Highlights

- Sensex closes lower, showing potential bearish momentum

- Nifty Auto hints bullish despite closing in red

- Nifty Energy declines, nearing oversold territory

Latest news

Nitin Gadkari reveals how he met Hamas chief Ismail Haniyeh hours before assassination in Tehran

BNP acting chairman Tarique Rahman returns to Dhaka after 17 years in exile

India revamps tax regime in 2025, new I-T Act to take effect from April 1

BNP's acting chief Tarique Rahman set to return to Bangladesh after 17-year exile

Navi Mumbai International Airport starts commercial flight operations

PM Modi attends Christmas service at Delhi church, greets citizens

Gujarat AAP MLA Chaitar Vasava refutes Rs 75 lakh extortion claims by BJP MP

AAP MLA Gopal Italia alleges bullying, extortion at Visavadar groundnut centre

Indian stock market sector-wise performance today - February 10, 2025

The national stock market indices showed varied performances on February 10, 2025, reflecting the economic sentiment.

In this article, we analyze the performance of key national indices including the Nifty 50,Nifty Bank,Nifty IT,Nifty Auto,Nifty Pharma,Nifty FMCG,Nifty Infra,Nifty Energy and Nifty Metal.

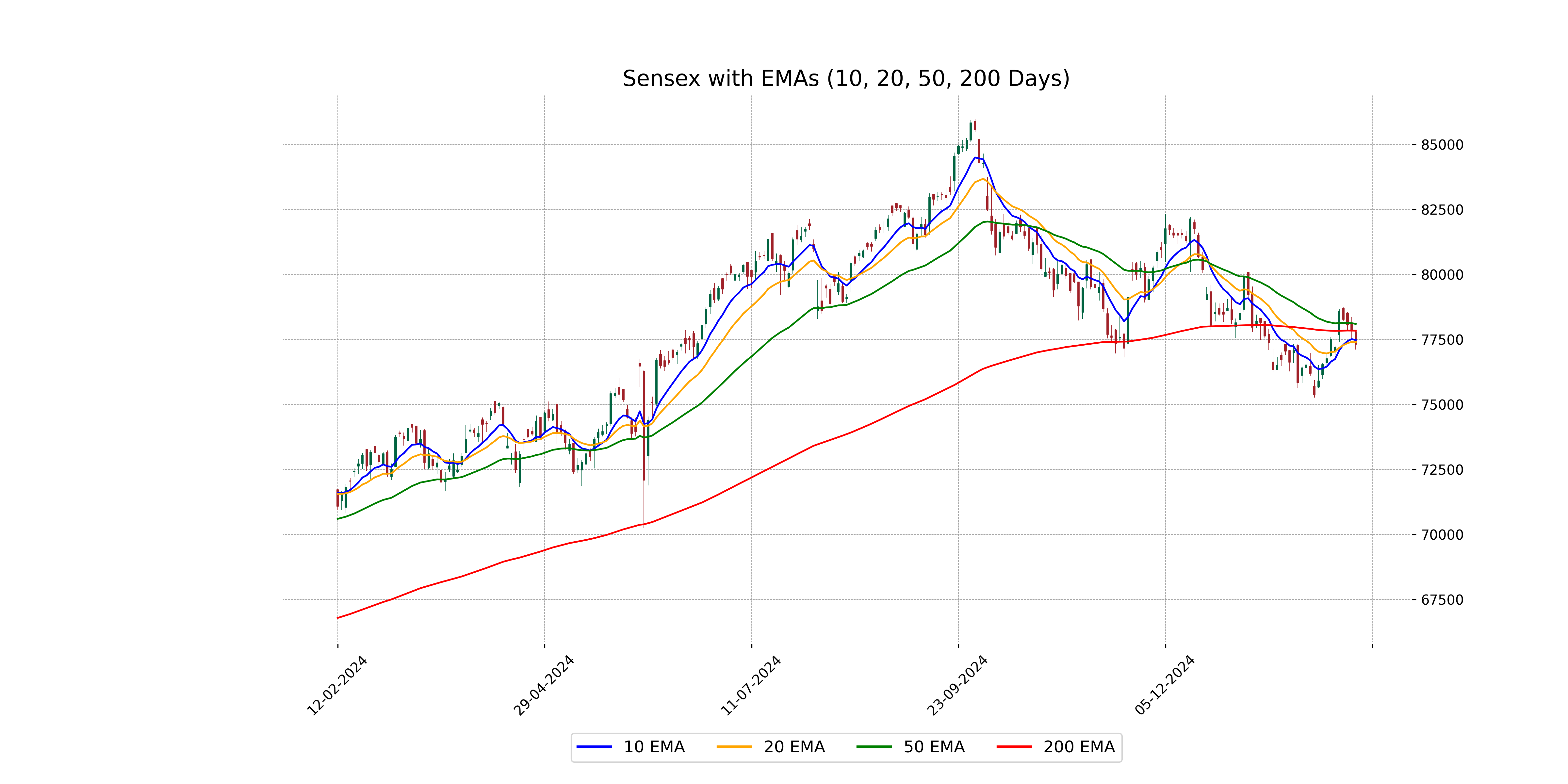

Analysis for Sensex - February 10, 2025

The Sensex opened at 77,789.30 and closed lower at 77,311.80, marking a decrease of 0.70% or a change of -548.39 points. The relative strength index (RSI) indicates a value of 48.42, suggesting a neutral market sentiment, while the moving average convergence divergence (MACD) is lower than its signal line, showing possible bearish momentum.

Relationship with Key Moving Averages

The Sensex closed at 77311.796875, which is below the 50-day EMA of 78094.24494170753 and the 200-day EMA of 77836.22204441404, indicating a potential bearish trend. It is, however, just below the 10-day EMA of 77474.82249075355 and close to the 20-day EMA of 77393.93462078446, suggesting some short-term consolidation or resistance.

Moving Averages Trend (MACD)

**MACD Analysis for Sensex:** The MACD value of -80.24, while close to the MACD Signal of -324.51, suggests that the Sensex's momentum is currently bearish but showing signs of potential convergence. The negative MACD value indicates recent downward pressure, but the close approach to the signal line could hint at a possible reversal or a reduction in the rate of decline.

RSI Analysis

The Relative Strength Index (RSI) for Sensex is currently at 48.42, indicating that the index is in the neutral zone, neither overbought nor oversold. This suggests a balanced momentum with no strong price movement signals in either direction.

