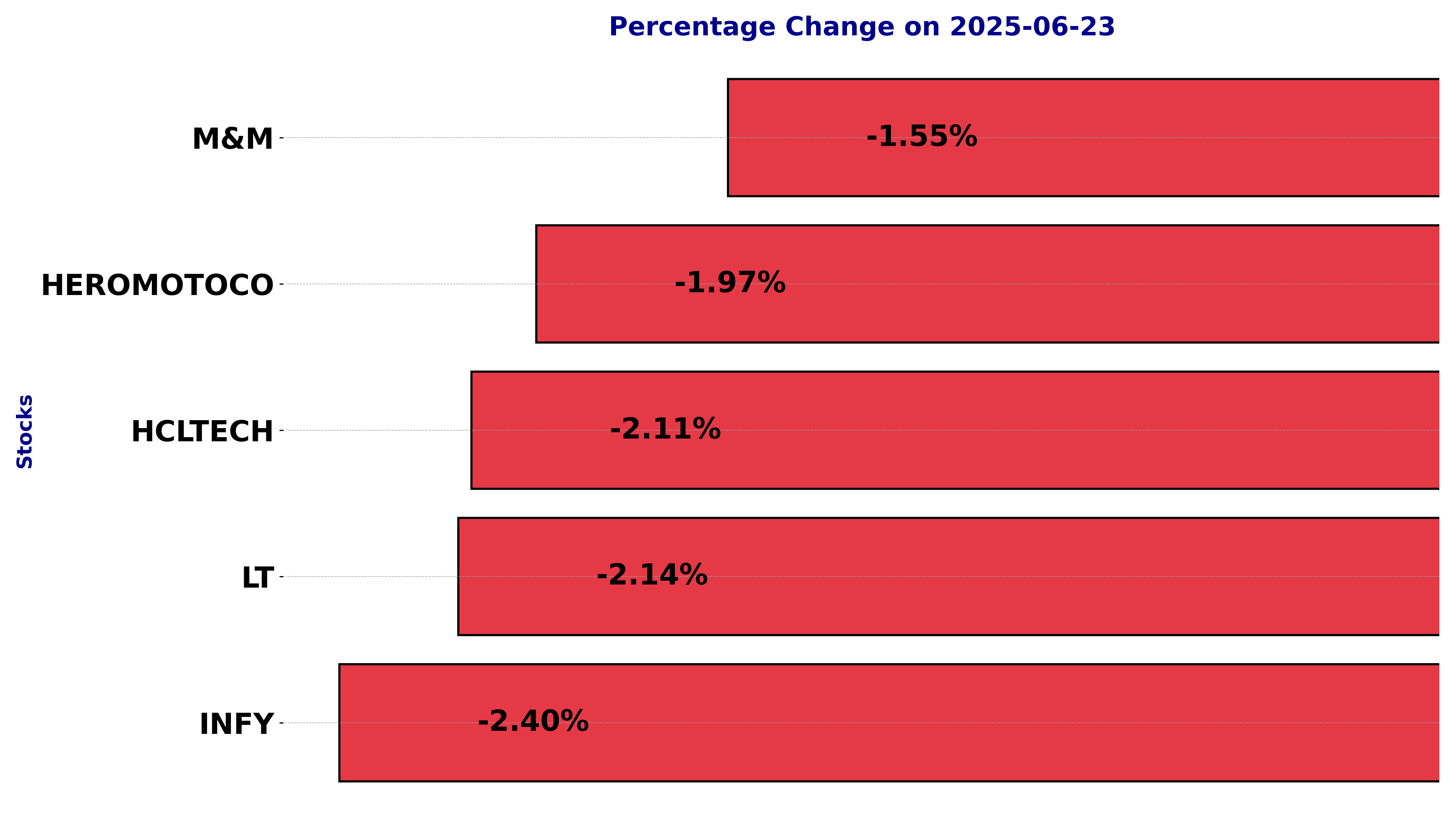

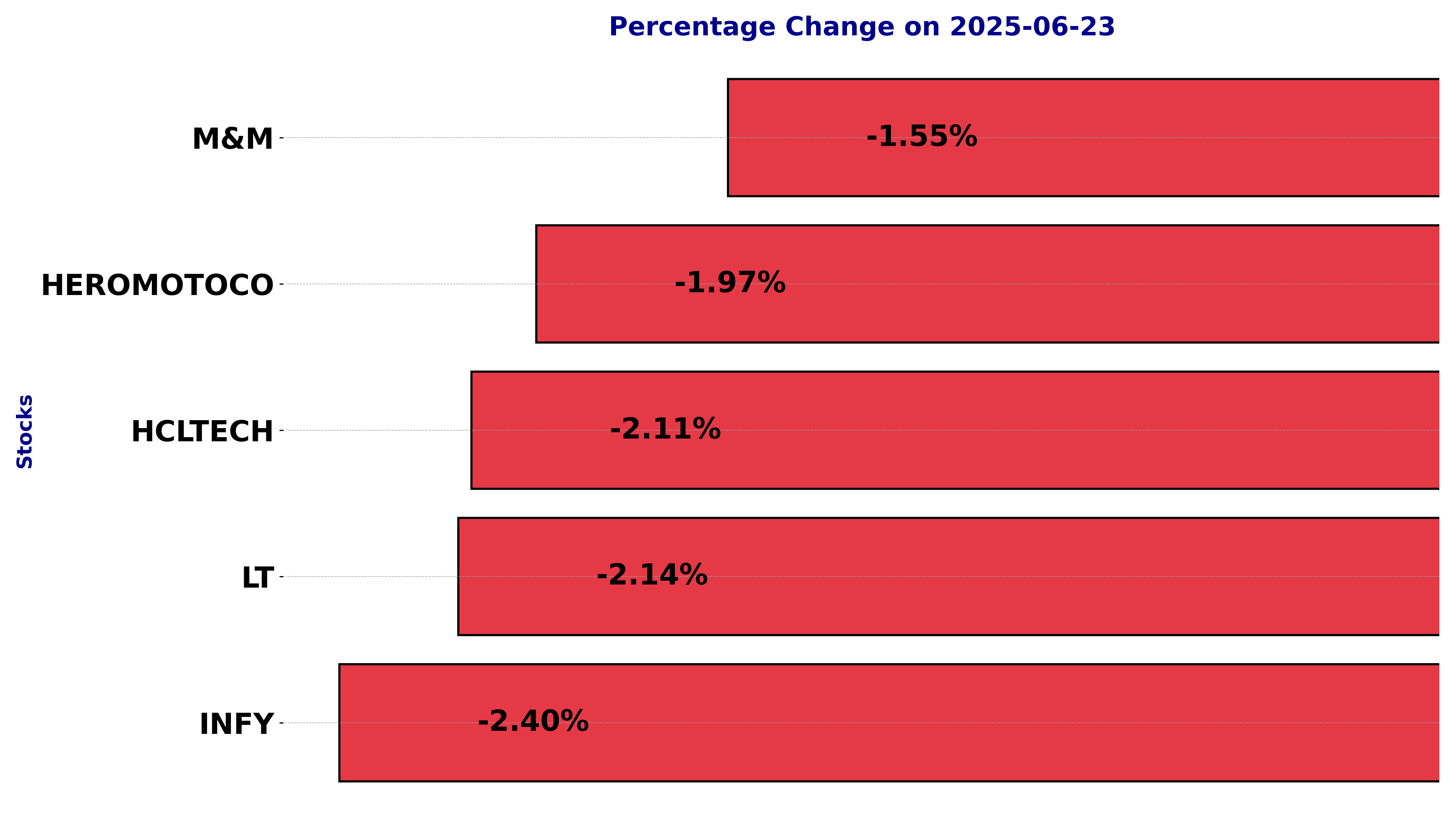

In this article, we will explore the technical indicators of some of the low-performing stocks on the Indian stock market, including HCLTECH, HEROMOTOCO, INFY, LT, and M&M.

By looking at these stocks through the lens of key technical factors, we aim to better understand their price movements, trends, and potential future performance.

