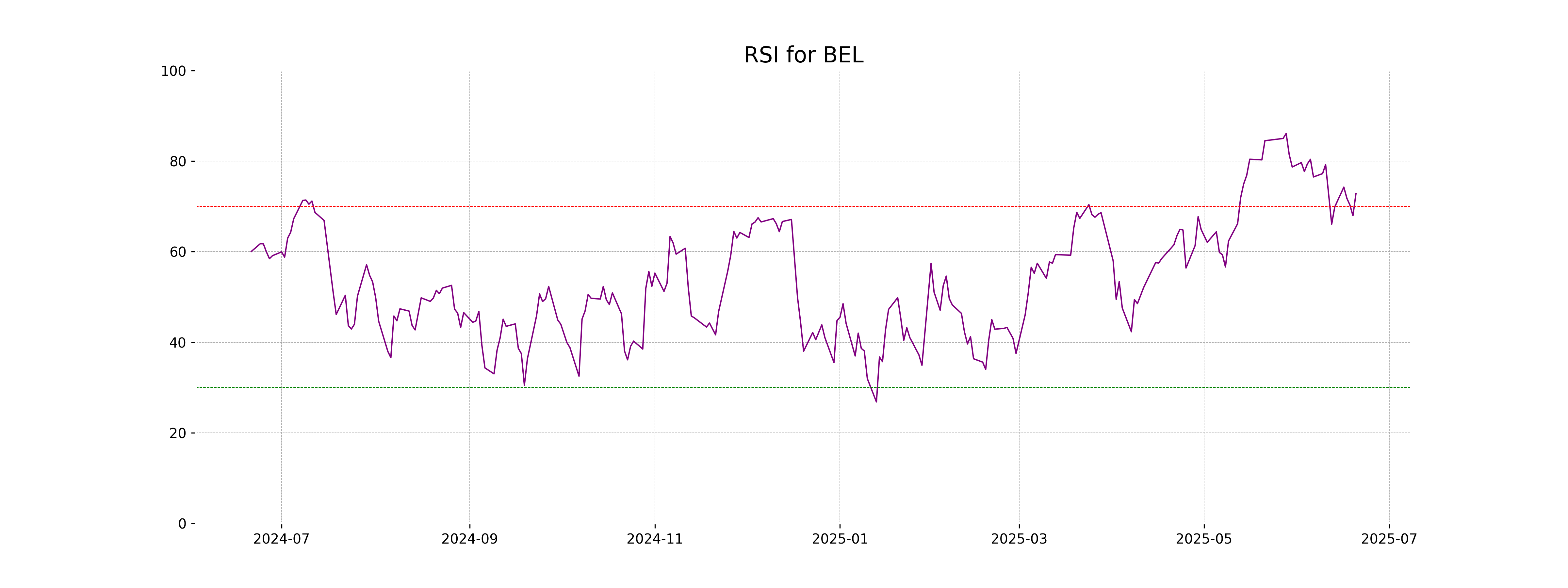

RSI Analysis

The RSI (Relative Strength Index) for Bharat Electronics is 72.85, which suggests that the stock is in an overbought condition. It's typically considered overbought when the RSI is above 70, which could indicate a potential for a price pullback or correction in the near term.

