Zero Depreciation Vs Consumable Cover- Know the Difference Now!

VMPL

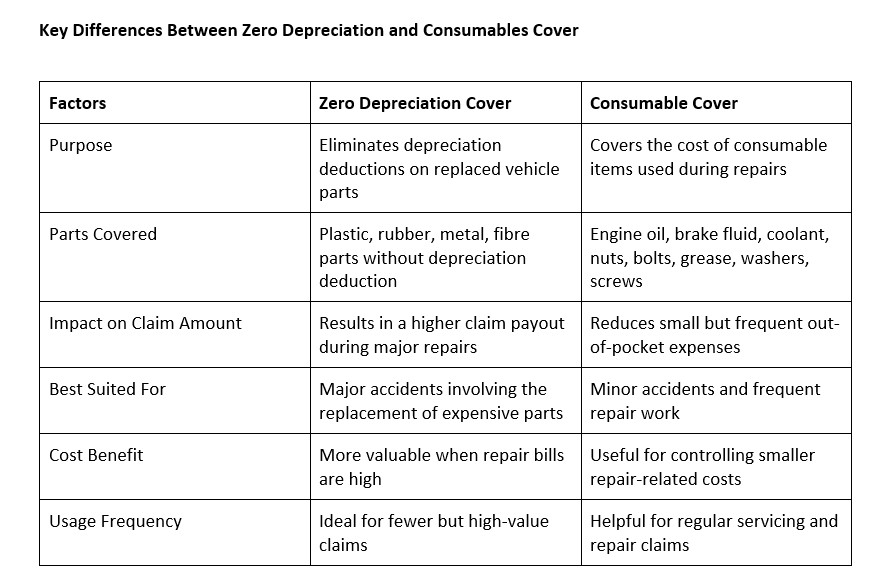

New Delhi [India], January 12: Choosing the right add-ons can significantly affect how much you receive during a claim. For many car owners, the comparison between different covers becomes confusing, especially when repair bills start adding up.

Understanding how zero-dep car insurance works in comparison to consumables cover can help you avoid unexpected out-of-pocket expenses and select protection that actually matches your usage.

What is Zero Depreciation Cover in a Car Insurance Policy?

Zero depreciation cover is an add-on that ensures depreciation is not deducted from the claim amount for replaced parts. Under a standard car insurance policy, insurers apply depreciation on parts like plastic, rubber, metal and fibre components, which reduces the final payout.

With zero depreciation cover, the insurer pays the full cost of replacing eligible parts without factoring in depreciation. This is especially useful for new or high-value cars, where spare parts are expensive and depreciation deductions can be significant.

What is Consumables Cover in Car Insurance?

Consumables cover is an add-on designed to cover items that are otherwise excluded from standard policies. These include engine oil, brake fluid, coolant, grease, nuts, bolts, screws, washers and similar materials that are used up during repairs.

Although consumables may seem inexpensive individually, their cumulative cost during accident repairs can be substantial. This add-on helps reduce small but frequent out-of-pocket expenses that arise during claim settlements.

When Should You Choose Zero Depreciation Cover and Consumables Cover?

Zero depreciation cover is ideal for new cars, luxury vehicles and cars driven regularly in traffic-heavy areas. It is also suitable for owners who want predictable repair costs and minimal financial impact during claims.

However, insurers often limit the availability of this add-on to cars below a certain age, usually five years.

Consumables cover works well for vehicles that undergo frequent servicing or minor accident repairs. It is also useful for cars driven daily, where wear-and-tear-related repairs are more common. It is generally affordable and complements other covers by reducing smaller expenses during claims.

Can You Opt for Both Covers Together?

Yes, both zero-dep car insurance and consumables cover can be taken together. When combined, they enhance overall claim settlement by covering depreciation losses and excluded consumable items.

Choose the Most Suitable Add-ons with TATA AIG Car Insurance

Choosing between zero-dep car insurance and consumable cover depends on your car's age, usage, and repair patterns. By carefully reviewing add-on options within your car insurance policy, you can ensure better financial protection during claims and avoid unexpected repair costs. Understanding these differences allows you to make a more informed decision and customise your coverage to suit real-world needs.

(ADVERTORIAL DISCLAIMER: The above press release has been provided by VMPL. ANI will not be responsible in any way for the content of the same.)