Analysis for Nifty Auto - February 10, 2025

Nifty Auto opened at 23,525.85 and closed at 23,112.65, marking a decrease of approximately 1.48% from the previous close of 23,459.95. The stock experienced a high of 23,636.30 and a low of 23,082.20. The current RSI is around 51.89, indicating a balance between overbought and oversold conditions.

Relationship with Key Moving Averages

The closing price of Nifty Auto at 23112.65 is below its 50 EMA at 23192.04 and 200 EMA at 23260.87, indicating a potential bearish trend relative to these long-term averages. However, it is slightly above the 10 EMA at 23103.39 and above the 20 EMA at 22986.60, suggesting some short-term bullishness.

Moving Averages Trend (MACD)

The Nifty Auto index shows a positive MACD of 69.45, which is significantly above the MACD Signal of -49.42. This suggests a bullish momentum for the index despite the recent closing below the previous day's level.

RSI Analysis

The RSI value for Nifty Auto is 51.89, indicating a neutral position in terms of momentum. A value around 50 suggests that the stock is neither in the overbought nor oversold territory, suggesting a balance between buying and selling pressures.

Analysis for Nifty Energy - February 10, 2025

Nifty Energy opened at 32,778.45, reaching a high of 32,834.25 and a low of 32,023.25, closing at 32,109.90. It experienced a decline of 2.16% from the previous close, with a points change of -707.40. The RSI indicates a bearish trend at 39.17, while the MACD shows momentum loss with a value of -655.51 compared to its signal line at -690.00.

Relationship with Key Moving Averages

Nifty Energy is currently trading below its 50 EMA (34810.65) and 200 EMA (37423.87), indicating a bearish trend. Additionally, the 10 EMA (32895.57) and 20 EMA (33344.01) are also above the latest closing value (32109.90), which further supports a bearish sentiment.

Moving Averages Trend (MACD)

The Nifty Energy index shows a negative MACD value of -655.51, indicating a bearish trend, which is further supported by the MACD being below the signal line (-690.00). This suggests that recent selling pressure may continue in the short term.

RSI Analysis

Based on the provided data, the RSI for Nifty Energy is 39.17, which indicates that the index is approaching the oversold territory. This suggests that the recent selling pressure may be diminishing, potentially signaling a buying opportunity if other indicators align.