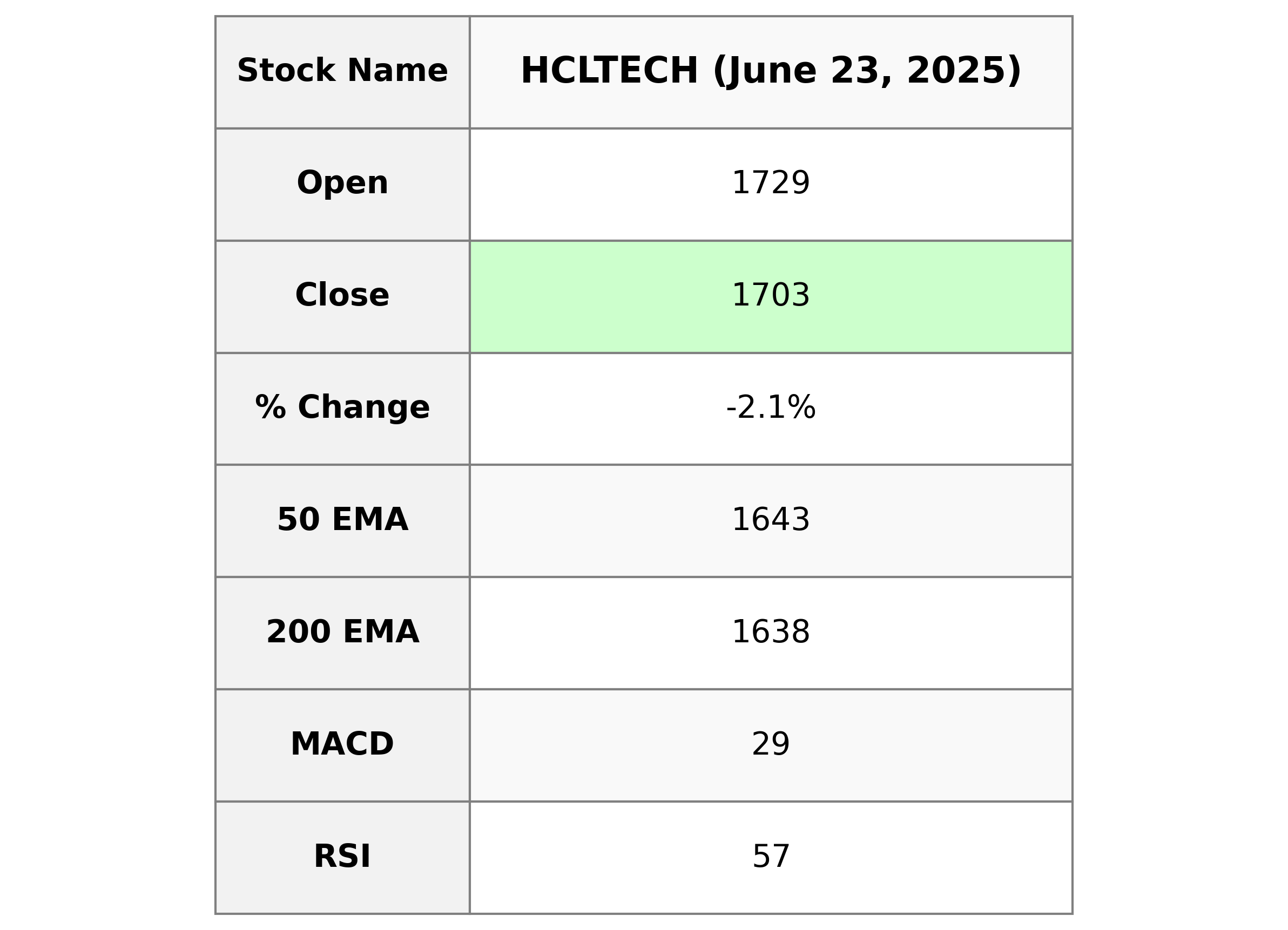

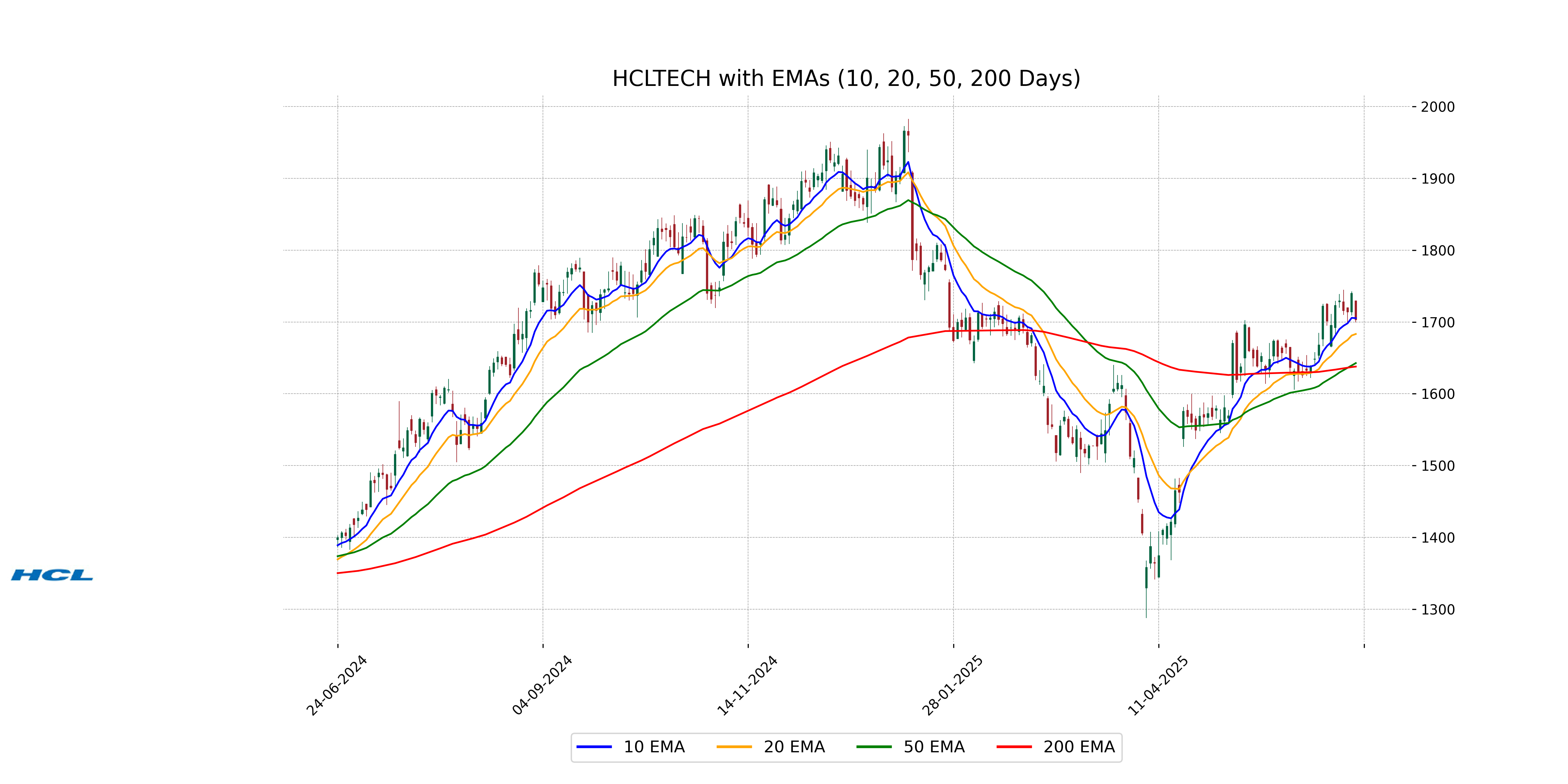

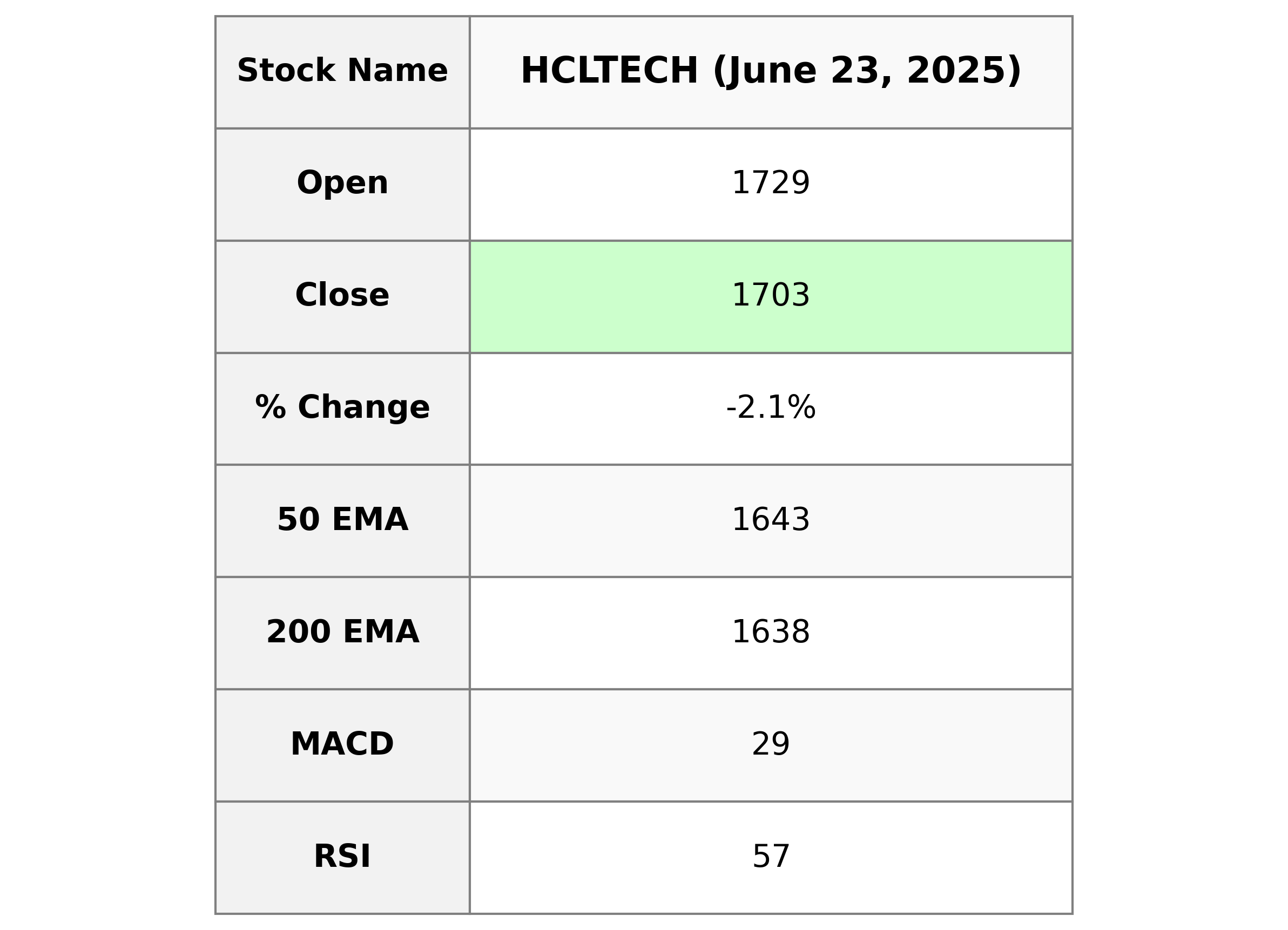

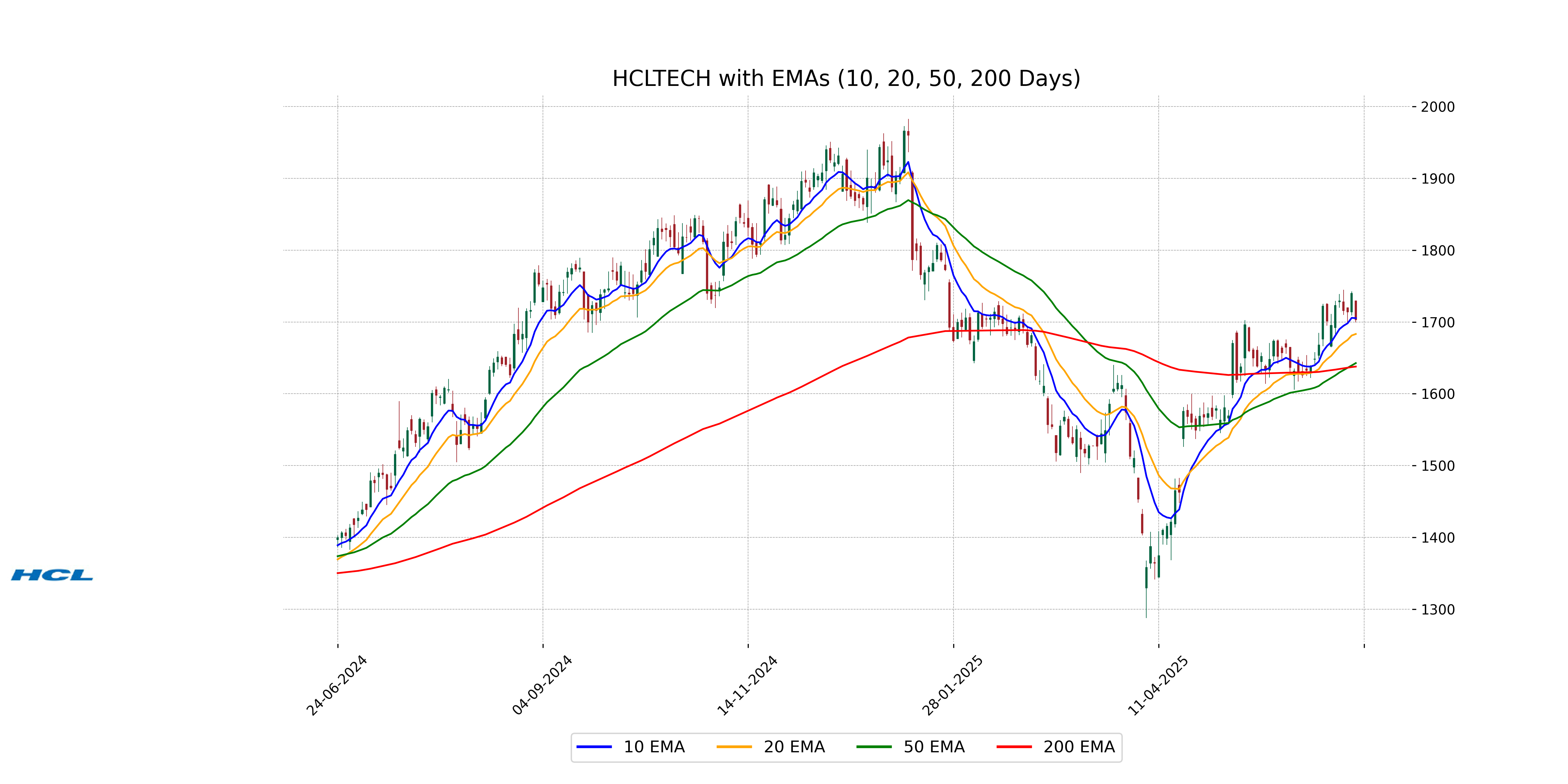

Analysis for HCL Technologies - June 23, 2025

HCL Technologies, a leading firm in India's Information Technology Services sector, showed a decrease in its stock price with a closing value of 1703.2, down by 2.11% from the previous close. Despite the decline, its RSI of 56.91 indicates a moderately stable trend, while the PE Ratio of 26.60 suggests a fair valuation relative to its EPS of 64.03.

Relationship with Key Moving Averages

HCL Technologies' current closing price of 1703.20 is above the 50-day and 200-day EMAs, which are 1642.73 and 1637.88 respectively, indicating a potential long-term bullish trend. However, it is slightly below the 10-day EMA of 1705.29, which may suggest short-term downward pressure.

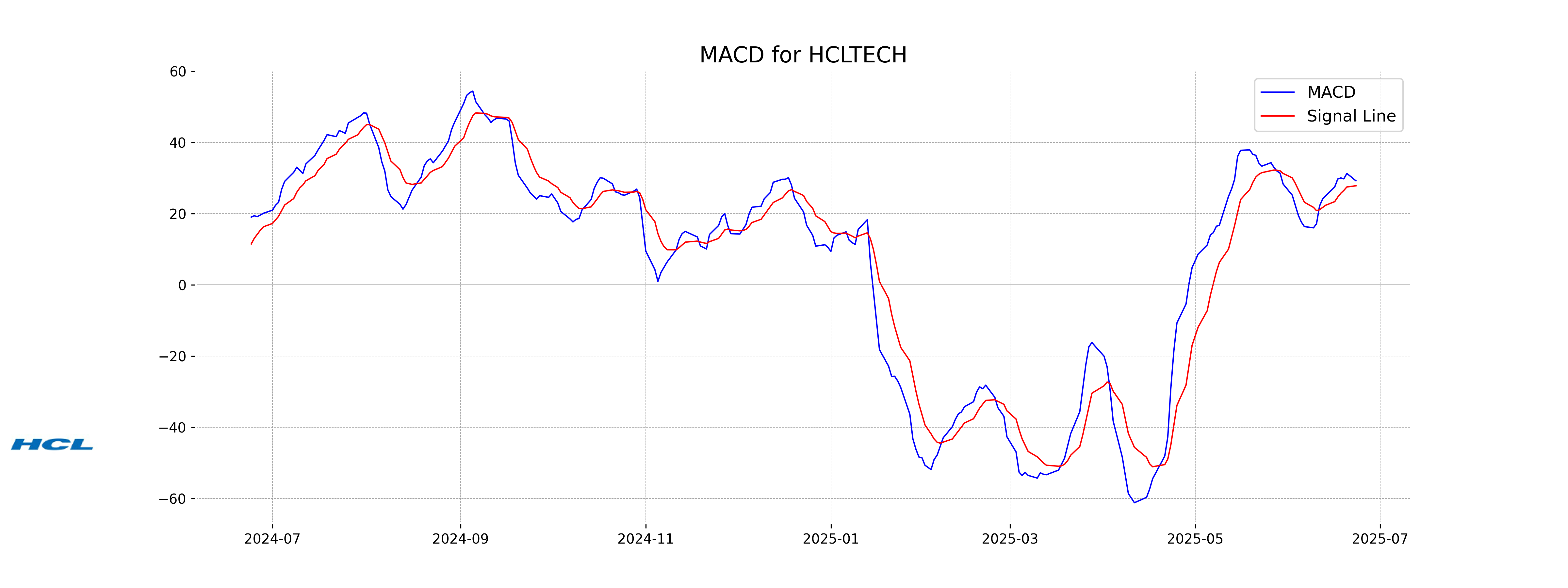

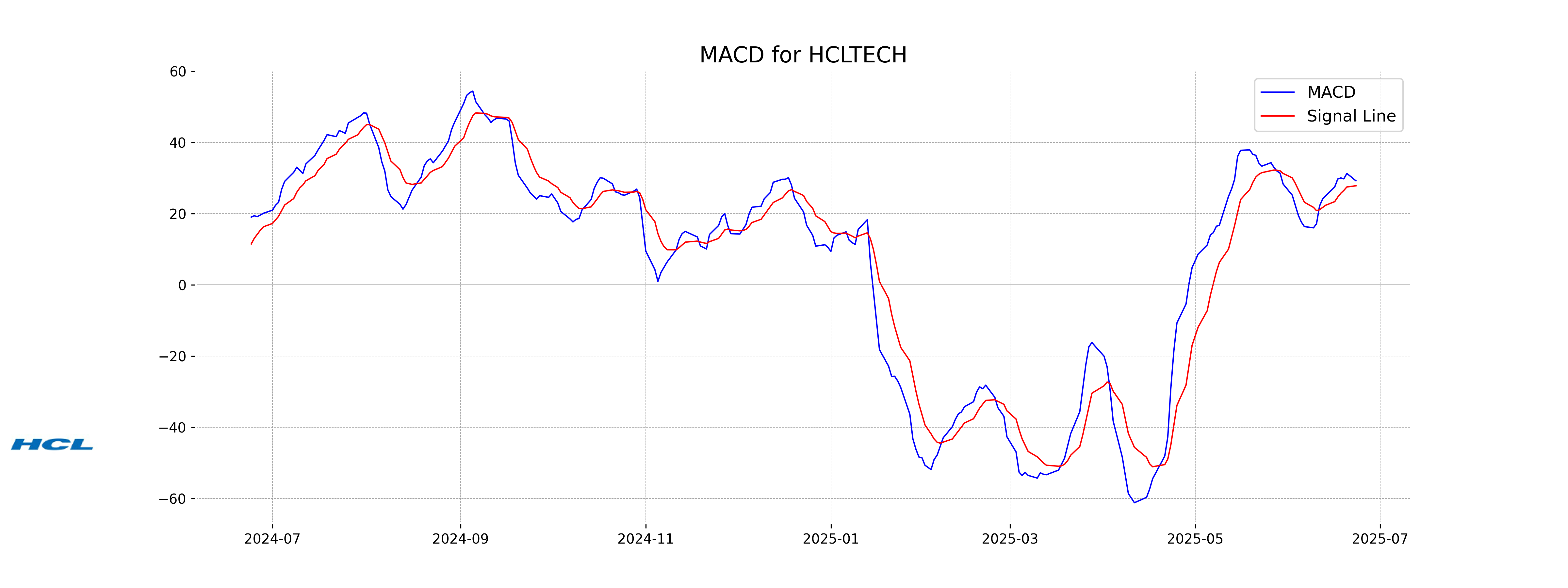

Moving Averages Trend (MACD)

HCL Technologies: The MACD value for HCL Technologies is 29.26, higher than the MACD Signal of 27.88, suggesting a bullish momentum in the stock. Despite the recent drop of 2.11% in its share price, the positive MACD trend might indicate potential near-term upward movement if the momentum continues.