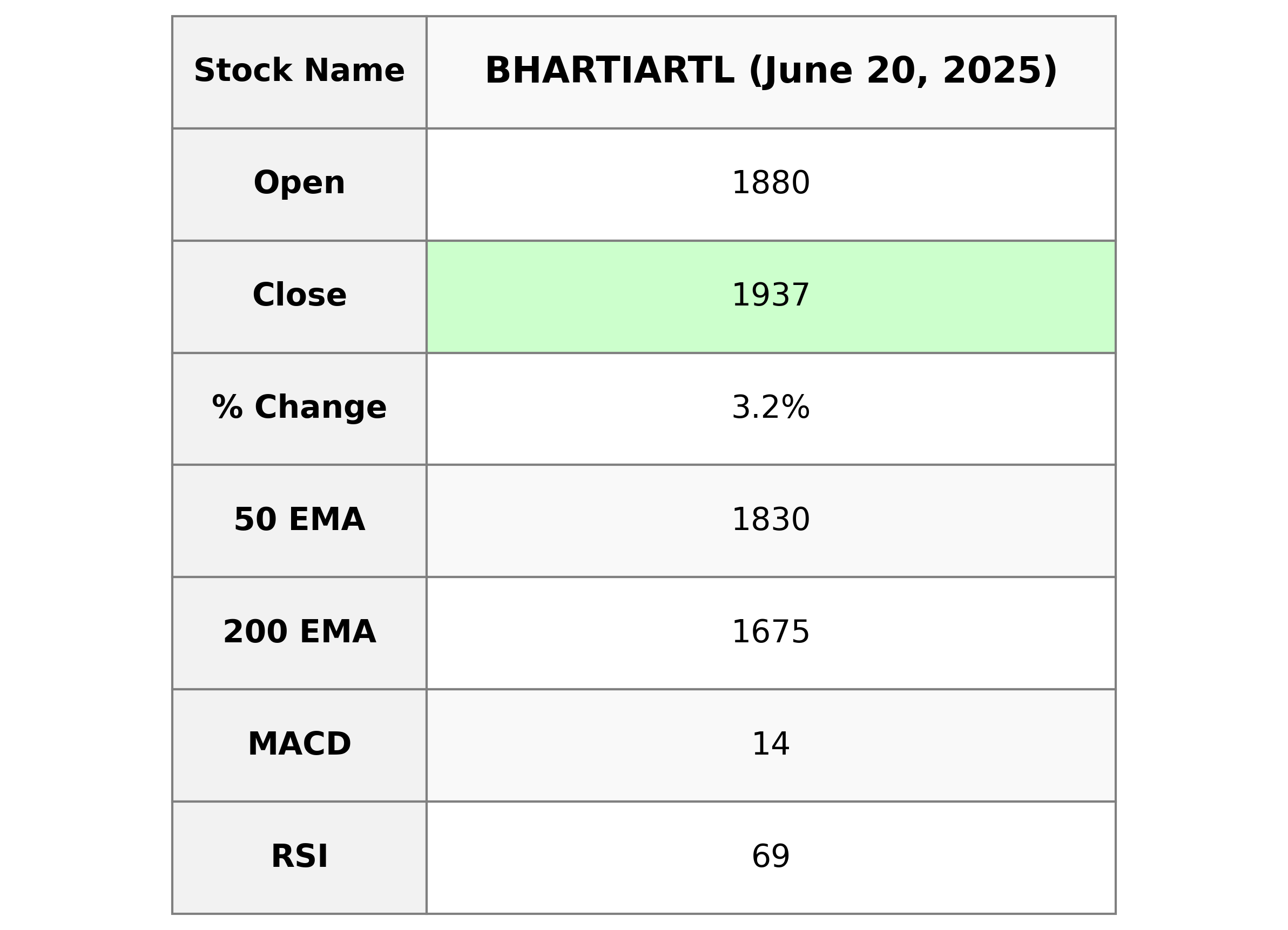

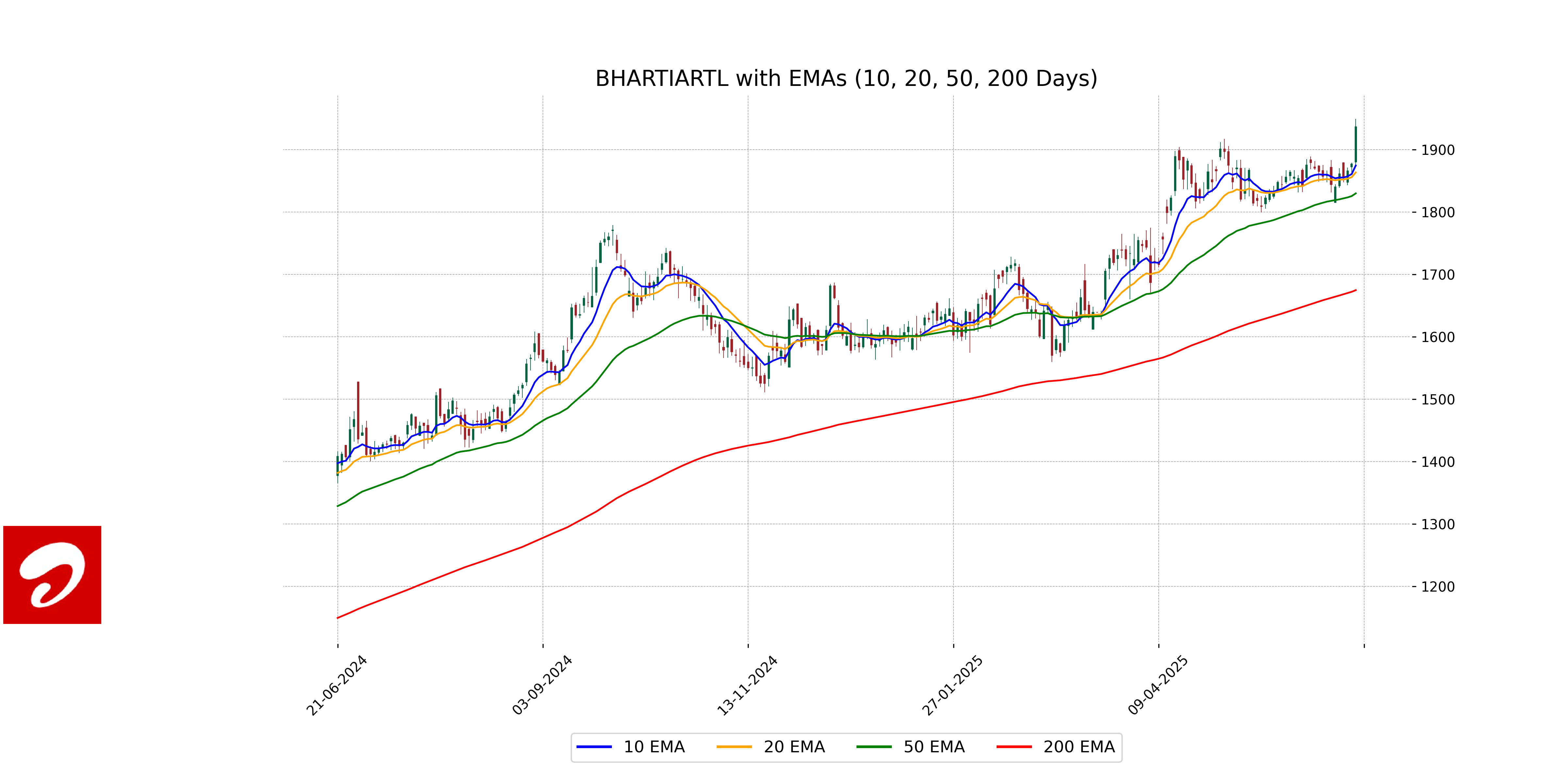

Analysis for Bharti Airtel - June 20, 2025

Bharti Airtel has shown a notable performance with a closing price of 1936.70, reflecting a percentage change of 3.18% from the previous close. The stock is trading above its 50 EMA of 1829.85 and 200 EMA of 1674.75, indicating a strong upward trend. The RSI of 69.09 suggests that the stock is nearing overbought conditions.

Relationship with Key Moving Averages

Bharti Airtel's current close price of 1936.70 is above its 50 EMA of 1829.85 and 200 EMA of 1674.75, indicating a bullish trend. Additionally, it is also above the 10 EMA of 1874.57 and 20 EMA of 1863.38, further reinforcing its upward momentum.