Analysis for Nifty FMCG - February 10, 2025

Nifty FMCG experienced a decline, as indicated by its close at 54856.65, down from the previous close of 55113.30. The index showed a negative percentage change of -0.47%, with a points drop of 256.65. Technical indicators suggest weakness, with an RSI of 39.02 and a MACD below the signal line.

Relationship with Key Moving Averages

The Nifty FMCG index has closed below its 10 EMA, 20 EMA, 50 EMA, and 200 EMA, indicating a bearish trend as the current close is lower than these key moving average levels. Additionally, the RSI is at 39.02, reflecting a weak momentum. The MACD is negative and below its signal line, further confirming the bearish outlook.

Moving Averages Trend (MACD)

Nifty FMCG's MACD value of -226.50 indicates a bearish trend as it is below the MACD signal line of -178.96. This suggests that the stock index may be experiencing downward momentum.

RSI Analysis

The Relative Strength Index (RSI) for Nifty FMCG is 39.02, which suggests that the index might be approaching oversold conditions as values below 30 typically indicate oversold levels. However, RSI is a momentum indicator and should be used alongside other indicators for comprehensive analysis.

Analysis for Nifty Infra - February 10, 2025

Nifty Infra opened at 8260.70 and closed lower at 8169.85, experiencing a percentage decrease of -0.96% with a points change of -79.40. The current RSI is 43.33, indicating some bearish momentum, while the MACD reflects a negative value of -61.95, slightly below its signal line. Moving averages show current values below the 50 and 200 EMA, suggesting a downward trend in the short to medium term.

Relationship with Key Moving Averages

The Nifty Infra index closed below its key moving averages, with the latest close at 8169.85, which is below the 10-day EMA of 8238.66, the 20-day EMA of 8275.24, the 50-day EMA of 8432.53, and the 200-day EMA of 8532.96. This indicates a bearish sentiment as the current price is below short, medium, and long-term averages.

Moving Averages Trend (MACD)

The MACD for Nifty Infra is -61.95, which is below the MACD Signal of -75.45, indicating a potential upward momentum or a trend reversal. However, given that both values are negative, the stock is likely in a bearish phase. It would be prudent to monitor for any further signals or changes, as the RSI at 43.33 also suggests a lack of strong buying momentum.

RSI Analysis

The RSI for Nifty Infra is 43.33, indicating that the stock is approaching the oversold territory but is not yet there. A value below 30 would suggest it is oversold, whereas levels between 30 and 70 show a more neutral stance, suggesting cautious optimism might be warranted.

Analysis for Nifty IT - February 10, 2025

The Nifty IT index experienced a slight decline, closing at 42,596.55, a decrease of 325.10 points from the previous close of 42,921.65, marking a percentage change of -0.76%. The index's RSI stands at 46.84, indicating a moderate momentum, while its MACD shows a subtle bearish sentiment. Both the 50-day and 10-day EMA are above the closing price, suggesting potential resistance in the short term.

Relationship with Key Moving Averages

**Nifty IT** closed below its 50 EMA and 10 EMA, indicating potential bearish momentum as the closing price of 42596.55 is lower than the 50 EMA of 43065.94 and the 10 EMA of 42745.50. However, it remains above the 200 EMA, which suggests a longer-term bullish trend despite recent declines.

Moving Averages Trend (MACD)

The MACD for Nifty IT is -194.13, with the MACD Signal at -260.66. Since the MACD is above the Signal line, it suggests potential bullish momentum, although the negative values indicate underlying bearish conditions.

RSI Analysis

The RSI for Nifty IT is 46.84, suggesting that the index is neither overbought nor oversold, as it sits near the middle of the 0-100 range. This indicates a state of equilibrium where buying and selling pressures are relatively balanced.

Analysis for Nifty Metal - February 10, 2025

Nifty Metal opened at 8560.90, hitting a high of 8563.75 and a low of 8319.35, finally closing at 8359.25. This marks a decline from the previous close of 8585.80, with a percentage change of -2.64%, amounting to a points change of -226.55. The relative strength index (RSI) is 46.90, indicating weaker momentum, and the MACD is below the signal line, suggesting a bearish trend.