RSI Analysis

RSI Analysis for HCL Technologies: The Relative Strength Index (RSI) for HCL Technologies is 56.91, which indicates that the stock is in a neutral state. An RSI of 56.91 suggests that the stock is neither overbought nor oversold, providing no immediate buy or sell signals based on RSI alone.

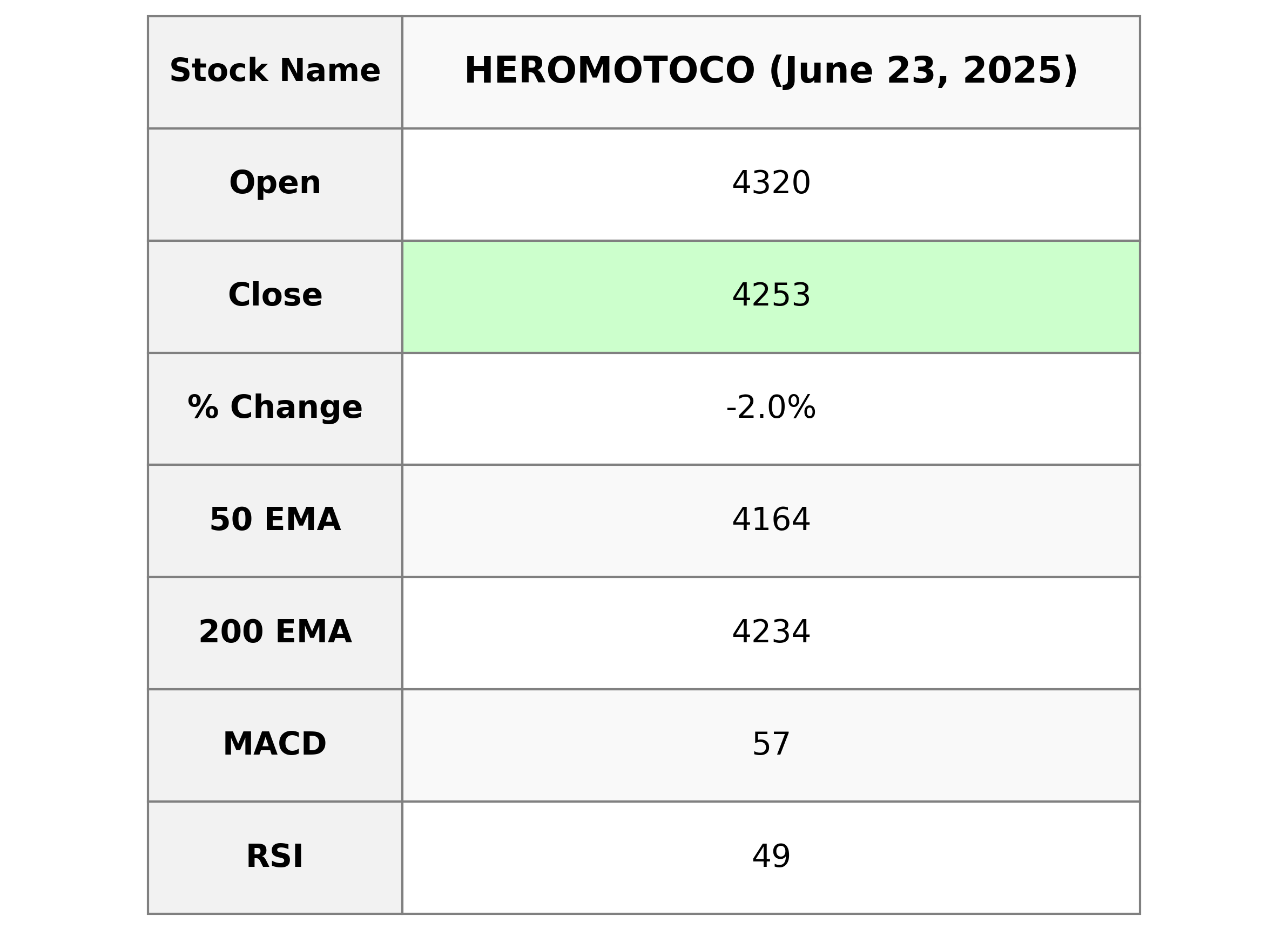

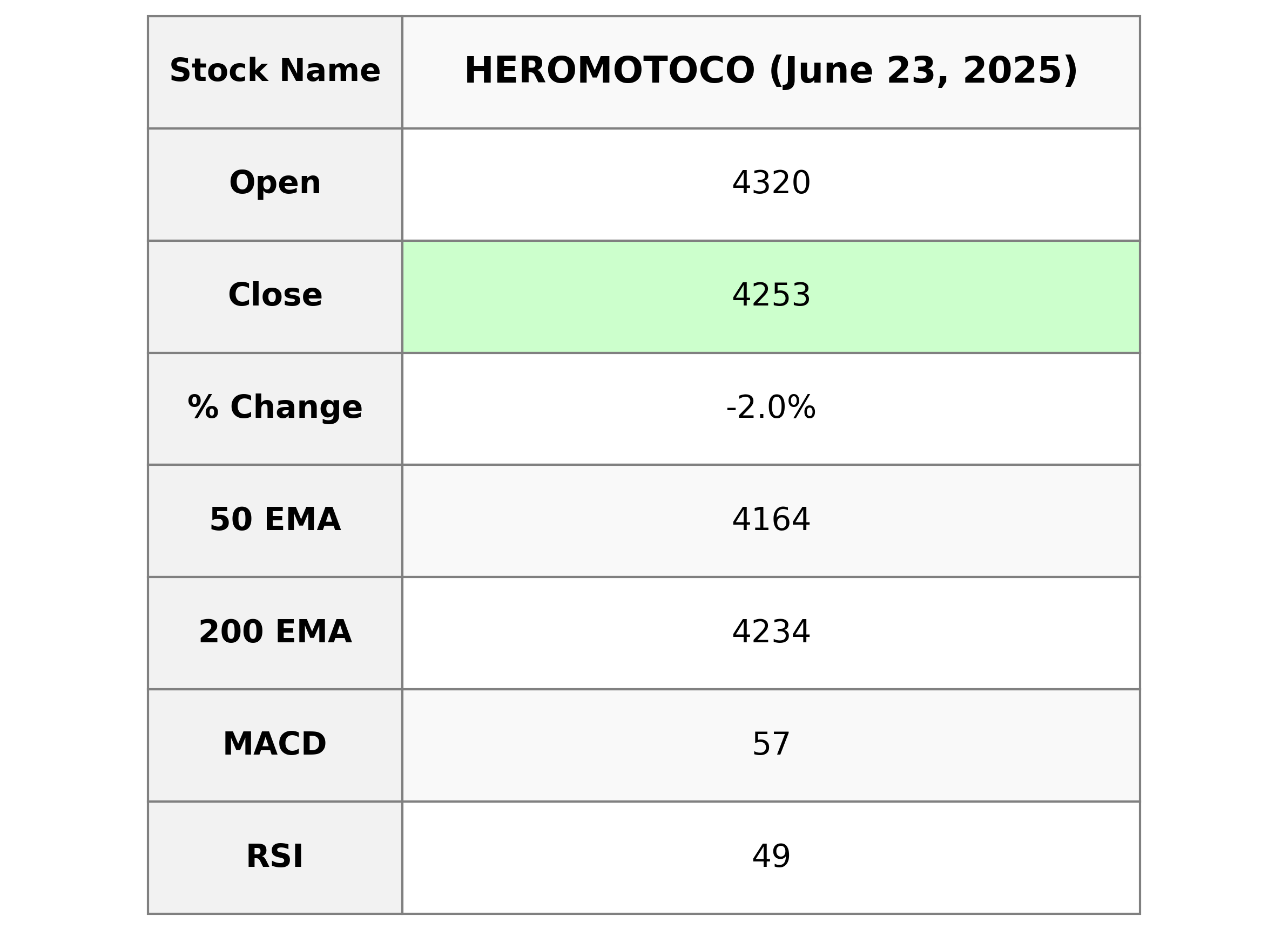

Analysis for Hero MotoCorp - June 23, 2025

Hero MotoCorp Performance Hero MotoCorp's stock opened at 4320.0 and closed at 4253.1, showing a decline of approximately 1.97% from the previous close of 4338.5. The stock experienced a high of 4324.7 and a low of 4245.0 during the trading period, with a volume of 580,608 shares. With a market cap of approximately 850.7 billion INR, the company operates in the Consumer Cyclical sector, specifically within the Auto Manufacturers industry in India. The RSI stands at 49.03, indicating a relatively balanced momentum, while the PE Ratio is 19.45 with an EPS of 218.66.

Relationship with Key Moving Averages

Relationship with Key Moving Averages for Hero MotoCorp: As of the latest data, Hero MotoCorp's closing price of 4253.10 is below the 10-day EMA of 4329.69 and the 20-day EMA of 4298.88, indicating short-term bearish momentum. However, it is slightly above the 50-day EMA of 4163.85 and the 200-day EMA of 4233.80, suggesting some longer-term stability or potential support around current levels.