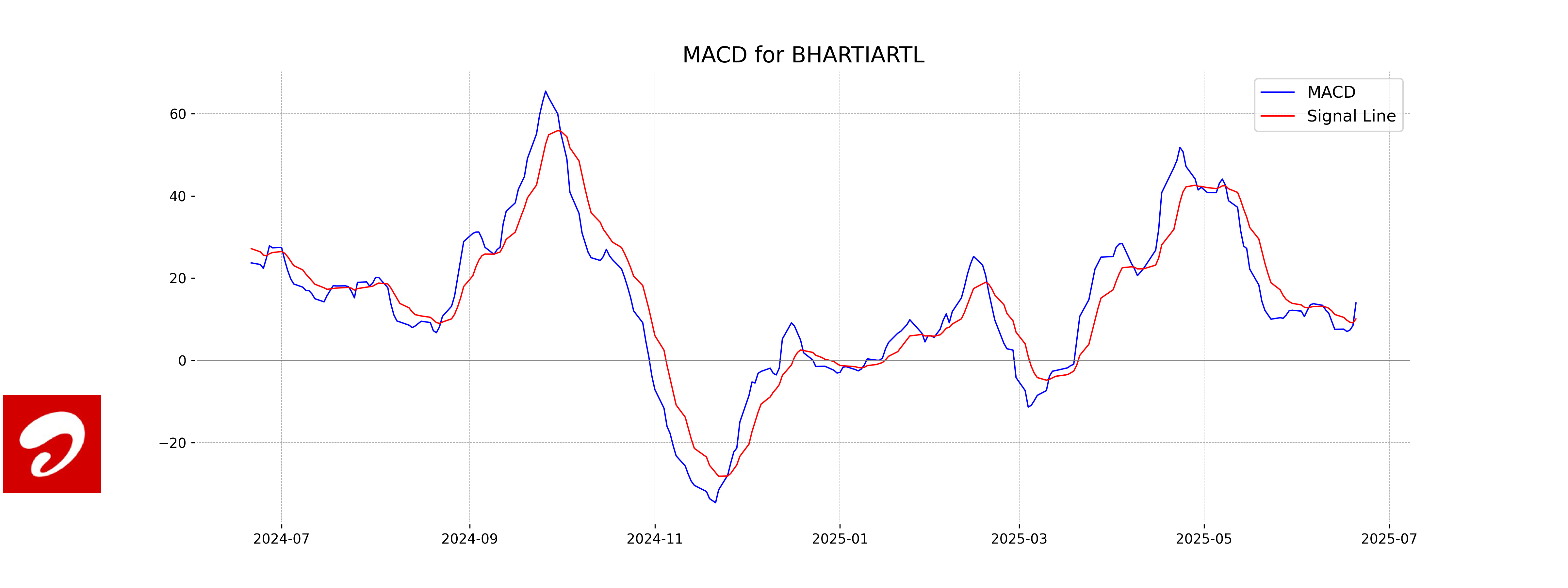

Moving Averages Trend (MACD)

MACD Analysis for Bharti Airtel: The MACD value of 13.95 is above the MACD Signal of 10.08, indicating a bullish momentum. This suggests that the recent uptrend in Bharti Airtel's stock price may continue.

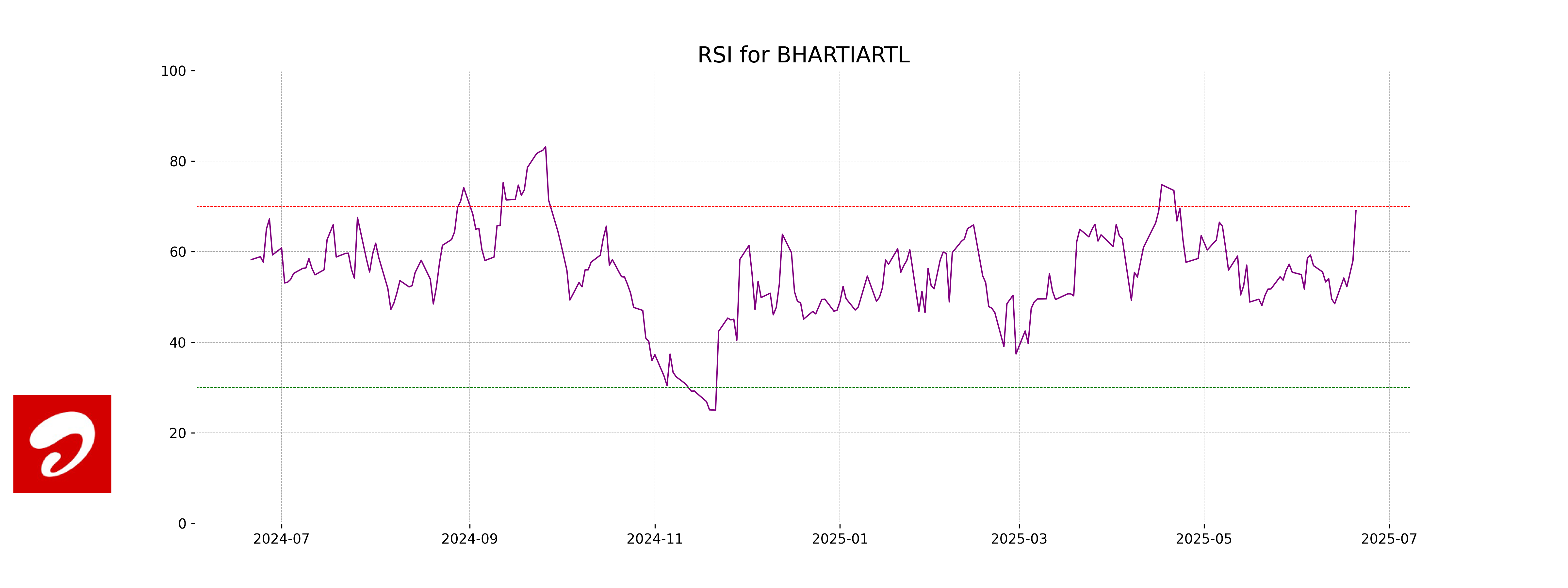

RSI Analysis

The Relative Strength Index (RSI) for Bharti Airtel is 69.09, which suggests that the stock is approaching overbought territory. An RSI above 70 typically signals that the asset may be overvalued and could be due for a pullback, while a reading around 50 indicates neutral momentum. At this level, investors should monitor for any reversal signals.