Relationship with Key Moving Averages

The Nifty Metal index closed at 8359.25, which is below both its 50-day EMA (8636.20) and 200-day EMA (8857.51), indicating a bearish trend. The index is, however, slightly below its 10-day EMA (8381.67) and 20-day EMA (8413.59), suggesting short-term weakness.

Moving Averages Trend (MACD)

Based on the MACD analysis for Nifty Metal, the MACD value of -72.72 is above its MACD Signal line of -109.53. This implies a potential bullish crossover may be forming, but the overall negative values suggest that the index is still in a bearish phase. Additionally, with an RSI of 46.90, the index is approaching the oversold region, possibly indicating a weakening selling momentum.

RSI Analysis

The RSI for Nifty Metal is 46.90, indicating a neutral momentum, as it is near the midpoint of the typical RSI range (30-70). This suggests that the stock is neither in an overbought nor oversold condition. Further analysis alongside other indicators is recommended for a comprehensive view.

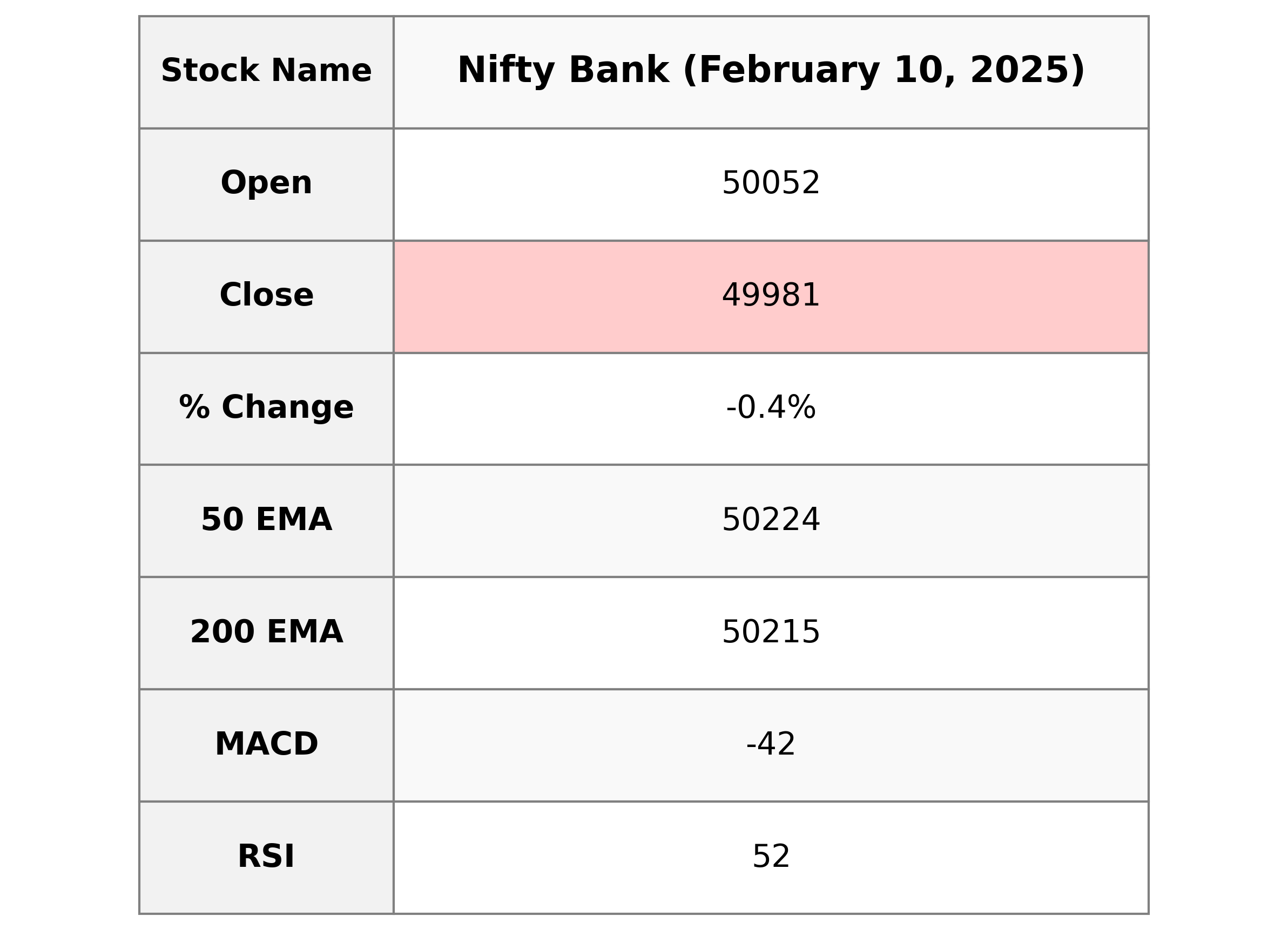

Analysis for Nifty Bank - February 10, 2025

Nifty Bank opened at 50,052.5, reaching a high of 50,155.65 and a low of 49,703.10, before closing at 49,981.0. The stock recorded a percentage change of -0.35% with a points change of -177.85 from the previous close of 50,158.85. In terms of technical indicators, the RSI is 52.17, and the MACD shows a negative divergence at -42.25, indicating potential bearish sentiment.

Relationship with Key Moving Averages

The closing price of Nifty Bank at 49981.0 is below its 50 EMA of 50224.07 and 200 EMA of 50215.42, indicating a bearish trend relative to these key moving averages. However, it remains above the 10 EMA of 49772.31 and the 20 EMA of 49660.87, suggesting a potential short-term strength.

Moving Averages Trend (MACD)

The MACD value for Nifty Bank is -42.25, which, along with the signal line at -298.22, suggests a potential trend reversal or a period of consolidation. Since the MACD is higher than the signal line, it indicates that momentum might be shifting positively even if the values are negative.

RSI Analysis

The Relative Strength Index (RSI) for Nifty Bank is 52.17, indicating a neutral state as it lies in the middle of the typical 30-70 range. This suggests that the index is neither overbought nor oversold, and may continue to move in line with current trends unless other market factors influence it.

Analysis for Nifty 50 - February 10, 2025