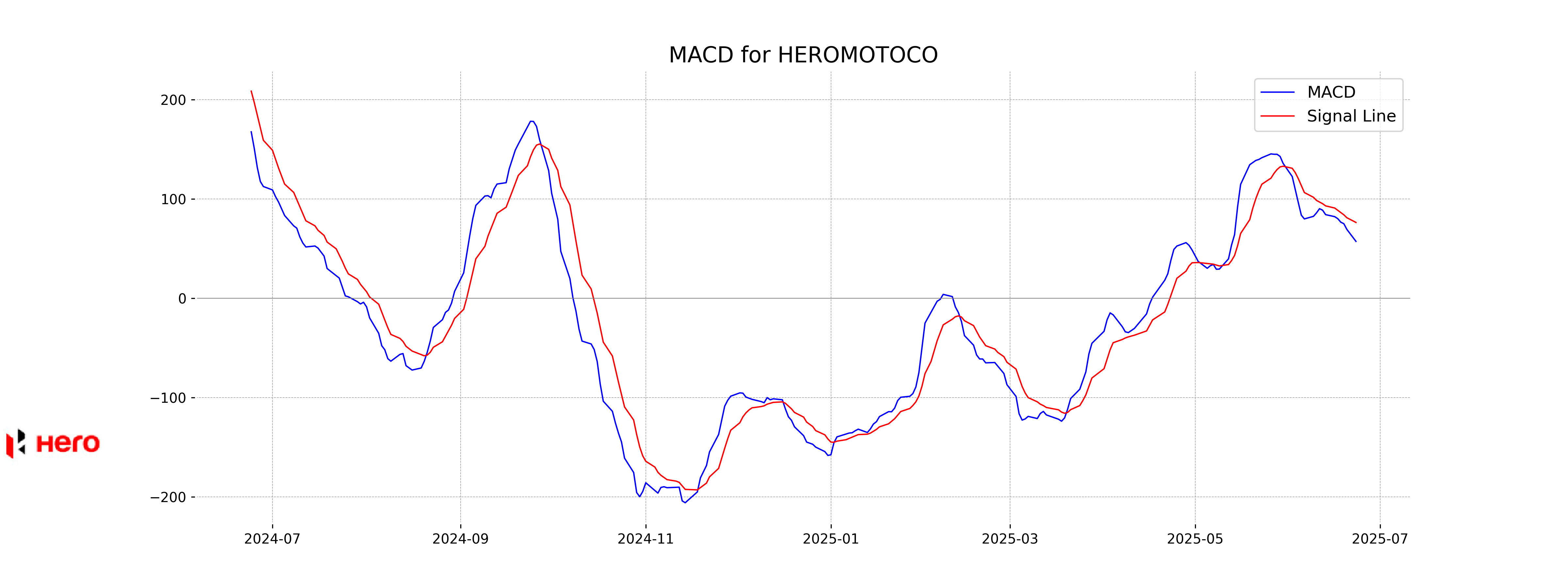

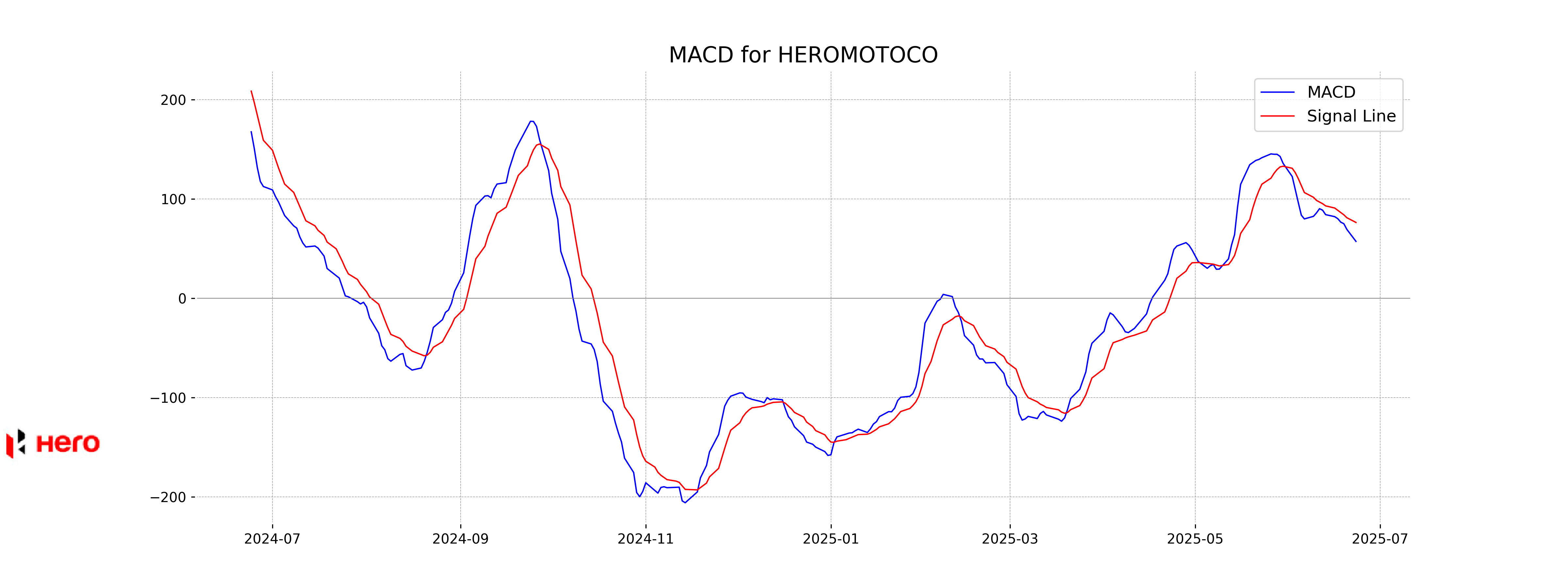

Moving Averages Trend (MACD)

Hero MotoCorp MACD Analysis: The MACD value of 57.37 is below the MACD Signal line of 76.44, suggesting a bearish signal and potential downward momentum in the stock price. This crossover, combined with RSI near 49.03, indicates cautious sentiment among investors.

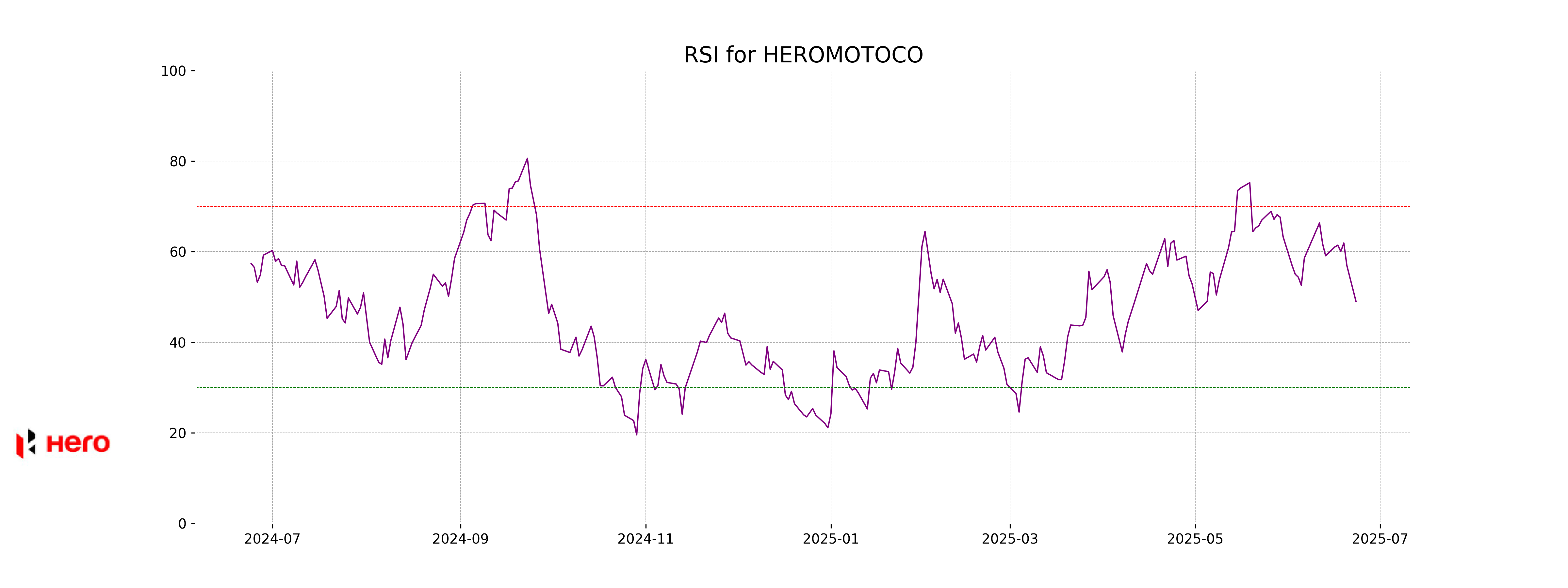

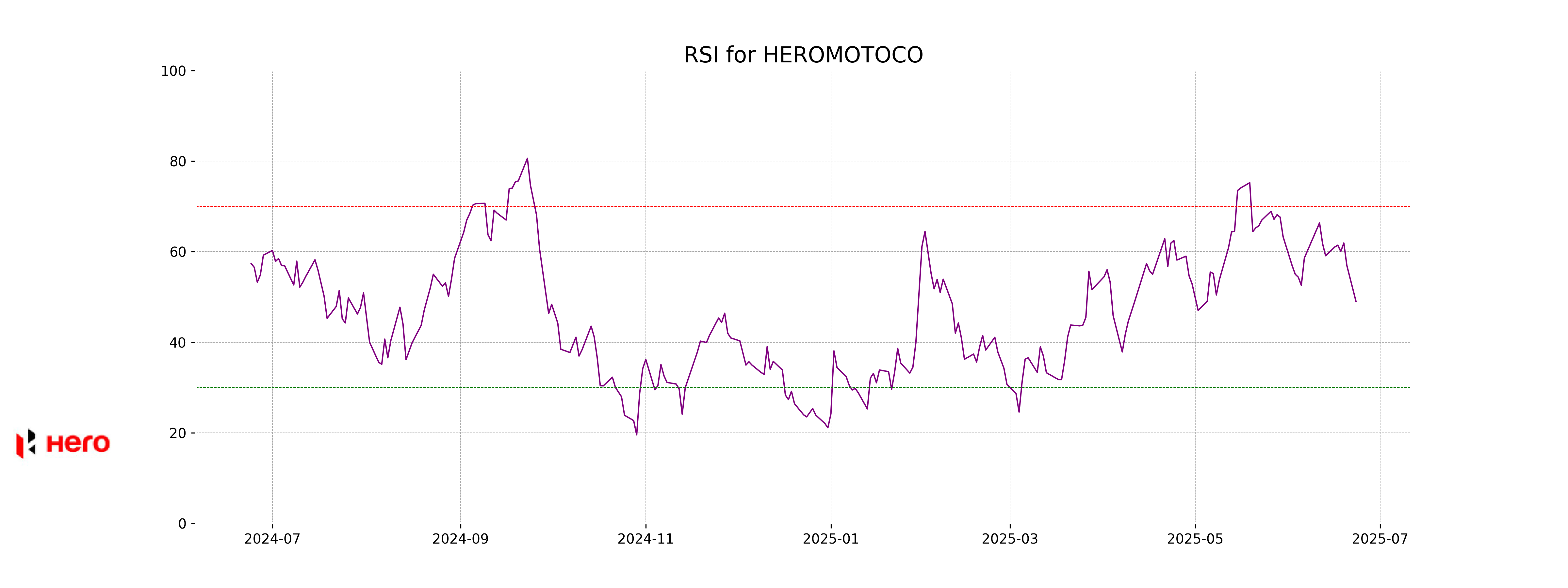

RSI Analysis

Hero MotoCorp's RSI is 49.03, indicating that the stock is in the neutral zone, neither overbought nor oversold. RSI values close to 50 suggest a balanced momentum, with no strong directional bias in recent price movements.

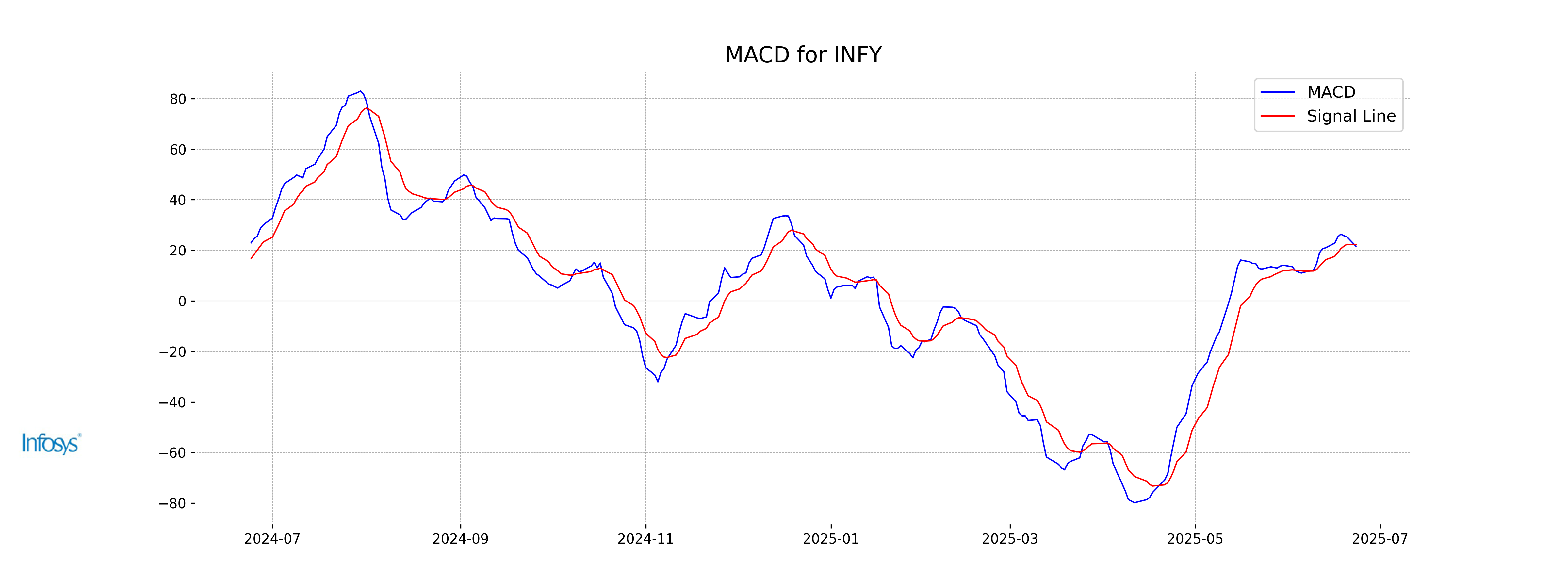

Analysis for Infosys - June 23, 2025

Infosys experienced a decrease in its stock price, closing at 1584.0, down from the previous close of 1622.9, marking a percentage change of -2.40%. The stock's RSI is at 50.77, indicating a neutral momentum, and its MACD value of 21.63 suggests a potential downtrend as it is below the MACD Signal of 22.22. The company's market cap stands at 6,565,078,237,184 with a PE ratio of 24.04, operating in the Information Technology Services industry within the Technology sector in India.