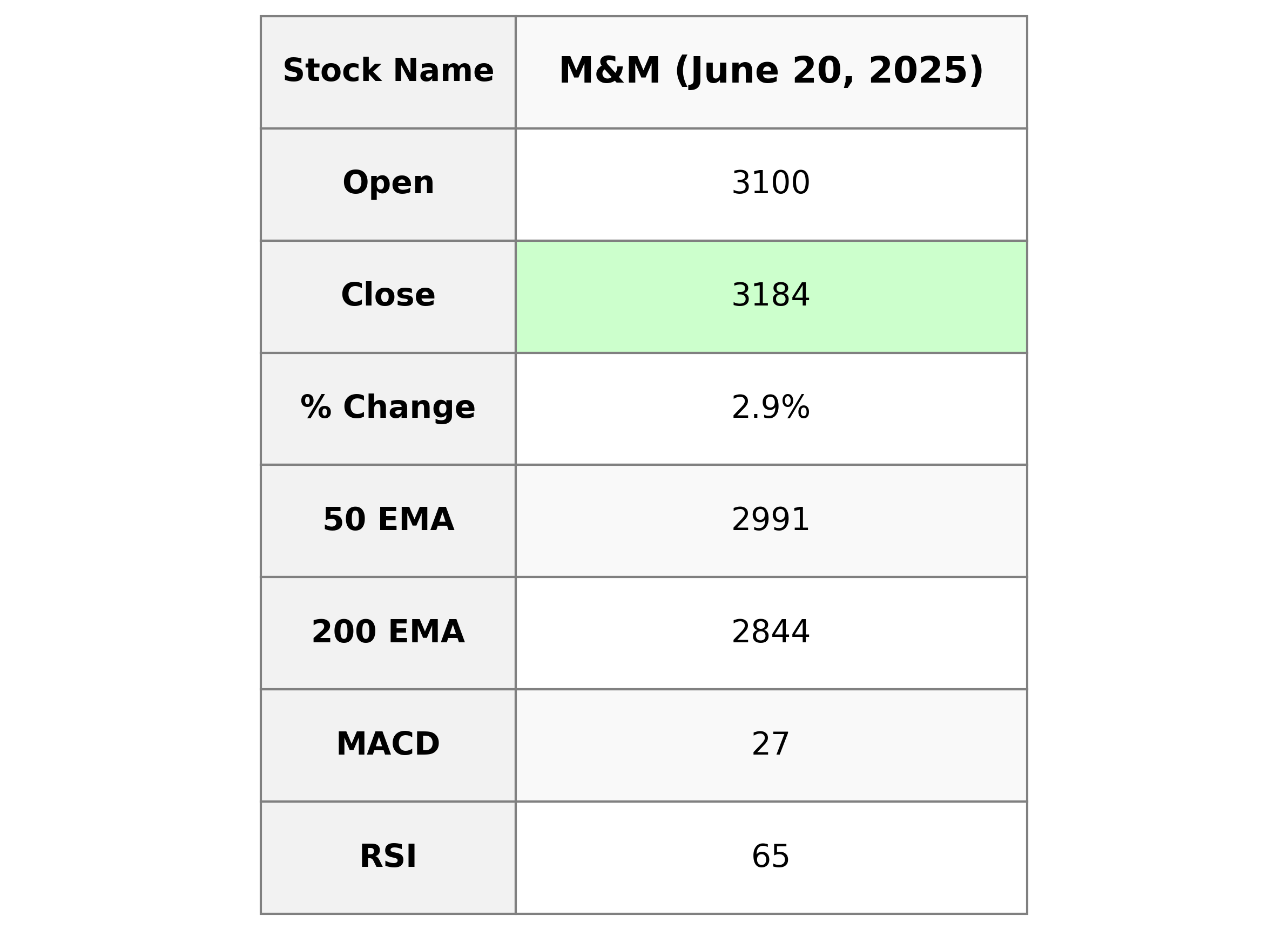

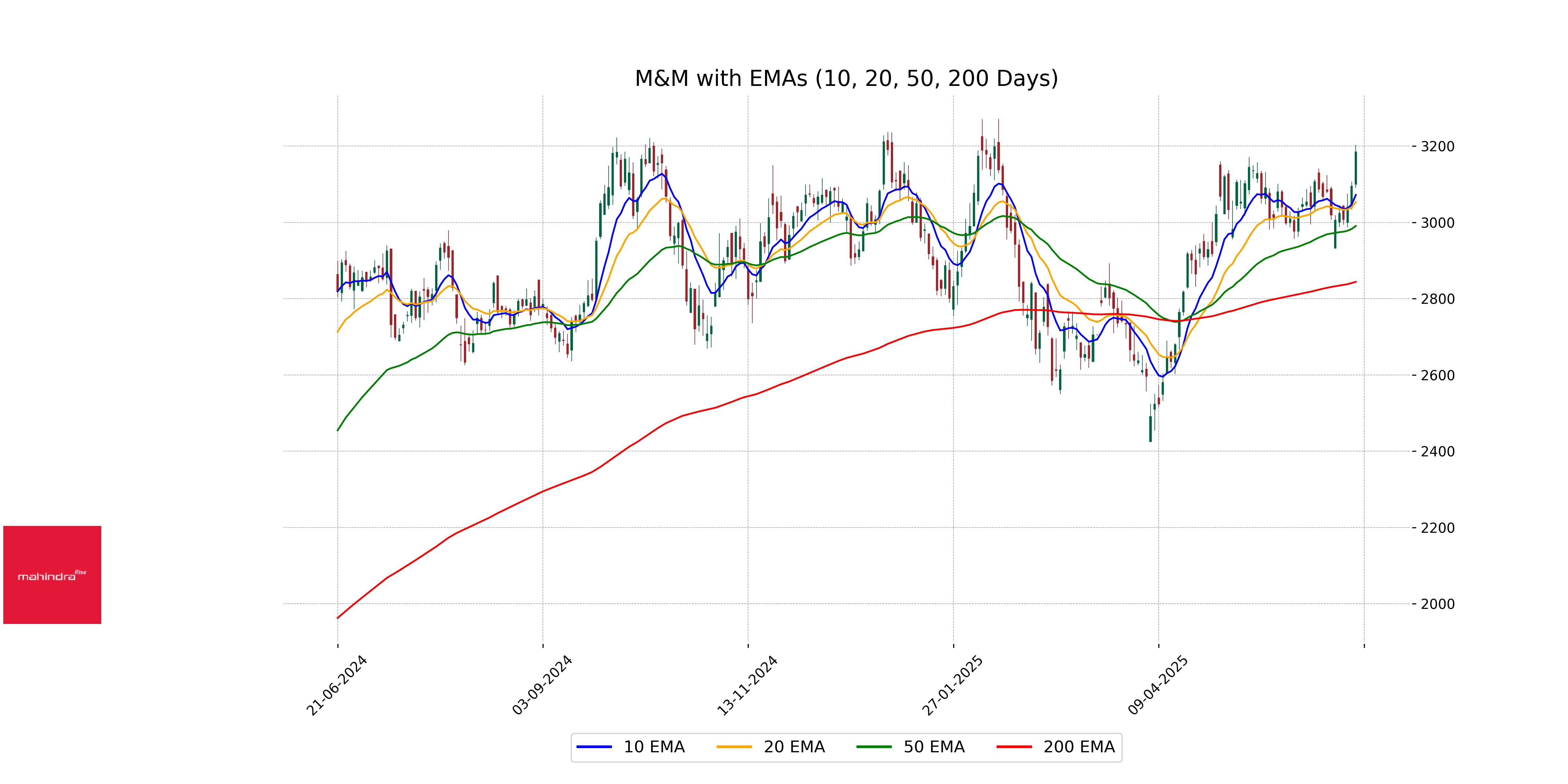

Analysis for Mahindra & Mahindra - June 20, 2025

Mahindra & Mahindra exhibited a positive performance, with the stock opening at 3100.0 and closing higher at 3184.4. The trading day saw a high of 3203.0 and a low of 3090.3. The stock experienced a percentage change of 2.90% and a points increase of 89.60, supported by a strong volume of 8,314,229 shares. The company's market capitalization is significant at 3,820,133,810,176, with a PE ratio of 27.66, indicating robust financial health in the Consumer Cyclical sector, particularly in the Auto Manufacturers industry in India. The technical indicators such as the RSI at 64.68 and the MACD above the signal line suggest a bullish trend.