The Nifty 50 opened at 23,543.80 and closed lower at 23,381.60, marking a decrease of 0.76% or a drop of 178.35 points from the previous close. Technical indicators show the index is below its 50-day and 200-day EMAs, with an RSI of 47.86 and a negative MACD divergence, indicating bearish momentum.

Relationship with Key Moving Averages

The Nifty 50 closed at 23381.60, which is below its 50-day EMA of 23653.35 and the 200-day EMA of 23620.55, indicating a short-term bearish trend. It is also slightly below its 10-day EMA of 23445.51 and the 20-day EMA of 23426.91, suggesting recent weakness relative to these averages.

Moving Averages Trend (MACD)

Based on the provided data, the MACD for Nifty 50 is -29.50 with a signal line at -98.78, indicating a bearish momentum but with potential for a reversal if the MACD line crosses above the signal line. The relatively lower RSI at 47.86 supports the current bearish sentiment, although it is nearing a neutral zone.

RSI Analysis

The RSI value for Nifty 50 is 47.86, which indicates a neutral zone, suggesting no significant overbought or oversold conditions. Generally, RSI values below 30 indicate oversold conditions, while values above 70 suggest an overbought market.

ADVERTISEMENT

Up Next

Indian stock market sector-wise performance today - February 10, 2025

New Zealand commits USD 20 bn investment in India under FTA in 15 yrs; on lines of EFTA pact

India, New Zealand conclude FTA talks; pact to offer duty-free access, USD 20 bn FDI

FTA with New Zealand to significantly deepen bilateral economic engagement: Govt

Rupee breaches 91-mark against US dollar for first time in intra-day trade

Microsoft commits USD 17.5 billion investment in India: CEO Satya Nadella

More videos

CBI books Anil Ambani's son, Reliance Home Finance Ltd. in Rs 228 crore bank fraud case

RBI raises FY26 GDP growth projection to 7.3 pc

RBI trims policy interest rate by 25bps to 5.25pc, loans to get cheaper

Rupee slumps to all-time low of 90.25 against US dollar in intra-day trade

Reliance completes merger of Star Television Productions with Jiostar

India to lead emerging market growth with 7pc GDP rise in 2025: Moody’s

Nifty hits record high after 14 months; Sensex nears all-time peak

Reliance stops Russian oil use at its only-for-export refinery to comply with EU sanctions

ED attaches fresh assets worth over Rs 1,400 cr in case against Anil Ambani's Reliance Group

India signs one-year deal to import 2.2 million tonnes of LPG from US