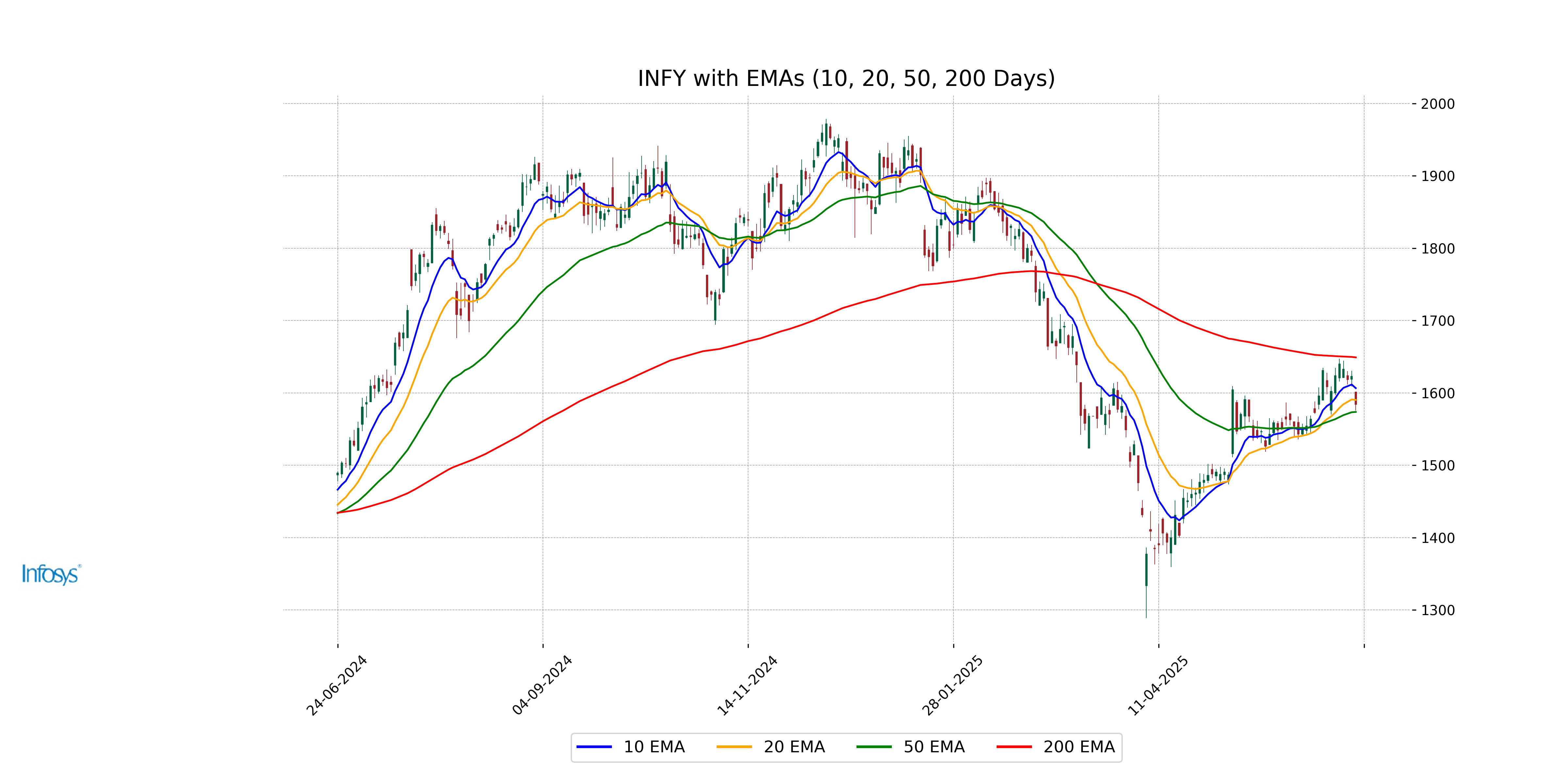

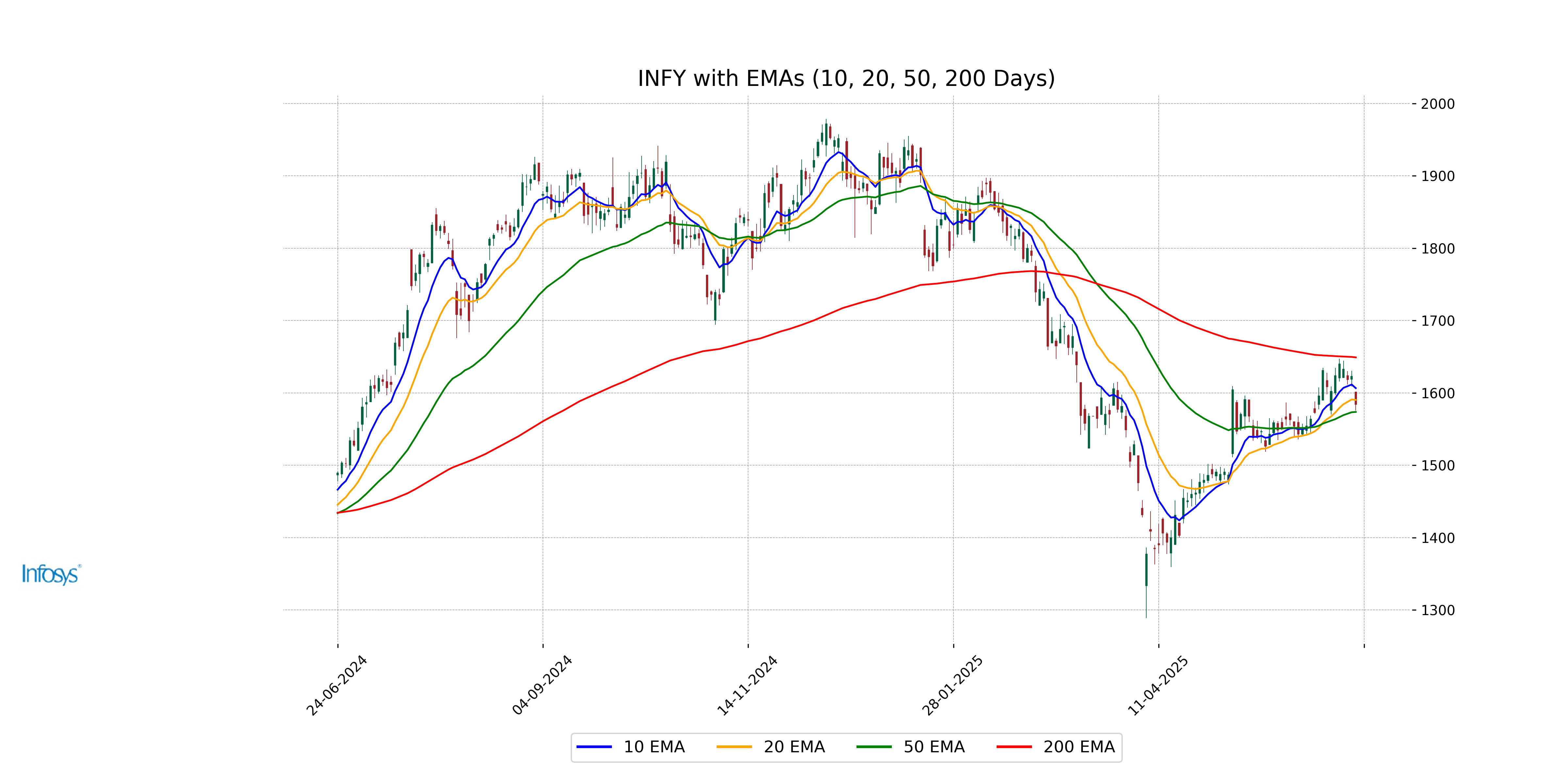

Relationship with Key Moving Averages

For Infosys, the current closing price of 1584.0 is above the 50-day EMA (1573.66) but below the 10-day EMA (1606.55), the 20-day EMA (1590.25), and significantly below the 200-day EMA (1649.06). This indicates a short-term bullish sentiment relative to the 50-day average, but a bearish outlook in the context of longer-term averages.

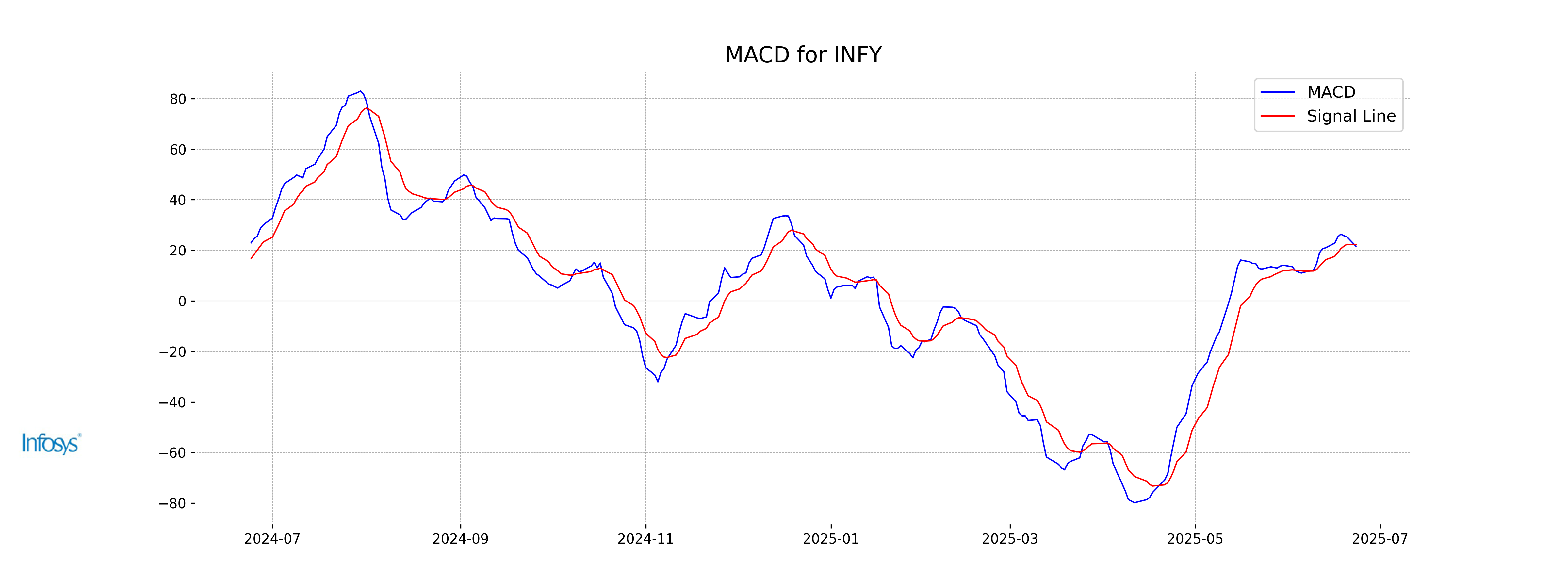

Moving Averages Trend (MACD)

Infosys currently has a MACD value of 21.63, which is below the MACD Signal line value of 22.22. This suggests a bearish trend, indicating potential downward pressure on the stock price in the short term.

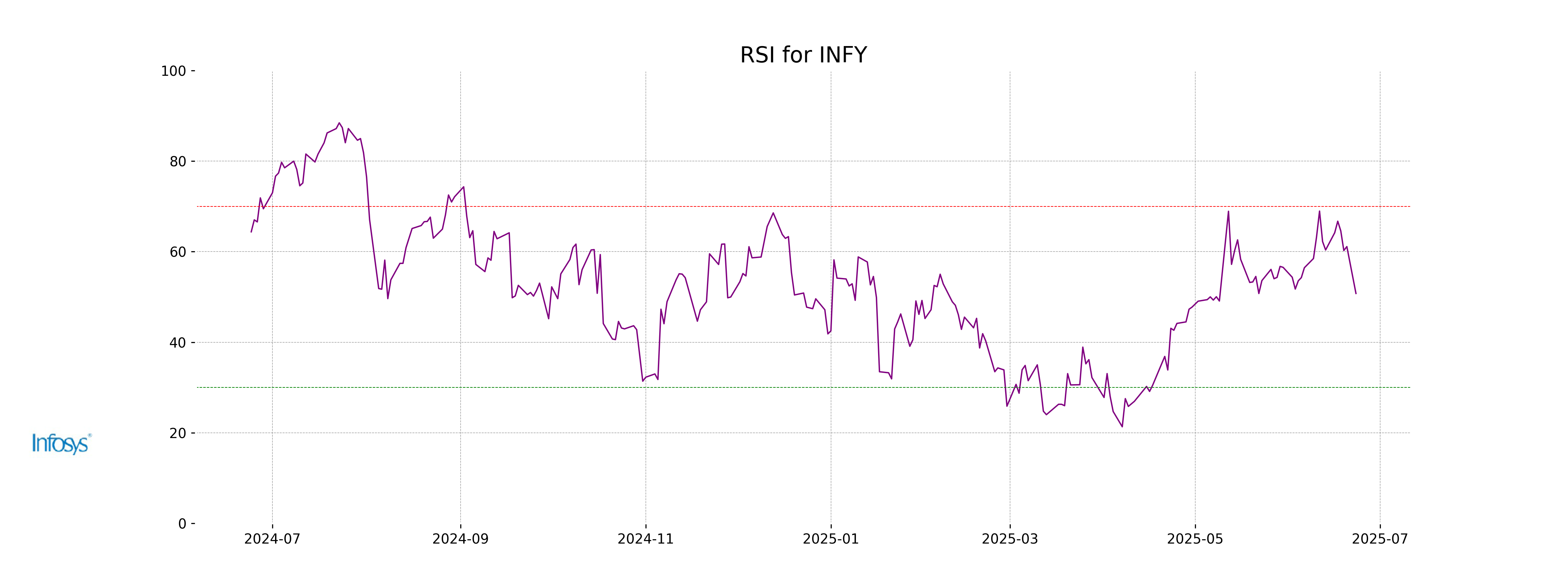

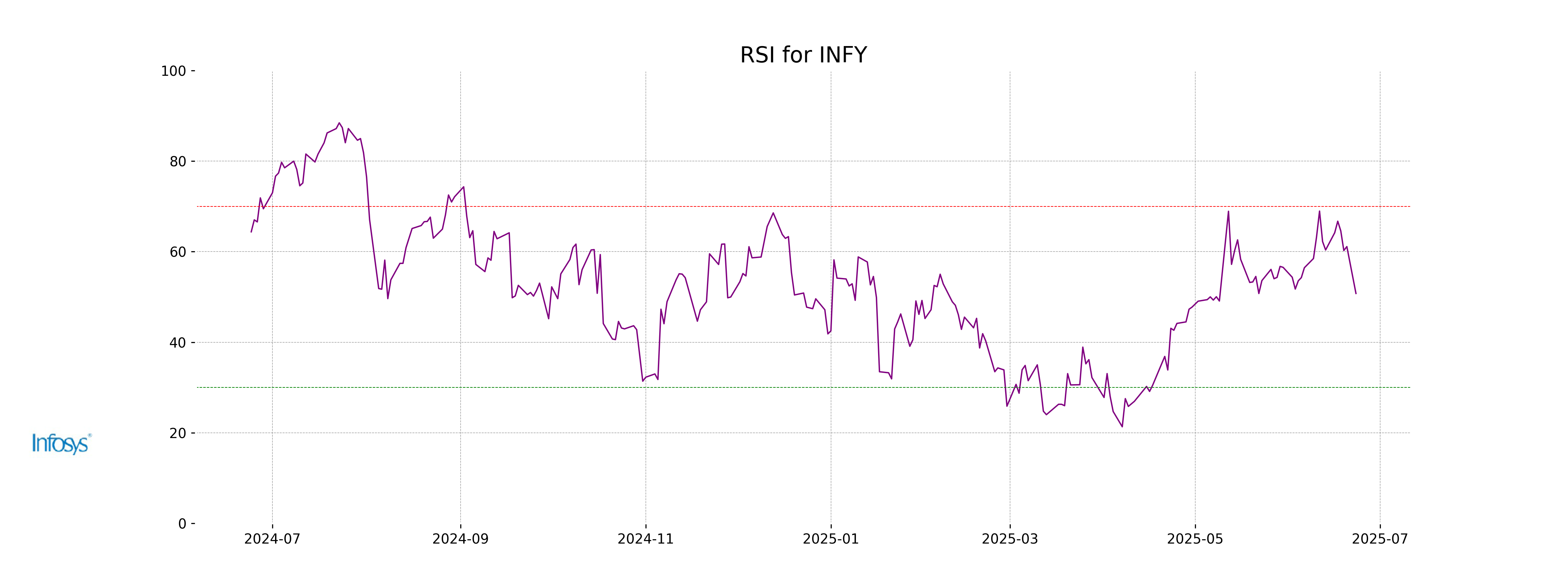

RSI Analysis

Infosys RSI Analysis: The Relative Strength Index (RSI) for Infosys is 50.77, which indicates a neutral momentum. Typically, an RSI below 30 suggests that a stock may be undervalued, and an RSI above 70 indicates it might be overvalued. Near the midpoint at 50, Infosys shows neither strong overbought nor oversold conditions at this time.