Relationship with Key Moving Averages

The stock price of Mahindra & Mahindra closed significantly above its 50-day EMA of 2990.63 and its 200-day EMA of 2844.03, indicating a strong upward trend. It is also trading above its 10-day EMA of 3071.95 and 20-day EMA of 3053.29, suggesting recent bullish momentum.

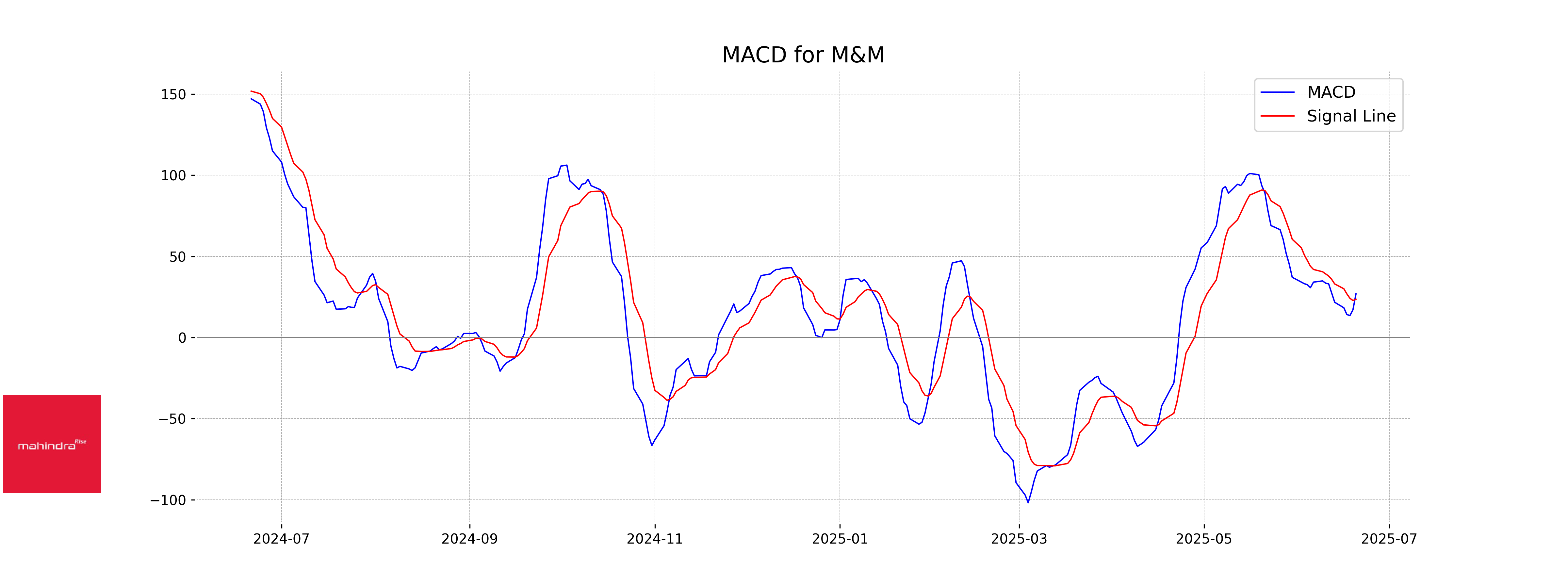

Moving Averages Trend (MACD)

MACD Analysis for Mahindra & Mahindra: The MACD (26.79) is above the MACD Signal Line (23.55), indicating a bullish crossover and suggesting potential upward momentum. This positive signal suggests that the stock may experience further gains in the near term.