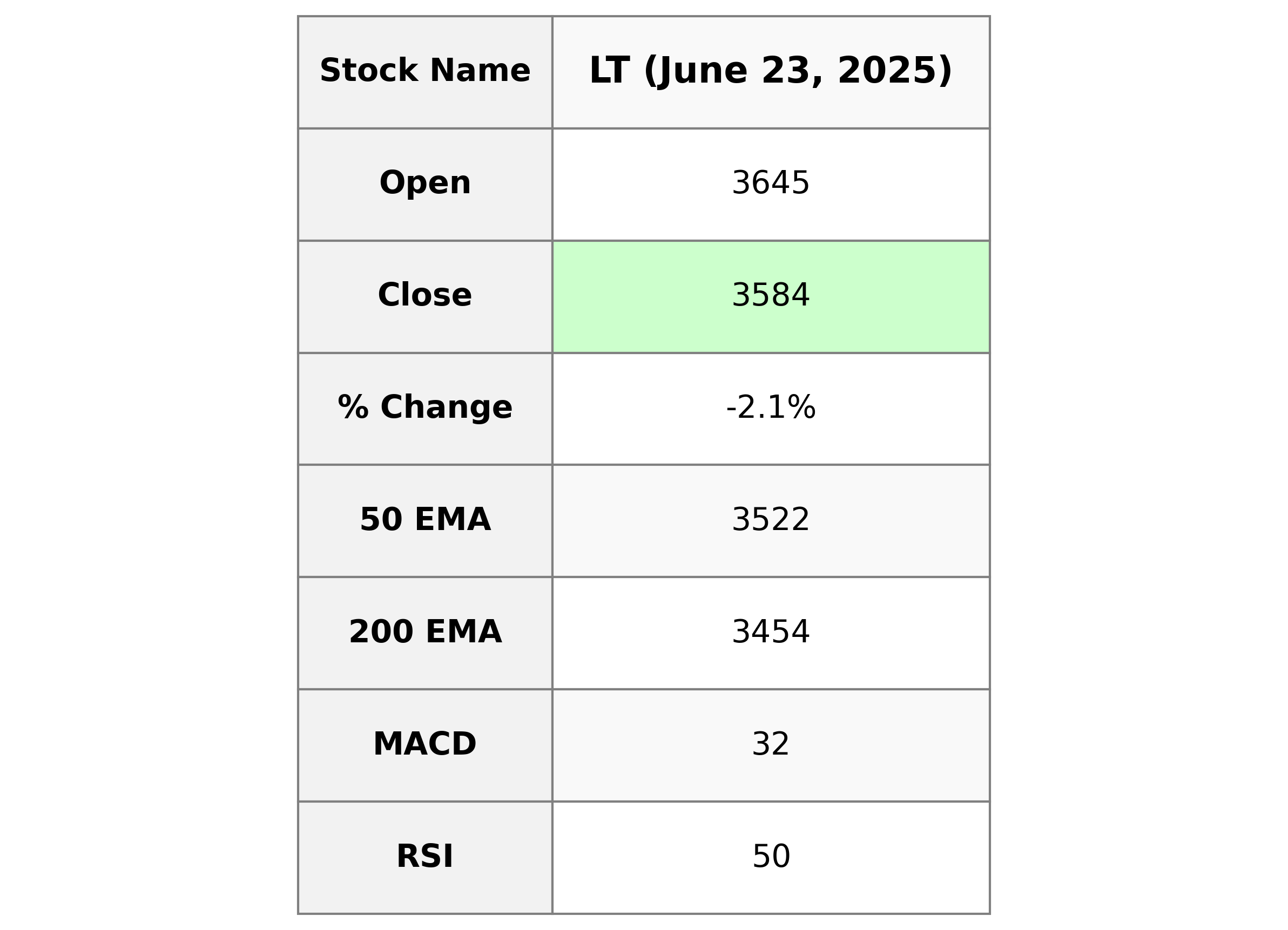

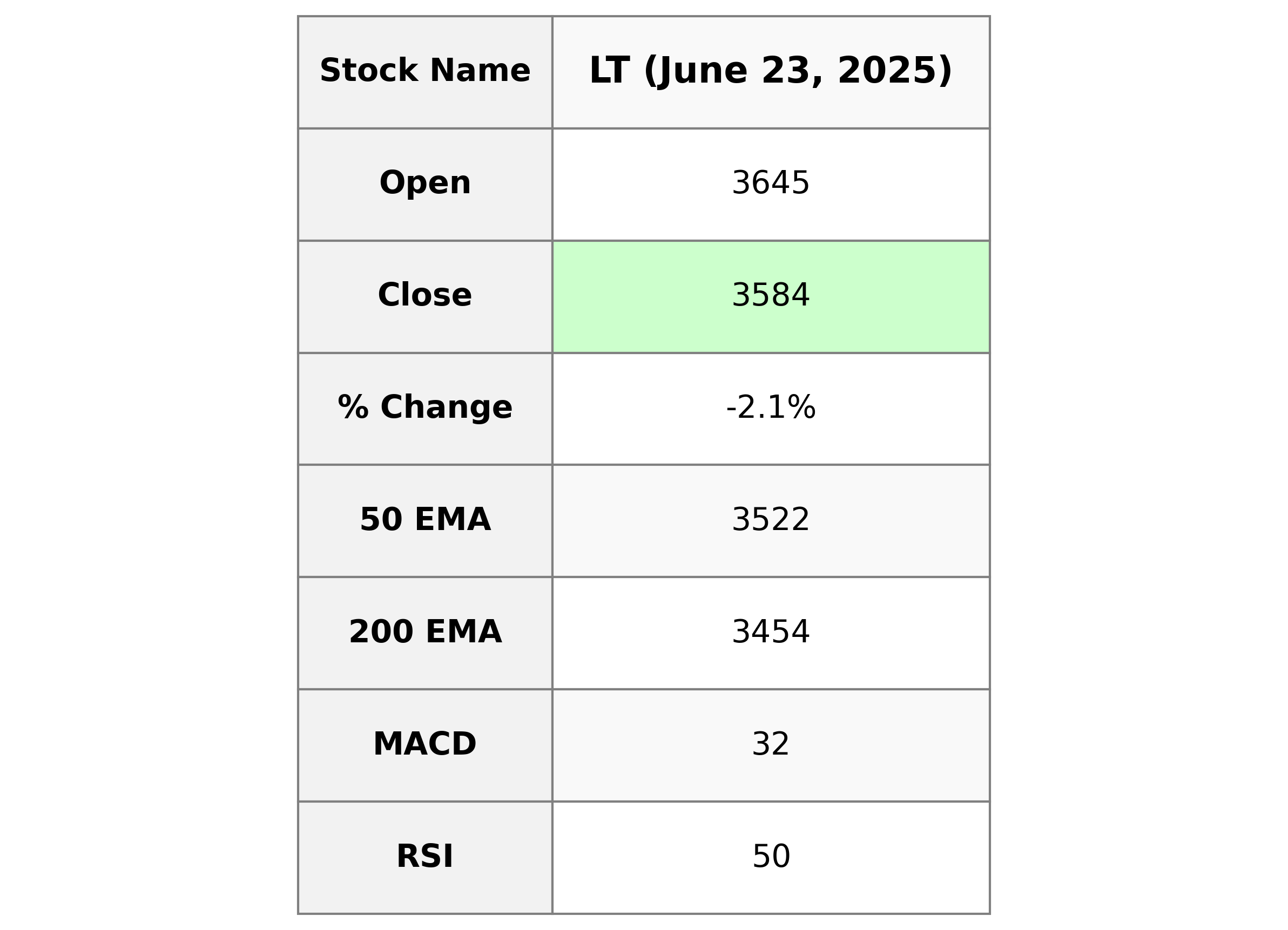

Analysis for HCL Technologies - June 23, 2025

HCL Technologies showed a notable decline in its stock performance. The stock opened at 3645, reaching a high of 3660 but closing lower at 3583.70, marking a 2.14% decrease. The 10-day EMA at 3622 and the MACD below its signal indicate bearish sentiment.

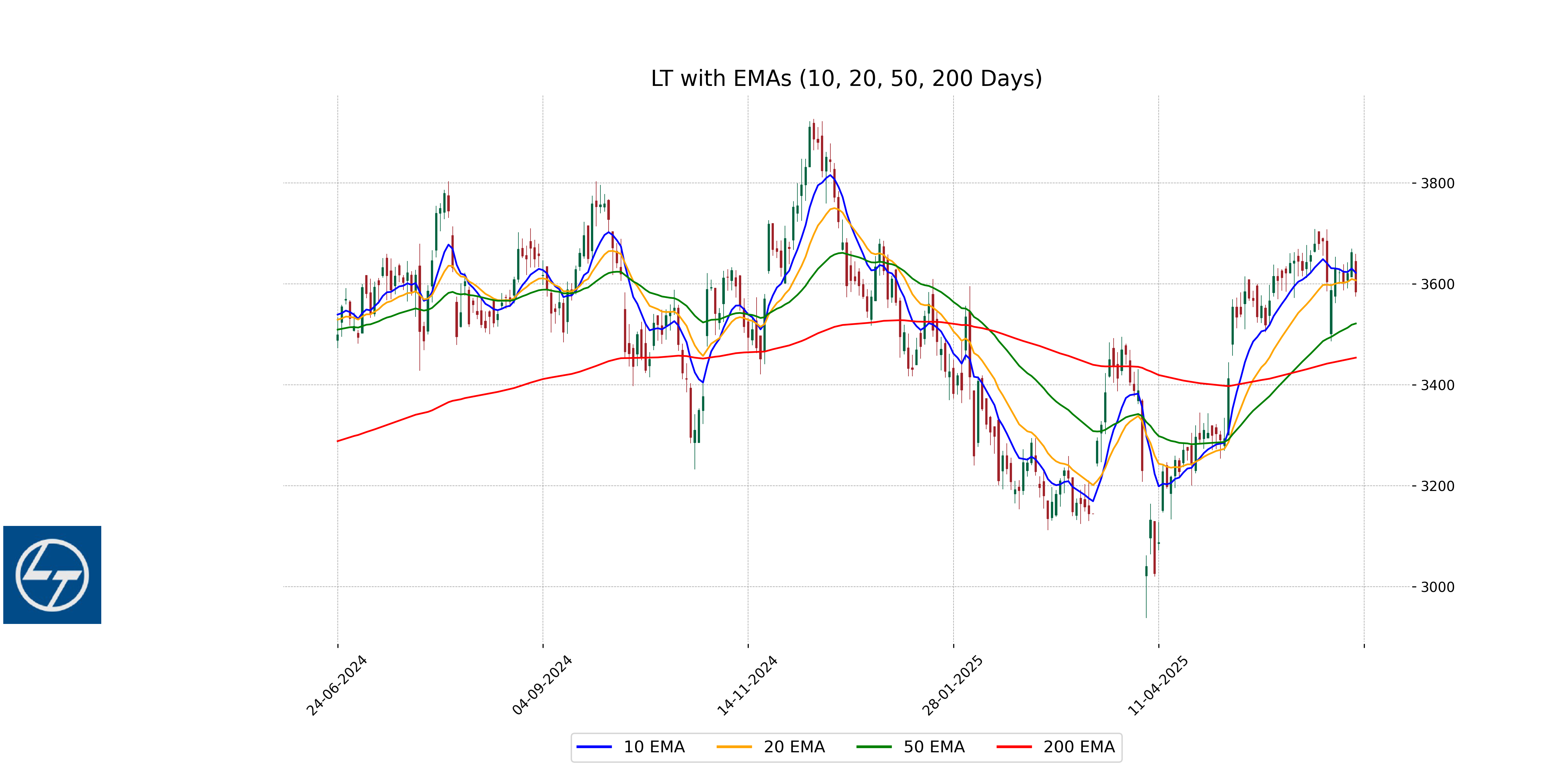

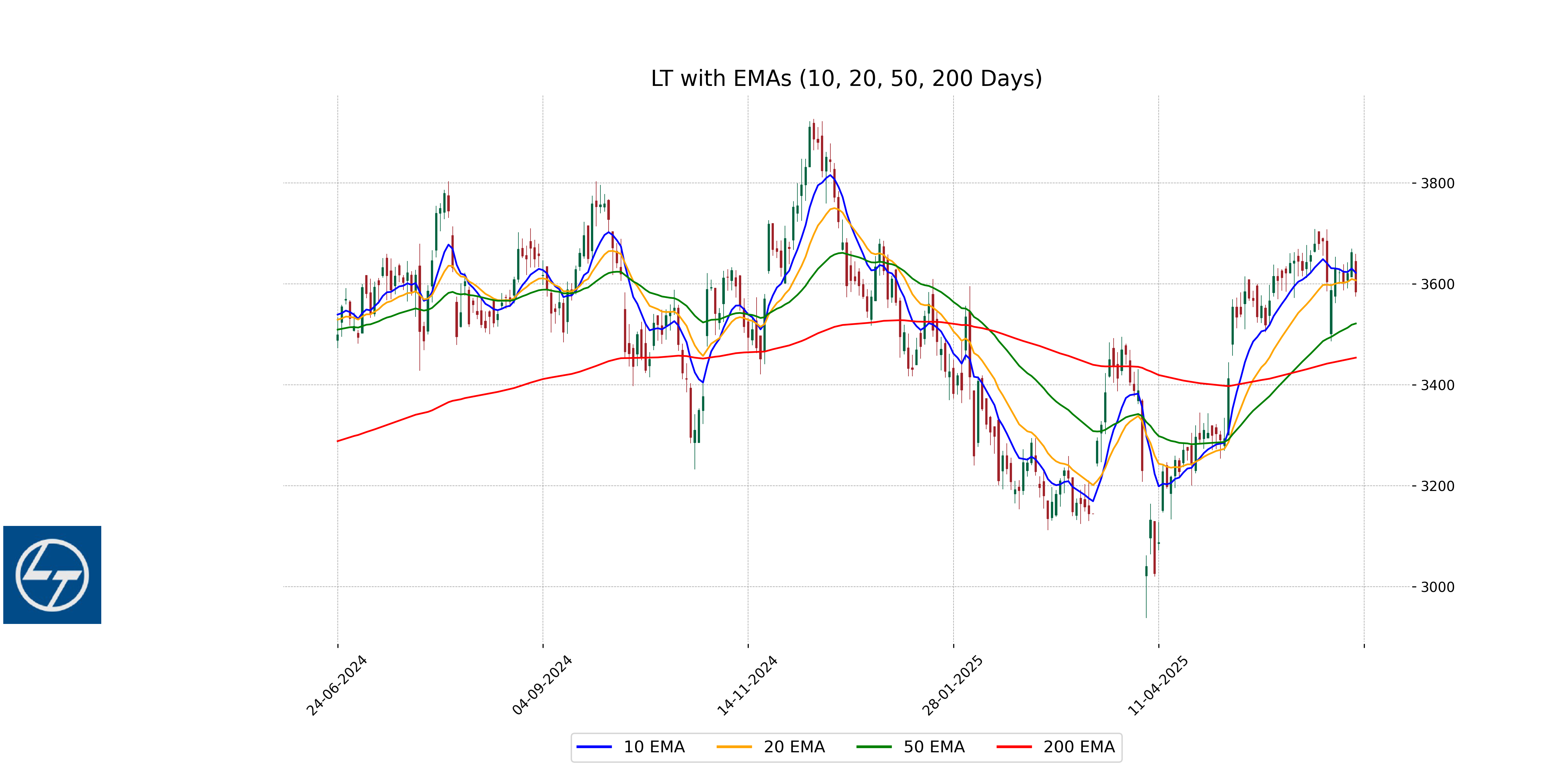

Relationship with Key Moving Averages

The current stock price of Larsen & Toubro (close: 3583.70) is below its 10 EMA (3622.05) and 20 EMA (3607.19), indicating a short-term bearish trend. However, it is still above the 50 EMA (3521.54) and 200 EMA (3453.80), which suggests a longer-term upward trend.

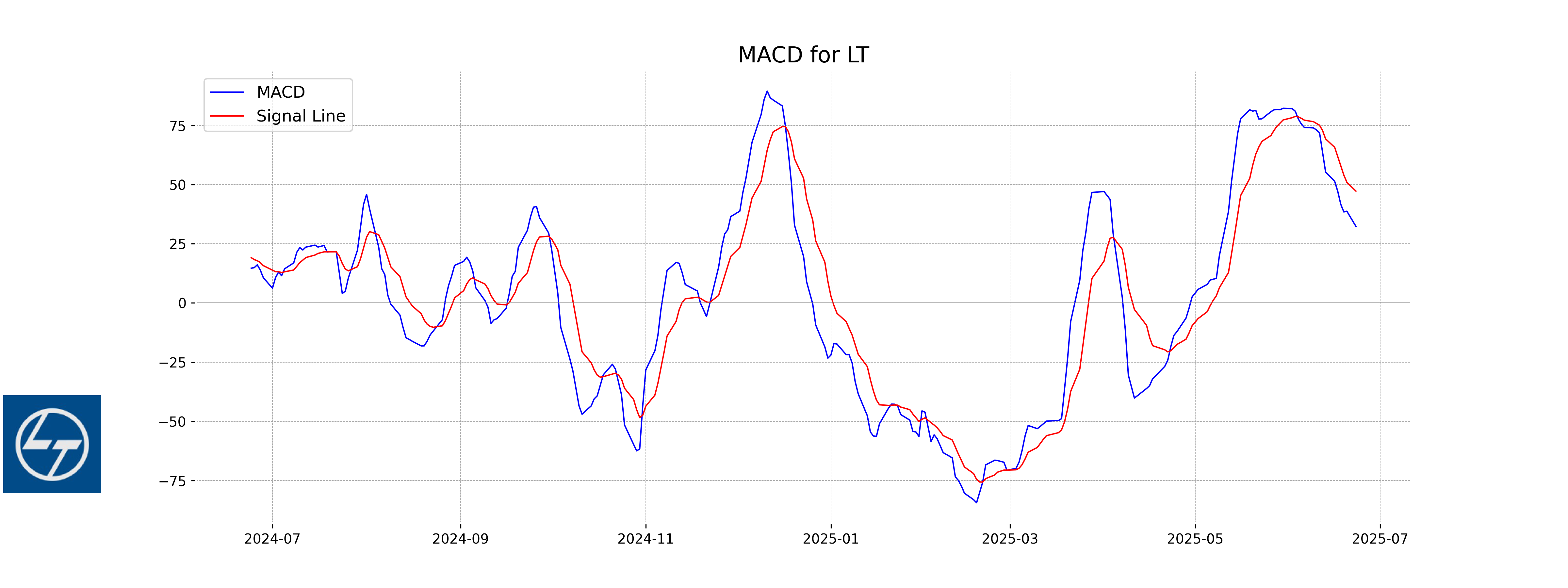

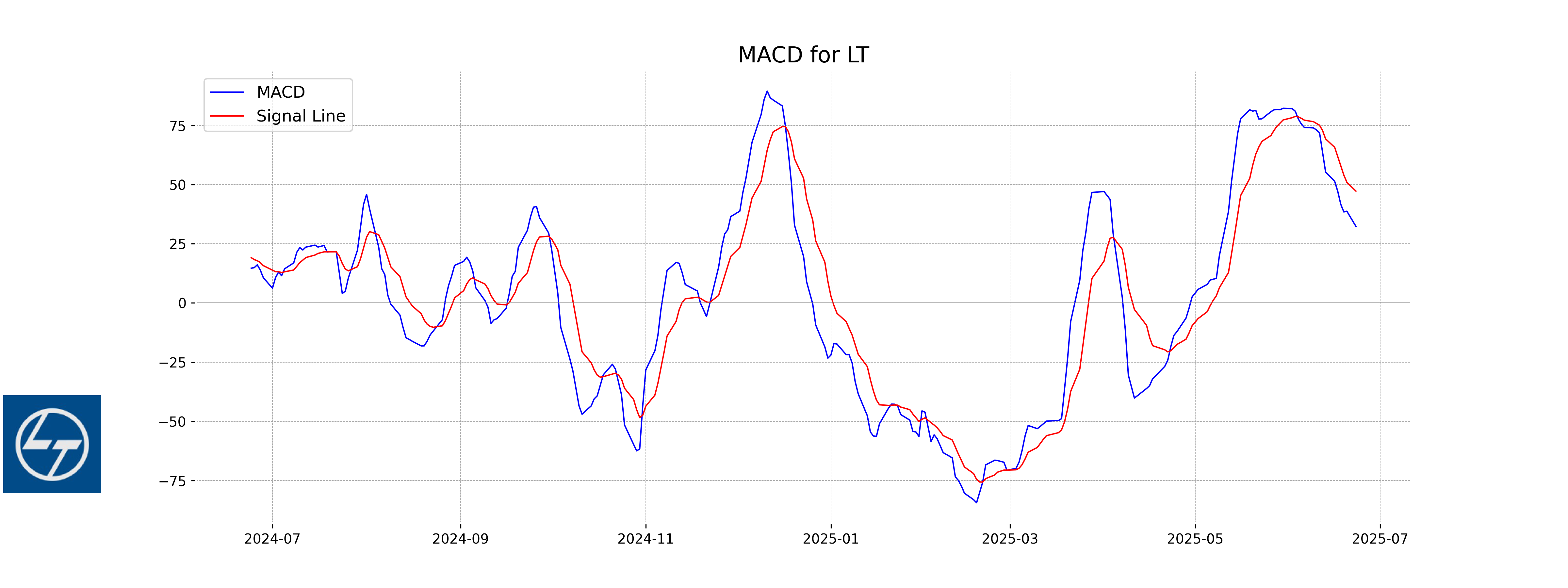

Moving Averages Trend (MACD)

For HCL Technologies, the MACD can be analyzed by comparing the MACD line with the MACD signal line. If the MACD line is above the MACD signal line, it indicates a potential bullish trend, suggesting upward momentum. Conversely, if the MACD line is below the MACD signal line, it may signal a bearish trend, suggesting potential downward momentum. Additionally, the divergence between the MACD line and the stock's movement can provide further insights into trend strength and possible reversals.

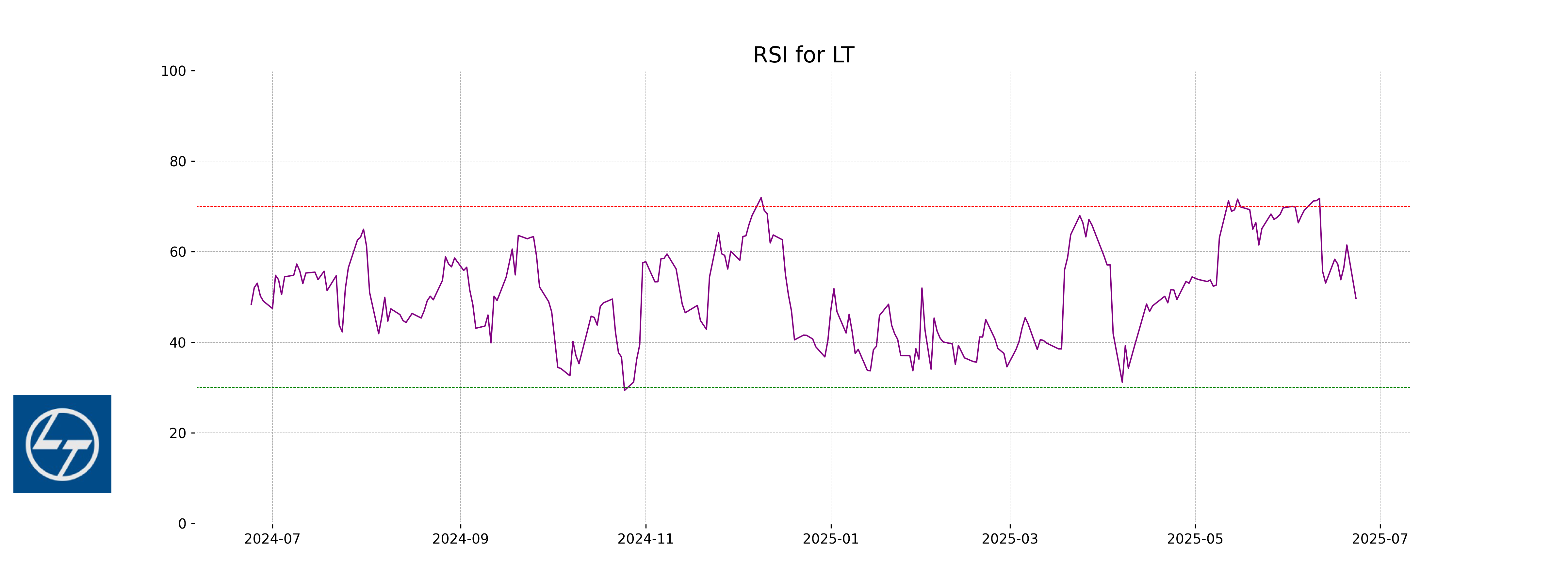

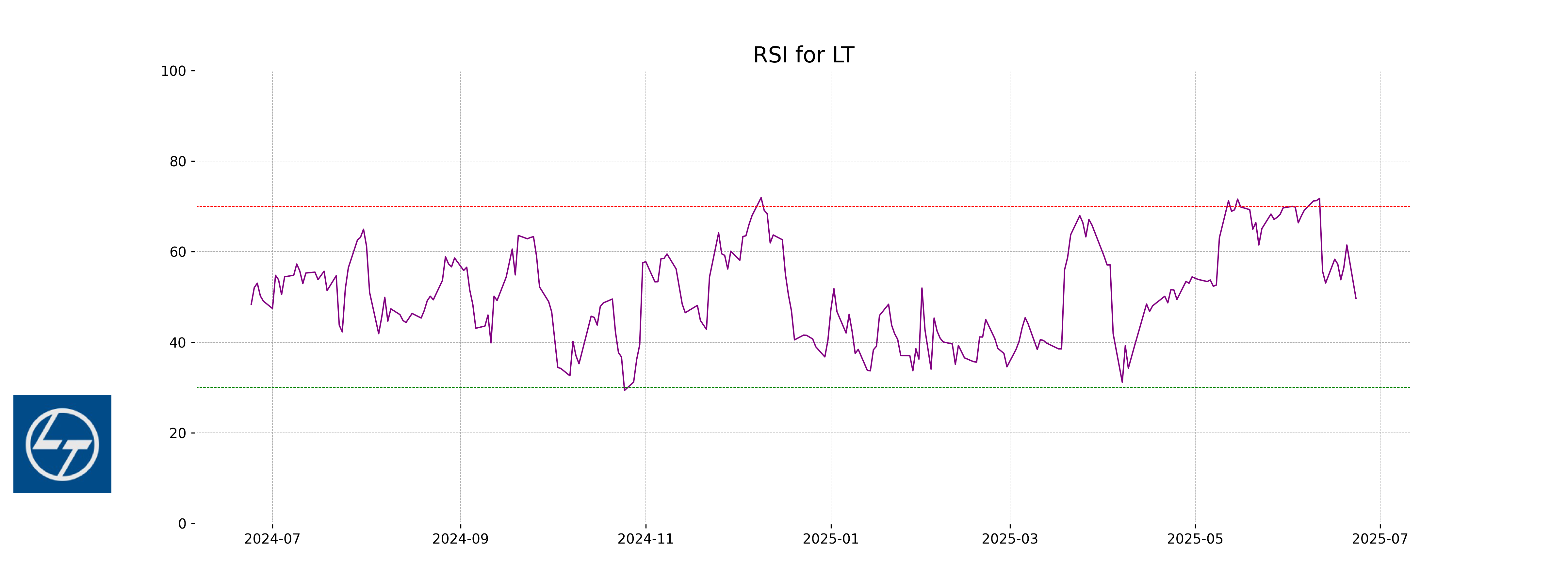

RSI Analysis

RSI analysis for HCL Technologies indicates a value of 49.69, suggesting the stock is neither overbought nor oversold. This implies that the stock is currently in a neutral zone, and traders might look for further price movement or confirmations before making buy or sell decisions.