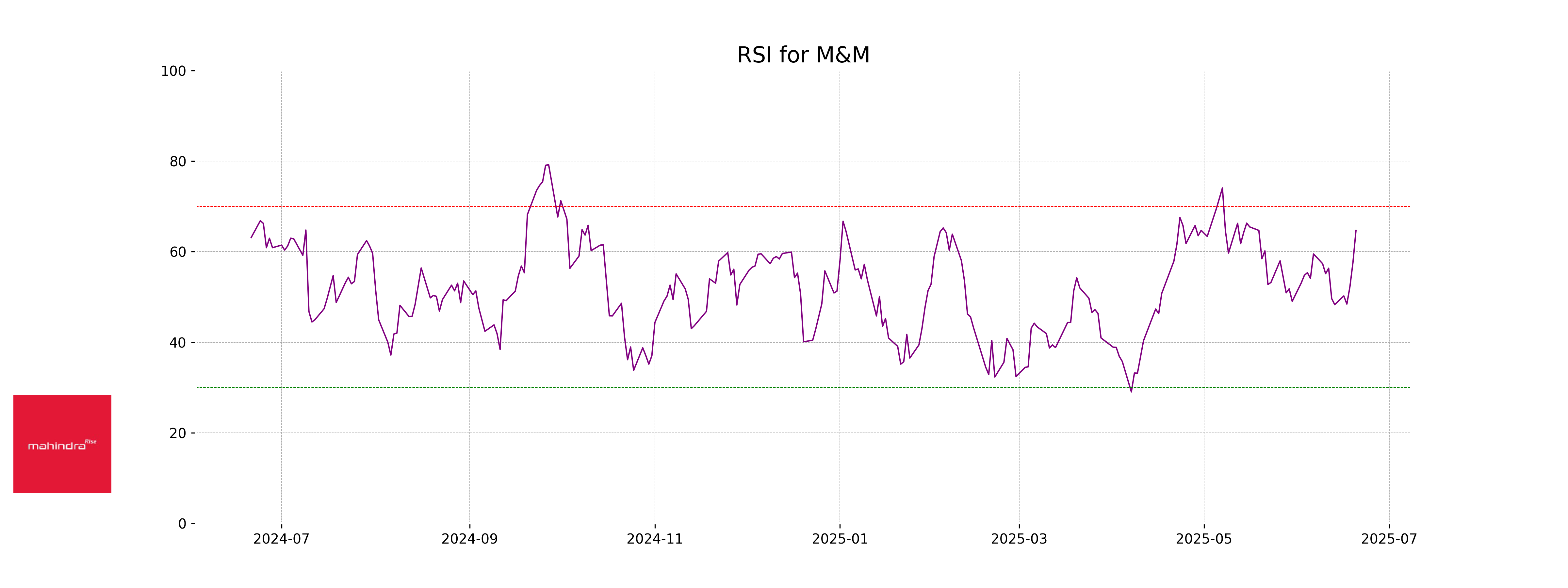

RSI Analysis

The RSI (Relative Strength Index) for Mahindra & Mahindra is 64.68, suggesting that the stock is nearing overbought levels but isn't in the overbought zone yet. This indicates positive momentum, but investors should proceed with caution as it approaches the overbought threshold of 70.

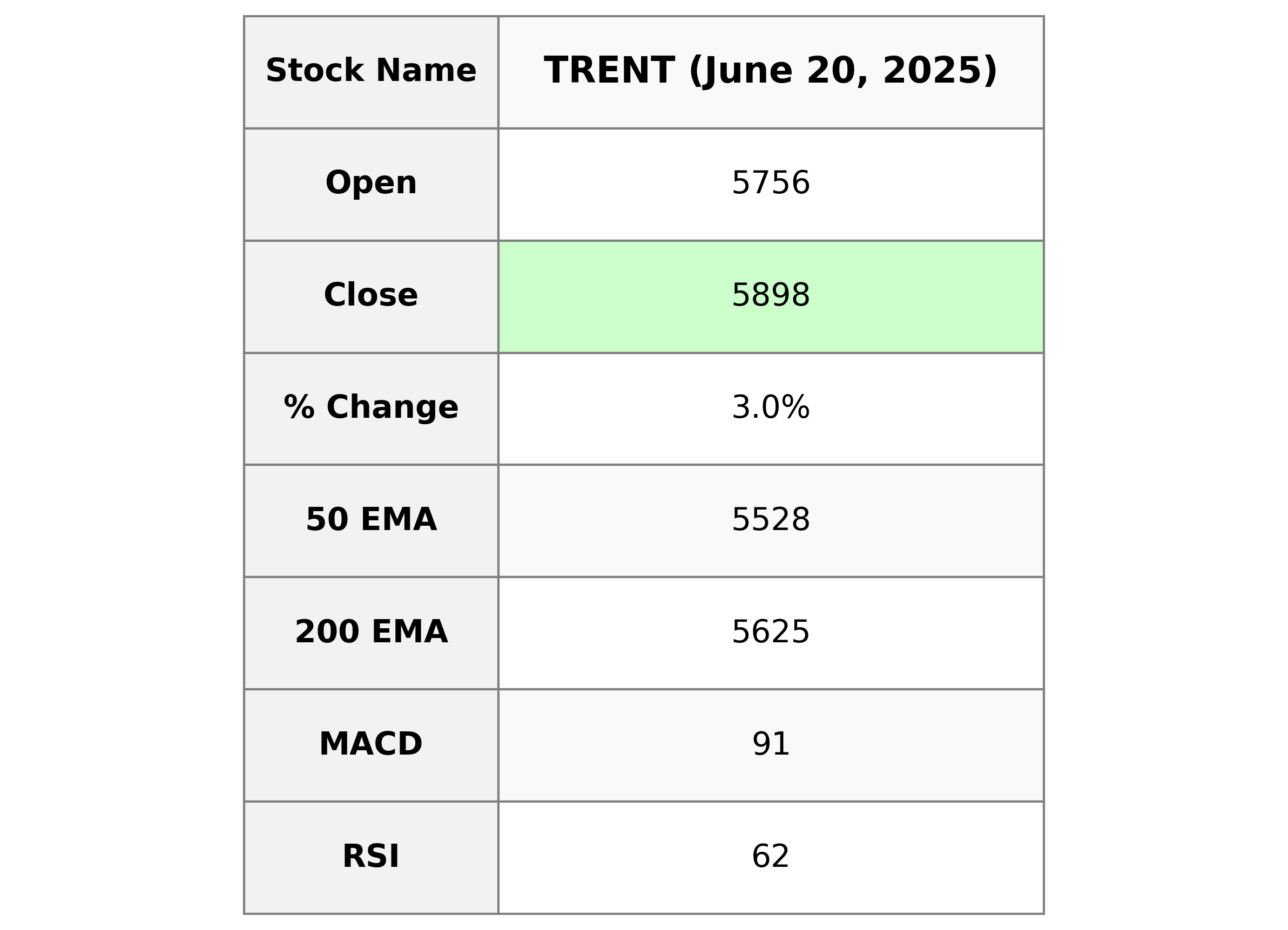

Analysis for Trent - June 20, 2025

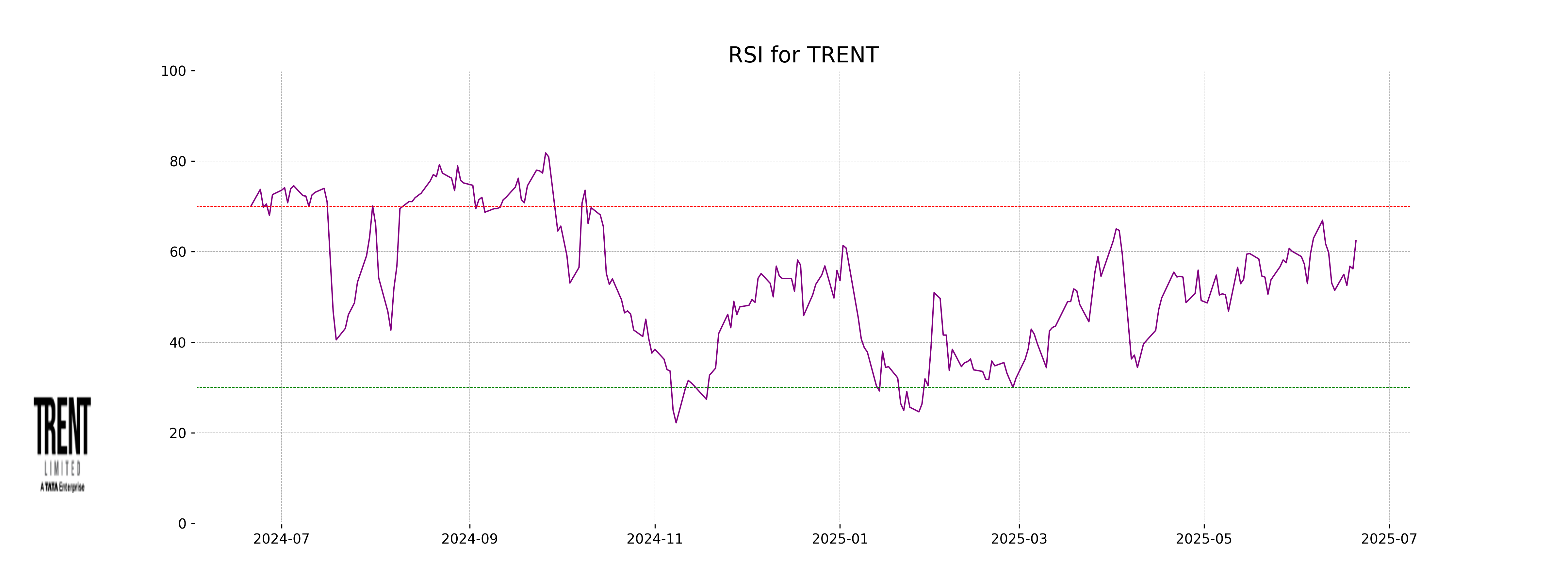

Trent, operating in the Consumer Cyclical sector and Apparel Retail industry in India, shows a positive performance with a closing price of 5897.5, reflecting a 3.04% increase from the previous close. The stock exhibits a strong RSI of 62.4, indicating bullish momentum, supported by positive MACD figures nearly aligned with its signal. With a market cap of approximately 2.1 trillion INR and a PE Ratio of 135.57, Trent displays robust market presence but also suggests a high valuation relative to its EPS of 43.5.