Analysis for Mahindra & Mahindra - June 23, 2025

### Mahindra & Mahindra Performance Summary Mahindra & Mahindra experienced a decline in its stock price, closing at 3135.0 compared to the previous close of 3184.40, marking a percentage change of -1.55%. The stock demonstrated a trading volume of 1,731,296 shares. With an RSI of 58.83, the stock is in a neutral zone, while the MACD indicator shows a divergence above the signal line, indicating potential bullish momentum in the near term.

Relationship with Key Moving Averages

Mahindra & Mahindra's current closing price of 3135.0 is above its 50-day EMA of 2996.29 and 200-day EMA of 2847.05, suggesting a longer-term uptrend. However, it is slightly above the 10-day EMA of 3083.41 and 20-day EMA of 3061.07, indicating short-term upward momentum.

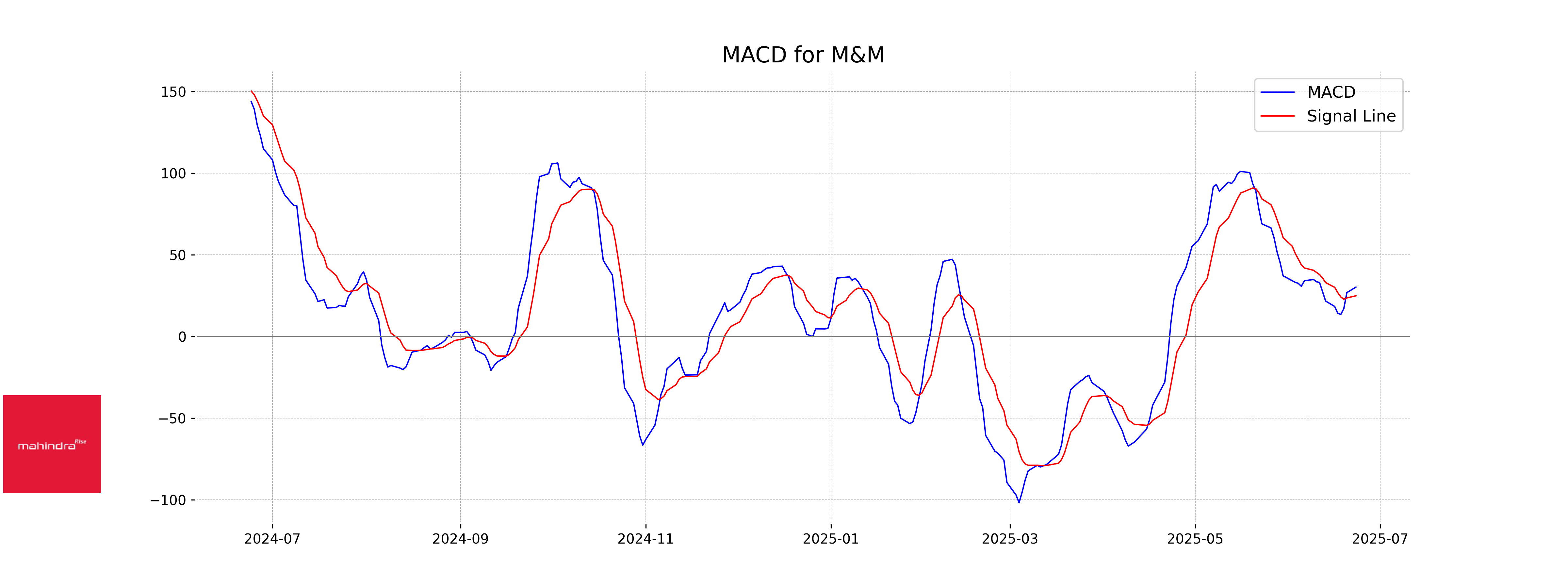

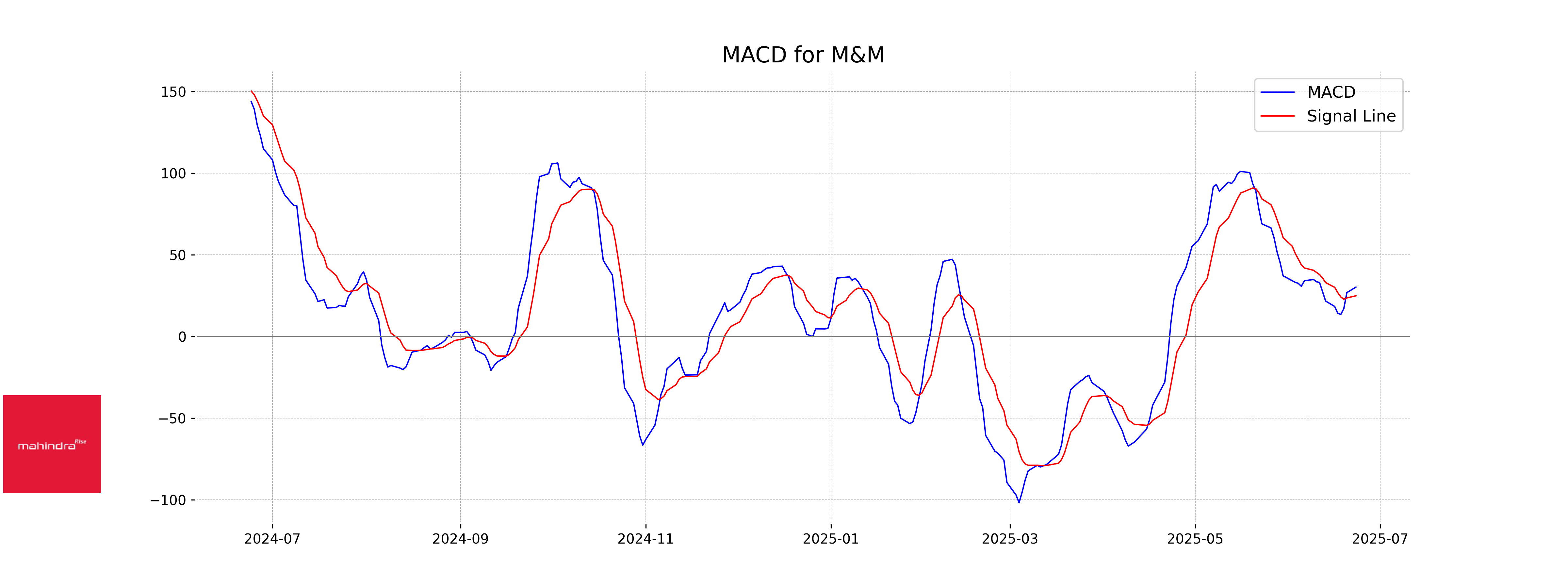

Moving Averages Trend (MACD)

The MACD for Mahindra & Mahindra is 30.19, with a MACD Signal of 24.88. As the MACD is above the MACD Signal line, it suggests a bullish momentum, indicating a potential upward trend in the stock's price.

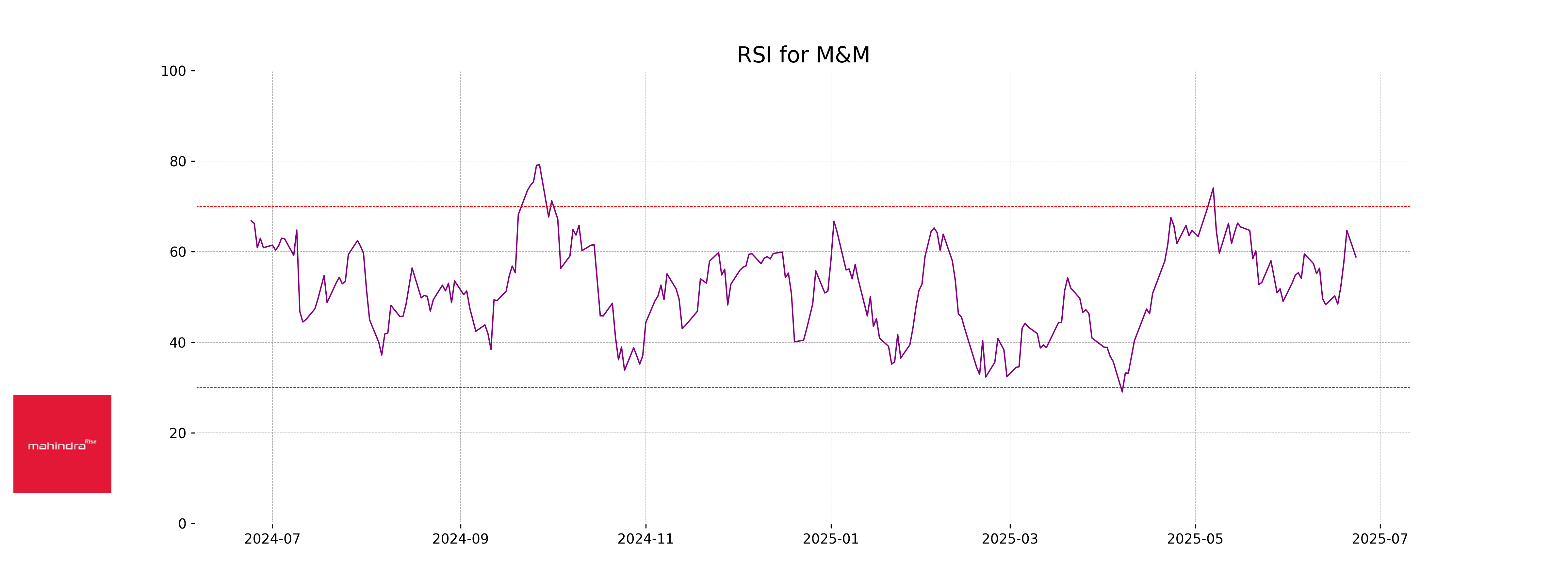

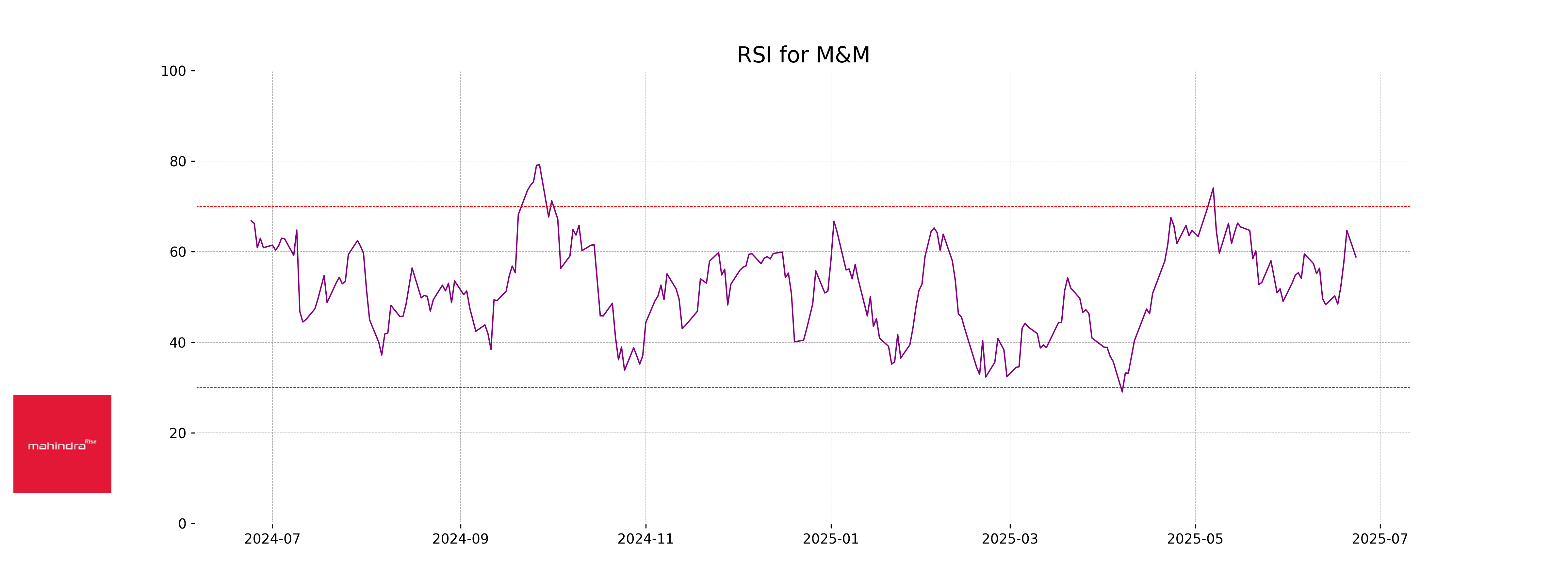

RSI Analysis

### RSI Analysis for Mahindra & Mahindra The Relative Strength Index (RSI) for Mahindra & Mahindra is 58.83, indicating a neutral position. Typically, an RSI above 70 suggests the stock may be overbought, while an RSI below 30 may suggest it is oversold. Currently, the stock is neither in overbought nor oversold territory, suggesting a balanced momentum.