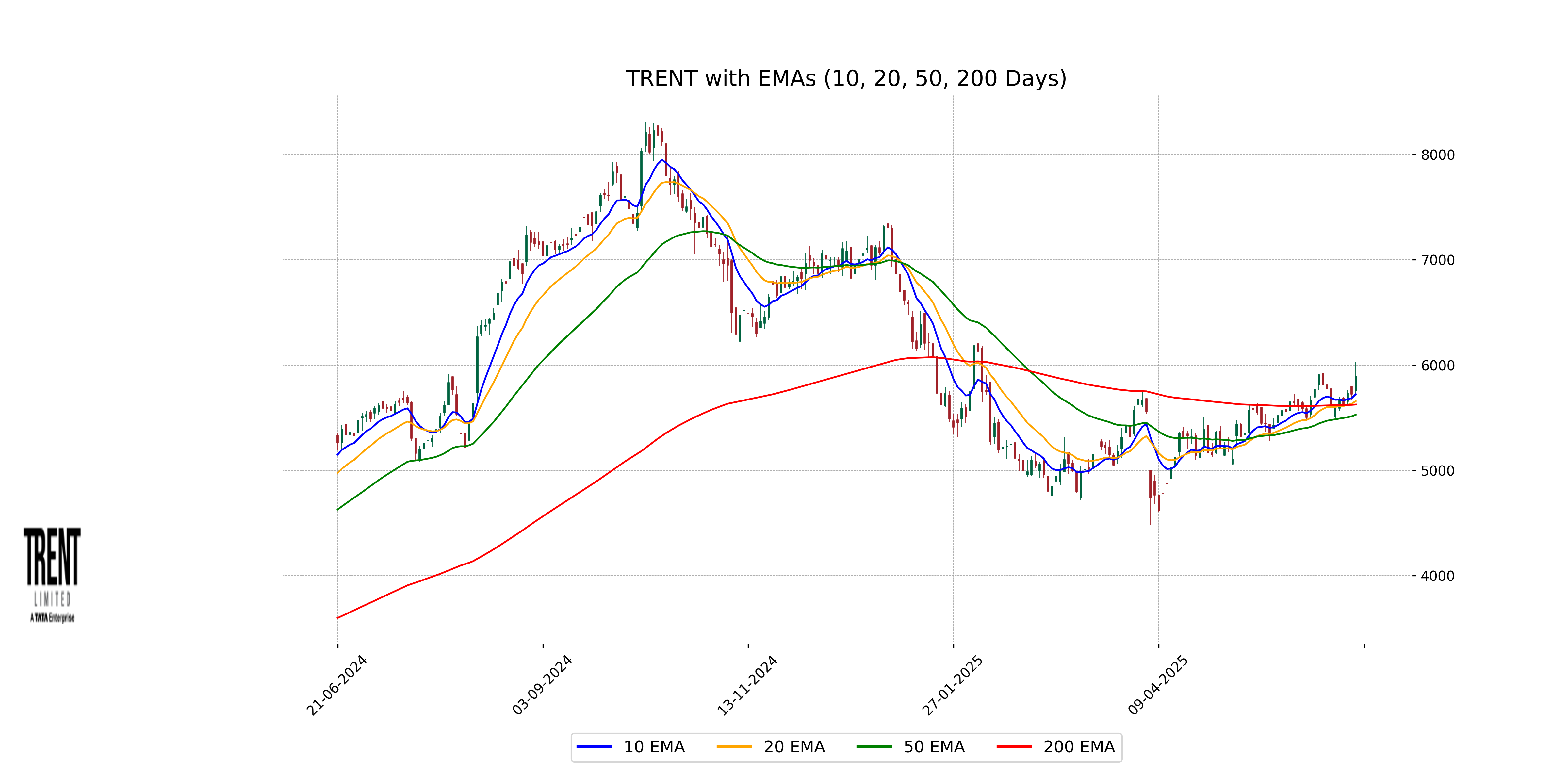

Relationship with Key Moving Averages

Trent's stock is trading above its key moving averages, specifically the 10 EMA at 5723.81 and the 50 EMA at 5528.34, indicating a bullish trend. The current close of 5897.5 also surpasses the 200 EMA of 5625.25, further reinforcing the bullish sentiment in the market.

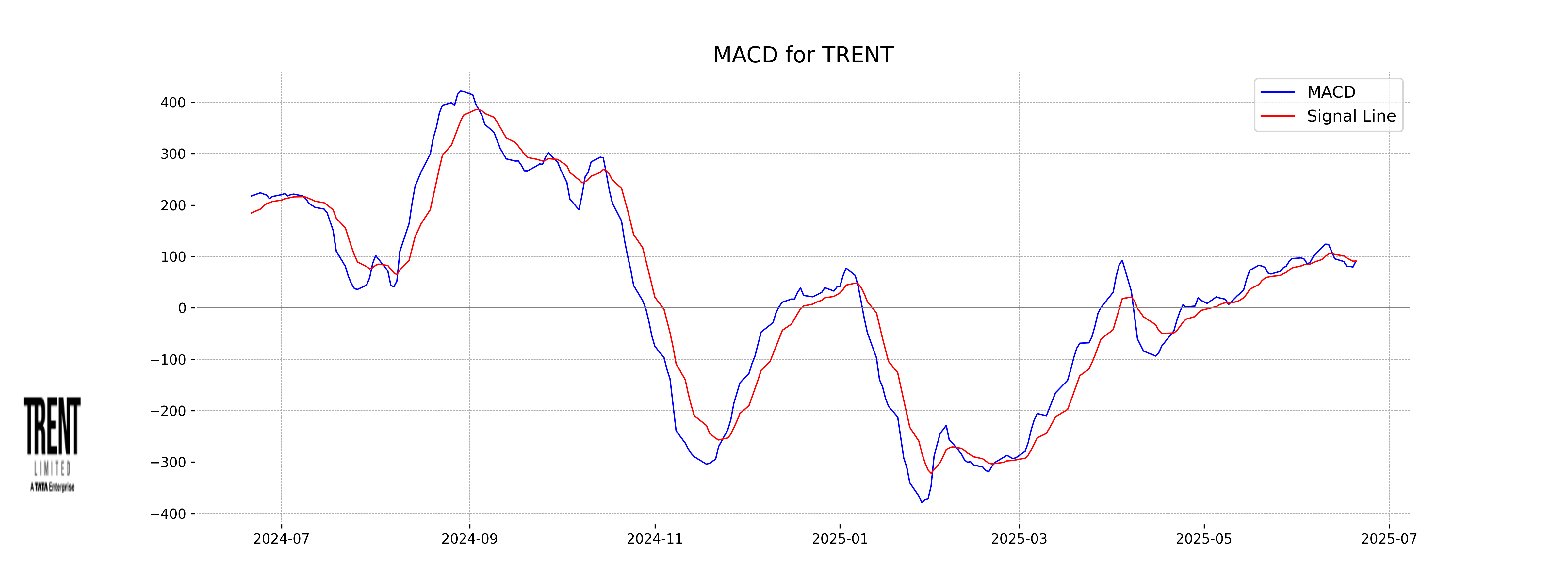

Moving Averages Trend (MACD)

Trent's MACD is slightly above the MACD Signal, indicating a bullish momentum in the stock's movement. With MACD at 91.0773 and MACD Signal at 90.9886, the slight separation suggests continued positive momentum if sustained. The RSI of 62.4 supports the bullish sentiment, showing strength but not yet overbought levels.

RSI Analysis

The RSI (Relative Strength Index) for Trent is 62.40, indicating a generally bullish sentiment as it is above the midpoint of 50. However, it is below the overbought threshold of 70, suggesting there may still be room for upward movement before potential overbought conditions arise.